In June of 2022, Dan Levin and Nick Janiga attended the Home Care Innovation and Investment Conference in Chicago where we met with and heard from operators and investors in the home care industry. Home care continues to be an area of interest for healthcare investors focused on consolidating fragmented industries and implementing value-based care models. This article summarizes key points from conversations we had and presentations that took place at the conference.

![]() INDUSTRY AND TRANSACTIONS

INDUSTRY AND TRANSACTIONS

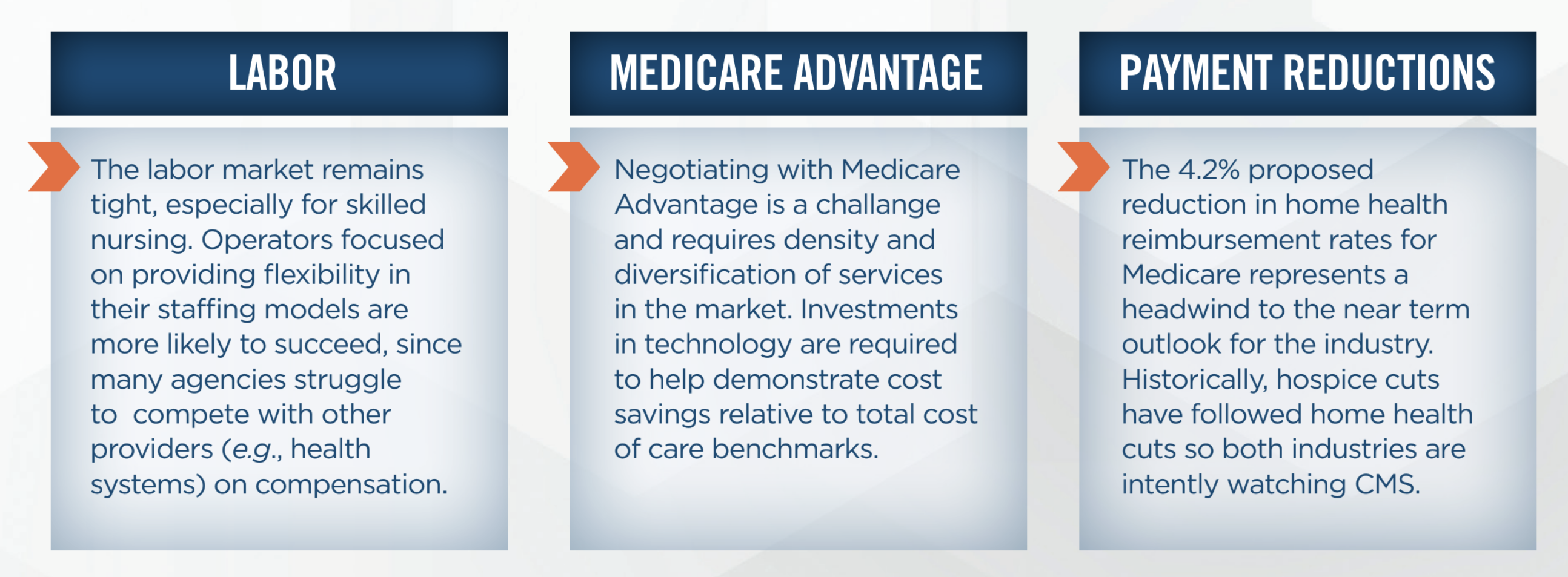

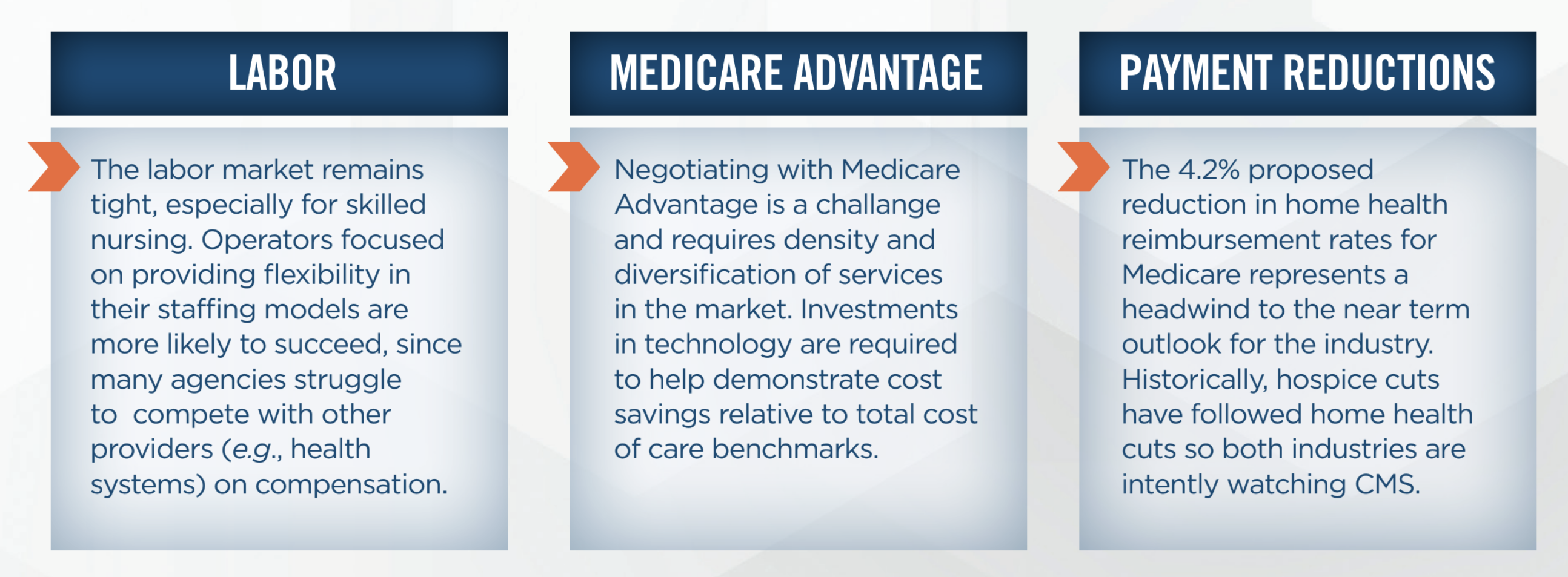

The home care industry is poised for growth through delivery of higher acuity services and greater utilization of value-based care arrangements, which led to many large transactions in recent years. In the first half of 2022, transaction activity moderated relative to the prior year, but industry participants expect activity to pick up in the second half of the year. With many large platforms transacting in recent years, a higher percentage of deal volume going forward is likely to be comprised of smaller tuck-in transactions. One possible headwind to M&A activity in the coming months is the recently announced proposed rule from CMS which projected a 4.2 percent cut in Medicare reimbursement to home health agencies. Buyers may hold off on transactions until the market gets more clarity regarding the CMS final rule later in the year, with many expecting the cut to ultimately be less than the projected 4.2 percent.

Despite this headwind, as well as those from higher interest rates and a moderate recession, many industry participants expect transaction activity to ramp up throughout the year. Some of the negative impacts from higher interest rates and a moderate recession have already been priced into the market and are unlikely to have a big impact moving forward unless conditions deteriorate significantly. Operators also discussed the possibility that a recession could ease some of the staffing difficulties plaguing the industry due to improved employee retention. More broadly, while staffing issues remain critical for many providers, some believe the worst is behind them and the pressures appear to be easing.

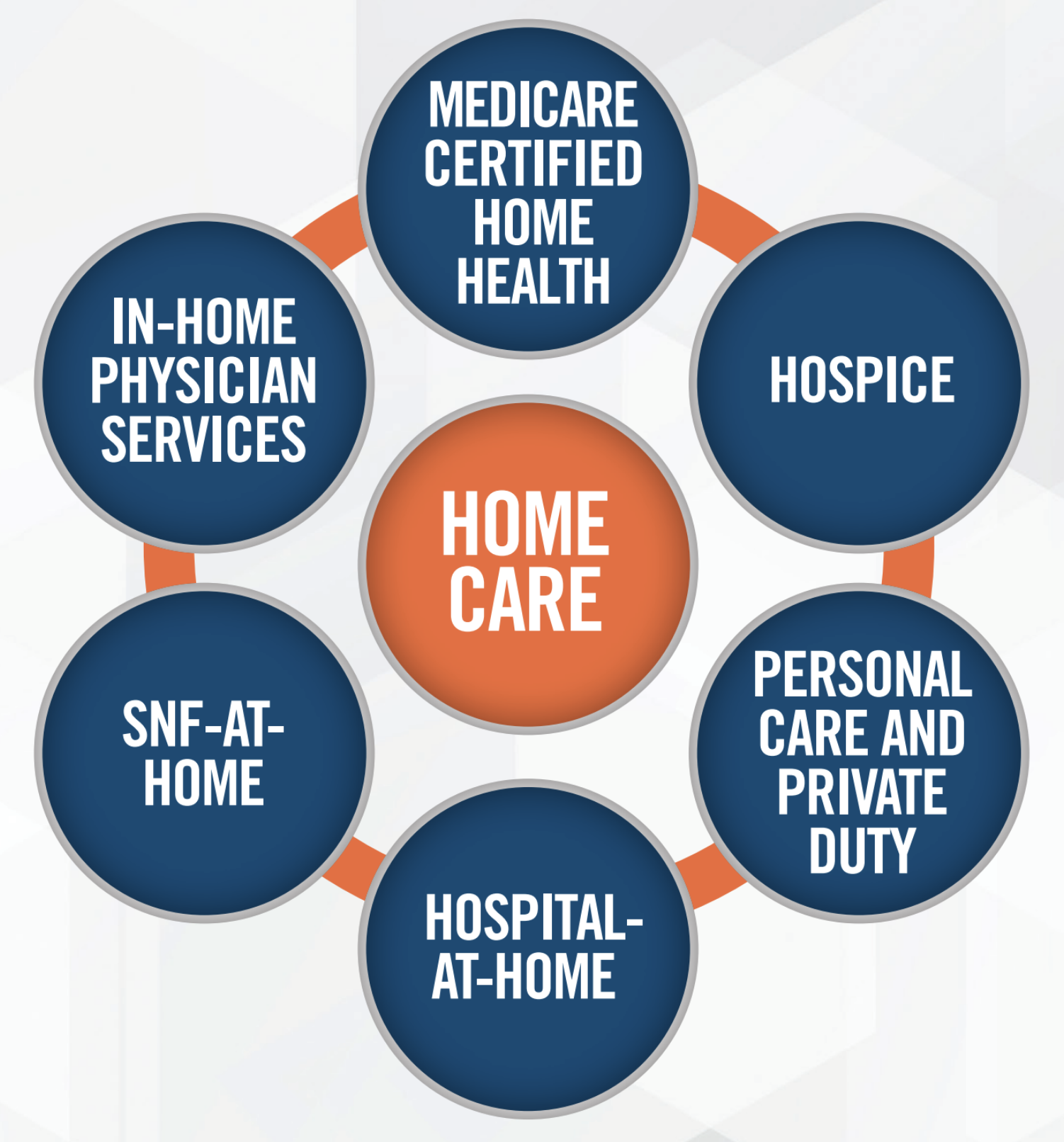

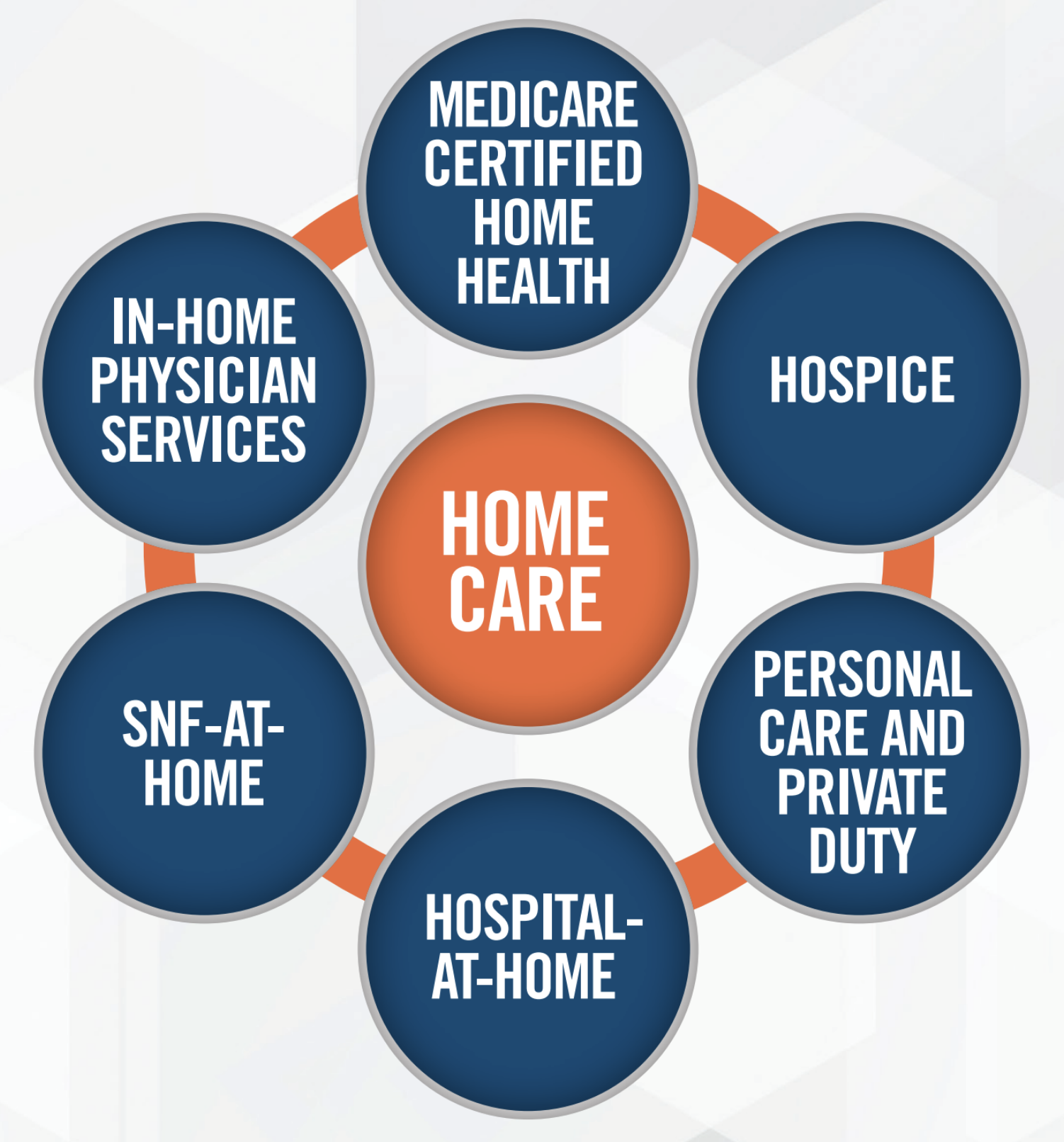

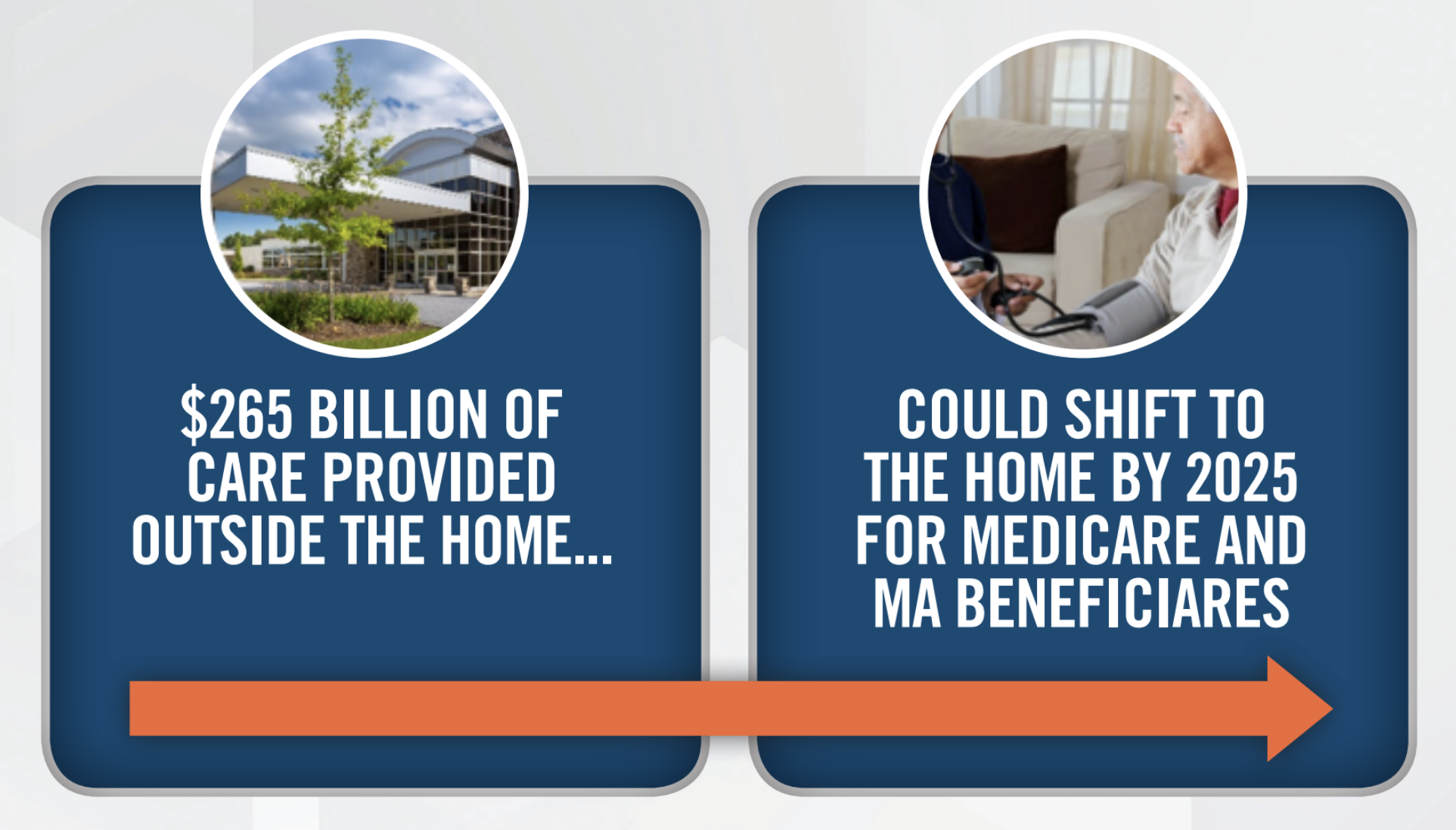

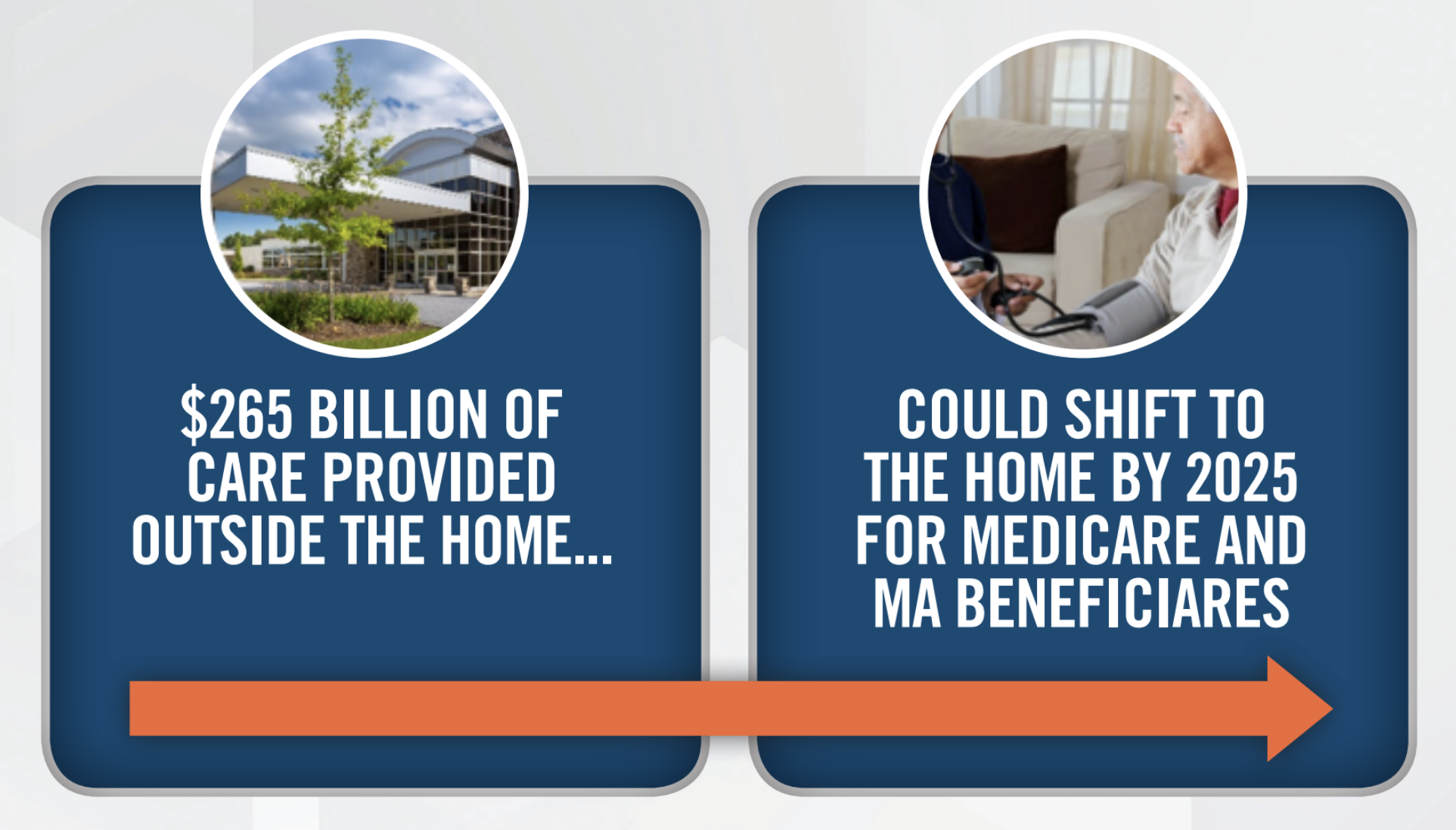

One of the key tailwinds supporting the home care industry is the volume of care currently provided in ambulatory and inpatient settings that is expected to move to the home in the coming years. A recent McKinsey study suggests that $265 billion of care currently provided in other settings could move to the home by 2025.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Virtually every provider and investor we spoke with believes there is an important place for home care in value based care networks. Many expect primary care providers who take risk to begin to focus more heavily on home health as a way to increase contact with patients and drive better outcomes. Hospital-at-home and SNF-at-home models provide examples of home care providers partnering with facilities to enter into risk arrangements. We connected with ACO investors and operators focused on making home care a key component of their care delivery networks. Home care operators discussed the importance of demonstrating through data to other providers and Medicare Advantage plans their ability to reduce costs and improve outcomes. Each of the home care providers discussed in this article has a potential role to play in value-based care, whether its lowering admissions to institutions through hospital-at-home and SNF-at-home joint ventures, or more involvement at the primary care level through the use of personal care and home nursing. Operators are confident that home care will play a larger and more critical role in the future as the healthcare system shifts more toward Medicare Advantage and value-based care arrangements.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Major areas of focus for the operators we connected with are presented in the following infographic.

Overall, the expectation among industry participants is that home health activity will pick up in the second half of 2022, partially driven by the market becoming more comfortable with PDGM. Many operators we have communicated with in the past, as well as those we connected with at the conference, have benefited from PDGM as their focus on higher acuity and more complex patients is better reflected in the reimbursement they receive. Participants noted that hospice reimbursement is typically a few years behind home health, suggesting that the 4.2 percent cut to home health in the proposed rule could foreshadow similar action on hospice reimbursement in the future. Hospice transaction volumes were down in the first half of 2022 but are expected to stabilize or increase in the second half of the year. From a valuation standpoint, the market for hospice platform transactions is in the range of 10x to 12x EBITDA, down from 15x EBITDA in recent years.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

We connected with and attended presentations from SNF-at-home providers with models focused on orthopedics, chronic care, and rural markets. Although every SNF-at-home model is unique, working with facilities and providers that are in risk-based arrangements, and being flexible with payors with respect to the manner in which risk is taken and shared amongst the parties are key components to many successful SNF-at home models. The types of risk models include upside/downside risk (i.e., shared savings and losses), as well as percent of DRG models. On the regulatory front, the Choose Home Act could provide a tailwind to the industry, but the legislation is awaiting a Congressional Budget Office score and rapid movement is unlikely. We expect continued growth of this model and further investment as more data proves its viability and benefits to the healthcare system.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

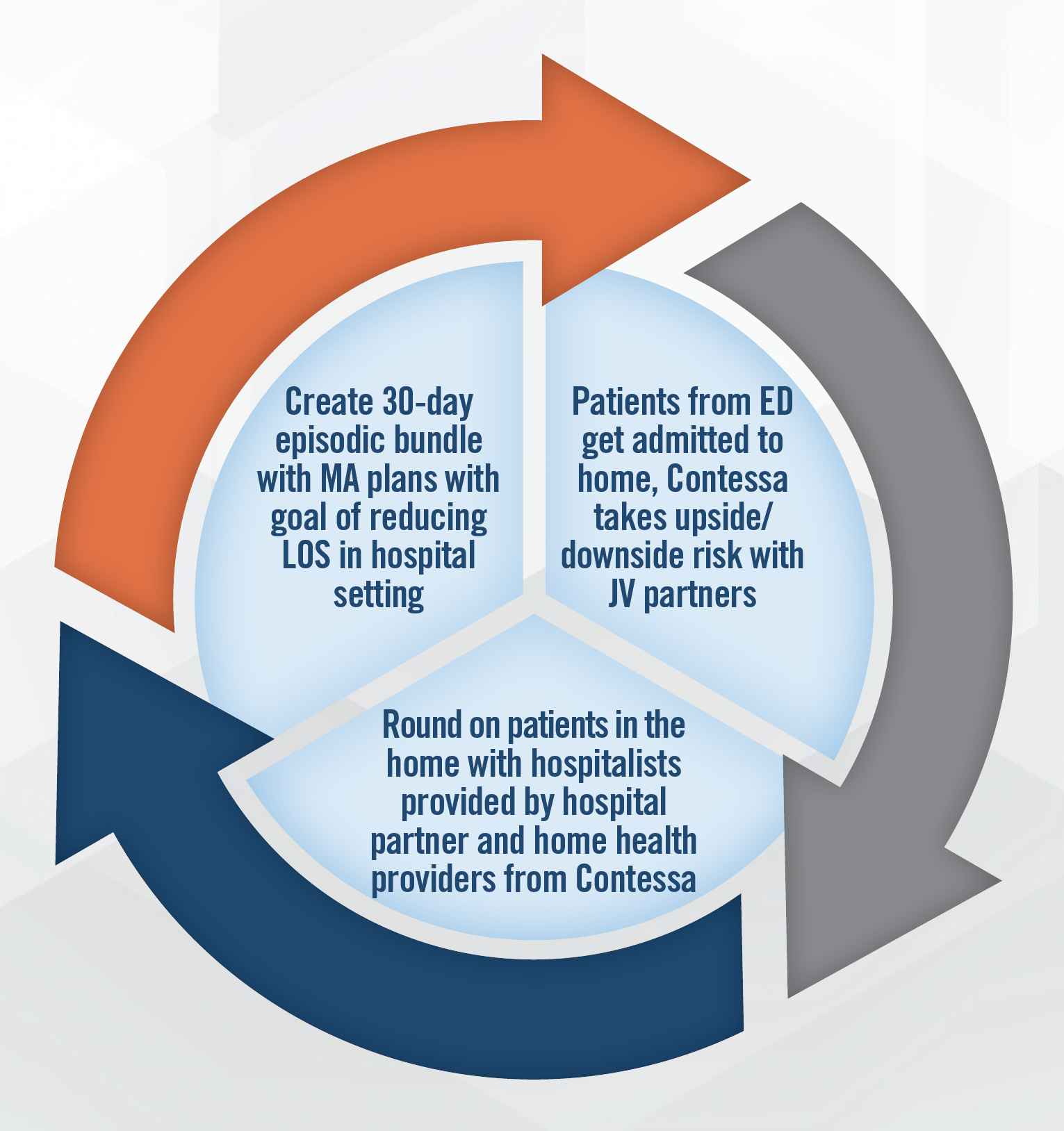

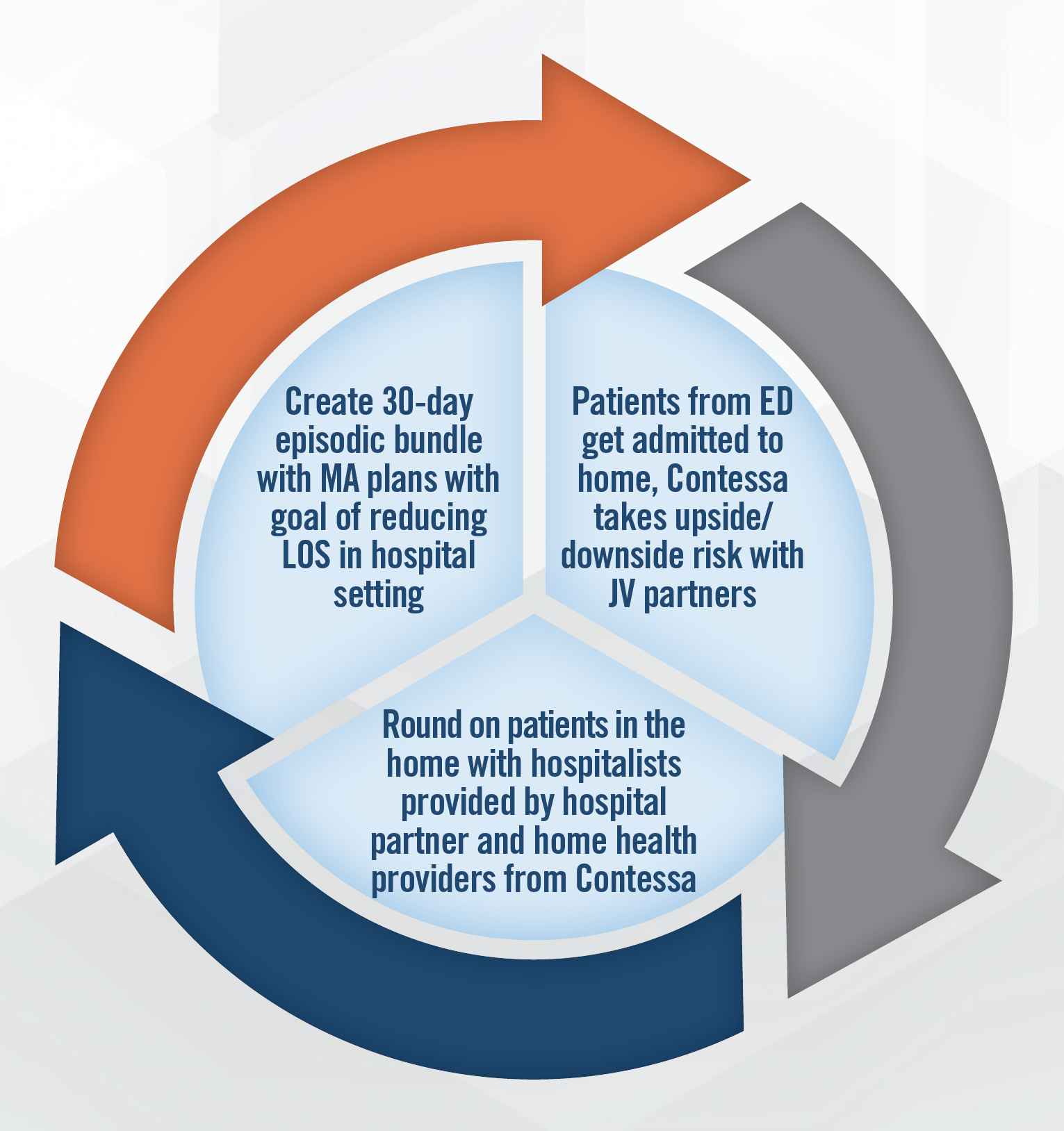

Hospital-at-home continues to be an area of high interest for the industry and investors as larger operators move more heavily into the sector. The growth and success of Contessa’s (acquired by Amedisys in 2021) joint venture model, and recent improvements in technology, point toward continued expansion of these services, particularly in connection with value-based care arrangements. In addition to the joint venture model, there are hospital-at home companies who enable hospitals and home care providers to implement hospital-at-home programs through use of licensed technology and other services. The lack of long-term clarity on the regulatory environment remains a key risk for operators in the sector, although a proposed extension of the CMS waiver could provide a tailwind. Another risk is the lack of the reimbursement clarity from CMS beyond the waiver period. The ability to find nurses to care for patients in these arrangements remains a challenge, and operators indicate they typically recruit nurses with hospital-based work experience due to the requirements of the role. The need for a rapid response network (including 30-minute call response time) requires providers to place a premium on nursing. Utilizing virtual visits has been and will continue to be critical to growth of hospital-at home arrangements, as is the use of social workers. Thus far, more than 100 hospital DRGs are covered by Medicare Advantage plans for hospital-at-home. An example of a Contessa (acquired by Amedisys in August of 2021 for 3.9x LTM revenue) joint venture model is presented in the following infographic.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Operators and investors increasingly recognize the important role that personal care providers play in the home care landscape. Personal care providers have access to the patient in the home on a far more frequent basis and can serve as the “glue” between other home care visits. Investors and operators expect a larger role for personal care in the healthcare ecosystem, particularly as we shift from a “sick care” system to one more focused on population health, social determinants of health, and preventive medicine. 2021 was a record year for personal care transaction volume, and participants expect this pace to continue moving forward.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

We met with and attended presentations from some of the most innovative in-home physician services companies in the sector, including those focused on advanced primary care. Many of these providers incorporate APPs, home health, and personal care to provide a high touch care model that manages chronic disease and reduces hospitalizations. These groups work with Medicare Advantage, Medicaid, and other value-focused payors. In some models, the provider is sub-capitated beneath the MA plan, while other models involve shared savings/losses or other risk arrangements. Each of the providers we spoke to and heard from emphasized the need to bring as much care as possible under the primary care umbrella and refer patients to specialized settings as needed.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

While transaction activity slowed down in the first half of 2022, the outlook for home care remains extremely favorable. Home care providers and investors are optimistic about the long-term future of the industry despite near term headwinds from the labor market, declining reimbursement, rising interest rates, and a moderate economic slowdown. We continue to see interest from clients that are active in the industry, and believe home care will continue to grow in size and importance within the healthcare industry.