The healthcare industry is an economic sector that is constantly facing unique challenges. The industry is highly regulated with rules that frequently shift in a manner that diverts clinical resources away from patient care and often place downward pressure on reimbursement.[1] Economic forces also have a significant impact within the industry. An aging population will bring about higher demand for healthcare services in the coming years which will be coupled with a declining labor force. Therefore, innovative solutions will be required to meet increased demand with fewer medical professionals.[2] Rising labor costs and other inflationary pressures also threaten to lower profitability in the near future. As companies in the industry attempt to navigate this challenging environment, they often find that it is difficult to succeed alone. A common strategy implemented to overcome these challenges involves the formation of joint ventures. This strategy allows two or more companies to collaborate to achieve common goals that would be more difficult for each entity to execute on their own.

![]() WHY DO HEALTHCARE COMPANIES CREATE JOINT VENTURES?

WHY DO HEALTHCARE COMPANIES CREATE JOINT VENTURES?

Oftentimes, complete business combinations or acquisitions do not create the most ideal outcomes. Some segments of each business may complement each other very well while others could create unnecessary and overly burdensome complications. Instead of combining whole businesses, joint ventures allow portions of two businesses to be combined and jointly operated much more effectively. For example, one healthcare company’s established service line could be combined with the underutilized assets of another healthcare business more efficiently than if the businesses spent the time and effort building out the missing pieces on their own.

![]() WHAT ARE THE BENEFITS OF JOINT VENTURES IN THE HEALTHCARE INDUSTRY?

WHAT ARE THE BENEFITS OF JOINT VENTURES IN THE HEALTHCARE INDUSTRY?

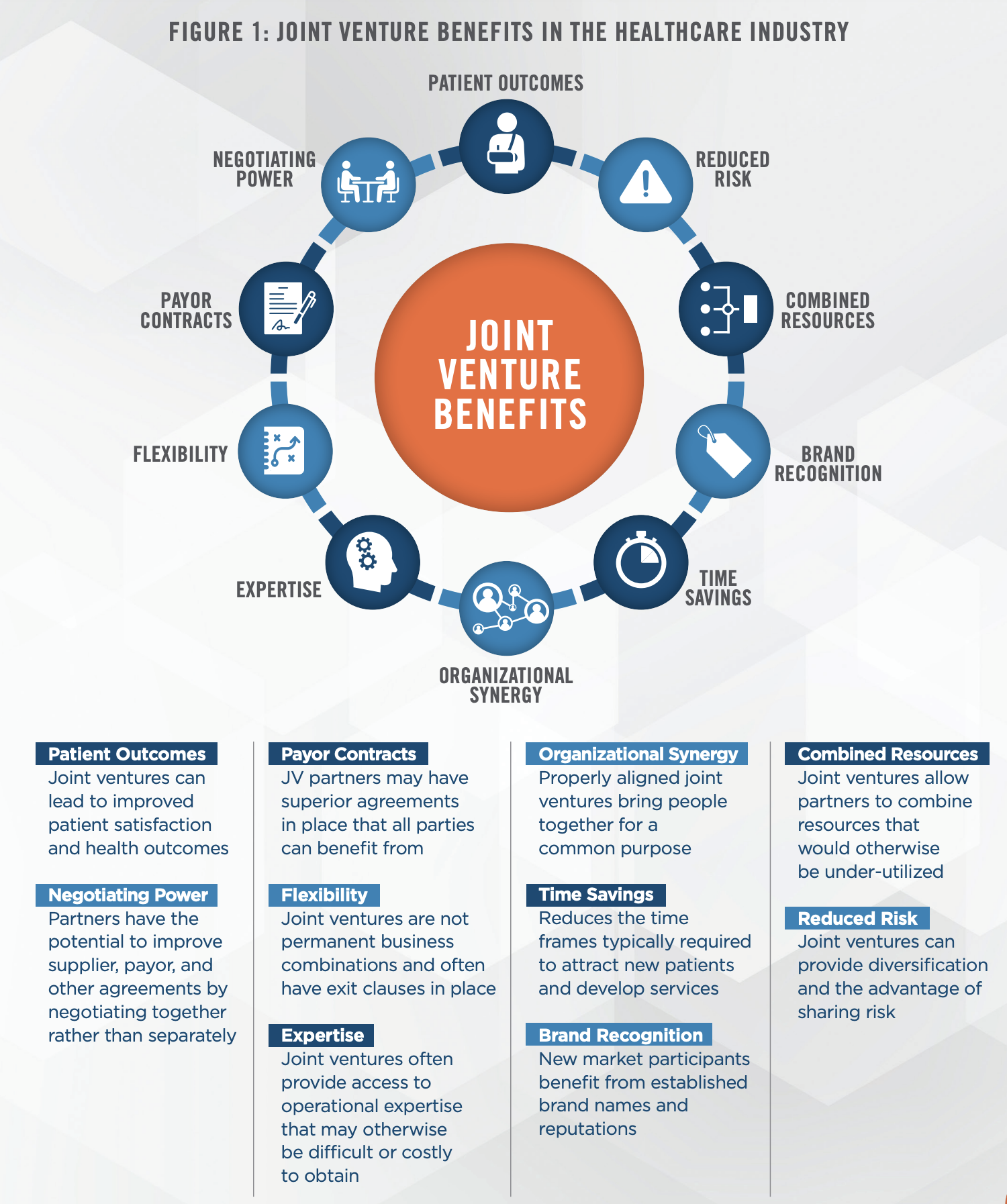

Joint ventures offer many benefits that can either be difficult to achieve or require long lead times if the companies continued to operate on their own. The Financial Accounting Standards Board (FASB) identifies a number of benefits that joint ventures offer in the following excerpt found within their definition of a joint venture:

The purpose of a corporate joint venture frequently is to share risks and rewards in developing a new market, product or technology; to combine complementary technological knowledge; or to pool resources in developing production or other facilities.[3]

While the FASB definition identifies a few of the general benefits, there are many other advantages that companies consider. Figure 1 outlines select benefits that are often the focal point of joint venture agreements in the healthcare industry.

Joint venture arrangements have the potential to offer participants the opportunity to reduce their risk while simultaneously realizing an increase in economic benefits. We have observed that healthcare companies can enter into new markets more effectively by setting up a joint venture with an established entity in the market, rather than entering unaided. When a new market participant enters into a joint venture with an established health system or other similarly situated entity, both parties have the potential to see greater benefits from working together. The new entrant typically benefits from the use of the established firm’s existing operations or assets in place, such as a tradename. The established business generally benefits from the new market participant’s value proposition such as high patient satisfaction scores, superior health outcomes, and managerial expertise.

In other situations, there are resources in the market that are either underutilized, or that perform inefficiently when operated separately from other complimentary resources. For example, hospitals are capital intensive entities that may need to acquire and maintain costly assets or services, even if it has a low utilization rate. Conversely, a local practice in the market may have demand for services that require the use of these assets or services, but the practice may not have the resources to acquire the assets and provide the services on their own, or they may not have sufficient demand to justify the investment. By entering into a joint venture, the hospital can increase its return on assets while the local practice can benefit by serving more patients. Alternatively, companies can enter into block lease arrangements, which enables two different entities to effectively collaborate and leverage a single asset base and service location rather than directly and inefficiently competing in the market.

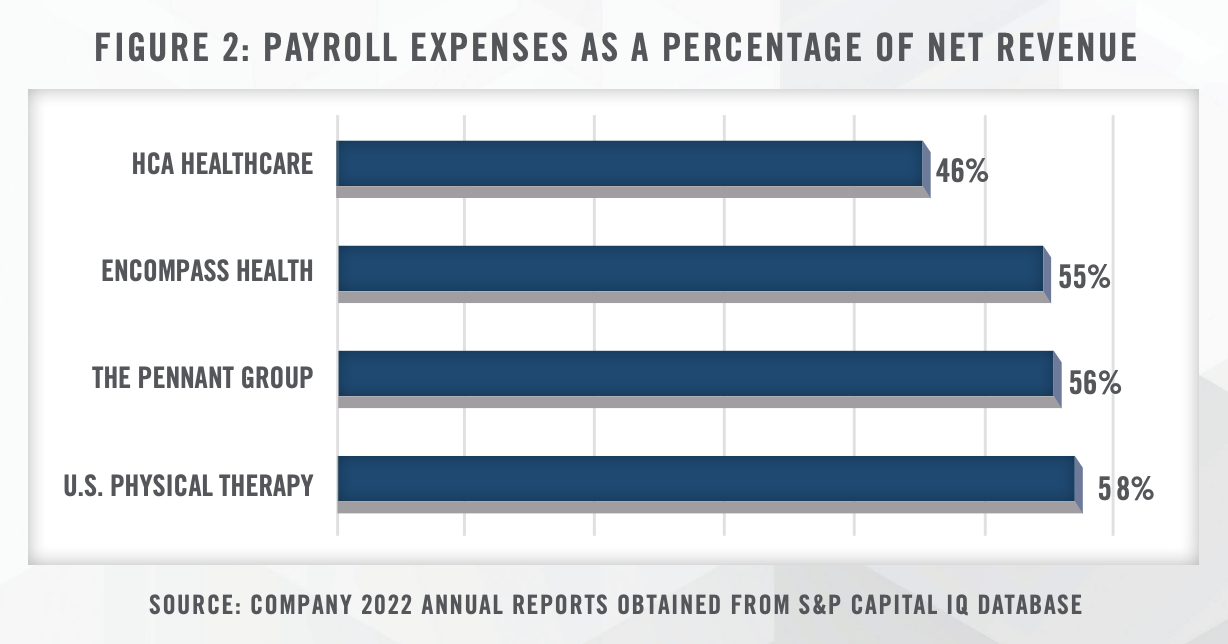

In addition to combining resources, joint ventures can allow companies to pool expertise in a way that would take significant investment in terms of both time and funding. Human capital represents a large portion of spending in the healthcare industry as shown in Figure 2, and the ability to combine this resource can have sigificant results. For example, physician groups often partner with management services organinzations which reduce the administrative burden on providers. This has the potential to improve health outcomes, and both patient and physician satisfaction, as providers are able to better focus on their practice.

The benefit of partnering with organizations with administrative expertise extends to most joint venture situations, especially if one partner operates a service line that is unfamiliar to the other. The operational requirements, financial barriers, licenses and certificates of need, regulations, and many other considerations could take a significant amount of time to understand and integrate if an organization were to expand from the ground up.

Joint ventures also allow for greater flexibility than traditional business combinations since nearly all joint venture contracts have exit agreements in place.[4] If the joint venture does not perform to either party’s minimum expectations, either entity may have the option to exit. While there may be a variety of costs associated with the exit, the costs of leaving a joint venture often are less than the costs of more traditional business combination failures.

![]() JOINT VENTURE STRUCTURES AND VALUATION IMPLICATIONS IN THE HEALTHCARE INDUSTRY

JOINT VENTURE STRUCTURES AND VALUATION IMPLICATIONS IN THE HEALTHCARE INDUSTRY

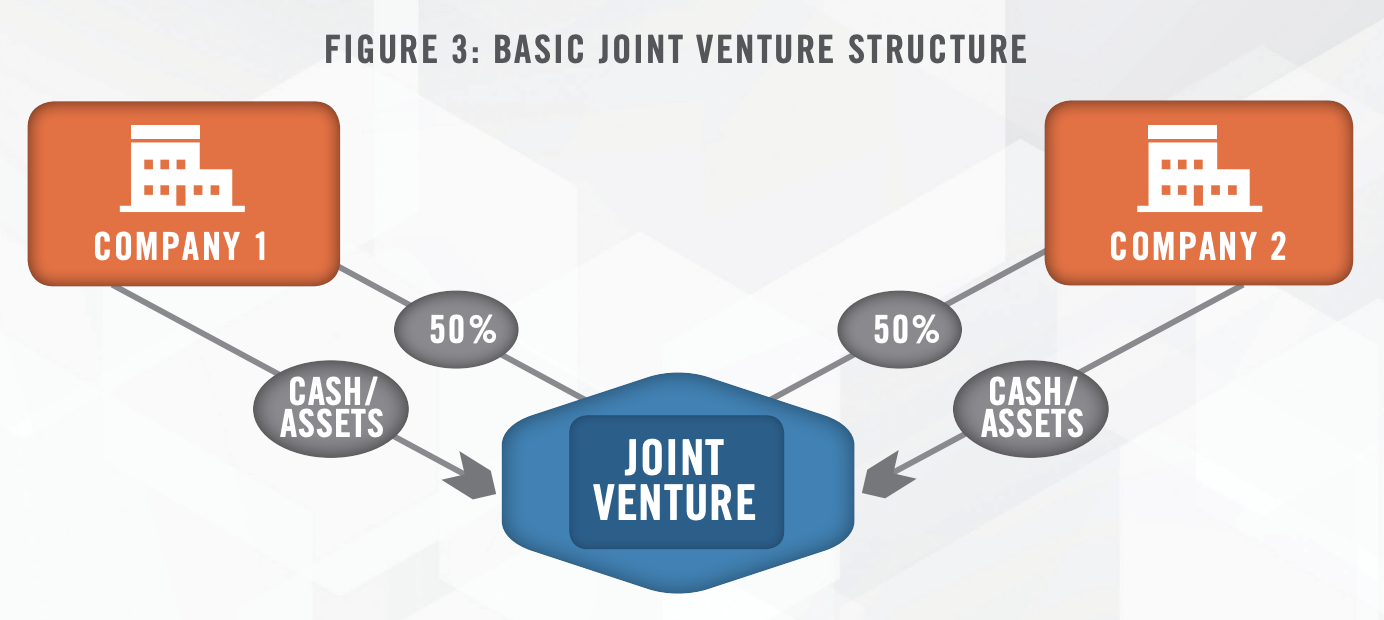

A joint venture is a separate legal entity owned and operated by two or more contributing entities and can take on many legal structures.[5] Figure 3 demonstrates an example of the basic structure of a joint venture formed by two companies.

The structure of the joint venture has the potential to impact the valuation of each entity’s contribution, and these structures are frequently more complicated than the example displayed in Figure 3. There are situations where one entity contributes less than fifty percent of value of the joint venture for a wide variety of reasons. For example, Company 1 may contribute significantly more assets of value to the joint venture than Company 2, and rather than contribute cash to bring their contribution value up to 50 percent, Company 2 may instead hold a noncontrolling position in the joint venture.

![]() WHICH HEALTHCARE COMPANIES ENGAGE IN JOINT VENTURES?

WHICH HEALTHCARE COMPANIES ENGAGE IN JOINT VENTURES?

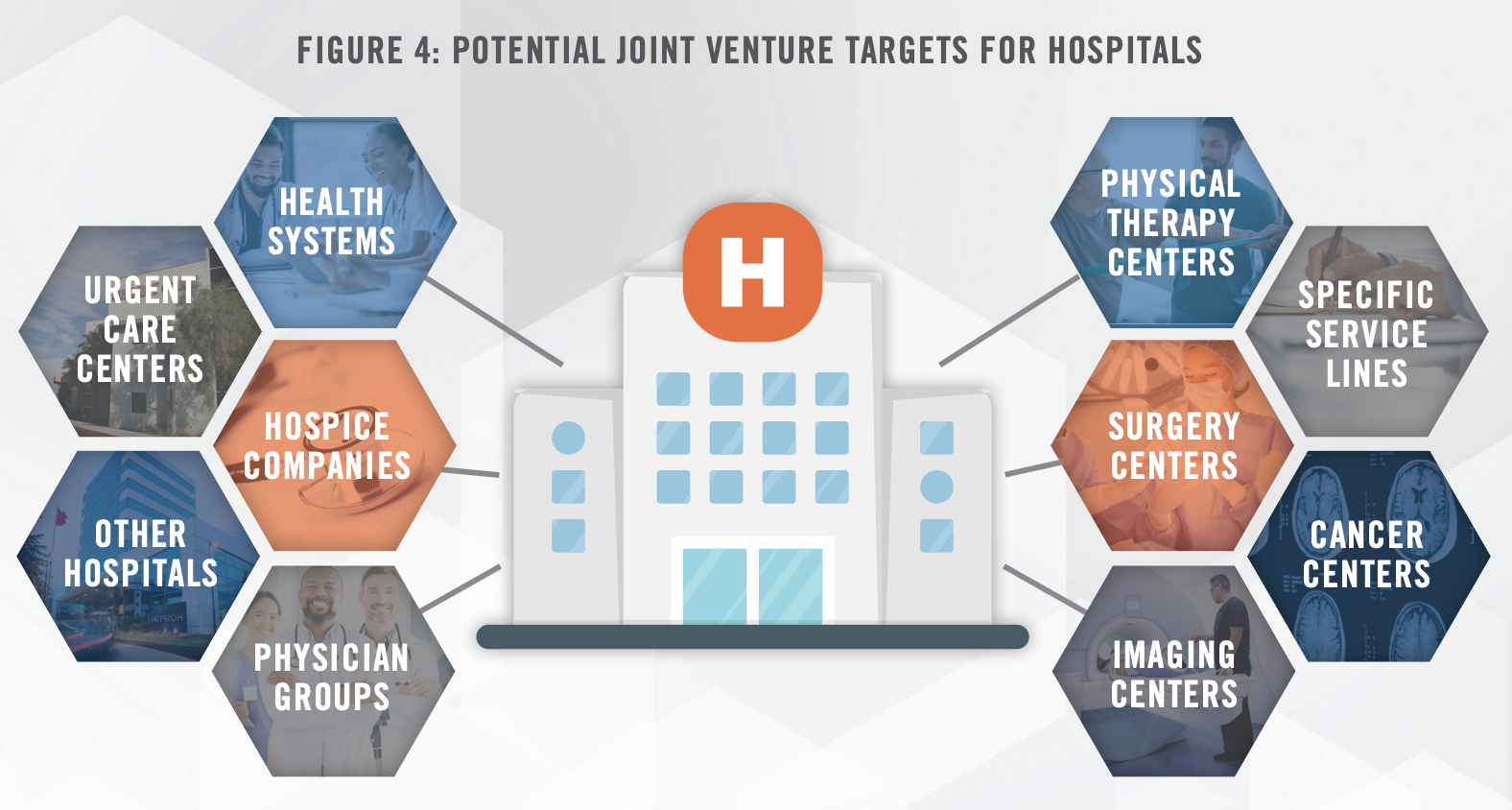

A considerable number of the joint ventures we observe involve hospitals and health systems due to a variety of market and regulatory pressures that incentivize health systems to seek out partnerships within the industry. These entities typically have tight operating margins due to the competitive nature of the industry, restrictions placed upon tax-exempt organizations under the tax code, and requirements to provide emergency services regardless of ability to pay under the Emergency Medical Treatment & Labor Act (EMTALA). By entering into joint ventures, hospitals and health systems can benefit financially and better fulfill their mission. Figure 4 outlines some of the common entities that hospitals partner with.

While hospitals and health systems often have the most incentive to enter into joint ventures and similar agreements with other healthcare providers, there are many other cases and situations where joint ventures can be advantageous. Other examples include:

![]() JOINT VENTURE EXAMPLES

JOINT VENTURE EXAMPLES

Imaging Center – A for-profit operator of diagnostic imaging centers, and a hospital, entered into a joint venture arrangement to address an industry-wide trend of payors actively redirecting patient volume from inpatient to outpatient settings. The for-profit operator contributed its existing freestanding imaging center operating business, which included imaging equipment, and its expertise in operating an efficient outpatient center. The hospital contributed its tradename, and its existing imaging business service line. The fair market value of these assets served to determine each entity’s respective ownership interest in the newly formed joint venture.

This example underscores an astute strategy that effectively addresses the industry trend of downward pressure on healthcare spending and payors redirecting patients to independent diagnostic testing facilities (IDTFs) and other outpatient healthcare providers and facilities. Emphasizing partnerships in the medical imaging sector, RadNet’s VP & CFO stated on a 2023 investor presentation: “More forwardthinking hospitals are looking for a strategy that gives a long-term viability in diagnostic imaging and one of those strategies is to partner with an outpatient player [that already have] assets or has the expertise to run outpatient centers efficiently.”

Physical Therapy – A for-profit operator of physical therapy centers and a non-profit health system entered into an arrangement to collaborate on providing physical therapy services in a shared service area. Each entity had several existing physical therapy centers that were contributed to the joint venture, which helped determine the initial ownership interest split of the two partners.

As the partners desired to split ownership such that each partner held a 50 percent ownership interest, a cash contribution occurred to supplement the entity whose operating business contribution was valued at an amount less than that of the other partner. The for-profit entity planned to provide management services to the joint venture on a go-forward basis as well. The joint venture planned to continue to open de novo locations in the future, leveraging each respective operating partners’ valued-added strengths to make the entity stronger, and more profitable, than the entities were when the parties competed. The combined portfolio of locations allowed for greater operating flexibility as well, such as the ability to flex certain staff members at different locations.

Joint Operating Agreement/Virtual Merger – Two health systems entered into an agreement to enhance musculoskeletal services in their community. By entering into a joint operating agreement, each party retained legal ownership of their respective service line assets, while allowing them to share financial risk as well as financial capital. This aligned their respective organizations to improve the quality of care in their community through increased efficiency, shared technology, and clinical integration between the parties.

Through the joint operating agreement, the parties shared in the profit and loss of the combined musculoskeletal joint operating company. When setting up the joint operating agreement, the parties determined the relative contribution of each party in order to determine the split of profit (or loss) shared by each entity going forward.

Behavioral Health Hospital – A for-profit hospital operator and a non-profit health system entered into a joint venture arrangement to improve behavioral healthcare in a community. The non-profit health system contributed its existing inpatient behavioral health service line operations to the joint venture, including intangible assets associated with the service line, such as its tradename, certificate of need, and other licensures. Vacant land was also contributed to the joint venture by the non-profit system. The appraised value of these tangible and intangible assets helped determine the health system’s initial ownership interest in the joint venture. The contribution of the for-profit health system consisted primarily of cash to fund the building of a new inpatient facility, purchase of new equipment, and initial net working capital. However, the for-profit partner also planned to contribute valuable management services to the joint venture post-transaction.

This example highlights a success story in which each party to the joint venture contributed various tangible assets, intangible assets, cash consideration, and services to improve healthcare in a community. This outcome would have been financially and operationally more difficult without a partner. Highlighting joint ventures in the behavioral health sector, Universal Health Services’ CFO indicated on a 2022 earnings call: “We think that the opportunity to joint venture with some acute care hospitals and probably even more importantly, some acute care hospital systems to offer behavioral services is a significant opportunity over the next 5 or 7 years.” For more in-depth information on Behavioral Health, read: Behavioral Healthcare: Public Company Commentary, Outlook, and Trends – Summer 2023

![]() POTENTIAL REGULATORY ISSUES TO CONSIDER

POTENTIAL REGULATORY ISSUES TO CONSIDER

While there are several benefits associated with setting up a joint venture arrangement, there are also regulatory issues to consider. Many of these are considered regularly throughout the normal course of business in the healthcare industry; however, joint venture agreements have the potential to add a layer of complexity.

Tax Implications

Many hospitals and health systems that have obtained tax-exempt status operate on tight margins or even budget deficits and have limited resources to expand and take advantage of growth opportunities. Historically, tax exempt bonds have been among the most attractive sources of financing with the lowest cost; however, these bonds come with a variety of restrictions. Joint ventures provide an alternative source of financing that not only provide capital but can more directly lead to growth and superior patient outcomes. Therefore, entering into a joint venture with a for-profit entity is an attractive strategy to fill in budgetary gaps while furthering the organization’s mission.

Referrals

Many of the joint ventures in the healthcare industry are created between referral sources and competitors. In these situations, it is essential to ensure and maintain compliance with the Physician Self-Referral Law (aka Stark Law) and the Anti-Kickback Statute. The Office of the Inspector General summarizes these laws as outlined herein.[6]

Physician Self-Referral Law

Prohibits physicians from referring patients to receive “designated health services” payable by Medicare or Medicaid from entities with which the physician or an immediate family member has a financial relationship, unless an exception applies.

Anti-kickback Statute (AKS)

The AKS is a criminal law that prohibits the knowing and willful payment of “remuneration” to induce or reward patient referrals or the generation of business involving any item or service payable by the Federal health care programs.

It is essential to be in compliance with these laws when entering into a joint venture. The best way to ensure compliance is to obtain fair market value and commercial reasonableness opinions that are independent and defensible.

![]() VALUING JOINT VENTURE CONTRIBUTIONS

VALUING JOINT VENTURE CONTRIBUTIONS

Contributions to a joint venture can take many forms. Cash is certainly the most straight-forward item that can be contributed to a joint venture, but other items such as tangible and intangible asset contributions may need to be appraised. Physical assets, such as medical equipment, are another item that is commonly contributed, particularly by hospitals, imaging centers, and other capital-intensive healthcare businesses. We often value these physical assets under a market approach and/or cost approach to determine their fair market value.

An existing operating business or service line can be contributed to a joint venture as well. A service line is a component of a larger business enterprise operation. It is important to be aware of the level of financial reporting of the subject service line when reviewing its income statements in connection with the valuation. For example, some service lines only report revenue and direct expenses of the service line, thus excluding other indirect operating expenses. Conversely, some service lines may report a substantial corporate overhead allocation expense in their income statements to account for indirect expenses attributable to the service line and/or health system. When valuing a service line, particularly under an income or market approach, it is important to closely understand the service line’s financial statements.

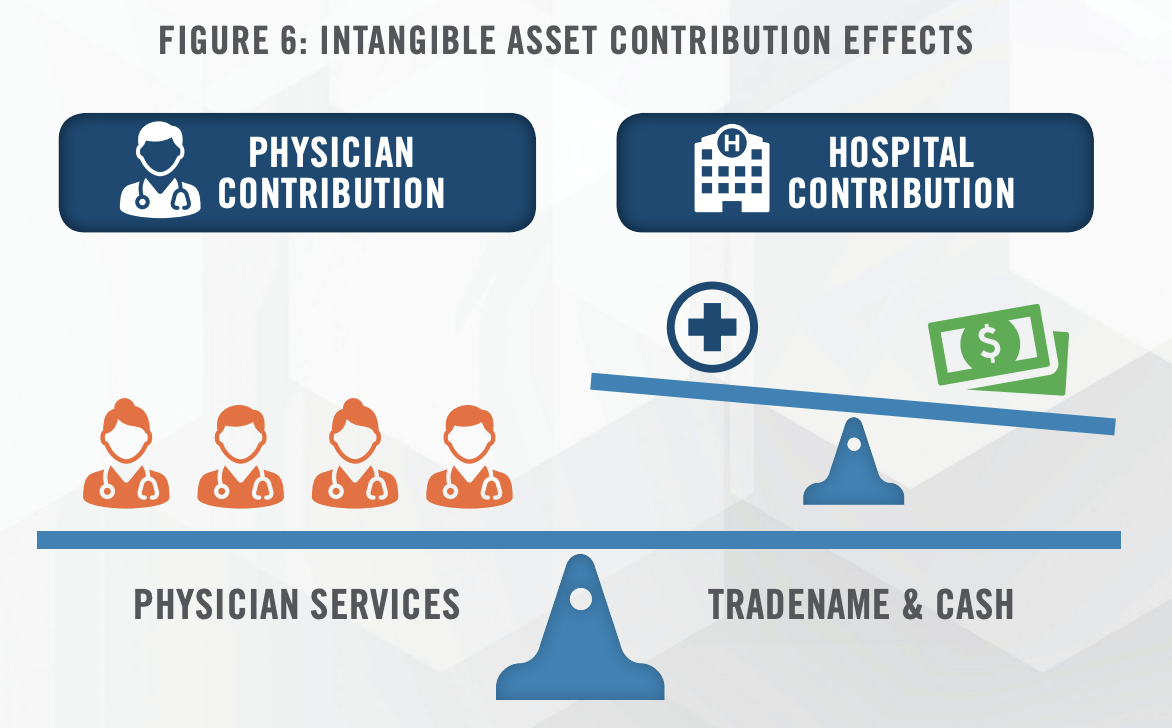

Intangible contributions are common contributions to joint ventures. Figure 6 illustrates the effect of a hospital’s intangible asset contribution to a joint venture with a physician practice. The hospital agrees to contribute cash and the use of its tradename while the physician group agrees to contribute its services. The tradename could have significant value depending on a variety of factors. The value of the parties’ contributions should balance and the value of cash should offset the value of the other assets being contributed by the investing entity, assuming a desired 50/50 ownership split. Failure to properly value the tradename could result in the hospital contributing more (or less) cash than is necessary to achieve a particular ownership split between the parties.

Other intangible assets could include those such as licenses (such as a Certificate of Need) and medical data. Certificates of Need are required in many states to operate a variety of healthcare entities and can be the primary reason a joint venture is established. Certain groups entering into a joint venture may have valuable clinical data that could be contributed to the joint venture. These are just a few examples of the many intangible assets that are often contributed to joint ventures in the healthcare industry. For a more in-depth discussion, read Intangible Assets in Healthcare. Intangible assets can be valued using cost, income or market approaches, or a combination of these three approaches.

![]() CONCLUSION

CONCLUSION

We have consulted numerous companies on creative and sophisticated joint venture arrangements in the healthcare industry. Economic concerns and the regulatory environment are certainly driving factors that will continue to incentivize decision makers in the healthcare industry to engage in these arrangements. There are a wide variety of assets that can be contributed to joint ventures and the accurate valuation of these contributions is essential to ensure that the interests of all parties involved are properly allocated. If you are considering engaging in a joint venture, contact the experts at HealthCare Appraisers for advisory and valuation solutions surrounding your transaction.

For more information, please contact:

Landon Forsythe, Analyst at lforsythe@hcfmv.com or (303) 276-3324

Matthew Muller, ASA, Director at mmuller@hcfmv.com or (303) 566-3179

Nicholas J. Janiga, ASA, Partner at njaniga@hcfmv.com or (303) 566-3173

[1] Regulatory Overload: Assessing the Regulatory Burden on Health Systems, Hospitals, and Post-acute Care Providers. American Hospital Association. October 2017

[2] Barrueta, A (2023). Hiring alone won’t solve the health care worker shortage. Last accesses October 27, 2023 from: https://about.kaiserpermanente.org/news/hiring-alone-wont-solve-health-care-worker-shortage

[3] ASC 323-10-20. Financial Accounting Standards Board. Last accessed on October 25, 2023 from: https://asc.fasb.org/1943274/2147481813.

[4] Johnson, B. (2016). Exit Playbooks Rather than Just Exit Clauses. Joint Venture Advisory Practice. Last accessed on October 25, 2023 from: https://assets.kpmg.com/content/dam/kpmg/pdf/2016/07/JointVenture-04.pdf

[5] (2020, November 30). Identifying a Joint Venture. US Equity Method Accounting Guide, 6.2. https://viewpoint.pwc.com/dt/us/en/pwc/accounting_guides/equity_method_of_accounting/Equity_method_account/chapter_6/62_identifying_a_joint.html#pwc-topic.dita_912db7b4-e843-4ebb-847c-d6c43a148a09

[6] Office of the Inspector General (n.d.). Fraud and Abuse Laws. Last accessed October 25, 2023, from: https://oig.hhs.gov/compliance/physician-education/fraud-abuse-laws/