Authors: Ciara A. Kerney, Hunter A. Wolfel, and Nicholas J. Janiga, ASA

![]() OVERVIEW

OVERVIEW

Over the years, HealthCare Appraisers has analyzed numerous medical transport arrangements. While it is hard to miss the warning sounds of an approaching ambulance, the fair market value (“FMV”) considerations involved in both medical transport arrangements, as well as the sale of an ambulance and/or medical transport entity, are often overlooked. The discussion herein highlights HealthCare Appraisers’ observations of common medical transport arrangements, the appraisal considerations involved in determining the FMV of an ambulance, and other nuances of such arrangements.

![]() SOUNDING THE SIRENS

SOUNDING THE SIRENS

Ambulance Swapping

In recent years, regulators increasingly sounded the sirens over ambulance “swapping” arrangements. Under an ambulance swapping arrangement, a provider of air or ground ambulance services offers its services to healthcare systems and/or facilities at a discount in exchange for the promise, implied or explicit, of more lucrative transports of patients covered by government programs such as Medicaid and Medicare. These types of transport arrangements have the potential to implicate the Physician Self- Referral Law (i.e., Stark Law) and/or Anti-Kickback Statute.

By way of example, in 2015, a nursing home operator settled with the government for over $3 million based on allegations of ambulance swapping.[1] Also in 2015, an ambulance provider settled with the government for more than $11.5 million over similar allegations.[2] More recently, four hospitals in the South paid $8.6 million to settle allegations related to the receipt of kickbacks from medical transport companies in exchange for more lucrative transport referrals. Such rulings have made the government’s stance clear – they will not hesitate to pursue both ambulance companies and the facilities they service. The rulings on these cases underscore the importance to all parties of ensuring compliance with the various state and federal laws and regulations that govern such arrangements.

As was the case with so many healthcare services arrangements, the swift spread of COVID-19 ignited the need for new federal guidance on emergency medical transportation. Around the onset of the pandemic, the Centers for Medicare and Medicaid Services (“CMS”) issued new guidance meant to serve as a call to action for hospitals complying with the Emergency Medical Treatment and Labor Act (“EMTALA”). Guidance included commentary on the implementation of emergency medical transports for Medicare beneficiaries effected by COVID-19.[3] While May 11, 2023 marked the end of the federal COVID-19 Public Health Emergency declaration, the speedy shift in emergency medical transportation regulations demonstrated by CMS during the pandemic serve as a prime example of the importance of remaining abreast of current reimbursement guidance as it relates to medical transport services.

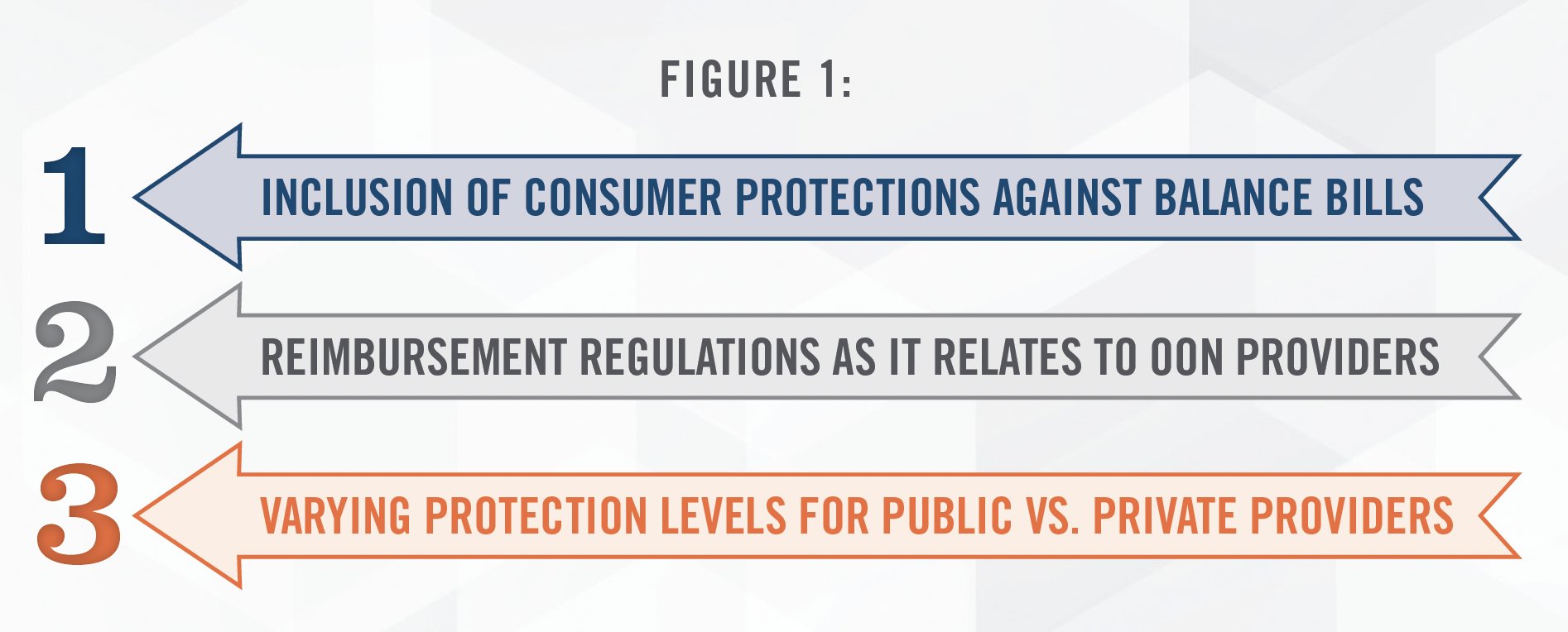

No Surprises Act

The No Surprises Act (the “Act”) was signed into law in December 2020 and went into effect on January 1, 2022. The Act was put in place to create new protections for consumers of healthcare services as it relates to receiving surprise medical bills after receiving many emergent and non-emergent services from out-of-network (“OON”) providers at in-network facilities, as well as emergency services from OON air ambulance service providers. While air ambulance services are currently covered under the Act, the guidelines currently in place do not extend to ground ambulance services. While the Act does not broadly cover ground ambulance services, certain states do currently offer a certain level of protection to consumers from surprise billing.[4] States with current protections include, but may not be limited to, Colorado, Delaware, Florida, Illinois, Maine, Maryland, New York, Ohio, Vermont, and West Virginia.[5] While such states provide some level of protection, Figure 1 outlines various categories and considerations in evaluating the varying protections offered on a state-by-state basis:

Given the often OON nature of ground ambulance services, it is certainly plausible that ground ambulance services may one day be included under the Act. In fact, according to a national study published by FAIR Health in September 2023, 59.4 percent of all ground ambulance claims[6] in 2022 were OON.[7] With the recent pushes towards price transparency, it is essential for providers and users of ambulance transport services to remain abreast of such changes and consider how quick changes in the healthcare regulatory environment have the potential to impact their current and future transport arrangements.

![]() FMV RISK CONSIDERATIONS

FMV RISK CONSIDERATIONS

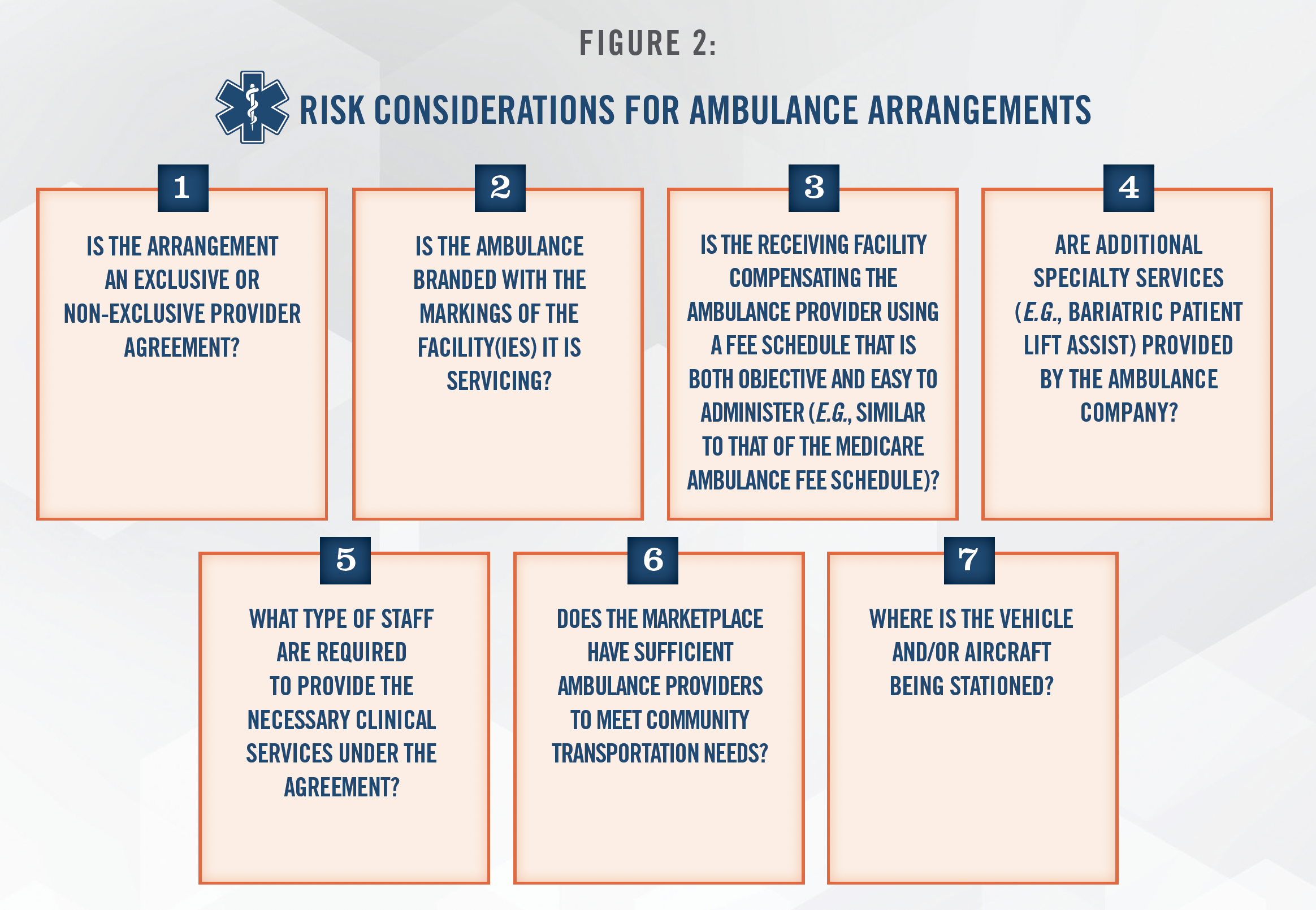

Based upon the government’s enforcement trend and in light of the spike in transports related to COVID-19 in recent years, Figure 2 outlines various risk factors to consider when evaluating the FMV compensation payable under either an air or ground ambulance transportation arrangement.

Each of the aforementioned items in Figure 2 may materially impact the FMV compensation associated with an ambulance transport arrangement. HealthCare Appraisers has the knowledge and expertise to properly consider and account for all factors of an ambulance transportation arrangement in arriving at an FMV conclusion.

![]() CROSSING STATE LINES

CROSSING STATE LINES

In addition to the aforementioned risk considerations, providers and users of ambulance transport services must also remain abreast of state-by-state restrictions related to medical transport services as controlled by the existence of state-based Certificate of Need (“CON”) programs. A CON is a formal permit issued by a state department of health or other regulatory agency that grants a company or organization the ability to provide specific healthcare services. As it relates to medical transport services, restrictions set by CON programs can vary on a state-by-state basis and can impact both intrastate and interstate transports. While the previously discussed risk considerations must be considered when entering into an ambulance transportation arrangement, CONs can add another layer of nuance in states with existing CON programs specifically impacting medical transport services.

By way of example, in 2019, an Ohio-based ambulance services business filed a federal lawsuit[8] in which they made the claim that Kentucky’s CON program arbitrarily prevents certain businesses from providing ambulance services through its restrictions on the issuance of CONs. In late 2022, a U.S. district judge ruled that such regulations were not unfairly restrictive, but rather fairly common across states that restrict new entrants into ground ambulance service areas or require a CON to operate.[9] Also noted in the ruling, within Kentucky, a CON is only required to conduct intrastate transports within the State of Kentucky and for interstate transports of Kentucky residents so long as the transports originates within Kentucky.

While this initial ruling was appealed with arguments from both sides to follow, this case serves as a prime example of the importance of remaining up to date on CON restrictions, as such restrictions can ultimately impact the ability to enter into an ambulance transport arrangement. For more information on CON programs and the factors that can influence the FMV of a CON, please refer to HealthCare Appraisers’ publication Understanding the Value of a Certificate of Need.

![]() SELLING THE FLEET – MOVING BEYOND THE BLUE BOOK

SELLING THE FLEET – MOVING BEYOND THE BLUE BOOK

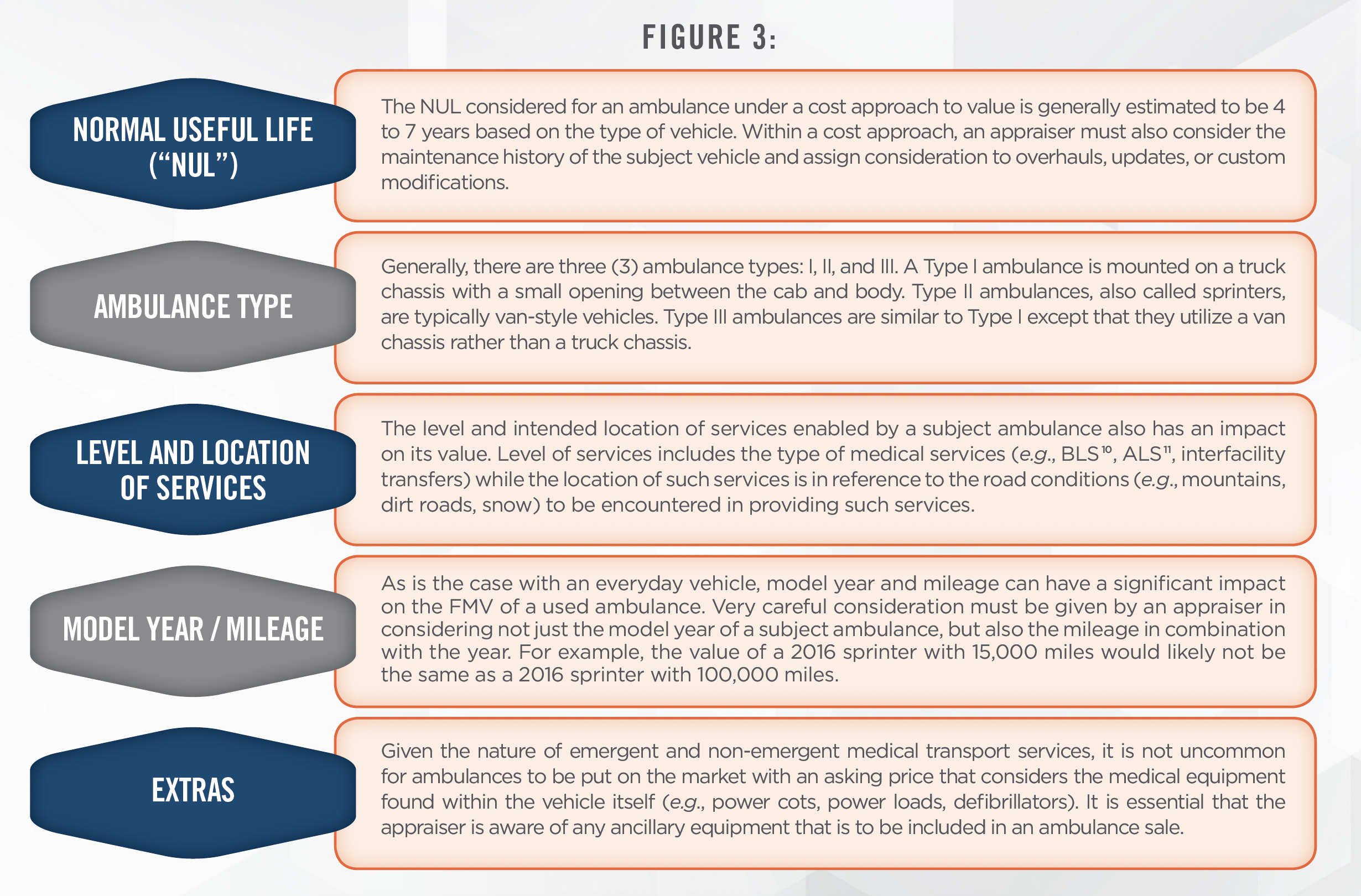

Should a healthcare organization find itself in a position to sell or buy all or part of a ground ambulance fleet, it is crucial to consider the impact an ambulance’s specifications have on its FMV. Beyond consideration of value differences related to manufacturer and model, additional considerations in valuing an ambulance include, but are not limited to, those outlined in Figure 3 below:

The value of a ground ambulance can be heavily dependent upon the considerations discussed herein. Similar to transport services arrangements, the sales of ambulances also have the potential to implicate the Physician Self-Referral Law and/or Anti-Kickback Statute.

![]() NAVIGATING AMBULANCE TRANSACTION TRENDS[12]

NAVIGATING AMBULANCE TRANSACTION TRENDS[12]

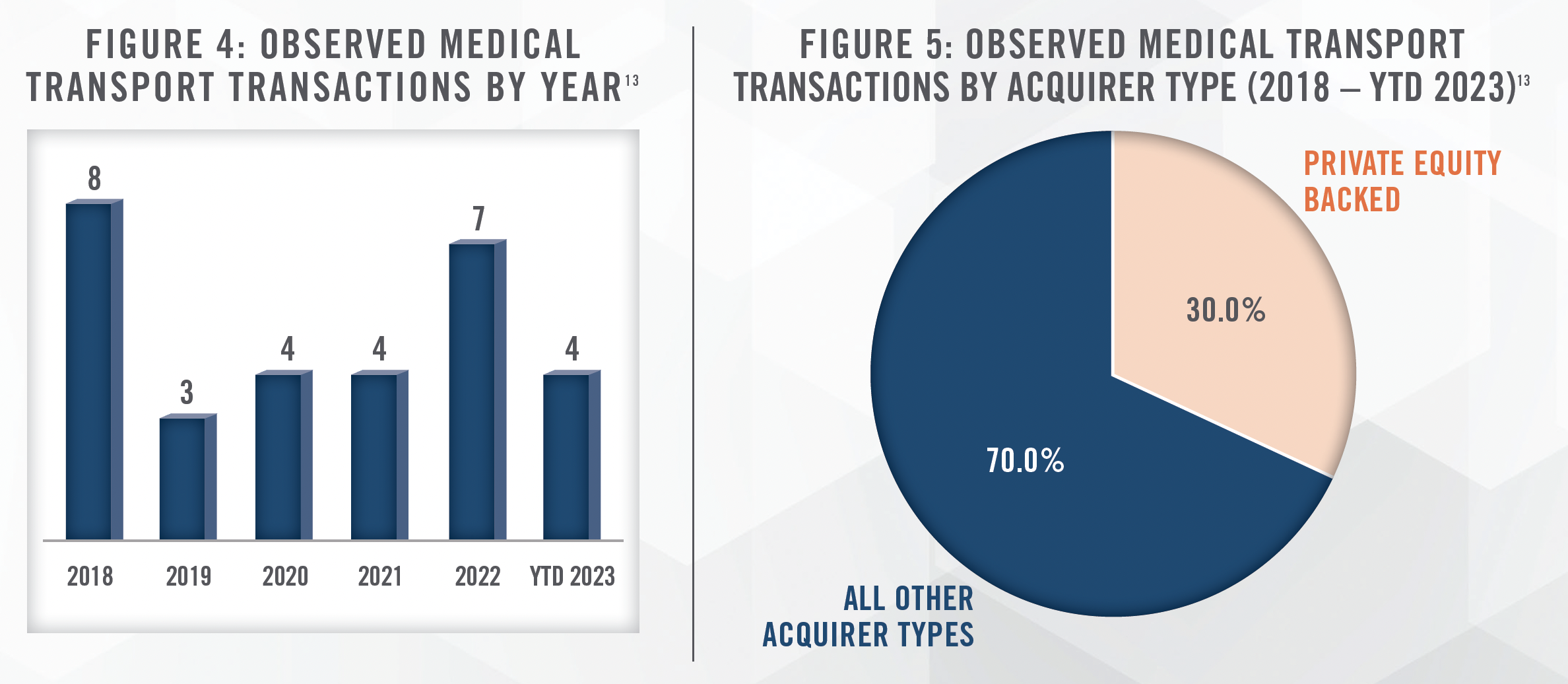

In addition to the prevalence of used ambulances sales, the medical transport industry continues to see entity transactions driven by a variety of strategic initiatives from varying market participants. In an effort to improve care coordination models, the industry has seen a recent push for the movement of medical transport services in-house. By way of example, Harrison Medical Center purchased Cynthiana, Kentucky based Brown Ambulance Service, Inc. in February 2023. Just a couple years prior, the industry also saw the acquisition of Meriden, Connecticut based transport provider Hunter’s Ambulance Service, Inc. by Hartford HealthCare Corporation in May 2021. Such acquisitions give both small, rural hospitals and large systems the opportunity to implement their own strategies to expand access to care in their communities, while ensuring patients’ choice of care site remains intact.

However, HealthCare Appraisers also observes the consolidation of medical transport companies without the involvement of local hospitals and/or systems. For example, in September 2020, while COVID hospitalizations and the need for emergency medical transport services continued to rise, Pafford Emergency Medical Services, Inc. acquired Medlife Emergency Medical Service, Inc. in order to expand services in Morehouse Parish, Louisiana. More recently, Empress Ambulance Service, Inc. acquired Hurleyville, New York based Sullivan Paramedicine, Inc. d/b/a Mobilemedic EMS in November 2022. As was the case with Empress’ acquisition of Mobilemedic, consolidations within the medical transport space often serve the purpose of assisting existing providers in their response to the needs of their growing patient populations. Such transactions also have the potential to allow providers to expand the types of services they can provide with the acquisition of new technology with advanced capabilities.

Figures 4 and 5 illustrate total annual transaction volume for the medical transport subsector between 2018 and year-to-date October 24, 2023, and provide a breakdown of such transactions by acquirer type. The data presented has been sourced from a single transaction database and is not meant to represent total medical transport transaction volume, but rather to serve as a proxy for the transaction activity in recent years.

![]() CONCLUSION

CONCLUSION

When evaluating the FMV compensation payable under ambulance transportation services arrangements, it is important to consider not only the value of the transport through applications of the market approach and/or cost approach, but all other elements of the arrangement, including, but not limited to, the level of exclusivity, marketplace factors, and use of branding. An inexperienced valuator may not know to look beyond the bumper-to-bumper of the ambulance transportation arrangement when determining FMV, thereby potentially putting an organization at risk of a swapping allegation. Before entering into an arrangement for the provision of medical transportation services, it is also necessary to have a comprehensive understanding of any state-by-state regulations regarding the provision of such services. If your organization finds itself in a position to sell all or part of its ambulance fleet, it is important to recognize the need to consider how each vehicle’s unique specifications can impact value.

HealthCare Appraisers has extensive knowledge on changes in ambulance transportation regulations, state specific medical transportation regulations, and appraisal considerations in valuing ground ambulances and medical transport companies. Professionals across HealthCare Appraisers’ business valuation, compensation valuation, and capital asset teams stand ready to assist in providing your organization with fair market value guidance across the entire spectrum of medical transport valuation needs.

For more information, please contact:

Ciara A. Kerney, Senior Associate at ckerney@hcfmv.com or (303) 628-5280

Hunter A. Wolfel, Director at hwolfel@hcfmv.com or (303) 566-3184

Nicholas J. Janiga, ASA, Partner at njaniga@hcfmv.com or (303) 566-3173

[1] George, Cindy. “Nursing home agrees to pay $3M in ambulance-swapping case.” EMS1.com, https://www.ems1.com/legal/articles/nursing-homeagrees-to-pay-3m-in-ambulance-swapping-case-KxPPvCroKDlFy7cm/. Accessed 9 August 2023.

[2] Adams, Andie. “Ambulance Companies to Pay $11.5M in “Swapping Kickback” Scheme.” NBCSanDiego.com, https://www.nbcsandiego.com/news/local/ambulance-companies-to-pay-115m-in-swapping-kickback-scheme/113875/. Accessed 9 August 2023.

[3] “Emergency Medical Treatment and Labor Act (EMTALA) Requirements and Implications Related to Coronavirus Disease 2019 (COVID-19).” CMS.gov, https://www.cms.gov/files/document/qso-20-15-emtala-requirements-and-coronavirus-0311-updated-003pdf.pdf-1. Accessed 9 August 2023.

[4] While consumer protections vary by state and ambulance company ownership structure, states with some level of balance bills protection include the following: Colorado, Delaware, Florida, Illinois, Maine, Maryland, New York, Ohio, Vermont, and West Virginia.

[5] “No Surprises Act Considerations for Ground Ambulance Billing.” MossAdams.com, https://www.mossadams.com/articles/2022/08/no-surprisesact-for-ground-ambulance-billing. Accessed 2 October 2023.

[6] Based on national study of billions of private healthcare claims from FAIR Health’s repository

[7] A Window into Utilization and Cost of Ground Ambulance Services, FAIR Health, Inc., September 2023.

[8] PHILLIP TUESDELL and LEGACY MEDICAL TRANSPORT, LLC, v. ADAM MEIER, in his official capacity as Secretary of the Kentucky Cabinet for Health and Family Services; KRISTI PUTNAM and TIMOTHY FEELEY, in their official capacities as Deputy Secretaries of the Kentucky Cabinet for Health and Family Services; and STEVEN DAVIS in his official capacity as Inspector General of the Kentucky Cabinet for Health and Family Services

[9] Such states include: Arizona, Arkansas, California, Connecticut, Florida, Hawaii, Illinois, Louisiana, Massachusetts, Nevada, New Mexico, New York, North Carolina, Ohio, Oklahoma, Oregon, Texas, Utah, Washington

[10] Basic Life Support (i.e., BLS)

[11] Advanced Life Support (i.e., ALS)

[12] Transaction data sourced from S&P Capital IQ

[13] LevinPro HC, Levin Associates, 2023, October, levinassociates.com