Authors: William G. Kaufmann, JD/MBA, Fred Lara, CFA, ASA, CVA and David. W. Sands, CVA

![]() INTRODUCTION

INTRODUCTION

Escalator clauses, also referred to as cost-of-living adjustments or annual escalators, are provisions embedded into many service contracts that automatically adjust upwards a rate of compensation by an agreed upon percentage or amount, at an agreed upon date. Oftentimes, such provisions are contained in agreements with “evergreen” annual renewal provisions after an initial defined term. These provisions are intended as a means of protecting providers from diminishing purchasing power associated with cost inflation.

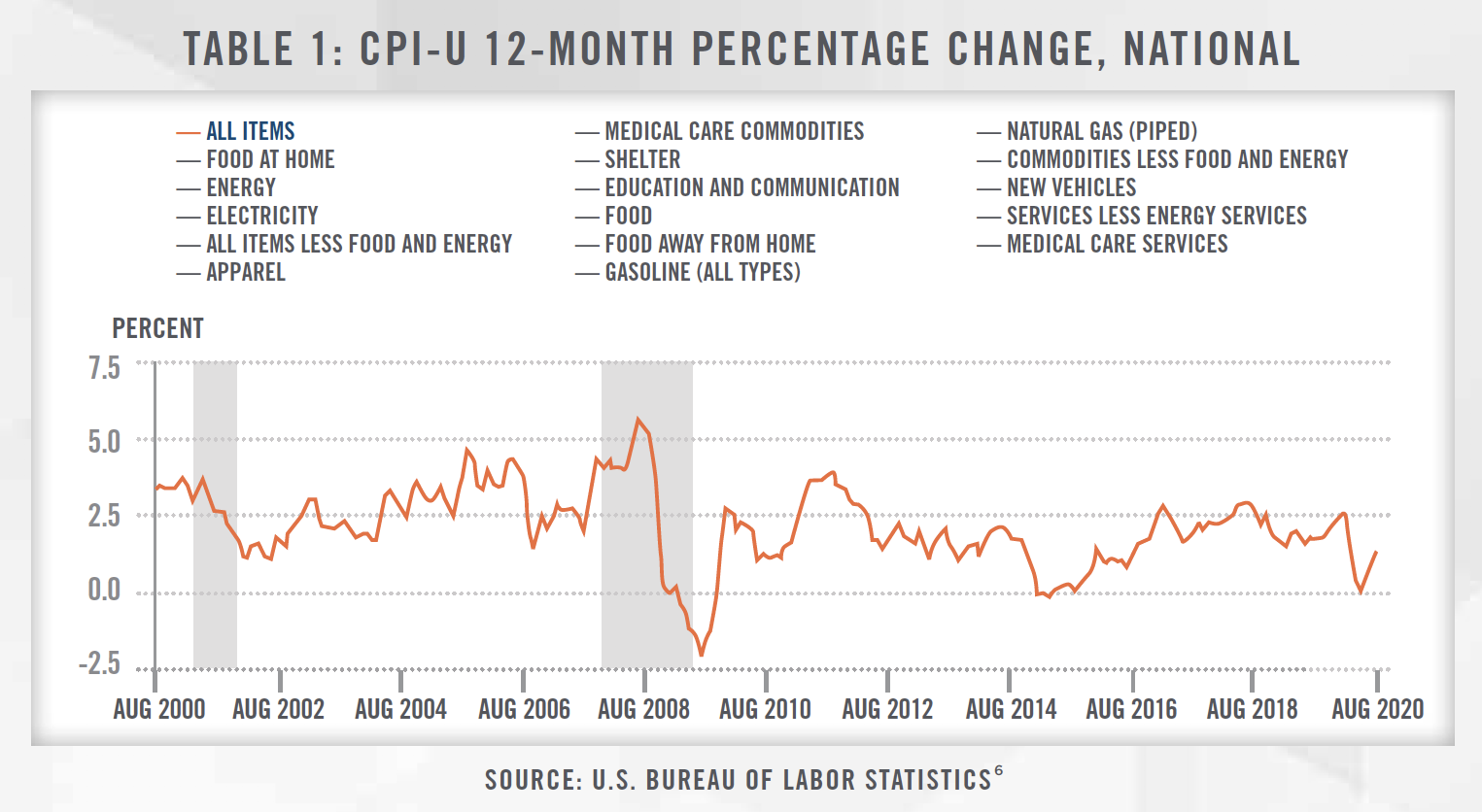

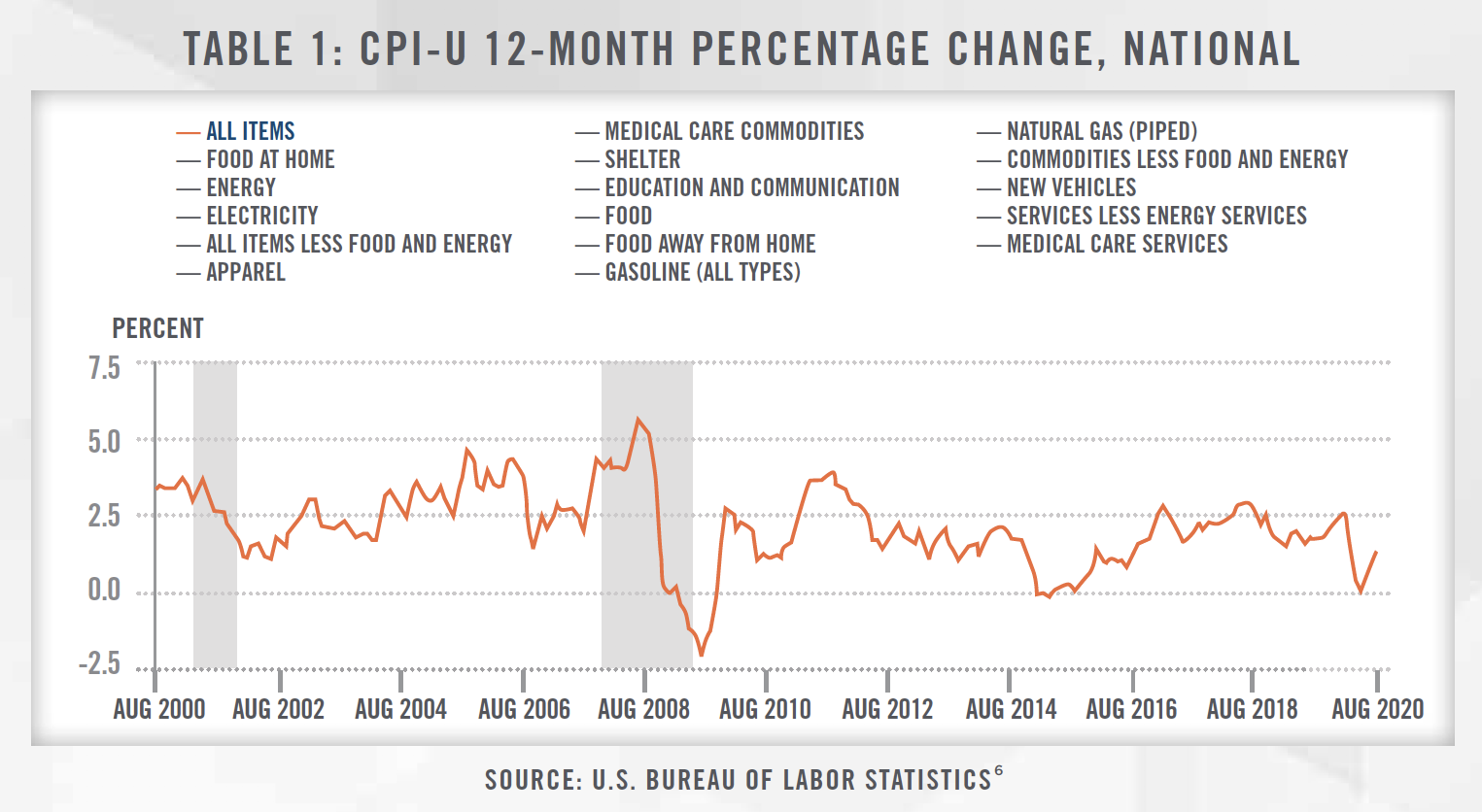

The Consumer Price Index (“CPI”), a commonly relied upon cost index referenced by escalator clauses, dropped at the outset of the Coronavirus pandemic while the US entered an economic shutdown. The index is a measure of the average change over time in the prices paid by consumers for a representative basket of goods and services ranging from oil and gas to healthcare. The CPI-U (the cost index for all urban consumers) declined 0.2% and 0.7%, in the months of March and April, respectively.[1] Drops in the CPI have been the exception rather than the rule over the past decade, and the recent declines were the largest since 2008.

In an economic environment where steady increases in costs (and reimbursement) cannot be taken for granted, hospitals are naturally becoming increasingly focused on long term cost containment. Further, if neglected or relied upon inappropriately, escalator clauses contained in agreements with physicians or physician-owned service providers may bring about Stark and Anti-Kickback compliance issues. In this article, we describe the most common escalator clause structures along with considerations and potential issues associated with their use.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

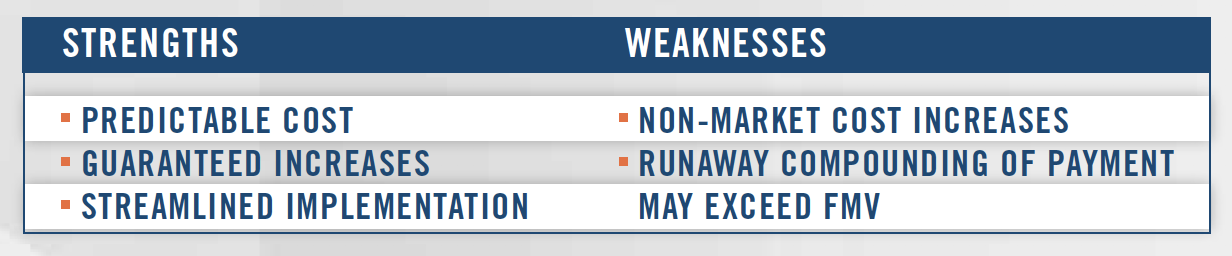

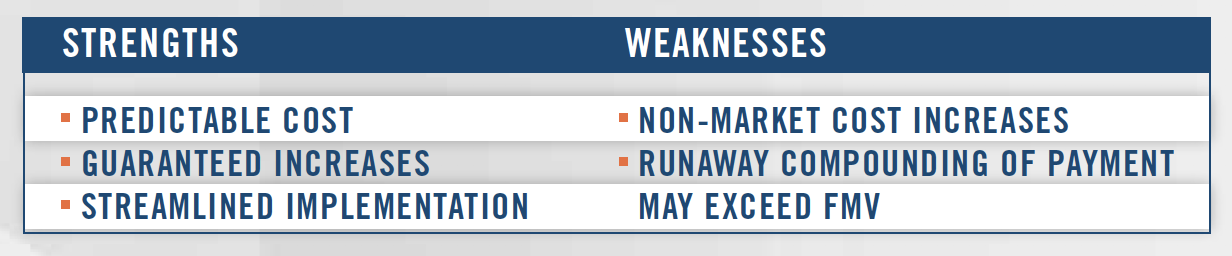

Fixed Percentage – This commonly observed structure sets forth an agreed upon percentage amount (e.g., 3%, etc.) that will be applied to the prior years’ rate of compensation. It is the most transparent and readily administered structure. As noted above, with recent trends in the CPI, steady and predictable cost increases may not be reflective of economic reality. Further, especially in certain evergreen contract renewal scenarios, the effect of compounding may yield outcomes divorced from market rates.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Though they may protect from risks of potential cost increases, fixed escalator clauses, if set too high, can introduce other unintended risks. For example, an agreed upon flat percentage increase of 4% per year yields an 8.16% price increase over a three-year term. Even more drastic, a flat percentage increase of 3% implemented in an agreement in 2010, which included an automatic renewal term, implies a payment increase of nearly 35% more today than in 2010.[2] In agreements for services valued based predominantly on current market rates (i.e., per procedure lithotripsy), the flat percentage increase can present a surprising total payment level, possibly exceeding fair market value, per the letter of the agreement.

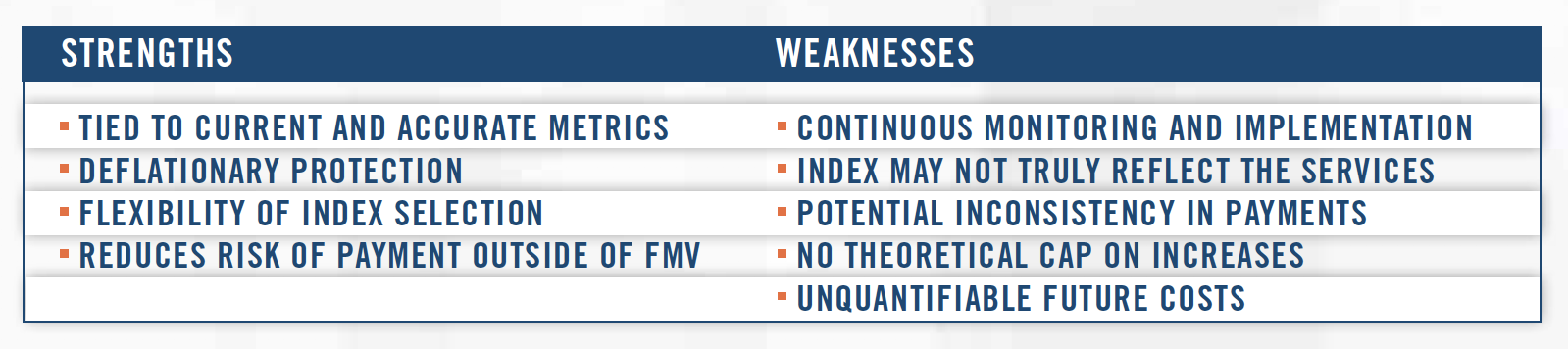

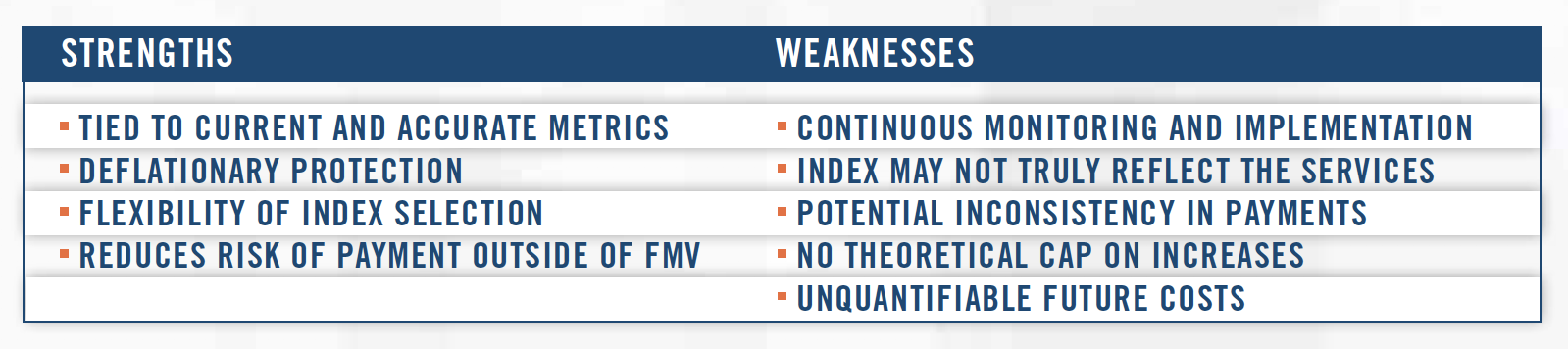

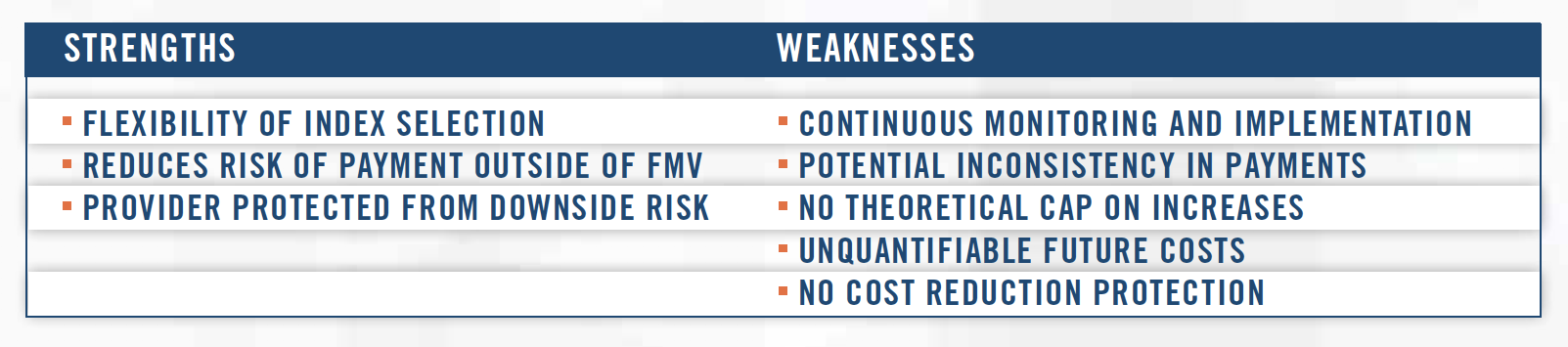

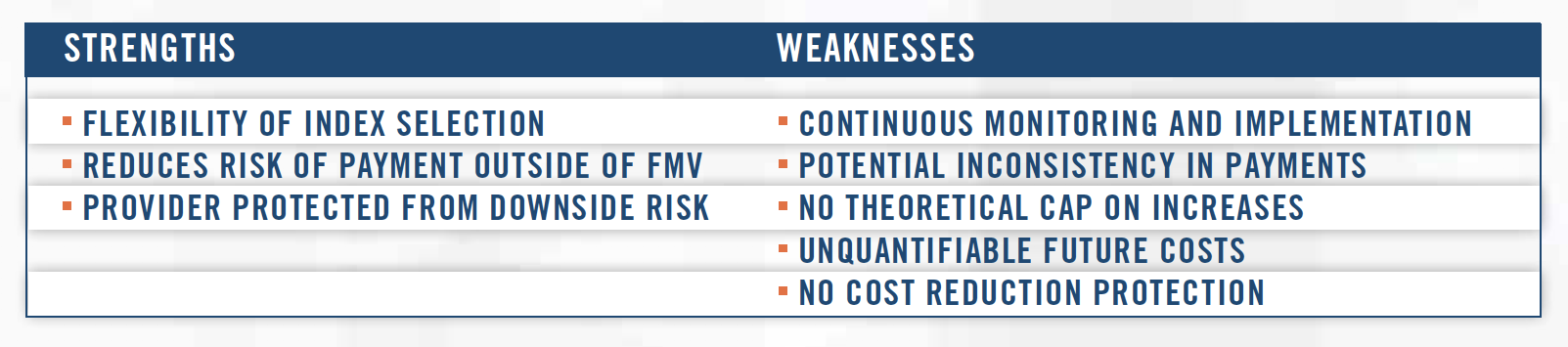

Index Based – This structure sets forth an agreed upon cost index (e.g., CPI-U, CPI for urban wage earners and clerical workers (“CPI-W”), etc.) that will be applied to the prior years’ rate of compensation. As indicated by recent CPI trends, there is the potential for a perhaps unexpected payment reduction if purely applied. Nevertheless, a variable structure (i.e., tied to an index) more accurately reflects realtime trends while requiring slightly more maintenance than a fixed alternative.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

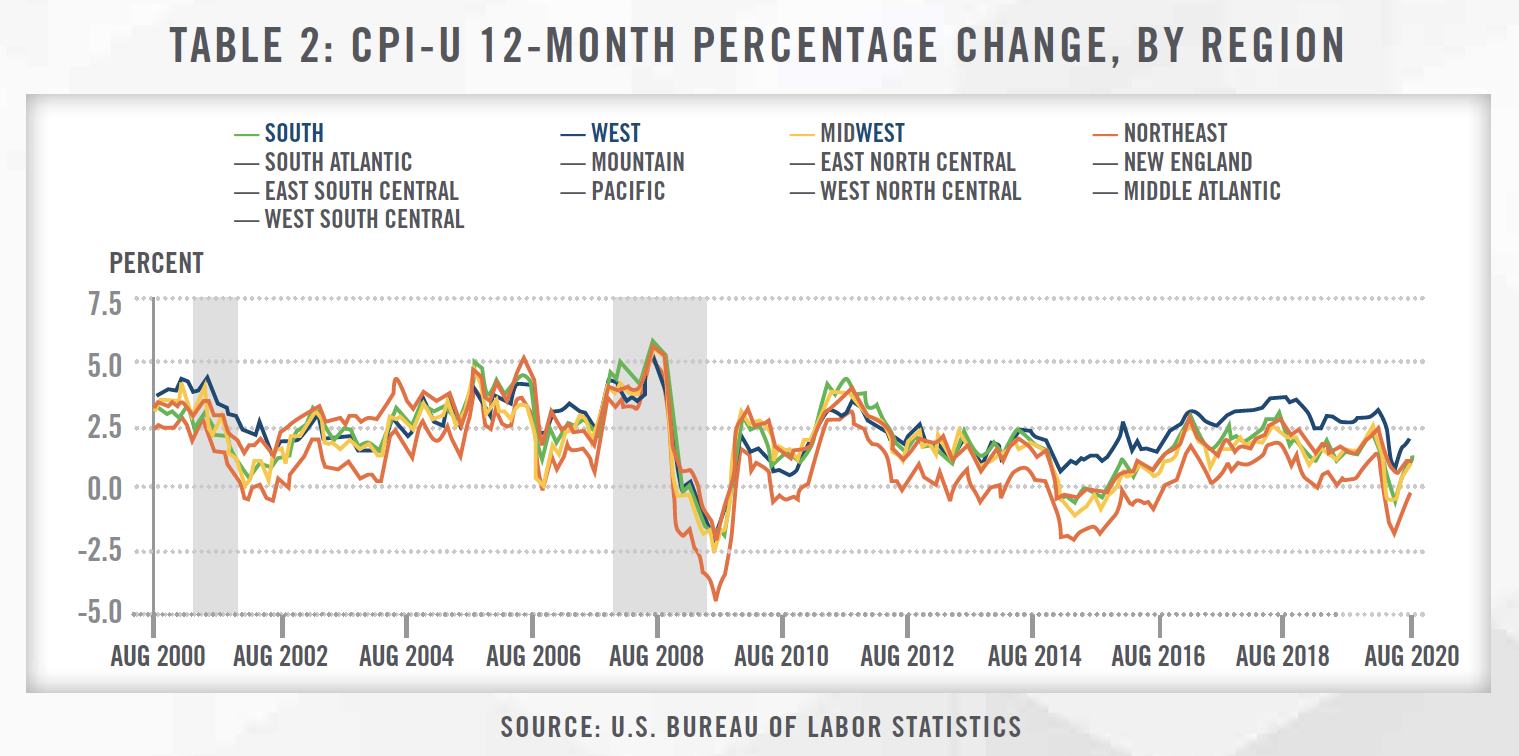

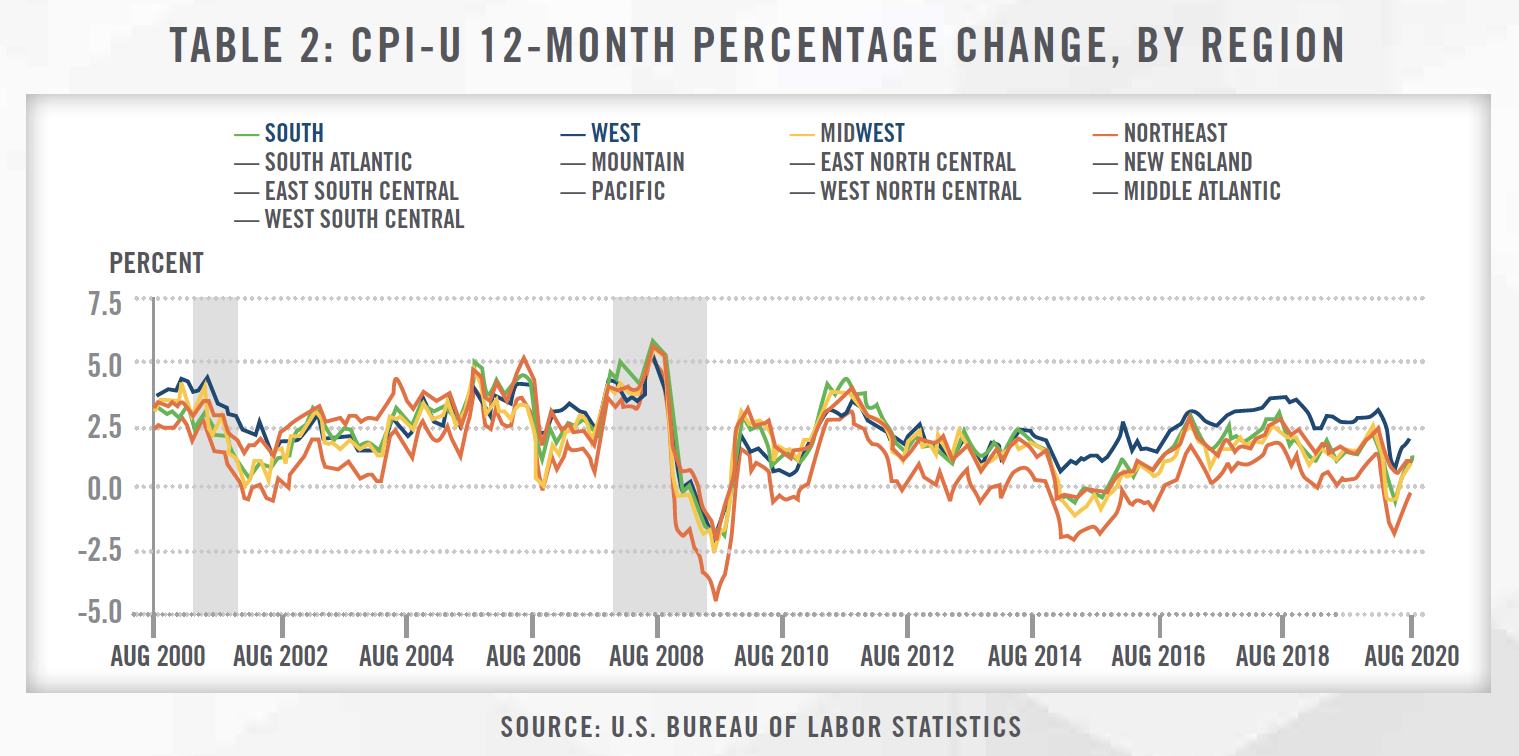

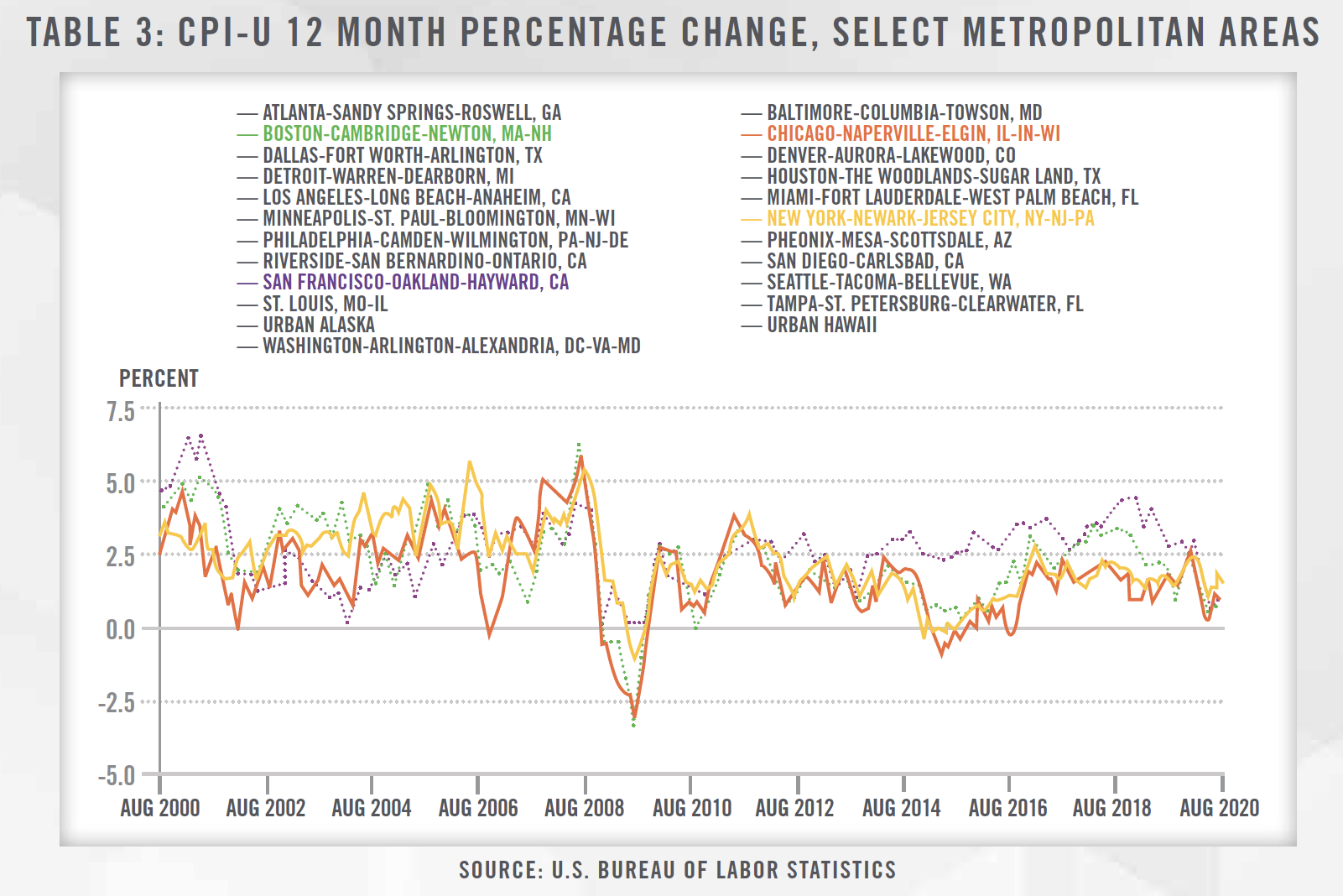

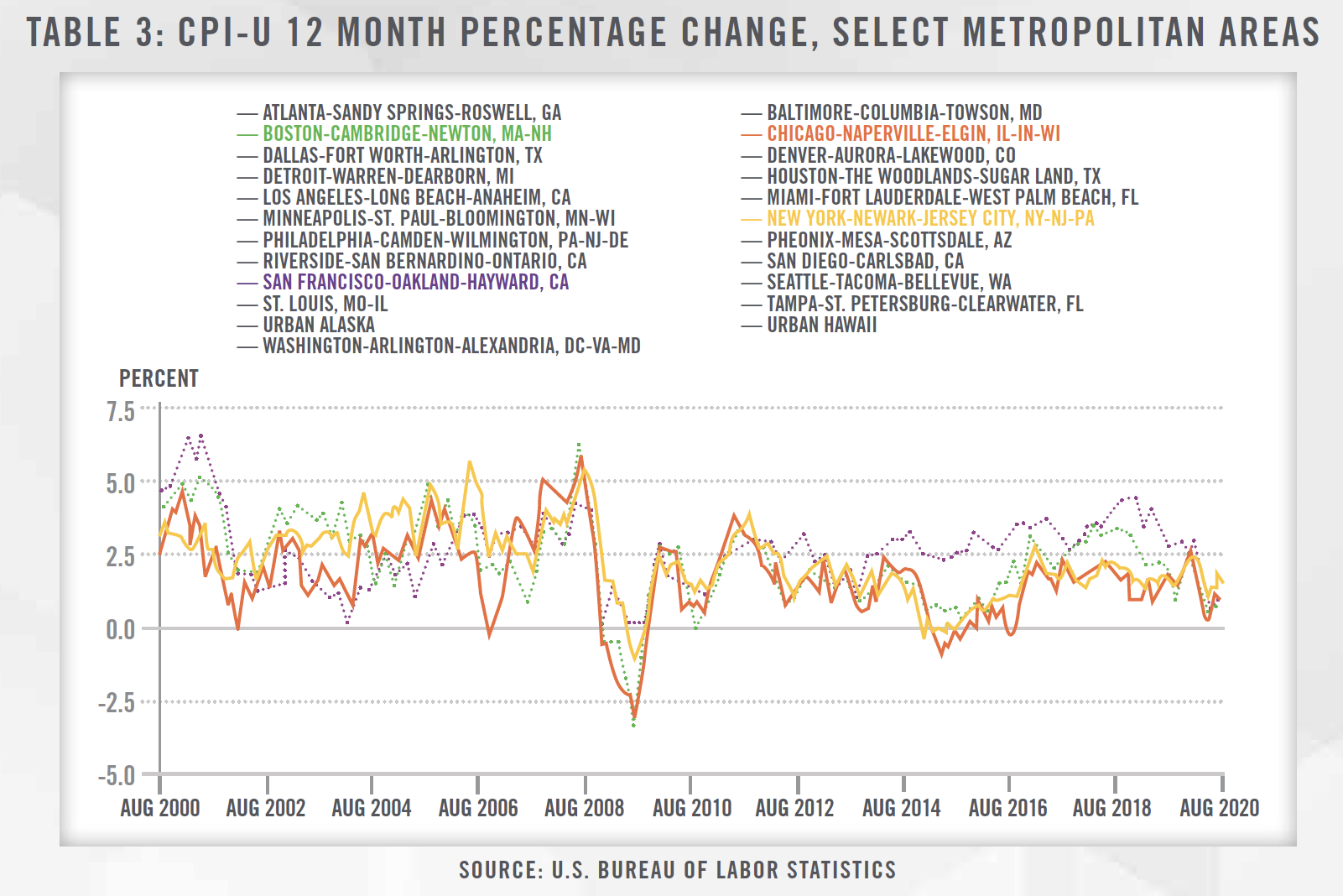

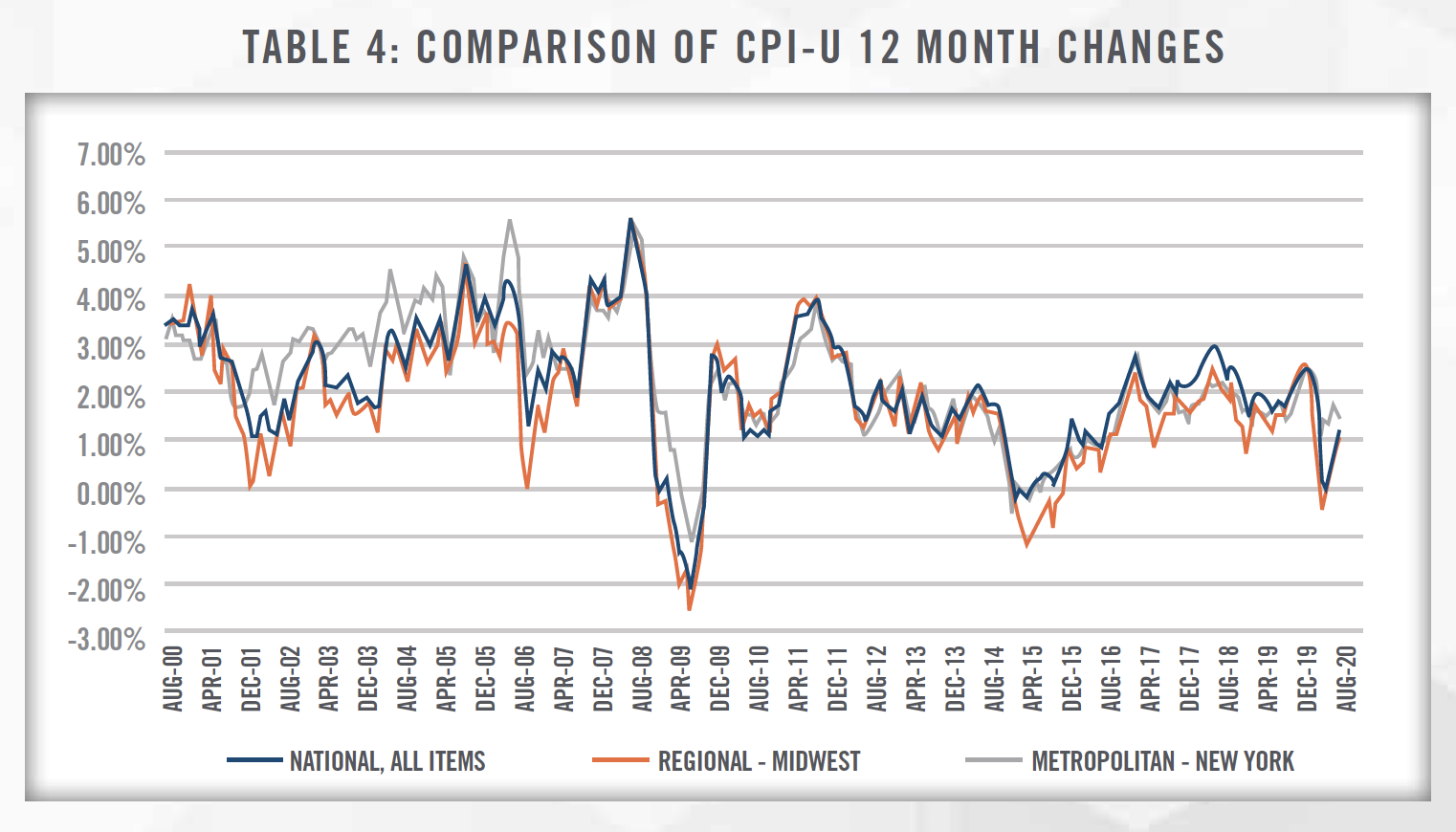

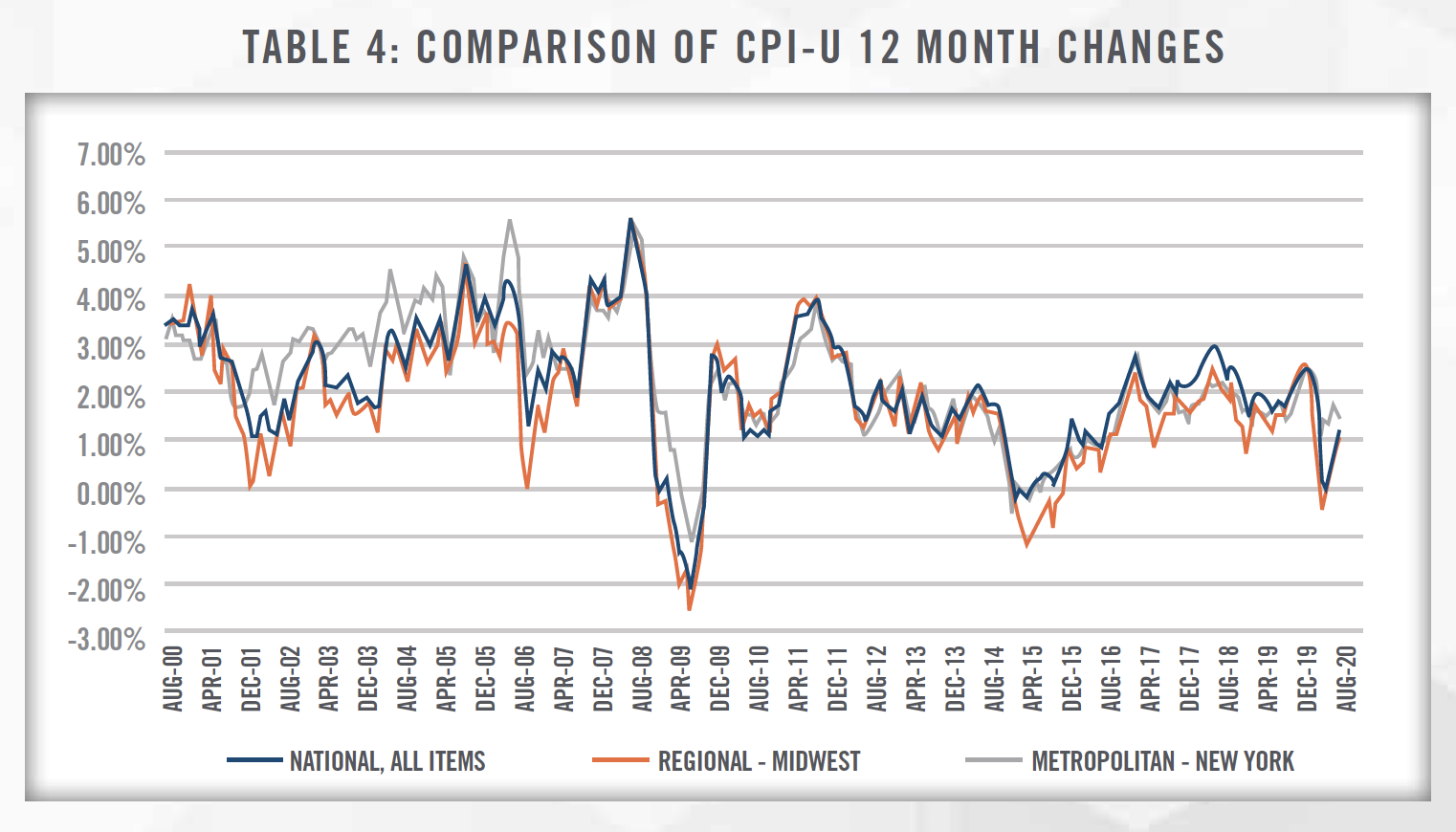

Two broad indices exist for price adjustments: the CPI for all urban consumers (i.e., CPI-U) and the CPI for urban wage earners and clerical workers (i.e., CPI-W).[3] According to the Bureau of Labor Statistics (“BLS”), which publishes the monthly data, the CPI-U “is a more general index and seeks to track retail prices as they affect all urban consumers. It encompasses about 87 percent of the United States’ population” while the CPI-W “is a more specialized index and seeks to track retail prices as they affect urban hourly wage earners and clerical workers. The CPI-W encompasses about 32 percent of the United States’ population and is a subset of the CPI-U group. The CPI-W places a slightly higher weight on food, apparel, transportation, and other goods and services. It places a slightly lower weight on housing, medical care, and recreation.” BLS also publishes CPIs for certain metropolitan areas,[4] regions (e.g., northeast, west, etc.), states, and census regions.[5]

Thus, a wide variety of index choices are available and contracting parties should thoughtfully choose and properly identify the appropriate index in the agreement. Below is a summary of the 12-month percentage change in CPI-U on national, regional, and metropolitan bases. While the general trend of changes is consistent from index to index, the underlying values clearly vary due to market-specific factors (e.g., comparing CPI-U national data in Table 1 versus CPI-U for Metropolitan – New York in Table 4, etc.).

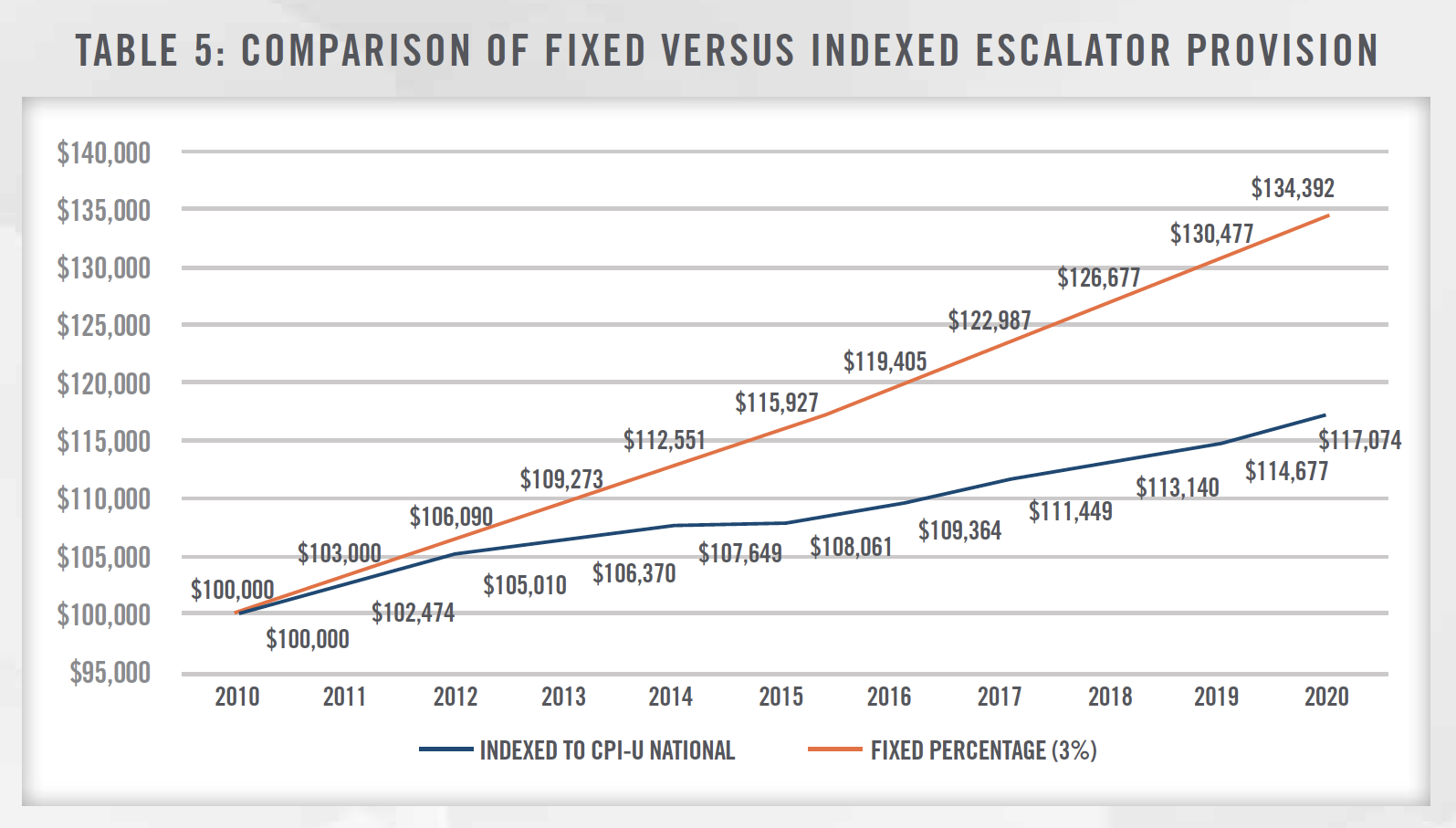

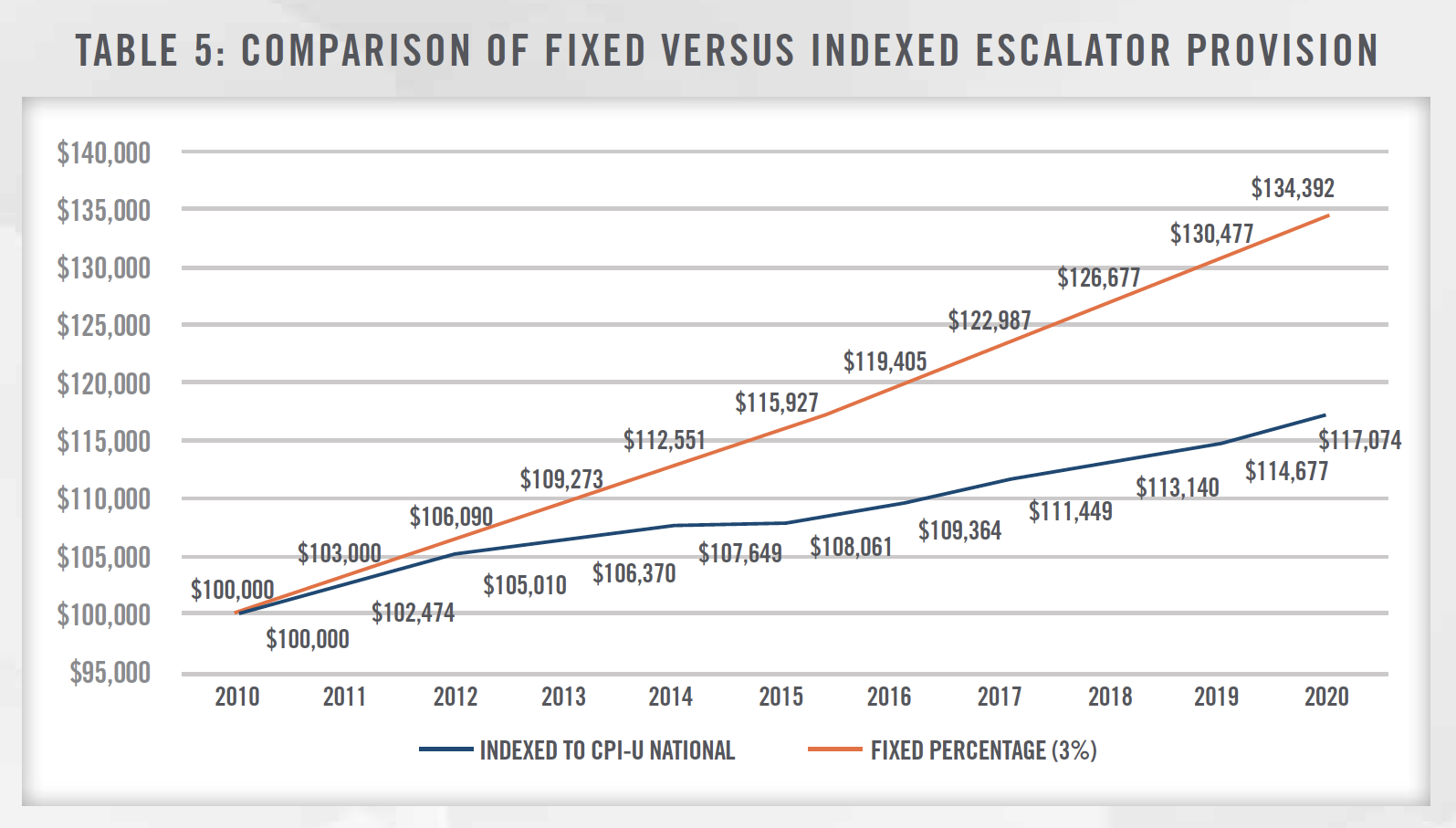

Furthermore, the following table illustrates the compounding effect of the fixed escalator provision tied to an index versus a flat percentage increase of 3%. Over a 10-year period, a $100,000 initial annual cost inflated to approximately $134,000 per year through a fixed 3% increase while the indexed cost inflated to approximately $117,000 per year, representing a 50% lower rate of increase.

Hybrid – This structure blends elements of the fixed and indexed structure. Typically, the hybrid approach relies upon the higher of a fixed percentage or a specific CPI index as the escalator amount. The hybrid approach only supports increases and lacks downside protection for the purchaser. However, if the fixed percentage is set low enough, the hybrid approach will closely resemble the variable structure. Given the uncertainty surrounding inflation and healthcare spending, or reductions thereto, a hybrid provision offers an attractive alternative to the fixed and variable structures.

Custom or Other Structures – We have observed a number of other custom structures intended to address an escalation in payment over time. Such structures are generally conceived to better reflect economic reality, or perhaps to better achieve a financial outcome for one of the parties. In the realm of pathology, we have observed rates of payment for certain services indexed to Medicare Physician Fee Schedule reimbursement levels from an earlier year (before a reimbursement cut). For physician professional services, we have observed rate increases tied to industry-specific compensation surveys (e.g., as published by the Medical Group Management Association,[7] American Medical Group Association,[8] etc.). In lithotripsy, we have observed an “optional” provision whereby an agreed upon escalator may be applied annually but when not applied is subject to “catch-up” such that the compounded escalated amount over many years may be applicable at the option of the service provider. While the above are actual examples of customized structures we have observed, custom structure options are only limited by the creativity of the contracting parties.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Though not an issue limited only to Hybrid or Custom/Other Structures, challenges associated with administering escalator clauses are generally exacerbated when the applicable “formula” is complex and requires lookup and comparison of multiple values. Employee turnover involving the parties who negotiated a deal involving a unique structure may further challenge those trying to administer these contracts in the future. Anecdotally, we note that governmental investigations that include reviews of hospital/physician arrangements have turned up instances of unapplied and misapplied escalator clauses resulting in payment rates requiring retrospective correction. A periodic internal audit of payment rates matched to agreement escalator provisions is a prudent step for any organization wishing to ensure against such a misstep.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

The appropriate usage of escalator clauses should generally align with agreements that have a large portion of underlying costs likely that consistently increase, such as staff salaries (e.g., annual raises, taxes, benefits, etc.), insurance, overhead, and supplies. Agreements associated with services having large portions of fixed costs (e.g., equipment, etc.) generally should more carefully consider whether an index is appropriate. Further, indices may not be appropriate in instances where underlying reimbursement or costs are expected to decline in the long term. We have observed such cost declines over time when IT hardware and software are involved, such as with dictation services, transcription services, as well as with outsourced PACS imaging storage.

A separate issue may arise in the context of service arrangements intended to compensate medical providers for the shortfall in revenue relative to the costs associated with the delivery of medical services. For example, it is common for hospital-based medical practices in specialties like anesthesiology, emergency medicine, and hospitalist medicine to receive financial support intended to cover the costs of full-time hospital coverage after accounting for professional collections. In such arrangements, the payment is a function of two variables: costs and revenues. While the costs of a professional medical service may increase, it is also possible for professional collections to increase at a rate that exceeds cost increases. Accordingly, an escalator provision attached to the financial support payment made by the hospital to a practice may result in above-market compensation if the practice’s professional collections increase at an unexpectedly high rate.

Given the potential issues associated with escalator provisions, before agreeing to one, parties should consider whether periodic (every two to three years) rate renegotiation is more appropriate for the services being transacted.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Contractual escalator provisions offer certain desirable benefits that will ensure they remain popular. For agreements with escalator provisions, parties should: (i) carefully choose the proper structure and index (i.e., fixed, variable, or hybrid); (ii) be mindful of the impact of compounding on the rate of payment over time especially in per-unit payment arrangements; (iii) ensure that the escalator provision selected is being correctly applied; and (iv) regularly revisit the outcome and appropriateness of the escalator provision to ensure consistency with FMV.

At HealthCare Appraisers, we are experienced in identifying, valuing, and advising on a variety of agreements containing escalator provisions and would be happy to assist with your contracting and FMV needs.

[1] U.S. Bureau of Labor Statistics, Consumer Price Index, Last modified September 11, 2020; https://www.bls.gov/news.release/cpi.toc.htm

[2] By way of comparison, an escalator provision tied to the CPI for all urban consumers over the same period would have only yielded a 20% cost increase.

[3] See https://www.bls.gov/cpi/tables/ for a list of various data files.

[4] https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-metro-area.htm

[5] https://www.bls.gov/regions/

[6] https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category-line-chart.htm

[7] https://www.mgma.com/

[8] https://www.amga.org/