Authors: Jordan A Zoeller, MAcc, CFA and Nicholas J. Janiga, ASA

While equity interest transactions and outright acquisitions are the most common pathways to acquiring a desirable healthcare business or asset, many healthcare businesses are approaching us regarding alternative methods to securing access to valuable partners within their community. Indeed, the market changes since 2022 are leading healthcare organizations to consider creative solutions to expand their networks or secure the ability to invest in desirable healthcare businesses. Similarly, we have examined derivatives utilized in order to meet state requirements such as certificate of need laws. Such derivative instruments include:

![]() Options (e.g., calls and puts);

Options (e.g., calls and puts); ![]() Forward contracts;

Forward contracts;![]() Rights of first refusal; and

Rights of first refusal; and![]() Convertible debt

Convertible debt

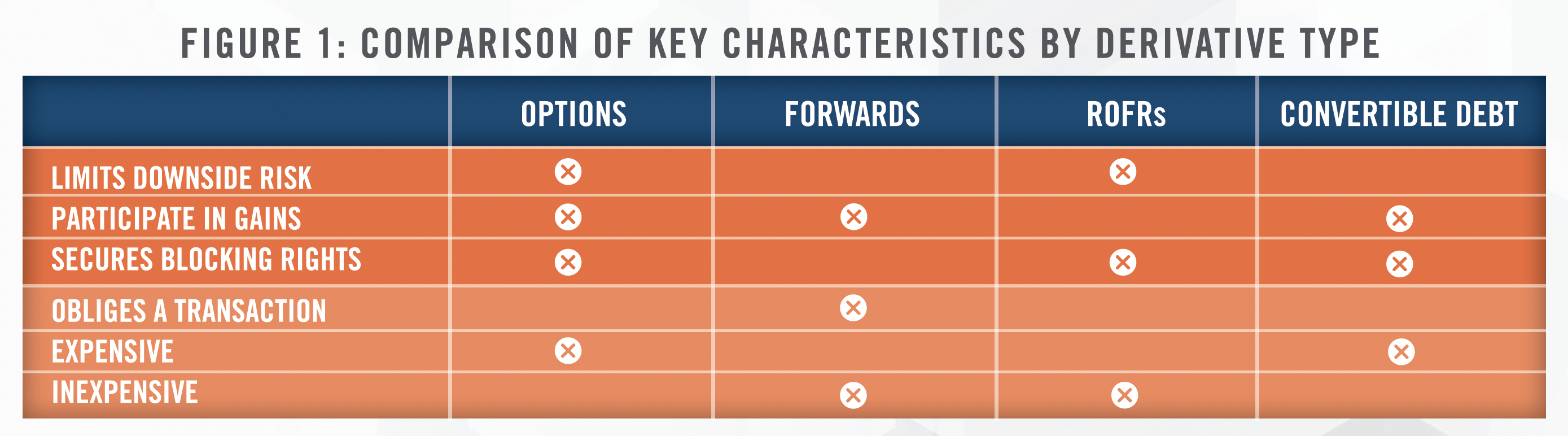

Determining what value, if any, derivatives have can be a difficult question to answer. Each derivative also maintains distinct advantages and disadvantages; a prudent selection of the derivative type employed is critical to achievement of the subject organization’s goals and objectives. We explore each of these types of instruments in further detail, with key characteristics summarized in Figure 1.

Options

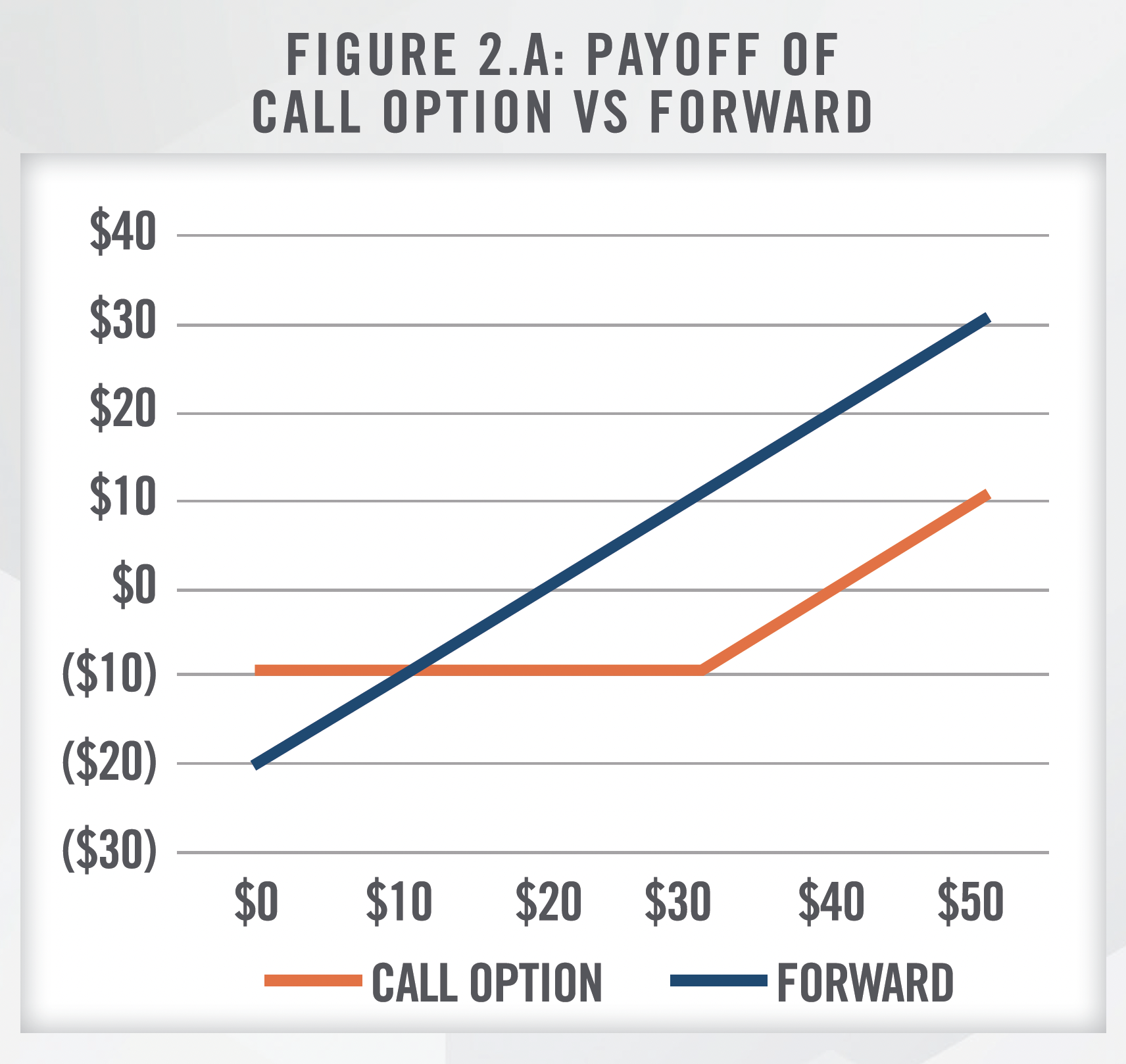

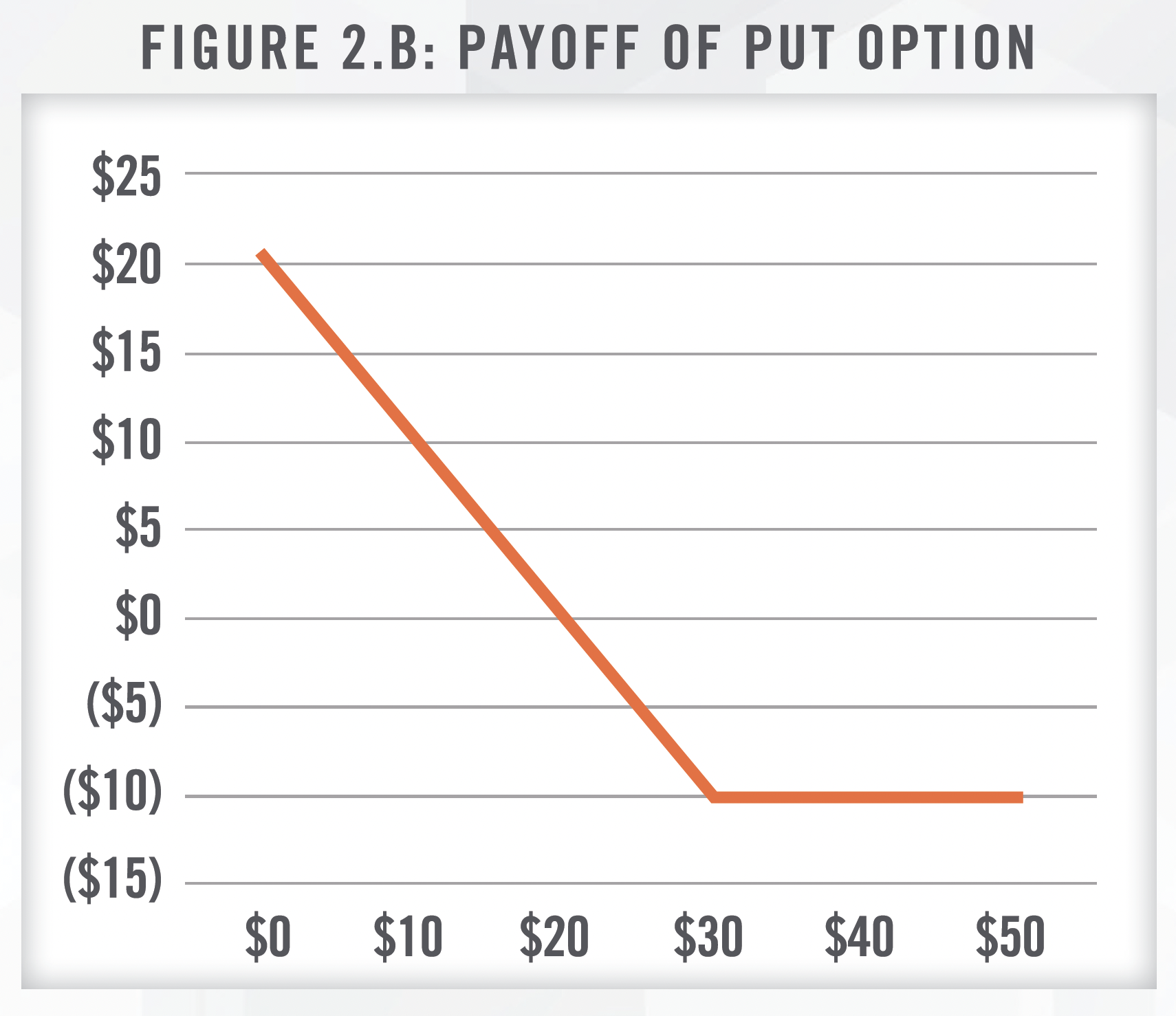

As the most requested type of derivative, options are generally comprised of calls (the right, but not the obligation, to purchase an interest/asset) and puts (the right, but not the obligation, to sell an interest/ asset). There are many further classifications of options besides calls and puts, such as European, American, or Bermudan[1] options, or current versus forward-start options.[2] Options are typically the most expensive derivative, given their underlying payoff mechanisms and the ability to assume material upside benefits while minimizing downside risk. This payoff structure is shown for a call option in Figure 2.a and for a put option in Figure 2.b. As the price of the business declines, only the price paid for the call option is lost; conversely, as the business value increases, the call option participates in the gains.

Forwards

Forwards, or forward contracts, are instruments which plan for the transfer of an interest in exchange for a specified amount of consideration, as of a date in the future. Many readers are familiar with “futures” of commodities like oil, gold, pork bellies, corn, or coffee as traded on exchanges making up the CME Group. Forwards function similarly to futures, but the forward contract is not standardized, nor available on a financial market exchange. There is no optionality component with a forward-an obligatory transaction will occur at the pre-ordained date. Although the purchase price consideration is not typically exchanged at the execution of the forward contract, the future risk and reward is transferred. This can be desirable in certain scenarios; for instance, where relatively stable or predictable outcomes are required for success, as well as projects which may require the participation of multiple parties to be successful. Figure 2.a displays a typical payoff structure for a forward. As the business declines, a dollar-for-dollar decline occurs in the payoff for the forward. This risk/ reward structure is similar to an outright, traditional investment in the business.

Right of First Refusal

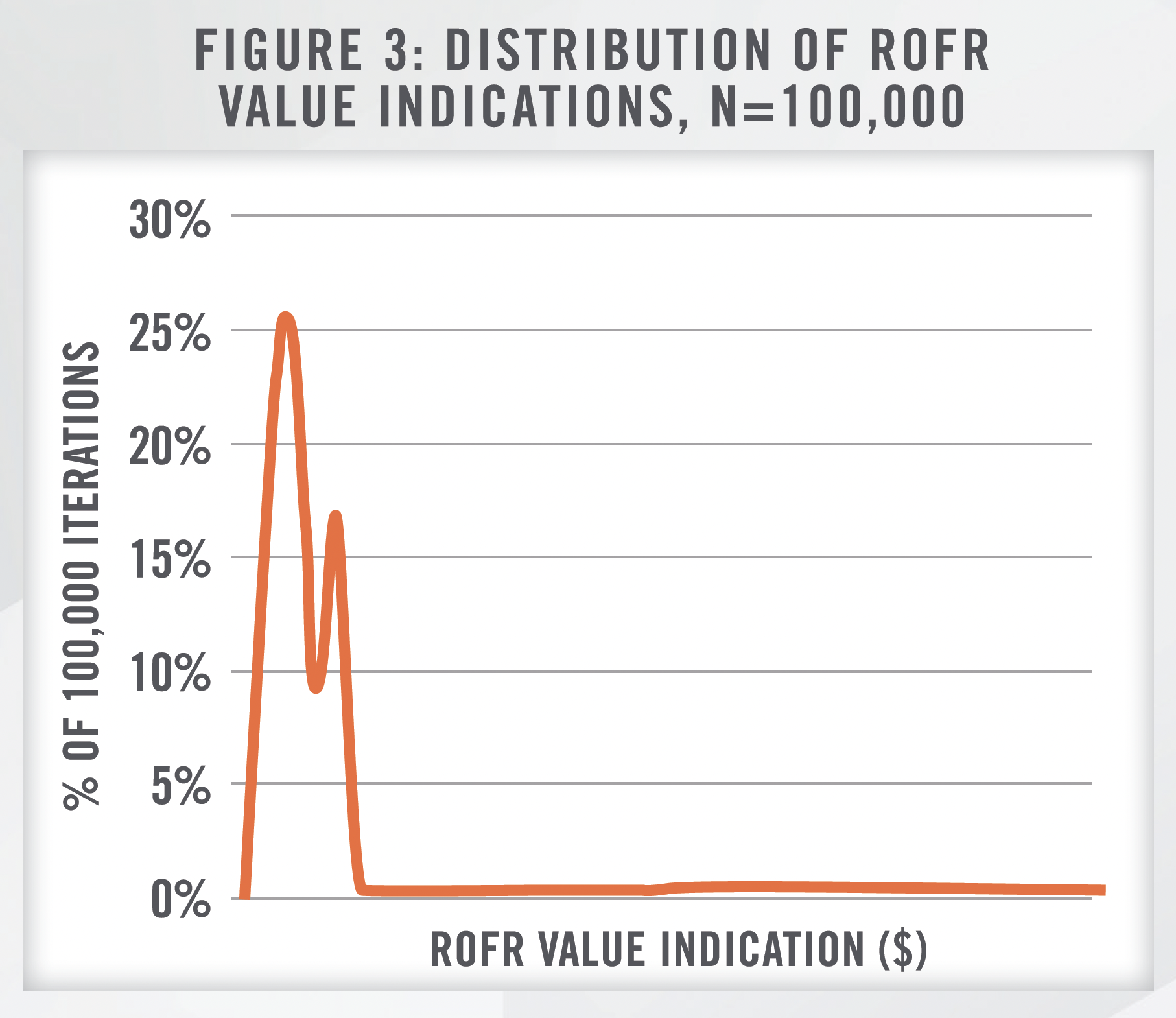

A right of first refusal (“ROFR”) is a tool that healthcare organizations can use to protect their interests. A ROFR is a pre-emptive right to purchase an asset or business interest at the price offered by a third-party buyer. It should not be confused with an option to purchase the asset, as the seller is not typically compelled to sell the asset or business interest to the right-holder under a typical ROFR agreement. Instead, if a seller wishes to divest their asset or interest, the right-holder will be “first in line” to purchase the center at any given offered transaction price. Figure 3 displays an example payoff frequency[3] for a ROFR. The largest frequency spikes indicate a ROFR typically expires without material value; however, there are long-tailed odds of a material payoff to a ROFR holder. In some circumstances, the existence of a ROFR could decrease a healthcare business’ overall marketability. Third-party bidders for a business may be less inclined to incur due diligence costs if a ROFR is disclosed, as it would increase the likelihood of a failed bid, compared to a scenario without a ROFR; accordingly, caution should be exercised by sellers.

While a ROFR may certainly be a standalone contract, they are frequently components of larger transaction agreements or governing documents. For example, a joint venture may choose to incorporate such a provision into the operating agreement specifically to allow existing joint venture members to acquire an interest in a sale.

Convertible Debt

Convertible debt, as a broad categorization, is composed of traditional debt along with an optionality component allowing the lender to convert their debt into equity of the borrower. Convertible debt is usually subordinated to other more senior classes of debt; however, it can provide a lender the ability to participate in any significant gains realized by the underlying business in the future, while enjoying a relative measure of safety in the event of liquidation (i.e., business failure) over common equity holders, although downside risk still exists due to interest rate risk and credit risk. The ability to convert into equity generally decreases the interest rate paid by the borrower, compared to debt/notes without such an optionality component. Debt securities may also maintain other features, include call features (to allow borrowers the ability to take advantage of lower interest rates) or payment-in-kind interest (to afford borrowers the flexibility to accrue, but not immediately pay, interest expense for a certain number of years).

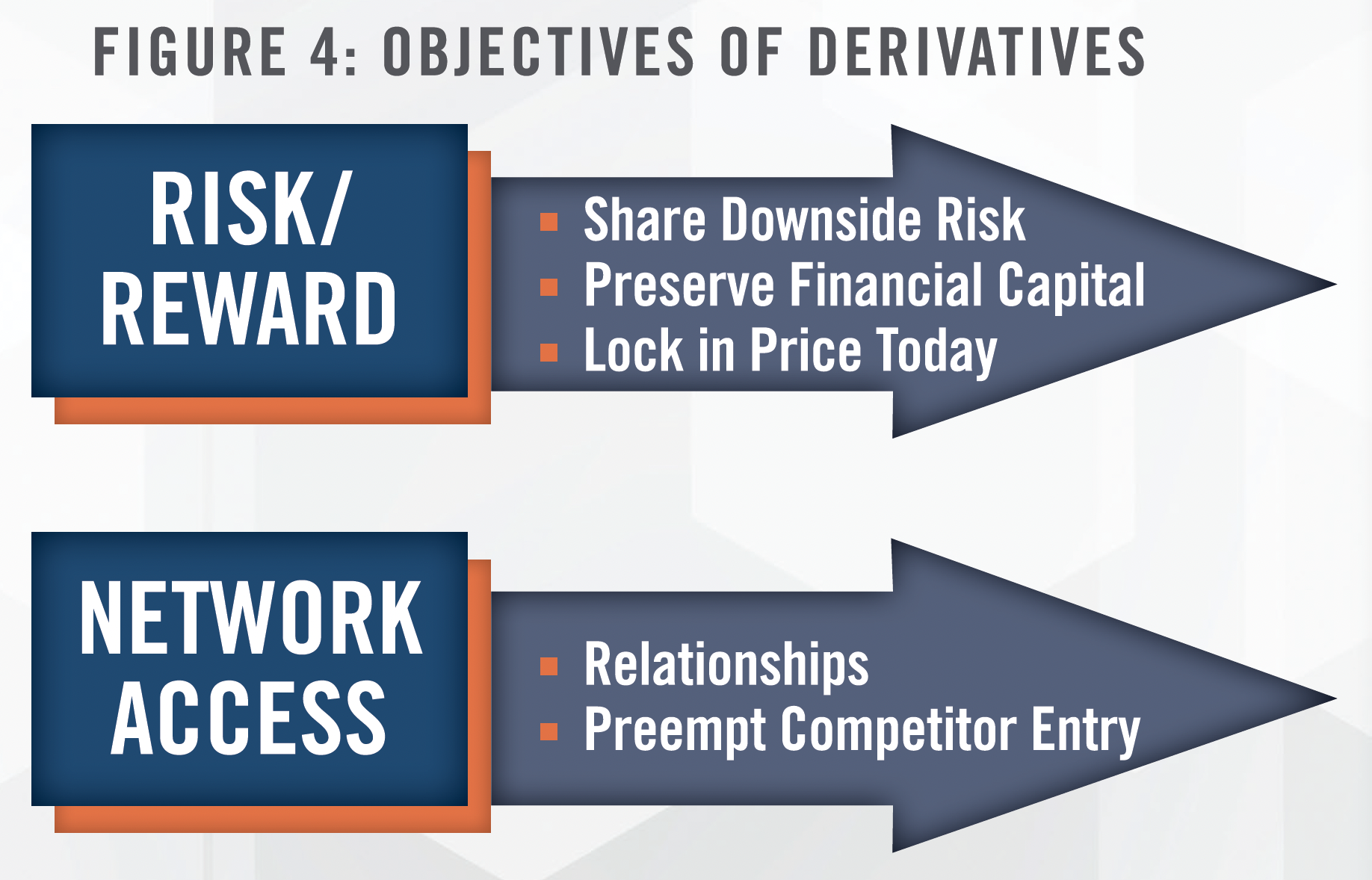

Goals Met by Derivatives

Although there can be many different reasons that derivatives are considered by clients, we generally see goals falling into one of two broader objectives.

Risk/Reward Structure

Derivatives can be utilized in an effort to align risk and reward characteristics in some manner, usually as the result of financial or regulatory hurdles. These considerations can be noted from the buyer, seller, or both. Examples include:

![]() A party wishes to limit downside risk in a risky

A party wishes to limit downside risk in a risky

de novo venture;![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

A carefully constructed derivative contract may allow an investor to eventually acquire the desired ownership interest while building funds necessary to do so. However, an investor is able to lock-in the purchase terms today.

Securing Network Access

Second, derivatives are utilized in a manner to carefully build-out health networks. A hospital system may wish to acquire numerous physician practices, but not have the funds to acquire them all outright today.[4] To avoid the possibility of losing these practices to competitors, a system may leverage derivatives to lock-in the ability to purchase the practice at a later date, without the need to front the cash consideration needed to acquire all practices simultaneously. In doing so, a health system can extend the amount of time it is able to dedicate to strategic planning, market assessments, or due diligence projects. A health system may also view derivatives as an opportunity to establish a relationship with the practice while the health system evaluates the practice for a more formal investment. Although the acquisition of a physician practice (either in part or in whole) is a traditional consideration of derivatives, we also observe interest in derivatives regarding management service organizations and friendly professional corporations (i.e., MSO/friendly PC) arrangements, affiliations, or partnership rights within a geographic area.

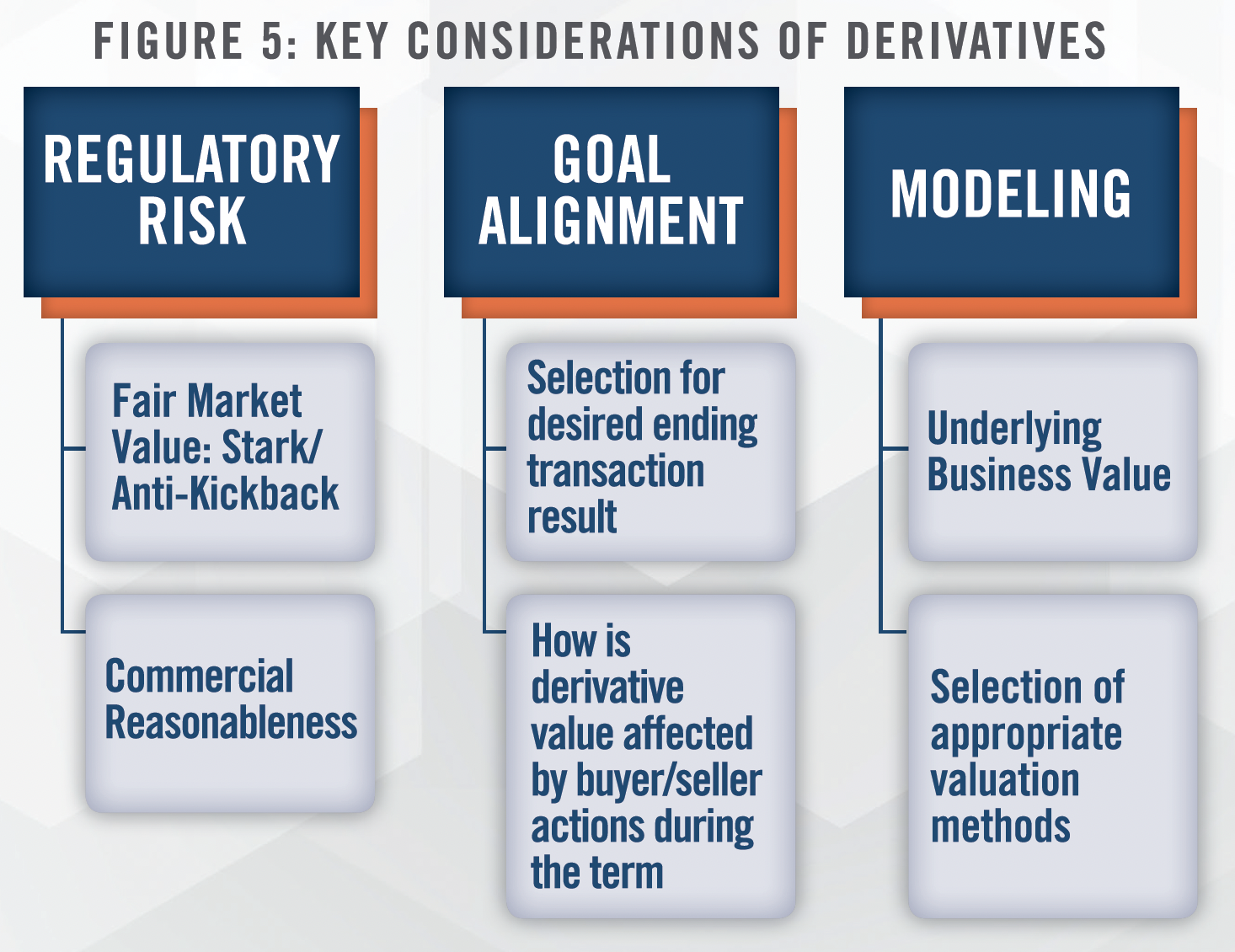

Other Considerations of Derivatives

Derivatives are unique instruments desired by healthcare organizations to achieve strategic aims. The primary consideration is aligning the intentions/goals of the parties to the appropriate derivative, as previously discussed. Another important consideration centers on the actions of the buyer/seller during the duration of the derivative. For example, the planning of distributions—what, if any, distributions are anticipated to be retained by the current owners?

There are also regulatory risks for which healthcare organizations may have differing appetites. For example, say a health system holds a 3-year call option on an ambulatory surgery center interest at a strike price of $2,000,000 (but only worth $1,000,000 today). After 3 years, if the fair market value of the ASC is $3,000,000, the call option would be worth $1,000,000.[5] However, some may have concerns regarding the purchase of the interest at less than fair market value under Stark Law and Anti-Kickback Statutes. Alternatively, the strike could be structured as a multiple of EBITDA, or the strike could “float” entirely at fair market value at the time of exercise. However, this fundamentally changes how the derivative operates and is valued as of today. Others are comfortable with the concept that the “totality” of the purchase transaction includes the call option at its outset, and that the resulting strike purchase price is commensurate with the risk borne by the health system.

Additionally, there may be commercial reasonableness considerations in the deployment of derivatives. For example, if a health system desired an option to purchase a high-quality cancer center or hospital facility, the health system would need the financial wherewithal to consummate a purchase in the event the facility was worth more than the strike price at expiration. Without the ability to raise necessary funds for purchase, the derivative may lack commercial reasonableness.

Suffice to say, the selection and construction of a derivative is best done in collaboration with legal counsel to fully understand regulatory risks.

Our Derivative Solutions

Once we have an understanding of our clients’ challenges and goals, we can design one or more derivatives to solve clients’ objectives. However, another challenge comes in modeling these derivatives. One of the most-cited options models in finance, the Black-Scholes (or Black-Scholes-Merton) model relies on only a few assumptions (both a benefit and a challenge) to render a call or put option value. Although its simplicity in inputs is attractive, its inputs can be difficult to model correctly.

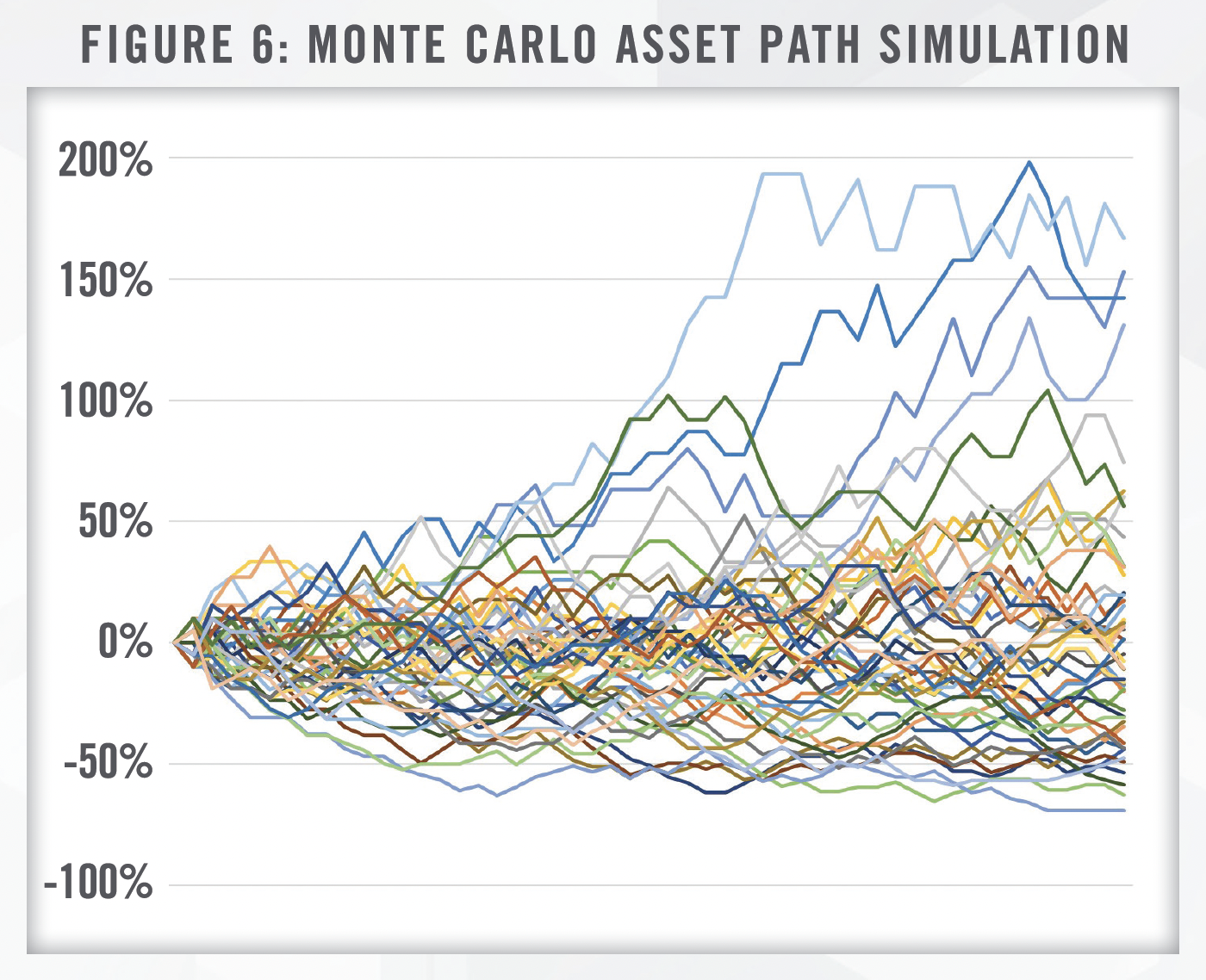

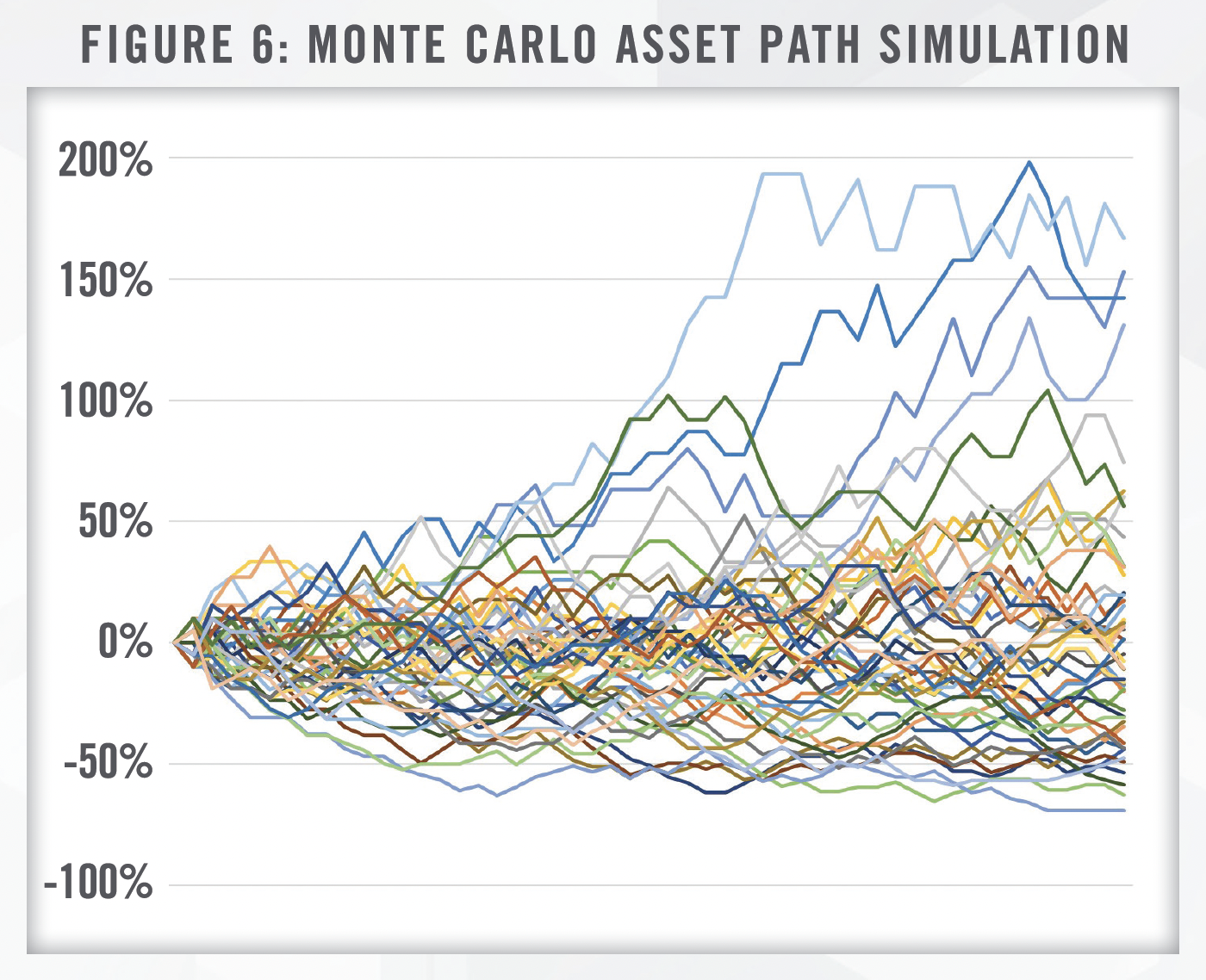

However, we have utilized multiple types of complex models to analyze the contemplated derivative arrangement, such as a Monte Carlo simulation. In such a simulation, we rely upon our known data points and reasonable range of expected values in tandem with millions of random iterations to produce an indication of expected value for the instrument. Through the use of numerous iterations, we expect to converge on a single expected value. Figure 6 provides an example output of the value of a particular surgery center based upon our understanding of the local market and regulatory environment[6]. Note, this asset path price does not appear to follow a normal, bell-shaped distribution curve. Multiple external and internal factors can affect the ultimate shape of the graph, causing skews which simplified valuation models cannot account for.

Another type of model we may consider is a probability-weighted expected return method (“PWERM”) model. In a PWERM, various scenarios are modeled, determining the value of the derivative under each of those scenarios. Scenarios are assigned a probability of occurrence, which can be based on historical analysis, expert expectations or projections, consultation with management, or other credible means. Like the Monte Carlo, it can explicitly consider a wide range of inputs and variables, although not all variables are suited for PWERM models. The assignment of scenario probabilities can also be subjective or biased if not objectively analyzed.

A lattice model is another type of model useful for derivative analysis. In a lattice model, discrete sub-periods are modeled, allowing a large degree of flexibility with various inputs, such as volatility, distributions, or early exercise. These sub-periods are modeled into a lattice grid or decision tree, tracking each possible projected scenario along with the indication of value and probability.

Often times we are approached by healthcare organizations requesting a fair market value opinion for an option, but they may better benefit from either a forward or a right of first refusal. In other circumstances, we may recommend a combination of derivatives be employed to achieve client goals. Derivatives are complicated instruments and may not function as originally anticipated. We help healthcare organizations by guiding them through various instruments to ensure their objectives are truly met, whether those goals are risk-management or broader network goals.

Case Study – ASC

Two healthcare providers desire to build a new ambulatory surgery center (“ASC”) in their local market. However, certificate of needs laws in the jurisdiction would generally prevent the building of a new facility. However, one party is permitted to build a hospital outpatient department (“HOPD”) without the need to obtain a new certificate of need. At a later date, the parties plan to convert the HOPD to an ASC (which they believe will also not require a certificate of need). The permitted provider would need to invest the upfront funds required for the construction, but would generally not have sufficient cases for profitability unless the second provider also performs cases at the facility. The permitted party approached our firm with a request to determine the fair market value of a forward-start call option for the second party to eventually buy into the ASC as originally desired.

The providers would like to form a joint venture from day one, but are precluded from doing so by certificate of need regulations. The permitted party is required to front the cash needed for construction of the HOPD, but lacks the case volume to make it profitable. The second party does not want to bring cases to a facility where they are not also owners. Additionally, by bringing cases to the facility, they are increasing the profitability, and value, of the very business they are attempting to buy into, with their involvement directly increasing the required purchase price. The permitted party is concerned that an excessive purchase price will deter the second party’s interest in the venture.

We examined whether the call option was the best instrument to achieve their goals. As noted herein, options represent expensive instruments due to the limited downside risk afforded to options. Here, the parties want to share the risks and rewards with one another, and a low purchase price consistent with fair market value is desired. Instead of the call option, we recommend a forward contract be utilized. The development costs of the facility are relatively known, and the physician group can purchase an ownership interest based on their desired share of these costs. Since a transaction will occur in the future, the second party shares in the risk and reward structure similarly to if they were able to obtain an ownership interest at the start of the venture. Since the transaction price is locked in today, the fair market value is more favorable to the second party (as desired by both parties) and avoids setting the price based on a profitable business several years down the road.

Case Study – Real Estate

Provider A was in negotiations to acquire Provider B, a large physician practice. Provider B owned a substantial real estate investment in its facility, which it ultimately desired to transact to Provider A. Provider A was primarily interested in the business value of Provider B, but was willing to consider a real estate component in order to secure the deal. Provider A did not wish to purchase the real estate immediately, but wished to delay any potential purchase 10 years in the future when additional funds were available. Additionally, Provider A preferred to minimize the costs of any employed derivatives. We proposed to Provider A the purchase of a call option and sale of a put option to help lower net costs. This structure allowed Provider A to “lock-in” the present day fair market value of the real estate, yet defer the actual purchase (i.e., transfer of purchase funds) to a future date. Based on our review of applicable real estate volatility in the local market, we believe there was an acceptably low risk of forced assignment of the real estate under the put option. Finally, Provider A was able to lock-in the potential purchase price of the real estate based on current valuations.

![]() SUMMARY

SUMMARY

Given the potential difficulties in executing transactions in certain environments (e.g., high inflation, rising interest rates, faltering credit markets, and a pending recession in 2023), many healthcare participants are looking at alternative methods of securing valuable network partners or desirable investments within their markets. While participants may have an idea of what type of derivative they would like to employ, the details of the derivative contracts are fundamentally important to discuss. We have assisted clients in both designing the right derivative that meets the goals and concerns of all involved, as well as valuing those derivatives to ensure that any consideration remains in fair market value compliance with Physician SelfReferral Law and Anti- Kickback Statutes.

[1] These classifications affect when options can be exercised to buy/sell the underlying interest.

[2] These classifications affect when options begin their lifecycle.

[3] Figure 3 is not comparable to Figure 2.a, as Figure 3 displays the predicted frequency of the ROFR’s ultimate value based on a Monte Carlo simulation.

[4] Alternatively, a system may simply desire to limit risk or apply a “probation period” to a practice.

[5] $3,000,000 value minus the $2,000,000 strike the health system must pay

[6] The number of market competitors, other similar surgery centers, local costs, and other specific factors can all impact the future value of the surgery center.