Authors: Ciara A. Pocino, David Y. Lo, CFA, and Nicholas J. Janiga, ASA

![]() OVERVIEW

OVERVIEW

Evolving healthcare regulations in the United States are incentivizing healthcare providers to deliver more cost-effective care while simultaneously commanding attention to quality of care. Medicare has led the charge with the implementation of payment rules tied directly to quality and outcome through various value-based care programs (e.g., the Merit-Based Incentive Payment System, Alternative Payment Models, etc.[1]).

The growth of value-based care programs has led to an increased interest in collaborative, cost-effective ventures, including, but not limited to, clinically integrated networks (“CINs”) and group practice subsidiary models (“GPSMs”). Such ventures serve as a way to bring hospitals and community physicians together to pursue common goals while allowing physicians to maintain some level of independence through a private practice setting. CINs and GPSMs create an environment to more efficiently manage clinical and financial data, which, in turn, can promote well-informed decisions that lead to improved patient outcomes. In a value-based healthcare environment, demonstrated improvements in patient outcomes often lead to enhanced reimbursement through not only value-based programs, but also contracts structured to incentivize providers to reduce costs and allow them to benefit from the value created through shared savings.

In connection with the formation of CINs and GPSMs, HealthCare Appraisers is routinely engaged to provide transactional advisory services such as reimbursement analyses. As is the case with any transaction in any industry, it is essential for the parties to understand the financial implications of the deal. Due to confidentiality and antitrust concerns, the sharing of certain proprietary information between the parties during the due-diligence process, such as payor contracts, may be prohibited. However, as an independent third party, HealthCare Appraisers is often able to gather the necessary data from both parties to perform a reimbursement analysis on their behalf. With this proprietary information in hand, a reimbursement analysis can help paint a clearer picture of the potential change in reimbursement from forming CINs or GPSMs.

![]()

![]()

![]()

![]()

![]()

![]()

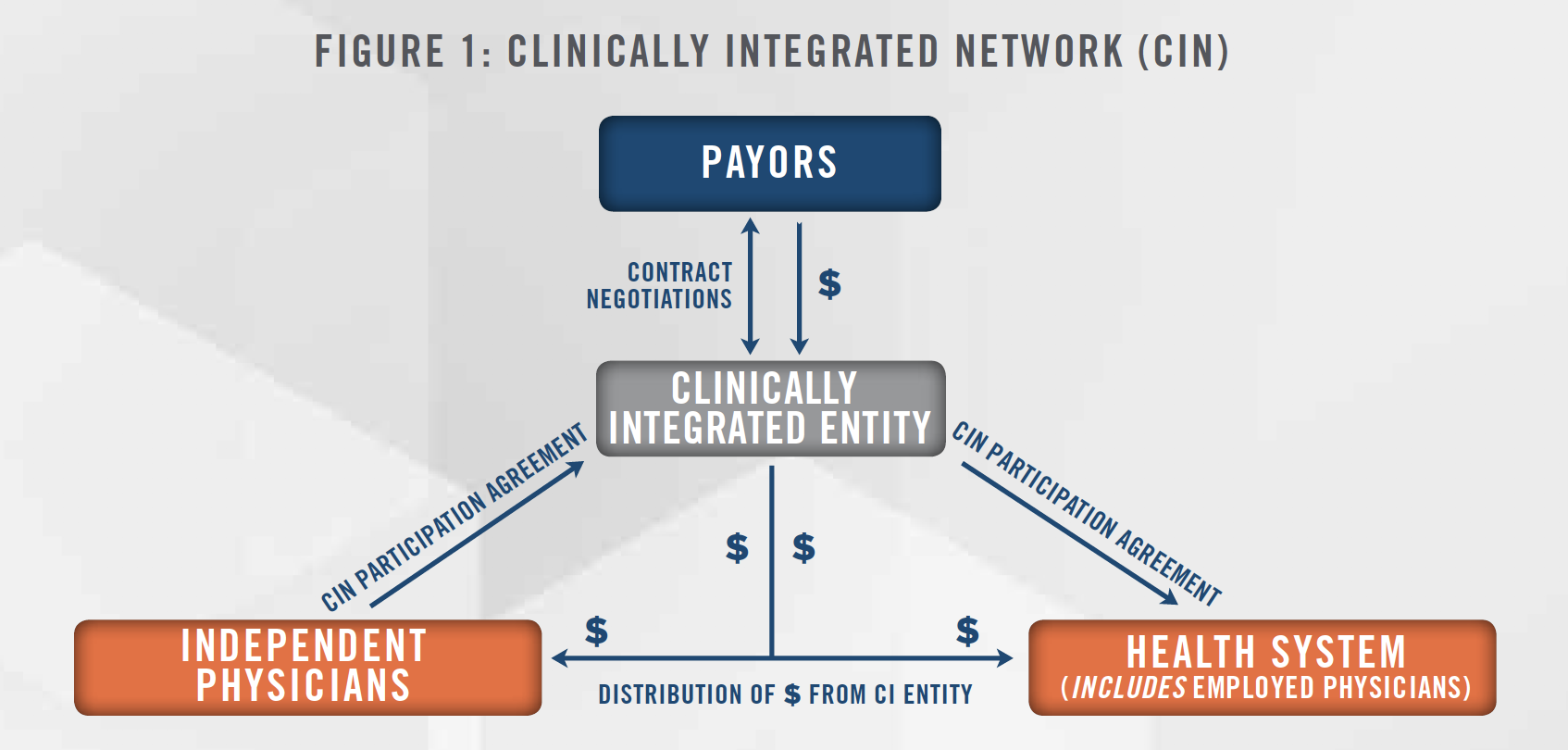

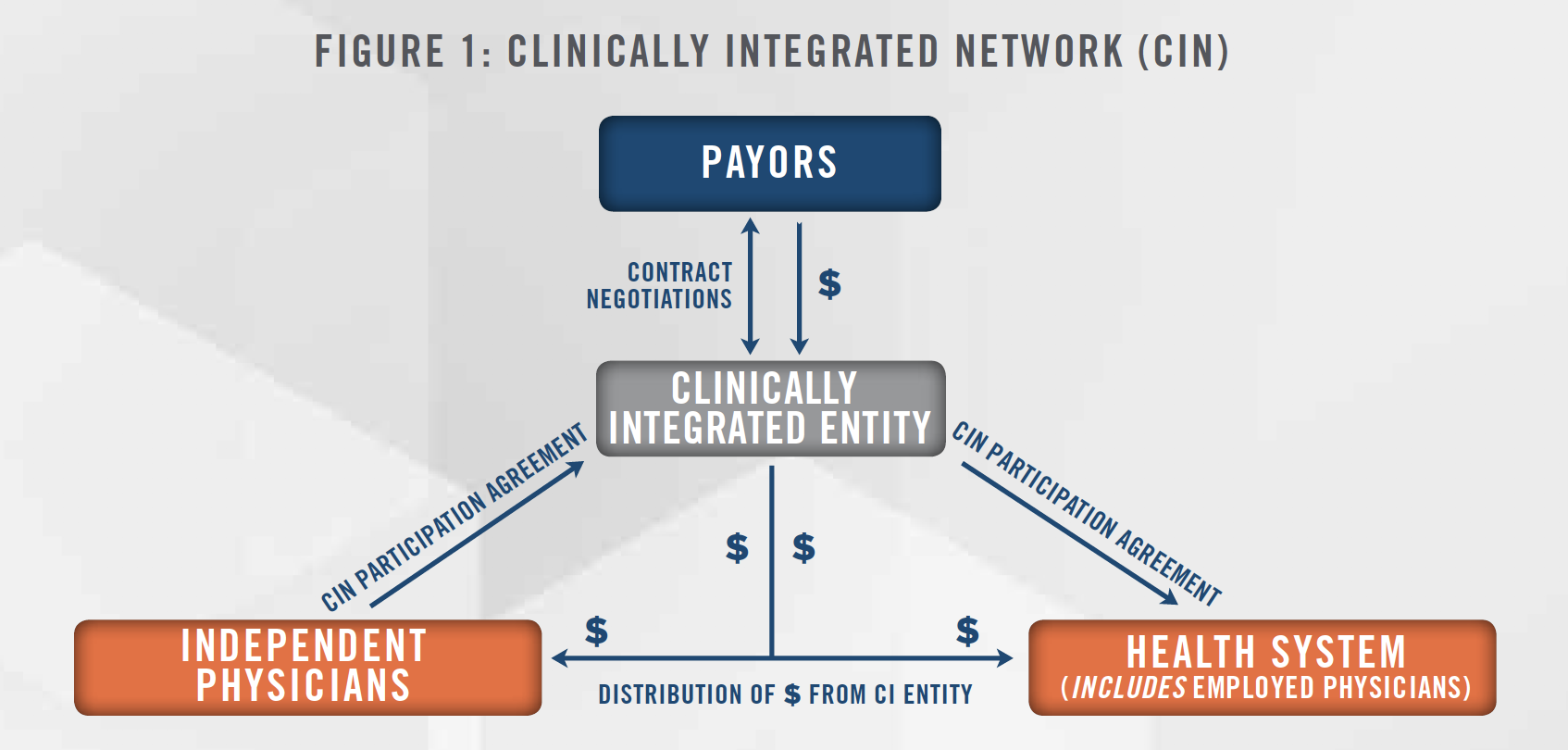

CINs are structured as a collaborative partnership (a “Network”) between a health system and independent physicians with a shared goal of delivering quality care, improved efficiency, and a higher coordination of care, as outlined in Figure 1.

A CIN model provides independent physicians the opportunity to maintain various aspects of independence while simultaneously creating a strategic alliance with larger health systems in their community. Some of the other benefits experienced by independent physicians under the CIN model include heightened coordination, cost savings attributed to increased operational efficiencies, access to the health systems’ technology and administrative support, and the ability for joint-payor contracting negotiated by the Network. With joint-payor contracting at play, alignment with a large community hospital can offer participating physicians with access to more advantageous reimbursement contracts.

Similarly, the Network created by CINs also provides certain advantages to the health system subject to the arrangement. CINs allow large health systems to align with independent community physicians, which is often helpful in garnering support for community healthcare initiatives. Health systems also have a lot to gain or lose when it comes to reimbursement, which is based on the Network’s ability to demonstrate increases in quality of care through data-driven results. Additionally, a CIN structure can assist a health system in avoiding the capital outlay and potential operating losses that may come with acquiring and managing affiliated physician practices.

Under the CIN organizational structure, participating physicians are compensated by the Network based on their practice’s achievement of predetermined quality metrics, which serves as an incentive to provide patients with more efficient, higher quality care at a lower cost.

![]()

![]()

![]()

![]()

![]()

![]()

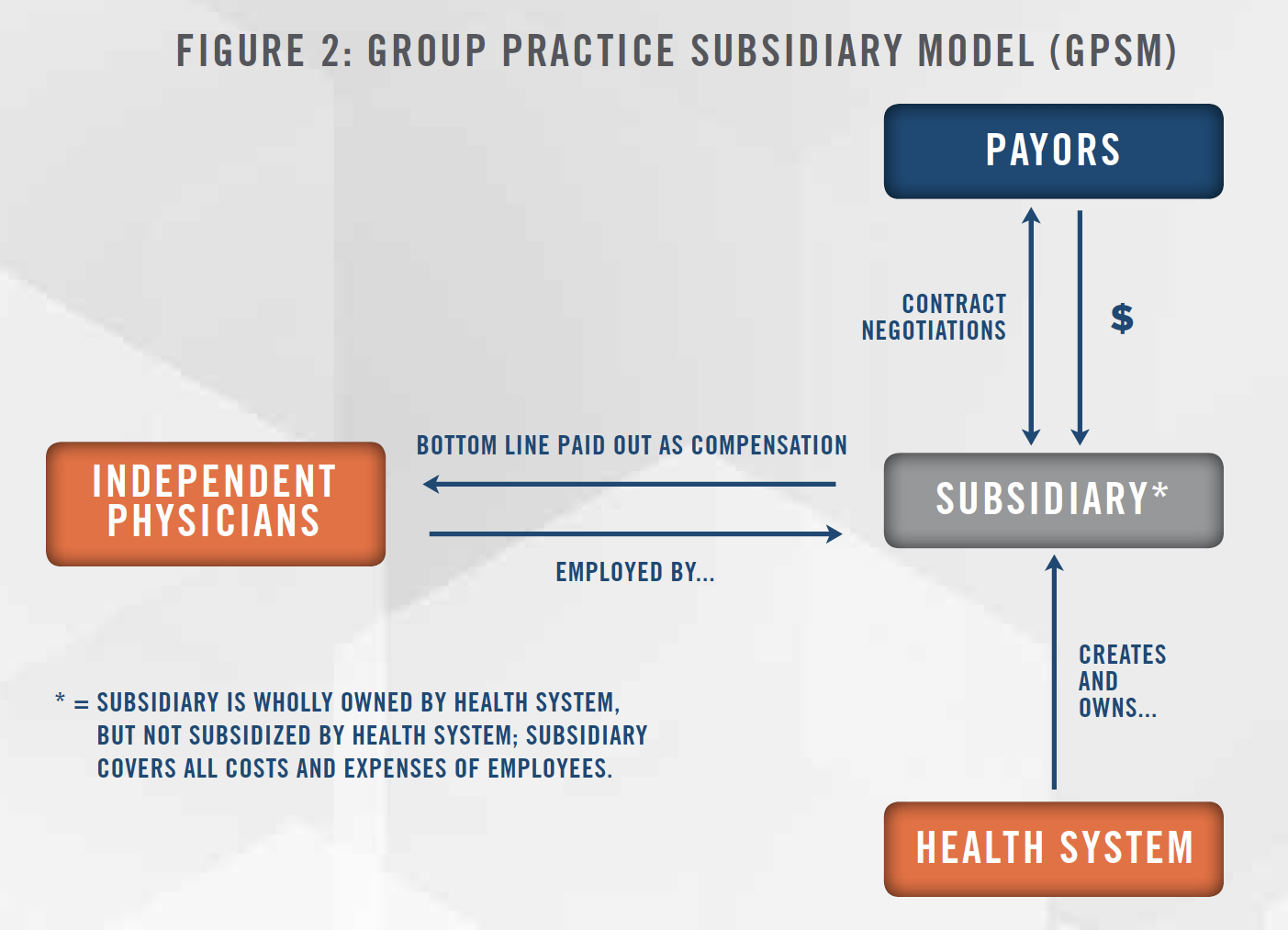

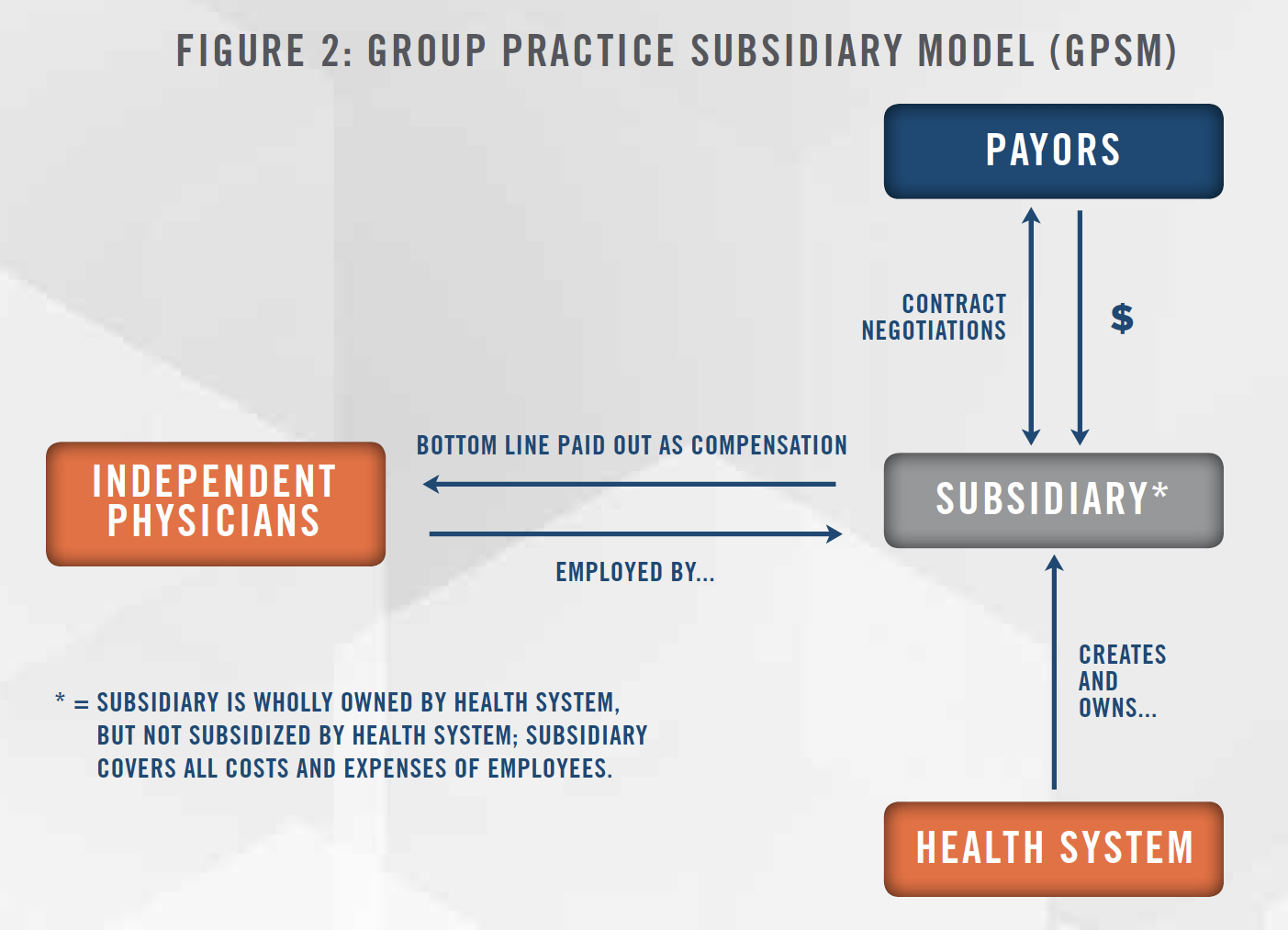

As depicted in Figure 2, under a group practice subsidiary model (i.e., a GPSM) a large health system creates a subsidiary under a new tax identification number. As a wholly-owned entity of the health system, the new entity is subject to a certain level of control by the health system (e.g., the authority to select the subsidiary’s governing board of physicians). At a time when independent physician offices are struggling to compete in a value-based healthcare environment, GPSMs allow practices to partner with their local community health system. While under a GPSM structure, independent physicians are technically employees of the subsidiary, the model still serves as a more autonomous option than direct hospital employment. As with a CIN, the GPSM gives health systems access to a larger network of physicians, which, in turn, supports both parties in their joint goal of better managing community health.

Given that the subsidiary does not subsidize practice operations under a GPSM, independent participating physicians remain economically at risk. However, it is assumed that the combined benefits of retaining control of day-to-day practice operations and access to the health system’s technology limit potential economic downside.

In a GPSM, the subsidiary negotiates reimbursement contracts with payors and directly receives all reimbursement for the professional services rendered by participating physicians. When all is said and done, physicians are compensated based on whatever money is left to be distributed after the entity covers all subsidiary and practice overhead costs (e.g., administrative overhead, employee salaries, etc.). Similar to the CIN model, the distribution of physician compensation can be based on achievement of various predetermined production and/or quality metrics, which creates further incentive for participating physicians to provide patients with a higher level of care.

![]()

![]()

![]()

![]()

![]()

![]()

Through HealthCare Appraisers’ extensive experience conducting reimbursement analyses, we have identified numerous nuances for valuators to be cognizant of, including, but not limited to, the following:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

With the shift to a value-based healthcare environment, alternative payment models are incentivizing large health systems and independent physicians to build strategic partnerships that can help them reach common goals of providing quality services and promoting positive patient outcomes within their community. HealthCare Appraisers is able to provide independent, third-party reimbursement analyses that assist our clients in identifying potential fits for their CIN or GPSM. As the way in which healthcare providers report and bill for their services rendered can vary greatly from provider to provider, HealthCare Appraisers’ vast knowledge and experience in identifying healthcare billing nuances allows us to accurately identify and appropriately account for the circumstances of a subject practice when completing a reimbursement analysis.

[1] Centers for Medicare & Medicaid Services, Valued-Based Programs, last accessed August 10, 2020 from: https://www.cms.gov/Medicare/Quality-Initiatives-Patient-Assessment-Instruments/Value-Based-Programs/Value-Based-Programs