With increasing pressures on reimbursement, a shift in focus by payors to inpatient costs and outcomes, and consolidation in the physician market, health systems and hospitals face numerous demands in operating efficient and high-quality service lines. For many facilities, contracts for coverage of key service lines – anesthesiology, emergency medicine, intensive care units, hospitalist medicine, radiology, and trauma centers – represent the single largest expense with outside physician vendors. What was previously a cost of doing business has become one of the primary drivers of a health system’s financial and operational success.

HealthCare Appraisers has consulted on thousands of hospital-based clinical coverage arrangements (“HBCCAs”). Far too often, we encounter HBCCAs which are auto-renewed year after year, or sent for fair market value (“FMV”) review at the eleventh hour, which hinders the negotiation and the ability to amend and improve a contract.

![]() BEYOND THE STIPEND, HOW TO NAVIGATE PROPOSALS

BEYOND THE STIPEND, HOW TO NAVIGATE PROPOSALS

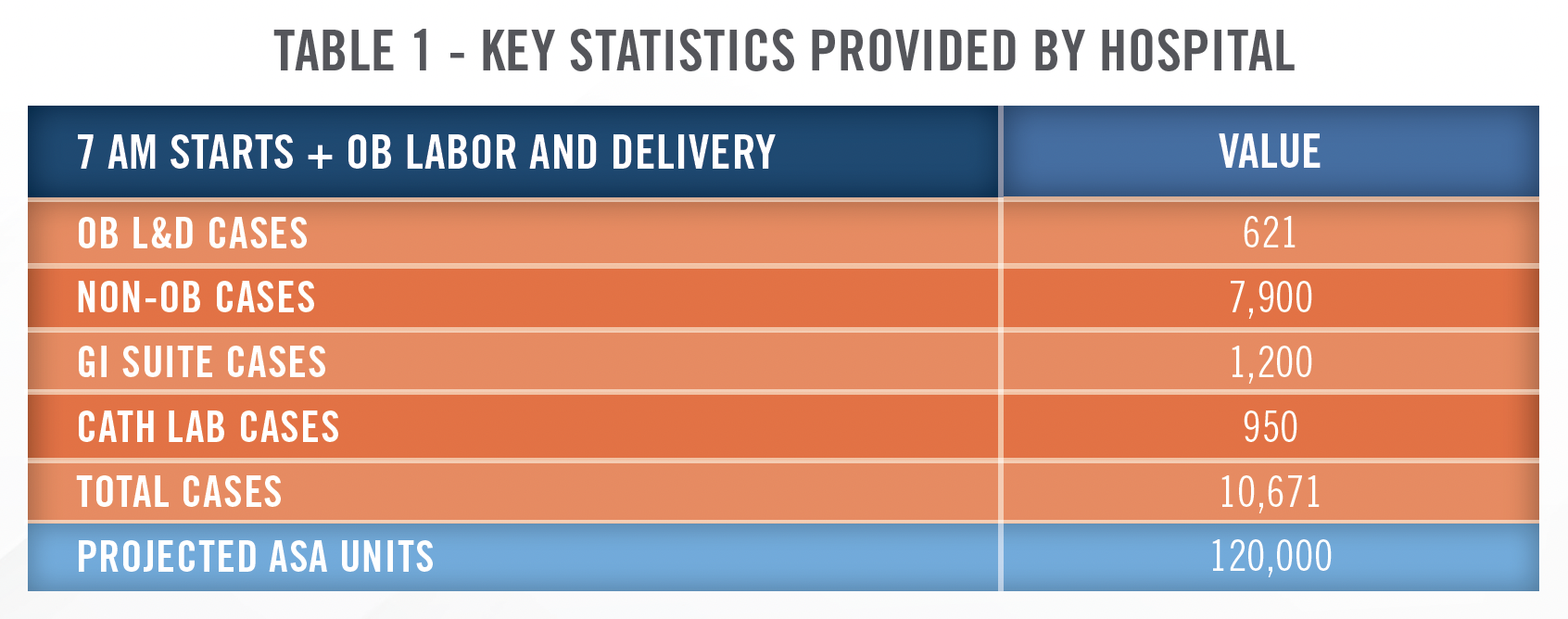

The following is a scenario in which many hospitals and health systems find themselves: their current anesthesia provider has given notice, and they now have 180 days, if not less time, to select and contract with a provider. The clock is ticking! Table 1 below is a summary of key data gathered from the hospital, including the number of anesthetizing locations requiring coverage, case volume, and ASA unit statistics based on the hospital’s historical coverage.

![]() WHAT IS THE REAL BOTTOM LINE?

WHAT IS THE REAL BOTTOM LINE?

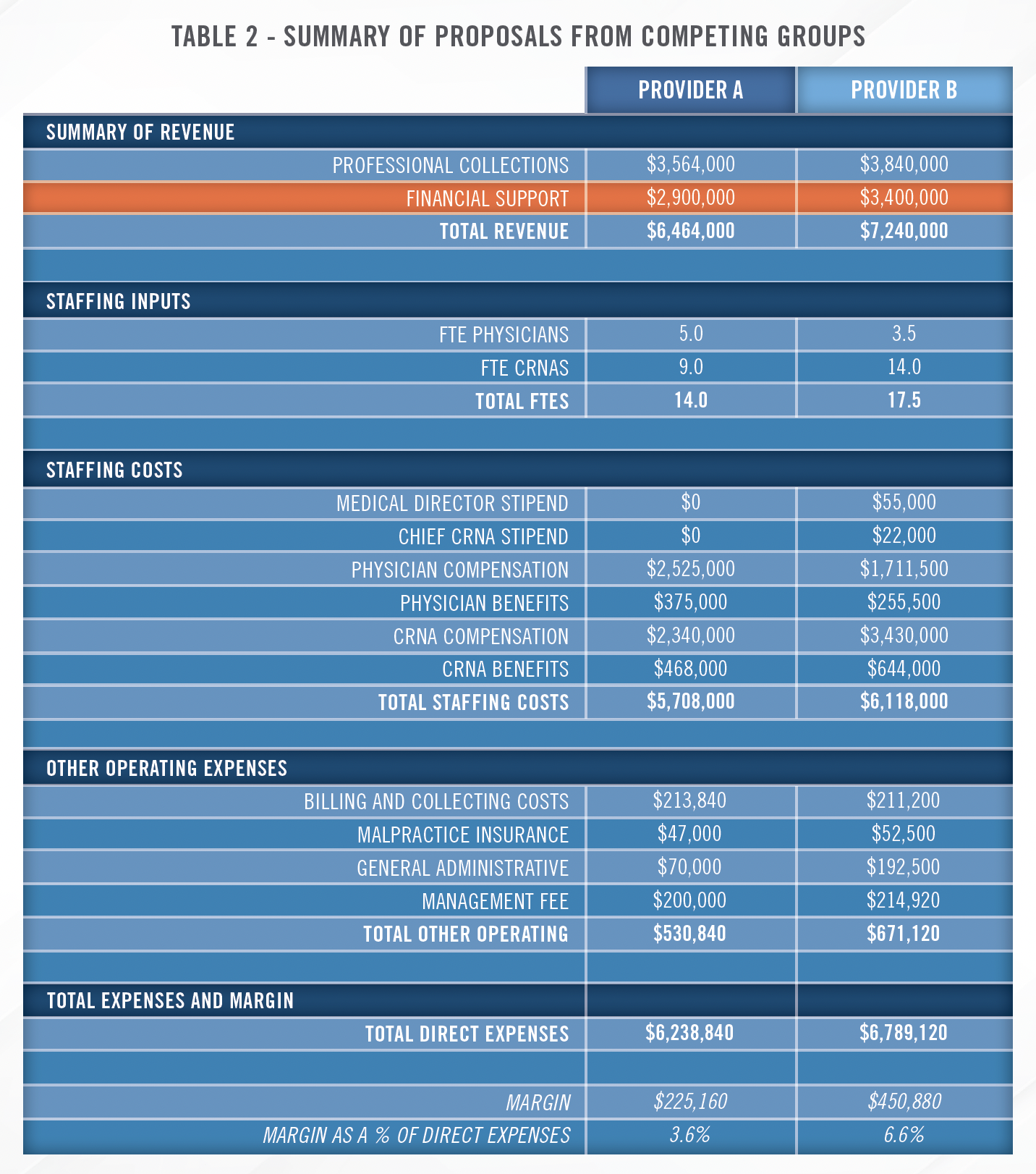

Table 2 below summarizes proposals from two different medical groups, Provider A and Provider B. Hospital operators are immediately drawn to the financial support row: Provider A requires $500,000 less in financial support compared to Provider B. The inclination of the hospital would be to move forward with Provider A, securing cost savings of $1,500,000 over a three-year term. But is that truly the case? Proposals such as these require thoughtful consideration and assessment to determine the extent of the value and utility provided under each proposal. In our experience, a lower level of financial support does not always correlate with long-term efficiency, success, and cost savings.

![]() PROFESSIONAL COLLECTIONS

PROFESSIONAL COLLECTIONS

Provider A’s projected annual professional collections, for the same case volume, are $276,000 less than Provider B. Hospitals and health systems need to be able to determine if a representation of collections is reasonable, achievable, and accurate. Is there a possibility that the Providers are intentionally understating collections, or providing lofty, unfeasible levels of collections to improve the optics of their bid?

A thorough review of each Provider’s collections provides an insight into the strength of commercial contracts (e.g., reimbursement for commercial payors as a percentage of Medicare) and billing practices of the contractors. It is prudent to ensure an accurate collections estimate, which is a core driver for validating the financial support under the arrangement.

![]() STAFFING, PRODUCTION, AND GROWTH

STAFFING, PRODUCTION, AND GROWTH

The two proposals are for the same number of anesthetizing locations and the same number of cases, however, each Provider has a different staffing model for anesthesiologists and certified registered nurse anesthetists (“CRNAs”). Depending on the long-term strategy for the anesthesiology service line, either of these bids can be effective or detrimental. While Provider A has fewer overall providers, such staffing can become a hindrance if the facility desires to grow surgical case volumes. Additionally, Provider A is less likely to be flexible and accommodating in adding additional shifts or blocks in the long run.

Additionally, an examination of the coverage schedules for each of the proposals will also shed light on the efficacy of the bid. How many on-site and on-call hours is each full-time equivalent (“FTE”) working? How burdensome is the call coverage? Is the on-call provider required to be off the next day?

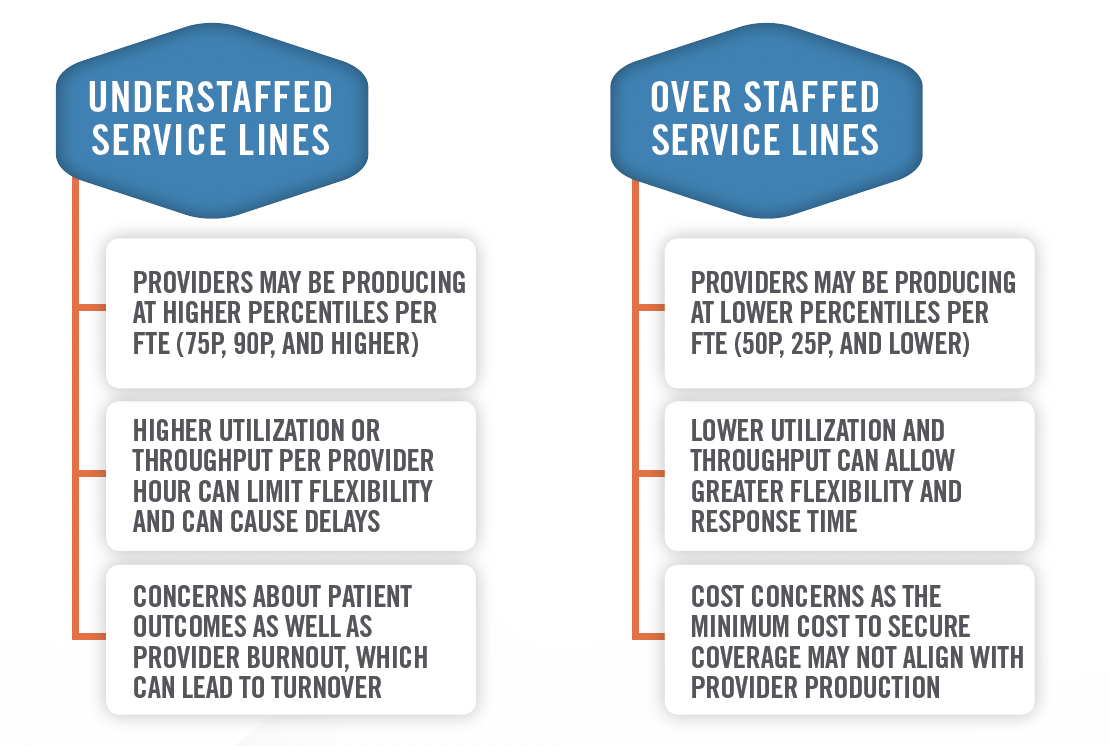

Understanding the expected production and worked hours per FTE, and reviewing these findings in conjunction with the facility’s strategy for the service line are key to long term and sustained efficiency and cost savings.

![]() FINDING BALANCE

FINDING BALANCE

Similar to benchmarking production, an understanding of cost per FTE in relation to the expected production and work requirements is just one more factor that is crucial to selection of an appropriate medical group. For example, if all providers are producing at the 40th percentile, no one is overworked and the facility’s desired coverage schedule is being provided. However, the provider may be requesting compensation for each of its FTEs in excess of the 75th percentile. Besides the potential compliance concerns, facility’s need to ask themselves if 75th percentile compensation is reasonable and cost efficient for the agreement. Does the medical group need these FTEs? Are the coverage requirements set forth in the agreement necessary, or do they need to be modified? Finding a balance of coverage, care, collections, and cost can be an overwhelming assignment, especially in the face of a looming coverage gap.

![]() PLANNING FOR SUCCESS

PLANNING FOR SUCCESS

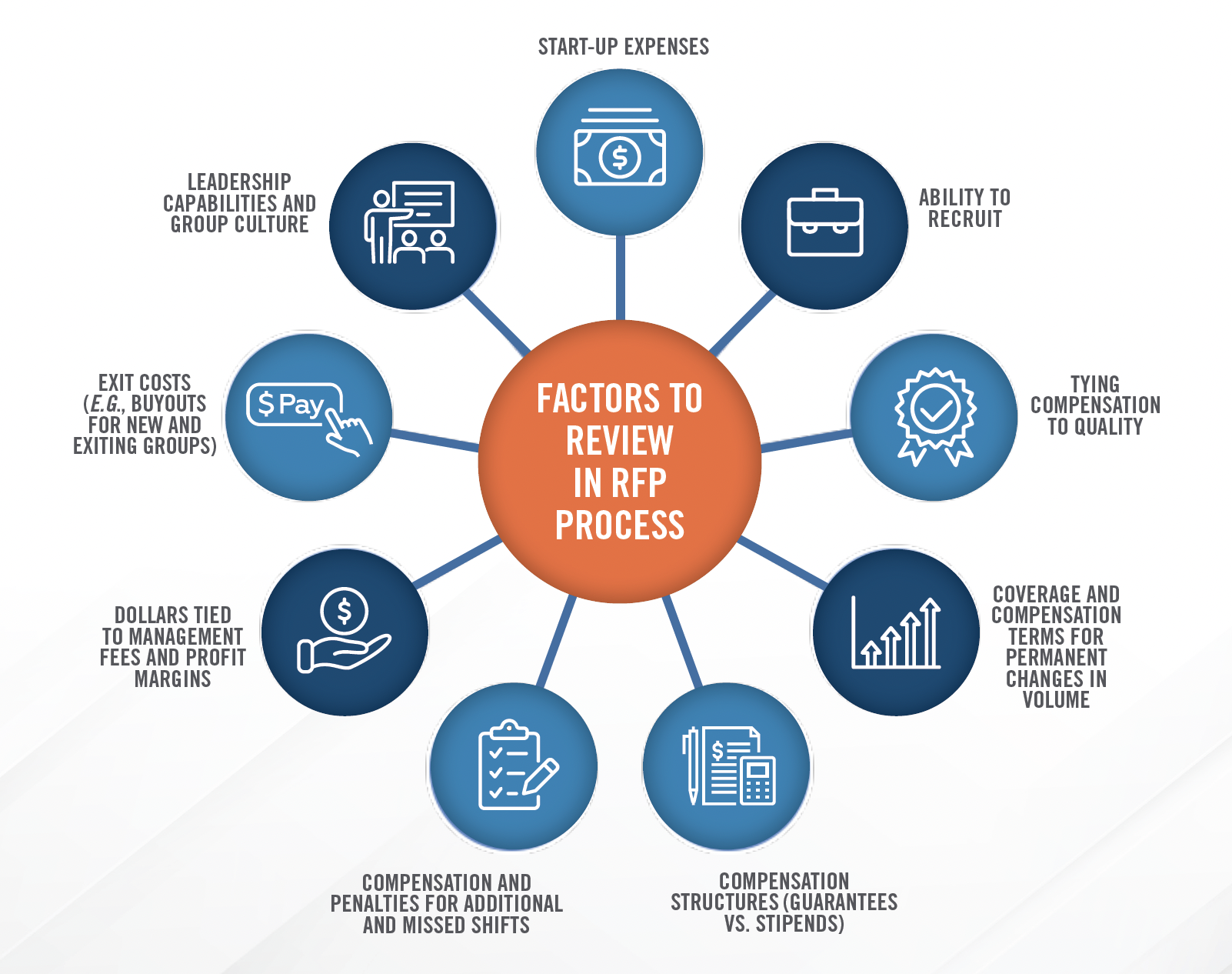

We recommend assessing all the factors discussed above for every proposal during the negotiation process. Beyond these vital and initial assessments, there are many other issues for health systems to navigate, including potential start-up expenses, the structure of the financial support, and compensation for quality, among others.

Start early and issue a request for proposal (“RFP”) for HBCCA arrangements. Whether or not the decision to issue an RFP was made independently or as a result of outside guidance, HealthCare Appraisers can help you navigate the sometimes daunting and complex RFP process. We can assist with reviewing each proposal, identifying strengths and weaknesses, and selecting a partner, not just another contractor. Our highlighted services include:

1. Assisting and creating the RFP questionnaire;

2. Coordinating responses and data provided by candidates;

3. Benchmarking and staffing review of each submission;

4. Summarizing and providing key recommendations on candidates;

5. Ensuring alignment with strategic goals; and (if requested)

6. Conducting a fair market value assessment of the selected RFP.