INTRODUCTION

Over recent years, HAI has observed numerous trends associated with hospital acquisitions and joint ventures. Smaller, community-based hospitals are typically the target entity due to a variety of factors, including: additional costs associated with meeting various regulatory requirements; pervasive and costly capital improvements; socioeconomic trends of micropolitan and rural communities; and funding acquisitions for outpatient service lines. Regional or national health systems, which offer the benefits of cost savings through economies of scale and access to capital, have been the typical acquirers. In addition to traditional hospital acquisitions, HAI has observed an increase in other types of transaction activity involving general acute care, specialty, and physician-owned hospitals within both the for-profit and not-for-profit spaces, including: joint ventures; co-branding; intangible asset purchase or licensing; and management services arrangements. Following is a discussion of these trends and the key valuation considerations for hospital transactions, due diligence, and financial reporting.

ANNOUNCED HOSPITAL ACQUISITIONS – TRENDS

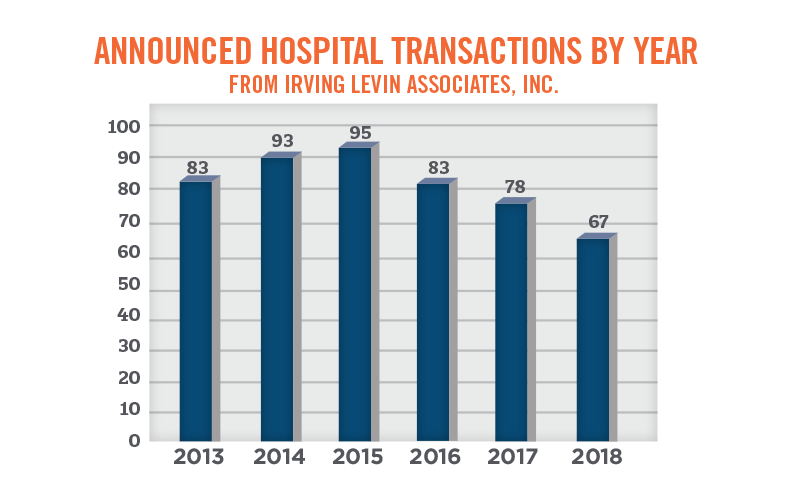

The following graph illustrates the number of announced hospital acquisitions by year as outlined in Irving Levin Associates’ merger and acquisition database over the past six years. Hospital acquisition plateaued in 2015, and has since been on the decline, with 95 acquisitions in 2015, to 67 in 2018. While the Irving Levin Associates’ database only represents a portion of the acquisitions that have occurred across the country, the relative year-over-year changes are consistent with our observations of the market as a whole.

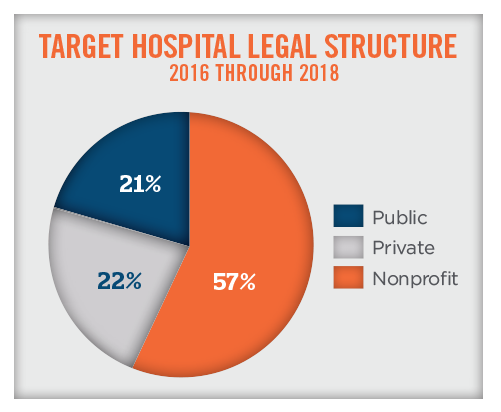

Of the transactions over the past three years, approximately 57 percent of the target hospitals were not-for-profit entities and 43 percent of the target hospitals were forprofit entities (both private and publicly traded entities). While private equity investment in bankrupt or otherwise financially distressed hospitals is still occurring, private equity investment in hospitals has notably decreased over the last three years, as firms have shifted their investment focus to outpatient facilities, with an emphasis on physician services (i.e., the reemergence of physician practice management companies).

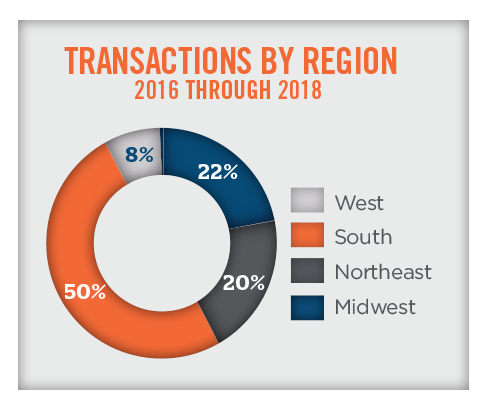

Due to regulatory and demographic factors, the transactions reported by Irving Levin Associates are concentrated in the Southern region of the United States, as illustrated in the pie chart below. The concentration can also be attributable to the fact that Community Health Systems, which has a deep presence in the Southern region, has divested dozens of hospitals in recent years. Geographical considerations have a significant impact on valuation due to the varying population demographics and health economics that impact entities on a state-by-state or even city-by-city basis.

ANNOUNCED HOSPITAL ACQUISITIONS – VALUATION COMMENTARY

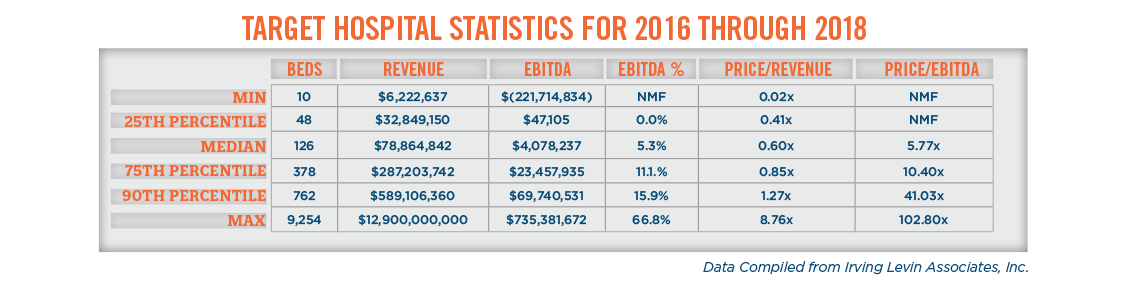

Transaction data that HAI analyzed over the past three years indicates a wide range in the size and profitability of acquired hospitals. Hospitals included in the transaction data range in size from 10 to over 9,000 licensed beds, with revenue ranging from $6.2 million to $12.9 billion and earnings before interest, taxes, depreciation, and amortization (“EBITDA”) margins ranging from under 1 percent to slightly over 66 percent. Caution and care should be used when interpreting the data for valuation purposes, as hospitals subject to the transaction data include bankrupt hospitals to thriving hospitals, and single physician-owned hospitals to transactions involving national health systems with acute-care hospitals in multiple states. Valuation analysts attempting to derive valuation multiples from this data should be mindful of these nuances, and adjust the selection of comparables accordingly.

The following table further outlines the aforementioned target hospital statistics across the 228 announced hospital acquisitions between 2016 and 2018.

Over the historical period analyzed, price-to-revenue multiples have ranged from less than 0.1x for small, financially distressed community hospitals, to over 8.0x for a multi-facility health system. Price-to-EBITDA multiples are also dispersed across a wide range over the historical period analyzed, with many of the higher price-to-EBITDA multiples resulting from distressed transactions that are based on the cost of acquired assets and prospective profitability after restructuring. It is important to note that the reported “price” differs from transaction to transaction, with “price” representing equity, invested capital (i.e., equity plus debt), or some other undefined “price” metric. This highlights the importance of valuation analysts carefully selecting transactions that are appropriate for comparison to a subject hospital and making appropriate adjustments to the valuation multiples.

PUBLICLY TRADED HOSPITALS – VALUATION COMMENTARY

Valuation guidance can also be gleaned from share prices of publicly traded hospitals, including: HCA Holdings, Inc. (NYSE: HCA); Community Health Systems, Inc. (NYSE: CYH); Tenet Healthcare Corp. (NYSE: THC); Universal Health Services Inc. (NYSE: UHS); and Quorum Health Corporation. (NYSE: QHC).

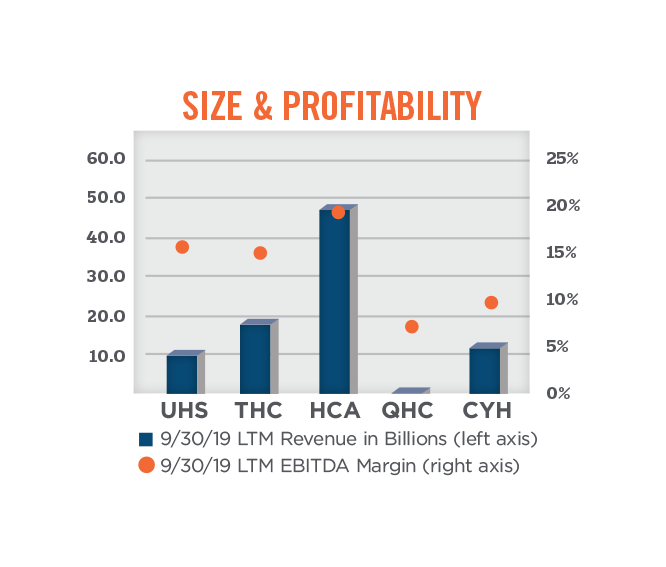

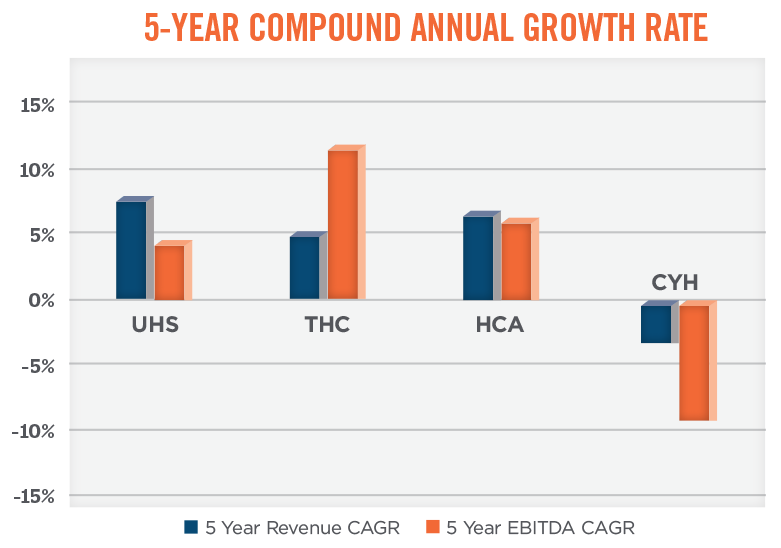

When using publicly traded companies as comparables under the market approach to valuation, it is very important to consider adjustments to the multiples to reflect differences in size, profitability, growth, diversification, geography, access to capital, etc. For public companies making notable acquisitions, it is important to understand the level of growth and profitability that relates to organic versus acquired growth, and to what degree these growth rates and levels of profitability are sustainable on a go-forward basis. Sustainability is tied, in part, to the availability of capital to continue the acquisition trend. The graphs below compare the size, profitability, and growth of the five aforementioned publicly traded hospital systems.

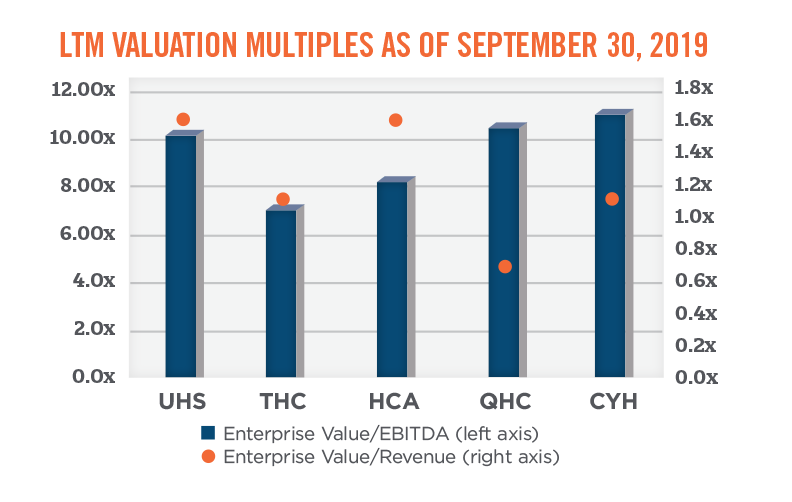

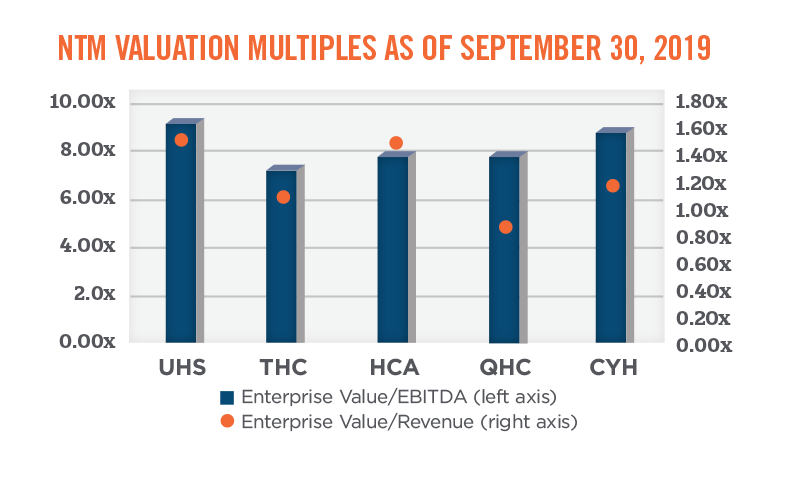

As shown in the graph below, the total enterprise value-to-EBITDA multiples for the publicly traded hospitals fall within a fairly broad range, from approximately 7.0x to 11.1x. Total enterprise value-to-revenue multiples for the publicly traded hospital systems are dispersed across a wide range as well, from a low of 0.7x to a high of 1.6x. When analyzing valuation multiples based on next-twelve month (“NTM”) expected performance, the multiple ranges tighten; the data implies an EBITDA multiple range of approximately 7.3x to 9.3x, and a revenue multiple range of approximately 0.8x to 1.5x.

Hospital valuation insight can also be gleaned from observing details of acquisitions by publicly traded hospital operators. Notable acquisitions in recent years include:

- The 2013 acquisition of Vanguard by Tenet, which resulted in implied enterprise value multiples of 0.7x revenue and 8.2x EBITDA;

- CHS’s purchase of HMA in 2014, which resulted in valuation multiples of 1.3x revenue and 8.7x EBITDA; and

- HCA’s 2019 acquisition of Mission Health, which resulted in an adjusted EBITDA multiple of 8.9x, and a revenue multiple of 0.8x

PHYSICIAN-OWNED HOSPITALS – TRENDS

Section 6001 of PPACA placed a moratorium on the development of new physician-owned hospitals, and limited existing physician-owned hospitals from future expansion beyond 2010. While this led to an observed increase in transaction activity driven by factors such as the constraints with additional physician syndication, the evolution of the relationship between a minority shareholder (e.g., management company) and the controlling physician owners, the desire to align with a larger corporate partner to assist with negotiating payor and expense contracts, and the acquisition or alignment of physician investors’ professional practices by competing health systems, transactions involving physician-owned hospitals have slowed in recent years. In HealthCare Appraisers’ 2018 Physician-Owned Hospital Valuation Survey, a collaborative publication with Physician Hospitals of America, we noted a divergence in the controlling-interest invested capital-to-EBITDA multiples observed by respondents in the market. Respondents mainly indicated that transactions are occurring at less than 4.0x or greater than 8.0x. This is consistent with HAI’s observance of physician-owned hospital transactions involving hospitals under deep financial distress or bankruptcy, as well as hospitals with attractive case volumes (e.g., orthopedics) that have been able to weather the impact of the moratorium. In regards to valuation insight from publicly traded companies, we note Medical Facilities Corporation (TSX: DR), which holds an ownership interest in eight ambulatory surgery centers, but also five physician-owned hospitals, is trading at a total invested-capital-to-EBITDA multiple of 4.8x. DR’s stock has declined in recent months after posting disappointing second quarter results.

We note that there are legislative efforts in Washington being pursued that, if successful, improve the outlook for physician-owned hospitals. The Department of Health and Human Services released a report in December of 2018 asking Congress to consider repealing Section 6001 of PPACA. Additionally, H.R. 3062: Patient Access to Higher Quality Health Care Act of 2019 was introduced to committee in June of 2019 as a means to repeal the moratorium on physician-owned hospitals put in place by PPACA.

PHYSICIAN-OWNED HOSPITALS – VALUATION COMMENTARY

When valuing physician owned-hospitals, it is important to understand the constraints caused by PPACA, such as limits on aggregate physician ownership, the number of operating and procedure rooms, and the number of licensed beds. Despite these limitations, physician-owned hospitals are able to expand certain outpatient service lines, such as diagnostic imaging and pathological laboratory services, as well as expand the number of observation beds to the extent there are constraints on bed capacity. Administrators of physician-owned hospitals have adapted to maximize the utilization of space, operating rooms, and licensed beds through altering business hours and staffing models. These nuances necessitate that an appraiser develop more detailed projections, which give specific consideration to each service line within the hospital. Failure to do so could result in a significant misspecification of value.

OTHER CONSIDERATIONS

Intangible Assets

Transactional activity is not always operationally focused, and HAI has observed an increase in transactions focused on the underlying intangible assets of a hospital, including, licenses, certificates of need, trade names, and know-how. These intangible assets may serve as the focus in an outright purchase, and are also frequently licensed or used as a contribution to a joint venture. Utilizing a well-known and respected hospital name, having access to experienced and sub-specialized medical personnel, and relying on proven management procedures, could result in less patient leakage, increased service offerings to patients, increased revenues, and a more efficient operating structure for a subject hospital.

Due Diligence

In addition to business enterprise valuations and fairness opinions, there is significant due diligence required for hospital transactions. This includes, but is not limited to, audit, tax, information technology system integration, operations, and compliance. Although each of these diligence activities has the potential to disrupt a transaction, compliance is arguably the most important diligence activity. Compliance issues identified in the due diligence process, especially those related to the fair market value and commercial reasonableness of existing contractual arrangements with referring physicians, introduce additional challenges and complications for parties focused on finalizing a transaction. Depending on the transaction structure, acquirers are concerned with successor liabilities that could be inherently acquired.[1] These liabilities are associated with coding practices, referral patterns, physician employment agreements, professional service agreements with physicians, and other similar compensation and service relationships. It is advisable that the acquirer engage an independent healthcare valuator to review and opine on the various compensation agreements.

Financial Reporting

After a business combination has occurred, there are certain financial reporting requirements under Accounting Standards Codification (“ASC”) 805 and ASC 958. While these financial reporting requirements have always been a point of consideration with for-profit entities, ASC 958 was issued in 2009 (effective in 2010) and requires not-for-profit entities to follow financial reporting guidance for business combinations in conformity with for-profit entities under ASC 805. Under these standards, the acquired tangible and intangible assets, as well as any assumed liabilities, must be allocated to the acquirer’s balance sheet at fair value as of the date of the combination. It is important to note that the definition of fair value may result in valuation considerations not consistent with the regulatory definition of fair market value, and, in certain instances, material differences in these values may exist. These differences are primarily related to the concept of “market participant” adjustments, which include reasonable operational and financial adjustments that can be realized by a hypothetical pool of investors, absent buyer-specific synergies. Common market participant adjustments include improved commercial payor contracting, the addition of certain patient services, reduced medical supplies and durable medical equipment costs, and improvements to staff utilization. Material differences in market participant adjustments can be particularly true for tax-exempt and/or struggling hospitals.

Tax-exempt business combinations involve community- or religiously-affiliated hospitals, and, in many instances, these entities are acquisition targets due to poor, moderate, or stagnate financial performance. Acquisitions of tax-exempt hospitals may be structured to include the assumption of debt held by the target hospital, the establishment of an endowment to benefit a community or religious affiliate of the target hospital, or a commitment to a certain level of capital improvements at the target hospital over a specified period of time. In these instances the purchase consideration may be limited to the fair value of the assumed liabilities, which could result in a bargain purchase.

Bargain purchases result when the fair value of the acquired assets is greater than the purchase consideration (i.e., cash paid plus liabilities assumed). This difference is recorded as a gain on the income statement, with the gain ultimately increasing book net assets on the balance sheet. This is a positive signal to the bond markets, as it indicates that the financial strength of the acquirer has improved as a result of the acquisition. This can lead to an acquirer realizing healthier financial ratios relative to static bond covenants, higher borrowing capacity, more flexible lending terms, and lower borrowing costs on a go-forward basis. Financial reporting requirements for business combinations can be complicated; it is recommended the acquirer have frequent discussions throughout the valuation process with their external auditors and valuation experts to navigate these requirements.

SUMMARY

Hospital transactions are complex. Regardless of the driving force or type of hospital transaction, it is more important than ever to understand the opportunities and risks that a transaction may present. Whether looking to acquire a hospital or enter into a joint venture or other alignment, hospital management must be prudent in selecting advisors who are well versed in the various structural, legal, and valuation issues that are present in these transactions.

If you have any questions about current or future business enterprise valuations, intellectual property valuations, due diligence, or financial reporting for business combinations, please contact Nicholas Janiga, ASA at (303) 566-3173 or njaniga@hcfmv.com and Matthew Muller, ASA at (303) 566-3179 or mmuller@hcfmv. com.

[1] As an example, in 2018, several years after Community Health Systems (CHS) acquired Health Management Associates (HMA) in 2014, a settlement of $262 million was paid by the now CHS subsidiary to settle false billing and kickback allegations that took place at HMA prior to the acquisition.