![]() HOSPITAL-BASED CARE

HOSPITAL-BASED CARE

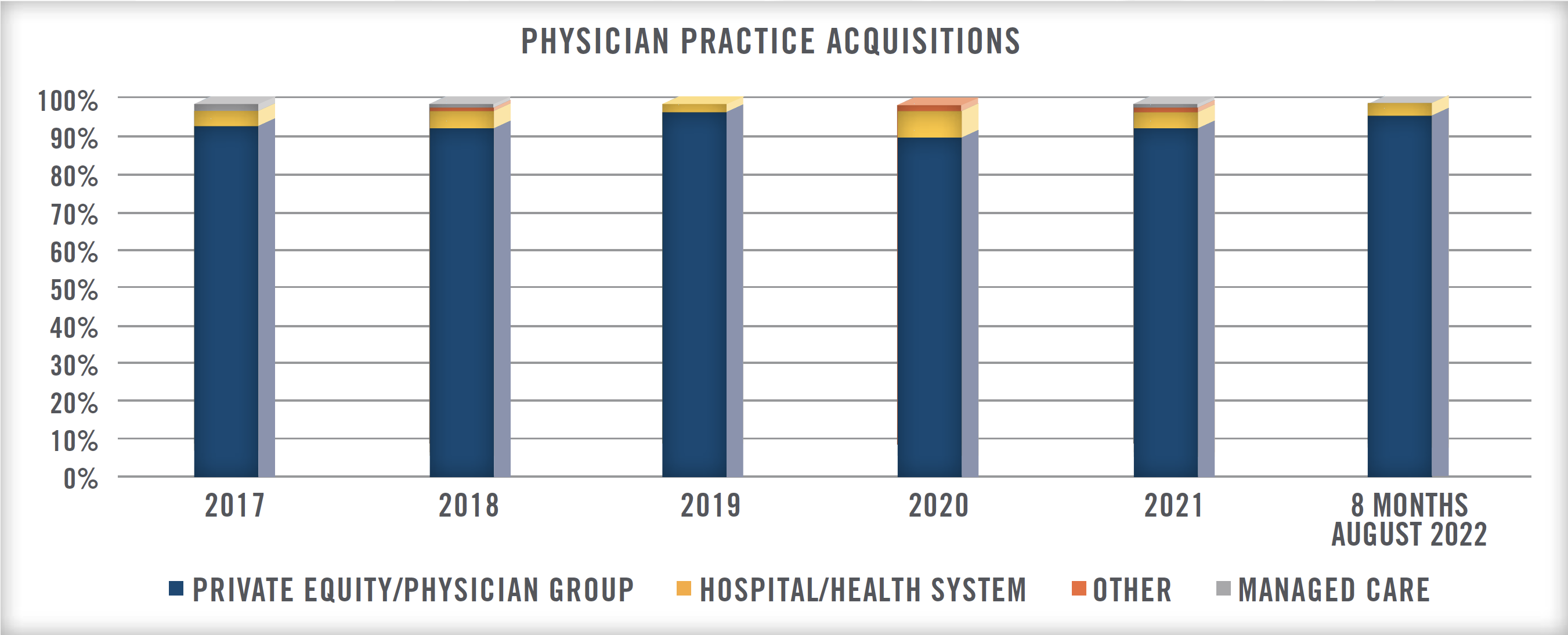

Physician practice acquisition activity has been robust for many years, resulting in a change in the composition of physician employment and practice ownership in the United States. From 2017 through August 31, 2022, there were more than 1,800 practice acquisitions reported by Irving Levin Associates, with private equity and their platform companies (Physician Practice Management organizations, or “PPMs”) driving much of the deal volume.[1] As a result of this acquisition activity, approximately 70 percent of physicians are employed by hospitals/health systems or corporate entities.[2] HealthCare Appraisers has extensive experience in the physician practice transaction space including valuing and advising practices, structuring and valuing physician compensation and management agreements between the management services organization and the friendly professional corporation, and valuing the personal goodwill of the sellers to be used in connection with their tax filings. This article focuses on the valuation of personal goodwill[3] within the physician practice space, as well as recent trends we have observed in these transactions.

Within the PPM space, the focus on medical specialties has broadened considerably in recent years. While the specialties of dermatology, ophthalmology, and dental[4] were the primary focus of PPMs in the early and mid-2010s, we have observed a substantial increase in platforms acquiring orthopedic, urology, gastroenterology, radiology, pain management, ENT, plastic surgery, and primary care practices. Similar business models have been taking shape in the behavioral health and fertility space, among others.

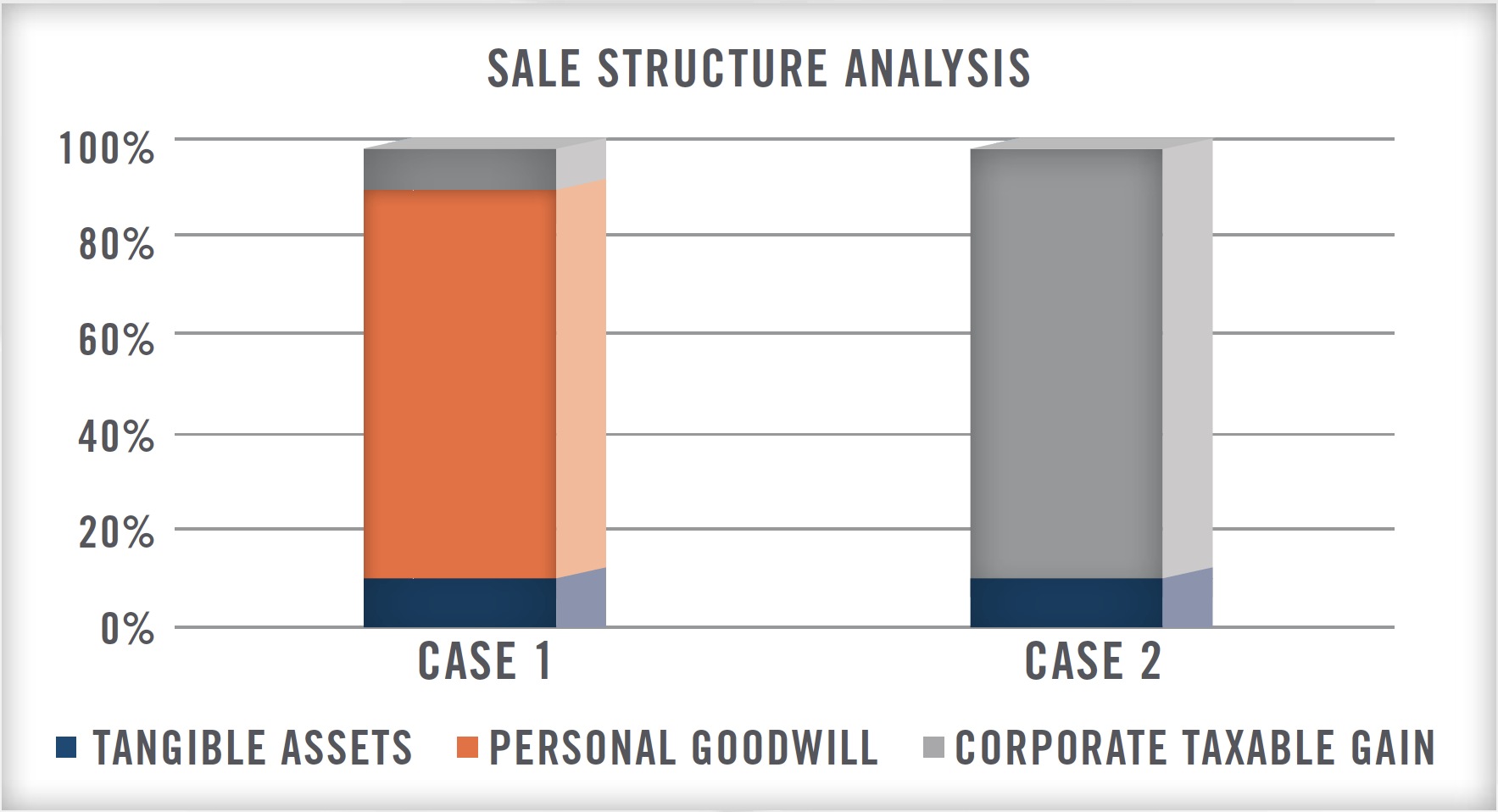

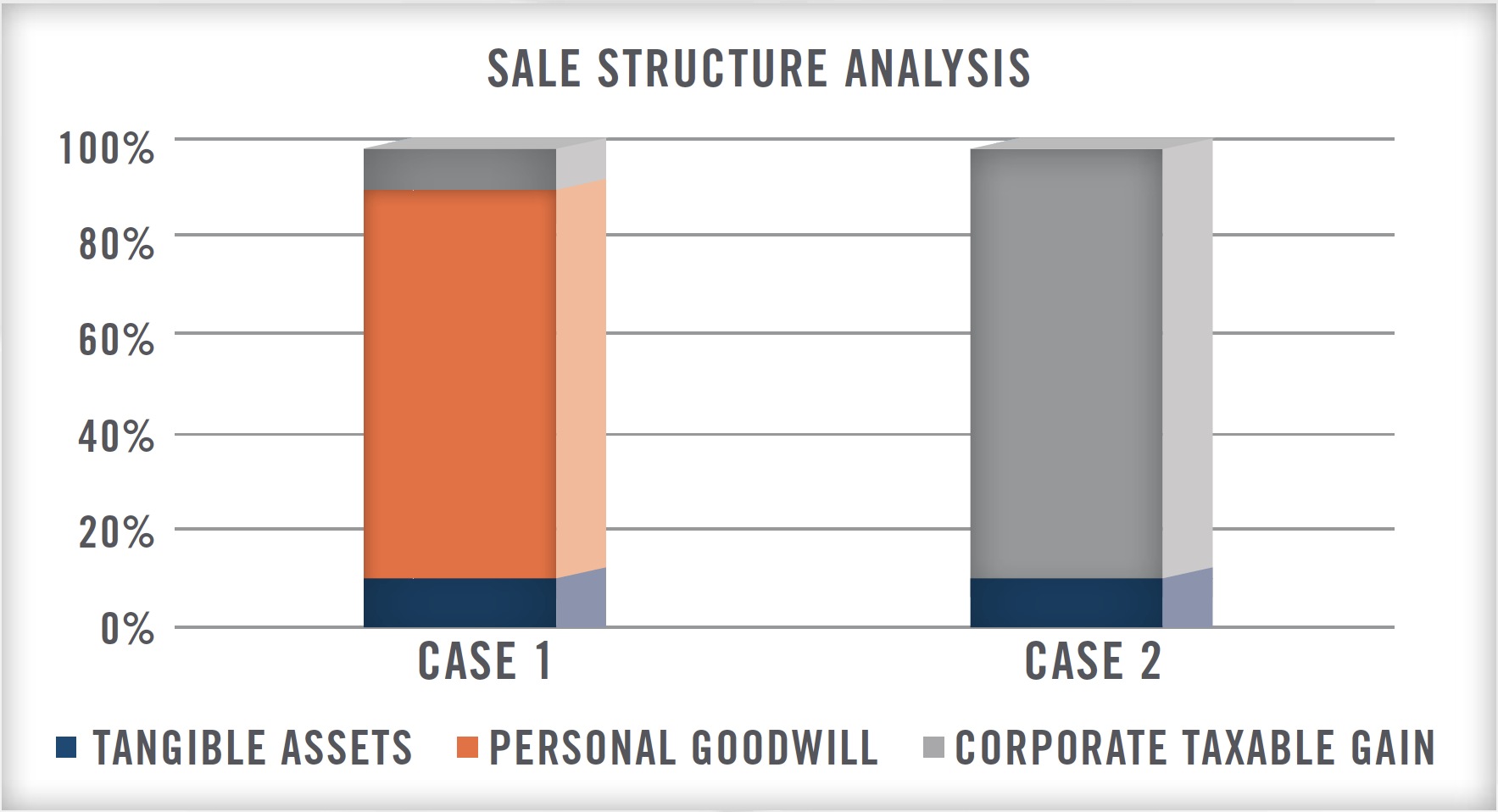

As deal volume remains robust and transaction multiples remain elevated, sellers of physician practices have financially benefited from the sale of their businesses. Optimizing the tax structure of these transactions to benefit the sellers frequently involves allocating a portion of the proceeds to personal goodwill, which may receive favorable tax treatment compared to enterprise or corporate goodwill.

![]() KEY TAX COURT CASES

KEY TAX COURT CASES

Goodwill is defined by the Internal Revenue Service (“IRS”) as “The value of a trade or business based on expected continued customer patronage due to its name, reputation, or any other factor.”[5] An important distinction that has been debated in US Tax Court (“Court”), is that between enterprise goodwill and personal goodwill; this topic has been addressed in several court cases. A few of the important court cases acknowledging personal goodwill are outlined in the following bullet points.

![]() In Martin Ice Cream Co. vs Commissioner, the Court stated: “This Court has long recognized that personal relationships of a shareholder-employee are not corporate assets when the employee has no employment contract with the corporation. Those personal assets are entirely distinct from the intangible corporate asset of corporate goodwill.”[6]

In Martin Ice Cream Co. vs Commissioner, the Court stated: “This Court has long recognized that personal relationships of a shareholder-employee are not corporate assets when the employee has no employment contract with the corporation. Those personal assets are entirely distinct from the intangible corporate asset of corporate goodwill.”[6]

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

As alluded to in the quotes from the Court, key considerations in establishing personal goodwill include whether the goodwill has been institutionalized through non-competition clauses within employment agreements, as well as the importance of personal relationships to the success of the business. Service-focused businesses, including physician practices, often meet the established criteria for the existence of personal goodwill. IRS Technical Advice Memorandum 200244009,[16] which involves a physician practice management company, indicated that goodwill associated with the professionals cannot be a corporate asset in the absence of an employment/noncompete agreement between the corporation and the shareholder. In our experience, the sellers of physician practices frequently have substantial personal goodwill that can be sold, transferred, or contributed as part of a transaction. A physician’s name, reputation, relationships, expertise, and specialization are typically key drivers of their medical practice, which supports the existence of personal goodwill.

![]() VALUATION APPROACHES

VALUATION APPROACHES

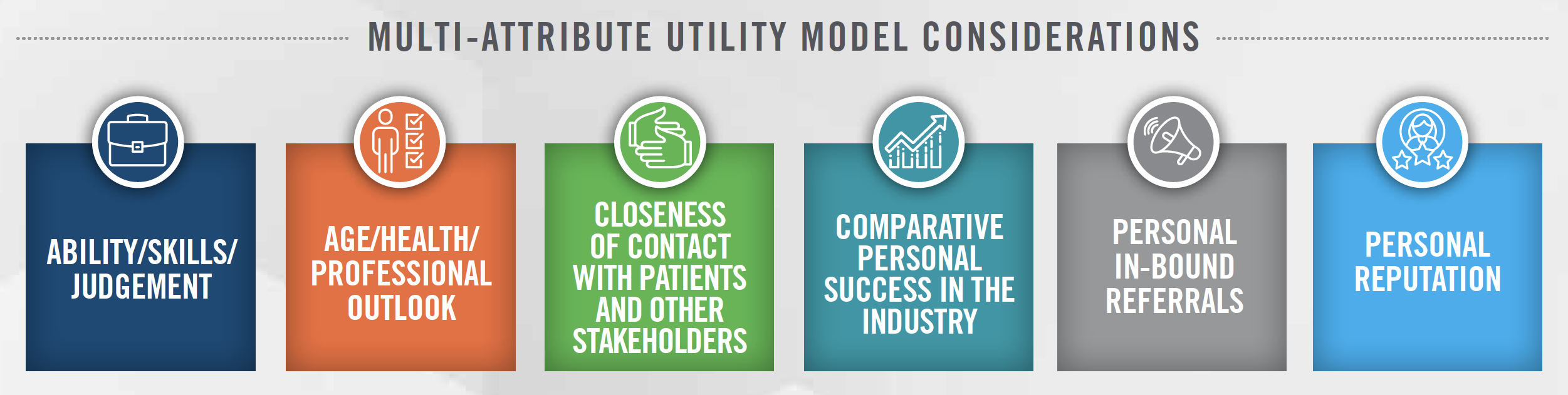

HealthCare Appraisers utilizes three approaches to value the personal goodwill of selling physicians. The two primary approaches are the “With and Without Method” and the Multi-attribute Utility Model (“MUM”). The third method is the residual method, in which the other assets of the practice, both tangible and intangible, are identified and valued, with the residual value representing personal goodwill. HealthCare Appraisers applies the residual method in conjunction with one or both of the other methods discussed below to provide support for the conclusions derived under the other models.

The With and Without Method under the Income Approach is typically applied in the valuation of personal goodwill for medical practices. This methodology uses cash flow models to project the revenues, expenses, and net cash flows the practice would expect to generate with and without the seller’s continued involvement in the business. Under the “with” scenario, the projections reflect the overall assumptions and cash flow projections for the practice “as is.” As a result, the “with” scenario includes the value attributable to the personal goodwill of the seller(s). The “without” scenario models the operations of the practice were the seller(s) to leave the practice. This scenario would, among other factors, take into account: (i) the loss of revenue to the practice from patients deciding to seek care elsewhere; (ii) revenues and costs associated with replacing the departed physician(s) with new providers; (iii) changes in staffing levels caused by fluctuations in patient encounters; and (iv) the impact of changes in the type(s) of ancillary services provided at the practice. The correct application of this methodology requires a deep understanding of the financial and operational drivers of a medical practice.

When assigning value to personal goodwill, it is important for an appraiser to take into consideration the probability of competition. HealthCare Appraisers utilizes a proprietary scorecard in which we analyze the willingness and ability of the selling physicians to compete absent a post-transaction non-compete agreement. Factors analyzed include barriers to entry, the economics of competition, and the likelihood of direct competition.

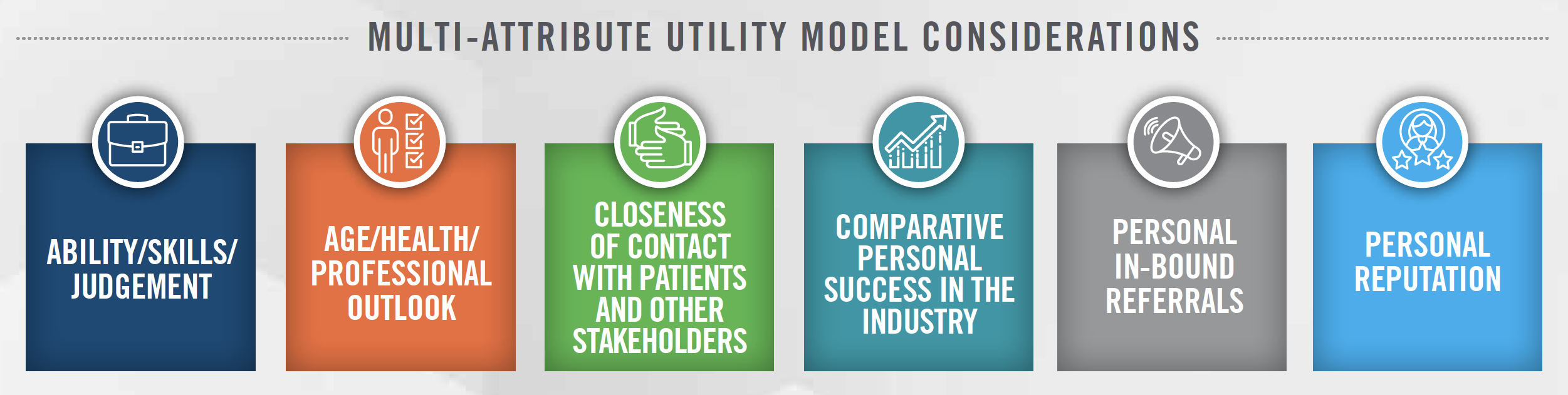

In addition to the With and Without Method, HealthCare Appraisers utilizes the MUM to value personal goodwill of selling physicians. The MUM has been accepted in numerous court cases and provides qualitative support to the more quantitative With and Without Method.[17] In our application of the MUM to personal goodwill valuations, we utilize a scorecard which contains the attributes associated with personal goodwill. We then assess the degree to which each attribute is present in the subject practice. The attributes or factors contributing to the presence of personal goodwill include the age and health of the seller(s), their comparative success in the industry, the marketing and branding of the practice, the source of referrals, the seller(s) reputation, as well as other factors. After scoring each of these attributes on the scorecard, we apply the resulting personal goodwill ratio to the total purchase consideration to calculate the personal goodwill of the seller(s).

The residual method for valuing personal goodwill values the asset by subtracting the value of all other tangible and intangible assets from the overall enterprise value of the practice. The difference, or residual, between the enterprise value and the other assets of the practice is assumed to represent personal goodwill, since all other assets have already been accounted for. Examples of other assets commonly found in physician practices include fixed assets, working capital, workforce, tradename, and electronic medical records. Under the residual method, each of these assets and any other assets determined to be present would be valued. The value of each asset is then subtracted from the enterprise value implied by the transaction. The remaining value is assigned to personal goodwill.

In our experience, properly accounting for the personal goodwill in a medical practice transaction may result in sale proceeds retained by the seller physicians that are up to 18 percent higher than if a transaction did not account for the personal goodwill. For large practice transactions, this can result in millions of dollars in tax savings that are retained by the sellers.

![]() ADDITIONAL CONSIDERATIONS

ADDITIONAL CONSIDERATIONS

For practices with multiple owners, we must take the additional step of allocating the personal goodwill attributable to each individual owner. In certain cases, this allocation is based on ownership percentage, but frequently the allocation is based on another metric, such as productivity, contribution to profitability, or a physician’s relative decrease in compensation in connection with the transaction. Examples of metrics used to allocate personal goodwill include historical or proforma wRVUs, professional collections, contribution margin, contribution to EBITDA, tenure or years of experience, among others. For practices with certain types of in-office ancillary services or related ancillary companies (e.g., ambulatory surgery centers), it may be appropriate to use different approaches to allocate the value of personal goodwill resulting from the in-office ancillaries and ambulatory surgery centers versus the professional practice. Conducting a MUM analysis that is relative to each of the owners can be useful in establishing an appropriate allocation as well, as to give consideration to items associated with personal goodwill value that may not be fully captured in a productivity-based metric (see contributing factors of MUM analysis discussed earlier as an example).

An additional consideration with respect to allocating proceeds from the sale is the status of the practice as either an S-Corp or C-Corp. In HealthCare Appraisers’s experience, when we value personal goodwill in connection with the sale of an S-Corp, the tangible and identifiable intangible assets are distributed evenly amongst the owners (or in proportion to their ownership percentage), while the personal goodwill is allocated disproportionately based on the methodologies previously described.

HealthCare Appraisers has also observed transactions where non-owners effectively take part in the sale by taking reductions in compensation and receiving a multiple of this reduction in exchange for the contribution of their personal goodwill. Most PPM transactions are structured such that the sellers “create” EBITDA by taking a reduction in compensation (known as a “scrape”), and then receive a multiple of this EBITDA through the sale of the practice. In certain cases, we have seen employed physicians receive a scrape to their compensation as well, which enables them to participate in the transaction. In these cases in particular, it is important to assess whether the presence of non-competition agreements between the employed physician and the practice being sold prevents the sale of personal goodwill (i.e., the employed physician’s personal goodwill has been institutionalized through the non-compete). We have also observed groups of physicians employed by hospitals sell their personal goodwill as part of a transaction in which they join a PPM.

The skill and effort committed by HealthCare Appraisers has contributed to a very favorable outcome in our transaction. If a potential client wants a sincere reference we would be happy to be included in the roster of very satisfied clients.

![]() IMPORTANCE OF OBTAINING AN APPRAISAL FROM A HEALTHCARE APPRAISAL EXPERT

IMPORTANCE OF OBTAINING AN APPRAISAL FROM A HEALTHCARE APPRAISAL EXPERT

The sale of a medical practice is an important financial and professional milestone in the life of many physician-owners. When contemplating a transaction, in addition to the total purchase price, sellers and their advisers should give specific consideration to the allocation of personal goodwill. Care must be taken before and during the transaction to establish if personal goodwill exists, if it is both salable and transferable to the purchaser, and if it is owned by a shareholder rather than by the practice itself. If the goodwill generated by the seller’s skill, expertise, reputation and loyal patients are attributable to personal goodwill, a separate sale of this asset may result in significant tax savings to the seller when it comes time to complete IRS Form 8594[18] under IRS Code §1060[19] during tax filing. An independent, third-party opinion of the fair market value provides the basis for the personal goodwill allocation through a defensible, quantitatively and qualitatively derived determination of the personal goodwill value being transferred.

[1] Irving Levin Associates; Physician Groups includes private equity backed platform companies as well as publicly-traded physician groups.

[2] Physician Advocacy Institute Study, accessed April 5, 2022

[3] Specifically, fair market value analyses as outlined in Internal Revenue Code Revenue Ruling 59-60

[4] Through dental service organizations (DSOs).

[5] IRS Publication 535 accessed on December 4, 2019 from the IRS website

[6] Opinion obtained from US Tax Court website, accessed April 5, 2022

[7] Ibid.

[8] Ibid.

[9] The Practical Tax Lawyer, Personal Goodwill in Sale of “C” Corporations, accessed September 16, 2022

[10] Ibid.

[11] Opinion obtained from US Tax Court website, accessed September 26, 2022

[12] Opinion obtained from US Tax Court website, accessed October 18, 2022

[13] Accessed from https://casetext.com/case/macdonald-v-commr-of-internal-revenue-5 on October 18, 2022 [14] Accessed from: https://casetext.com/case/cullen-v-commr-of-internal-revenue on October 18, 2022

[15] Accessed from: https://casetext.com/case/estate-of-taracido-v-commissioner on October 18, 2022

[16] IRS National Office Technical Advice Memorandum #200244009 released November 1, 2002 and accessed from their website on April 5, 2022

[17] BVR’s Guide to Personal v. Enterprise Goodwill

[18] IRS Form 8594 accessed from the IRS website on April 5, 2022

[19] Obtained from Cornell Law website on April 5, 2022