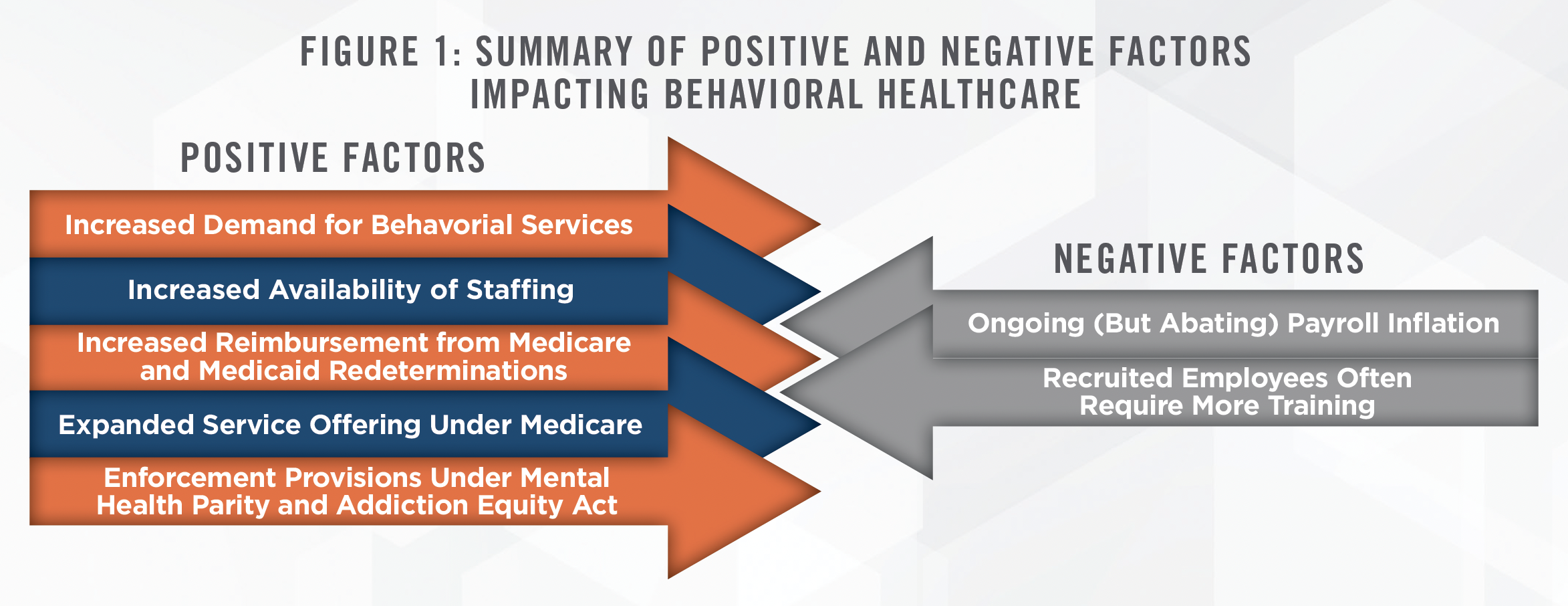

The behavioral health sector has faced numerous challenges, both historically and during the COVID-19 pandemic, but long sought relief may finally be arriving. From recent conference calls[1] for public behavioral health operators (Universal Health Services (“UHS”) and Acadia Healthcare (“ACHC”) reporting in late July 2023, we note many key trends and observations which are expected to impact the sector, summarized in Figure 1. On balance, these developments are expected to favorably impact the fair market value of behavioral health businesses as well as provider compensation.

![]() ABATEMENT OF COVID-19’S EFFECTS

ABATEMENT OF COVID-19’S EFFECTS

While providers benefited from governmental stimulus and other financial measures, the pandemic caused significant hardships in retaining adequate levels of staffing (primarily nursing) to otherwise operate at capacity. Behavioral healthcare was particularly hampered in this regard. However, UHS indicated on its call that many nurses were finally returning to their pre-pandemic employment, as the lure of premium pay from travel positions has dissipated. UHS also indicated that wage inflation persists above pre-pandemic levels, and that new employees often require more training in behavioral health, temporarily straining payroll budgets. Nonetheless, the ability to hire clinical staff (albeit at higher costs) is allowing providers to take on additional patient volume, negating the increased expense.

![]() MEDICAID REDETERMINATIONS

MEDICAID REDETERMINATIONS

The end of the COVID-19 emergency declaration also brought the beginning of Medicaid redeterminations. The behavioral healthcare industry is relatively more reliant on Medicaid than medical healthcare[2], causing industry observers to speculate that the loss of Medicaid coverage would prove to be a headwind going forward. Although each state’s Medicaid program may follow a different timeline for redeterminations, UHS indicated on its call that no net negative effects have yet occurred. On the contrary, many disenrolled patients are obtaining commercial coverage under employer-based or exchange plans, yielding a net benefit to providers on balance. Given the existing capacity constraints, we expect any continuation of this trend to boost revenue metrics for providers throughout the year. ACHC’s call was more neutral, stating simply that there has not been a net negative effect to date. Many Medicaid patients who are eligible to remain enrolled are finding assistance from both UHS and ACHC, as both providers are actively working with affected patients to ensure continuity of coverage where able.

![]() INCREASED MENTAL HEALTH SERVICES UTILIZATION

INCREASED MENTAL HEALTH SERVICES UTILIZATION

UnitedHealth Group Inc. (“UNH”), a major commercial payor, indicated during its most recent earnings call that utilization of mental health services spiked in the recent quarter by double-digit percentages.[3] Most industry experts agree that demand for mental health services has increased in recent years due to public recognition of the benefits of such services, as well as lessened perceived stigmas. UNH’s timing to highlight this particular statistic happens to coincide with the federal government’s recent announcement of increased enforcement efforts related to the Mental Health Parity and Addiction Equity Act (discussed further herein). Nonetheless, the increased demand for mental health services bodes well for behavioral health providers, even as capacity continues to be limited.

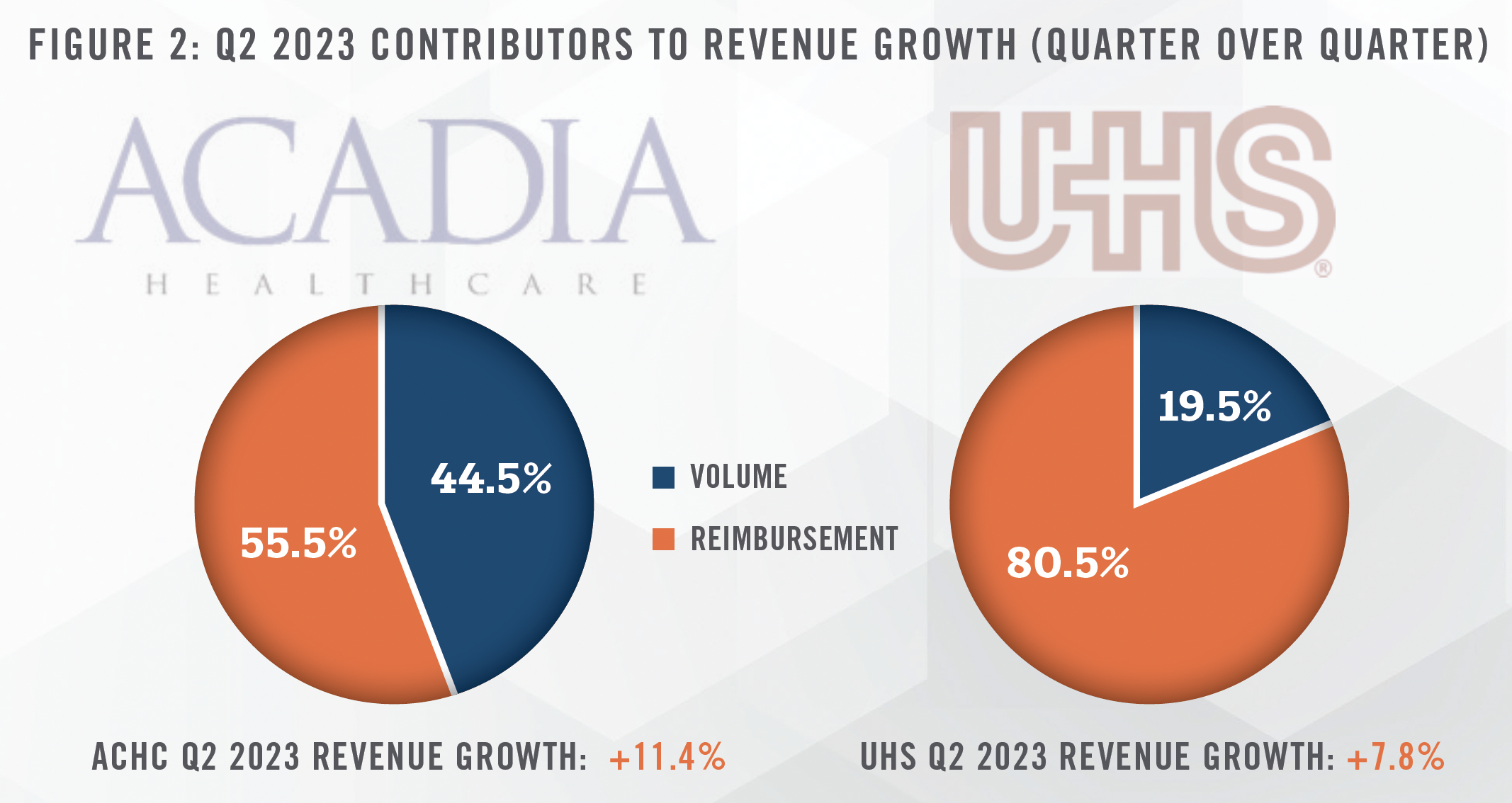

Both UHS and ACHC indicated positive same-facility growth in Q2 2023. In both cases, over half of this revenue growth is attributable to increases in reimbursement. ACHC specifically identifies support from favorable payor rate increases as this reimbursement growth factor. However, given prior commentary in past quarters, UHS indicated that it continues to renegotiate or terminate poorer-paying contracts. Figure 2 compares the sources of same-facility revenue growth in Q2 2023.

![]() FEDERAL REGULATIONS – MEDICARE PHYSICIAN FEE SCHEDULE 2024: PROPOSED RULE

FEDERAL REGULATIONS – MEDICARE PHYSICIAN FEE SCHEDULE 2024: PROPOSED RULE

The Centers for Medicare and Medicaid (“Medicare”) announced its proposed rule for the Medicare Physician Fee Schedule in 2024. Of particular note, Medicare intends to cover intensive outpatient programs (“IOPs”) for Medicare patients, increasing the spectrum of care afforded to beneficiaries.[4] Particularly, substance use disorder patients will now have an “in-between” option between inpatient hospitalization and outpatient therapy to better manage their care. Additionally, Medicare will allow a variety of counselors, including mental health and substance use disorder counselors, to enroll in Medicare beginning in 2024. The changes in IOP and extended counselors, for addiction medicine, are estimated to increase Medicare spending by $994 million annually by some estimates.[5] Existing providers may find expanding the spectrum of available care to their behavioral patients will afford greater opportunity to serve patients through an extended cycle of behavioral healthcare.[6] Under the proposed rule, Medicare also intends to increase reimbursement to psychiatrists and psychologists by 3 percent in non-facility settings, exceeding reimbursement growth (or more frequently, declines) expected by other specialties.[7]

![]() FEDERAL REGULATIONS – MENTAL HEALTH PARITY AND ADDICTION EQUITY ACT ENFORCEMENT

FEDERAL REGULATIONS – MENTAL HEALTH PARITY AND ADDICTION EQUITY ACT ENFORCEMENT

President Biden also announced new enforcement provisions under the Mental Health Parity and Addiction Equity Act (the “Act”) designed to ensure greater equity between medical care and behavioral healthcare.[8] Although originally enacted in 2008, the Act has not generally had the desired effect of bridging the disparity in medical and behavioral healthcare. Provider networks are often criticized for continued failings, such as being too small, at full capacity given the size of the beneficiary pool, requiring excessive preauthorization, and providing inadequate reimbursement. These failings are consequences of loopholes in the Act or insufficient penalties. Under the Act, payors are expected to report outcome-driven analytics demonstrating comparable behavioral health to medical health outcomes, to abstain from providing narrower networks of behavioral healthcare versus medical care, and to expand coverage to certain insured populations. These new provisions will generally put the onus on payors to demonstrate equitable coverage between medical and behavioral healthcare, which is widely not believed to have yet been achieved. With no slowdown in demand, these new enforcement measures will benefit behavioral health providers as payors seek to strengthen such provider networks for their beneficiaries. However, payors will face a considerable challenge in bolstering networks in the face of constrained supply of services. Given this imbalance in demand and supply, we believe the fair market value of behavioral health provider compensation is expected to outpace growth in broader healthcare provider compensation levels.

![]() JOINT VENTURES

JOINT VENTURES

Although certainly not limited to the behavioral healthcare sector, providers such as UHS and ACHC are increasingly seeking out joint venture projects by partnering with healthcare systems, particularly in the inpatient, intensive outpatient programs, and specialty-driven facilities (e.g., child & adolescent or geriatric facilities). Such joint ventures can combine the expertise of operators with underutilized (but valuable) assets, such as certificates of need or high-demand service lines. As of this writing, ACHC most recently announced a joint venture with Nebraska Methodist Health System to develop a freestanding behavioral health hospital in the Omaha market.[9] Similarly, UHS has opened a specialty behavioral hospital in collaboration with Valley Children’s Healthcare in Madera, California.[10] We expect these types of ventures to continue for the foreseeable future.

![]() CONCLUSION

CONCLUSION

The behavioral healthcare sector has long played a secondary role within healthcare from the perspective of payors and Medicare. The COVID-19 pandemic imposed additional burdens on behavioral healthcare providers, ranging from decreased patient volumes to difficulties in staffing and maintaining capacity. However, relief appears on the horizon in obtaining ample staff to resume normalized capacity. In our view, broad-based demographic factors of increasing demand and constrained capacity, combined with new federal regulations and enforcement actions to ensure parity, are likely to support strong reimbursement gains for the sector’s foreseeable future, favorably impacting behavioral healthcare business valuations. Additionally, pressure from federal regulations on payors competing to secure limited provider resources is expected to result in increased market levels of compensation for behavioral healthcare providers.

[1] Universal Health Services, Inc. Q2 2023 Earnings Conference Call July 26, 2023; Acadia Healthcare Company, Inc. Q2 2023 Earnings Conference Call July 28, 2023

[2] Centers for Medicare and Medicaid. Last accessed July 27, 2023 from: https://www.medicaid.gov/medicaid/benefits/behavioral-health-services/index.html

[3] UnitedHealth Group Inc., Q2 2023 Earnings Conference Call July 14, 2023

[4] Centers for Medicare and Medicaid, Fact Sheet. Last accessed July 27, 2023 from: https://www.cms.gov/newsroom/fact-sheets/calendar-yearcy- 2024-medicare-physician-fee-schedule-proposed-rule

[5] Legal Action Center, “The Cost of Adding Substance Use Disorder Services and Professionals to Medicare.” August 2022. Last accessed on July 31, 2023 from: https://www.lac.org/assets/files/LAC_Medicare_Budget_Impact_Report_08_08_2022-submitted.pdf

[6] ACHC also discussed its recent acquisition of Turning Point Centers, citing its accretive value in its ability to allow for a comprehensive spectrum of care in the Salt Lake City market.

[7] Centers for Medicare and Medicaid, Calendar Year 2024 Medicare Physician Fee Schedule Proposed Rule. Last accessed July 27, 2023 from: https://public-inspection.federalregister.gov/2023-14624.pdf

[8] https://www.whitehouse.gov/briefing-room/statements-releases/2023/07/25/fact-sheet-biden-harris-administration-takes-action-to-make-iteasier-to-access-in-network-mental-health-care/

[9] Businesswire, “Acadia Healthcare Forms Joint Venture Partnership With Nebraska Methodist Health System”. July 24, 2023 10 “River Vista Behavioral Health Hosts Ribbon Cutting Ceremony.” Last accessed August 1, 2023 from: https://uhs.com/river-vistabehavioral-health-hosts-ribbon-cutting-ceremony/