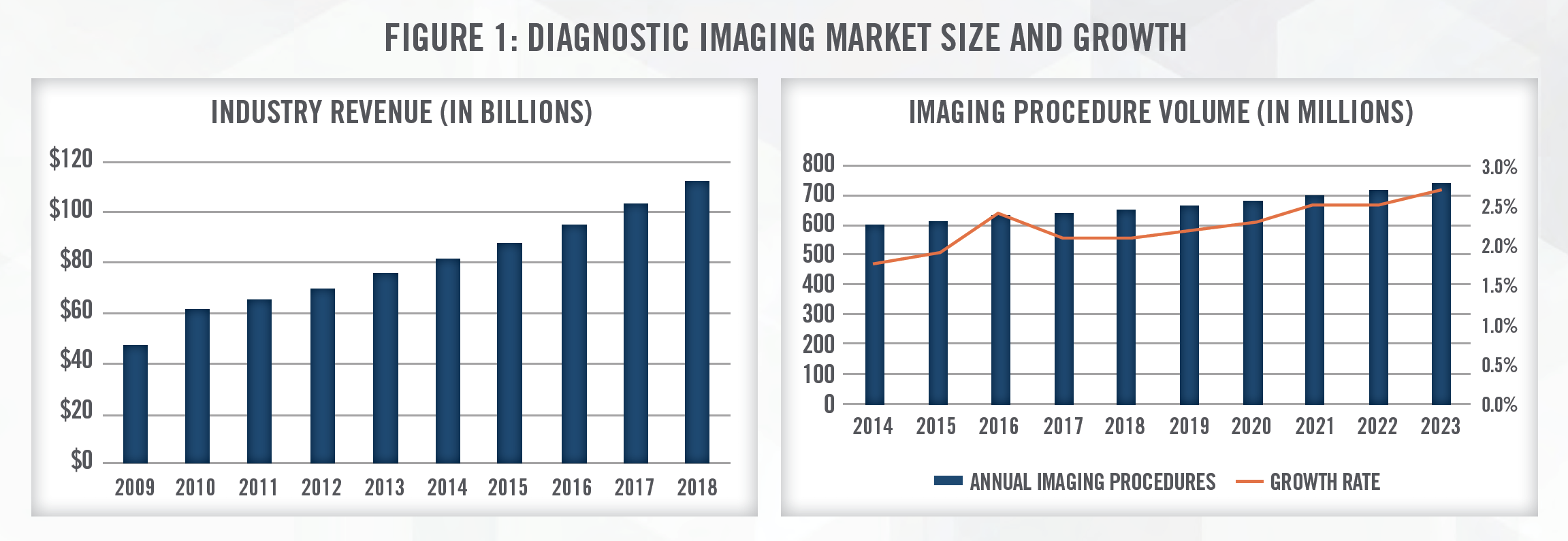

The imaging market in the United States is estimated to generate more than $100 billion[1] annually with radiology practices and imaging centers accounting for approximately $19 billion[2] in annual revenue. Annual imaging procedures have been growing at a low single digit pace and are projected to continue to grow at a low single digit pace, with a modest acceleration in growth rates in the coming years (Figure 1).

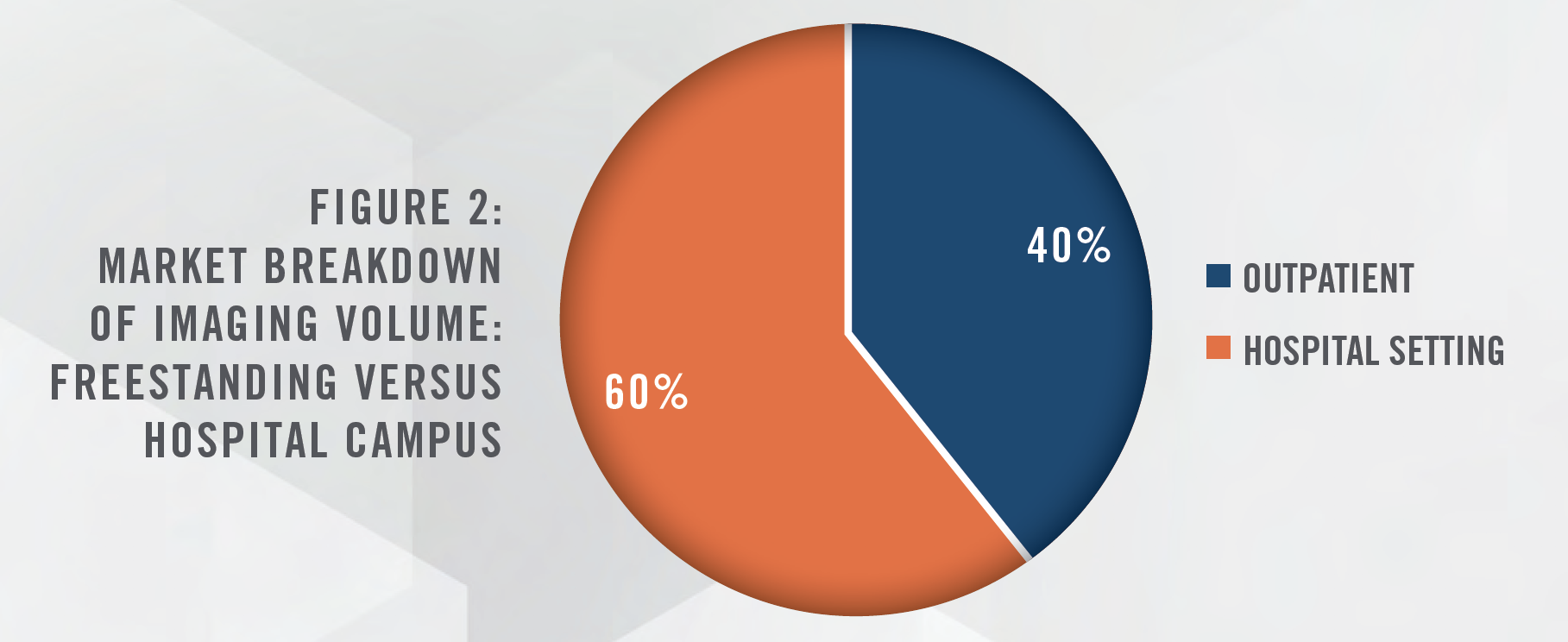

Approximately 40 percent of imaging volume is performed at outpatient imaging centers and physician clinics, while the remaining 60 percent is conducted within hospitals (Figure 2). Within the outpatient segment, there are more than 6,000[3] independent diagnostic testing facilities (“IDTF”) in what is a highly fragmented market. This article discusses the major trends impacting the imaging industry, including the shift from hospital departments to IDTFs, the regulatory landscape, the impact of COVID-19, consolidation of radiology practices, and valuations within the industry.

![]() HOSPITAL DEPARTMENT OUTMIGRATION

HOSPITAL DEPARTMENT OUTMIGRATION

One of the major ongoing trends impacting the diagnostic imaging industry is the shift of outpatient volumes away from the hospital setting. Diagnostic imaging volumes have been shifting away from hospital campuses due to the lower cost of performing these procedures at IDTFs. Site neutral payment policies from CMS and site of care reviews during the prior authorization processes implemented by private payors in the last few years have been a further catalyst helping to drive imaging volume to IDTFs. Site neutral payment policies make hospital department imaging procedures less profitable, thus not allowing them to support the higher expense structure and instead seek joint venture partners in operating IDTFs. Estimates regarding the percentage of procedures that could be impacted by site of review policies from private payors range from 80 percent to 90 percent in non-rural markets[4], suggesting the impact to hospitals from these policies, especially if implemented by additional payors, could be substantial.

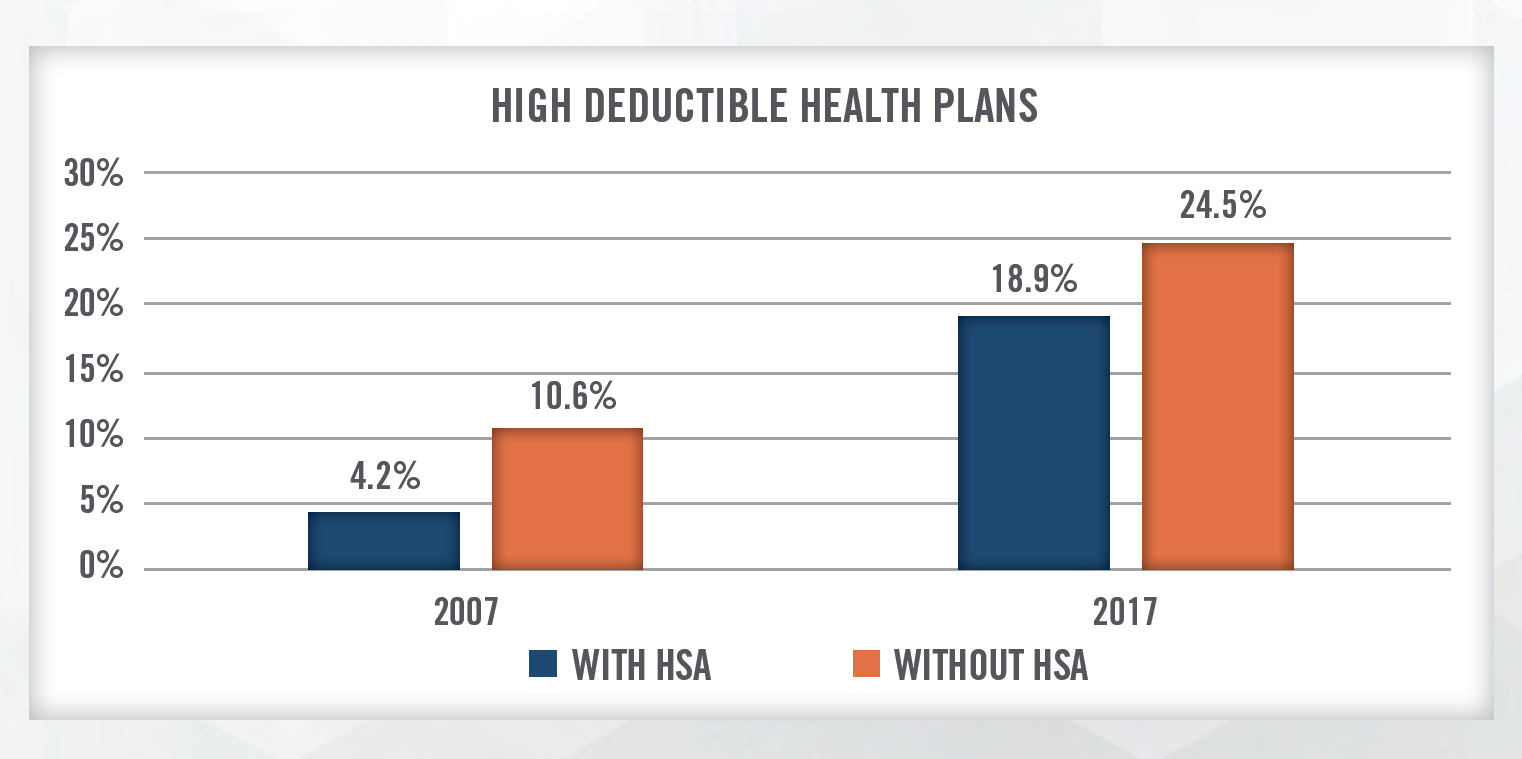

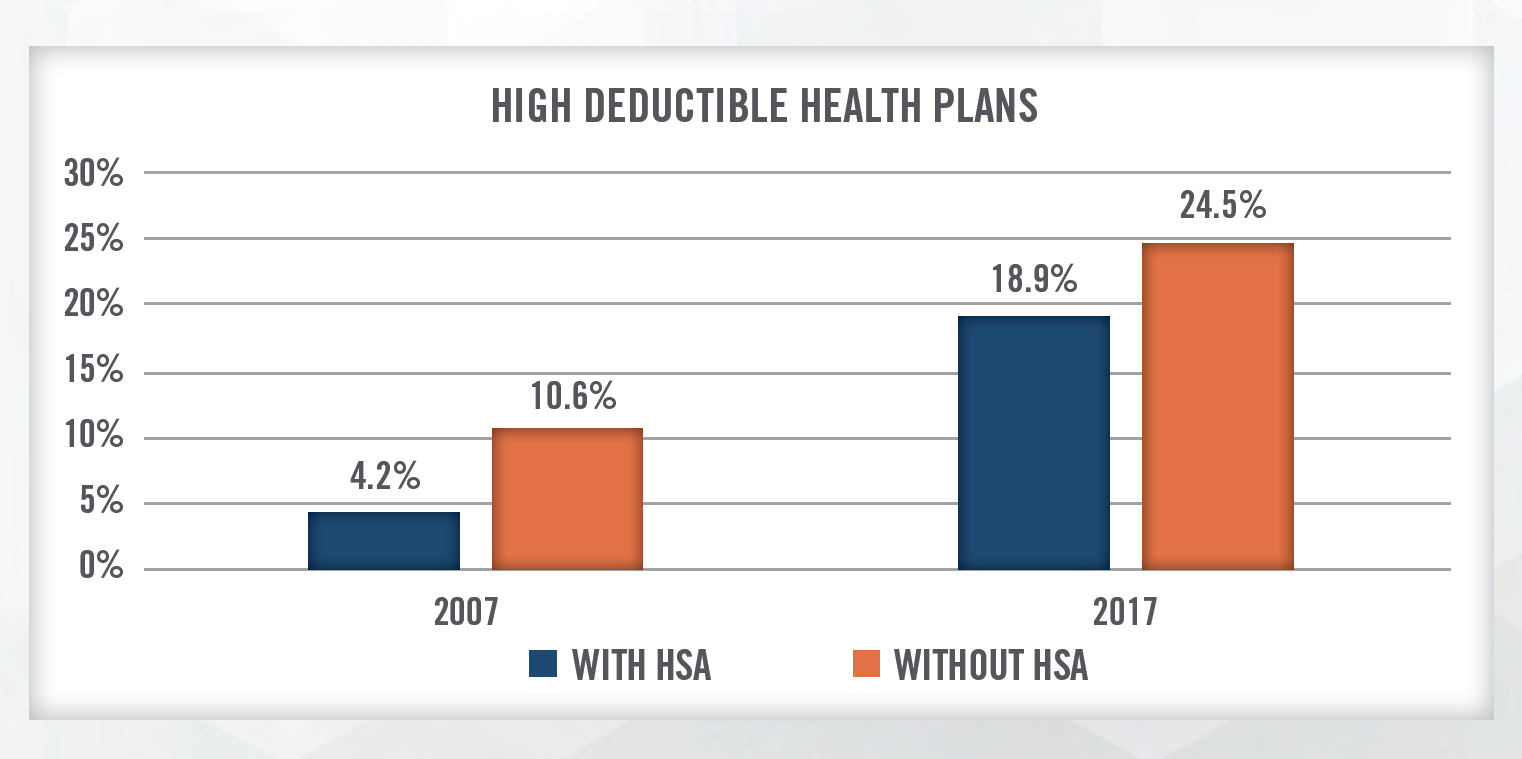

In addition to action by payors, the rise of high deductible health plans and recent price transparency regulations should help accelerate the trend toward lower cost settings. Radiologic imaging is one area of healthcare in which there is a well-documented elasticity of demand, resulting in price discrepancies for comparable services having a large impact on consumer behavior.[5] Price transparency regulations make it easier for consumers to ascertain comparative price information prior to choosing a site of service. These regulations, coupled with the trend toward high deductible health plans (outlined in Figure 3, which illustrates that high deductible health plans have increased from approximately 15 percent of the private insurance market to more than 43 percent in recent years[6]) in which consumers are more incentivized to price shop for healthcare services, should create an environment in which IDTFs continue to gain market share. Convenience is also a factor driving consumer behavior as visiting an IDTF for a scan is preferable to navigating a hospital campus.

FIGURE 3: GROWTH IN HIGH DEDUCTIBLE HEALTH PLANS

Another factor potentially accelerating the shift from hospital-based outpatient imaging is COVID-19. During the most intense period of the pandemic, hospitals and acute care settings have been extremely focused on COVID-19 patients and other very acute cases. As a result, procedures that would normally be done within the hospital setting that can be done in an ambulatory environment have shifted to IDTFs. The following quote from RadNet’s CEO Howard Berger discusses this recent trend and its potential longer-term impact in more detail.

“Furthermore, for the last couple of months, hospitals have focused on COVID-19 and other very acute patients. This will continue for some time. The vast majority of outpatient business that historically has been performed within the hospitals prior to COVID-19 has shifted to the ambulatory providers such as RadNet. This means that patients and the referring physicians will become accustomed to using outpatient providers, and we don’t believe this business will be recaptured by a hospital for some period of time. Ambulatory patients will likely feel more comfortable and safer being directed into freestanding alternatives to hospitals. This could have a material impact on our volumes in the future and could accelerate the existing trend, mostly because of the differential in cost of hospitals losing outpatient business to ambulatory freestanding providers. The acceleration of this trend could also drive more hospitals towards joint ventures and partnerships, which now represents over 25% of all RadNet facilities.”

The shifting of diagnostic imaging volume to the IDTF setting has impacted provider strategies in a variety of ways. As indicated in the quote from RadNet’s CEO, non-hospital providers of radiologic imaging (and many other healthcare services as well) are increasingly receiving interest from hospitals and health systems regarding joint venture arrangements. These joint venture IDTFs provide benefits to both parties, as hospitals are able to mitigate some of the negative impact from lost volume, as well as provide physicians and patients a wider range of imaging service options. IDTFs benefit from increased volume from hospitals and potentially better reimbursement rates from payors as partnerships with health systems provide IDTFs with more negotiating power.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

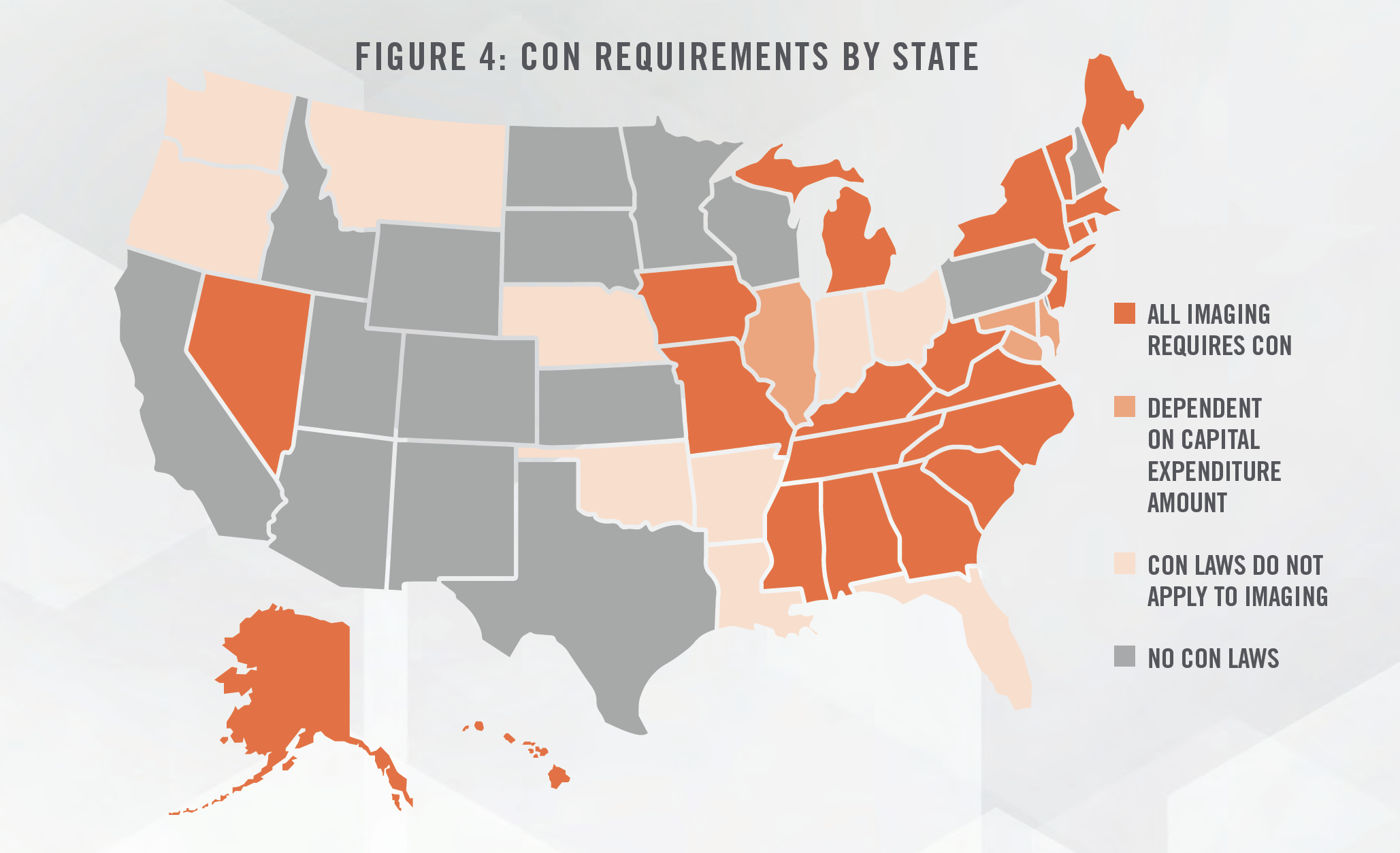

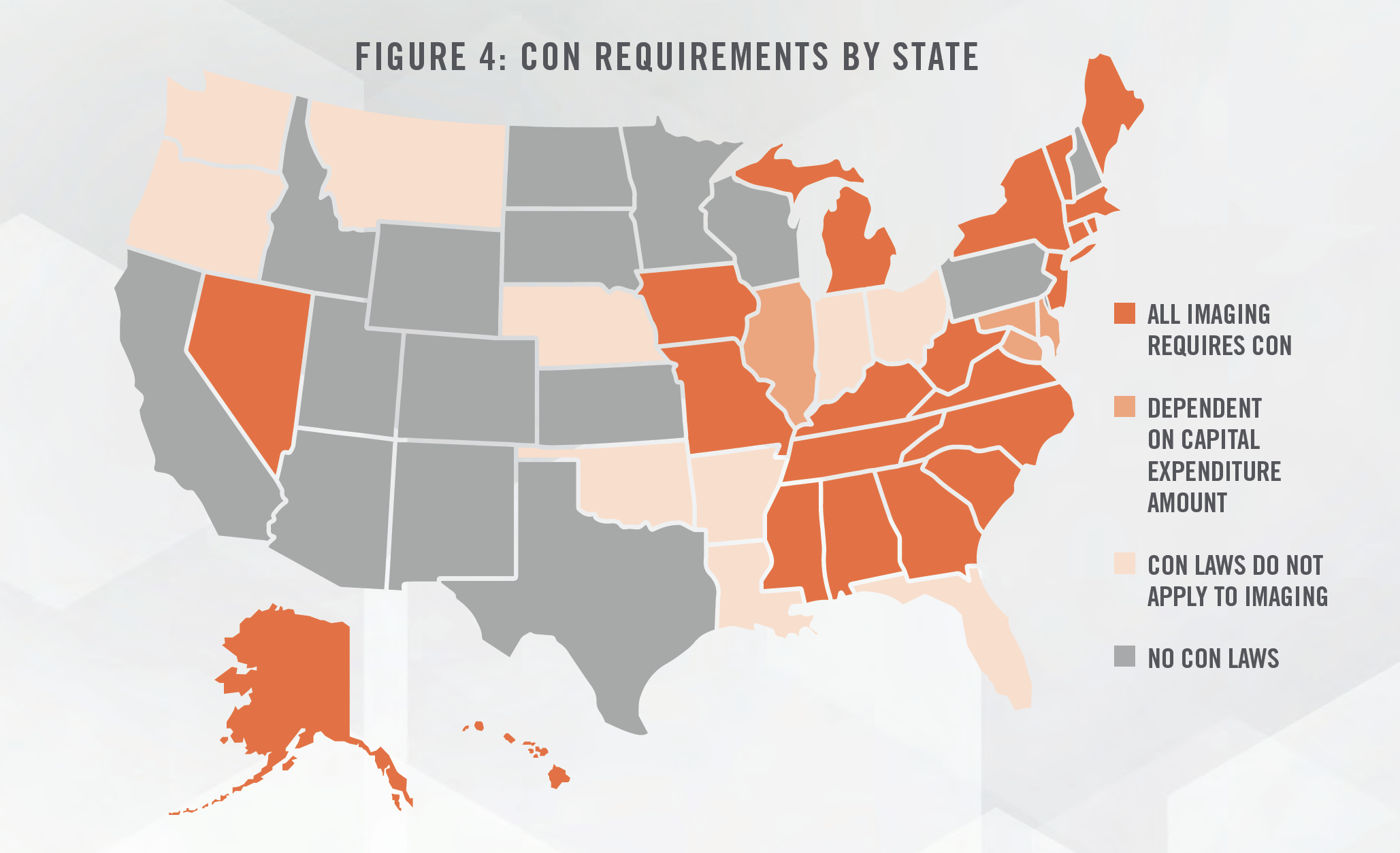

There are many regulations and legal considerations that impact the performance and valuation of IDTFs. Some of the key regulations include certificate of need (“CON”) laws, price transparency regulations, site neutral payment initiatives, and the Stark Law and Anti-Kickback Statute.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

As with every other area of healthcare, diagnostic imaging has been dramatically affected by COVID-19, as medical practices closed and healthcare facilities experienced substantial declines in patient volumes. RadNet, Inc., one of the largest IDTF operators in the country, reported that its volumes for the month of April were down 85 percent on the East Coast, and noted that much of its presence on the East Coast is concentrated in New York and New Jersey, which were hit particularly hard by the virus, while its West Coast volume was down 65 percent. RadNet also closed roughly 100 centers and diverted volume to other centers that remained open to reduce costs. Mednax, Inc. reported that its radiology physician group service line was down between 50 percent and 60 percent in April. Both companies indicated they are taking a cautious approach regarding volume projections going forward, but RadNet does expect to open the remainder of its currently closed imaging centers by the end of 2020.

In the near-term, the COVID-19 pandemic could impact IDTF operations in a number of ways. Centers have already started enabling patients to sign-in to an appointment virtually and wait in the car until it is time for the scan to start to reduce crowding in waiting rooms. There is also likely to be more time in between patients enabling IDTF operators to sanitize equipment and change personal protective equipment. The following quote from RadNet, Inc. management illustrates some of the steps the company has taken to address COVID-19 and make IDTFs safer for patients.

“One of the things that we’ve instituted, which is something that we are contemplating continuing into the future potentially permanently are virtual waiting rooms. So that patients are able to check in, fill out the intake forms digitally, either on their phone or we can give them an iPad, and then go back to their cars and sit in their cars in isolation. And then we’re able to text them or call them at the time of their appointment, so that they’re not waiting in a crowded waiting room with other patients and are not associated with any risk because of that. So that’s been the biggest operational change that we’ve had in our waiting rooms, and it’s been met with high success and has been applauded by our patients.”

Industry operators believe changes in the practice of medicine resulting from COVID-19 could have lasting impacts on the imaging industry. One example of this is the increase in utilization of telemedicine and the impact that could potentially have on physicians relying more heavily on diagnostic imaging tests instead of traditional in-person examinations. The following quote from RadNet, Inc. management discusses this point in more detail.

“Additionally, during this COVID-19 period, telehealth and telemedicine has flourished. I believe this will continue in the post-COVID era. More patients will be availing themselves of telemedical services in the future, and I believe this would be beneficial for RadNet. Because telemedicine does not allow for the traditional physical exam, I believe physicians will order more diagnostic tests and rely on their results for diagnostics and treating their patients at a distance. In particular, I believe this will drive increased utilization of routine imaging, specifically ultrasound and x-ray, as tools that will be utilized earlier in the patient diagnostic staging.”

Other long-term impacts resulting from COVID-19 are likely to include an increase in remote reading of images by radiologists, as well as an acceleration of the trend toward consolidating radiology groups. The main forces driving consolidation of radiology practices include private equity-backed platform organizations and large public company operators of physician practices 6 (discussed in more detail in the following Transactions section). The trend of consolidation in radiology practices has been underway prior to COVID-19, but financial distress and lack of access to advanced technology and economic scale will likely cause many smaller independent practices to consider joining with a corporate sponsor or a health system.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

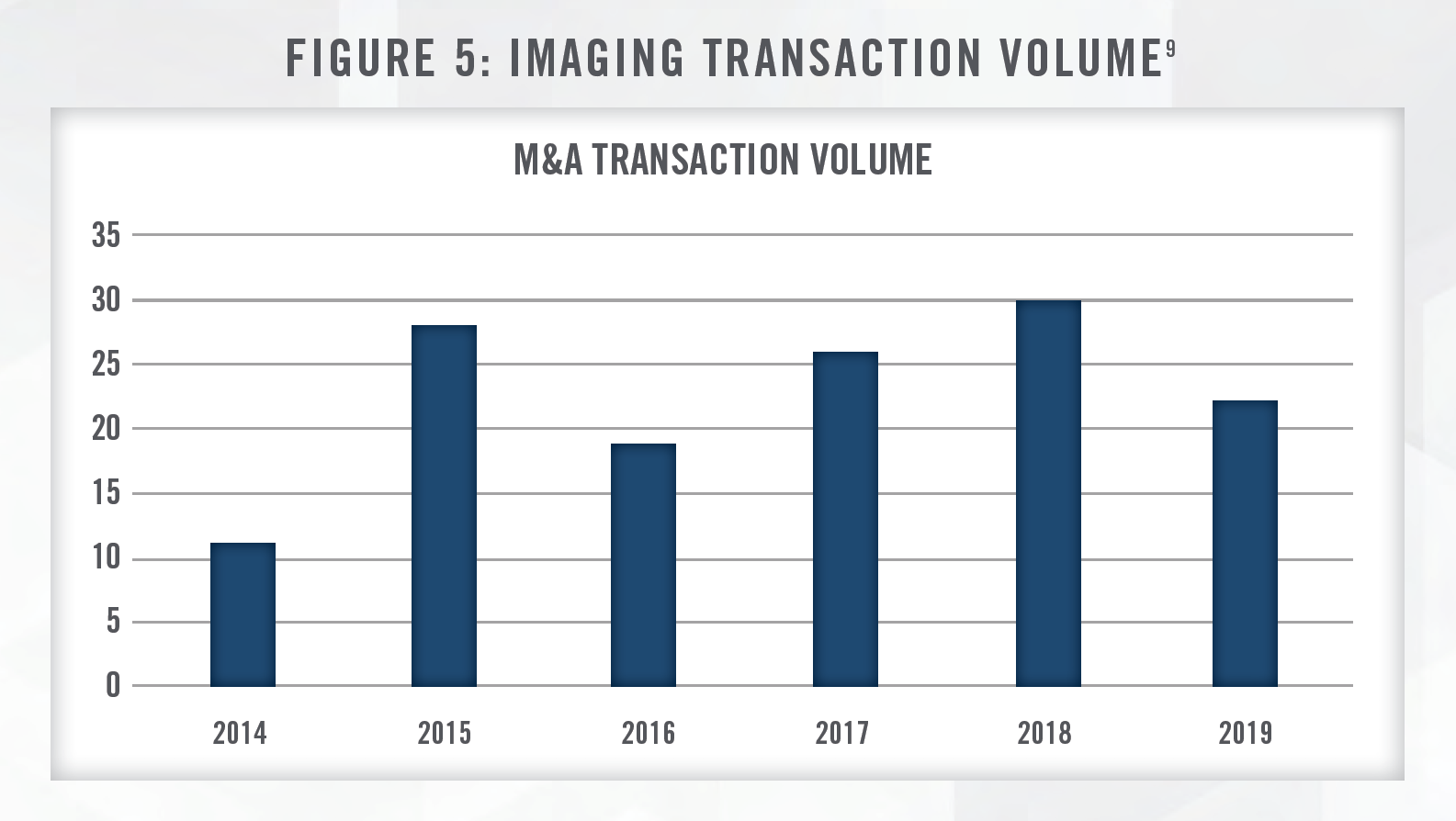

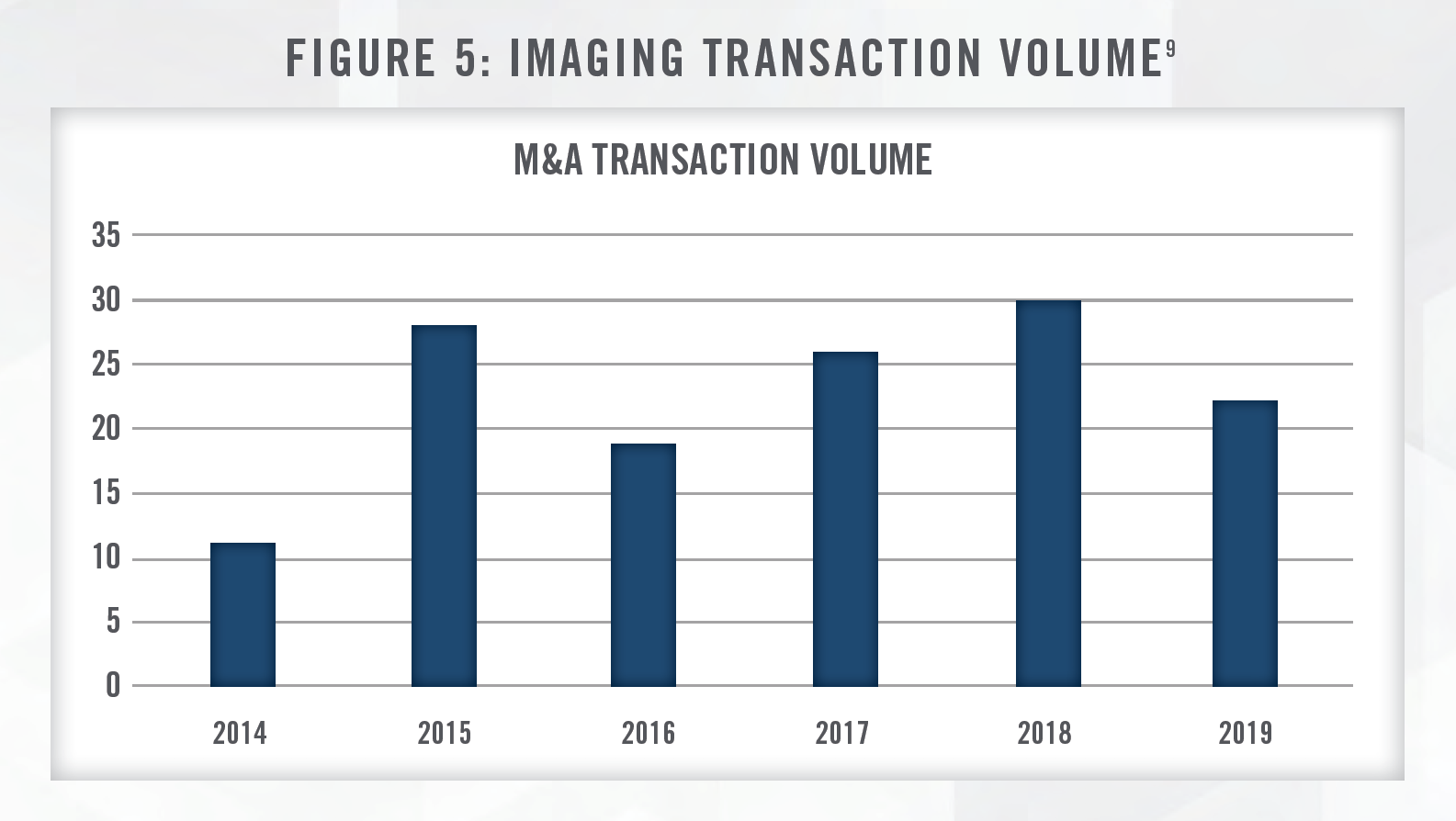

Transaction activity in the radiology sector has been steady in recent years, with interest primarily coming from hospitals and large private equity-backed organizations. For many of the reasons discussed herein, hospitals are interested in acquiring ownership in imaging centers, frequently through joint venture arrangements. Private equity sponsors, as well as publicly traded physician services organizations, have also been active in acquiring radiology practices due to the fragmented market and the benefits of scale. Figure 5 presents merger and acquisition volume in the radiology space over the last several years.

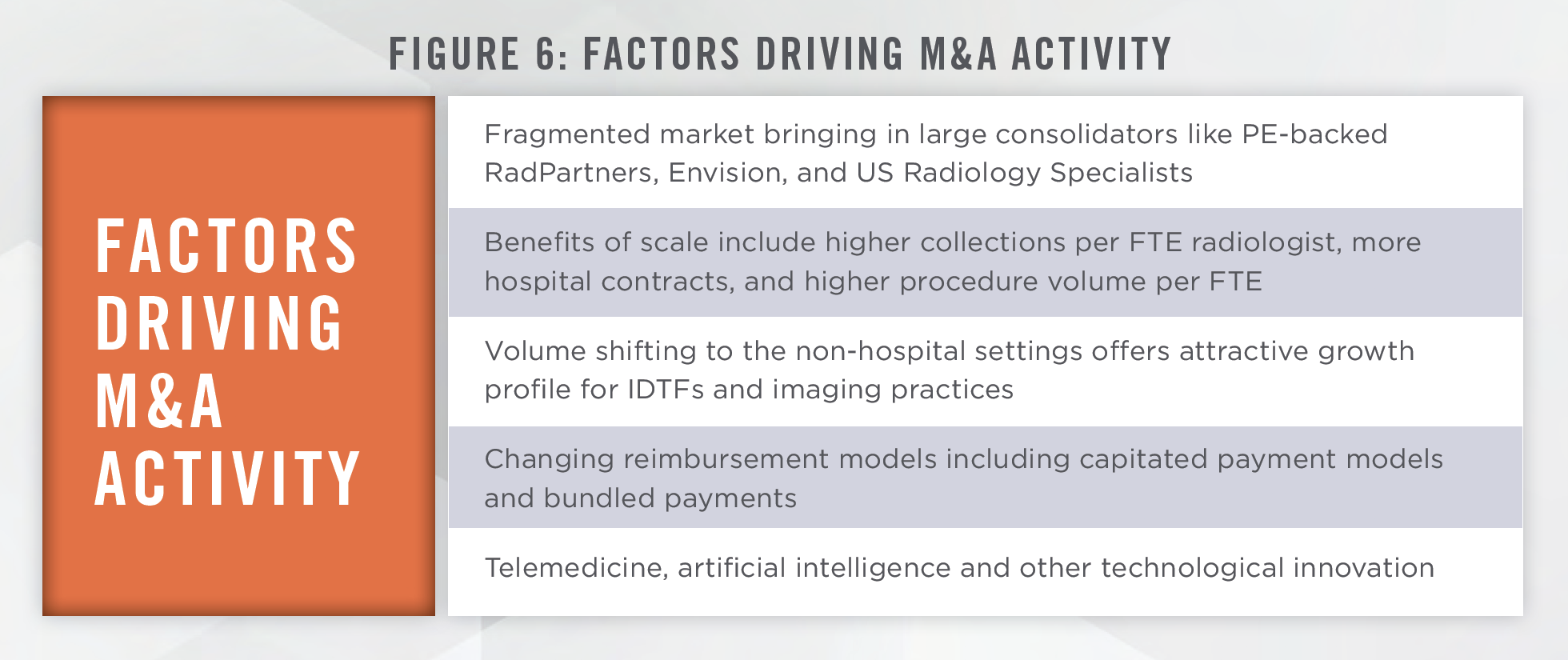

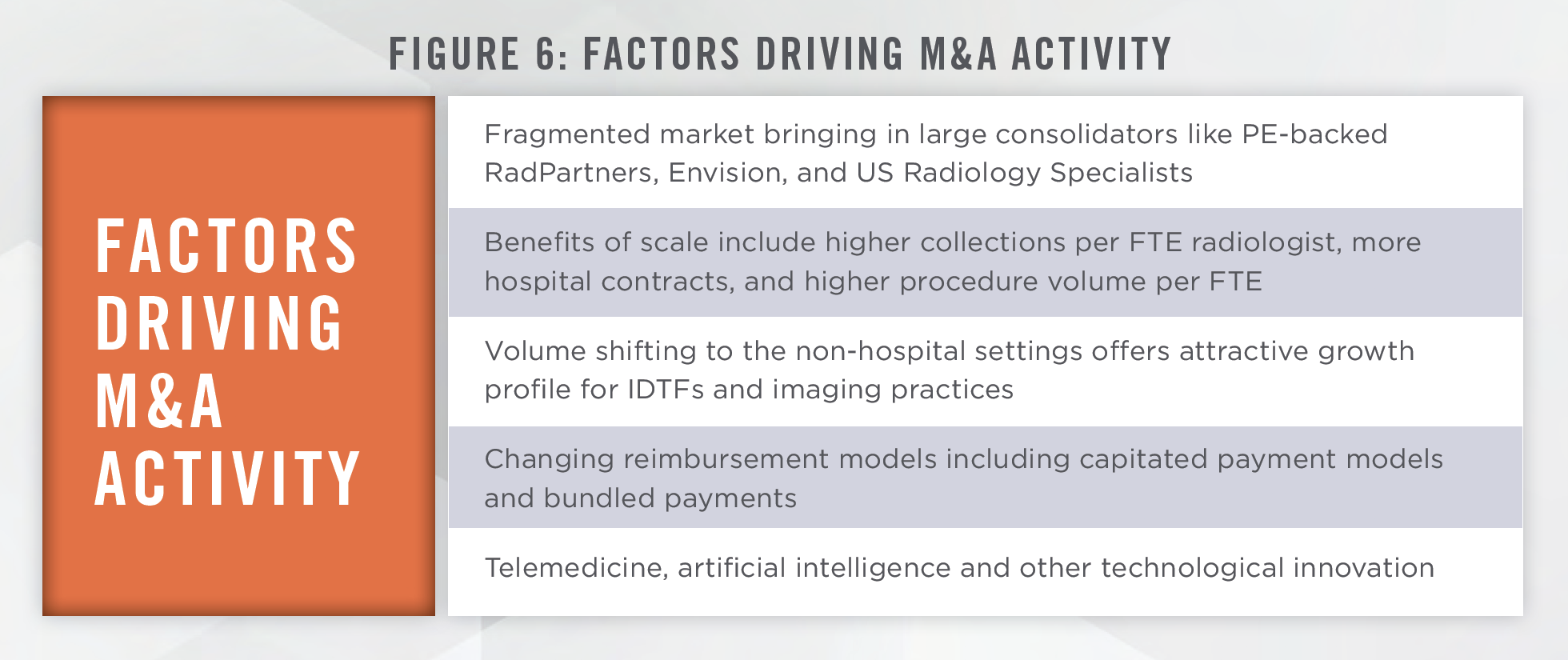

There are many factors that make the radiology market an attractive sector for acquirers. Radiology practices and IDTFs remain highly fragmented, although interest in these entities from private equity firms and publicly traded operators has been increasing and consolidation activity could accelerate as a result of COVID-19. Figure 6 outlines some of the key factors that have contributed to interest in the radiology industry in recent years.

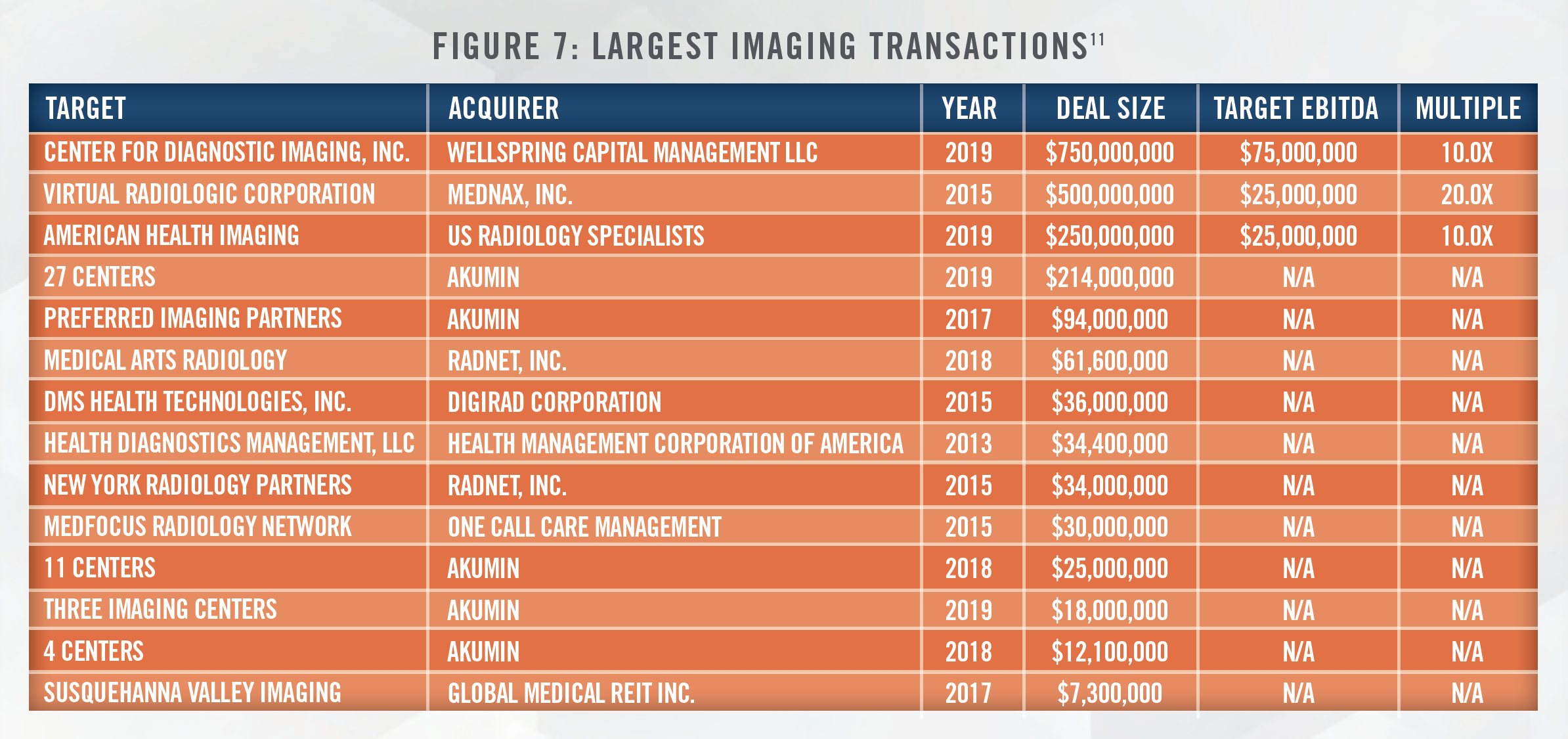

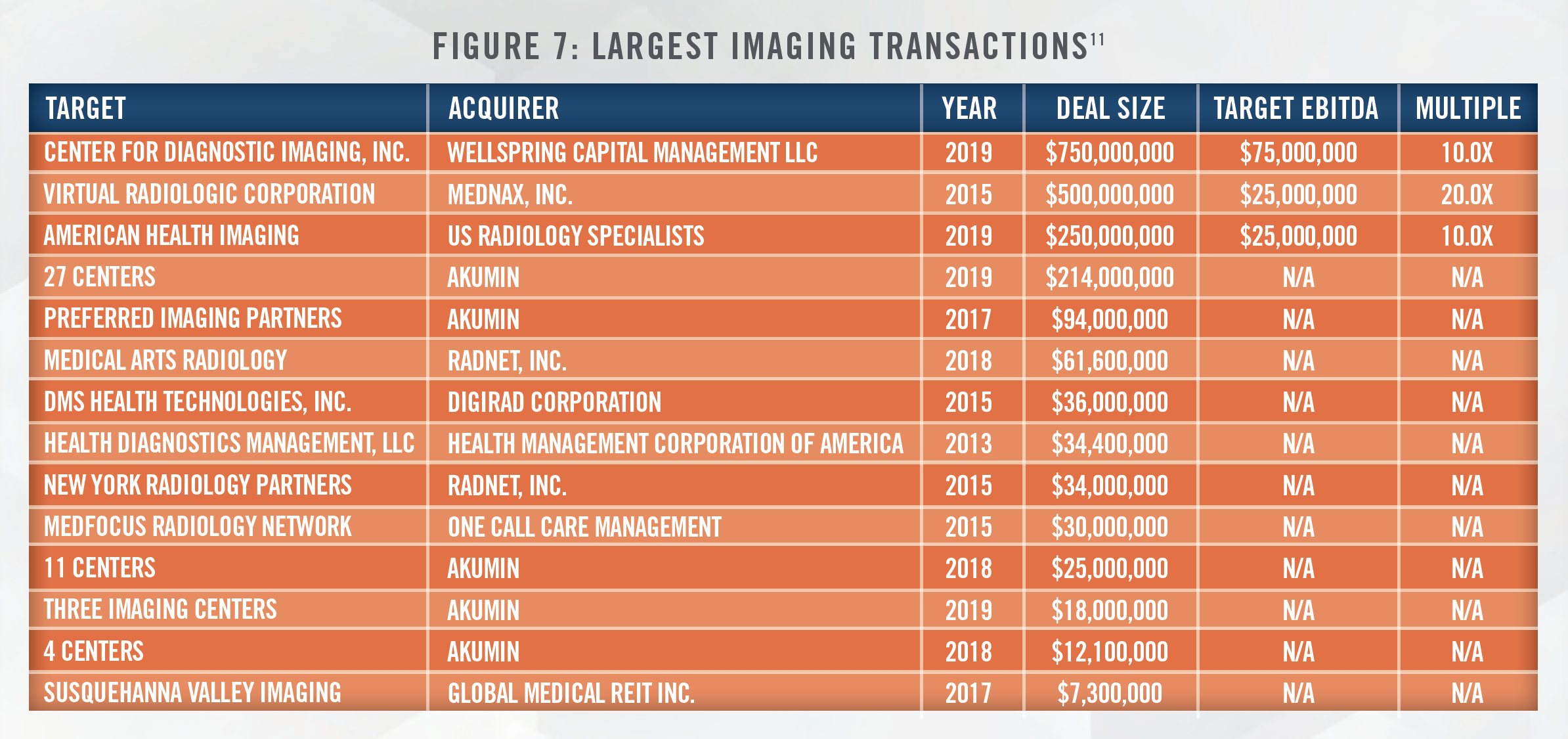

While the industry remains highly fragmented, there have been many large deals in recent years and several private equity-backed organizations, along with publicly traded operators, are starting to reach considerable scale. RadNet, Inc. is the largest provider focused solely on outpatient imaging services in the county with 335 imaging centers as of March 31, 2020. Akumin owns or operates 125 centers in 7 states throughout the United States and is publicly traded on the Toronto Stock Exchange. There are many benefits to scale in the radiology sector, with larger practices experiencing higher revenue per FTE radiologist, a greater number of hospital contracts per group, and more procedures per full-time equivalent physician than smaller practices.[10] Some of the largest radiology transactions in recent years are presented in Figure 7. Mednax, Inc. announced plans in June of 2020 to sell its radiology business, which is one of the largest in the country, with approximately $550 million in revenue and $90 million in EBITDA. Investment analysts on a recent business update call with Mednax, Inc. speculated that the radiology business could sell for a multiple ranging between 8x and 10x earnings before interest, taxes, depreciation, and amortization (“EBITDA”).

Another important factor driving consolidation in the imaging sector is the growth of value-based payment models, which are more easily implemented by larger groups with access to technological and financial resources. Examples of value-based payment models in the imaging space include capitated payment arrangements whereby radiology groups and/or imaging centers receive a per member, per month (“PMPM”) payment to provide a population with imaging tests. One such arrangement exists between RadNet, Inc. and EmblemHealth, in which RadNet, Inc. receives the PMPM payment to manage the outpatient imaging needs of certain EmblemHealth members. Radiology groups can also participate in bundled payments, particularly certain types of surgical procedure bundles involving orthopedic surgery or other specialties where diagnostic imaging is a component of the episode of care.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

The three standard approaches to valuing businesses and interests in businesses may all be considered when valuing diagnostic imaging centers and radiology practices: the Income, Market and Cost Approaches.

Income Approach: The income approach generally attempts to quantify the future economic benefits expected to accrue to the owner of the business, business interest, or asset. Two methods commonly utilized under the income approach are the multi-period discounted cash flow method and single-period capitalization method. When utilizing either income approach method to value an imaging center, the valuator normalizes recent performance, projects the expected future financial performance of the center, and discounts the cash flows expected to be generated at a riskadjusted rate of return. Important considerations include payor mix and modality mix, expectations surrounding governmental reimbursement rates, and age and condition of the imaging equipment. Larger radiology practices with employed physicians, or practices that also own an imaging center, are frequently valued under an income approach. Expertise is often required when projecting an imaging center entity that bills globally (i.e., both professional and technical components of the service) to determine the appropriate read fee (i.e., payment to physicians) so that the technical business of the imaging center can be valued separately.

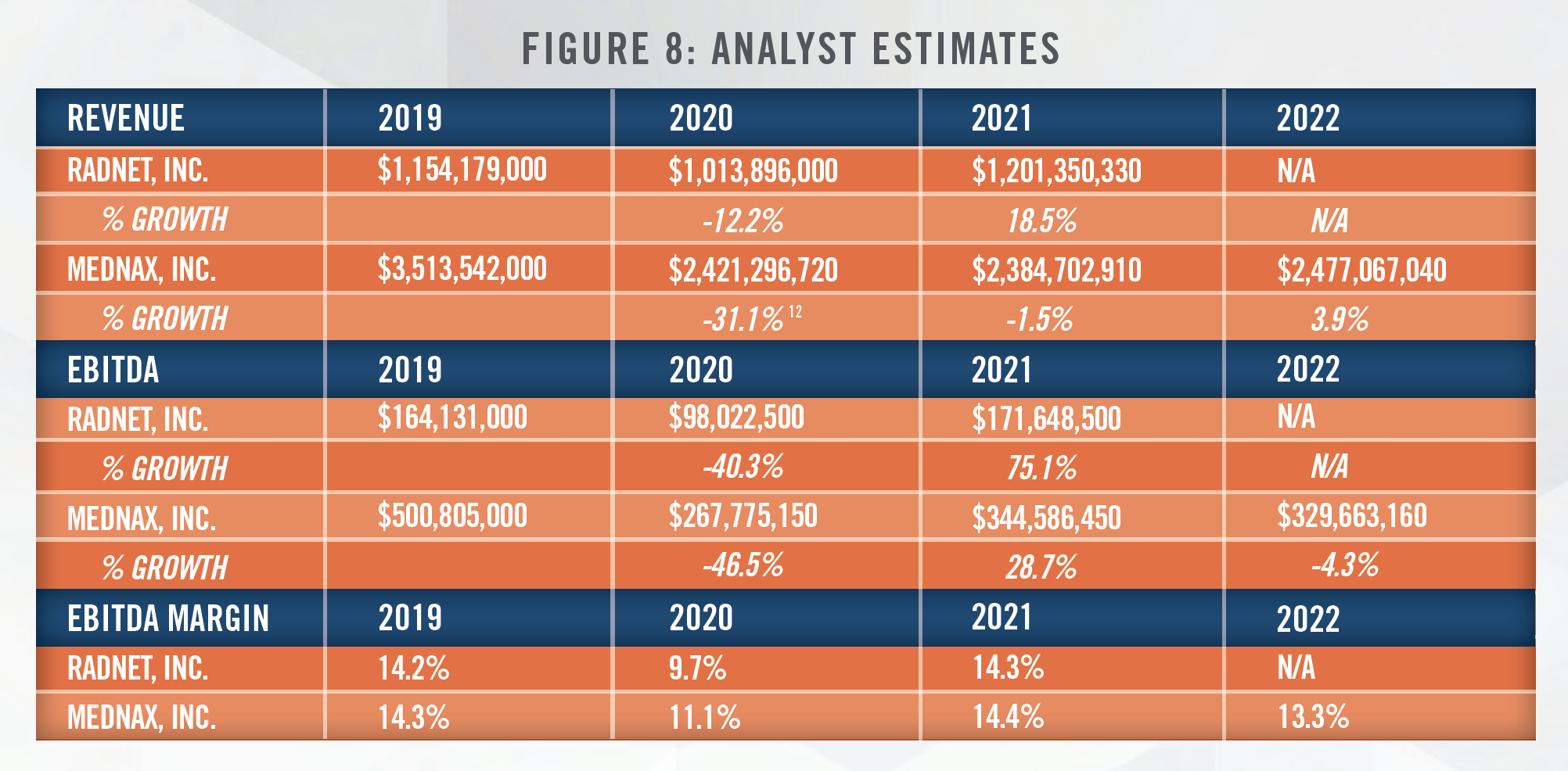

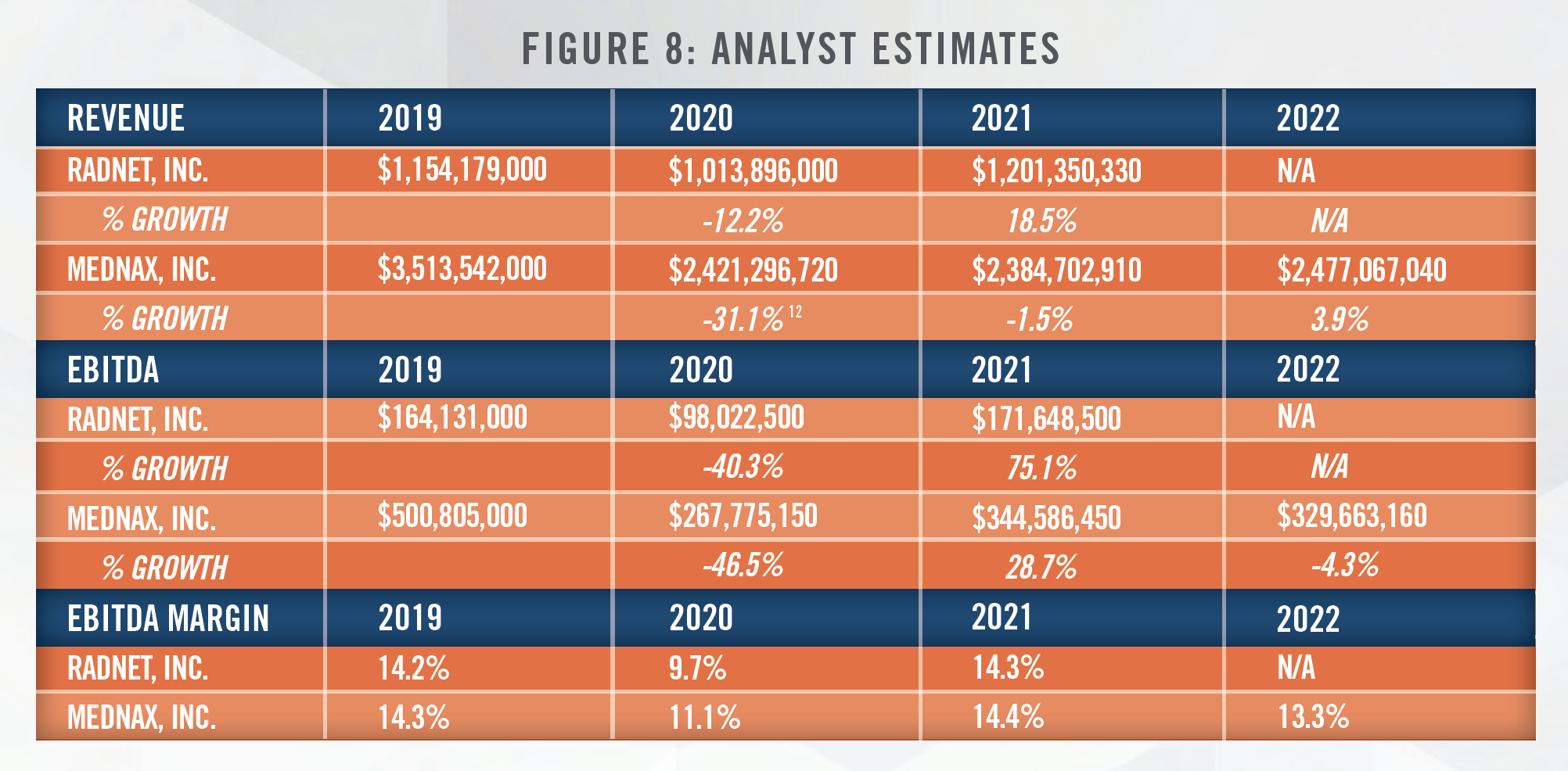

Analyst estimates of future performance for publicly traded companies operating in the radiology space provide some context for the outlook for the sector. Figure 8 presents forward revenue, EBITDA, and EBITDA margin estimates for RadNet, Inc. and Mednax, Inc. taken from S&P Capital IQ. We note that Mednax, Inc.’s recently announced plans to sell its radiology business is not yet reflected in these estimates. Once analysts update their estimates for Mednax, Inc., a valuator could observe the delta between the new and old estimates to determine the implied outlook for its radiology business.

The estimates in Figure 8 also reflect the significant disruption caused by COVID-19, and contain a higher degree of uncertainty and variability than estimates under normal economic conditions.

The outlook for a radiology practice or imaging center will also be impacted by reimbursement dynamics. Reimbursement for the technical component of radiologic imaging procedures has been cut dramatically in recent years.[13] The 2020 Final Rule from CMS is projected to have a 0 percent impact on diagnostic imaging reimbursement, a 1 percent decrease for interventional radiology reimbursement, a 1 percent increase for nuclear medicine, and 0 percent impact for radiation oncology reimbursement. Longer-term, some fear that CMS’s realignment of Evaluation and Management (“E&M”) procedures beginning in 2021 could have a negative impact on radiologists due to the budget neutral provisions of the realignment. Beginning in 2021, the effective payment for E&M CPT Codes will increase, which means reductions in reimbursement for other procedures in order to meet the budget neutral requirement. Radiologists bill relatively few E&M procedures, and CMS has estimated the reduction to radiology reimbursement could reach 8 percent for diagnostic radiology and 6 percent for interventional radiology, while the American College of Radiology believes the reductions could be even greater.[14] Understanding these reimbursement dynamics and having the tools to help quantify the impact is critical to the valuation and consultative process.

Market Approach: The market approach attempts to quantify the value of an imaging center or radiology practice by referencing the valuation multiples paid in closed transactions for similar entities, as well as the valuation multiples for publicly-traded operators that generate business through the provision of services similar to those provided by the subject entity.

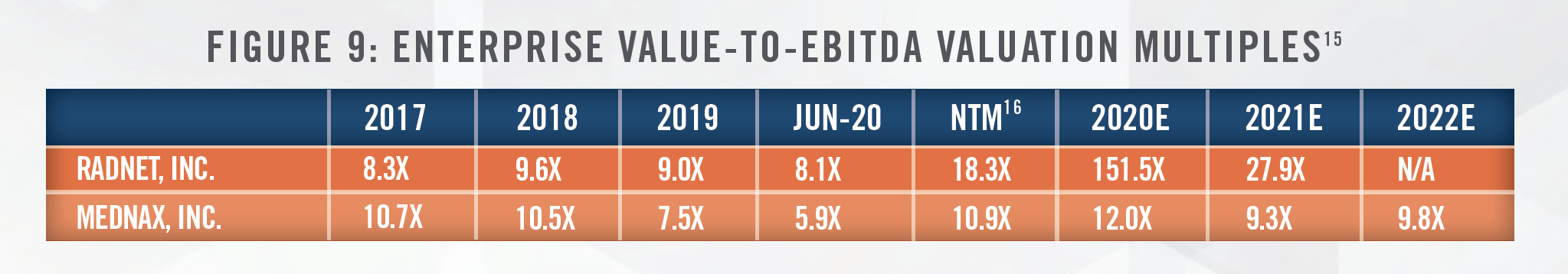

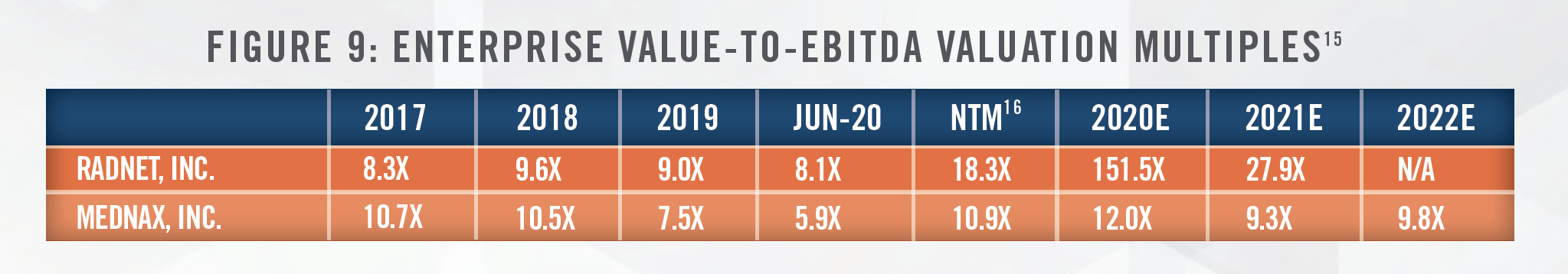

When applying the market approach, it is important to understand the comparability of the subject entity to the market data that is available. A multitude of factors, including many of those discussed in the income approach section, may influence an appraiser’s decision to apply a valuation multiple higher or lower than the median or average that is indicated by the market data. In addition, when comparing to public companies, it is important to consider adjustments for size, scope and geographic diversity that may lead to higher valuation multiples for public companies than for private, stand-alone operators. Figure 9 presents historical and forward enterprise value-to-EBITDA valuation multiples for RadNet, Inc. and Mednax, Inc. The figure illustrates the average trading multiples for each of the past three years, the trailing 12-month EBITDA multiple in June of 2020, and the implied forward EBITDA multiples using forward estimated EBITDA from Figure 8.

As with the forward estimates discussed previously, the implied forward valuation multiples are impacted by COVID-19 and may not be applicable when applying to a normalized earnings metric. The sharp decline in projected EBITDA in 2020 for many companies may result in EBITDA multiples not reflective of valuations in a normalized marketplace.

In addition to viewing the valuation multiples from the public companies, commentary from the management teams also provides insight into valuation multiples in the space. Both RadNet, Inc. and Mednax, Inc. have pursued acquisitive growth strategies and have discussed valuation multiples that they have observed and paid when competing for acquisitions. For example, RadNet, Inc. has indicated that it typically pays 4x to 5x EBITDA for tuck-in acquisitions in markets where it already has a large presence. Both RadNet, Inc. and Mednax, Inc. have indicated that valuation multiples for large radiology groups and imaging centers have reached double digits in many cases, with the elevated multiples mostly attributable to private equity groups that use these larger practices as platform acquisitions when entering new markets. The quote below is from Mednax, Inc. CEO Roger Medel in the second quarter of 2019.

“We also have taken a step back on radiology acquisitions, and that is related to valuation. We have seen that there are a number of private equity firms that have jumped into the radiology field and those [valuation] multiples are higher than double-digit [valuation] multiples. And so that’s not a field that we’re going to be joining in — for the foreseeable future at those kinds of [valuation] multiples.”

Cost Approach: The cost approach determines the value of an imaging center by estimating the costs an investor would incur to recreate a center providing the same level of benefits as the center being valued. Costs that would likely be considered in the valuation include facility expense, imaging equipment and other fixed assets, expenses associated with hiring the workforce necessary to staff the center, as well as costs associated with obtaining the necessary licenses and accreditations to legally operate the center. The cost approach typically represents a floor value, and would be considered when valuing unprofitable centers or de novo/start-up centers. The cost approach is also commonly considered when valuing radiology practices where the earnings of the practice are considered compensation for the clinical services provided by the physicians. Cost approach valuation methods may include concerns over premise of value. HAI frequently works with lenders to help them understand the value of their collateral under various premises of value, including liquidation value, which may be a more prevalent concern during COVID-19.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

The diagnostic imaging market is undergoing many changes related to reimbursement, regulations, COVID-19, and an influx of capital from private equity buyers. Volumes are expected to continue to shift to non-hospital settings, which will likely drive increased interest in joint venture activity between hospitals and radiology groups. Much of the valuation and transaction advisory services HAI provides in the radiology space involves structuring joint ventures between imaging center operators, physician groups and hospitals or health systems. HealthCare Appraisers has the experience and insight to provide the necessary valuation and consulting services to meet the needs of the changing market.

[1] RadNet, Inc. Investor Presentation; Accessed June 8, 2020

[2] IBISWorld Reports; Accessed June 8, 2020

[3] Ibid 1

[4] Advisory Board; Scrutiny over hospital imaging prices continues: How you should respond to UHC’s new policy; https://www.advisory.com/research/imaging-performance-partnership/the-reading-room/2018/10/uhc-imaging-policy Accessed June 8, 2020

[5] Health Affairs; https://www.healthaffairs.org/doi/full/10.1377/hlthaff.2014.0168 Accessed June 8, 2020

[6] Centers for Disease Control and Prevention; https://www.cdc.gov/nchs/products/databriefs/db317.htm Accessed June 8, 2020

[7] Advisory Board; https://www.advisory.com/research/imaging-performance-partnership/the-reading-room/2018/08/site-neutral#:~:text=Here’s%20how%20that%20affects%20imaging,-10%3A15%20AM&text=In%202017%2C%20CMS%20implemented%20a,physician%20offices%20and%20-freestanding%20clinics.&text=Currently%2C%20this%20rate%20equals%2040%25%20of%20the%20hospital%20rate. Accessed June 8, 2020

[8] HealthcareDive; https://www.healthcaredive.com/news/anthem-will-no-longer-pay-hospitals-for-outpatient-mris-ct-scans/503706/ Accessed June 8, 2020

[9] Irving Levin Associates, S&P Capital IQ, Company Filings

[10] Radiology Business; https://www.radiologybusiness.com/sponsored/1077/topics/leadership/100-largest-private-radiology-practices Accessed June 8, 2020

[11] Irving Levin, S&P Capital IQ, and other publicly available resources

[12] Includes impact from COVID-19 and divestiture of anesthesia service line.

[13] Two major pieces of legislation that negatively impacted reimbursement rates include the Deficit Reduction Act of 2005 and the American Taxpayer Relief Act of 2012.

[14] Healthcare Administrative Partners; https://info.hapusa.com/blog-0/how-the-medicare-final-rule-for-2020-will-affect-radiologists#:~:text=Full%20 implementation%20in%202021%20means,not%20meet%20the%20ordering%20criteria. Accessed June 5, 2020

[15] S&P Capital IQ

[16] NTM = Next Twelve Months