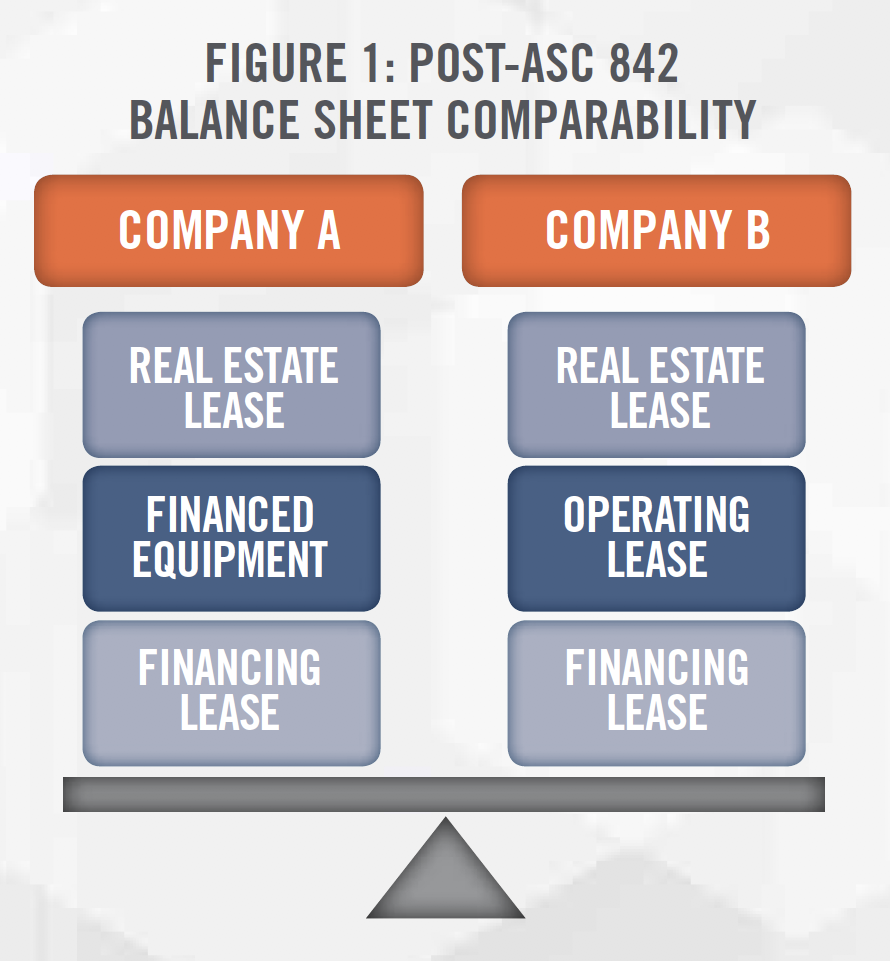

The Financial Accounting Standards Board (“FASB”) enacted a change in how companies should (or will) record liabilities from operating leases in Accounting Standards Codification 842 (“ASC 842”) when preparing financial statements under generally accepted accounting principles, or “GAAP”. Broadly speaking, ASC 842 requires companies to calculate a present value for the liability of transactions, including office space rent and certain equipment leases, much like the current process for capital equipment leases. This change resolves several grievances that analysts and accountants previously held, such as the former ability of management to relegate these liabilities to the footnotes of financial statements. One of the end goals of ASC 842 was to increase transparency regarding future promised payments; additionally, ASC 842 enables a more direct apples-to-apples comparison of financial statements between firms. In issuing ASC 842, FASB indicated that such operating lease liabilities should not be considered debt (i.e., in the capital structure), but continue to be a cost of operations.[i]

U.S. public companies began required implementation of ASC 842 with fiscal years starting December 15, 2018; as such, all public companies in the U.S. now record these liabilities. FASB proposed private companies implement ASC 842 for fiscal years beginning December 15, 2021.[ii]

Publicly traded companies have reacted to changes caused by ASC 842. While presentation of income statements has not dramatically changed for these companies, balance sheets have ballooned with recorded liabilities and corresponding right-of-use lease assets. As such, some companies are responding by shortening the duration of future leases, which directly decreases the associated liabilities. Furthermore, recent uncertainty surrounding COVID-19 may also cause businesses to re-evaluate their leases, whether that be through more flexible lease arrangements with shorter durations, or fewer space and equipment leases altogether.

Those in the profession of valuing U.S. companies must consider the impacts of ASC 842. When applying the Income Approach to valuing a business, we may project rent/lease expense to become less stable as leases are renegotiated more frequently in the future (i.e., in effort to minimize the recorded liability on the balance sheet), instead of relying on inflationary adjustments.

The Market Approach involves observing closed transactions or public companies to determine the value of a private business. The discrepancy in the implementation timeline of ASC 842 between public and private companies should cause an appraiser to closely examine the data selected to value companies using the Market Approach. Such data may require new adjustments as a result of ASC 842. To use the guideline public company method to determine the value of a private company, appraisers must now make any necessary adjustments to ensure that valuation multiples (e.g., Enterprise Value-to-EBITDA) are consistent between the reporting requirements for the entity subject to a valuation and the guideline public company. In the future, valuation multiples from comparable closed transactions may need to be adjusted, dependent on the date of transaction and accounting standard utilized.

Some widely used sources of market data include total operating liabilities within calculations of total debt for public companies. This deviation from FASB’s guidance stems from the divergence with ASC 842’s international counterpart – International Financial Reporting Standards 16 (“IFRS 16”). IFRS 16 states that such operating lease liabilities should be considered a source of financing; in other words, operating lease liabilities should be included in debt. Faced with this incongruity, some market data sources have chosen to follow IFRS 16 guidance, which allows international companies to be compared to U.S. companies.[iii] IFRS 16 imposes no requirement to separately identify what would normally be considered operating lease liabilities versus financial lease liabilities.

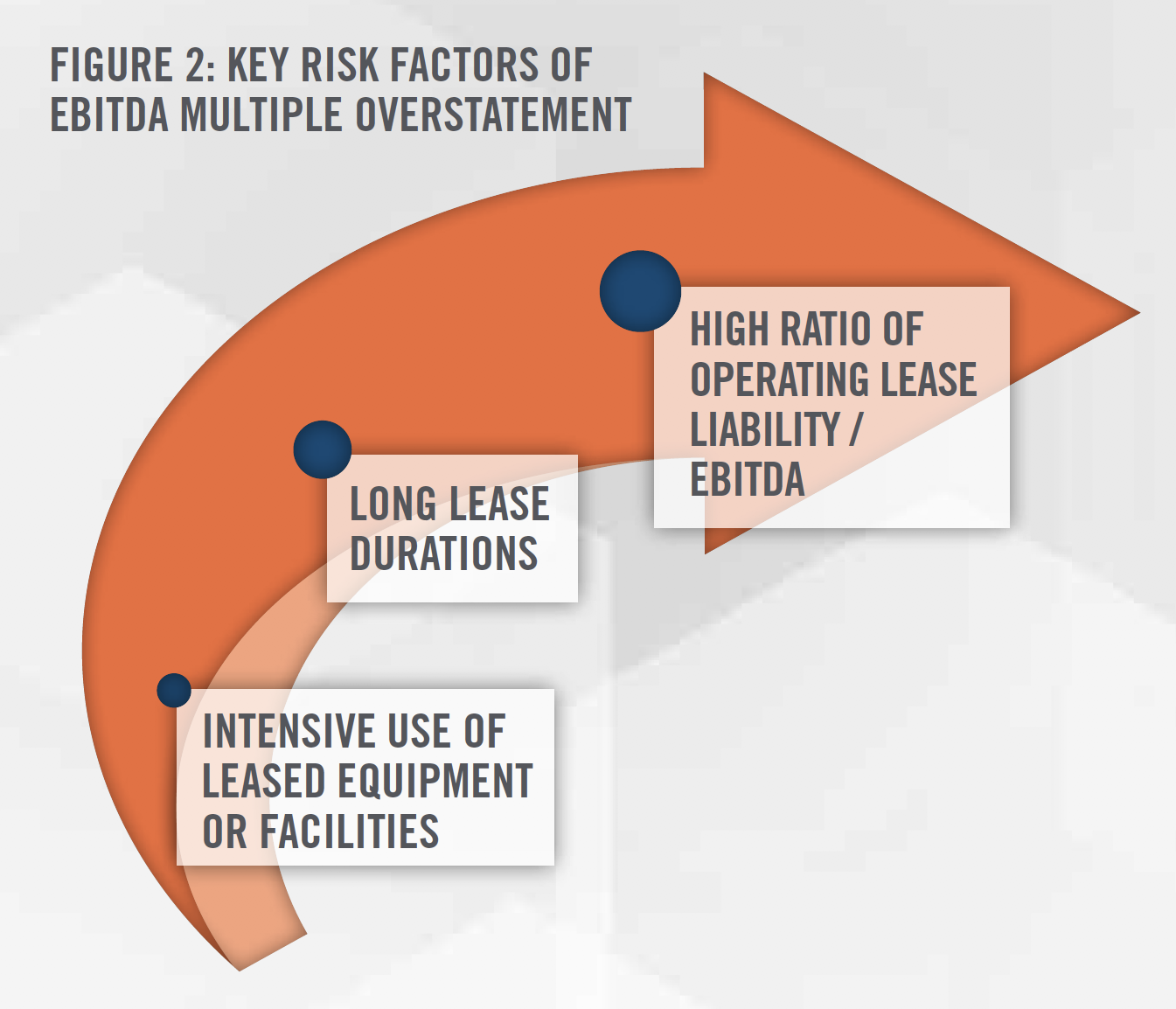

Such a divergence in the treatment of lease liabilities has material ramifications on use of the Market Approach. If an analyst were to forego adjusting total debt for the new inclusion of operating lease liabilities, a selected valuation multiple could inadvertently overstate the value of a business.

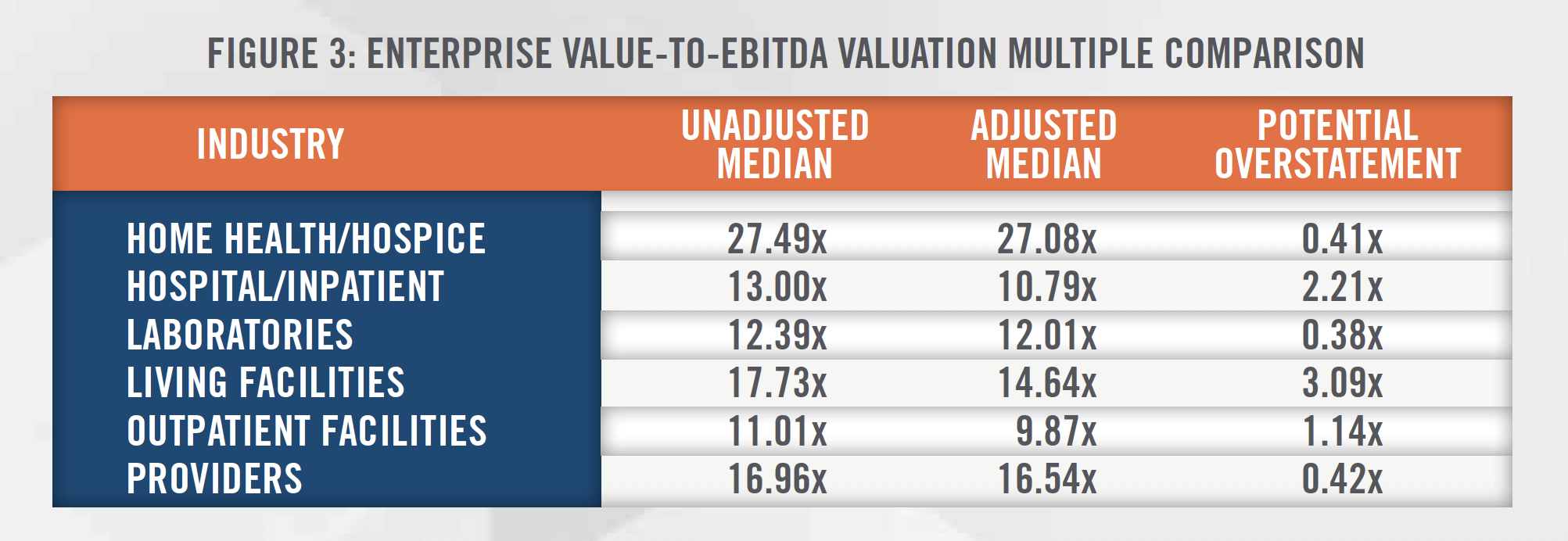

In Figure 3, we outline aggregated valuation multiples of publicly traded companies that comprise various subsegments of the healthcare industry. Also shown is the tentative overstatement of Enterprise Value-to-EBITDA valuation multiples if adjustments for operating lease liabilities are not made.[iv] Certain subsegments of the healthcare industry are more prone to this accounting change, notably senior living facilities and outpatient facilities, such as ambulatory surgery centers and imaging facilities. Home health agencies and laboratories are relatively unaffected given the lower level of leases typically utilized. Broadly speaking across all subsegments, firms with weakened financial performance and compressed EBITDA margins are more susceptible to this overstatement. Naturally, firms that utilize higher levels of facility and equipment leasing, especially those with extended durations, are at higher risk of overstatement.

Users of market data sources should also be wary of the EBITDA calculation for firms that report under IFRS. IFRS 16, in contrast to ASC 842, calls for lease expense to be reported largely as depreciation and interest expense. Furthermore, IFRS 16 does not require companies to delineate depreciation and interest expense arising from operating leases, although firms may elect to do so. As a result, market data sources might report total depreciation and interest expense inclusive of these amounts. Adjustments to reported EBITDA figures may be warranted when using IFRS-based data to evaluate GAAP-based subject entities.

Failing to properly account for operating lease liabilities in the appraisal of a company could also lead to a miscalculation of equity value when total debt is subtracted from a determined Enterprise Value. While the overstatement of the valuation multiple is material at 0.4x to 3.0x (from Figure 3), we expect COVID-19 to exacerbate this potential overstatement, as EBITDA is projected to decline for most firms in the coming year. By contrast, operating lease liabilities will be much slower to decrease, as the contracted lease amounts are generally more inflexible. When EBITDA declines x percent, and assuming operating lease liabilities remain constant, the overstatement increases [1 / (1 – x) – 1] percent.[v]

For U.S. healthcare companies, the EBITDA overstatement mentioned in the prior paragraph could lead to noncompliance with healthcare regulations if healthcare businesses are transacted using inflated valuation multiples. Additionally, the overstatement could result in erroneous indications of value in either tax court or other litigation. HealthCare Appraisers always remains abreast of changes in the market to provide clients with reliable FMV guidance.

[i] Financial Accounting Standards Board, ASC 842 Basis for Conclusion 14, last accessed 3 June 2020 from: https://asc.fasb.org/imageRoot/50/77977550. pdf.

[ii] Journal of Accountancy, 8 April 2020, last accessed 3 June 2020 from: https://www.journalofaccountancy.com/news/2020/apr/fasb-proposes-effectivedate-delays-revenue-recognition-lease-accounting-for-certain-entities-coronavirus-pandemic.html.

[iii] S&P Capital IQ Webinar, Operating Lease Accounting: Effect on S&P Capital IQ Fundamentals. Registration and Subscription required. Last accessed 22 May 2020 from: https://pages.marketintelligence.spglobal.com/Operating-Leases-Effects-on-the-SP-Capital-IQ-Platform-Registration-January-2020.html?utm_source=On24.

[iv] Financial data provided by S&P Capital IQ as of December 31, 2019.

[v] e.g., a decrease in EBITDA of 10% would result in 1 / (1 – 0.1) – 1 = 11.1% increase in the overstatement.