Emerging as an essential tool in the efforts to combat the novel coronavirus (COVID-19), the telemedicine industry is expected to reach $155 billion, growing at a compound annual growth rate of over 15 percent through 2027.[1] This article provides background information on the telemedicine industry, insight into what has been driving growth of this industry, as well as recent market activity. Lastly, we discuss the valuation considerations associated with the telemedicine industry including the approaches to value, and how they are applied in the context of telemedicine service arrangements, businesses, intellectual property, and capital assets.

![]() BACKGROUND

BACKGROUND

Telemedicine is a subset of the telehealth industry which broadly refers to the application of technology to healthcare. Telemedicine is a means of delivering medical professional services via the use of electronic communication systems and software. This method of care was originally employed to deliver medical services remotely for rural areas of the country. However, improvements in technology and changing consumer preferences have propelled telemedicine to be adopted widely in other areas of the country.

As COVID-19 continues to make its way around the globe, a clear path has been paved for the telemedicine industry to take flight. The technological infrastructure already in place by telemedicine companies permits healthcare providers to provide virtual consultations during which they can collect information on patients’ symptoms and, subsequently, provide patients with a recommended course of action (e.g., self-quarantine, in-person follow-ups, etc.). Telemedicine consults not only eliminate the need for patients with mild symptoms to go to a physical doctor’s office or hospital, but they can help reduce the prospects of receiving a costly healthcare bill. According to an analysis released by UnitedHealth Group, the average cost of treating common primary care conditions at a hospital emergency department is approximately 12 times higher than when treated at a physician office.[2]

However, with such an extraordinary and abrupt surge in patient usage of telemedicine offerings, telemedicine companies are struggling to meet demand as their infrastructure is stretched beyond its capacity, leading to the need for platform upgrades. With various telemedicine providers such as the Cleveland Clinic reporting a 15-fold increase in telehealth visits due to COVID-19,[3] telemedicine companies are now rushing to find the clinical staff necessary to meet consumer demand. While telemedicine offers a much needed alternative to in-person care during a time full of uncertainties, there are various limitations of telemedicine in the fight against the spread of COVID-19, including, but not limited to, the inability to perform physical virus testing, and provide bedside availability for acutely ill patients whose symptoms may worsen. As the world is forced to adapt and evolve due to the uncertainties associated with the spread of COVID-19, it is conceivable that the virus will expedite the adoption of telemedicine as we continue to see consumers utilize this technology for the first time.

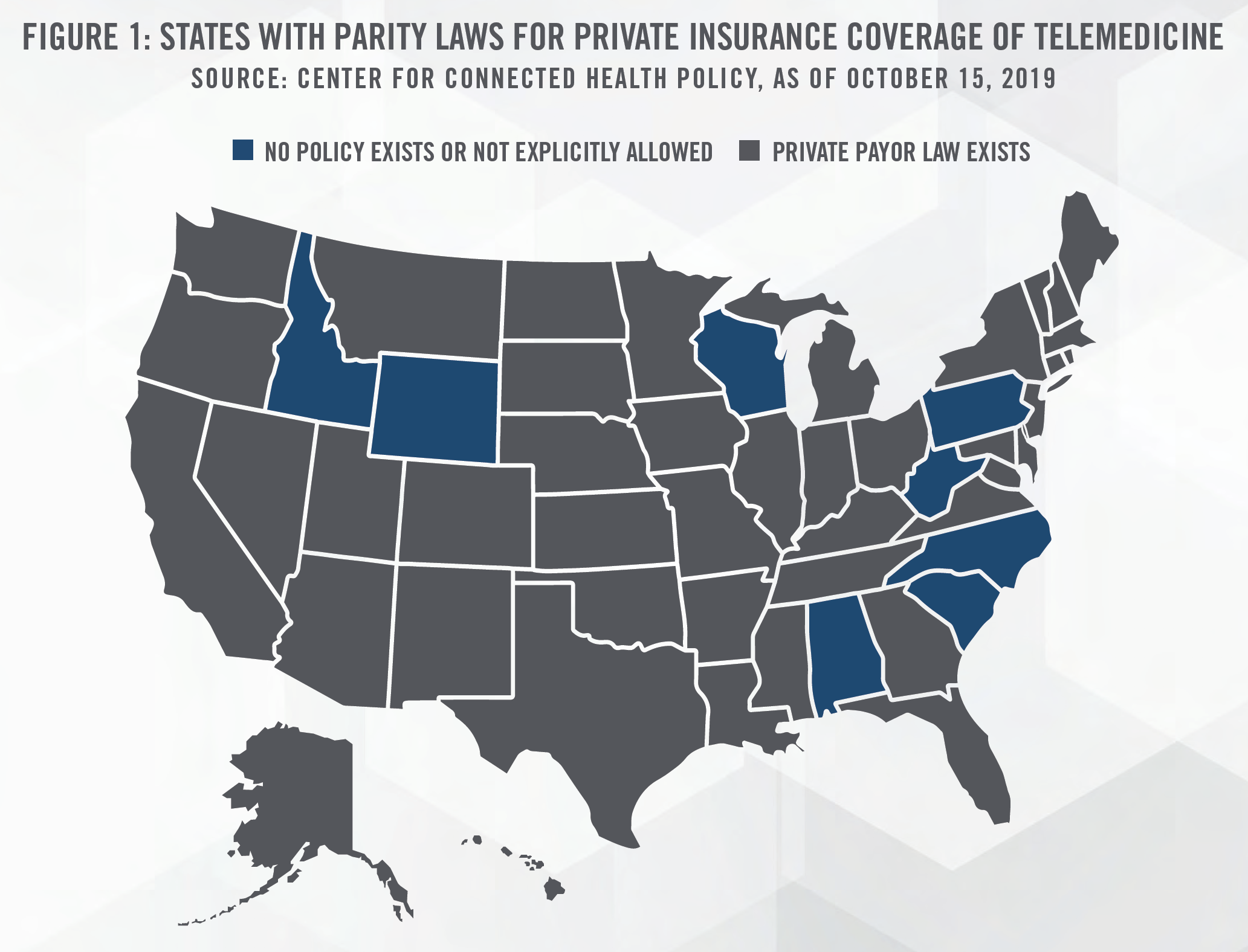

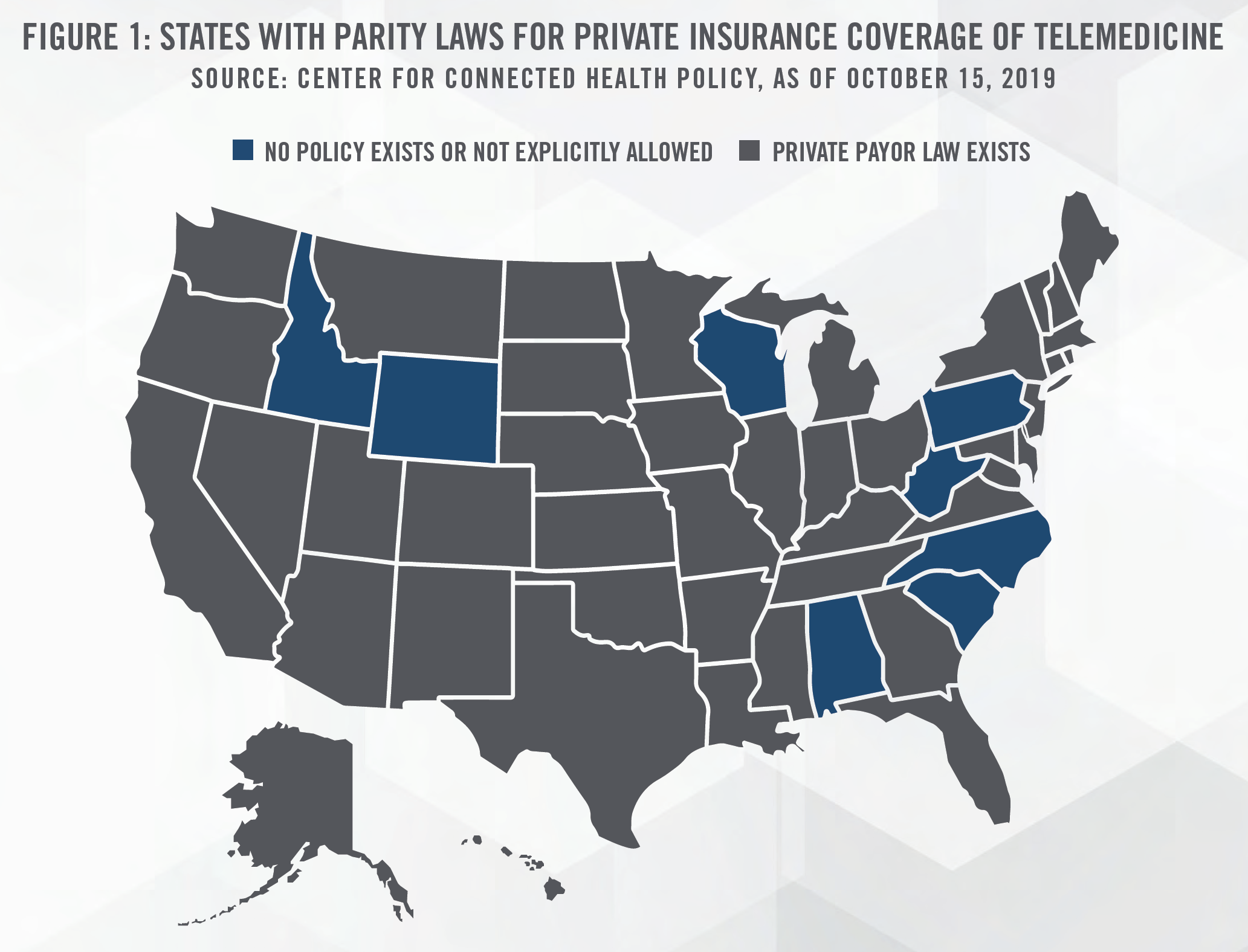

Many of the prior challenges associated with reimbursement have been addressed as a response to COVID-19, as CMS expanded Medicare reimbursement for telehealth services in the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”). While most states have passed laws that govern private payor telehealth reimbursement policies (outlined in Figure 1), the CARES Act will reimburse clinicians for provision of telehealth services to its patients including mental health counseling, common office visits, and preventative health screenings. Previously, Medicare beneficiaries would only receive coverage for routine services in certain circumstances, such as if they lived in a rural location. This is important given that Medicare beneficiaries are typically more vulnerable to COVID-19.

The Health and Human Services Secretary Alex Azar has called upon states to loosen regulations allowing doctors and medical professionals to practice across state lines. Furthermore, in a letter from CMS to clinicians on April 7, 2020,[4] CMS provided additional workforce flexibilities by temporarily waiving Medicare and Medicaid’s requirements that physicians be licensed in the state where they are providing services, in order to contribute to COVID-19 relief efforts. Historically, physicians had to obtain a license for each state they were practicing medicine in, which meant that physicians would be unable to provide telemedicine services across state lines unless they were licensed in the appropriate state. The Interstate Medial Licensure Compact (IMLC) was created to make it easier for physicians to obtain licenses to practice in multiple states, and further increase access to healthcare for patients in rural or underserved communities. Currently, 29 states, the District of Columbia, and the Territory of Guam are members of the IMLC.

Another hinderance to the adoption of telehealth is the lack of access to broadband internet in rural areas and Tribal Lands where over 19 million households lack access to “fixed terrestrial advanced telecommunications” capability.[5] The CARES Act allocates $100 million to the U.S. Department of Agriculture’s Rural Utility Services for its Reconnect Pilot Program to help expand broadband service in eligible rural areas.[6]

Even with these various challenges in the telemedicine industry, several tailwinds will support the growth of the telemedicine industry in coming years as discussed in the following section.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

According to IHS Markit Ltd, physician demand will grow faster than supply in the U.S., leading to a projected primary care and non-primary care shortfall of between 46,900 and 121,900 physicians by 2032.[7] The primary reasons behind the shortage of physicians are an aging workforce combined with an aging population which will generally require more healthcare services. More than two out of five active physicians will be age 65 or older within the next decade, with over 40 percent of the physician workforce expected to retire over the next decade.

The use of telemedicine is able to alleviate the physician shortage in many ways. The increased access to preventive care through telemedicine may help prevent emergency room visits, while remote patient monitoring has the ability to help reduce hospital admissions, re-admissions and emergency room visits.[8] Telemedicine may also benefit rural communities through efficient utilization of physician resources. Specialty physicians who have excess availability may treat patients outside of their typical markets, benefiting both physicians and patients alike. Lastly, telemedicine companies have increased the efficiency of providers by using the power of artificial intelligence to help triage/diagnose patients. 98point6, a text-based telemedicine start-up company, recently raised $43 million (total money raised of $129 million) to expand its AI-powered services which are able to perform tasks such as determine the most relevant information to gather from patients, in a natural dialogue format. While telemedicine can help alleviate the shortage of physicians, telemedicine companies face issues in adding and training their providers to scale their platforms.

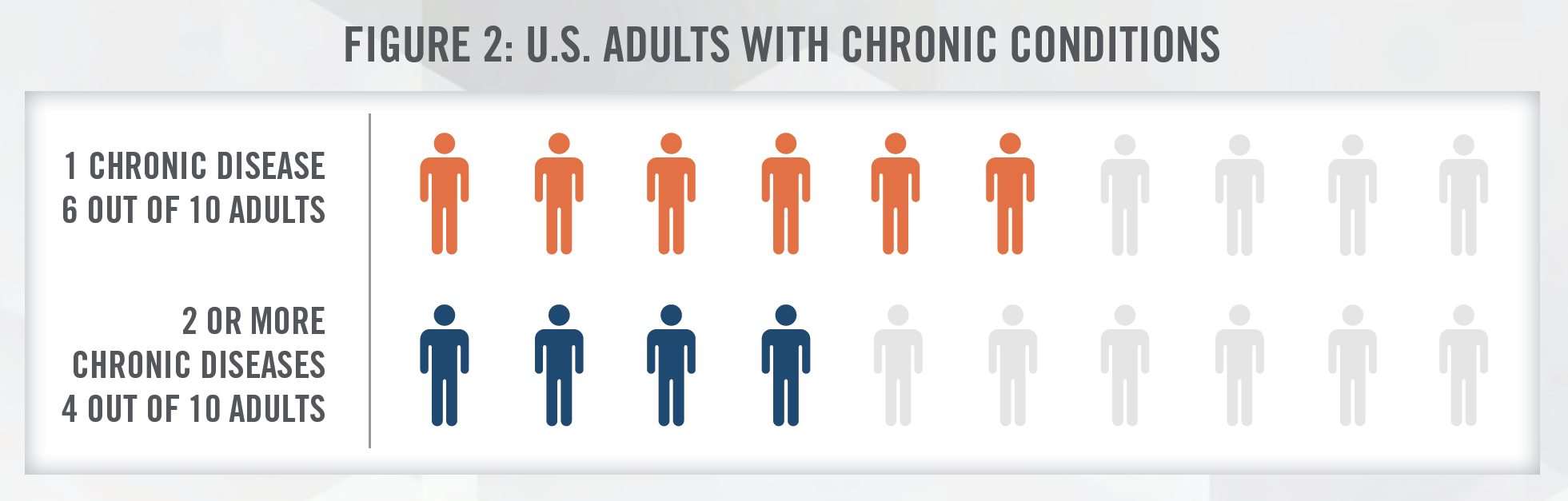

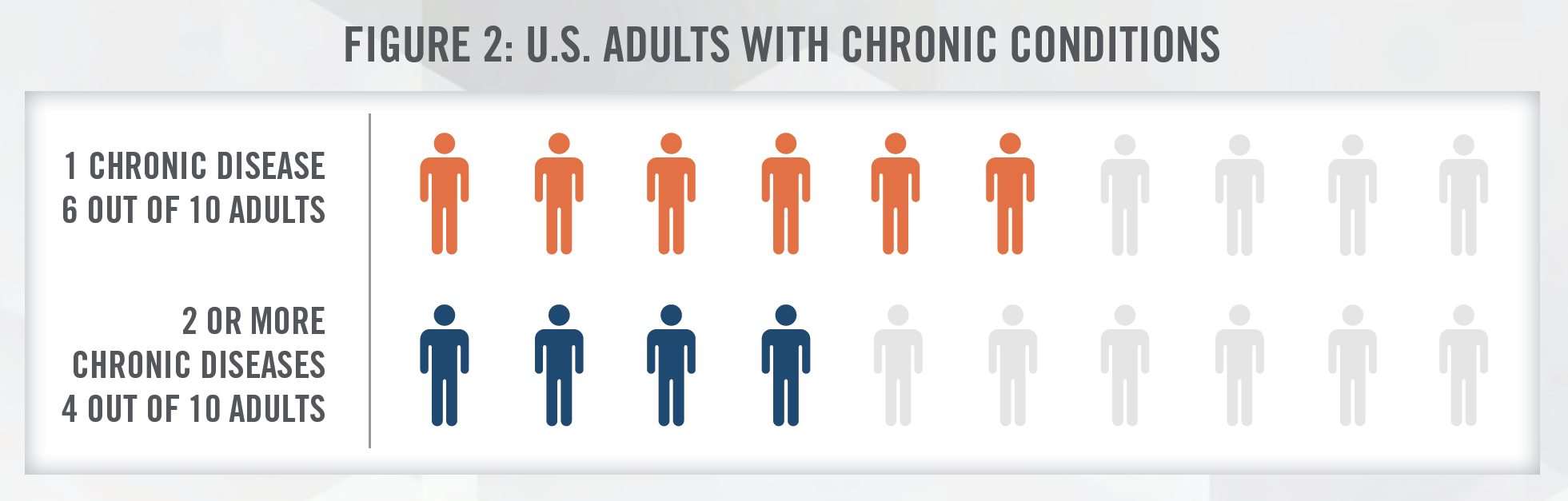

Apart from the challenges related to the projected shortage of health care professionals, there are also compounding challenges with the aging population. The U.S. population under the age of 18 is projected to grow by only 3.5 percent, however the population aged 65 and over is projected to grow by 48 percent between 2017 to 2032.[9] The development of chronic disease is often associated with, and more common among, older age groups. The Centers for Disease Control and Prevention (CDC) estimated that about 60 percent of all adults in the U.S. have a chronic disease and that 40 percent have two or more.[10] Remote patient monitoring can reduce the cost of chronic disease management. Doctors and specialists can use video, audio, and other digital tools to manage a patient’s condition remotely, reducing the need for in-person consultations. With a higher concentration of elderly population living in rural areas, transportation and mobility challenges can be partially mitigated with the use of telemedicine.

The prospect of better patient care at lower costs is a major catalyst for the adoption of telemedicine. According to a study conducted by researchers at Boston-based Massachusetts General Hospital (MGH), the effectiveness of in-person and virtual visits was found to be equal.[11] According to a recent American Journal of Critical Care report, more than 1,200 nurses responded to an online survey where about 79 percent agreed tele-ICU systems enable nurses to improve patient care, and approximately 75 percent agreed it improves job performance.[12]

From a cost perspective, operational efficiency and better patient outcomes achieved through providing medical services via telemedicine can result in material cost savings. This model of care helps providers cut down costs by increasing physician availability and productivity. Providers that leverage telemedicine as part of their continuum of care can help provide care sooner, resulting in fewer procedures, shorter hospital stays and fewer medical office visits for patients.[13] According to a study performed on 650 patients using the JeffConnect telemedicine platform at Philadelphia-based Jefferson Health, the net cost savings to the patient and payor per telemedicine visit ranged from $19 to $121 per visit.[14] When compared to the $49 per consult rate of the platform, the cost savings can be material. Additionally, the study also indicated that the majority of the cost savings were generated through diverting patients away from emergency departments.

The use of telemedicine will ultimately lead to not only better outcomes, but cost savings for patients and providers. As the healthcare provider industry moves towards a value-based reimbursement model, it will become increasingly important to find cost and operational efficiencies where available. While there are still challenges to be addressed ranging from EHR integration to privacy concerns, telemedicine is a technology that will become more widely accepted as patients, providers, and payors realize the benefits of this technology.

Many of the “temporary” measures to facilitate telemedicine adopted by the government and private payors may become permanent features of the healthcare marketplace. In relation to new telemedicine developments associated with COVID-19, CMS administrator Seema Verma has stated: “I think it’s fair to say that the advent of telehealth has been just completely accelerated, that it’s taken this crisis to push us to a new frontier, but there’s absolutely no going back.”[15] Furthermore, in May of 2020, BlueCross BlueShield of Tennessee updated its policies to permanently reimburse member-to-provider and provider-to-provider telemedicine consultations for in-network providers.[16]

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

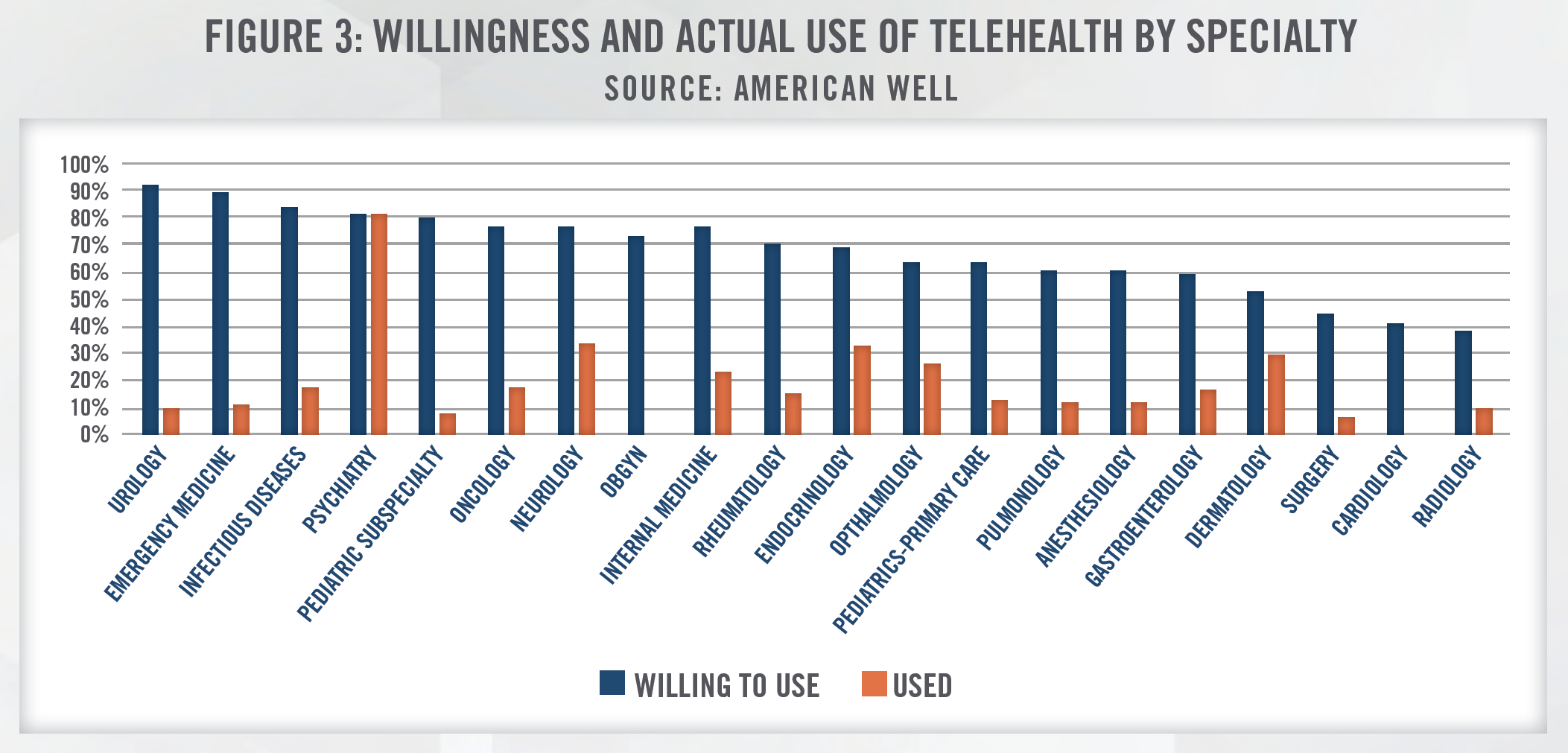

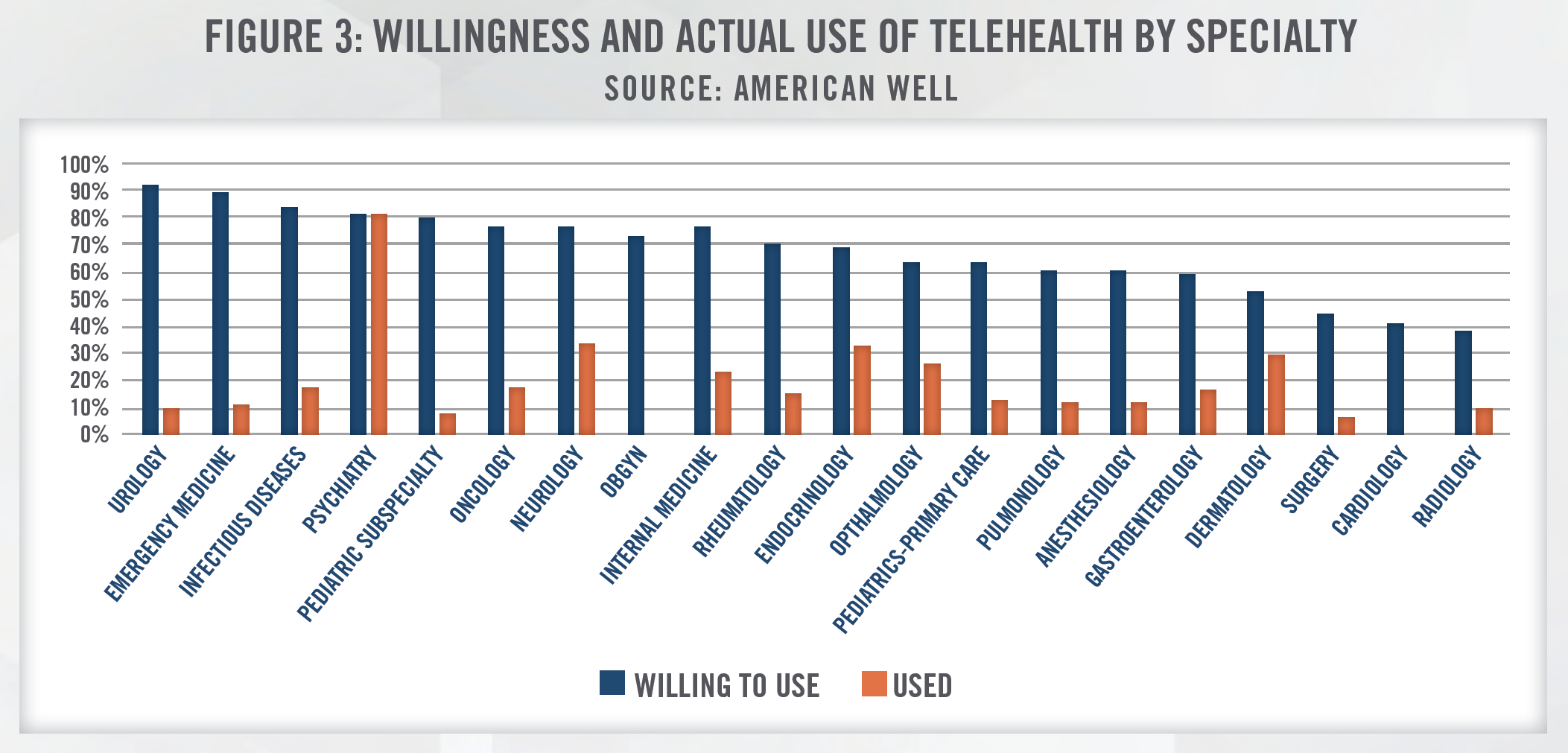

The stakeholders in the telemedicine industry have developed unique models to deliver clinical care, driven by economies of scale, use of medical devices and population health analytics, among other factors. Furthermore, the use of telemedicine is not limited to any one branch of medicine and is currently being used in specialties such as primary care, critical care, neurology, psychiatry, radiology, as well as for prescribing medications and home health services. Typically, a telemedicine platform can facilitate two types of consultations: synchronous or asynchronous. The American Telemedicine Association (ATA) defines synchronous telemedicine as, “interactive video connections that transmit information in both directions during the same time period” and defines asynchronous telemedicine as, “store-and-forward transmission of medical images and/or data because the data transfer takes place over a period of time, and typically in separate time frames. The transmission typically does not take place simultaneously.” Asynchronous and synchronous telemedicine are different in terms of time, costs, and provider involvement. Additionally, telemedicine can typically be broken down into three modalities, which include videoconferencing,[17] remote patient monitoring, and store-andforward. The most common uses of telemedicine, by specialty, are outlined in Figure 3.[18] There’s generally a large gap in physicians’ willingness to use telehealth and their actual telehealth usage. According to a survey published by American Well, the top barriers to physician telehealth usage are due to uncertainty around reimbursement and questions about clinical appropriateness. As noted earlier herein, payors have taken steps to permanently provide reimbursement for telemedicine services as a result of developments from COVID-19. Similarly, given limited alternatives, providers have sought to develop clinical pathways that utilize telemedicine technology to treat patients during periods of required social distancing.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

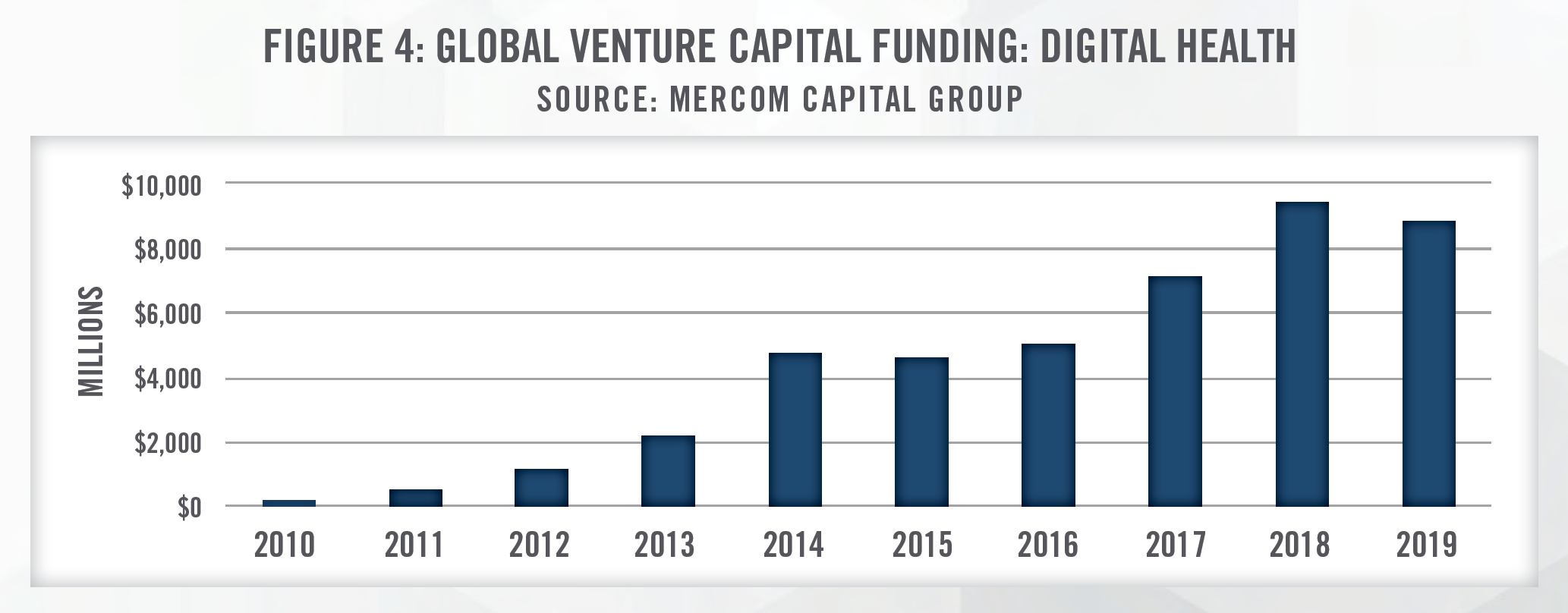

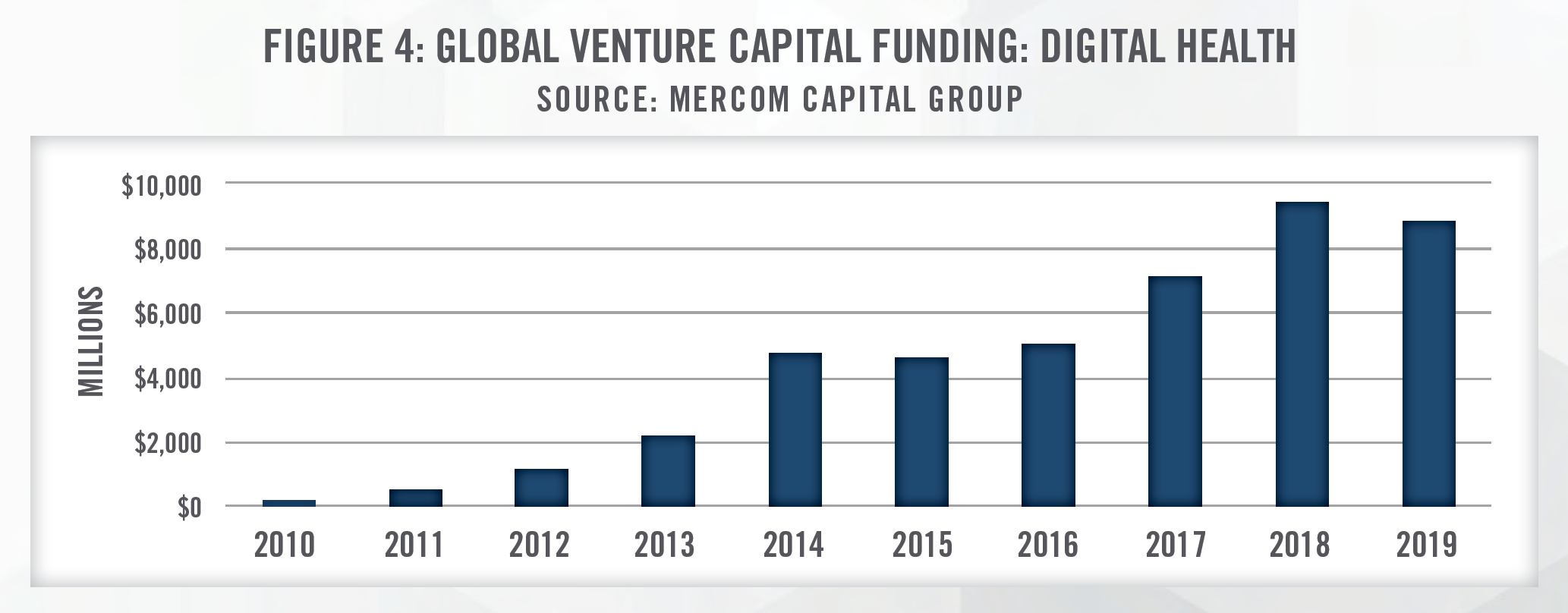

Telemedicine has rapidly expanded from a niche component of the healthcare delivery model to an essential way for providers and companies to deliver patient care. Merger and acquisition activity in this sector has been robust in recent years as early stage companies look to quickly expand through horizontal integration. Vertical integration is also taking place as more established, mature companies look to deepen their ability to offer telemedicine services. Global venture capital funding has increased significantly for companies within the broader digital health industry which includes telemedicine, data analytics, mobile health applications, clinical decision support and mobile wireless technologies. In the first quarter of 2020, global venture capital funding reached a record of $3.6 billion compared to $2.0 billion in the first quarter of 2019. Just the telemedicine sector is attracting an increasing amount of venture capital investment as well, with venture capital investment in the first quarter of 2020 at $788 million – a figure more than triple the $220 million raised in the first quarter of 2019.[19]

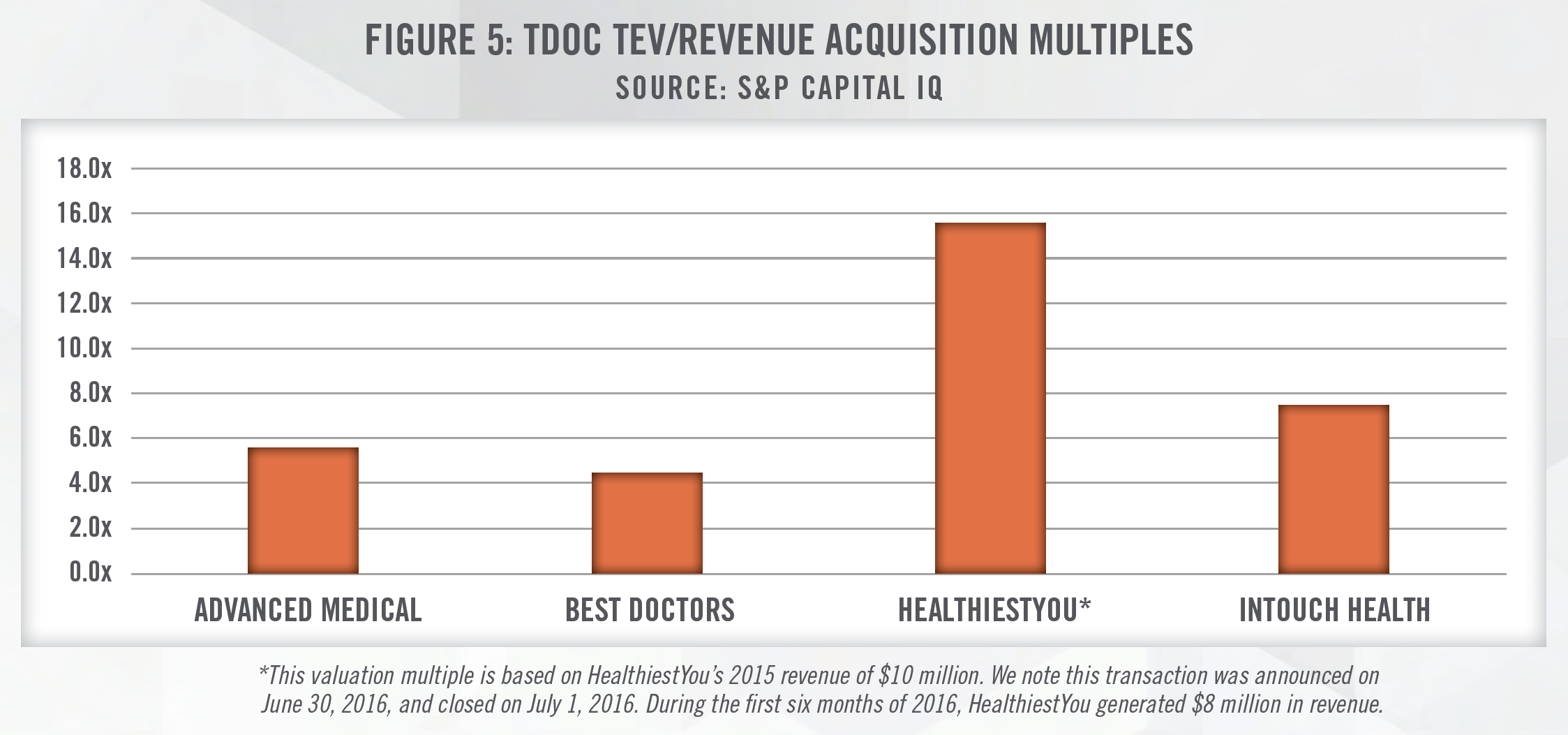

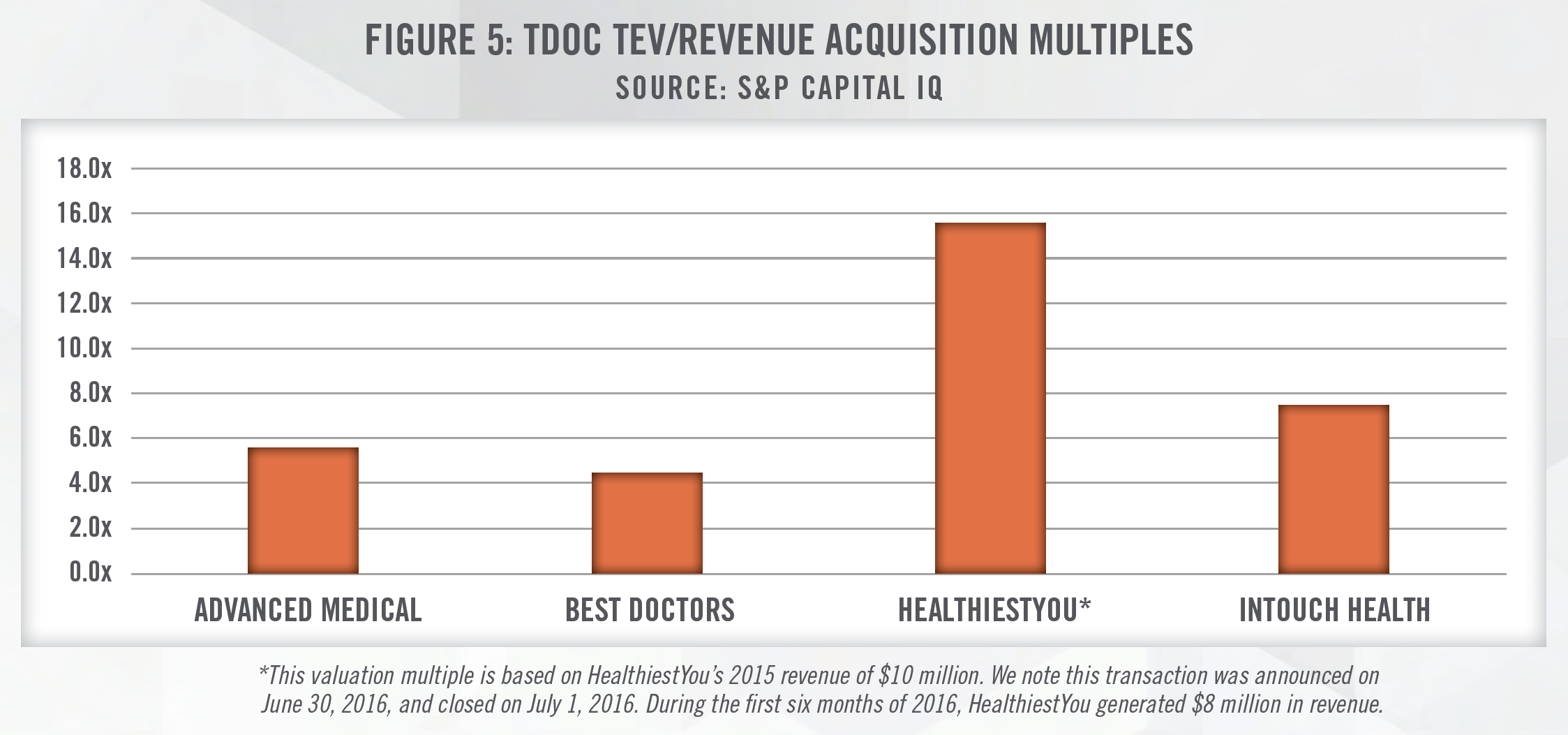

Teladoc Health, Inc. (NYSE: TDOC) is a prime example of a telemedicine company that has been expanding rapidly in recent years, engaging in horizontal integration to do so. TDOC acquired HealthiestYou in 2016, Best Doctors in 2017, MédecinDirect SAS and Vida Health in 2019, and announced acquisitions of TelaDietitian and InTouch Technologies in December 2019 and January 2020, respectively. Figure 5 outlines Total Enterprise Value to Revenue (TEV/Revenue) multiples for several of these recent transactions.

Given many telemedicine companies are still in the early growth stage of the business cycle, it is common for these companies to be generating negative levels of earnings. The latest acquisition of InTouch Technologies positions TDOC as a company that is able to not only provide a telemedicine platform and provider network as part of its business model, but also the equipment necessary to provide telemedicine services. The high revenue multiples outlined in Figure 5 reflect the strong optimism for telemedicine companies. Recently, it was announced that UnitedHealth’s Optum was in advance talks to acquire AbleTo, a virtual behavioral healthcare provider, for $470 million (i.e., a valuation around 10x forward revenue).[20]

In 2019, American Well acquired Aligned Telehealth. The combined businesses will pair American Well’s telemedicine delivery care platform with Aligned Telehealth’s access to a network of clinical experts to provide care – another example of horizontal integration occurring in the telemedicine sector. Another notable development in telemedicine delivery involving American Well is their joint venture platform with the Cleveland Clinic announced in October 2019 called “The Clinic.” The goal of the joint venture is to expand patient access to renowned specialists that are employed by Cleveland Clinic. This venture is significant not only in that it highlights further horizontal integration occurring in telemedicine, but also the push towards treating patients with higher levels of acuity through virtual visits. While many virtual outpatient provider visits are at the primary care related level, this venture highlights the growth of visits into care involving nationally renowned specialists.

It is notable that an investor in American Well is Anthem (NYSE: ANTM). Vertical integration is occurring in many areas of the healthcare delivery system, and as this example shows, telemedicine is not excluded from this trend. Another example of this is Cigna’s (NYSE: CI) investment in MDLIVE, a telehealth provider of online and on-demand healthcare delivery services and software.

Large consumer technology companies have also been entering into the telemedicine industry, whether to provide its own employees access to healthcare or to develop technology that can used by any of the company’s customers. Technology companies such as Amazon have made acquisitions (e.g., Health Navigator) to help develop its own telemedicine platform, Amazon Care, which it offers to its Seattle based employees. In prior years, Apple was in discussions with both One Medical and Crossover Health, companies that are able to provide telemedicine services.

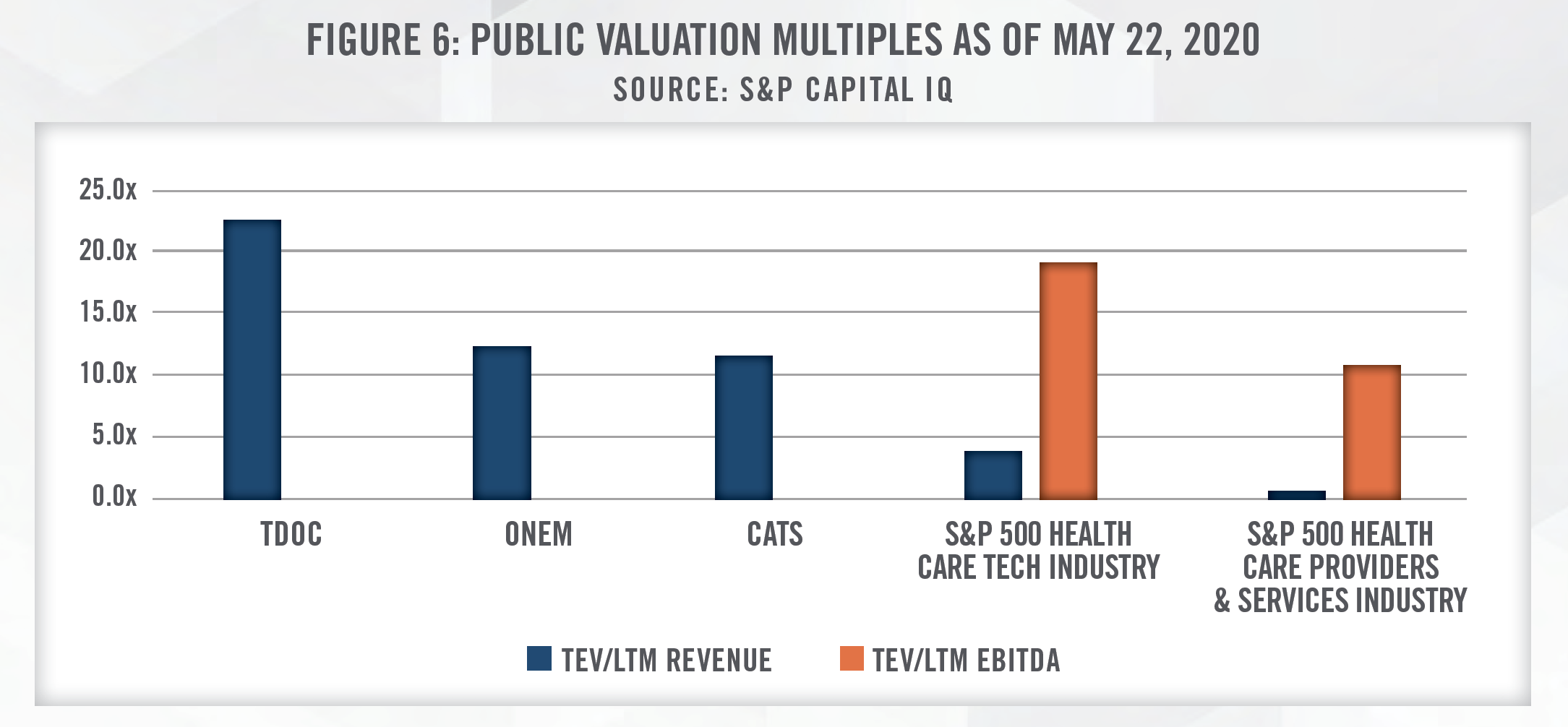

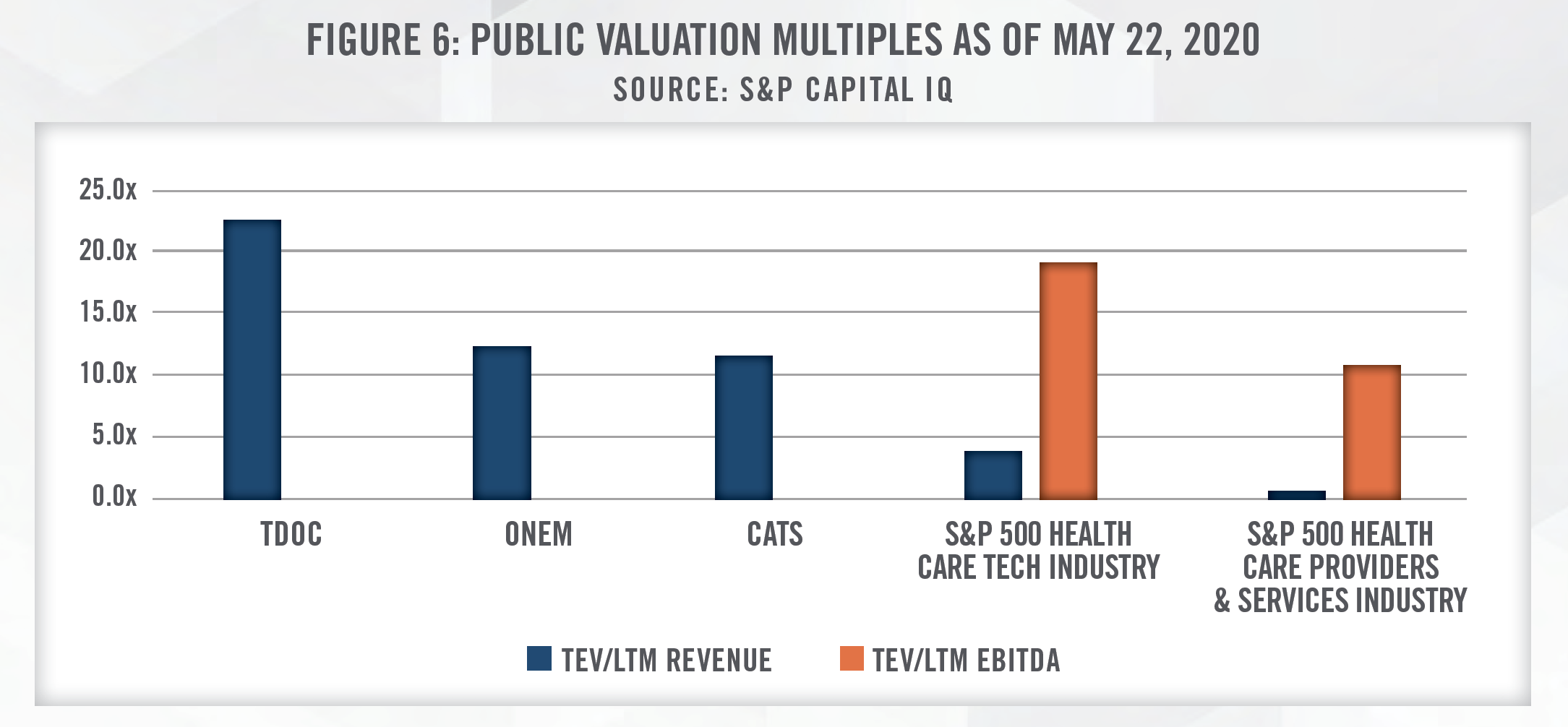

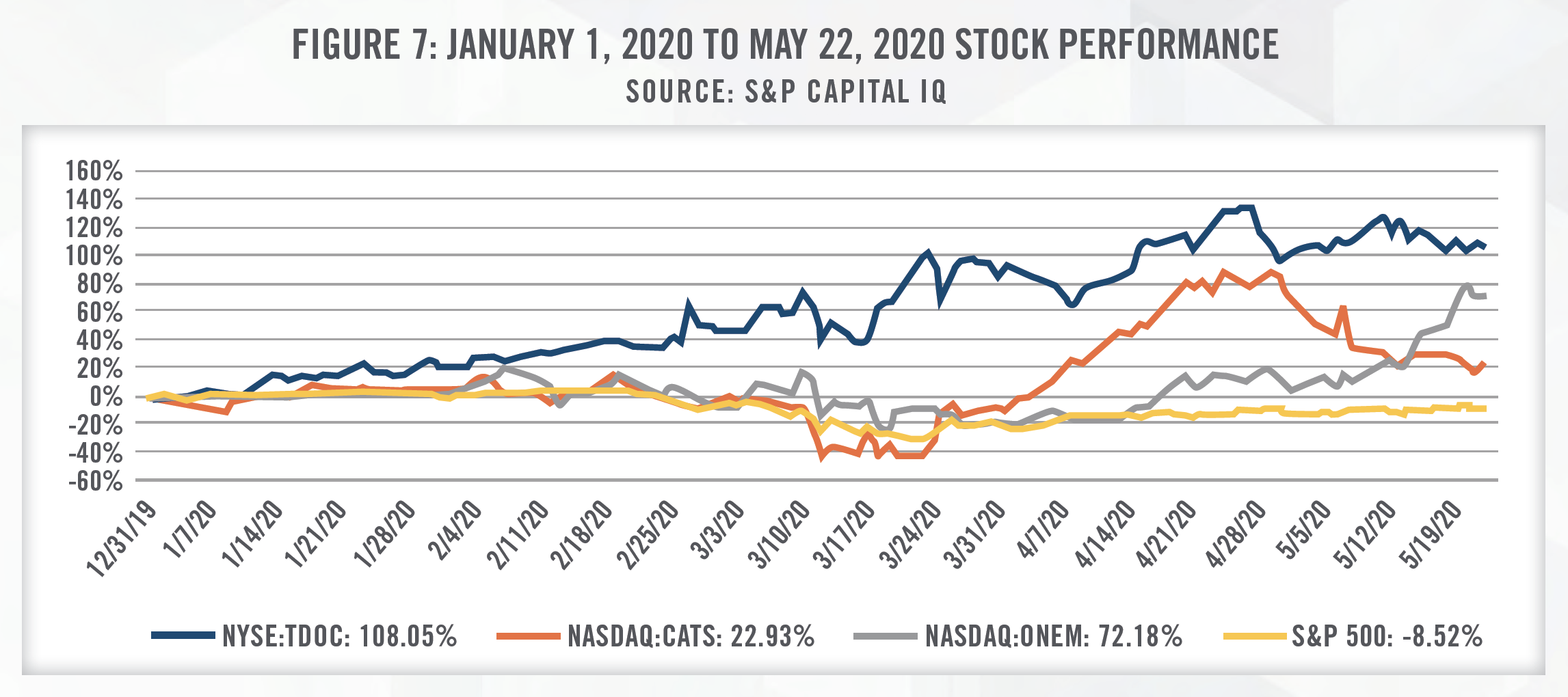

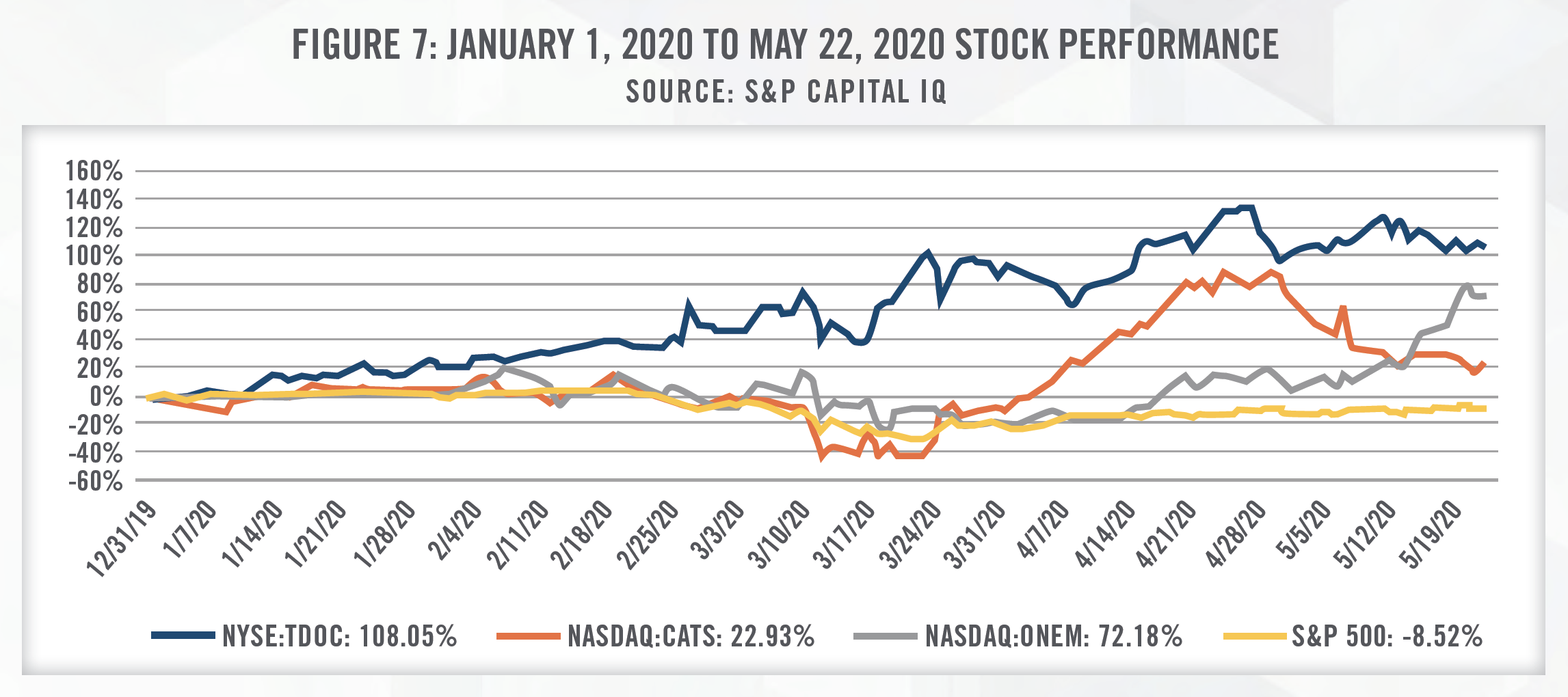

The public exchanges highlight the robust future growth expected for telemedicine companies. Figure 6 outlines TEV/Revenue multiplies for three publicly traded companies: TDOC, 1Life Healthcare d/b/a One Medical (Nasdaq: ONEM), and Catasys (NASDAQ: CATS). ONEM operates a membershipbased primary care platform, providing medical services both in-office and virtually. CATS utilizes AI to identify untreated behavioral health conditions that worsen chronic medical disease, and then treats patients through its OnTrak™ Program, a suite of virtual and in-patient services.

As outlined in Figure 6, TDOC, ONEM, and CATS are trading at TEV/Revenue multiples above 10.0x, despite not currently generating positive EBITDA over the last 12 months. As comparisons, the S&P 500 Health Care Tech Industry index is trading at under 5.0x revenue and approximately 19.0x EBITDA, while the broader S&P 500 Health Care Providers & Services Industry index is trading at under 1.0x revenue and almost 10.0x EBITDA. These figures highlight the high levels of growth investors are expecting of stocks in the telemedicine sector as compared to the broader healthcare tech and services industries.

While TDOC is not yet profitable, they have experienced an unprecedented number of patient visits as a result of COVID-19. As announced by TDOC, “The company is now routinely providing in excess of 20,000 virtual medical visits per day in the United States, representing an increase of over 100 percent as compared to the first week of March.”[21] Furthermore, revenue for the first quarter of 2020 is expected to be approximately $180 million, compared to $129 million in the first quarter of 2019 – approximately a 40 percent increase. Since the beginning of March 2020 when COVID-19 began spreading more rapidly in the U.S., the stock of TDOC has significantly outperformed the broader market, further signaling the expected growth within this industry.

Similarly, on March 25, 2020, the Chairman and CEO of CATS attributed recent growth of the business to COVID-19 stating, “Our surging March enrollment and the halving of disenrollment rates to 4.9 percent have in part been driven by the COVID-19 pandemic. As more states have recently entered the ‘stay at home’ and ‘lockdown’ phase of the pandemic, we anticipate continued and sustained improvements in our enrollment metrics.”[22] Furthermore, CATS Chief Medical Officer stated, “Anxiety, depression and substance use are becoming more acute as families sequester themselves amidst COVID-19 pandemic uncertainties. We are seeing record levels of enrollment in the Catasys OnTrak™ programs because they are entirely telephonic, face none of the capacity restrictions of brick-and-mortar healthcare centers, and are delivered by our own Catasys-credentialed Care Coach employees who have deep experience in helping members cope with feelings of extreme stress.”[23]

The stock performance of ONEM has generally tracked with the S&P 500 until the middle of April. Since then, the stock price of ONEM has increased by over 80 percent. Having closed its IPO in February of 2020, their limited national brand awareness and specific business model may limit the growth of ONEM. While ONEM offers primary care services over video chat, it also incurs fixed occupancy costs to provide in-office services. Furthermore, as a membership-based service provider, most of its membership revenue has historically been from enterprise clients. Benefit reductions or layoffs during and after COVID-19 may lead to a decrease in patient service revenue and also may result in non-renewals of contracts with enterprise clients due to low member activation.[24] Despite these challenges, recent optimism as states begin to re-open has aided the performance of ONEM’s stock.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

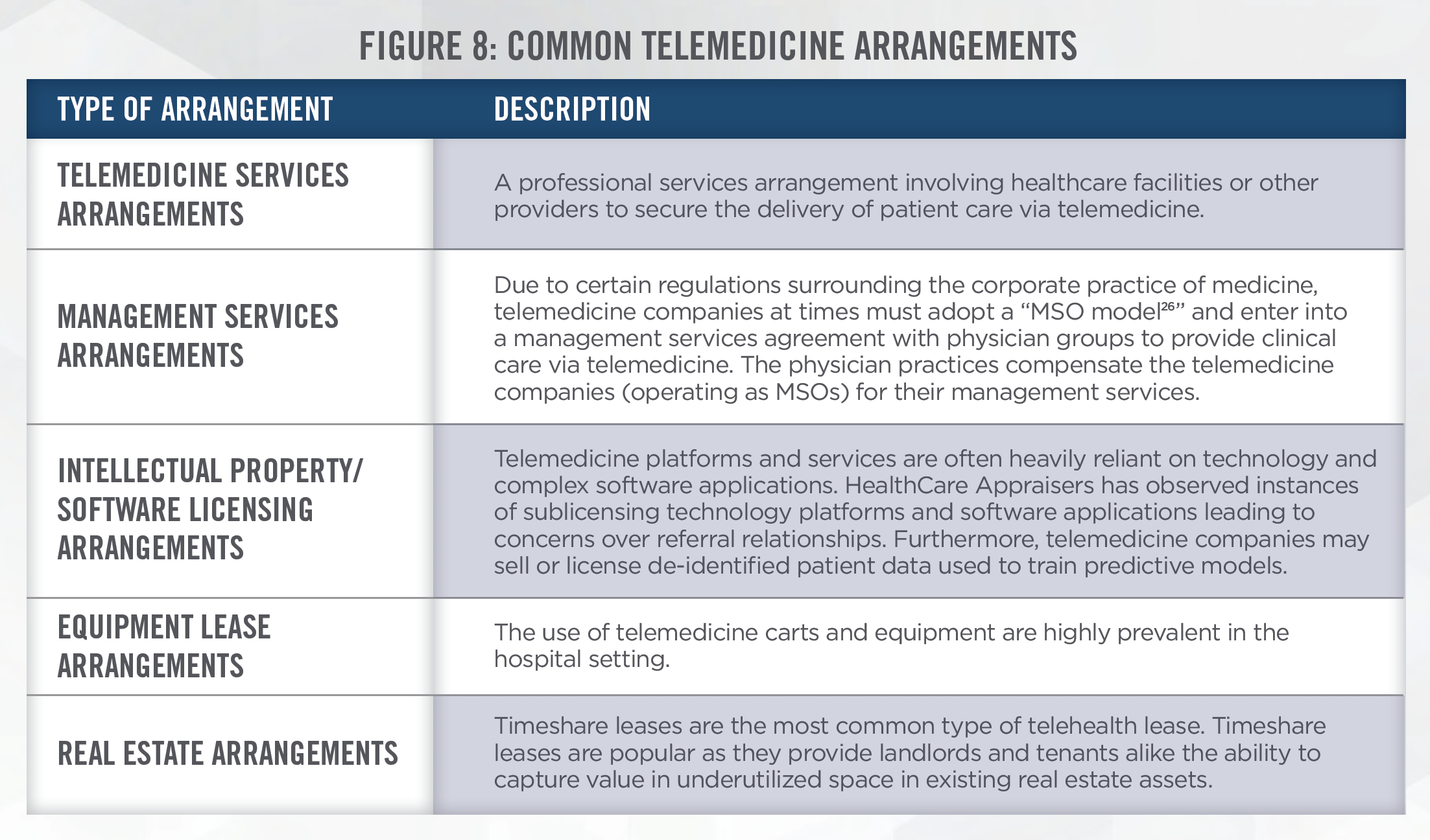

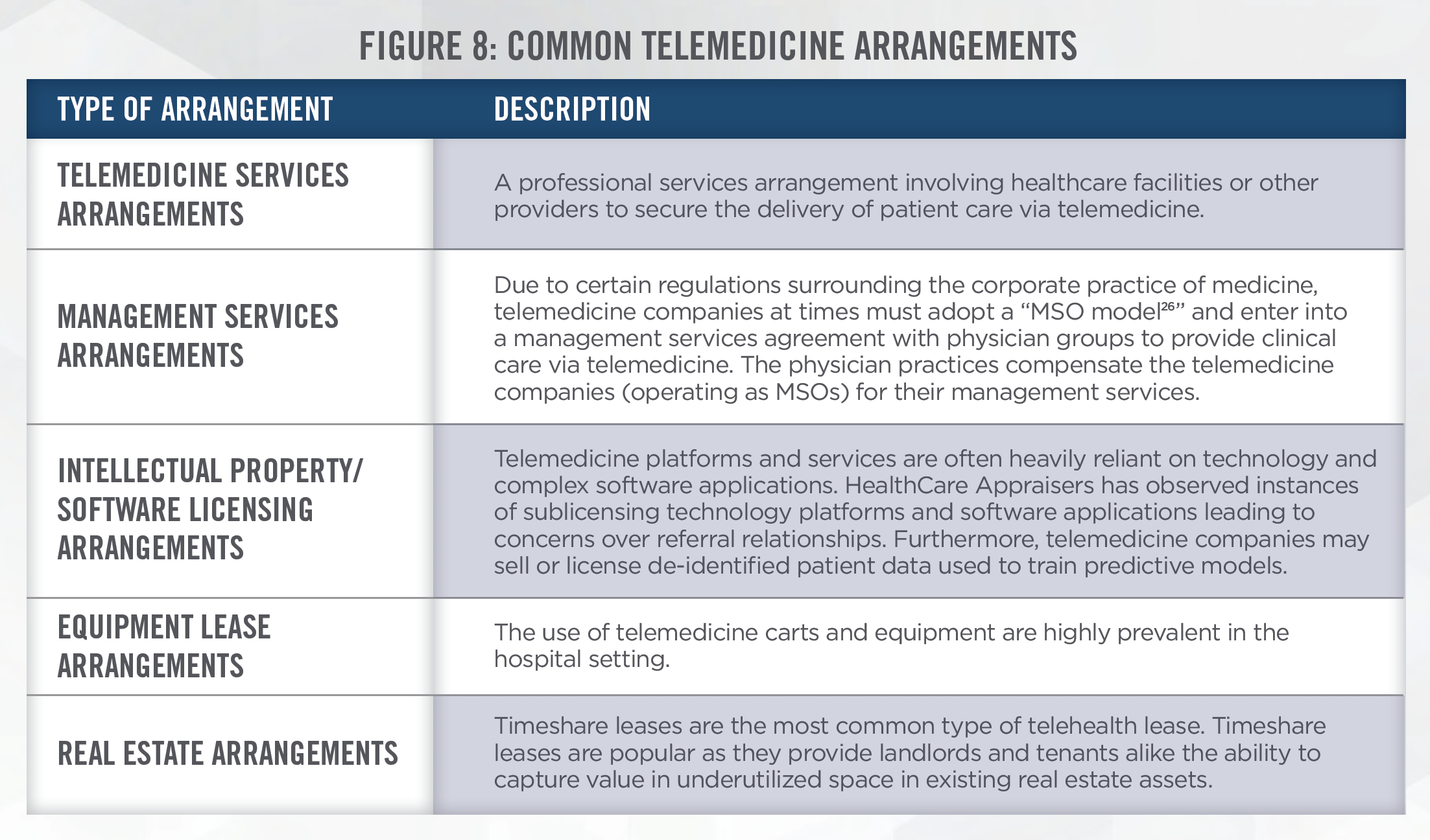

In the telemedicine industry, all laws and statutes applicable to traditional healthcare entities are no less important. In 2019, “Operation Brace Yourself” was a months-long investigation which uncovered one of the largest health care fraud schemes which involved telemedicine and durable medical equipment marketing executives responsible for over $1.2 billion in losses.[25] Regulators are expected to continue applying scrutiny to telemedicine providers to protect the safety of patients, their data, and to provide transparency between providers and patients. Through our fair market value service offerings, we have encountered a wide breadth of arrangements involving exchanges of cash or in-kind services for the professional medical services, equipment, data, software, and other intellectual property of telemedicine providers. Common telemedicine arrangements are outlined in Figure 8.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

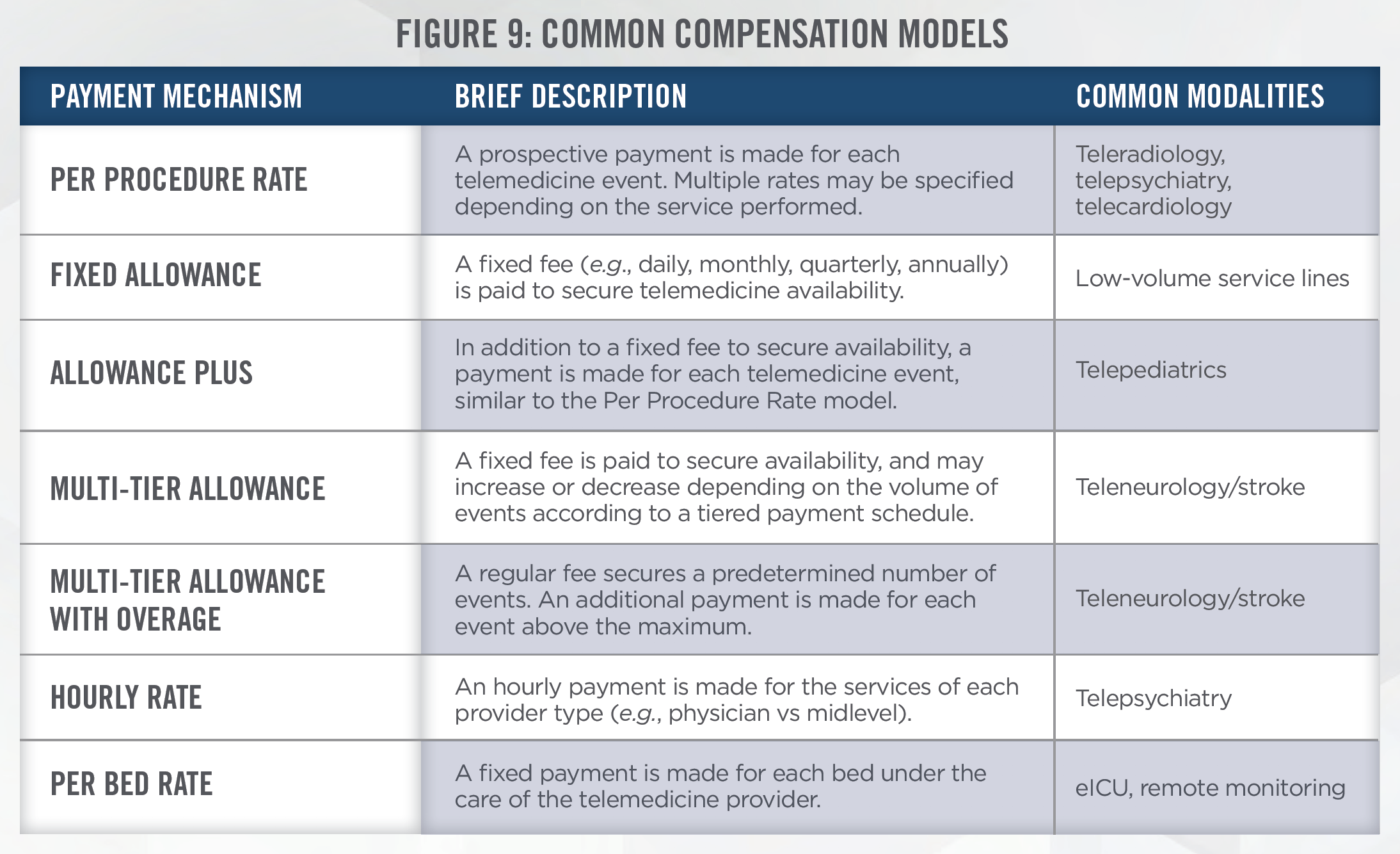

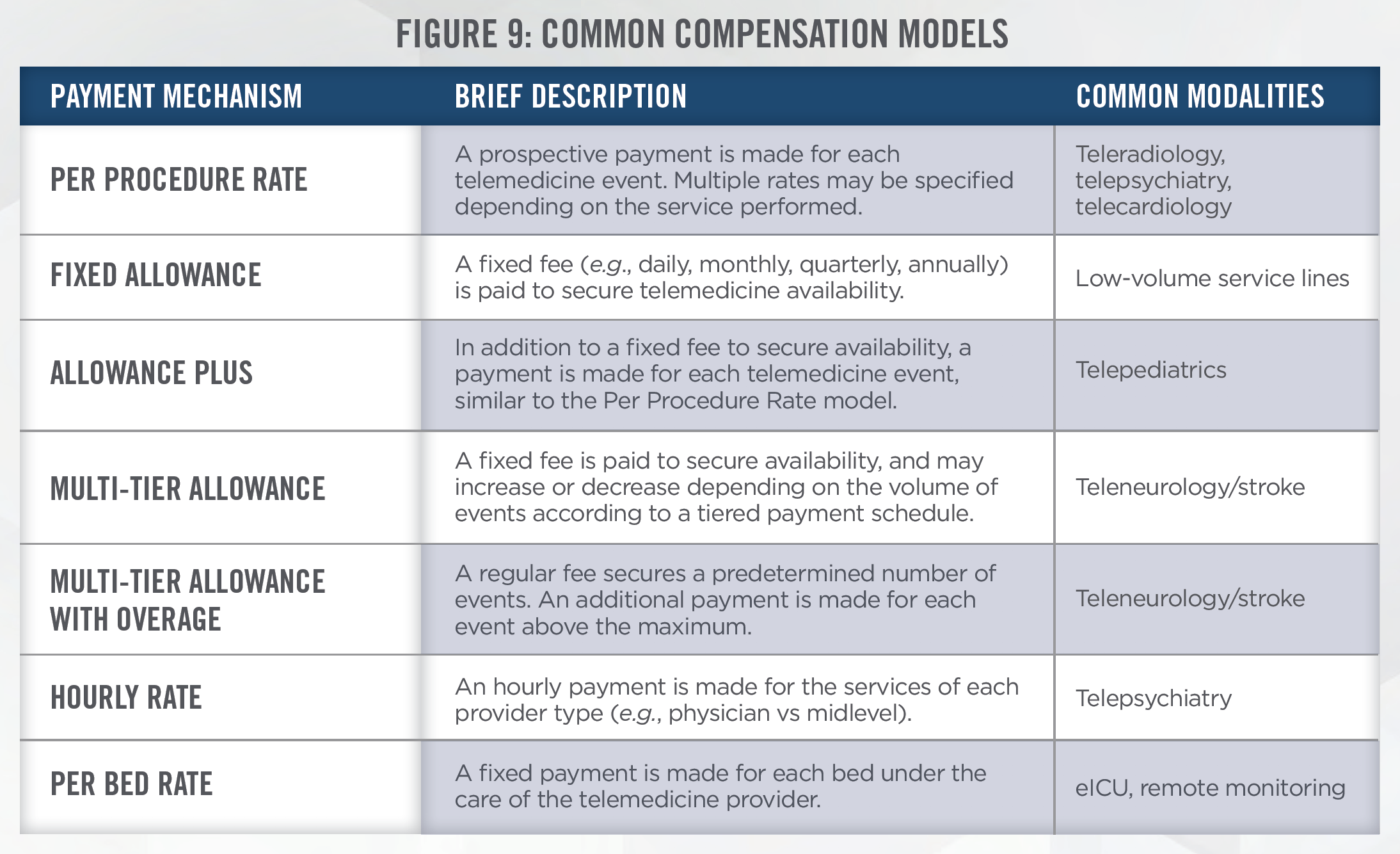

While typically not on-site at hospitals, physicians and other health care professionals who render care through telemedicine are nonetheless still able to refer patients to purchasers of their services. For example, a tele-psychiatry provider may refer a patient for lab testing at a facility that compensates them for their availability. In addition, the same referral patterns may flow in the opposite direction— purchasers of telemedicine services may be in a position to refer patients to the telemedicine service provider. This is common in hub-and-spoke telemedicine models whereby a “hub” facility with access to specialized providers is paid by an outlying “spoke” facility for access to specialist consultations. In the event a higher level of care is needed, the spoke facility may refer the patient to the hub facility for more specialized medical care. For these and other reasons, it is important for purchasers of telemedicine services to demonstrate compliance with the Stark Law and Anti-Kickback Statute, which involves validating the fair market value (“FMV”) and commercial reasonableness of the compensation paid (or in-kind value exchanged) for such services. Common compensation models for telemedicine service arrangements are outlined in Figure 9.

HealthCare Appraisers always considers all three valuation approaches when valuing telemedicine arrangements: the Market Approach, Asset/Cost Approach, and Income Approach. When utilizing the Asset Approach, HealthCare Appraisers determines the estimated annual cost to provide the telemedicine services, accounting for such costs as provider compensation, overhead expenses, malpractice premiums, clinical support staff, technology and equipment costs. When utilizing the Market Approach, HealthCare Appraisers algorithmically assesses the burden of telemedicine coverage by utilizing our Scoring Algorithm Methodology which considers various factors including the expected number telemedicine events, the number of providers rotating the telemedicine coverage, the payor mix of the service location(s), and various other factors. Whenever possible, we also reference prior arrangements deemed to be consistent with FMV in establishing comparables as part of the Market Approach.

Notwithstanding, one of the greatest hurdles faced by telemedicine valuators is the lack of benchmark data with which to evaluate telemedicine services. Furthermore, with the limited existing benchmarks, the service models that underpin telemedicine arrangements vary widely with respect to the scope of resources used. Support staff, telemedicine equipment and technology, and training / implementation programs are just a few of the resources that may or may not be utilized in a given telemedicine arrangement. Additionally, telemedicine reimbursement policies vary considerably at the state level and continue to evolve at the federal level. Finally, the types of medical care that can be rendered via telemedicine continues to expand or otherwise change. For example, several expansionary reimbursement opportunities for telemedicine services were included in the 2020 Medicare Physician Fee Schedule including the ability for telemedicine providers to provide remote physiologic monitoring.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

The rise of telemedicine has led to the need for valuations of the intellectual property (“IP”) and software that serve as the backbone of all telemedicine platforms. HealthCare Appraisers has seen private firms, health systems, and medical groups develop their own telemedicine platforms which they license out to other providers which have entered into arrangements to license the technology. In other instances, health systems and technology companies may look to acquire a telemedicine company and its associated IP.

The Cost Approach provides an indication of value for the subject IP and/or software based on the concept of replacement cost. The premise of this approach is that in a hypothetical negotiation, a prudent buyer would pay no more for the subject IP or software than the amount for which the buyer could replace the IP or software with a new IP or software having the same utility (i.e., the principle of substitution). Therefore, HealthCare Appraisers utilizes a Cost to Recreate New Method in which we are able to capture all costs including initial development costs as well as costs associated with on-going development. To convert these costs into a FMV licensing fee, it’s important to assess: (i) the useful life of the software; (ii) the potential market share and/or number of users; and (iii) an appropriate level of return on investment.

In determining licensing fees for use of telemedicine IP, valuators might also consider the use of a Market Approach. However, telemedicine software often differs in capabilities resulting in a wide range of observed licensing fees. Due to this uncertainty, it is important to carefully consider the market data being relied upon.

When valuing a telemedicine company, a valuator should also consider an Income Approach which looks at the estimated future economic benefit to be generated by the company. Given the higher uncertainty in being able to sustain high levels of growth or achieve profitability, it is important that an appropriate risk-adjusted rate of return is used in discounting the future cash flows.

Telemedicine companies are also in a unique position to collect and de-identify patient data. As researchers and AI companies seek to develop new health insights, services and products, we expect there to be an increase in data licensing agreements between health systems and consumer technology companies. This topic is further discussed in the article: No Free Lunch: The Hidden Value of “Free” Data Sharing Arrangements. We discuss the specific considerations that need to be made when valuating patient data in the article: Bytes to Bucks: The Valuation of Data.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Telemedicine services are generally not heavily dependent on capital equipment. The carts used in a hospital or medical office include a computer tower, monitor, camera, and portable medical devices. The portable medical devices utilized in telemedicine typically include diagnostic monitoring equipment such as blood pressure monitors, pulse oximeters, and electrocardiographs (ECGs). In a hospital setting, these devices are administered by advanced practice providers, or other hospital staff. For at-home use, the portable medical devices are used by the patient to self-administer proper tests and care at the direction of a remote provider. Telemedicine software can range from very basic software packages that allow for data collection, to complex software systems that allow for cloud-based interactions between patient and provider. When appraising capital equipment related to a telemedicine business for a potential transaction, the Cost and Market Approaches are typically utilized. When appraising telemedicine software, it is important for an appraiser to bifurcate value from the software that may be attributable to IP.

In addition to acquisitions involving telemedicine equipment, HealthCare Appraisers has been involved in the appraisal of telemedicine professional service arrangements, many of which require the FMV lease payment associated with telemedicine equipment. When appraising telemedicine equipment in connection with a lease, it is important for an appraiser to have an understanding of the remaining useful life of the assets, which party is responsible for the insurance and maintenance of the equipment, and consideration of the technology support services in place, among several other considerations.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

The telemedicine industry will continue to grow and evolve as it becomes more widely adopted by both physicians and patients. While COVID-19 has accelerated the use of telemedicine, there are still challenges to be resolved before the use of telemedicine becomes the norm. Despite these challenges, we expect investment and transactional activity in the telemedicine sector to continue. In this dynamic industry, HealthCare Appraisers has the experience and expertise required to render valuation opinions of telemedicine businesses, intellectual property, capital equipment, and service arrangements.

[1] Grand View Research, April 2020 Press Room, “Telemedicine Market Worth $155.1 Billion By 2027 | CAGR: 15.1%” last accessed on April 15, 2020 from: https://www.grandviewresearch.com/press-release/global-telemedicine-industry

[2] U.S. News; “‘Avoidable’ ER Visits Fuel Health Care Costs,” last accessed on May 18, 2020 from: https://www.usnews.com/news/health-news/ articles/2019-07-22/avoidable-er-visits-fuel-us-health-care-costs

[3] STAT, “Surge in patients overwhelms telehealth services amid coronavirus pandemic,” last accessed on April 6, 2020 from: https://www.statnews. com/2020/03/17/telehealth-services-overwhelmed-amid-coronavirus-pandemic/

[4] CMS Dear Clinician Letter, last accessed on April 16, 2020 from: https://www.cms.gov/files/document/covid-dear-clinician-letter.pdf

[5] Federal Communications Commission, 2019 Broadband Deployment Report, released May 29, 2019

[6] Covington & Burling LLP, “CARES Act Will Support Internet Connectivity for Remote Education, Healthcare, and Work”, last accessed on April 6, 2020 from: https://www.globalpolicywatch.com/2020/03/cares-act-will-support-internet-connectivity-for-remote-education-healthcare-and-work/

[7] IHS Markit Ltd, The Complexities of Physician Supply and Demand: Projections from 2017 to 2032, April 2019

[8] Becker’s Hospital Review, “KLAS: Remote patient monitoring reduces admissions, readmissions, ER visits,” last accessed on April 16, 2020 from: https://www.beckershospitalreview.com/telehealth/klas-remote-patient-monitoring-reduces-admissions-readmissions-er-visits.html

[9] IHS Markit Ltd, The Complexities of Physician Supply and Demand: Projections from 2017 to 2032, April 2019

[10] Centers for Disease Control and Prevention, Chronic Diseases in America, last accessed on April 7, 2020 from: https://www.cdc.gov/chronicdisease/resources/infographic/chronic-diseases.htm

[11] Massachusetts General Hospital, January 14, 2019 Press Release, “Virtual video visits may improve patient convenience without sacrificing quality of care, communication,” last accessed April 7, 2020 from: https://www.massgeneral.org/news/press-release/virtual-video-visits-may-improve-patientconvenience- without-sacrificing-quality-of-care-communication

[12] Healthcare IT News, “Telemedicine improves patient care, outcomes in ICU, nurses say,” last accessed on April 7, 2020 from: https://www. healthcareitnews.com/news/telemedicine-improves-patient-care-outcomes-icu-nurses-say

[13] Kaiser Permanente, “Telehealth’s potential to transform care delivery,” last accessed on April 7, 2020 from: https://business.kaiserpermanente.org/insights/telehealths-potential-to-transform-care-delivery

[14] HealthLeaders, “Cost Savings for Telemedicine Estimated at $19 to $120 per Patient Visit,” last accessed on April 7, 2020 from: https://www.healthleadersmedia.com/clinical-care/cost-savings-telemedicine-estimated-19-120-patient-visit

[15] Becker’s Hospital Review, “‘The genie’s out of the bottle on this one’: Seema Verma hints at the future of telehealth for CMS beneficiaries,” last accessed on May 16, 2020 from: https://www.beckershospitalreview.com/telehealth/the-genie-s-out-of-the-bottle-on-this-one-seema-verma-hints-at-the-futureof- telehealth-for-cms-beneficiaries.html

[16] Becker’s Hospital Review, “BlueCross BlueShield of Tennessee makes COVID-19 telehealth coverage permanent,” last accessed on May 16, 2020 from: https://www.beckershospitalreview.com/telehealth/bluecross-blueshield-of-tennessee-makes-covid-19-telehealth-coverage-permanent.html

[17] We observe that payors, including Medicare, have acknowledged that audio-visual technology may not be a requirement for certain types of telehealth consultations. In some instances, they have reimbursed for phone call consultations, which do not involve a video component.

[18] American Well; Telehealth Index: 2019 Physician Survey

[19] FierceHealthcare; “Telemedicine companies see funding boom of $788M in Q1,” last accessed on April 24, 2020 from: https://www.fiercehealthcare.com/tech/telemedicine-companies-saw-a-funding-boom-q1-2020

[20] CNBC; “UnitedHealth’s Optum is in advanced talks to acquire remote mental health provider AbleTo for about $470 million,” last accessed on May 6, 2020 from: https://www.cnbc.com/2020/04/27/unitedhealth-near-buying-telehealth-provider-ableto-for-470-million.html

[21] Teladoc Health Previews First-Quarter 2020 Results, April 14, 2020 Press Release, last accessed on April 16, 2020 from: https://ir.teladoc.com/news-andevents/ investor-news/press-release-details/2020/Teladoc-Health-Previews-First-Quarter-2020-Results/default.aspx

[22] Business Wire, “Catasys’ Telehealth-Enabled OnTrak™ Programs See Surge in Enrollment and Engagement Amidst COVID-19 Pandemic,” last accessed on April 17, 2020 from: https://www.businesswire.com/news/home/20200325005200/en/

[23] Ibid.

[24] ONEM Form 10-K for the fiscal year ended December 31, 2019.

[25] The United States Department of Justice; April 9, 2019 Press Release, last accessed on May 18, 2020, from: https://www.justice.gov/opa/pr/federalindictments-and-law-enforcement-actions-one-largest-health-care-fraud-schemes

[26] For a brief primer on the structure of MSOs and their associated professional practices, refer to the following brief authored by Chapman and Cutler LLP (last accessed May 16, 2020): https://www.chapman.com/insights-publications-Health_Care_Management_Service_Organizations.html