Authors: Matthew J. Muller, ASA, Giulia Pace, MBA, and Nicholas J. Janiga, ASA

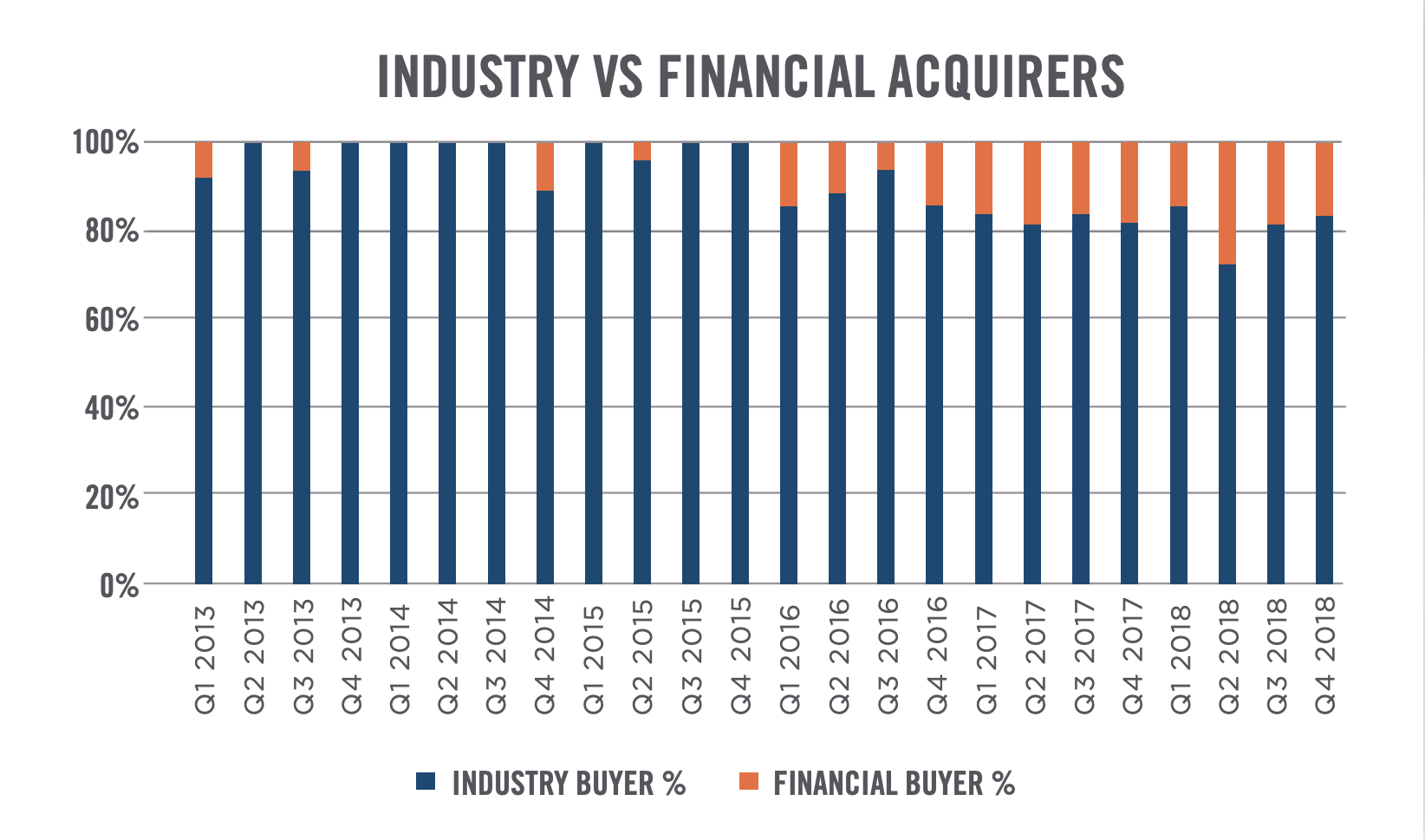

Acquisition activity involving physician practices has been occurring at a robust pace for many years. A February 2019 presentation by the Physicians Advocacy Institute[1] found that from July 2016 through January 2018, 8,000 physician practices were acquired by health systems. Facing competition from increasingly competitive integrated health systems, independent physician groups have expanded their reach and economies of scale by acquiring smaller practices. Adding to this flurry of M&A activity, private equity investors have been active in the physician practice management arena. In 2017, over 100 physician practices were acquired by private equity firms.[2] Physician practice management acquisition activity has spanned a broad range of physician sub-specialties, including ophthalmology, orthopedics, urology, gastroenterology, radiology, and pain management.

![]() FIGURE 1

FIGURE 1

Source: Irving Levin Associates

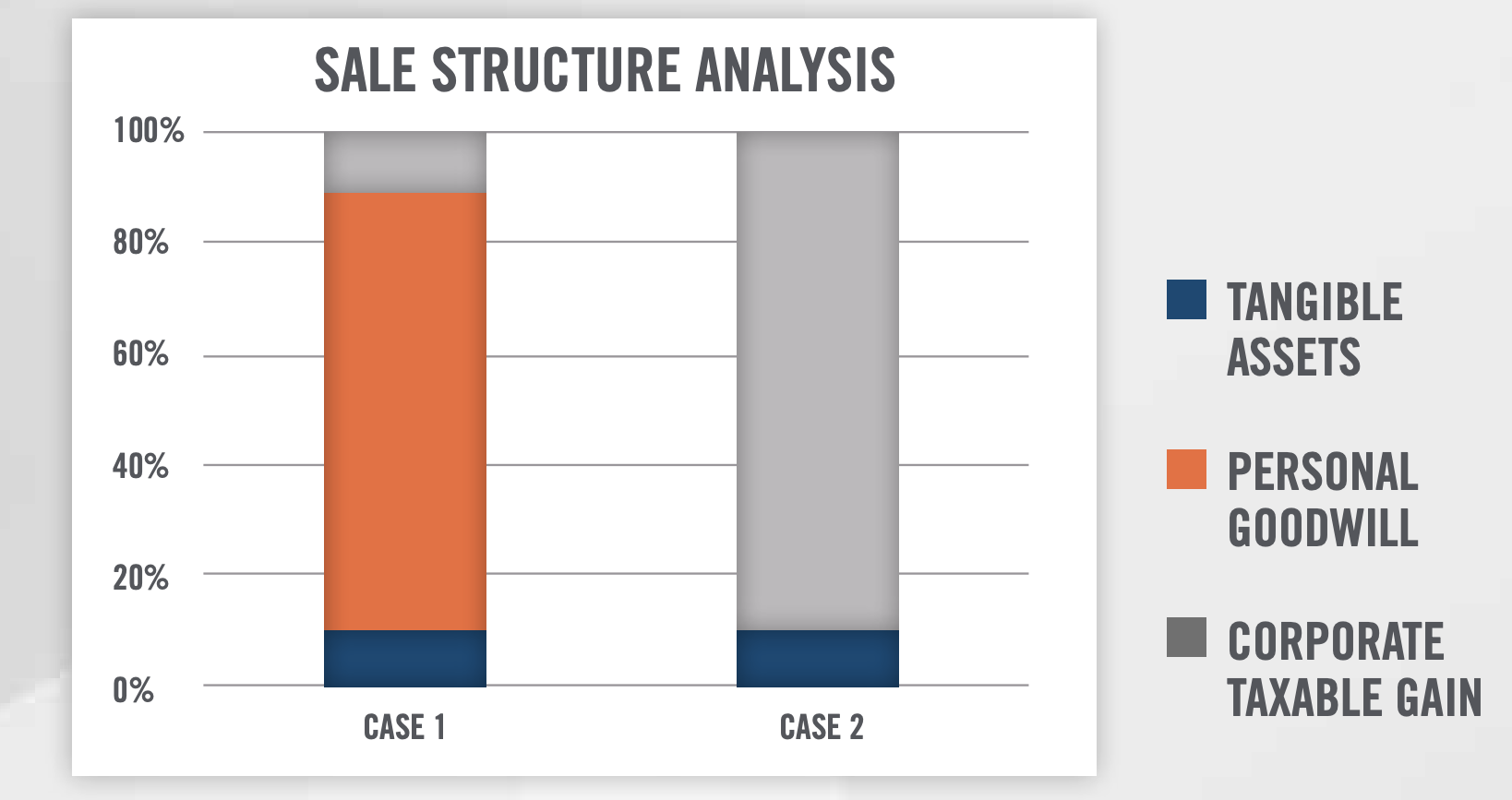

While these transactions can lead to payouts to the physician owners selling their practices, a large component of these payments may end up in the hands of the Internal Revenue Service (“IRS”) come tax time. When appropriate, allocating a portion of the sale proceeds from the sale of a medical practice to Personal Goodwill can lead to significant tax savings for the selling physician shareholders.

Key Tax Court Cases

Goodwill is defined by the IRS as “The value of a trade or business based on expected continued customer patronage due to its name, reputation, or any other factor.”[3] An important distinction, that has been debated in US Tax Court (“Court”), is that between Enterprise Goodwill and Personal Goodwill; this topic has been addressed in several court cases. A few of the important court cases acknowledging personal goodwill are outlined in the following bullet points.

- In Martin Ice Cream Co. vs Commissioner, the Court stated: “This Court has long recognized that personal relationships of a shareholder-employee are not corporate assets when the employee has no employment contract with the corporation. Those personal assets are entirely distinct from the intangible corporate asset of corporate goodwill.”[4]

- In Bross Trucking vs. Commissioner, the Court stated: “Bross Trucking may have had a developed revenue stream, but only as a result of Mr. Bross’ having personal relationships with the customers. It follows that Bross Trucking’s developed customer base was also a product of Mr. Bross’ relationships. Mr. Bross was the primary impetus behind the Bross Family construction businesses, and the transparency of the continuing operations among the entities was certainly his personal handiwork. His experience and relationships with other businesses were valuable assets, but assets that he owned personally.”[5]

- Norwalk vs. Commissioner, in which the Court found “there is no salable goodwill where, as here, the business of a corporation is dependent upon its key employees, unless they enter into a covenant not to compete with the corporation or other agreement whereby their personal relationships with clients become property of the corporation.”[6]

In the previous cases, Personal Goodwill was not institutionalized, but not all transactions will result in the presence of Personal Goodwill. In Solomon vs. Commissioner, the Court ruled that the success of a business was not solely attributable to the relationships and goodwill held by the shareholders, but rather to the company’s processing, manufacturing, and sale of pigments (i.e., products, not relationships, were the primary reason Solomon’s customers conducted business with Solomon).[7]

As alluded to in the quotes from the Court above, key considerations in establishing Personal Goodwill include whether the goodwill has been institutionalized through non-competition clauses within employment agreements, as well as the importance of personal relationships to the success of the business. Service-focused businesses, including medical practices, often meet the established criteria for the existence of Personal Goodwill. IRS Technical Advice Memorandum 200244009[8], which involves a physician practice management company, indicated that goodwill associated with the professionals cannot be a corporate asset in the absence of an employment/noncompete agreement between the corporation and the shareholder. In our experience at HealthCare Appraisers, we have been involved in numerous appraisals of medical practices involving material levels of Personal Goodwill. A physician’s name, reputation, and relationships are typically key drivers of his or her medical practice, and in turn, they support the existence of Personal Goodwill.

![]()

![]()

![]()

![]()

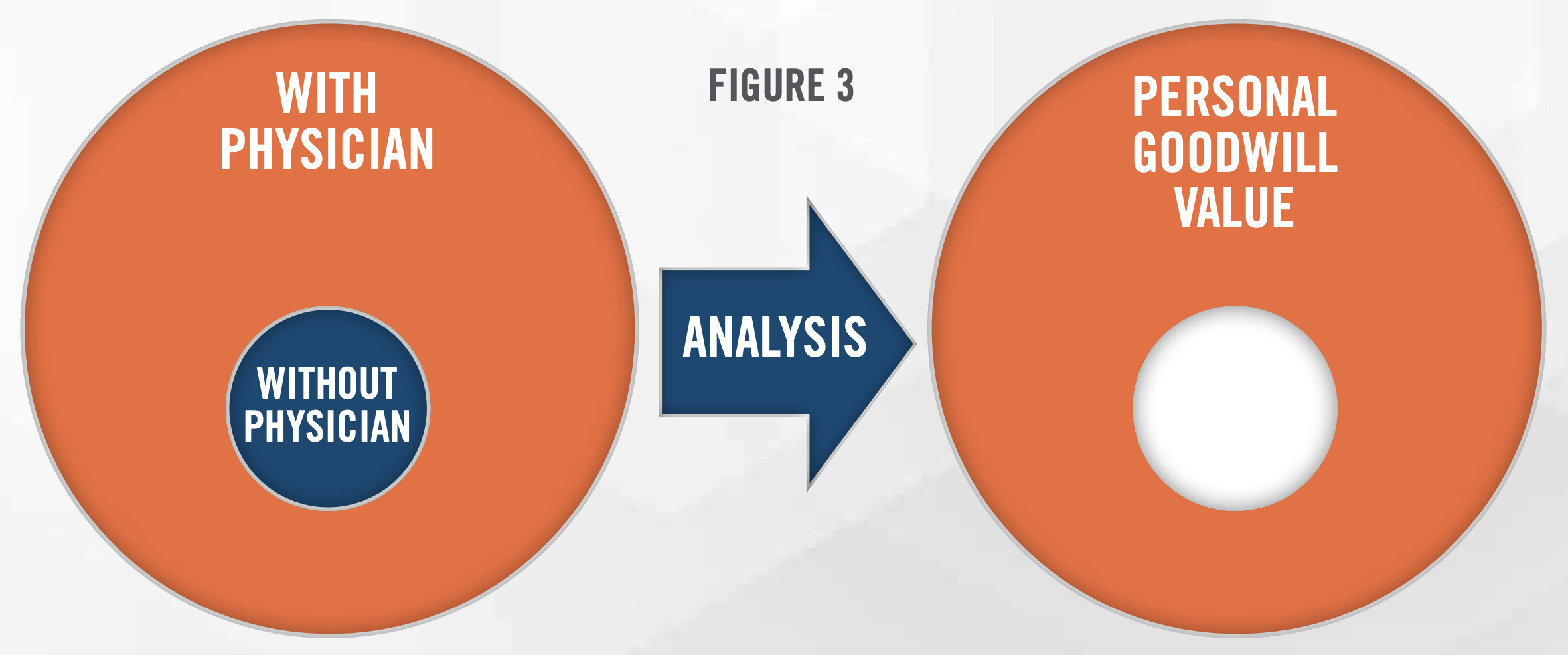

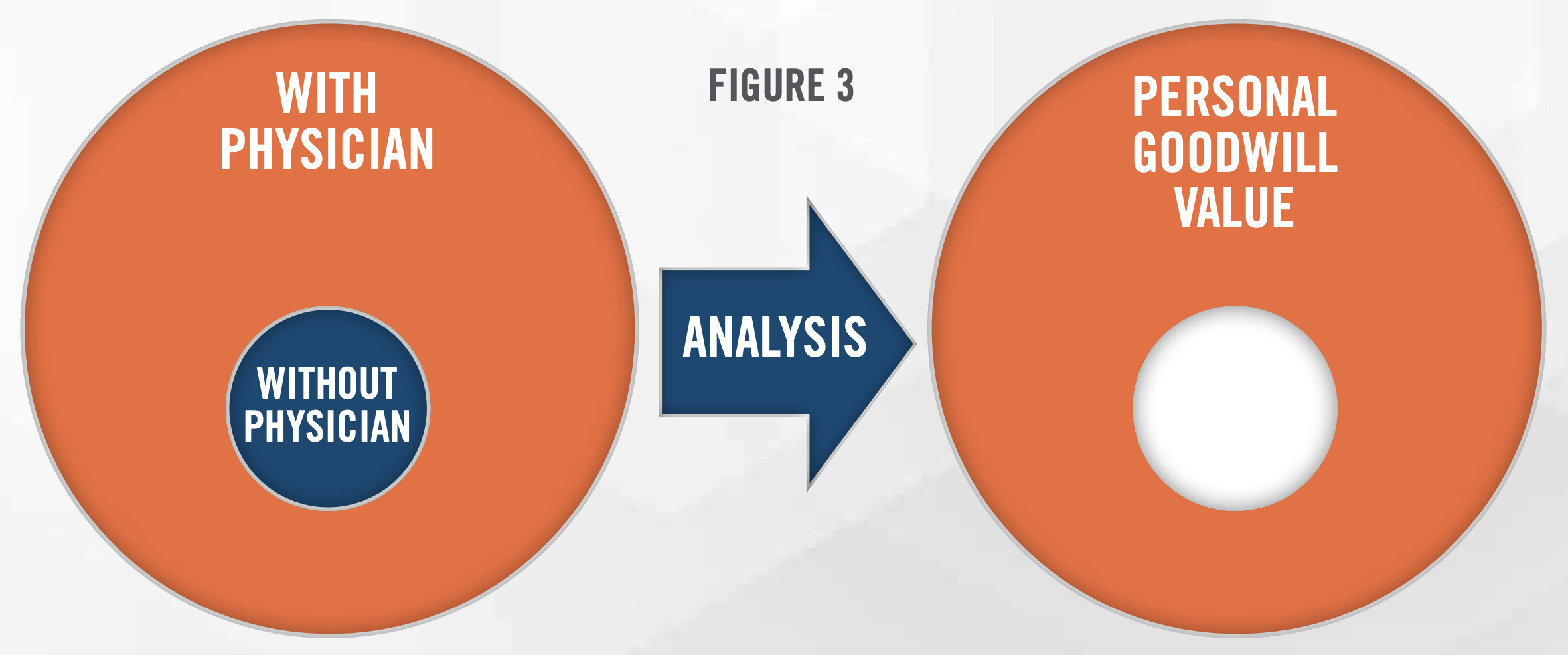

Valuation Approach

The “With and Without Method” under the Income Approach is typically applied in the valuation of Personal Goodwill for medical practices. This methodology uses cash flow models to project the revenues, expenses, and net cash flows the practice would expect to generate with and without the particular owner-physician’s continued involvement in the business. Under the “with” scenario, the projections reflect the overall assumptions and cash flow projections for the practice “as is.” As a result, the “with” scenario includes the value attributable to the Personal Goodwill of physician-owner. The “without” scenario models the operations of the practice were the physician-owner to leave the practice. This scenario would, among other factors, take into account: (i) the loss of revenue to the practice from patients deciding to seek care elsewhere; (ii) revenues and costs associated with replacing the departed physician with new providers; (iii) changes in staffing levels caused by fluctuations in patient encounters; and (iv) the impact of changes in the type(s) of ancillary services provided at the practice. The correct application of this methodology requires a deep understanding of the financial and operational drivers of a medical practice.

![]()

![]()

![]()

![]()

When assigning value to Personal Goodwill, it is important for an appraiser to take into consideration the probability of competition. HAI utilizes a proprietary scorecard in which we analyze the willingness and ability of the selling physicians to compete absent a post-transaction non-compete agreement. Factors analyzed include barriers to entry, the economics of competition, and the likelihood of direct competition.

In our experience, properly accounting for the Personal Goodwill in a medical practice transaction may result in sale proceeds retained by the seller physicians that are otherwise up to 18 percent higher than if a transaction did not account for the Personal Goodwill.

Importance of Obtaining an Appraisal from a Healthcare Appraisal Expert

The sale of a medical practice is an important financial and professional milestone in the life of many physician-owners. When contemplating a transaction, in addition to the total purchase price, sellers and their advisers should give specific consideration to the allocation of personal goodwill. Care must be taken before and during the sale transaction to establish if Personal Goodwill exists, if it is both salable and transferable to the purchaser, and if it is owned by a shareholder rather than by the practice itself. If the goodwill generated by the seller’s skill, expertise, reputation and loyal patients are deemed, in fact, Personal Goodwill, a separate sale of this asset may result in significant tax savings to the seller when it comes time to complete IRS Form 8594[9] under IRS Code §1060[10] during tax filing. An independent, third-party determination of the fair market value of Personal Goodwill should be considered by a healthcare appraisal expert to provide support for the Personal Goodwill allocation, and to provide a defensible, quantitatively-derived determination of the value being transferred.

[1] Presentation by Physicians Advocacy Institute dated February 2019 titled: Updated Physician Practice Acquisition Study: National and Regional Changes in Physician Employment 2012-2018 and accessed from their website on December 4, 2019

[2] Haefner, Morgan, Private Equity Firms Buying More MD Practices: 5 Notes, published on January 5, 2019, and accessed on Becker’s Hospital Review website on December 4, 2019

[3] IRS Publication 535 accessed on December 4, 2019 from the IRS website

[4] Opinion obtained from US Tax Court website, accessed December 4, 2019

[5] Opinion obtained from US Tax Court website, accessed December 4, 2019

[6] Opinion obtained from US Tax Court website, accessed December 4, 2019

[7] Opinion obtained from US Tax Court website, accessed December 4, 2019

[8] IRS National Office Technical Advice Memorandum #200244009 released November 1, 2002 and accessed from their website on December 4, 2019

[9] IRS Form 8594 accessed from the IRS website on December 4, 2019

[10] Obtained from Cornell Law website on December 4, 2019