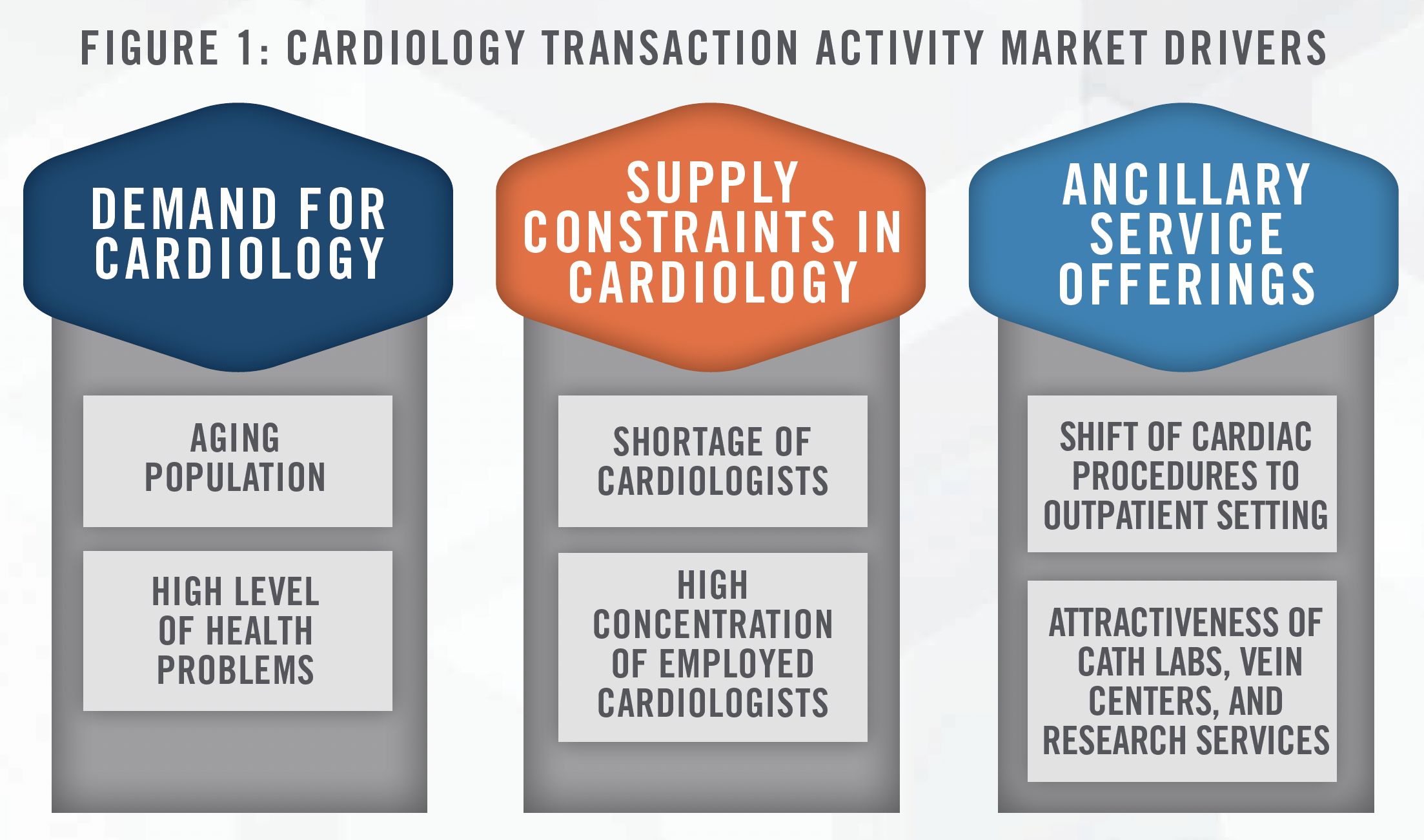

The cardiology sector has experienced a surge in transaction activity in recent years, with the main buy-side participants being private equity-backed physician practice managers (“PPMs”) and health systems. This article discusses the key drivers to transaction activity in the cardiology sector (outlined in Figure 1), provides insight into the current transaction environment, and outlines the value propositions that different buyers bring to a transaction.

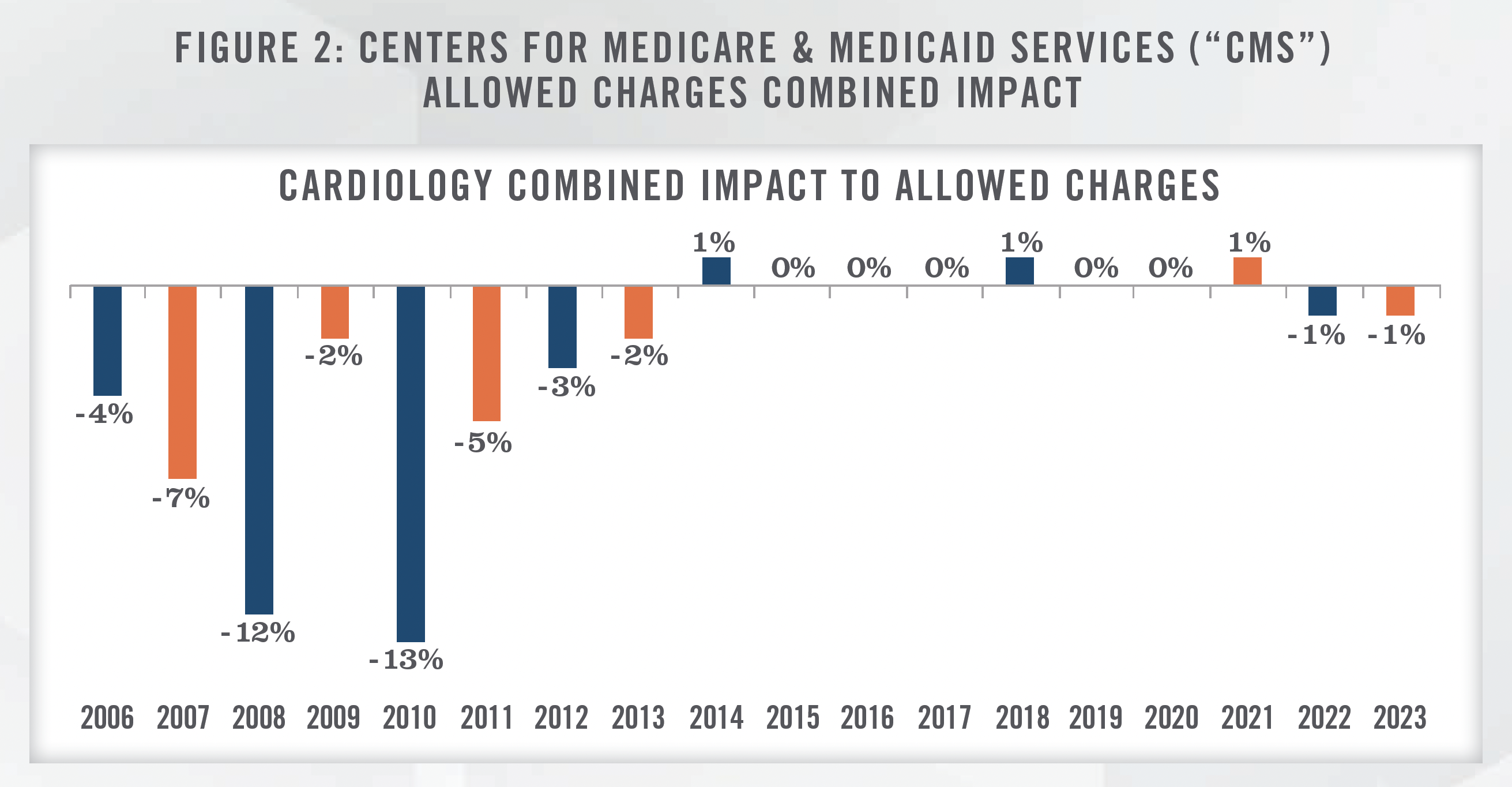

The popularity of transaction activity in the cardiology space is not unprecedented, as we observed numerous cardiology acquisitions occurring between 2008 and 2012. The Deficit Reduction Act of 2005, which resulted in in-office ancillary cuts to Medicare reimbursement for cardiologists (illustrated in Figure 2), helped fuel a surge in health systems acquiring cardiology practices.

The pressures of the Patient Protection and Affordable Care Act of 2010 continued fueling the trend of cardiology group and hospital alignment. Based on survey data gathered by the Medical Group Management Association (“MGMA”) for the four major cardiology specialties,[1] just under 15 percent of physician respondents were from hospital owned entities in 2006, compared to approximately 86 percent in 2022. Coupled with this trend, compensation for cardiologists as tracked by the same MGMA surveys has increased by an average compound annual growth rate[2] of approximately 2.4 percent from 2006 to 2022.

Supply and Demand in Cardiology

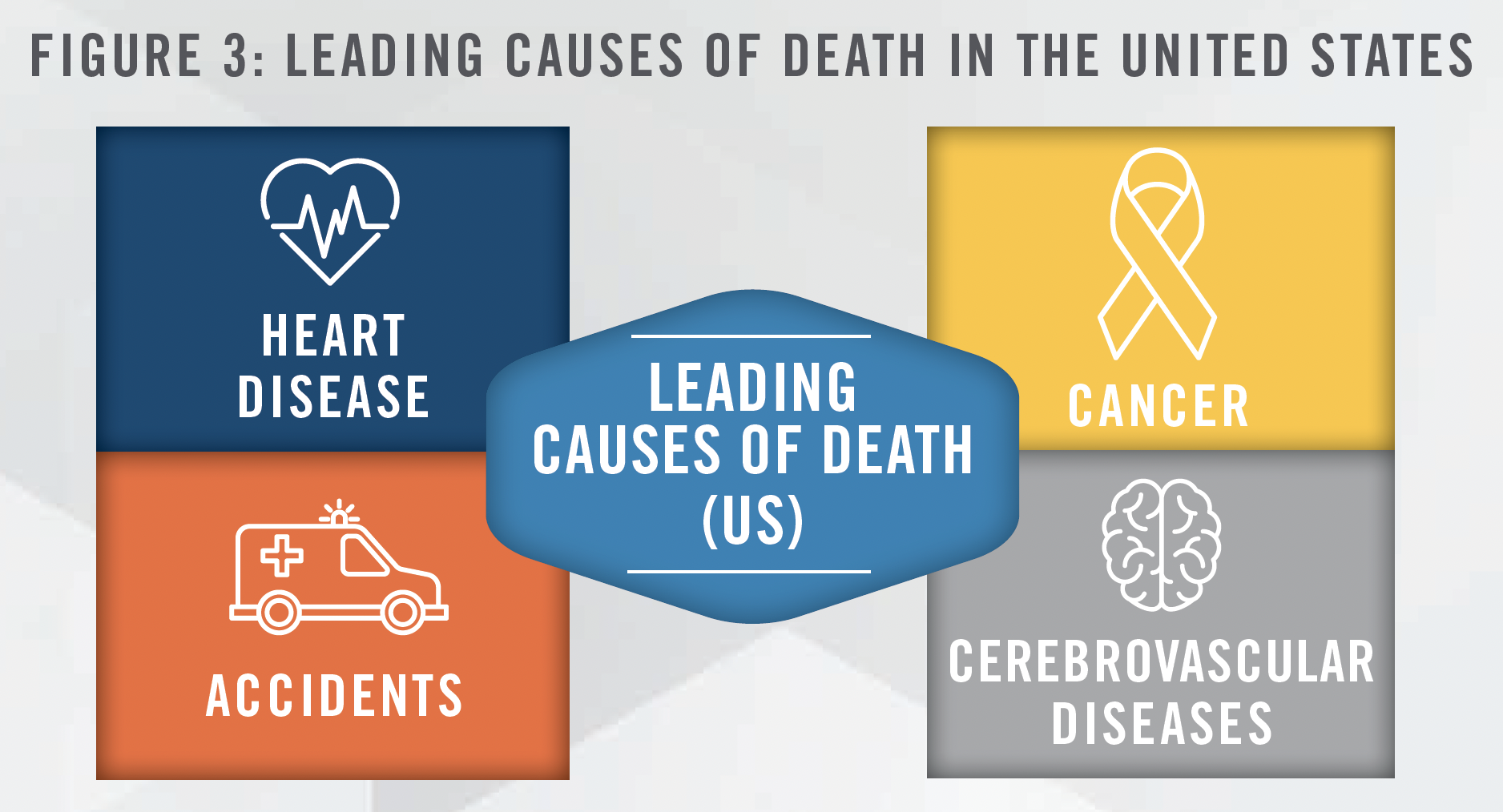

According to the U.S. Census Bureau, as of July 2022, over 55 million Americans were 65 years of age or older, which equates to approximately 17 percent of the U.S. population.[3] The aging population is expected to continue to grow in the coming years with the Administration for Community Living projecting Americans aged 65 or older to surpass 94 million by 2060.[4] Combined with the current size and expected growth of the aging population in the U.S., a high proportion of adults in the U.S. have significant health problems. The Harvard School of Public Health states that approximately two in every three adults in the U.S. are considered overweight or obese.[5] Additionally, the leading cause of death in the U.S. is attributable to heart disease,[6] with recent studies indicating that only approximately 7 percent of Americans have optimal heart health.[7] Given these factors, demand for cardiology procedures is expected to rise in the near future as more adults require cardiac care.

Coupled with the high expected demand for cardiology services is a fear across the U.S. surrounding a constrained supply of cardiologists. The chair of the American College of Cardiology stated in 2022 that “there is a shortage of cardiologists, and [the shortage] is only going to get worse.” Additionally, the chair noted that just over 26 percent of cardiologists are over the age of 61 and that the number of cardiologists finishing training is merely a fraction of the number of cardiologists planning to retire over the next decade.[8] Additionally, the vast majority of cardiologists are employed by health systems across the U.S., with just over 67 percent of cardiologists employed by health systems as tracked by the Physicians Advocacy Institute from 2019 through 2021.[9]

These factors foreshadow a future in America where demand for cardiology outpaces the supply of cardiologists, which, in turn, has influenced a spike in cardiology transaction activity recently as entities work to secure cardiologists to take advantage of this expected increase in demand.

The Rise of Outpatient Procedures and Other Ancillaries

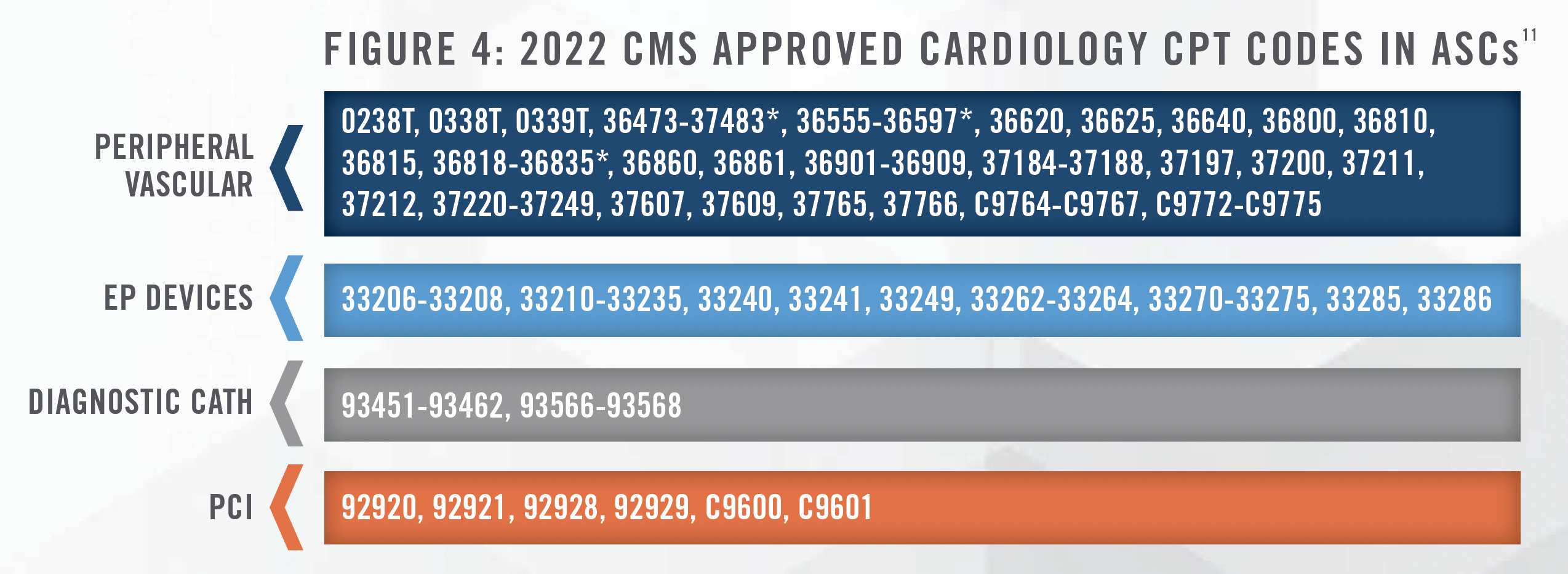

In 1982, CMS approved its first procedures for the ambulatory surgery center (“ASC”) setting, with the approved list of procedures expanding to over 2,000 by 1995.[10] To this day, CMS continues to approve new procedures to be performed in ASCs. These CMS initiatives have created strong tailwinds for cardiology in recent years, most notably with the approval of PCI stenting in ASC settings in 2020. Figure 4 displays CMS approved cardiology CPT Codes for the ASC setting in 2022.

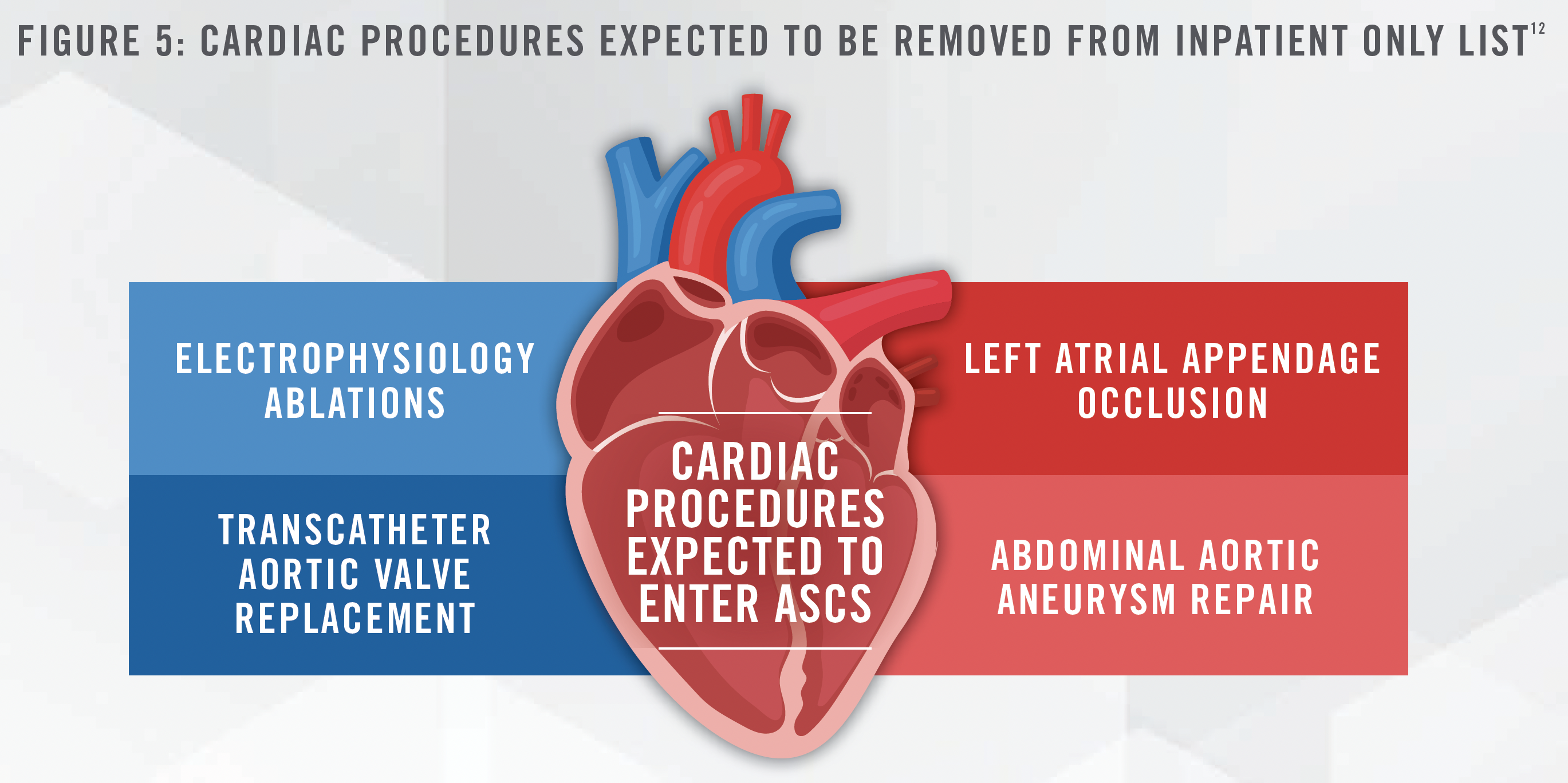

Cardiologists expect this tailwind to continue to be strong, with multiple procedures expected to be approved in the ASC setting over the next few years, as highlighted in Figure 5:

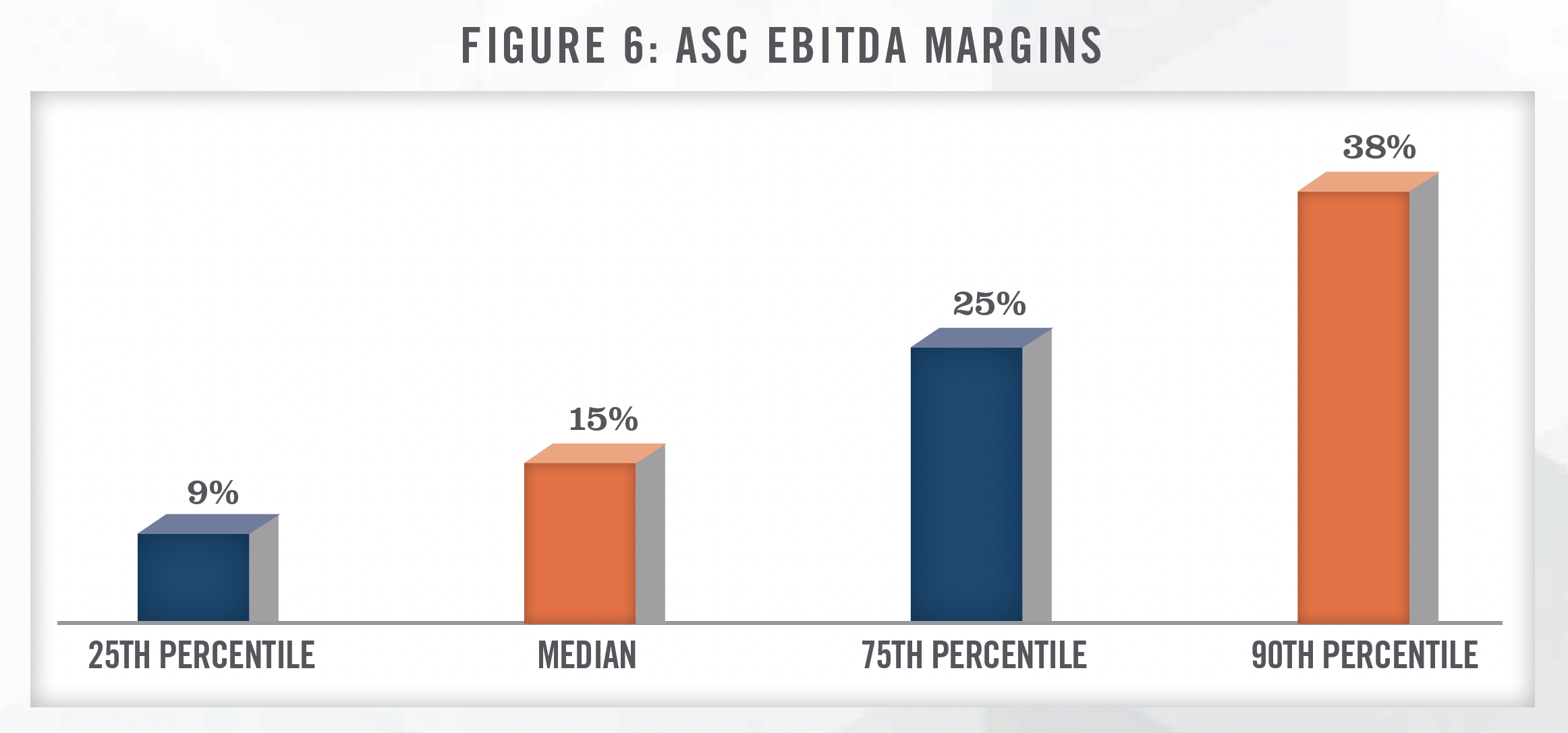

Additionally, J. Eric Evans, the CEO and Director of Surgery Partners, Inc. (NASDAQ: SGRY), stated in the company’s quarterly earnings call on March 1, 2023 that, “we are preparing for the next wave of cardiac procedures that we expect to migrate to outpatient settings starting in earnest over the next five years.”[13] We also note from our experience working with various ASCs that these cases tend to generate high profitability and can boost an ASC’s overall financial performance. Figure 6 depicts EBITDA margins for ASCs based on HealthCare Appraisers’ 2021 ASC Valuation and Benchmarking Survey.

Overall, the current and expected growth in cardiac procedures shifting from hospitals to ASCs is a key driver that has helped bolster transaction activity in cardiology.

Office-Based Ancillaries

Another common ancillary service many cardiology groups provide are various cardiac imaging services (i.e., EKGs/ECGs, CT/PET scans, MRIs, etc.) as well as cardiac catheterization to confirm these imaging results. The provision of cardiac imaging and catheterization is vital for both the diagnosis and maintenance of various cardiovascular diseases. These services are typically performed in office-based labs or cath labs (“OBLs”), which can be built as extensions of a physician’s office or in a hybrid model with an ASC. Under the hybrid model, a physician group will operate the facility as an OBL certain days of the week and as an ASC on the remaining days. Operating an OBL brings similar benefits as an ASC by improving the efficiency and quality of care provided by the cardiology group. Additionally, the provision of imaging and catheterization services through an OBL is viewed as a major positive by patients as they are able to seek all of their cardiac care from one provider as opposed to having to be referred to a secondary provider.

Vein Clinics

We have also witnessed many cardiology practices that operate vein clinics, which are setup to provide treatments for conditions such as varicose and spider veins. Whether cosmetic or medically necessary, offering vein ablation services can result in both conveniences for patients, as well additional revenue streams to a cardiology practice. Although there will be certain incremental direct expenses, such as staffing and supply related expenses associated with operating a vein ablation service line, practices may be able to leverage indirect expenses that are more fixed in nature, such as administrative support and occupancy expenses, to yield favorable contribution margins of this service line to the overall financial performance of the practices.

Cardiology Clinical Research

We have observed several cardiology groups engaged in clinical research activities coordinated through their practices. These clinical research activities involve working with a study sponsor (typically large pharmaceutical firms) who relies on the cardiology group to provide the requisite clinical care related to the study. Given the voluntary nature of clinical research, clinical research service lines often vary in size. While clinical research service lines will have certain direct expenses that are incremental in nature, such as payroll expenses associated with a clinical research director and coordinator and principal investigator fees, the leveraging of other indirect fixed expenses (as described in the preceding paragraph on vein clinics), can result in a clinical research service line that provides positive financial benefit to a practice. While the research service lines are many times a smaller component of the larger medical practice operations, these services can have other indirect positive impacts on a medical group, including strengthened reputation in both the local and national market.

Bundled Payments

Another major benefit of having various ancillary service offerings is the ability to bundle pricing with payors, which has been a push by CMS and many private payors that has gained traction in recent years. Under a bundled payment model, CMS and private insurers pay providers for the entirety of care provided to a patient for a medical event as opposed to payments for each individual component. In addition to the bundled payment model, CMS and private insurers have started to develop reimbursement plans where payment is made for total lives managed versus paying for each service provided (i.e., a capitation model). Both of these payment models are considered value-based care (further discussed below) and the end goal is to drive down costs and motivate providers to efficiently coordinate care while reducing the amount of duplicative tests and treatments. Cardiology groups that have the ability to provide ancillary services to patients are in the best position to transition to these value-based payment models.

Value-Based Care

As the healthcare sector continues to move to value-based enterprises and value-based care initiatives, cardiology is an area that that is poised for opportunity in this arena. An example initiative summarized on the CMS Innovation Center website is the “Million Hearts” initiative – an initiative co-led by CMS and the CDC. The Million Hearts initiative is described as one to “drive adoption and use of a focused set of high impact clinical quality measures for the ABCS (Aspirin when appropriate, Blood pressure control, Cholesterol management, and Smoking cessation) and align these measures across public and private national programs.” The ABCS and secondary Million Hearts measures can be found in the CMS Quality Payment Program (QPP) throughout both the Merit-based Incentive Payment System, including the Cardiology, Family Medicine, and Internal Medicine specialty measures groups, and in some Advanced Payment Models like the Comprehensive Primary Care Plus initiative. In addition to their presence in the above-listed measure initiatives, these clinical quality measures can be found throughout other public systems such as the Health Resources and Service Administration Uniform Data System, the CMS Shared Savings Program, and the CMS Transforming Clinical Practices Initiative.[14]

As the patient base in the cardiology sector typically is comprised of a large number of Medicare beneficiaries, this fact may bode well for the future of cardiology-focused, value-based initiatives put forth by CMS.

Transaction Environment in Cardiology

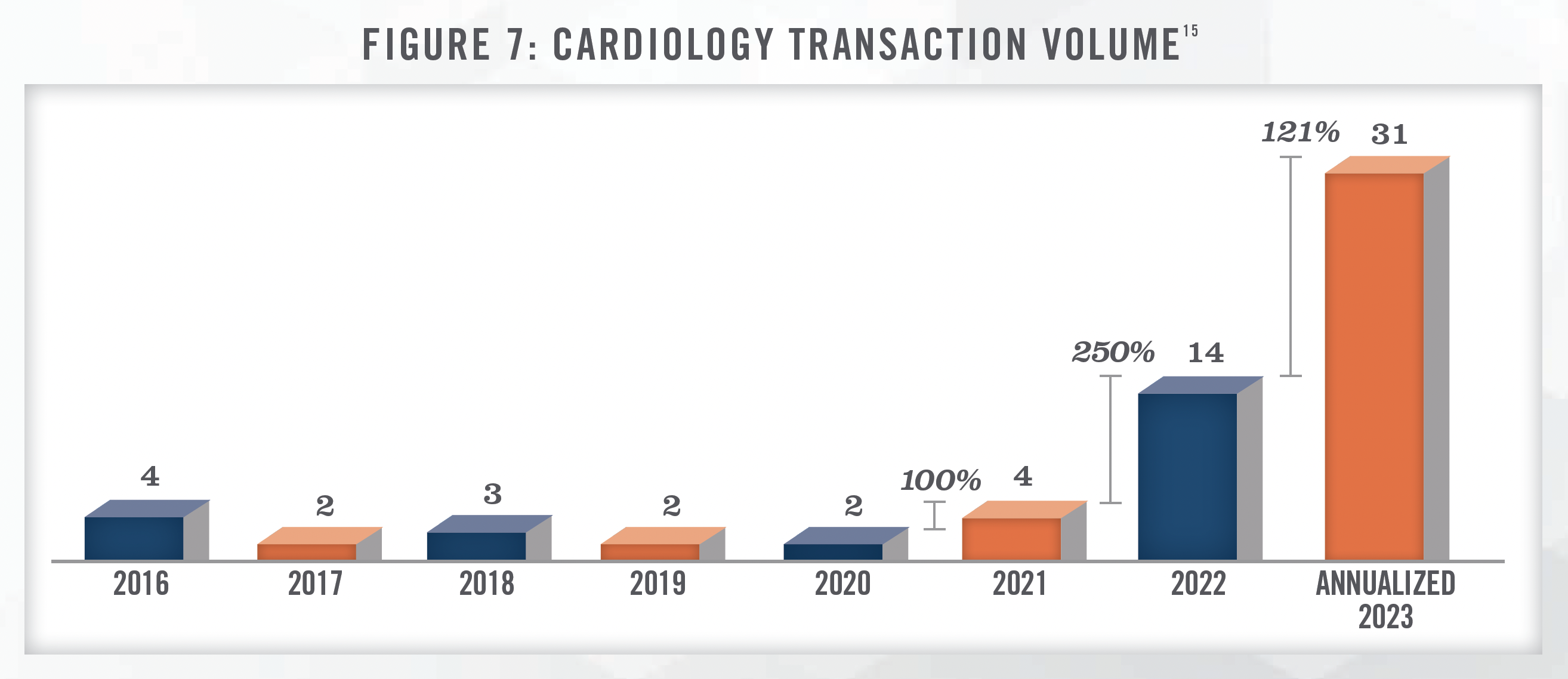

The highlighted drivers have fueled great interest in the cardiology space. Figure 7 illustrates annual transaction volume for cardiology in the United States from 2016 to 2023. We note that the data presented has been sourced from a single transaction database and is not meant to represent total cardiology transaction volume, but serve as a proxy for the increased transaction activity. We note that most cardiology transactions are private and not publicly disclosed.

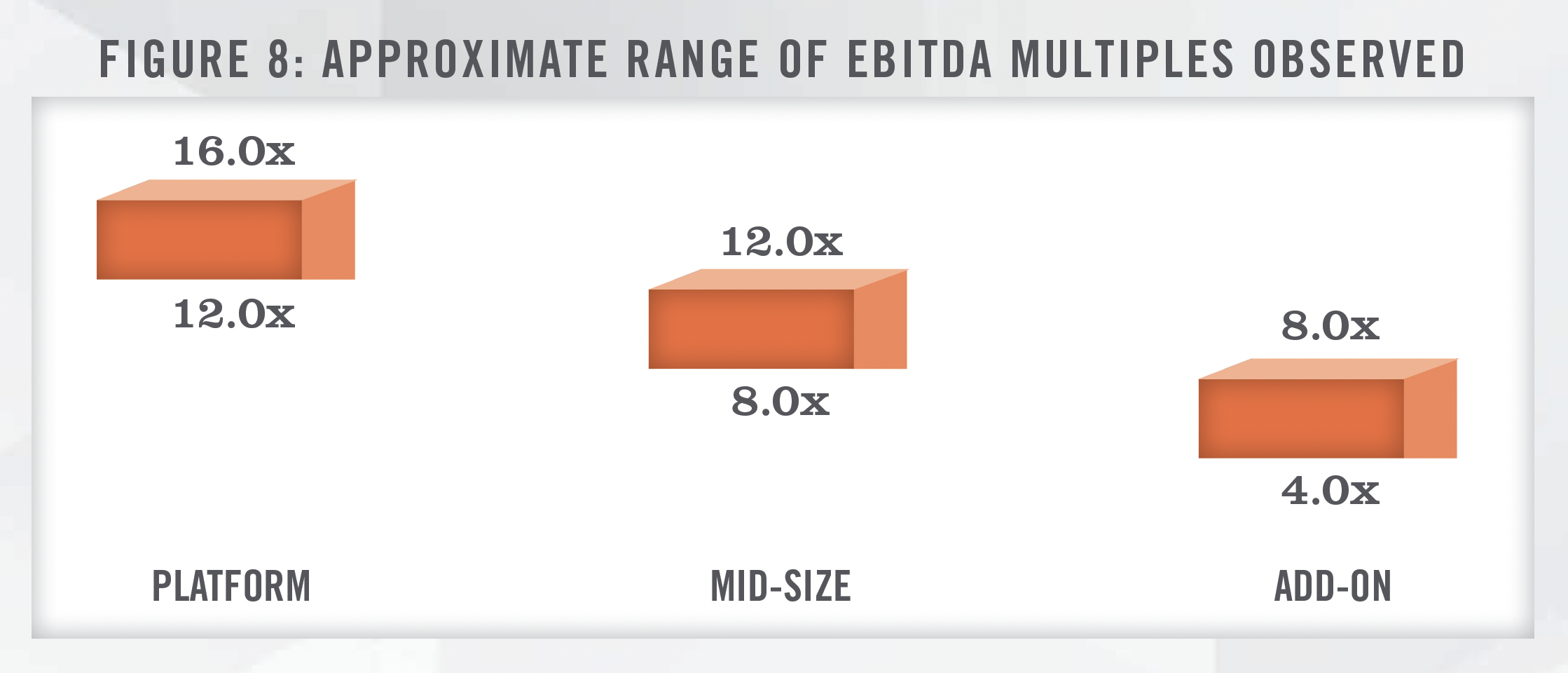

In addition to the transaction activity illustrated in Figure 7, the authors have had numerous conversations with PPMs and investment banks regarding cardiology investment activity in recent years. From the authors’ conversations, PPMs bid off adjusted EBITDA with multiples ranging anywhere from 8.0x up to 18.0x depending on the size and productivity of the groups as well as the types of ancillary services that are offered. Figure 8 presents the approximate range of valuation multiples for various types of transactions.

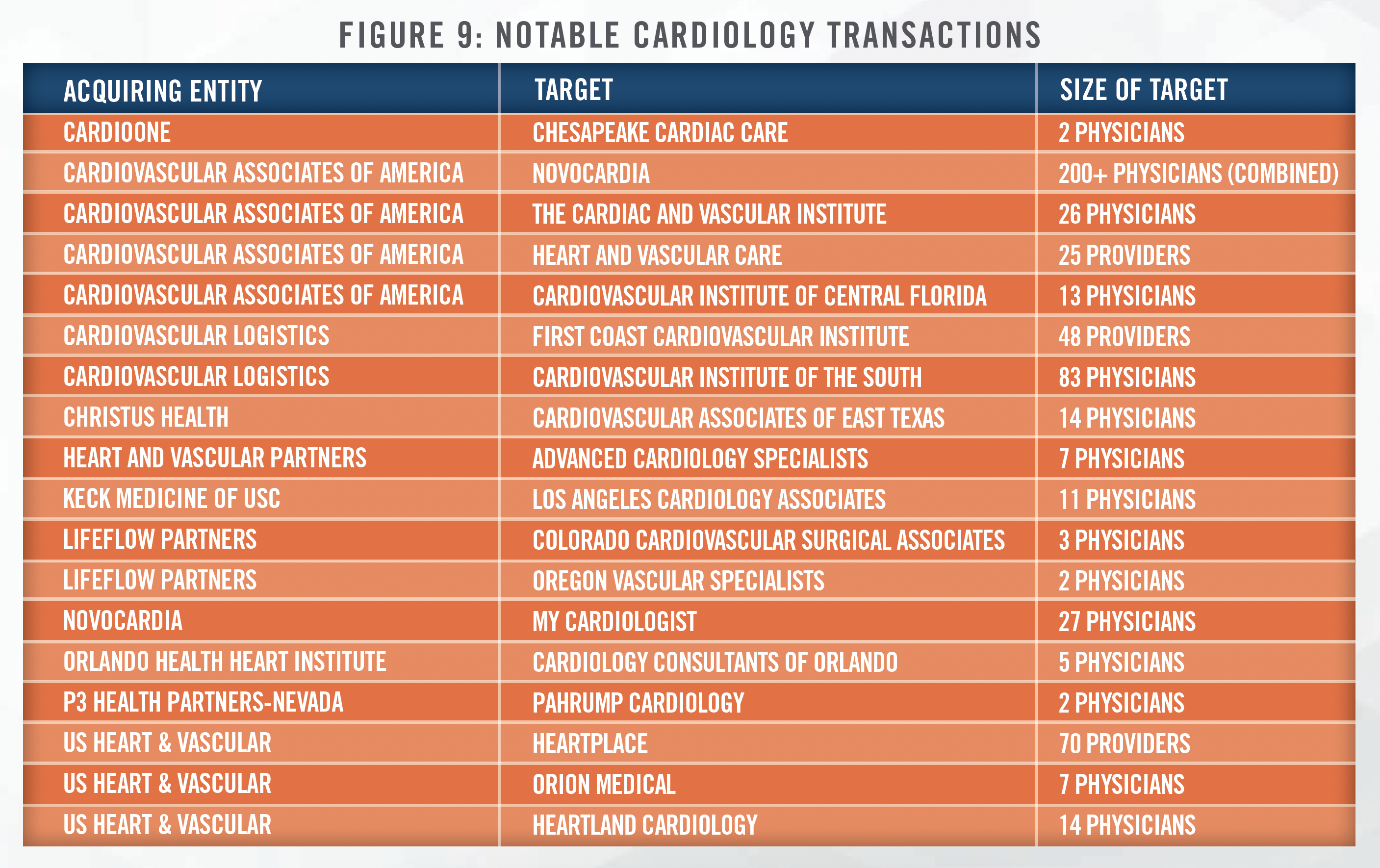

Health system transactions tend to differ from PPMs in that health systems typically focus their offers on lucrative employment contract compensation, as compared to the levels of upfront business value offered by PPMs. Notable transactions in the cardiology space that we have observed in recent years are presented in the following figure:

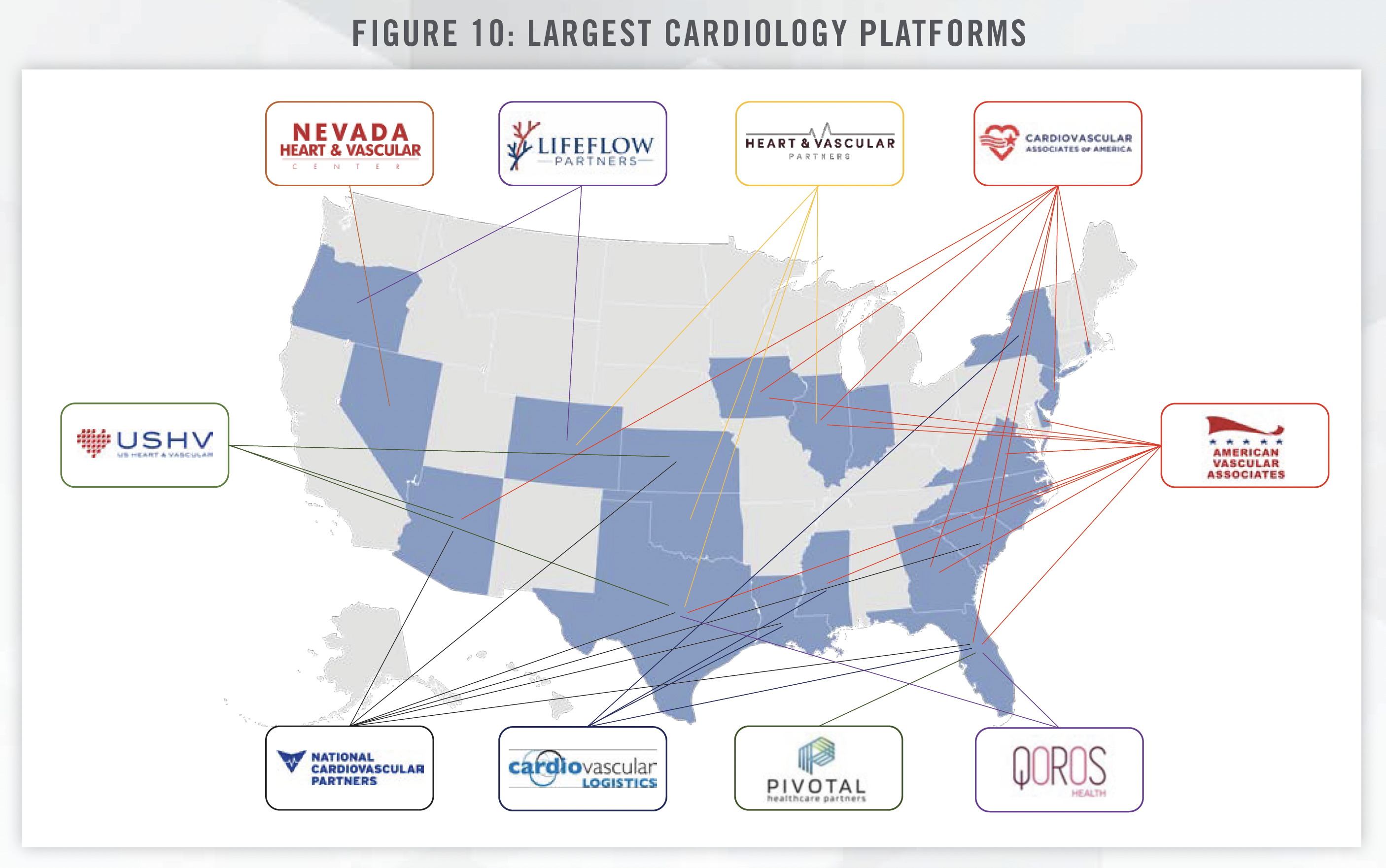

A notable recent transaction occurred in April of 2023, with Cardiovascular Associates of America’s (CVUSA) acquisition of Novocardia. While terms of the deal were not disclosed, Novocardia’s private equity sponsor, Deerfield Management, will remain a co-investor and hold a board seat, while CVUSA’s investor, Webster Equity Partners, will continue to lead investment strategy for the organization.[16] Novocardia now operates as a division of CVUSA, and functions as the value-based care arm of CVUSA.[17] The combined operations consist of over 200 cardiovascular physicians across eight states. CVUSA is amongst the largest cardiology platforms in the United States, as illustrated in the following figure:

How Different Buyers Approach Transactions

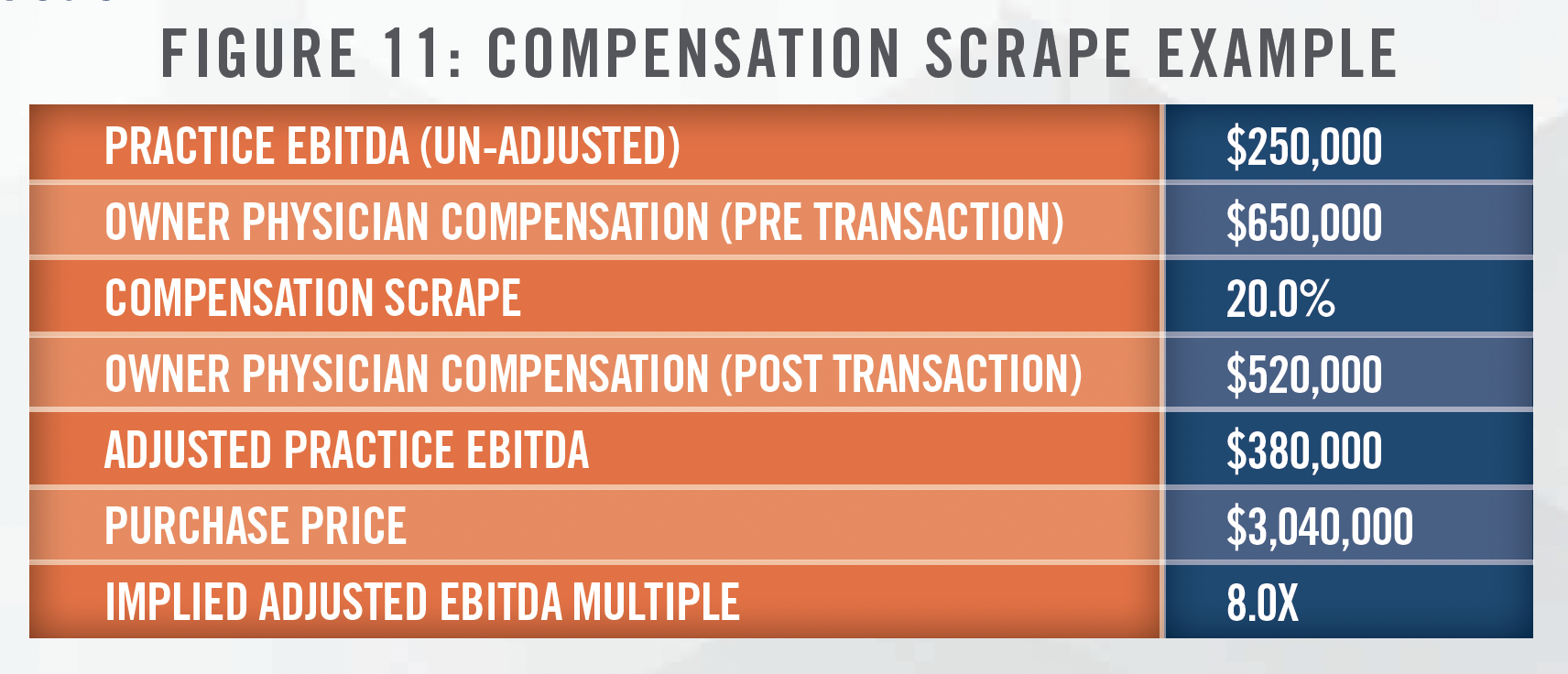

Based on our involvement with physician practice transactions involving private equity-backed PPMs, a common strategy involves the owner physicians of the target practice agreeing to take a “scrape” (i.e., pay cut) post transaction, which increases EBITDA on an adjusted basis, and, in turn, purchase price. Figure 11 depicts an example of a scrape and the coinciding purchase price in a hypothetical transaction.

Under this transaction approach, physicians sacrifice annual compensation in exchange for a higher upfront purchase price. We note that a portion of the upfront purchase price is typically paid as rollover equity in the post-transaction business, which typically ranges from 20 percent to 40 percent of the total purchase consideration. The provision of rollover equity incentivizes the physician group to stay engaged post transaction as a second lucrative payment can be achieved should the PPM sell the medical group for a high exit multiple. These higher exit multiples can be achieved through organic growth and the PPM’s willingness to invest in the addition of ancillary services (ASCs, OBLs, etc.) post transaction. Many smaller physician groups lack the capital needed to build and develop these ancillary services on their own, which motivates them to enter into an agreement with a PPM. Physician involvement in a transaction with a PPM does carry risk, as the rollover equity could potentially decrease in value depending on how the PPM is able to execute both on its ability to rollup additional cardiology medical groups into its PPM, as well as its ability to grow the revenue and/or profitability of the groups that comprise the PPM. Rollover equity is another item that makes it difficult to compare a PPM transaction to a health system transaction.

We note that physicians do not only inherit additional risk by partnering with PPMs. A PPM typically manages all of the non-clinical administrative work post transaction, which allows the physicians to focus solely on providing the best care possible for their patients without the burden of managing the business aspects of a medical practice. The ability to leverage the C-suite of a PPM can allow a practice to grow in ways that many would not be able to achieve on their own.

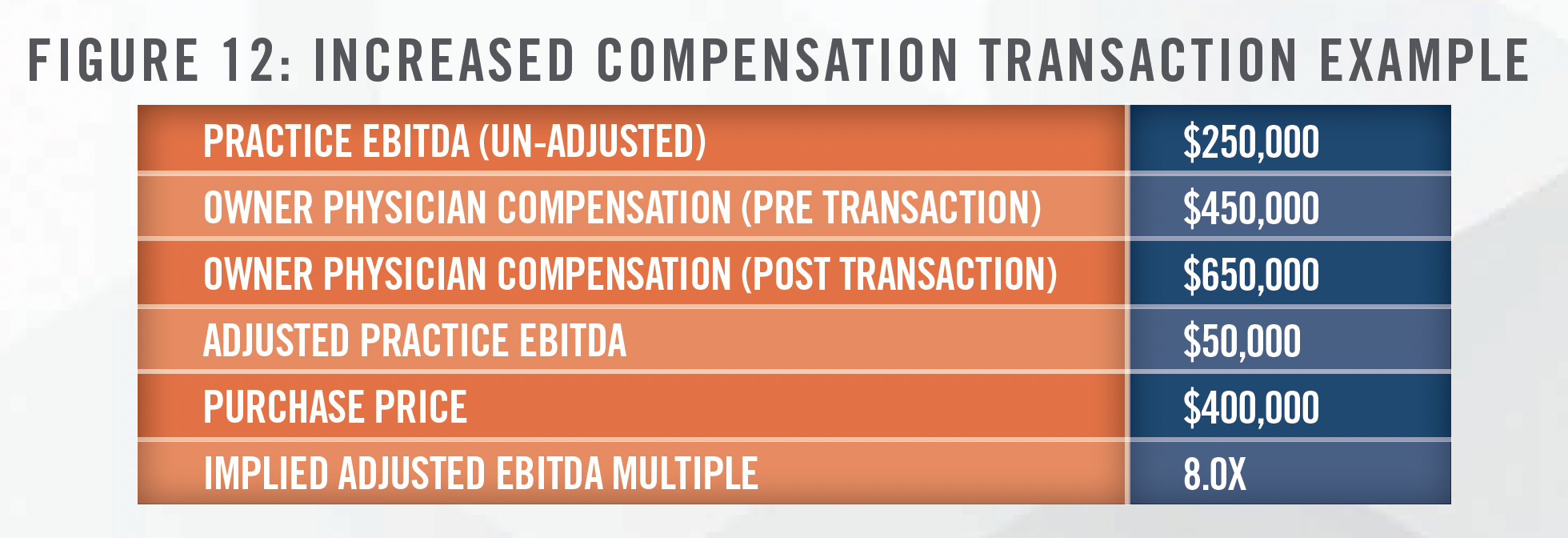

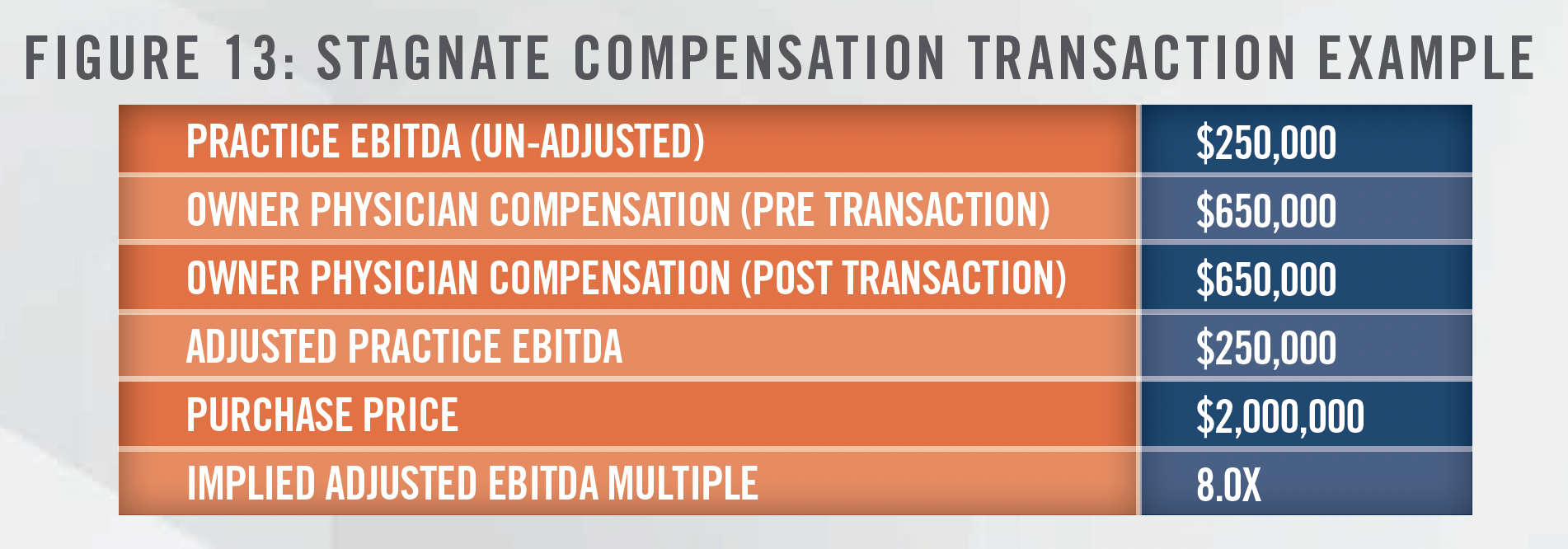

Conversely, health systems tend to approach physician groups with lower upfront purchase prices but higher ongoing compensation packages. Based on the health systems we have worked with, post-transaction compensation tends to be tied to productivity (typically a compensation per wRVU metric), which rewards physicians for high productivity and motivates them to continue building their practices. The dynamics vary depending on the physician group’s compensation pre-transaction, with some health system transactions still commanding upfront purchase prices above tangible asset value as the target physician groups historically were compensated at high levels. Another important item to note is that the compensation health systems pay the physicians post transaction must be consistent with fair market value. Should the target physician group already have high compensation levels, the health system may be constrained by fair market value and not be able to provide a higher compensation package. In many instances this is the result of practices in which there are many employed physicians, Advanced Practice Providers, and in-office ancillary services, allowing owner physicians to earn high levels of compensation compared to peers producing at similar levels of personally performed services. Figure 12 highlights a scenario where a physician group receives a higher compensation package, while Figure 13 highlights a scenario where fair market value constrains the ability of the health system to increase compensation post transaction.

As highlighted in the figures, purchase price and post-transaction compensation are inversely related. Transactions involving health systems typically leave the physician group with different risk than transactions involving PPMs. While there is uncertainty surrounding the future value of rollover equity and achieving of income repair in a PPM transaction, uncertainty surrounding the future compensation levels under an employment contract, which are typically governed by what compensation level is fair market value, can be a risk factor under a health system transaction.

Potential Impacts of FTC Proposal to Ban Non-Compete Agreements

On January 5, 2023, the Federal Trade Commission (“FTC”) proposed a rule that would ban noncompete agreements if enacted. If put into effect, employers would be barred from entering into future non-competes with employees and all noncompete agreements currently in effect would be disbanded. The major exception to this proposed rule is that transactional noncompete agreements would still be allowed for those who own a 25 percent or greater interest in the subject business of the transaction.[18] We also note that this is only a proposed rule by the FTC which will need to go through a commentary and review process. Following the commentary and review process, a majority vote of the FTC commissioners will be needed to make the rule final. Even after going final, there is the potential for legal challenge that could delay or block the enactment of the rule. The vote has already been delayed, pushed to an April 2024 date. Ultimately, the impact on how this potential new rule may impact acquisition activity of cardiology medical practices is uncertain.

![]() CONCLUSION

CONCLUSION

The increasing age and deteriorating health of Americans, an expected shortage of cardiologists in the future, and the shift of cardiac procedures to outpatient settings have led to increased transaction activity in cardiology practices in recent years. Cardiology groups are in a position to benefit whether they enter into a deal with a private equity-backed PPM or a health system. Each option comes with its own benefits and associated risks, but the cardiology space is expected to continue its already fluid structure going forward with a continued high volume of transactions expected in the coming years.

![]() Read the other articles in our 2023 Trends and Outlook series:

Read the other articles in our 2023 Trends and Outlook series:

2023 Industry Outlook: Gastroenterology Practices and Ancillary Services

[1] Electrophysiology, Invasive, Invasive/Interventional, and Noninvasive Cardiology specialties.

[2] Based on the average of observed compound annual growth rates for each of the four cardiology specialties.

[3] U.S. Census Bureau QuickFacts, last accessed April 12, 2023, https://www.census.gov/quickfacts/US

[4] Administration for Community Living, “2021 Profile of Older Americans,” last accessed April 12, 2023, https://acl.gov/sites/default/files/Profile%20of%20OA/2021%20Profile%20of%20OA/2021ProfileOlderAmericans_508.pdf

[5] Harvard T.H. Chan School of Public Health, “Obesity Prevention Source,” last accessed April 12, 2023, https://www.hsph.harvard.edu/obesityprevention-source/obesity-trends-original/obesity-rates-worldwide/

[6] Centers for Disease Control and Prevention, “Heart Disease Facts,” last accessed April 12, 2023, https://www.cdc.gov/heartdisease/facts.htm

[7] O’Hearn MS, Meghan, et al., “Trends and Disparities in Cardiometabolic Health Among U.S. Adults 1999-2018,” last accessed April 19, 2023, https://www.sciencedirect.com/science/article/abs/pii/S0735109722049944?via%3Dihub

[8] Merritt Hawkins, “The Cardiology Job Market in 2022,” last accessed April 12, 2023, https://www.merritthawkins.com/news-and-insights/blog/career-insights/cardiology-job-market-2022/

[9] Physicians Advocacy Institute, “COVID-19’s Impact on Acquisitions of Physician Practices and Physician Employment 2019-2021,” last accessed April 12, 2023, http://www.physiciansadvocacyinstitute.org/Portals/0/assets/docs/PAI-Research/Physician%20Practice%20Trends%20 Specialty%20Report%202019-2022.pdf?ver=MWjYUAcARbuGP9uxcgQkPw%3D%3D

[10] Ambulatory Surgery Center Association, “History,” last accessed April 13, 2023, https://www.ascassociation.org/50yearsofascs/timeline

[11] Cath Lab Digest, “The Cardiovascular Shift to the Outpatient Setting,” last accessed April 19, 2023, https://www.hmpgloballearningnetwork.com/site/cathlab/cardiovascular-shift-outpatient-setting

[12] Cardiovascular Business, “How to Prepare Hospitals for the Migration of Cardiovascular Procedures to OBLs and ASCs,” last accessed April 13, 2023, https://cardiovascularbusiness.com/topics/healthcare-management/healthcare-economics/how-prepare-hospitals-migrationcardiovascular-procedures-obls-and-ascs

[13] Surgery Partners, Inc., “Q4 2022 Surgery Partners, Inc. Earnings Conference Call Mar 1, 2023 at 8:30am EST,” last accessed April 19, 2023, https:// ir.surgerypartners.com/events/event-details/q4-2022-surgery-partners-inc-earnings-conference-call

[14] Obtained from: https://millionhearts.hhs.gov/files/MH_CQM.pdf; Last accessed July, 2023.

[15] LevinPro HC, Levin Associates, 2023, May, levinassociates.com. Italicized percentages depict year over year growth in observed transactions.

[16] Obtained from : https://cvausa.com/news/cvausa-novocardia-merger; last accessed July 5, 2023.

[17] Obtained from: https://novocardiahealth.com/about; last accessed July 5, 2023.

[18] University of Maryland Francis King Carey School of Law, “The FTC’s New Noncompete Proposal: A Potential Win for Workers and Possible Mass Changeover Across All Industries?” Last accessed April 19, 2023, https://www.law.umaryland.edu/content/articles/name-659569-en.html