Authors: Alyse Bentz, JD, MPH and Kevin Obletz, JD, CVA

Medicare Advantage Plans (otherwise known as Medicare Part C) represent alternatives to traditional Medicare plans. These Medicare Advantage Plans, which are approved by Medicare and are offered through private insurers, bundle coverage for hospital, medical, and, in many cases, prescription drug services (i.e., Medicare Parts A, B, and D, respectively) into a single plan. Because Medicare Advantage Plans are offered through private insurers, they are often sold by agents or brokers who can educate consumers on their varying and specific features and help ensure consumers select the plan that best suits their needs.

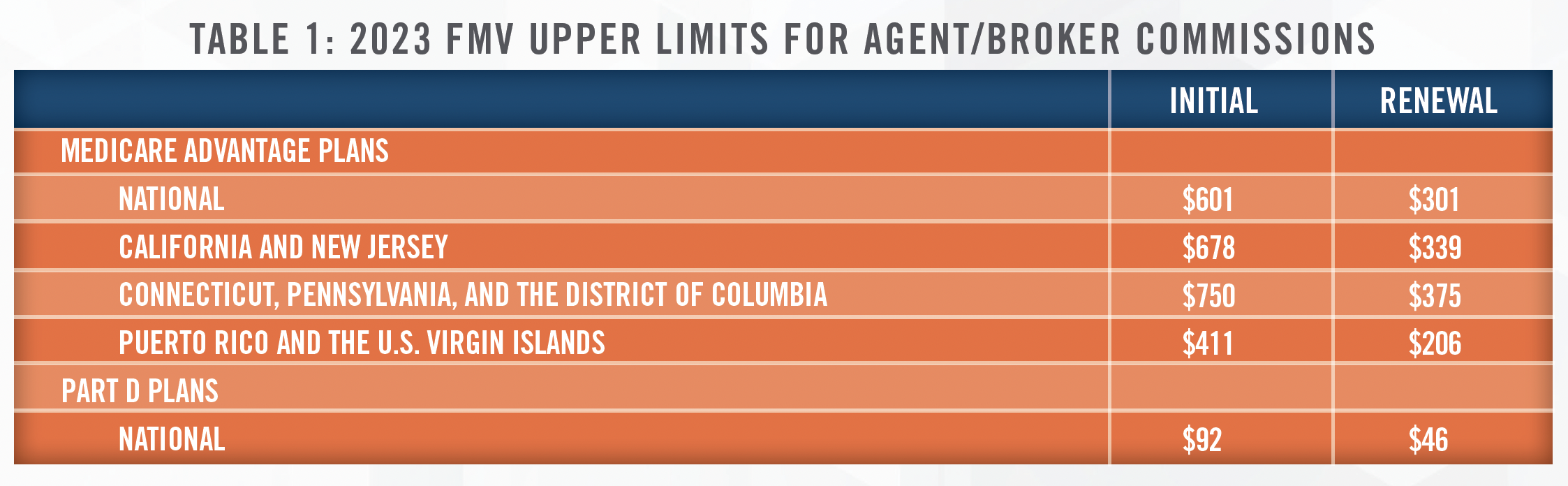

Once a patient has enrolled in a Medicare Advantage Plan, the private insurance company aligned with that particular plan will compensate the agent/broker by way of a commission. Under applicable laws,[1] this enrollment commission must be consistent with fair market value (“FMV”). However, unlike other areas of health law, whereby the government has provided a general definition of FMV without any specific guidance on the method(s) to be used in order to arrive at an FMV conclusion, the government has specified exact dollar values that constitute FMV for Medicare Advantage Plan agent/broker commissions.[2] The table below summarizes the 2023 Agent/Broker Commissions for Medicare Advantage Plans and Part D Prescription Drug Plans:

While agent/broker enrollment commissions are capped (i.e., fees cannot exceed the FMV limits set forth in Table 1 above), “administrative payments” made by insurers, which cover a wide range of administrative services and have been broadly defined to include any services other than enrollment of beneficiaries, are not subject to these caps. These services include, but are not limited to, “training, customer service, agent recruitment, operational overhead, or assistance with completion of health risk assessments.”[3]

Because administrative payment amounts are not set by law (i.e., as is the case with agent/broker enrollment commissions), the payment rates are negotiated between insurance companies and independent agencies. However, per applicable Medicare marketing guidelines,[4] such payments must still be consistent with FMV. In their 2021 proposed rulemaking, CMS noted the following:

“All payments of this type must not exceed the value of those services in the marketplace. This standard is intended to ensure that plans do not use these administrative payments as a means to circumvent the limits on compensation to agents and brokers. Plans must limit these payments to the amounts that would be fairly negotiated on the open market for the administrative services being performed and should be able to demonstrate that the administrative payments were made for actual performance when necessary.”[5]

Accordingly, when utilizing a single agent/broker for enrollment and other related services, care must be taken to ensure that there is a clear delineation between services that may be characterized as pertaining to enrollment (whereby payment caps must be adhered to) versus other administrative functions (whereby no pre-set payment caps are in place). Once clearly identified, it is equally as important to ensure that any such administrative services are consistent with FMV.

[1] See, e.g., 42 CFR § 1001.952, 42 CFR §422.2274, and 42 CFR §423.2274.

[2] In fact, the government has even specified the amount that may be paid to individuals for referrals to agents/brokers. See, 42 CFR § 422.2274(f) for referral fees paid for Medicare Advantage Plans and 42 CFR § 423.2274(f) for referral fees paid for voluntary Medicare prescription drug benefit plans.

[3] See, 42 CFR § 422.2274(e).

[4] Administrative payments ““must not exceed FMV or an amount that is commensurate with the amounts paid to a third party for similar services during each of the previous two years.” CY 2019 Medicare Communications and Marketing Guidelines (Updated 9-5-2018), CMS, available at https://www.cms. gov/Medicare/Health-Plans/ManagedCareMarketing/Downloads/CY2019-Medicare-Communications-and-Marketing-Guidelines_Updated-090518.pdf.

[5] 86 FR 5864, 5994 (Jan. 19, 2021).