As with all sectors of healthcare, the lab industry has been dramatically impacted by COVID-19. In addition to COVID-19, the industry is dealing with reimbursement pressures as a result of changes in governmental reimbursement rates. In this article we provide background information on labs, timely factors affecting lab operations, transaction activity in the lab space, valuation considerations for labs, and how COVID-19 is impacting lab operations.

![]() OVERVIEW

OVERVIEW

Pathology is a medical specialty that involves the laboratory examination of body tissue for diagnostic or forensic purposes. The field contains two main divisions: anatomic and clinical pathology. Anatomic pathology primarily consists of tissue evaluation, while clinical pathology covers most of laboratory medicine – including routine tests such as glucose and sodium, up to molecular tests for cancer markers and genome sequencing.[1]

Both clinical pathology and anatomic pathology are further classified into numerous sub-specialties. While laboratories vary in the scope and types of pathology services provided, many laboratories are clinical or anatomic focused, and further, are focused on one of the sub-specialized clinical or anatomic areas.

![]()

![]()

![]()

![]()

![]()

COVID-19

COVID-19 has had an impact on all areas of the healthcare industry, including laboratories. However, while laboratory base business operations may have decreased during 2020 as a result of fewer individuals receiving routine preventative care and elective procedures, many clinical laboratories reported this has been offset by increases in COVID-19 testing. For example, in its third quarter earnings call, Laboratory Corporation of America (LabCorp) reported revenue growth of 33 percent year-over-year in the quarter, 31.5 percent of which was due to organic revenue growth. The increase of 31.5 percent was driven by revenue growth in COVID-19 testing of 32.6 percent, partially offset by a reduction in its organic base business of 1.1 percent. Quest Diagnostics (Quest) also posted a strong third quarter driven by COVID-19 testing. Clinical laboratories have benefited from CMS increasing reimbursement for facilities using high throughput technology for COVID-19 testing. While COVID-19 tests have been a boon for those clinical labs offering these services, financial performance may have deteriorated for labs not offering those services. Anatomic labs may have seen their specimen volumes decline during 2020 as patients avoid office visits. Thus, the effects of COVID-19 on the operations of a laboratory can vary greatly depending on the services offered by each specific lab.

Provider Compensation

Many valuation items our firm has encountered in relation to clinical labs relate to provider compensation. Services provided by pathologists to these labs can vary, such as medical director services, administrative services, professional services, and call coverage services. For more detailed information on the types of pathology services and compensation structures, please reference HealthCare Appraisers guide, Pathology: A Comprehensive Guide to Pathology Arrangements.

Marketing Arrangements and Referral Sources

There are regulatory and valuation concerns that need to be addressed when structuring relationships with sales and marketing representatives, whether they are employed by the lab or hired as contractors. The Eliminating Kickbacks in Recovery Act (“EKRA”) of 2018 restricts the ability of labs to compensate sales representatives under a traditional commission structure, and has caused many labs to restructure and obtain FMV opinions regarding their arrangements with sales and marketing employees and contractors. For more information on EKRA and its implications for labs, please reference HealthCare Appraisers’ article on the topic.

While anatomic labs may not have the same EKRA related regulatory constraints as clinical labs, referral sources and marketing-related expenses of an anatomic lab can still be an important factor in an appraisal. For example, a dermatopathology lab may need to hire sales professionals to help generate referrals from dermatologists. This would also lead to travel, meals, and entertainment expenses related to the sales team, which has the potential to add a large expense to the lab’s operations. As operations of an anatomic lab grow geographically, transport expenses related to specimens can grow, which could lead to shrinking margins. Thus, it is important for an appraiser to assess not only current sales, marketing, and transport costs, but how these levels of expenses may be affected by future projected growth of an anatomic lab.

Transaction and Public Company Valuation Multiples

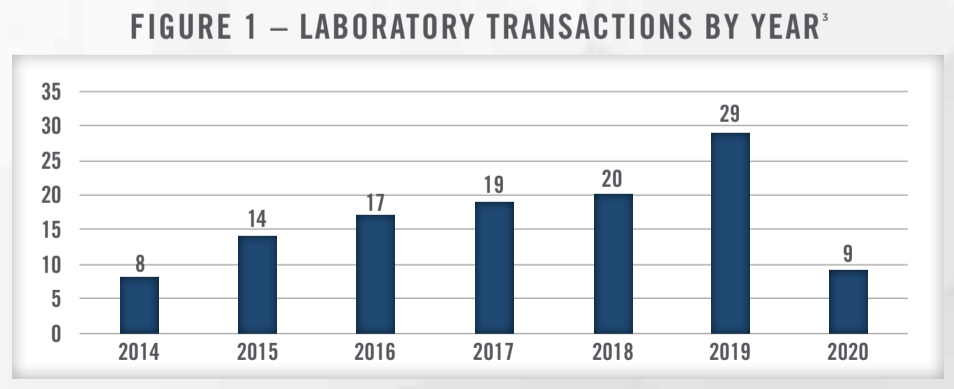

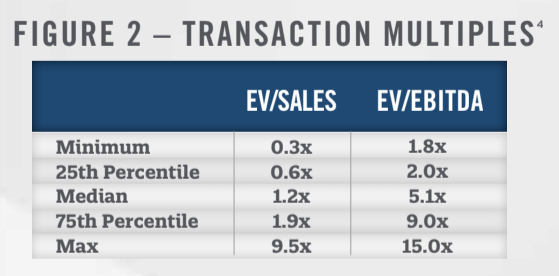

The number of transactions in the laboratory space has been steadily increasing the last several years for a variety of reasons. Reimbursement pressures have caused many hospitals to sell their outreach laboratories or enter into joint ventures with management companies to reduce costs and manage risk.[2] Recent examples of this include Marin General Hospital and Hurley Medical Center selling their outreach lab operations. There continues to be consolidation in the lab space as well, with LabCorp and Quest increasing their market share through acquisitions and partnerships with hospitals and other healthcare organizations. Given the ongoing reimbursement headwinds facing the lab industry, consolidation is expected to continue in order for providers to realize cost synergies and economies of scale. Figure 1 presents the number of publicly reported lab transactions taking place from 2014 through the first half of 2020.

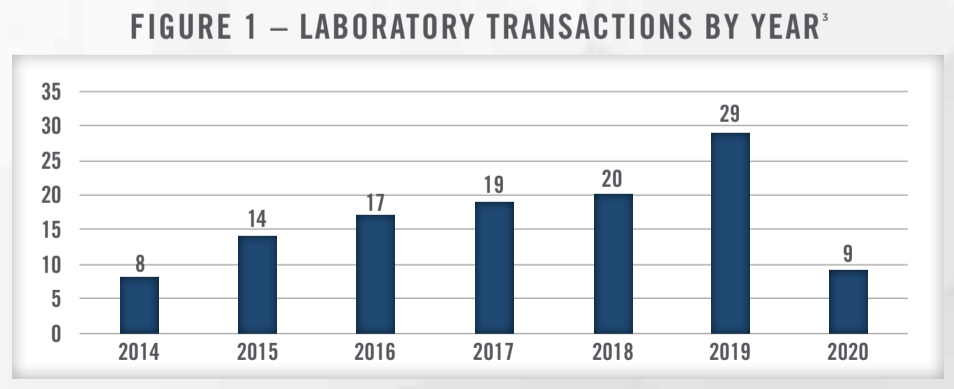

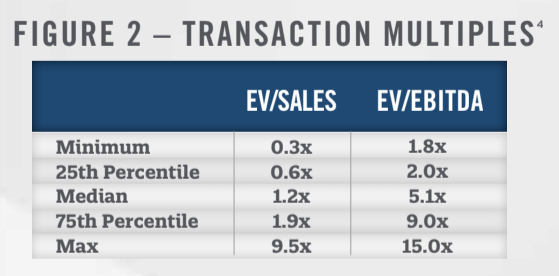

Although most transactions in the lab market are private and do not report valuation metrics, we have compiled the transactions that include valuation data and presented them in Figure 2. Within the dataset which includes transactions from 2011 through 2019, 20 transactions reported enterprise value (“EV”)-to-sales multiples and 14 reported EV-to-earnings before interest, taxes, depreciation and amortization (“EBITDA”) multiples.

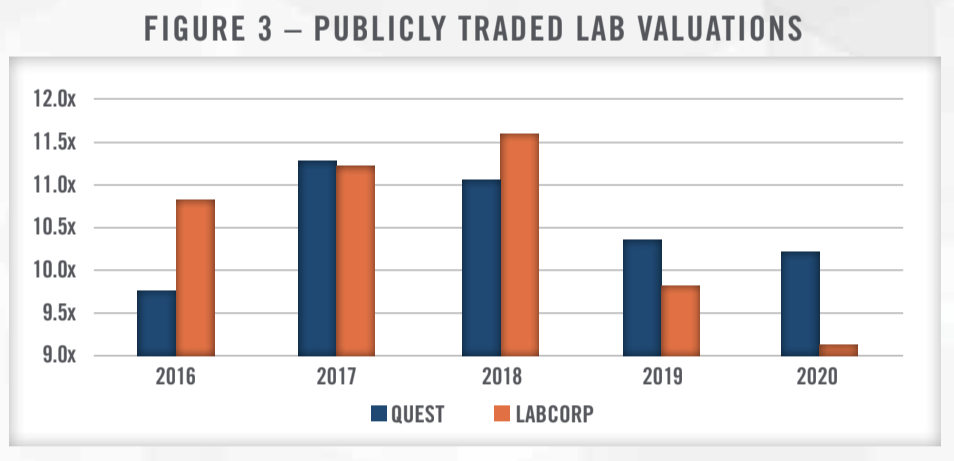

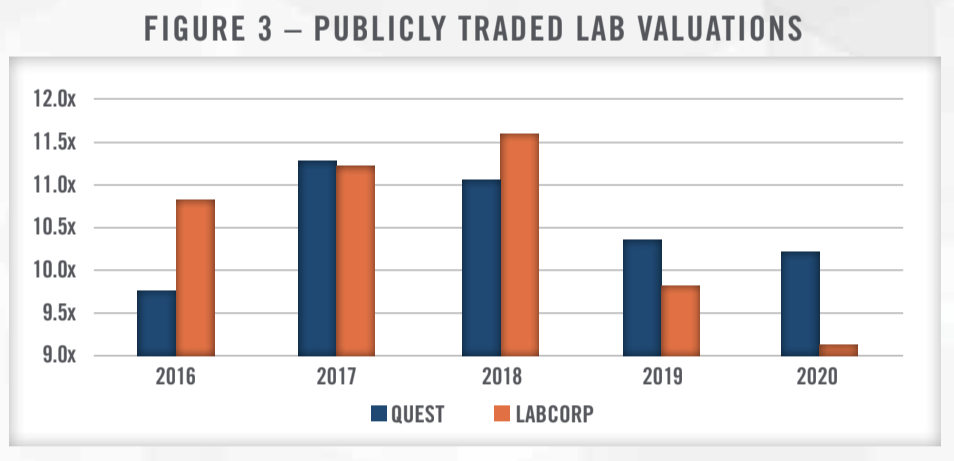

In addition to the multiples paid in closed transactions involving private companies, valuation information can be obtained through analyzing share prices of publicly traded operators in the space. The two largest providers in the laboratory market are LabCorp and Quest, both of which are publicly traded. Figure 3 presents average trailing twelve-month EV/EBITDA multiples for Quest and LabCorp from 2016 through November of 2020. Both companies have traded in a fairly tight range, ranging from 9.0x to 11.5x trailing twelve-month EBITDA. Compared to the transaction multiples presented in Figure 2, this represents a premium over the 75th percentile, illustrating the benefits of size and diversification ascribed to the public companies. For comparison purposes, we also note that the share prices used in calculating the enterprise value represent non-controlling interests while the transactions in Figure 2 include aspects of control.

![]()

![]()

![]()

![]()

![]()

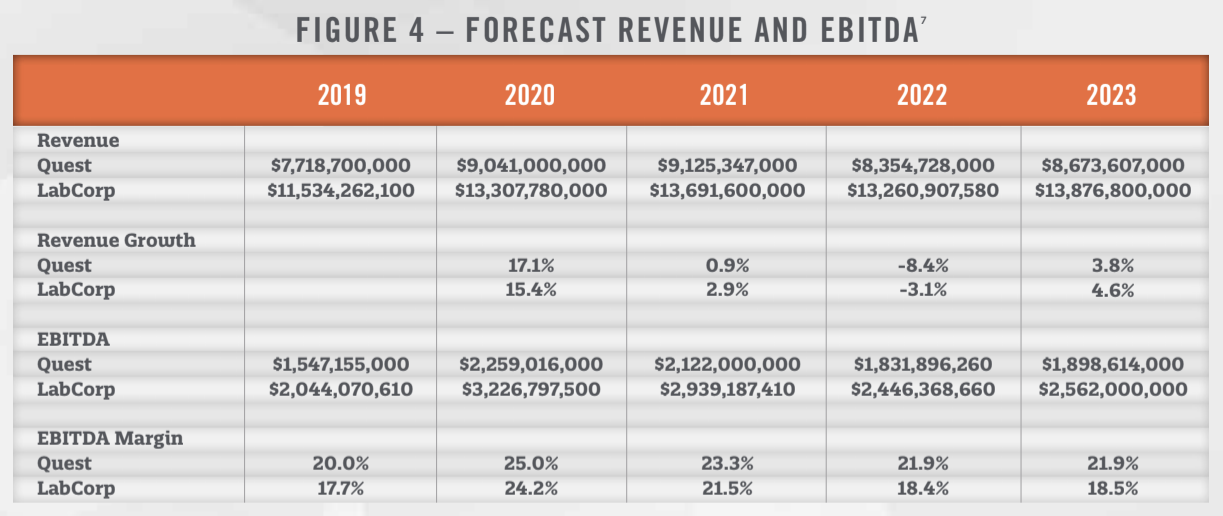

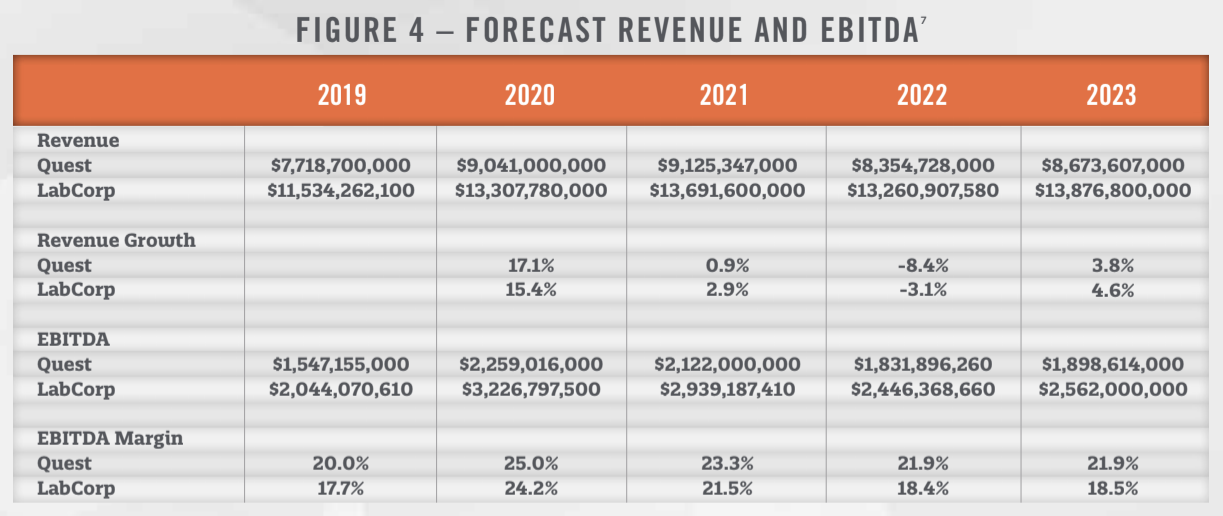

One the major factors impacting the outlook for labs is the looming cuts to reimbursement rates stipulated by the Protecting Access to Medicare Act (“PAMA”). Under PAMA, the lab industry is expecting significant reductions in reimbursement rates, although the cuts have been delayed from 2021 until 2022 by the CARES Act.[5] PAMA was enacted in 2014 and sets Medicare reimbursement rates equal to the weighted median of private payor rates.[6] The reduction in payment rates are capped at 15 percent per year from 2022 through 2024, and are anticipated to have a significant impact on industry revenue, as illustrated in Figure 4, which presents the forecasted revenue growth and EBITDA for Quest and LabCorp as anticipated by investment analysts.

As illustrated in Figure 4, both companies are anticipated to see declines in revenue and EBITDA in 2022. In addition to the negative impacts from PAMA, the change to the 2021 Medicare conversion factor in the Physician Fee Schedule originally contemplated a 9 percent payment reduction to pathologists in 2021. However, this reduction will be tempered somewhat by the passage of the Consolidated Appropriations Act on December 27, 2020, which revised the conversion factor for 2021 to $34.89. While higher than the $32.41 outlined in the Final Rule, it is still lower than last year’s $36.09.

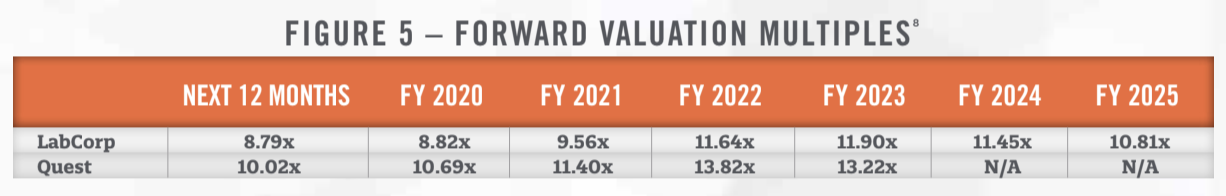

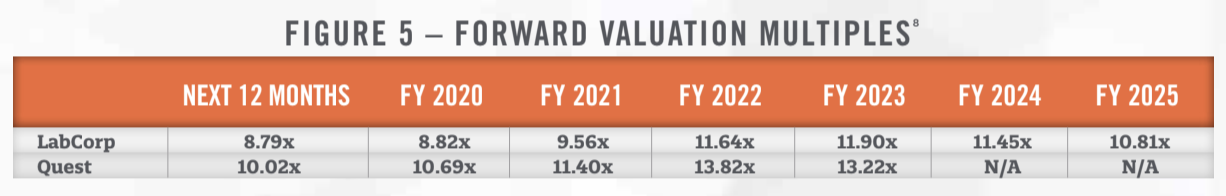

While the outlook for reimbursement rates represents a headwind to industry growth, valuation multiples in the space are not projected to decline as a result. Figure 5 below presents the forecasted EV/EBITDA multiples for Quest and LabCorp as anticipated by investment analysts. As illustrated in Figure 5, multiples are largely anticipated to increase over the next several years.

![]()

![]()

![]()

![]()

![]()

While labs continue to face headwinds such as reimbursement pressures, and government regulation, their importance in the healthcare system is highlighted in events such as the COVID-19 pandemic. HealthCare Appraisers has been involved in numerous lab related appraisals, from business valuations for transactions, to physician compensation arrangements, to the appraisal of marketing arrangements. Given the continually changing regulatory environment and outlook for labs, it is important to engage an experienced healthcare valuator when encountering lab related appraisal needs.

[1] Lockhart, Valerie, MD, MBA, FCAP, Overview of Anatomic and Clinical Pathology, College of American Pathologists, August, 16, 2019; Accessed October 30, 2020 from https://documents.cap.org/documents/overview-anatomic-clinical-pathology-medical-students.pdf

[2] 360Dx; https://www.360dx.com/clinical-lab-management/hospitals-explore-new-models-labs-post-pama#.X-KOHdhKiUk; Accessed November 30, 2020

[3] Source: Irving Levin, Kaufmann Hall, Hammond Hanlon Camp LLC, Provident Healthcare Partners

[4] Source: DealStats, Irving Levin

[5] Xifin.com; https://www.xifin.com/resources/rcm-resources/pama-headquarters, Accessed November 30, 2020

[6] Centers for Medicare and Medicaid Services; https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/ClinicalLabFeeSched/PAMA-Regulations; Accessed November 30, 2020

[7] S&P Capital IQ

[8] S&P Capital IQ