![]() BACKGROUND AND DESCRIPTION OF HIGHLIGHTED CASE

BACKGROUND AND DESCRIPTION OF HIGHLIGHTED CASE

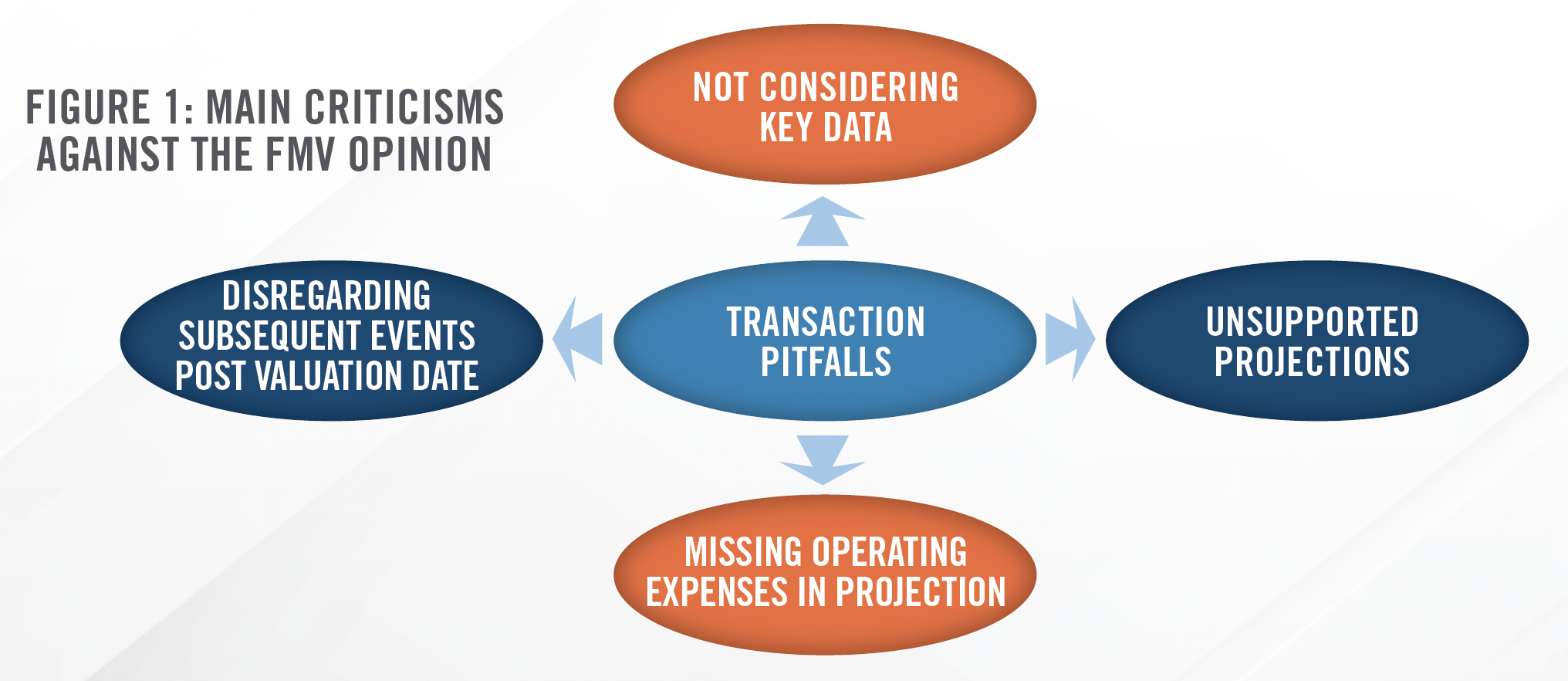

In 2013, a health system (the “Health System”) initiated discussions with an ambulatory surgery center (“Center”) regarding a contemplated transaction wherein the Health System would acquire the assets of Center from 16 owner physicians (“Physician Owners”). During these discussions, the Health System’s CFO (“Relator”) performed a high-level business valuation of Center, arriving at a conclusion of value ranging from $8,000,000 to $10,000,000 for the assets of Center. On December 31, 2014, the Health System reached an agreement to purchase Center’s assets for $25,120,000 based on a fair market value (“FMV”) opinion obtained from an accounting firm (the “FMV Opinion”). The transaction closed on March 31, 2015. Relator, who at the time of the transaction closing date was no longer employed by the Health System, learned of the transaction and later filed a qui tam action against the Health System, alleging that the Health System violated the False Claims Act (“FCA”) and the federal Anti-Kickback Statute (“AKS”) by paying above FMV to induce future patient referrals. Based on a decision reached in 2022 on defendant’s motion for summary judgement, we have outlined several areas in which healthcare market participants should be careful in order to avoid transaction pitfalls and costly litigation.[1] In this article, we take a deep dive into how the FMV Opinion was scrutinized during this case and highlight proper methodologies that can be applied to ensure FMV opinions do not misstate FMV. The main criticisms made against the FMV Opinion include not considering key data items that would reduce the value of the appraisal if utilized, unsupportable case volume assumptions that lacked a reasonableness check, certain operating expenses not being accounted for in the projections, deteriorating financial performance after the valuation date, and not obtaining a final version of the report. We have encountered some of these same pitfalls when reviewing other appraisals across various transactional circumstances.

![]() VALUATION PITFALLS

VALUATION PITFALLS

Capital Expenditure Assumptions

One criticism involved Relator claiming that the FMV Opinion’s capital expenditure (“Capex”) assumptions were understated in the valuation. Specifically, Relator indicated that the FMV Opinion assumed $900,000 in aggregate Capex over a six-year period within the projections. Relator also highlighted that the Physician Owners of Center specified during the valuation process that approximately $1,948,000 in Capex would be incurred shortly after the contemplated transaction. The Capex figure provided by the Physician Owners is substantially higher than what was assumed in the FMV Opinion, and had the FMV Opinion relied upon the Physician Owners’ representation, the FMV Opinion would have arrived at a lower conclusion of value (all else equal).

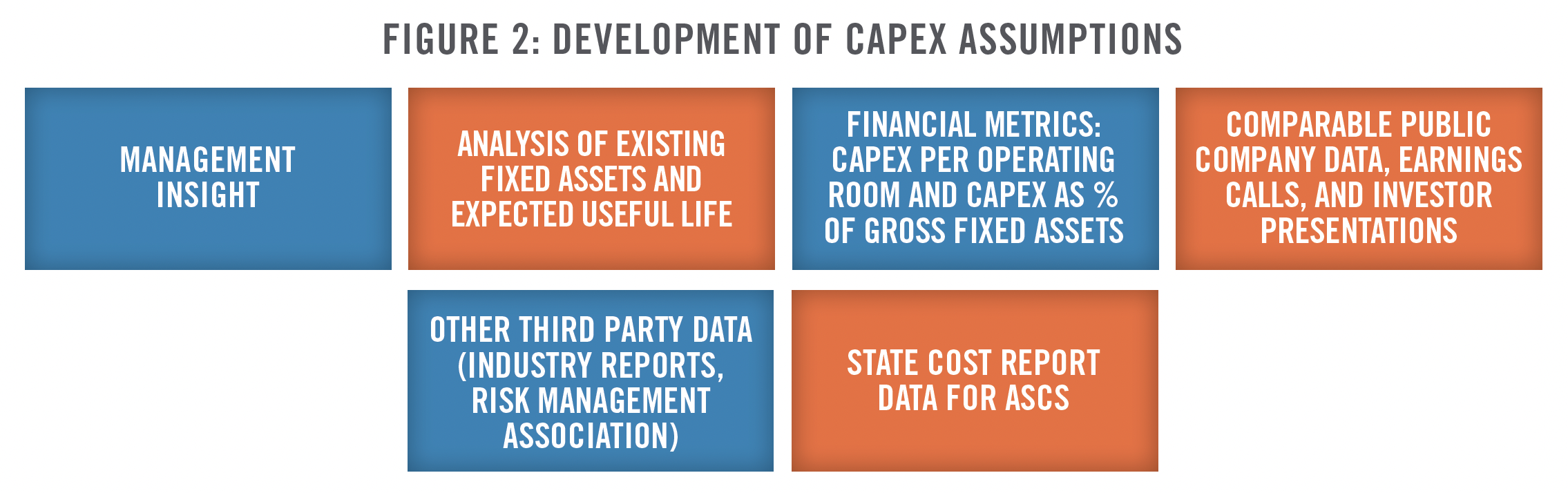

While assumptions and information provided by management of the target entity should always be confirmed by due diligence, it is important to take this information into consideration and have substantial support when deviating from management representations within the valuation. Regardless of whether or not management provides insight into the anticipated Capex needs of the subject entity, there are numerous methodologies that should be utilized in conjunction with each other to support a Capex assumption.

One process that should always be taken is analyzing the gross fixed assets held by the target entity as well as the useful life of the fixed assets in order to ensure the business is maintaining an adequate amount of capital equipment throughout the projection period. For businesses where high revenue growth is expected, an appraiser would likely need to account for Capex for new fixed assets in addition to maintenance Capex. Specific consideration should be made for what new equipment will be needed if an ASC is expected to add additional service lines. For instance, the ASC may need to acquire robotics equipment or patient positioning devices if they are expected to begin performing total joint replacement cases. Additionally, valuators should analyze various financial metrics such as Capex per operating room and Capex as a percentage of gross fixed assets to ensure reasonability of the projections. Fixed asset and Capex data can also be gathered from comparable, publicly traded companies and measured against revenue, volume, operating and procedure rooms, or other metrics to assist in forecasting similar levels of Capex for a scaled down business. HealthCare Appraisers has a capital asset team that specializes in capital asset planning and valuation, and advises on complex fixed asset and capex related needs.

Case Volume Projections

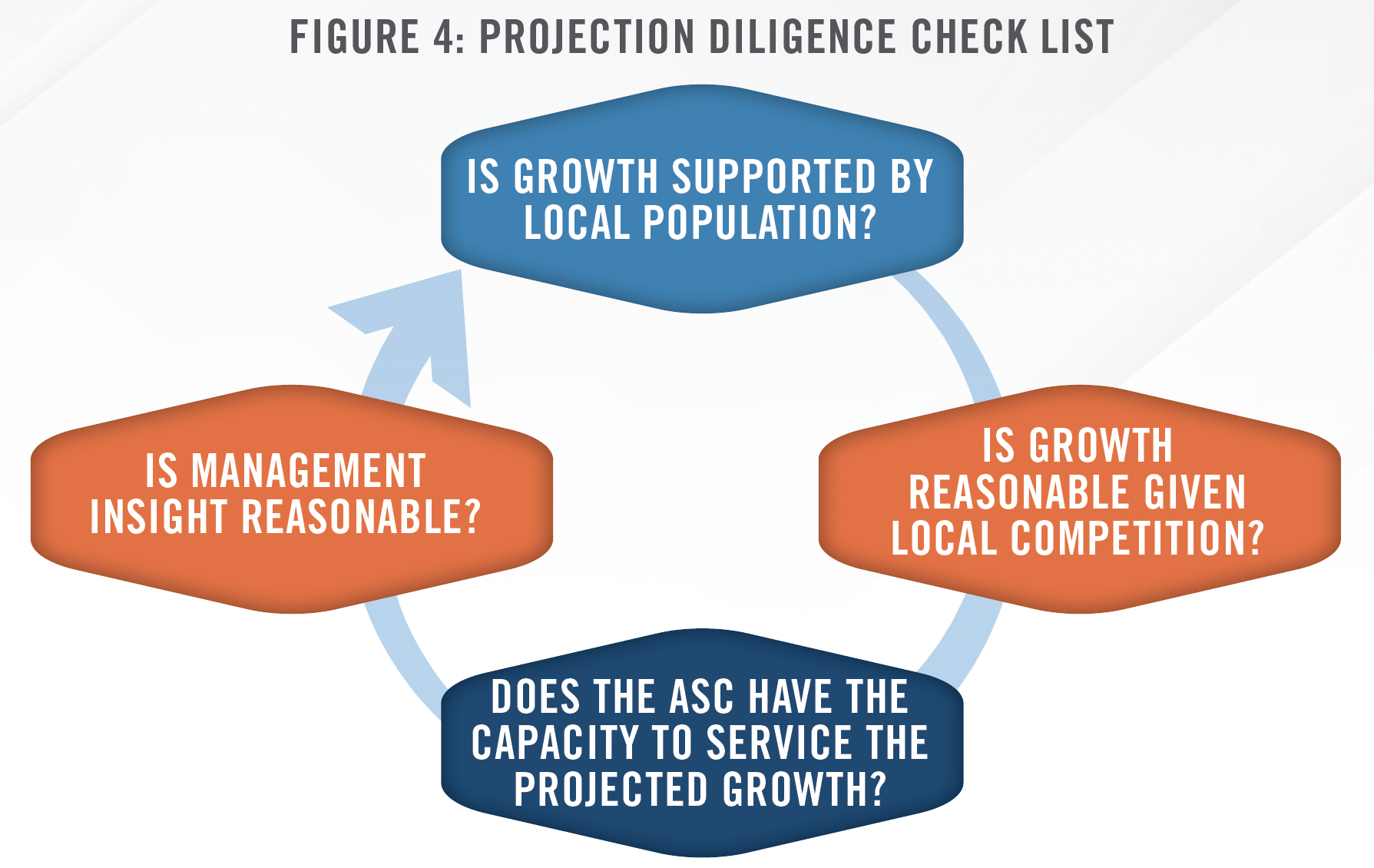

Relator claimed that the FMV Opinion included increases in case volume in the projections when the Health System was expecting Center’s volume to decline. Additionally, Relator claimed that the projections did not consider whether Center had the operating room capacity to perform the projected case volumes. During the appraisal process, it is important to gain insight into expectations for future revenue and volume growth. This insight should be gathered from the subject company, the acquiring company (if they have strong knowledge of the local market), and from independent research and due diligence regarding the market. When an appraiser is gathering this insight, they must be aware of the various stakeholders and their respective interests in the contemplated transaction if they are providing information that will be utilized in a forecast.

There are various ways to assess reasonability of input received regarding revenue or volume expectations. An appraiser should make themselves knowledgeable of the local market by performing research into the level of competition the subject company faces, and by reviewing census data on the serviceable area, including historical population growth, household income data, and the age dispersion of the community. It could be a major red flag for an appraiser to forecast double digit growth for an ASC in a community that has shown a significant decline in its population historically. However, in some circumstances, population decline might not have an immediate impact on case volumes at an ASC, depending on the population demographics of the serviceable market. For instance, markets with a high population of baby boomers may have higher surgeries per capita due to the needs of this particular population segment.

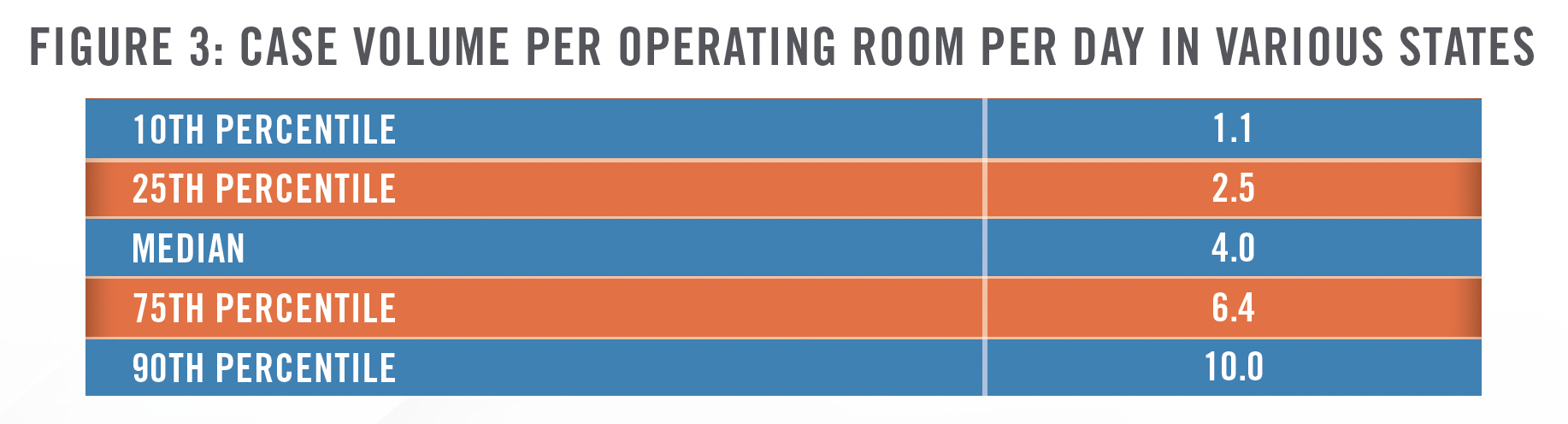

In addition to the serviceable market of the target business, consideration should be given to a subject entity’s capacity to meet the revenue or volume growth that is being projected. Certain metrics can be utilized to perform this reality check. Specific to ASCs, benchmark data can be analyzed for case volume per operating room per day (or per hour) to ensure that the projected case volume is reasonable, such as HealthCare Appraisers’ ASC Valuation & Benchmarking Survey. Certain states also publicly release cost report data for ASCs. Figure 3 displays a sample analysis of cost report data published by select states including California, Illinois, Indiana, Kentucky, Michigan, Minnesota, Montana, Nevada, and Virginia.

Medicare time study data can also be utilized to understand the time required to perform the projected case mix, being mindful of the operating hours of the subject business. Lastly, an appraiser should benchmark the projected productivity on a per physician basis to verify that the target business has an adequate number of providers to achieve the projected performance.

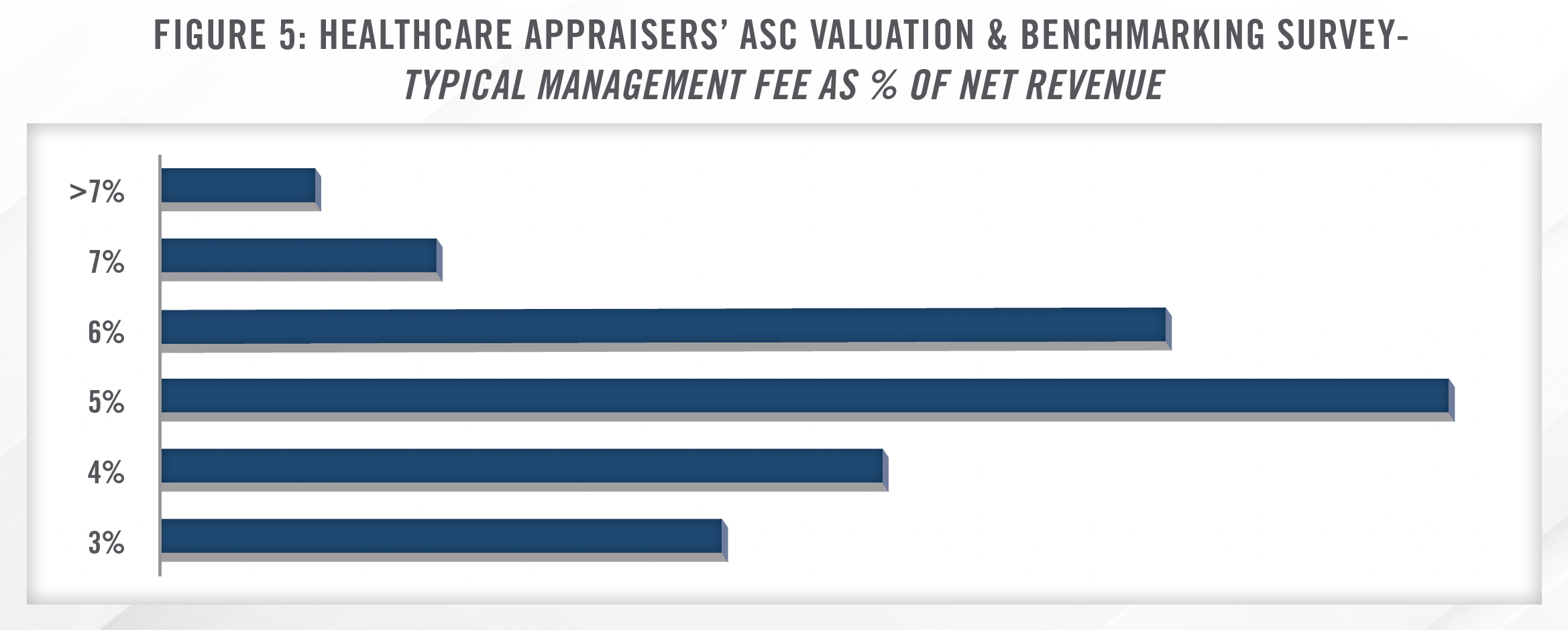

Management Fees

Relator claimed that the FMV Opinion failed to include management fee expenses in the projections even though management fees were expected to be paid post-transaction. From our experience, it is common for ASCs to pay a third-party or related party for management services. When valuing an entity that is expected to incur these expenses going forward, it is important to properly project this expense and ensure the management fees are in line with market norms. We commonly observe management fees structured as flat dollar amounts, percentage of net revenue, or another activity-based fee based on a relevant operational metric. For businesses that are expected to experience changes in revenue going forward, projecting management fees as a percentage of revenue may be preferred. However, we note that some state laws restrict management fee payments from being structured as a percentage of revenue. When utilizing a percentage of revenue, the fees could be set ahead of time based on a budget and paid as a fixed annual payment. Additionally, to ensure the projected management fees are in line with the market, benchmark data should be utilized. An appraiser can gather this data by analyzing publicly available form 990 data for management fees or utilizing third party resources such as surveys from Medical Group Management Association or HealthCare Appraisers’ most recent ASC Valuation & Benchmarking Survey, data for which is depicted in Figure 5.

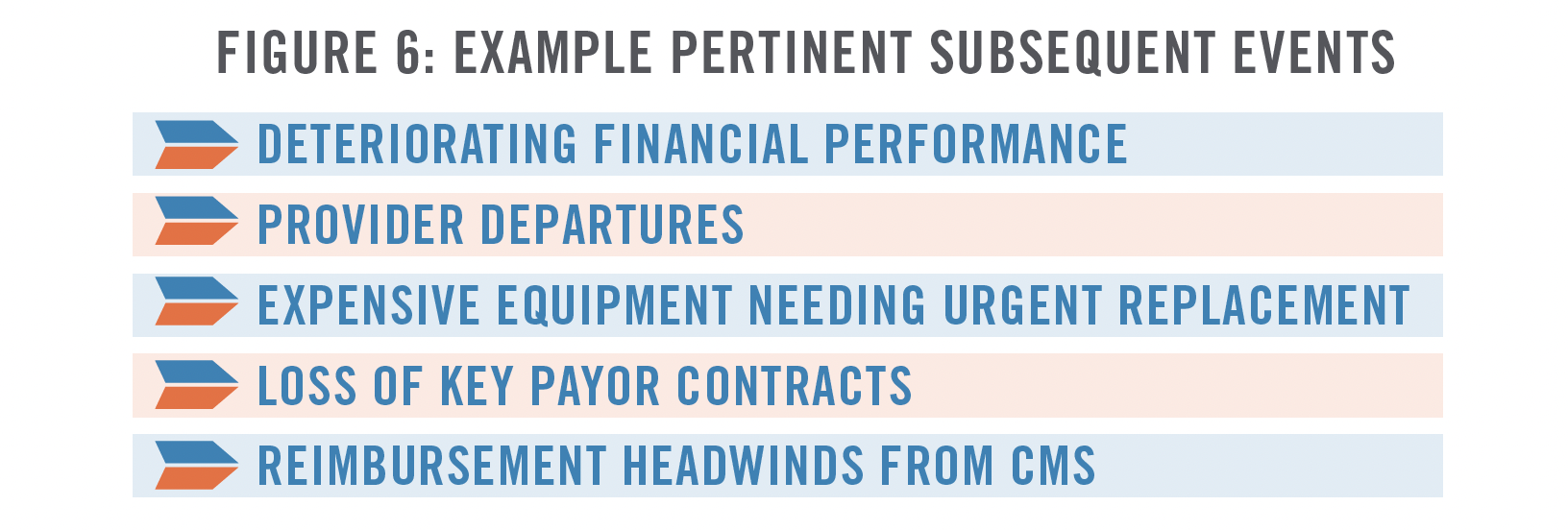

Subsequent Events Between Valuation Date and Closing Date

Another issue brought up by Relator was that the FMV Opinion utilized a valuation date of September 9, 2014 although the transaction closed on March 31, 2015. Between the valuation date and the closing date, Center had deteriorating financial performance, which was not taken into account in the FMV Opinion. From our experience, business transactions are typically a lengthy process where negotiations and revisions of purchase documents typically occur once an appraisal has been completed. Therefore, it is not uncommon for the valuation date of an appraisal to precede the actual transaction closing date. However, the parties involved in the transaction need to ensure that financial performance has not changed materially between the valuation date and the closing date. Should a situation arise wherein the target business has experienced a subsequent event and/or material changes to its financial and operational performance (or expected performance) after the valuation date, the appraiser should request the required information to update their valuation and roll the valuation date forward (see example pertinent subsequent events outlined in Figure 6). Otherwise, their opinion may not represent FMV at the transaction closing date.

Draft versus Final Version of FMV Opinion

Lastly, Relator highlighted that the FMV Opinion was in draft form and that no final version of the FMV Opinion was made available. It is important to finalize all transaction documents when a transaction closes to ensure there are no outstanding issues with the appraisal. This also creates an opportunity to ensure no subsequent events have occurred between the valuation date and transaction closing date.

![]() CONCLUSION

CONCLUSION

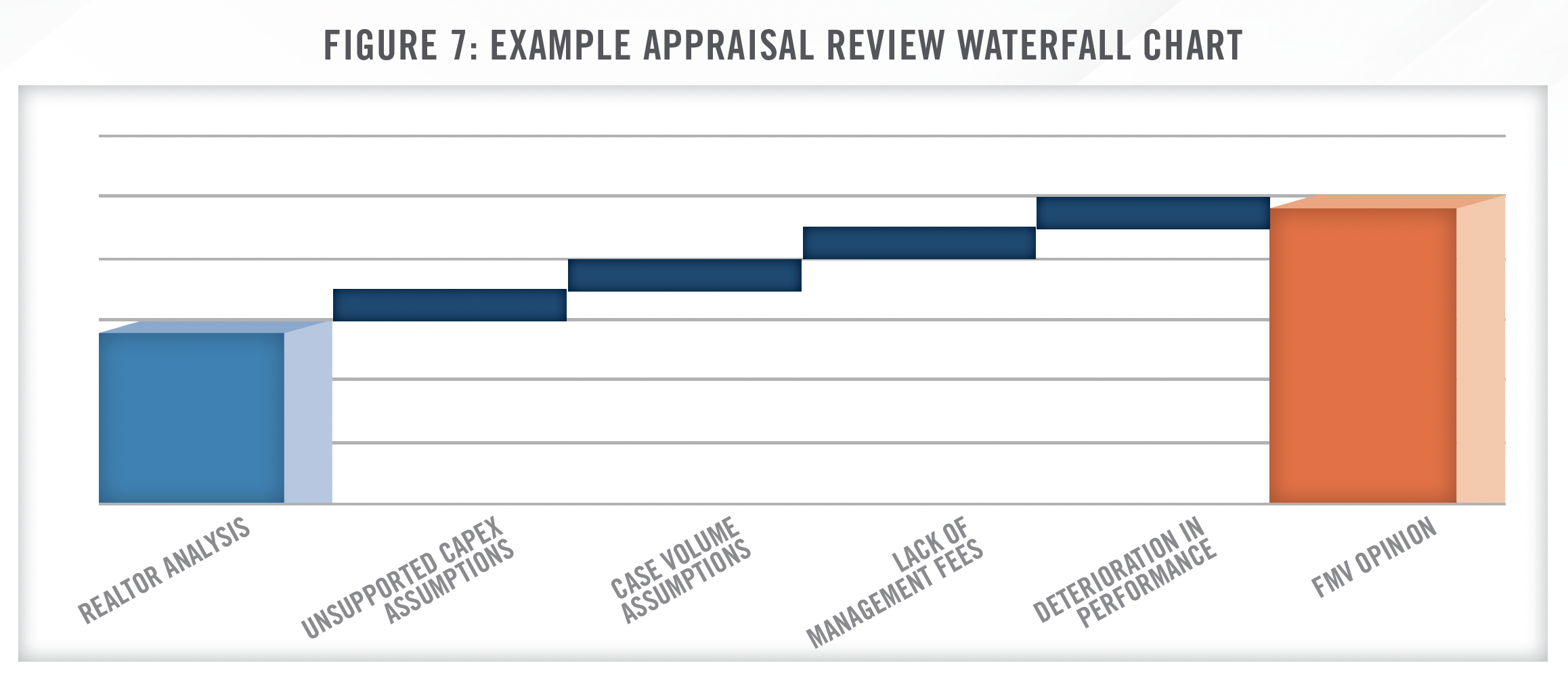

Relator highlighted many relevant pitfalls in the FMV Opinion, including unsupported capital expenditure assumptions, case volume projections that were inadequately supported, management fees not being properly accounted for, deteriorating performance between the valuation date and transaction closing date, and the FMV Opinion not being finalized. It is vital for an appraiser to ensure all assumptions utilized in an appraisal are supportable and best reflect the future operating capacity of the subject business. Failing to produce adequate support for valuation work product can create litigation risk, lead to substantial fines and penalties for the parties involved in the transaction, and tarnish the credibility and reputation of all involved (including the appraiser).

At HealthCare Appraisers, we pride ourselves in providing credible, defensible, independent appraisals in the healthcare industry through our strong knowledge off valuation and advisory issues surrounding healthcare transactions. Even if we do not provide the initial opinion of value, we regularly provide appraisal review and litigation support services to assist clients in assessing if FMV opinions can be relied upon in connection with a transaction. Figure 7 displays a graphic we commonly utilize when performing appraisal reviews. We have utilized the issues present in the FMV Opinion and how they lead to an overstatement of FMV to illustrate the sample figure.

[1] United States District Court for the District of Arizona Case, 3:18-cv-08041-DGC, https://www.govinfo. gov/content/pkg/USCOURTS-azd-3_18-cv-08041/pdf/USCOURTS-azd-3_18-cv-08041-2.pdf