![]() INTRODUCTION

INTRODUCTION

The women’s health industry has experienced significant growth and transformation in recent decades, driven by demographic and population trends, sociopolitical change, and increased investment interest. Looking ahead, it is crucial to understand the key factors that will shape the future of this growing segment of the healthcare industry. This article provides an overview of some of the influences and drivers within the women’s health segment, highlighting relevant valuation considerations, transaction dynamics, and key trends.

![]() INDUSTRY OVERVIEW

INDUSTRY OVERVIEW

The global women’s health market has grown to an estimated total value of nearly $41.5 billion in 2022, with a forecasted compound annual growth rate of over 5 percent from 2023 through 2030 [1] As government and private payors in the United States lean heavily into value-based care and incentivize a narrowing of gaps in health equity, quality and access, there will be increasing need to fill the white space in funding and research, accommodate broader coverage and meet higher consumer demand. Concurrently, growth in evidence-based research and public discourse surrounding health concerns that disproportionately impact women[2] are attracting clinical, financial and political investment in women’s health around the world. Shifts in life expectancy and demographic control of healthcare dollars are giving rise to a rapidly expanding market that will be dominated by the historically underrepresented and underserved, presenting new opportunities for innovation and meaningful growth. Women’s health is a diverse sector of businesses including multiple specialties, such as obstetrics and gynecology (OB/GYN), fertility, and numerous ancillary services. Over the past several years, hundreds of new companies have entered the women’s health space, with particularly strong growth in the fertility market and complementary service offerings across the continuum of care.[3]

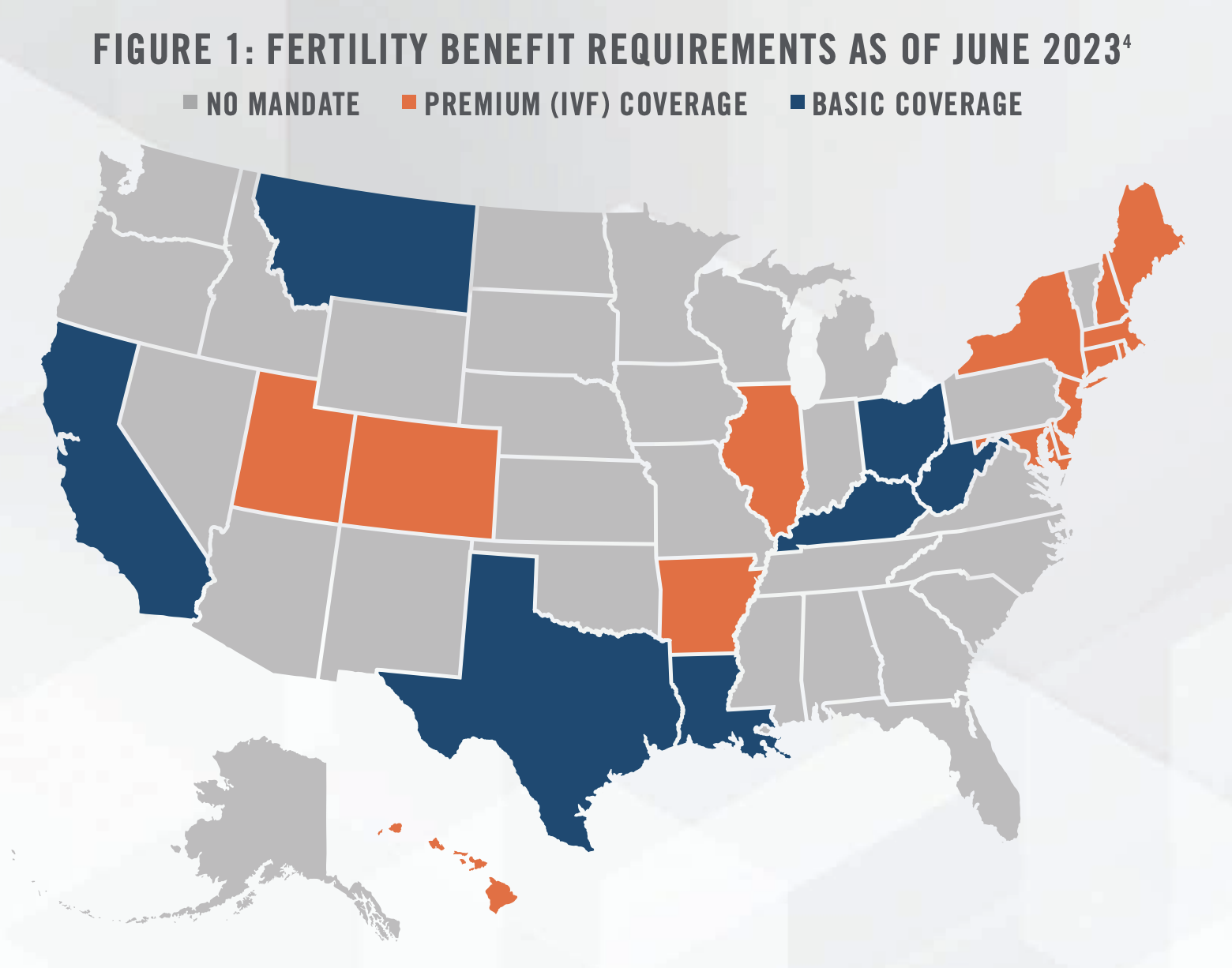

Increasing interest in the fertility subsector is driven in part by a rise in women seeking fertility services. Certain states have implemented mandates (see Figure 1) that require insurance providers to cover fertility services, resulting in reduced overall costs and a significant surge in patient volume. However, there may be growing gaps in coverage due to uncertainty created at the state level by the Dobbs decision. Additionally, many women are choosing to delay pregnancy to later points in life compared to previous generations, leading to increased demand for fertility services. From an investment perspective, interest in fertility businesses is also driven by the potential for developing additional revenue streams through untapped ancillary services such as egg bank donation programs and surrogacy matching. While growth in the sector remains strong, the demand for these services is constrained by a scarcity of Reproductive Endocrinologists and other fertility specialists, highlighting a need for healthcare companies and investors to be forward-thinking about incorporating these providers into their service offerings.

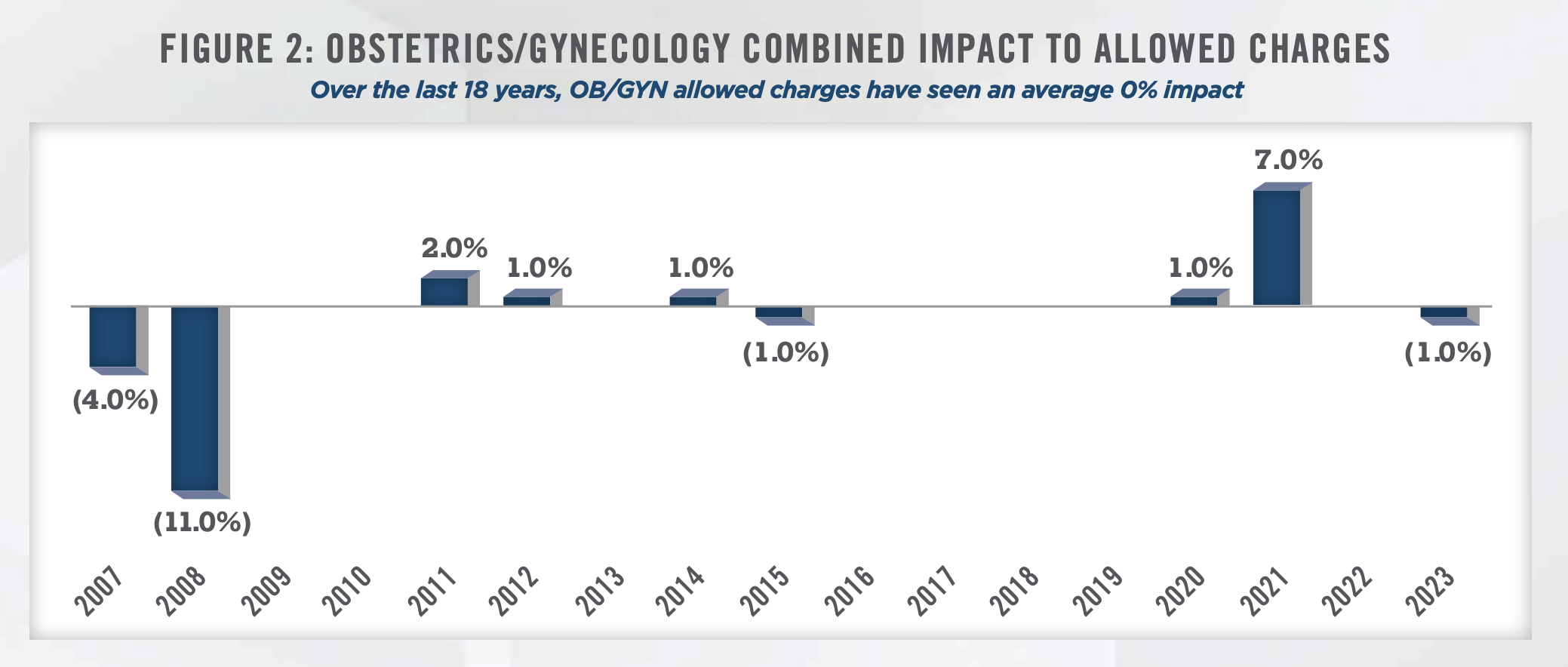

On the OB/GYN side, practices benefit from increasing levels of insurance coverage and reimbursements. Patients are more likely to visit doctors for preventive care when they have health insurance, and a material portion of OB/GYN care is preventive. In 2021, the most recent data available, the Census Bureau reported 91.7 percent of people are covered by public or private health insurance, up 0.3 percentage points from the prior year.[5] However, the OB/GYN industry faces challenges with low reimbursement rates, particularly from Medicare and Medicaid. According to IBISWorld, government payors account for over one-third of total industry revenue in 2022, with the majority of this revenue derived from Medicaid to be approximately 29.6 percent and Medicare accounting for a smaller portion estimated to be 6.0 percent.[6] Changes in Medicare reimbursements for OB/GYNs have historically been modest (see Figure 2).[7]

A unique aspect of women’s health practices is a high concentration of customers within specific demographic groups and a high concentration of products and services. IBISWorld reports over two-thirds of products and services offered by OB/GYN practices are segmented to preventive care, and less than one-third of services include new problems, chronic problems, and pre- or post-surgery or injury cases. Preventive care offerings include pelvic exams, cancer screenings, prenatal testing, and contraceptive services. While a narrow concentration of services can be seen as a risk, OB/GYN preventive care services benefit from being medically necessary and therefore lead to lower volatility for OB/GYN practices as compared to other healthcare providers.

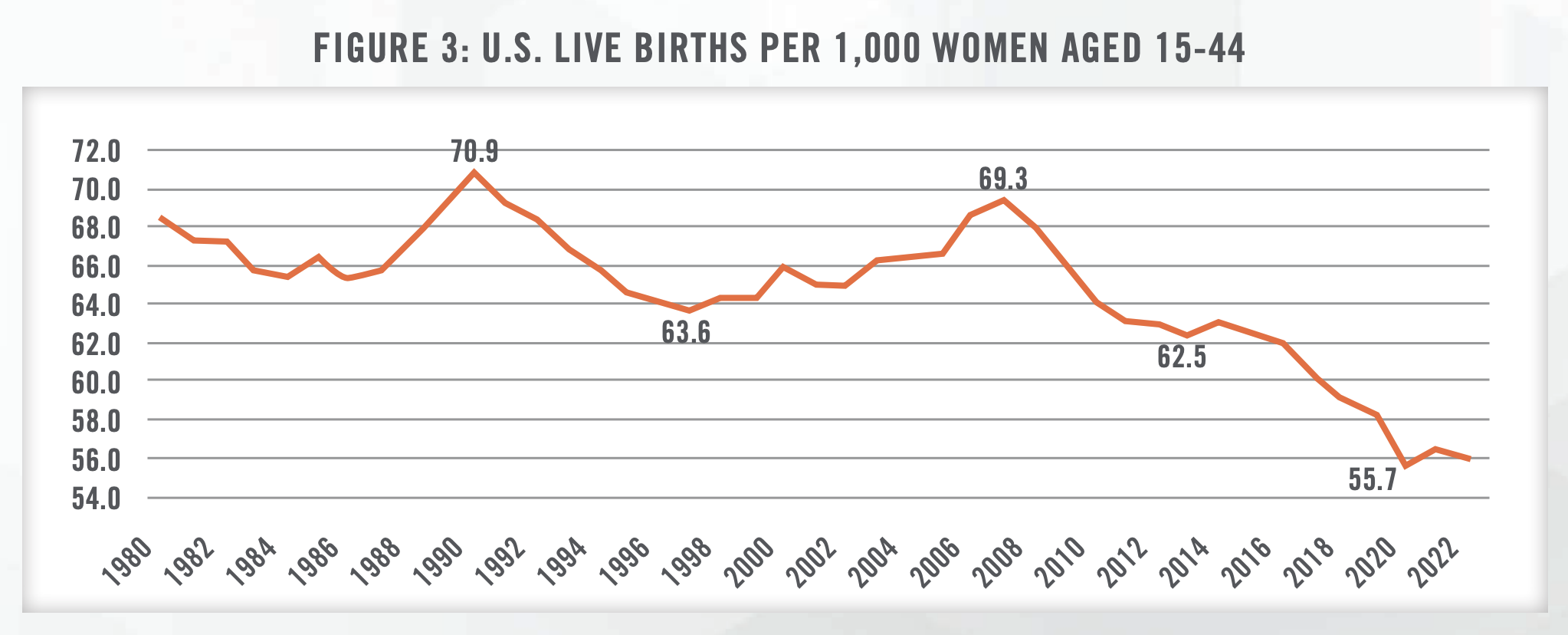

Figure 3 illustrates the change in general fertility rates in the United States since 1980.[8] The number of births in the United States has declined at an annualized rate of 1.5 percent over the five years to 2022. While this trend does present a challenge to the industry, it also creates opportunities for increased contraceptive care. Common contraceptive measures include prescription oral and implantable contraceptives, both of which require patients to maintain consistent visits with an OB/GYN provider. Implantable contraception in particular comes with a higher initial cost, and many OB/GYN practices are able to generate consistent profits by offering this service.

The women’s health industry has been experiencing a shortage of doctors. According to the Association of American Medical Colleges, from 2016 to 2021, the number of active OB/GYN physicians grew only 0.8 percent to 42,496 OB/GYNs.[9] However, the demand for OB/GYNs has been rising faster than the supply, as reported by the American Congress of Obstetrics and Gynecologists (ACOG). A 2017 report by ACOG estimated that 40 to 75 percent of OB/GYNs experience some form of professional burnout.[10]

While the traditional model for women’s health was that OB/GYNs made an extraordinary commitment to their patients providing pre-natal, delivery, and post-delivery care, today’s OB/GYNs are looking for more stability and work-life balance. This shifting mindset has given rise to the growing use of Obstetric Hospitalists also known as “laborists.” Laborists are OB/GYNs dedicated solely to attending labor and deliveries in the hospital. This approach not only allows OB/GYNs to focus on broader maternal health issues, but but also fosters a more manageable schedule. Another factor is the growing trend of OB/GYNs choosing subspecialties such as gynecologic oncology, reproductive endocrinology and infertility, and female pelvic medicine and reconstructive surgery. While these specialized fields contribute to advancing women’s health, they also contribute to a reduced pool of available OB/GYNs for routine maternal preventive care and normal deliveries.

Furthermore, obstetric physicians face mounting challenges due to the ongoing closures of maternity units across the nation. Since 2011, a staggering 217 hospitals in the United States have closed their labor and delivery departments.[11] The trend shows no signs of stopping, with at least 13 closures announced in the past year alone.[12] In certain markets where hospitals are discontinuing labor and delivery services, the responsibility to bridge the care gap is falling on physician practices.

In this complex landscape of women’s healthcare challenges, payors are becoming increasingly sensitive to the profound impact of social determinants of health (SDOH). These SDOHs not only influence the prevalence of health conditions but also affect women’s access to care and their overall well-being. Addressing these underlying societal factors is essential for achieving equitable healthcare outcomes for women, particularly in the face of ongoing hospital closures and the need for enhanced research efforts. Reimbursement models are evolving to consider socioeconomic status, access to education, employment opportunities, and housing conditions which play pivotal roles in determining women’s health outcomes.

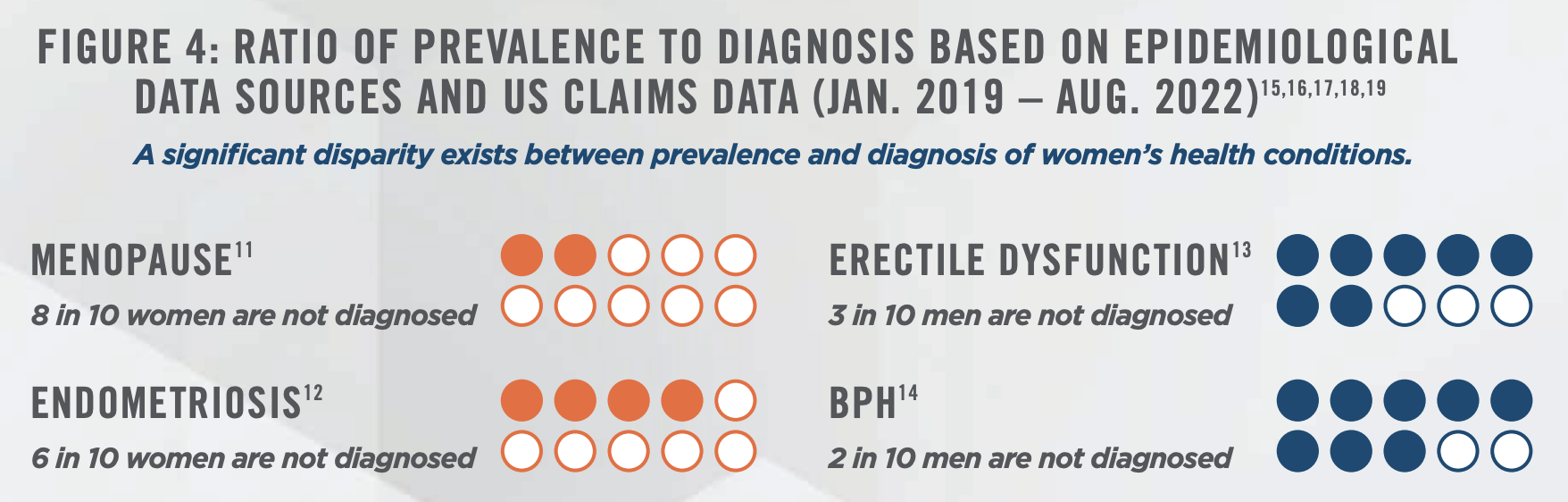

Historically, women’s health has been an under-resourced and underserved area of healthcare. A 2022 study published in the Journal of Obstetrics and Gynecology found that only 11 percent of the funding allocated by the National Institutes of Health supported research focused on women’s health.[13] Additionally, McKinsey & Co. reported only 1.0 percent of healthcare research funding, excluding Oncology, is allocated to women’s health conditions.[14] McKinsey & Co. estimates that for every woman officially diagnosed with a women’s health condition, there are roughly four cases that remain undiagnosed. In contrast, the disparity between epidemiological prevalence and documented diagnoses for men’s health conditions narrows down to approximately 1.5 times (see Figure 4). Insufficient research on women’s health persists, despite a compelling need that more evidence-based information would lead to better outcomes.

The financial burden of women’s healthcare is substantial for employers and families. Menopause care alone costs employers $27 billion annually, while maternal morbidity results in $6.6 billion in productivity losses each year. Approximately $80 billion is spent annually on autoimmune condition management for women, who account for 80 percent of all autoimmune disorders. Furthermore, 20 percent of women of reproductive age have multiple chronic conditions, contributing significantly to the nearly $3.15 trillion spent annually on care for chronic conditions.[20]

Investment in physician practices across the entire healthcare spectrum has been on the rise. Notably, medical group deals increased 33 percent from 2021 to 2022.[21] Regarding women’s health in particular, heightened sociocultural factors, expanded coverage, and rising incidence levels have created an attractive investment opportunity in the industry.

![]() KEY TRENDS

KEY TRENDS

Several key trends are shaping the women’s health industry in 2023:

1. Adoption of Value-Based Care: The industry is experiencing a shift towards value-based care arrangements. This transition incentivizes providers to focus on prevention, outcomes, and utilization, leading to higher quality care at a lower cost. Providers are increasingly integrating care models to deliver a comprehensive suite of services, leading to improved patient outcomes and cost savings. Given that 68 percent of the dual eligible population[22] are women, Medicaid and Medicare Advantage value-based offerings will be shaped by the needs of that population. According to a study published by the Medicaid and CHIP Payment and Access Commission (MACPAC), a 2020 review of all Medicaid programs found that 41 states implemented programs focused on payment initiatives to improve maternal health. The vast majority of these payment initiatives focused on policies to encourage the use of long-acting reversible contraception (LARC) immediately postpartum, and approximately onethird of the payment initiatives used reductions in payment to discourage certain interventions. Per the study, 14 states implemented pay-for-performance programs that provide financial incentives to providers that meet certain metrics, 10 states have implemented perinatal episode of care models, and four states have implemented pregnancy medical homes (PMH).[23]

Additionally, CMS’s Center for Medicare & Medicaid Innovation (CMMI) funded a study from 2013 to 2017 called the Strong Start for Mothers and Newborns. The study’s findings, published in 2018, found that women who received prenatal care in Strong Start Birth Centers had better birth outcomes and lower costs relative to similar Medicaid beneficiaries not enrolled in Strong Start. In particular, rates of preterm birth, low birthweight, and cesarean section were lower among Birth Center participants, and costs were more than $2,000 lower per mother-infant pair during birth and the following year. CMS hopes the findings will prove useful to state Medicaid programs seeking to improve the health outcomes of their covered populations.[24] In 2022, the Biden-Harris Maternal Health Blueprint was published, outlining five national priorities to improve maternal health. In support of these priorities, the U.S. Department of Health and Human Services (HHS) awarded over $65 million to HRSA-funded centers to address the maternal mortality crisis.[25]

In addition to these efforts, CMS has recently published new changes aimed at advancing health equity and increasing participation under the Accountable Care Organization (ACO) Realizing Equity, Access, and Community Health (REACH) model.These changes are expected to enhance healthcare for Medicare patients and the model’s financial and operational stability. Currently, 132 participants are enrolled under ACO REACH, a value-based care model that commenced in January this year, replacing the Direct Contracting Model.26 The new model encourages providers to form ACOs for fee-for-service Medicare enrollees and allows providers to take on more financial risk, with participants required to implement health equity plans to address disparities in care.

2. Expansion of Integrated Care Models: Women’s health providers are diversifying their service offerings through strategic expansions into relevant subspecialties. For example, OB/GYN practices have expanded into fertility services, at-home diagnostics, hormonal care, pelvic floor rehabilitation, endometriosis and PCOS care – among other services – capitalizing on the growing demand for fertility services. This trend enables practices to capture new patient volumes, provide care across more of the continuum, and create diversified revenue streams.

3. Maternal-Fetal Medicine Focus: Maternal-Fetal Medicine (“MFM”) has gained increased partnership interest from investors and strategic acquirers. Hospitals are now placing a higher demand on MFM and other subspecialists to staff hospital departments, such as neonatal intensive care units and spearhead integrated care programs. This demand is particularly pronounced in states like Texas, where stringent level-of-care guidelines mandate that MFM physicians must arrive at the patient bedside within 30 minutes for urgent requests.[27] Additionally, addressing the persistent maternal mortality disparities between rural and urban populations, investments in MFM solutions in rural communities have been on the rise. The integration of MFM services with regionally dominant OB/GYN practices is expected to drive revenue diversification and support the growth of comprehensive women’s health platforms.

We note Pediatrix Medical Group, Inc. (NYSE: MD) is a prominent provider of newborn, maternalfetal, and various pediatric subspecialty care services in the United States. Pediatrix is pursuing an organic growth strategy that involves collaborating with hospital partners to develop integrated service programs. This strategy positions Pediatrix as a solutions provider across the maternal-fetal, newborn, and pediatric continuum of care.[28]

4. Menopause Opportunity: Historically, menopause care has been overlooked, often limited to addressing acute symptoms through hormonal therapy, and only a fraction of women were aware of such options. Presently, a greater understanding has emerged regarding the link between menopause and prevalent daily symptoms like insomnia, fatigue, cognitive fogginess, and weight fluctuations. If left untreated, these issues can lead to metabolic changes that heighten menopausal women’s vulnerability to conditions like osteoporosis, diabetes, and heart disease, which subsequently strain healthcare systems. A 2023 study by Mayo Clinic found that 15 percent of women either missed work or cut back on hours because of menopause symptoms, and that loss of productivity costs women an estimated $1.8 billion annually.[29] Despite the severity of these symptoms, they continue to be inadequately addressed. The gap in care is disconcerting, considering women spend over a third of their lives in the peri- to postmenopausal phase.

Leading players in this market are poised to provide comprehensive solutions for both hormonal and nonhormonal menopausal symptoms, aiming to proactively mitigate adverse health outcomes. Successful ventures will adopt a holistic approach, combining personalized dietary and lifestyle adjustments with hormone therapy and routine metabolic health screenings. Numerous companies are already meeting the demand for tailored menopause care. For instance, Gennev, integrated within Unified Women’s Healthcare, offers virtual menopause management through its OB/GYNs and dietitians. Additionally, True Women’s Health provides its members personalized care through both the clinic setting and telehealth, that encompasses a wide range of women’s health services, from hormones and sexual health to nutrition, weight optimization, mental health, and more.

Just as companies have broadened their benefits packages to attract and retain talent through fertility treatments, parental leave, and childcare provisions, a similar trend is emerging with the integration of menopause-specific care. These benefits can include virtual access to the limited pool of approximately 1,000 certified specialists across the United States, who can be challenging to find locally. Additionally, these benefits can include coverage for potentially costly hormone treatments that might not be covered by certain insurance plans.

Changes in life expectancy are shaping the composition of the Medicare Advantage and dualeligible population. The 50+ market is expected to realize annual grow of 6.7 percent through 2030, meaning that the menopausal and post-menopausal populations are growing, and agerelated conditions are increasing in prevalence.[30] Given a history of underrepresentation of women in medical research and limitations on access to care, significant gaps in expertise and service availability have given rise to extensive potential for growth and a need to fill broad white space within the market. With changing life expectancy and increasing prevalence of conditions disproportionately affecting women, there is a growing interest in establishing women-focused services.

Notably, the pharmaceutical company, Bristol Myers Squibb, and Samsung’s venture capital arm are eyeing menopause healthcare as the global population ages. About 100 startups are now developing menopause interventions.[31] Although often labeled a niche health topic, menopause will impact roughly half the population at some point in their life and with a greater number of working women the impact to both patients and their employers will be significant. Therefore, expansion into menopause products and services is expected to offer a significant market opportunity in the coming years.

5. Increased Coverage for Infertility Treatment: Statewide mandates in the United States have expanded coverage for infertility diagnosis and treatment, with an increasing number of states requiring health insurance companies to offer or cover these services (see Figure 1). This regulatory change, combined with a larger proportion of women in the workforce, has led to an increased prevalence of private insurance and out-of-pocket payments for fertility services. Launched in 2016, Progyny, Inc. is a benefits management company specializing in fertility and family building benefits solutions in the United States. Progyny announced its Initial Public Offering (IPO) in 2019 and currently has contracts with over 370 employers to provide coverage to 5.4 million employees and their partners. Per its most recent annual report, Progyny estimates that the addressable market for fertility benefits consists of approximately 8,000 self-insured employers representing approximately 75 million covered lives in total. Additionally, Progyny notes that when comparing the United States to other countries, the percentage of babies born utilizing assisted reproductive technology (ART) is materially lower, at less than 2 percent in the United States compared to approximately 10 percent in Denmark and 6 percent in Japan.[32] Based on these factors, there is room for significant growth for fertility treatment coverage in the United States.

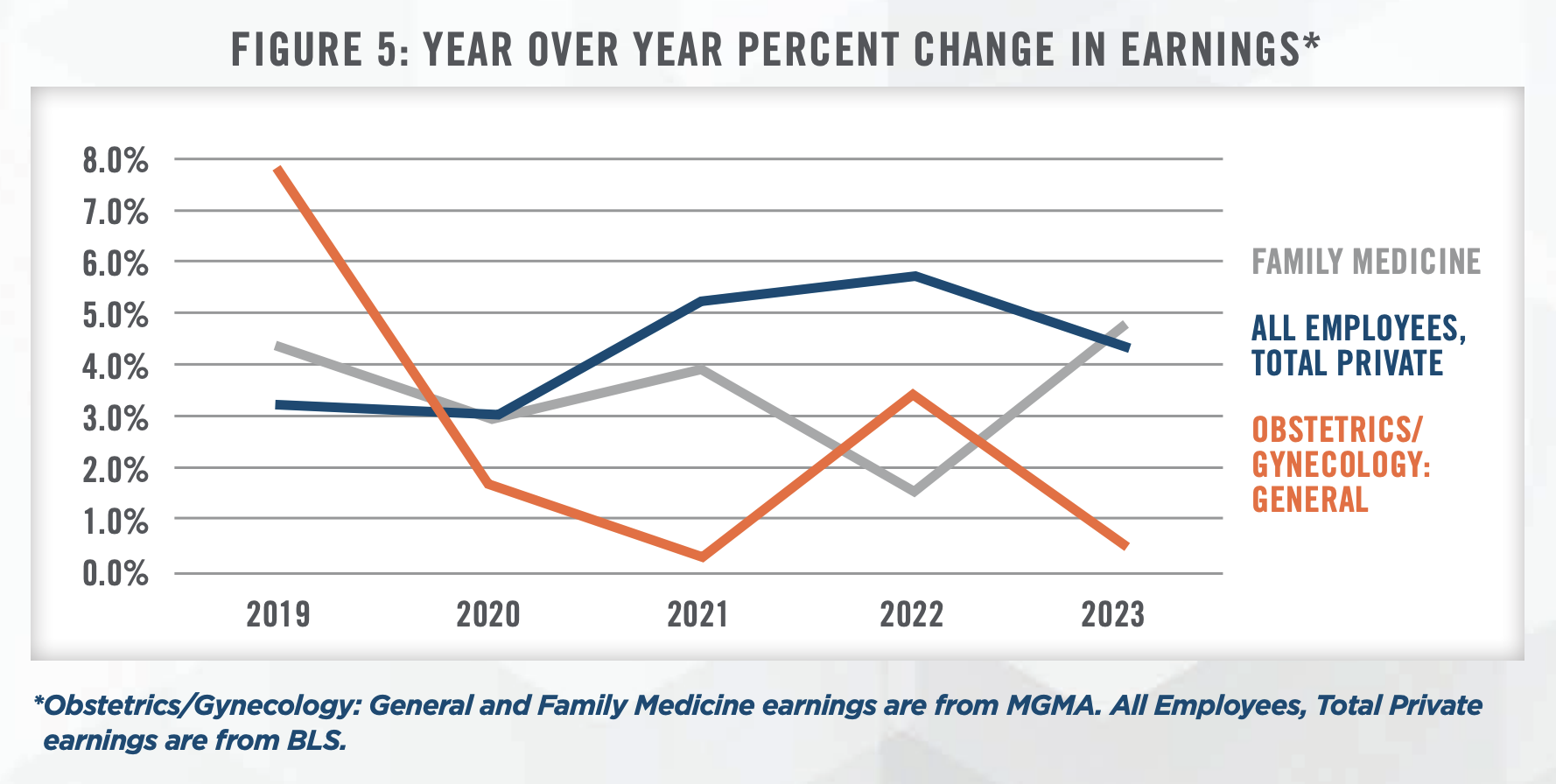

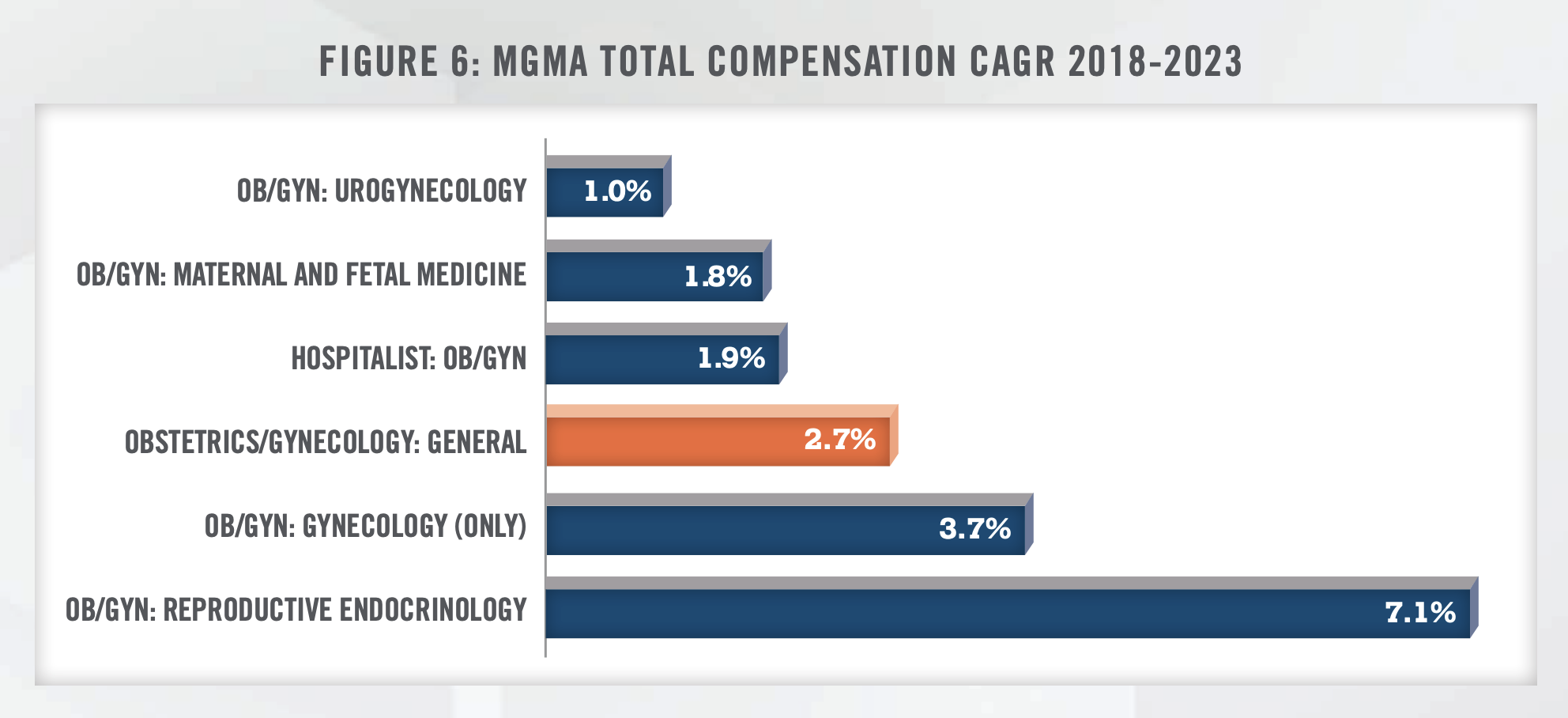

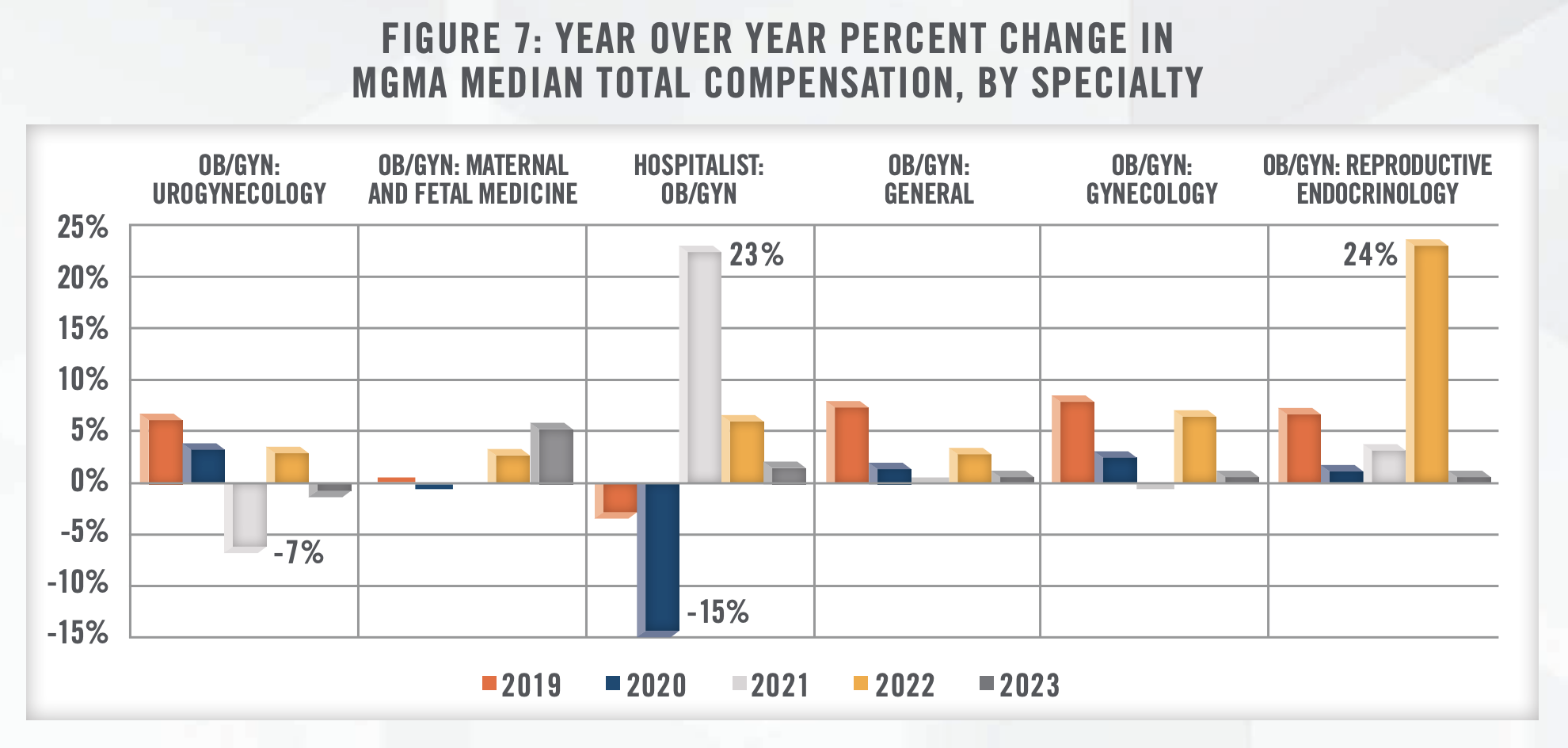

6. Physician Shortage and Provider Compensation: The American Congress of Obstetricians and Gynecologists (ACOG) projected a shortage of up to 8,800 OB/GYNs by 2020 and up to 22,000 by 2050.[33] As previously mentioned, the number of active OB/GYN physicians increased only 0.8 percent from 2016 to 2021.[34] Additionally, per MGMA Provider Compensation data, total compensation for OB/GYN generalists has remained fairly muted. Between the 2018 and 2023 MGMA Provider Compensation Surveys, median total compensation for OB/GYN generalists has increased at a compound annual growth rate of 2.7 percent, compared to an annual growth rate of 4.3 percent for all nonfarm employees in the United States over the same period (see Figures 5, 6, and 7).[35] Slow wage growth and projected provider shortages are likely to be primary headwinds in the women’s health industry going forward.

![]() TRANSACTION ACTIVITY

TRANSACTION ACTIVITY

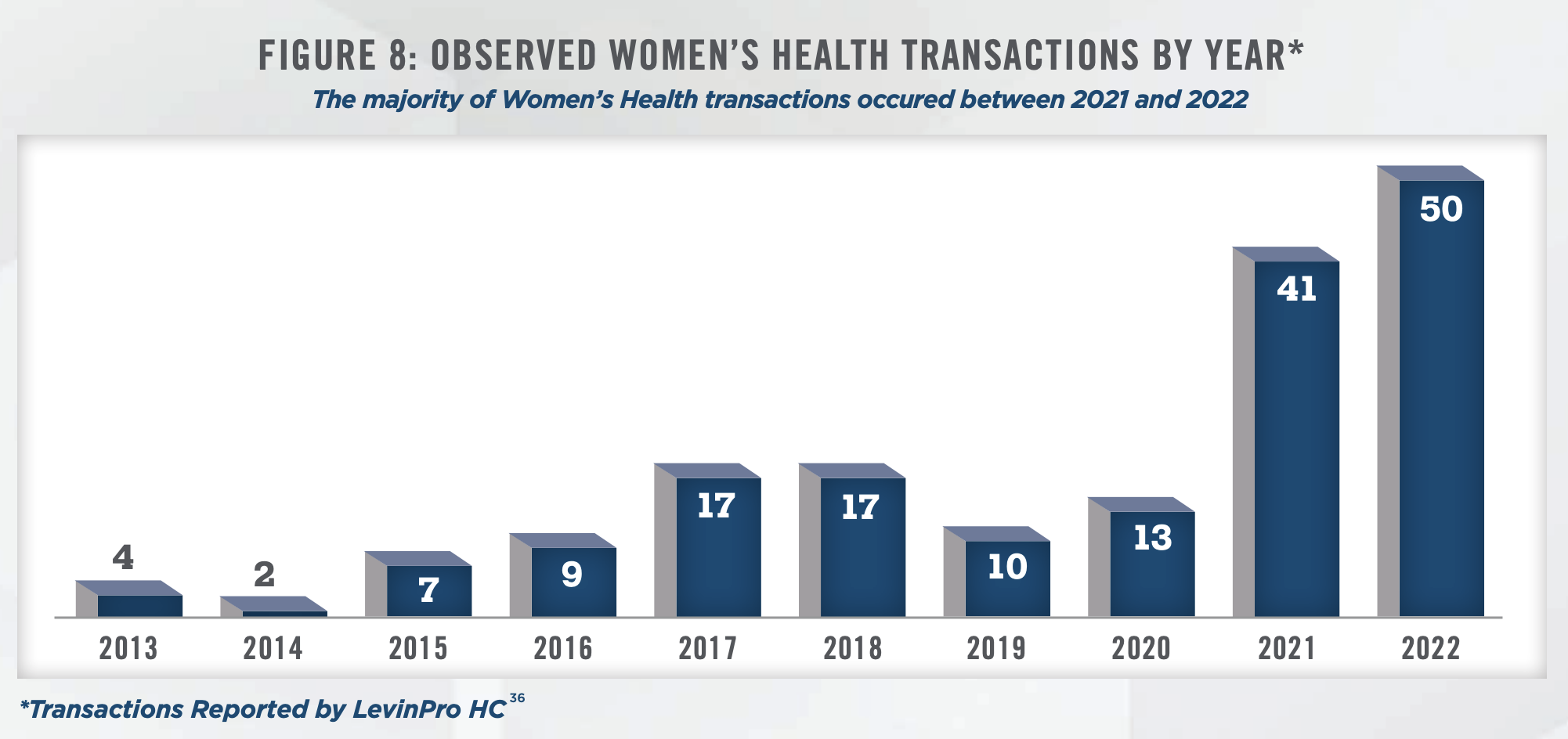

Transaction activity in the women’s health industry has been robust, driven by the growing interest of investors and the consolidation of market participants. Figure 8 illustrates annual transaction volume for women’s health in the United States from 2013 to 2022. The data presented has been sourced from a single transaction database and is not meant to represent total women’s health transaction volume, but to serve as a proxy for the increased transaction activity in recent years. Between 2021 and 2022, approximately 90 transactions have occurred, accounting for around 70 percent of the deal volume over the past five years.

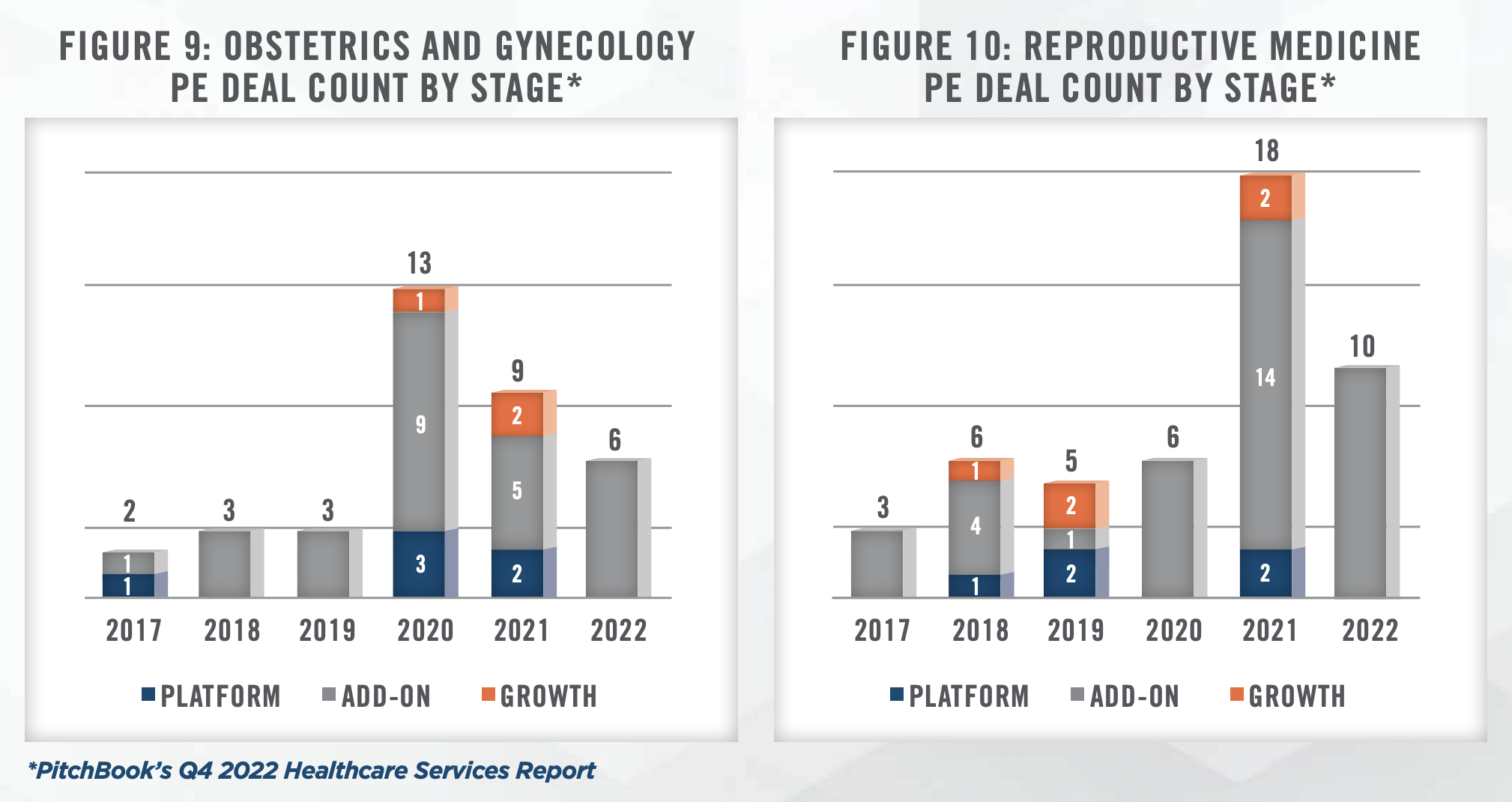

Private equity-backed platforms have been at the forefront of transaction activity, leveraging their capital resources and expertise in building scalable businesses. Larger platforms have pursued consolidation trategies, acquiring smaller physician groups to achieve greater scale and operational efficiencies (see Figures 9 and 10). This trend is expected to continue as private equity sponsors aim to position their platforms for strategic exits or public offerings. Secondary buyouts have also gained prominence, as existing private equity-backed platforms reach the end of their investment horizons. Secondary acquisitions present an opportunity for new investors to enter the market, injecting fresh capital and driving further consolidation within the industry.

Notable Transactions

The increased transaction volume in the women’s health industry reflects a growing interest from both strategic and financial buyers, as the industry continues to experience growth and faces new challenges.

Notable transactions in the industry include Kindbody raising $100 million in capital funding from Perceptive Advisors in March 2023.[37] Kindbody, a fertility clinic operator and employer benefits provider, is a later stage venture capital-backed startup that was founded in late 2018. In 2022, Kindbody made three strategic acquisitions, including Vios Fertility Institute, Phosphorus Labs, and a gestational surrogacy agency. Today, Kindbody offers comprehensive women’s health and fertility services, including fertility treatments, adoption, surrogacy, maternity care, gynecology, and holistic wellness services. They leverage modern technology to provide accessible and high-quality care at low prices. Kindbody has raised over $290 million in equity and debt funding from leading investors including Perceptive Advisors, GV (formerly Google Ventures), RRE Ventures, Claritas Health Ventures, Rock Springs Capital, NFP Ventures, and TQ Ventures. With its latest financing increasing its valuation to $1.8 billion, the company now holds the title of the largest women-owned fertility company serving employers and consumers.

In May 2020, Amulet Capital Partners, a middle-market private equity investment firm based in Greenwich, Connecticut, focused exclusively on the healthcare sector, and Shady Grove Fertility, the largest independent fertility practice in the United States, announced the formation of US Fertility, a business support services platform. US Fertility supports fertility focused physician practices with a range of non-clinical services, including clinical and business information systems, facilities and operations management, finance and accounting, and fertility treatment financing programs.[38] As of August 2023, US Fertility is comprised of six fertility groups across the country.

Another notable transaction is the acquisition of Gennev by Unified Women’s Healthcare for an undisclosed amount in October 2022, making Unified Women’s Healthcare the leader in menopause care in the U.S.[39] Currently, Gennev consists of 28 board-certified OB/GYNs supporting their patients through menopause and midlife.[40]

LifeStance, a major behavioral health provider, has formed a partnership with Gennev, a digital health platform focused on menopause care, to enhance its integrated care offerings. The collaboration aims to address the growing importance of women’s health, particularly menopause, within the behavioral health industry. With a team of OB/GYNs, registered dietitians, and health coaches, Gennev provides personalized menopause care plans. The partnership aligns with LifeStance’s strategic goal of offering comprehensive care and reflects the need to proactively address behavioral health conditions during menopause. This collaboration signifies the recognition of the interconnectedness between mental health, primary care, and reproductive health in delivering holistic care for women.[41]

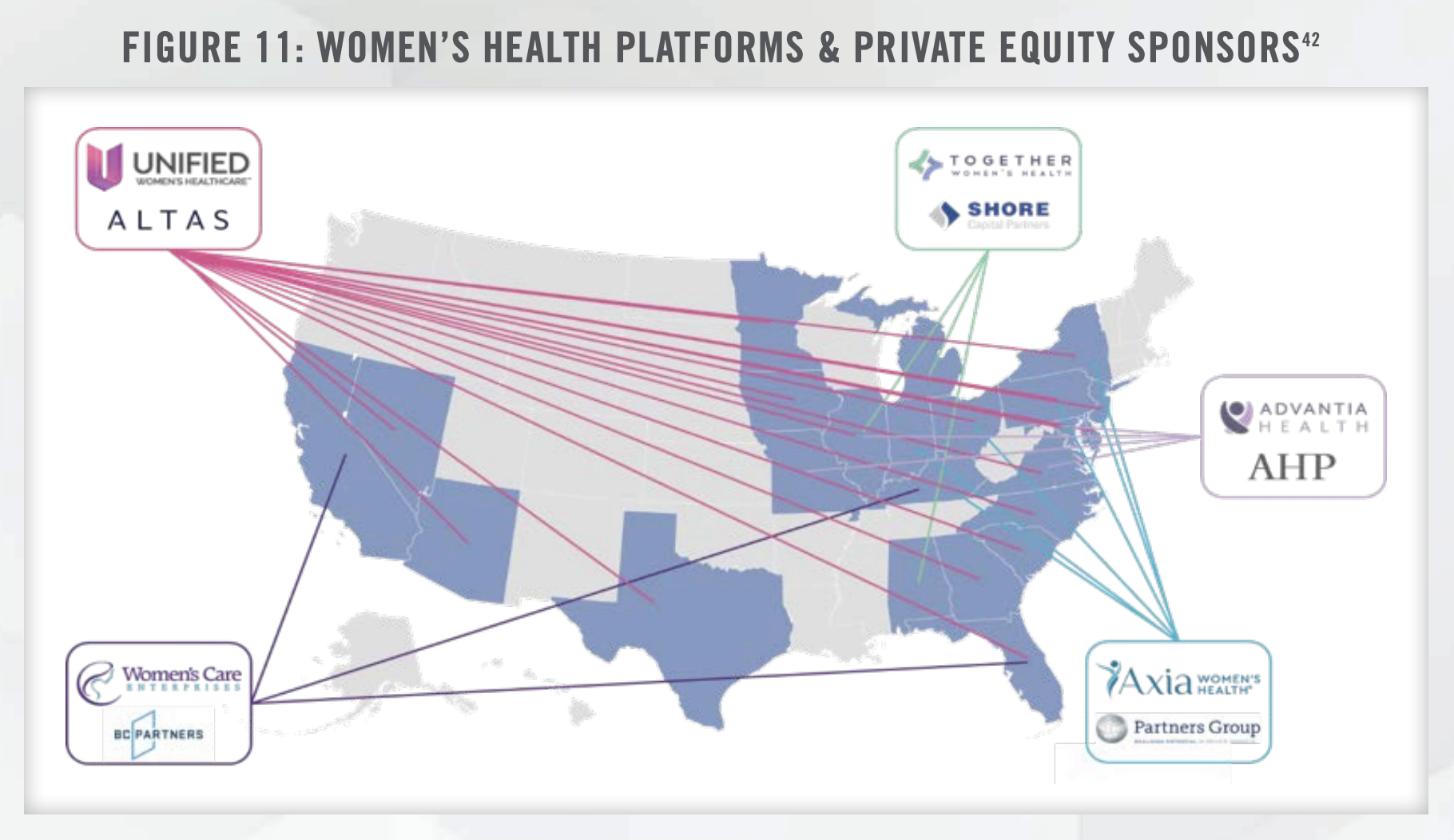

Women’s Health is a leading healthcare industry of interest for private equity investment. Women’s health platforms and private equity sponsors across the nation are shown in Figure 11.

![]() PRACTICE VALUATIONS IN THE WOMEN’S HEALTH SPACE

PRACTICE VALUATIONS IN THE WOMEN’S HEALTH SPACE

Valuation expectations in the women’s health space have been influenced by multiple factors, including revenue growth, profitability, patient volume, and market share. While there is no one-size-fits-all approach, certain financial metrics and considerations play a significant role in determining practice valuations.

Historically, valuations in the women’s health industry have been driven by revenue multiples. However, as the industry evolves towards value-based care and integrated care models, there is an increasing focus on the quality of earnings and patient outcomes. Practices with well-documented patient outcomes, effective cost management strategies, and strong referral networks often command higher valuations.

Moreover, the presence of ancillary revenue streams, such as in-house diagnostics, genetic testing, or telehealth services, can positively impact practice valuations. Diversified revenue streams provide stability and the potential for incremental revenue growth, making the practice more attractive to investors.

According to research published in 2017 by the medical social network Doximity, approximately 36 percent of OB/GYNs are 55 years-old or older and of the 50 metropolitan areas evaluated in the research, Doximity found 32 metro areas where at least one third of OB/GYNs are 55 years-old or older. Additionally, the Doximity report noted that ACOG found that most OB/GYNs tend to retire between the ages of 59-69 years, with the median retirement age being 64 years old. The Doximity analysis also found that nationally, the average age of OB/GYNs is 51, and the Association of American Medical Colleges’ (AAMC) 2021 Active Physicians by Sex and Specialty report found that approximately 60 percent of OB/GYNs are now female (as compared to only 7 percent in 1970).[43, 44, 45] Based on these figures, many retiring OB/GYNs may be contemplating the sale of their practices in the coming years. In order to recognize the highest possible value for their practices, retiring OB/GYNs will need to consider the aforementioned factors and begin preparations well in advance of an anticipated retirement date.

![]() CONCLUSION

CONCLUSION

The women’s health industry continues to undergo rapid transformation, driven by demographic trends, growth in demand, expanding coverage, and increased investment interest. Key trends such as the adoption of value-based care, expansion of integrated care models, a focus on maternal-fetal medicine and menopause, and increased coverage for infertility treatment are shaping the industry landscape.

Transaction activity remains robust, with unprecedented venture capital investment and private equity-backed platforms driving consolidation and strategic acquisitions. Valuation expectations are influenced by financial metrics, patient outcomes, and the presence of ancillary revenue streams.

As the industry continues to evolve, it is crucial for women’s health providers, investors, and other stakeholders to stay informed about emerging trends and market dynamics. By embracing innovative care models, leveraging technology, and adapting to changing patient needs, the women’s health industry can deliver improved outcomes and drive sustainable growth in the years to come.

If you are looking to engage in a women’s health practice deal or compensation arrangement, contact the experts at HealthCare Appraisers for assistance with valuation and advisory issues surrounding your transaction.

For more information, please contact:

Cecelia R. Chavez, AM, Senior Associate at cchavez@hcfmv.com or (469) 995-7148

Chris Vaughan, MBA, ABV, Manager at cvaughan@hcfmv.com or (225) 307-0859

Nicholas J. Janiga, ASA, Partner at njaniga@hcfmv.com or (303) 566-3173

![]() Read the other articles in our 2023 Trends and Outlook series:

Read the other articles in our 2023 Trends and Outlook series:

2023 Cardiology Industry Outlook: A Reviving Heartbeat

2023 Industry Outlook: Gastroenterology Practices and Ancillary Services

[1] Women’s Health Market Size, Share & Growth Report, 2030 (grandviewresearch.com)

[2] Women’s health research lacks funding – these charts show how (nature.com)

[3] Modern Healthcare, May 2023, Women’s Health Investor Summit 2023 Takeaways. (https://www.modernhealthcare.com/digital-health/womenshealth-investor-summit-2023-nyse-supernode-ventures-takeaways)

[4] Resolve: The National Infertility Association, June 2023, Insurance Coverage by State. (https://resolve.org/learn/financial-resources-for-familybuilding/insurance-coverage/insurance-coverage-by-state/)

[5] U.S. Census Bureau, Current Population Survey, 2022 Annual Social and Economic Supplement (CPS ASEC). (https://www.census.gov/data/tables/time-series/demo/income-poverty/cps-hi/hi.html)

[6] IBISWorld, December 2022, Industry Report Gynecologists & Obstetrics in the US.

[7] Centers for Medicare and Medicaid Services (“CMS”), Final Rule, 2006 through 2023.

[8] Centers for Disease Control and Prevention, Data from the National Vital Statistics System. Accessed August 2023. (https://www.cdc.gov/nchs/data_access/Vitalstatsonline.htm#Births)

[9] Association of American Medical Colleges, 2022 Physician Specialty Data Report. (https://www.aamc.org/data-reports/workforce/data/percentage-change-number-active-physicians-specialty-2016-2021)

[10] The American College of Obstetricians and Gynecologists (ACOG), October 2019, Why Ob-Gyns Are Burning Out. (https://www.acog.org/news/news-articles/2019/10/why-ob-gyns-are-burning-out)

[11] Chartis, February 2023, Rural Health Safety Net Under Renewed Pressure as Pandemic Fades. (https://www.chartis.com/insights/rural-healthsafety-net-under-renewed-pressure-pandemic-fades)

[12] CNN, April 2023, Maternity Units Are Closing Across America Forcing Expectant Mothers to Hit the Road. (https://www.cnn.com/2023/04/07/health/maternity-units-closing/index.html)

[13] Temkin SM, Noursi S, Regensteiner JG, Stratton P, Clayton JA. Perspectives From Advancing National Institutes of Health Research to Inform and Improve the Health of Women: A Conference Summary. Obstet Gynecol. 2022 Jul 1;140(1):10-19. doi: 10.1097/AOG.0000000000004821. Epub 2022 Jun 7. PMID: 35849451; PMCID: PMC9205296.

[14] McKinsey & Company, April 2023, Closing the data gaps in women’s health. (https://www.mckinsey.com/industries/life-sciences/our-insights/closing-the-data-gaps-in-womens-health)

[15] Estimated US female population experiencing vasomotor symptoms; Craig Best et al., “Prevalence of menopausal symptoms among mid-life women: findings from electronic medical records,” BMC Women’s Health, August 2015, Volume 15.

[16] “Endometriosis,” Office on Women’s Health, US Department of Health & Human Services.

[17] Arthur L. Burnett et al., “Prevalence and risk factors for erectile dysfunction in the US,” American Journal of Medicine, February 2007, Volume 120, Number 2.

[18] Benign prostatic hyperplasia with lower urinary tract symptoms; Gary Boas, “Prostatic Artery Embolization (PAE),” Radiology Rounds, Massachusetts General Hospital Department of Radiology, September 2019, Volume 17, Number 9.

[19] Image re-created from “Closing the data gaps in women’s health,” McKinsey & Company, April 2023.

[20] Fierce Healthcare, May 2023, Parsley Health Rolls Out Comprehensive Women’s Health Program as Company Rapidly Builds Out Employer-Focused Business. (https://www.fiercehealthcare.com/providers/parsley-health-rolls-out-comprehensive-womens-health-program-companyrapidly-moves)

[21] Levin Associates, January 2023, Record-Breaking Health Care M&A Activity Recorded in 2022. (https://www.levinassociates.com/press/recordbreaking-health-care-ma-activity-recorded-in-2022-according-to-acquisition-data-from-levinpro-hc/)

[22] Medicaid.gov (https://www.medicaid.gov/about-us/program-history/medicaid-50th-anniversary/entry/47704).

[23] MACPAC – Value-Based Payment for Maternity Care in Medicaid: Findings from Five States (https://www.macpac.gov/wp-content/uploads/2021/09/Value-Based-Payment-for-Maternity-Care-in-Medicaid-Findings-from-Five-States.pdf)

[24] Strong Start for Mothers and Newborns – Evaluation of Full Performance Period 2018. (https://innovation.cms.gov/files/reports/strongstartprenatal-fg-finalevalrpt.pdf)

[25] US Department of HHS. (https://www.hhs.gov/about/news/2023/05/19/hhs-announces-over-65-million-address-maternal-health-crisis-investnew- approaches-care.html).

[26] Fierce Healthcare, August 2023, CMS Unveils New Changes to ACO REACH Model. (https://www.fiercehealthcare.com/payers/cms-drop-newchanges- aco-reach-model)

[27] 25 Tex. Admin. Code §133.209 (2023). (https://texreg.sos.state.tx.us/public/readtac$ext.TacPage?sl=R&app=9&p_dir=&p_rloc=&p_tloc=&p_ ploc=&pg=1&p_tac=&ti=25&pt=1&ch=133&rl=209)

[28] Pediatrix Medical Group, Inc., Form 10-K, February 2023.

[29] Mayo Clinic, April 2023, Impact of Menopause Symptoms on Women in the Workplace. (https://www.mayoclinicproceedings.org/pb-assets/Health%20Advance/journals/jmcp/JMCP4097_proof.pdf)

[30] Nature, May 2023, Women’s Health Research Lacks Funding – These Charts Show How. (https://www.nature.com/immersive/d41586-023-01475- 2/index.html)

[31] Modern Healthcare, May 2023, Women’s Health Investor Summit 2023 Takeaways. (https://www.modernhealthcare.com/digital-health/womenshealth-investor-summit-2023-nyse-supernode-ventures-takeaways)

[32] Progyny, Inc. Form 10-K, March 2023. (https://www.sec.gov/ix?doc=/Archives/edgar/data/1551306/000155130623000015/pgny-20221231.htm)

[33] Doximity, June 2018, 2018 OB-GYN Workforce Study – Looming Physician Shortages: A Growing Women’s Health Crisis. (https://assets.doxcdn.com/image/upload/pdfs/ob-gyn-workload-and-potential-shortages-2018.pdf)

[34] Association of American Medical Colleges, 2022 Physician Specialty Data Report. (https://www.aamc.org/data-reports/workforce/data/percentage-change-number-active-physicians-specialty-2016-2021)

[35] Economic Policy Institute – Nominal Wage Tracker. (https://www.epi.org/nominal-wage-tracker/)

[36] LevinPro HC, Levin Associates, 2023, June, levinassociates.com

[37] PR Newswire, March 2023, Kindbody Announces $100 Million in New Funding to Further Accelerate Growth. (https://www.prnewswire.com/newsreleases/kindbody-announces-100-million-in-new-funding-to-further-accelerate-growth-301761116.html)

[38] US Fertility Press Release, May 2020. (https://www.usfertility.com/about-us-fertility/newsroom/amulet-capital-and-shady-grove-fertility-form-usfertility/)

[39] Business Wire, October 2022, Unified Women’s Healthcare acquires Gennev to become the leader in menopause care in the U.S. (https://www.businesswire.com/news/home/20221017006101/en/Unified-Women%E2%80%99s-Healthcare-acquires-Gennev-to-become-the-leader-inmenopause- care-in-the-U.S)

[40] Gennev, August 2023, Meet Your Menopause Care Team. (https://www.gennev.com/doctors)

[41] Behavioral Health Business, May 2023, How LiftStance’s Latest Partnership Reflects One of Health Care’s Biggest Trends. (https://www.bhbusiness.com/2023/05/16/how-lifestances-latest-partnership-reflects-one-of-health-cares-biggest-trends/)

[42] Sourced from each platform and/or private equity sponsor’s respective website. Accessed August 2023.

[43] Doximity, June 2018, 2018 OB-GYN Workforce Study – Looming Physician Shortages: A Growing Women’s Health Crisis (https://assets.doxcdn.com/image/upload/pdfs/ob-gyn-workload-and-potential-shortages-2018.pdf)

[44] Association of American Medical Colleges, 2022 Physician Specialty Data Report. (https://www.aamc.org/data-reports/workforce/data/activephysicians-sex-specialty-2021)

[45] Novant Health, October 2018, Female ob-gyns are now the majority (https://www.novanthealth.org/healthy-headlines/having-choice-means-a-lot)