Authors: Andrew Worthington and James R. Hills, CPA/ABV

ORIGINALLY PUBLISHED BY THE AMERICAN ASSOCIATION OF PROVIDER COMPENSATION PROFESSIONALS

![]() HOSPITAL-BASED CARE

HOSPITAL-BASED CARE

Due to requirements set forth by the Emergency Medical Treatment and Labor ACT (“EMTALA”)[1], Medicare-participating hospitals are required to treat and stabilize all patients who walk through their doors. As a result, most hospitals operate certain key service lines, including an emergency department, a hospitalist medicine program, and an intensive care unit, to name a few. Such service lines typically require continuous (i.e., 24 hours per day, 365 days per year) on-site and/or on-call coverage. As a result, the physicians, advanced practice professionals (“APPs”), and nurses staffing these service lines are primarily shift-based providers.

Regardless as to whether such shift-based providers are employed or contracted by hospitals, revenue from related professional services is oftentimes insufficient to cover corresponding costs to secure such services. As a result, hospitals are routinely searching for ways to improve shift efficiencies, reduce nonproductive downtime, and realize cost reductions.

Historically, certain hospitals have sought to accomplish these objectives by including work relative value unit (“wRVU”) production thresholds in select hospital-based physician compensation models. Under these models, in lieu of receiving a base shift rate only, a physician may instead receive a reduced base shift rate in exchange for the opportunity to earn additional incentive compensation to the extent their personal wRVU production exceeds of a predetermined wRVU threshold. The general premise being that by motivating providers to exceed wRVU thresholds, hospitals can ensure that their providers are busy and efficient, and realize a more cost-effective program overall.

While this approach may have some success, we believe the premise needs to be reconsidered. Herein, we review the common wRVU-based compensation model approach to driving efficiencies, and present our argument that physician compensation models for shift-based coverage that are weighted more towards quality of care and patient outcomes may produce better results for all stakeholders. For purposes of this article, we will look at two case studies: one for hospitalist medicine and one for critical care.

![]() wRVU-BASED MODELS

wRVU-BASED MODELS

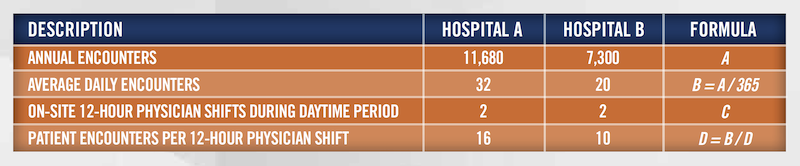

Prior to establishing wRVU thresholds, it is imperative that hospitals diligently assess and challenge current staffing levels. For a hospital-based service line, coverage shifts need to be assessed in conjunction with detailed operational review of the underlying sub-specialty, patient volumes, and patient acuity. In the table below, we’ve summarized two hypothetical hospitalist medicine programs.

As set forth above, patient encounters per physician shift are materially different between the two hospitals. Today’s Hospitalist reports that, over the past 10 years, the average number of patients seen per 12-hour hospitalist physician shift is 16.[2] Accordingly, Hospital B may want to assess the need for staffing two physicians on-site during daytime hours. If the average hospitalist encounter requires 45 minutes (12 hours per shift / 16 patient encounters per shift), the physicians at Hospital B could each have up to approximately 4.5[3] hours of non-billable downtime per shift. However, these averages do not necessarily apply equally to all shifts. For example, overnight or nocturnist hospitalists typically have fewer billable opportunities for the same patients cared for by the daytime hospitalist physician.[4]

Finally, while reference is made to the encounters per shift benchmark as reported by Today’s Hospitalist, HealthCare Appraisers has observed a myriad of actual operational results due to the unique dynamics and operating characteristics impacting each hospitalist program. And since hospital-based providers have little control over inpatient volumes, simply setting a wRVU threshold may not lead to material efficiency improvements. Prior to incorporating wRVU-based production models, hospitals should understand the relevant usefulness of such models, considering the facts and circumstances specific to their respective programs.

![]() FOCUS ON QUALITY

FOCUS ON QUALITY

As set forth above, a number of operating characteristics, metrics, and data are considered when developing appropriate staffing and compensation models for hospital-based service lines. Additionally, the market is slowly beginning to incorporate aspects of quality into the equation. Today’s Hospitalist reports that 85% of hospitalists have compensation plans where at least 5% of total compensation is paid in the form of bonuses and incentives.[5]

The Hospital Value-Based Purchasing (“VBP”) Program adjusts Medicare payments and funding to participating hospitals based on patient care quality, efficiency, safety, and overall patient experience.[6] Specifically, 2% of a participating hospital’s base operating Medicare DRG payments are withheld. The total of such reductions for all participating hospitals are then redistributed back to participating hospitals based on respective VBP performance results, such that a participating hospital can earn back a value-based incentive payment percentage that is less than, equal to, or more than the applicable reduction for the respective year. In short, when assessing a hospital-based service line, the overall efficiency of the service line affects a hospital’s Medicare funding.

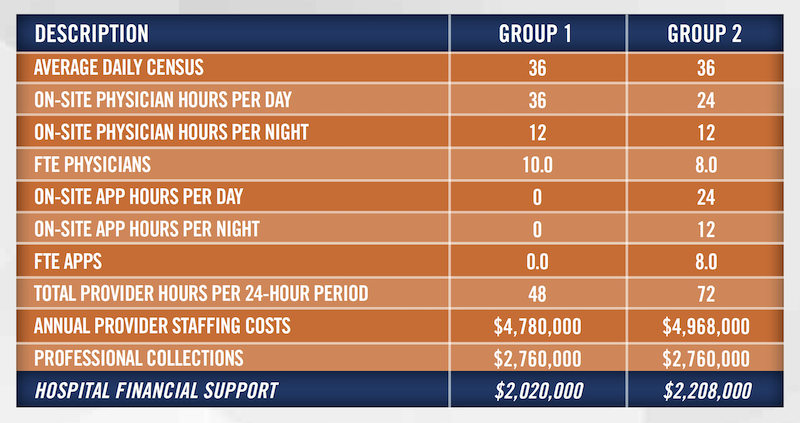

For example, two key quality metrics associated with the VBP program relate to Central-Line-Associated Bloodstream Infections (“CLABSI”) and Catheter-Associated Urinary Tract Infections (“CAUTI”). Since the vast majority of these procedures are performed in the intensive care unit (“ICU”), quality of care and patient outcomes are paramount when assessing the efficiency of this service line. In the hypothetical example below, a hospital is exploring the viability of different staffing models from two independent medical groups for purposes of providing exclusive clinical services coverage of its ICU.

At first glance, Group 1 may appear to be the more cost-efficient option since the hospital’s financial outlay (i.e., the financial support required for Group 1 is $188,000 less than that of Group 2). However, Group 2 may be the better option for the hospital for the long term. While Group 2 may not provide the most cost-effective solution initially, it may provide a better patient-to-provider ratio, which, all things being equal, will likely yield better patient care quality outcomes. In the long run, if Group 2 provides better patient outcomes and resulting improved reimbursement, hospital’s net cost for this service line over the longer term may be lower.

This high-level example does not take into account the experience, skill level, and standard operating procedures of either group. More providers does not necessarily lead to better outcomes. An in-depth review of the underlying operations, financials, and other intangibles of any hospital-based service line is necessary to make a fully informed staffing structure and provider/contractor selection decision.

Regardless, with critical care providers almost directly affecting a hospital’s Medicare funding, it may make sense to compensate for more coverage than to risk losing Medicare funding.

![]() CONCLUSION

CONCLUSION

Hospitals have a number of hospital-based service lines and related provider arrangements and patient care and outcomes to manage. When it comes to assessing the cost efficiency of a hospital-based service line, the overall staffing model and provider compensation plans of the service line should be routinely evaluated and modified as needed to facilitate the best financial and quality outcomes for the hospital, its patients and providers.

With so many factors to consider in an ever-changing landscape, service line optimization can be a daunting task. HealthCare Appraisers is an industry expert when it comes to compensation plan design, hospital-based clinical coverage arrangements, and employment agreement analyses. Contact us to experience how we think differently.

[1] https://www.cms.gov/Regulations-and-Guidance/Legislation/EMTALA

[2] Today’s Hospitalist. www.todayshospitalist.com/trends-patient-volumes-hospitalists. Accessed August 18, 2022

[3] 12 hours – [(45 minutes per average encounter x 10 encounters per shift per hospitalist)/60 minutes per hour = 7.5 patent encounter hours per shift) = 4.5 hours idle hours per shift per hospitalist.

[4] Most inpatients of a hospitalist medicine program will be rounded on and discharged during daytime hours. Since an inpatient can only be billed one evaluation and management code per day, a nocturnist can only generate revenue for an overnight admission. Despite this, the nocturnist will still be responsible for each patient in the unit, and may see and assess each one.

[5] https://www.todayshospitalist.com/salary-survey-results/. Accessed August 18, 2022

[6] https://www.cms.gov/Medicare/Quality-Initiatives-Patient-Assessment-Instruments/Value-Based-Programs/HVBP/Hospital-Value-Based-Purchasing. Accessed August 18, 2022