![]() ASC VALUATION, TRANSACTION, AND INDUSTRY TRENDS IN 2023[1]

ASC VALUATION, TRANSACTION, AND INDUSTRY TRENDS IN 2023[1]

The ambulatory surgery center (ASC) sector has been an attractive one for healthcare investors in recent years. The shift of surgical procedures from an inpatient to outpatient setting, the aging population, and ability for ASCs to provide quality care at typically a lower price point than a hospital outpatient department setting, have been beneficial to ASC investors. As a result, we have observed continual strong investor interest in ASCs over the last year. Outlined herein, we discuss insights on valuation and transaction trends involving notable ASC operators, developments in state Certificate of Need laws, and state-level financial and operational metrics for ASCs available for review and analysis.

![]() INSIGHTS FROM PUBLICLY TRADED COMPANIES

INSIGHTS FROM PUBLICLY TRADED COMPANIES

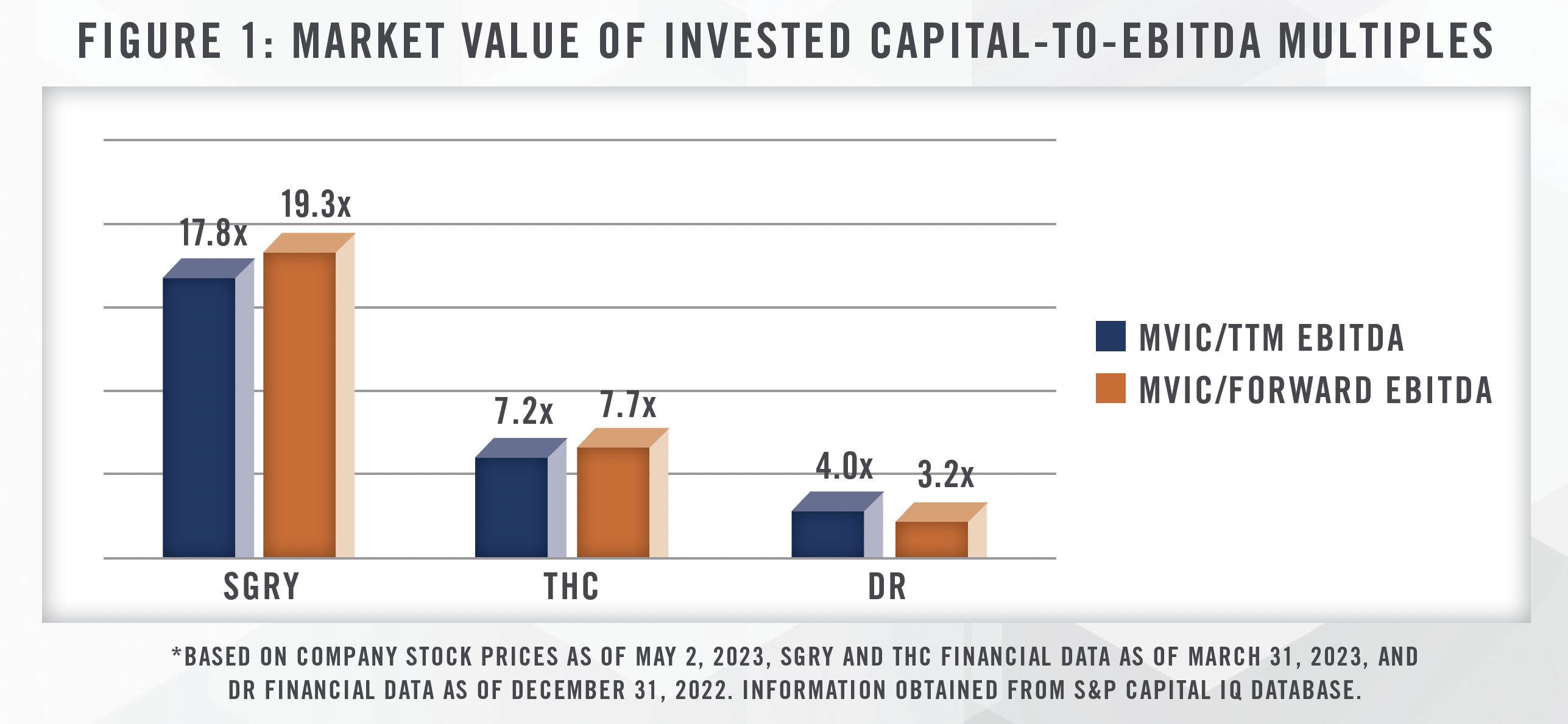

Publicly traded companies that are active in the ASC space provide insightful information as it pertains to industry trends, transaction activity, and valuation multiples. Figure 1 outlines valuation multiples for three publicly traded companies with a notable ASC presence in their portfolio: Tenet Healthcare (NYSE: THC), Surgery Partners (NasdaqGS: SGRY), and Medical Facilities Corp (TSX: DR). Other notable companies with sizeable ASC portfolios include HCA Healthcare with 126 ASCs, UnitedHealth Group (SCA Health) with over 320 surgical facilities, and Envision Healthcare (AmSurg) with over 250 ASCs.

While valuation multiples provide general insight into how the market prices the value of managers who own portfolios of ASCs, we note there are some limitations in observing the public company valuation multiples. First, the companies outlined in Figure 1 are much larger in size and scope than a single ASC, and thus have a lower risk profile, which is important to consider when comparing to a single ASC. Medical Facilities Corp’s operating portfolio is comprised of six ASCs, but also four specialty hospitals. While Tenet Health has a sizeable hospital portfolio, ASCs comprise a large component of its profitability. Normalized, adjusted EBITDA for Tenet’s ambulatory division was $1.3 billion in 2022, which comprises approximately 43 percent of company-wide EBITDA.

Quarterly earnings calls, investor presentations, and other SEC filings for these public companies offer additional useful insight into the ASC industry.

Surgery Partners

On a March 2023 quarterly earnings call, Surgery Partners communicated to investors that its mergers and acquisitions team deployed $246 million on transactions in 2022, at an overall average multiple under 8.0x. This sub-8.0x multiple figure was further mentioned as one spanning acquisitions totaling $870 million made from 2018 through 2022, which on the surface, highlights relative valuation consistency for acquisitions of ASC ownership interests by Surgery Partners in recent years. In regards to the approximate three to four facilities divested each year, these transactions were represented on the call as typically occurring at multiples north of 7.0x or 8.0x. Upon further review of Surgery Partners’ 2022 annual report, we note that acquisitions in 2022 were comprised of a mix of ownership interests. Controlling interest acquisitions were made in seven surgical facilities and a physician practice in 2022, while non-controlling acquisitions spanned seven surgical facilities and seven in-development de novo surgical facilities (i.e., 14 non-controlling acquisitions in total). Guidance on transaction multiples paid by Surgery Partners were not delineated between controlling versus non-controlling ownership interests; however, from our experience, non-controlling ownership interests in ASCs typically transact at a discount to controlling ownership interests in ASCs. Thus, caution must be used in drawing conclusions from transaction multiples referenced during Surgery Partners’ earnings call, as they appear be based on a blend of transactions involving controlling and non-controlling ownership interests.

A focal point of acquisitions in 2022 for Surgery Partners were those that focused on musculoskeletal (MSK) procedures, as Surgery Partners experienced a 13 percent year-over-year increase in MSK procedures being performed in the fourth quarter of 2022. Notably, Surgery Partners communicated it is preparing for the next wave of cardiac procedures they expect to migrate to outpatient settings starting “in earnest” over the next five years.

Tenet Healthcare / United Surgical Partners International

Tenet Healthcare (Tenet) holds a large ASC portfolio through its United Surgical Partners International (USPI) division. Tenet’s 2022 annual report indicated that USPI held indirect ownership interests in 442 ASCs and 24 surgical hospitals. Similar to Surgery Partners, Tenet expects to be active in growing its ASC portfolio in the coming years, with a goal of owning and operating 575 to 600 ASCs by the end of 2025. A notable investment in 2022 included a joint venture with United Urology Group, in which USPI acquired ownership interests in 22 ASCs.

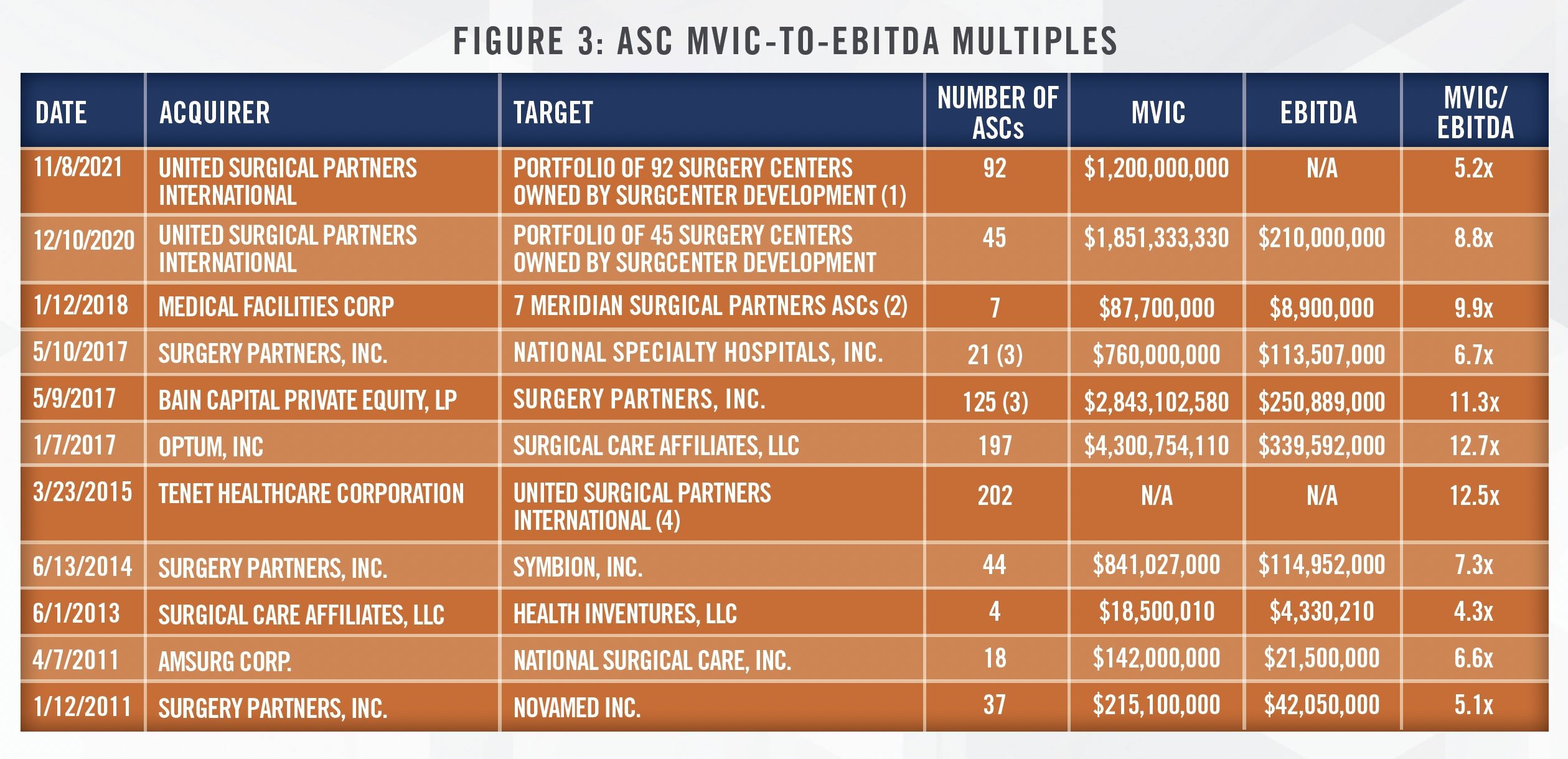

Tenet’s investor presentations and quarterly earnings calls provide insights into ASC transaction multiples. A February 2023 investor presentation outlined that average acquisition multiples for its ASC ownership interest approximates 8.0x, though it does not state if this approximate multiple is for controlling ownership interests, or a blended multiple for acquisitions of controlling and non-controlling ownership interests. However, we note the majority of USPI’s investments are for controlling ownership interests; Tenet’s annual report indicated that in 2022, controlling ownership interests in 30 fully operational ASCs occurred, while non-controlling interests in seven ASCs occurred. Interestingly, Tenet represents that post-synergy acquisition multiples of the ASC ownership interests it purchases are below 5.0x. Tenet made a high-profile multi-transaction acquisition of a total of 135 ASCs from SurgCenter Development in recent years, which in its February 2023 earnings call indicated were acquired at an average multiple of under 10.0x pre-synergies. The transaction of mature ASCs that occurred in December of 2020 was for controlling interests in 45 centers, for a multiple of 8.8x. A second transaction in November of 2021 for 92 centers[2] involved a mix of mature and early-stage ASCs, with nearly all of the interests in this acquisition being minority interests. An investor presentation indicated an estimated valuation multiple for this portfolio at 5.2x based on fully-ramped Years 3 to 4 EBITDA for the 92 centers. Notably, Tenet indicated in recent earnings call that it is behind on its expected ramp-up of these centers by approximately one year.

Medical Facilities Corp

Medical Facilities Corporation’s (MFC) operations consist of four specialty hospitals and six ASCs – all of which are located in the United States – despite the company being traded on the Toronto Stock Exchange. Upon review of MFC’s 2022 audit, we note MFC recorded an impairment loss related to its MFC Nueterra ASCs – a portfolio of five ASCs located throughout the Midwestern United States. The value of the collective goodwill and other intangibles with indefinite useful lives for this portfolio decreased from $15,900,000 at the beginning of 2022, to $540,000 at 2022 year-end. As part of its impairment calculation, the audit states that market multiples as it pertains to this portfolio were utilized. Enterprise value (EV) to trailing twelve-month (TTM) EBITDA multiples of 8.2x to 8.7x (8.6x to 9.7x in 2021) were utilized in the analysis, which were estimated by the auditor based upon review of public company transaction multiples, non-public transaction multiples provided by a third party consultant, and guideline public company multiples. While there was little commentary from management on this portfolio during its March 2022 earnings call other than “continued underperformance” of these ASCs, it highlights the fact that ASCs are not immune from financial distress, despite the many tailwinds the sector is currently enjoying. At HealthCare Appraisers, we have certainly encountered ASCs that are struggling financially, which in many instances is the result of physicians retiring, or otherwise ceasing to perform cases at the ASCs for a variety of reasons such as health or relocation, and the subject ASC not having a succession plan in place to backfill for these cases once these departures occur.

![]() INSIGHTS FROM STATE LEVEL PUBLIC RECORDS

INSIGHTS FROM STATE LEVEL PUBLIC RECORDS

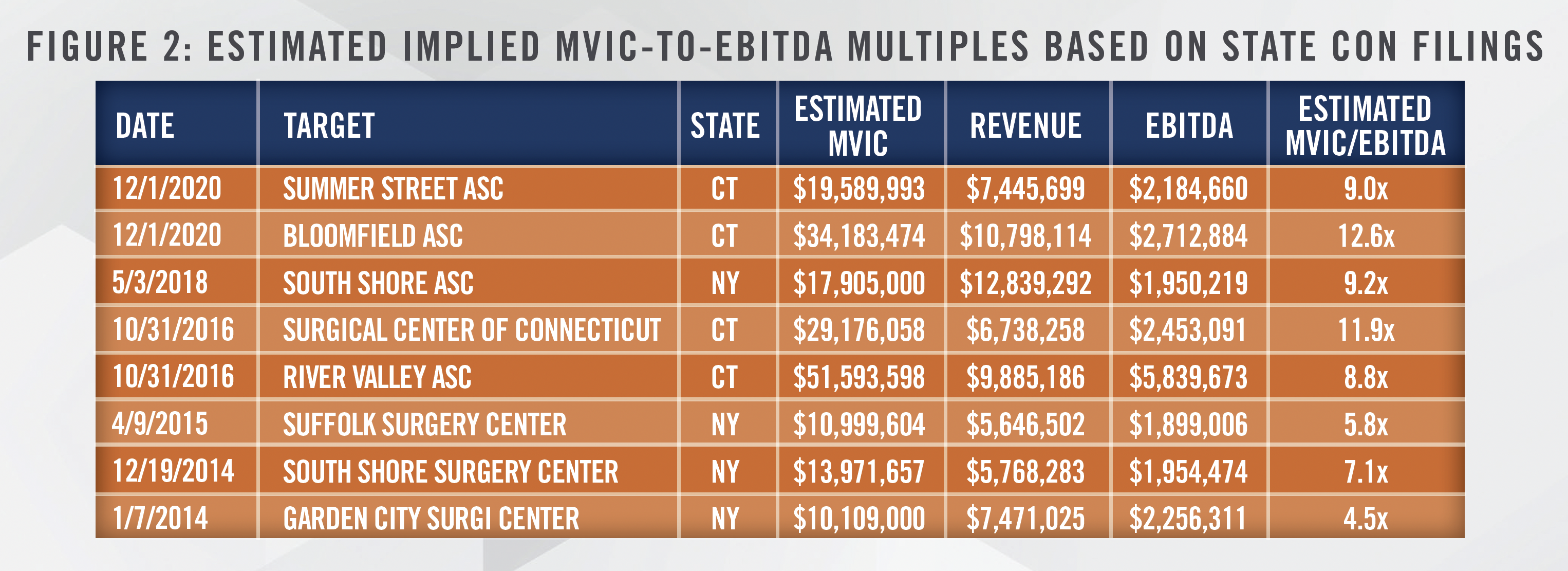

States with Certificate of Need (CON) offices also provide information that allows a user to access public information as it pertains to transactions involving ownership interests in ASCs. For example, a review of the CON filings for the state of Connecticut over the last several years provides insight into several estimated implied transaction multiples. In the examples below, we have explained how useful information can be gathered from these filings.

In a December 2020 purchase agreement contained in a CON filing, a buyer agreed to purchase a 56.155 percent ownership interest in Summer Street ASC, LLC d/b/a Specialty Surgical Center of Connecticut, a multi-specialty ASC located in Stamford, Connecticut. The purchase agreement outlined the transaction to occur in two phases – Phase 1 of the purchase would be a 49 percent non-controlling ownership interest in the center occurring in December 2020, while Phase 2 would involve an acquisition of a 7.155 percent ownership interest that would result in the buyer obtaining a controlling interest in the ASC. The Phase 2 transaction, which was contingent on approval from the Connecticut Office of Health Strategy, officially occurred in May of 2022. The filing indicates that the 7.155 percent ownership interest was acquired for $1,125,893. Operating revenue of the center was $7,199,129 in 2019, and was projected to be relatively consistent in 2021 at $7,445,699. Revenue was only $5,412,471 in 2020, which is attributable to the COVID-19 pandemic. Thus, projected EBITDA of $2,184,660 for 2021, as reported, is likely the best indicator of normalized EBITDA for the center at the time the transaction occurred. Dividing the $1,125,893 purchase consideration by 7.155 percent results in an implied 100 percent equity value of the Center of $15,735,751. The debt balance of the Center as of December 31, 2019 equaled $3,854,242, which when added to the equity value, arrives at an implied market value of invested capital of the center of $19,589,993. This indicates an implied EBITDA multiple of 9.0x for this transaction.[3] We note that this does not necessarily indicate the transaction occurred at this multiple – the center’s debt balance at close may have increased or decreased over the 11 months from the reported available balance sheet in the filings compared to when the purchase agreement was executed in December of 2020. However, the above analysis provides insight into a reasonable estimate of an implied valuation multiple paid for a controlling ownership interest in an ASC.

In a transaction very similar in structure to the one previously described, a buyer purchased a 49 percent non-controlling ownership interest, and after obtaining CON approval, an 8.5 percent ownership interest to obtain control, in Bloomfield ASC, a multi-specialty ASC located in Bloomfield, Connecticut. The filings indicated this executed purchase agreement also took place in December of 2020, in a similar Phase 1 and Phase 2 transaction structure as the previous example. The purchase of an 8.5 percent ownership interest for $2,570,857 implies a 100 percent equity interest value of $30,245,376. The debt balance as of December 2019 was equal to $3,938,098, which would result in an estimated market value of invested capital of $34,183,474. 2021 EBITDA was projected to be $2,712,884. This results in an implied forward EBITDA multiple of 12.6x. As mentioned in the previous example, closing adjustments may well impact this figure – if when the buyer eventually bought in debt was reduced to $0, the estimated implied transaction multiple is actually 11.1x.[4]

Similar analyses from 2017 indicate estimated implied purchase multiples of 11.9x for Surgical Center of Connecticut, and 8.8x for River Valley ASC, both also in the state of Connecticut.

The previous transaction multiples, estimated based on the state filings data, suggests transaction activity in ASCs in Connecticut from 2017 to 2020 in the high single digit to low double digit multiples range. However, the examples highlight several cautions in estimating transaction multiples based on public filings data:

1) As outlined herein, there are certain estimates involved by an analyst in arriving at valuation multiples from CON filings, given transaction details are not all fully transparent, and certain key items in the filings are redacted.

2) In CON states, a CON can be a significant barrier to entry, which in turn can increase the purchase price of an ASC in these states. Obtaining implied transaction multiples from CON states alone may result in skewed statistics, especially if an analyst is attempting to apply those market multiples to a transaction in a state that does not have CON laws for ASCs.

3) Value of a center is driven by a variety of factors, such as the outlook on growth, which are not easily observable from simply looking at the implied valuation multiple of a subject transaction.

Utilizing similar research methods for other CON states with publicly available data, we have generated other estimated implied valuation multiples for ASC transactions in New York and Connecticut, which are outlined in Figure 2:

![]() OTHER VALUATION MULTIPLE INSIGHTS

OTHER VALUATION MULTIPLE INSIGHTS

A variety of other sources can be utilized to develop insight into ASC transaction multiples. Figure 3 below outlines valuation multiples for larger, multi-center ASC transactions that have occurred in past years

Data obtained from public filings and S&P Capital IQ databases

(1) Purchase portfolio of 65 mature ASCs, 11 ASCs open less than one year, and 16 planned centers. The purchase is for a noncontrolling interest in 86 ASCs, and controlling interest in 6 ASCs. Valuation multiple based on fully ramped Year 3-4 EBITDA multiple as outlined in an investor presentation, which may include operational synergies.

(2) EBITDA estimated assuming EBITDA margin is 25 percent. Press release indicated EBITDA margin “in the mid-20’s.

(3) Includes both surgical hospitals and ASCs.

(4) In 2017, Tenet increased their ownership in USPI by another 23.7 percentage points at a multiple that approximates 10.0x

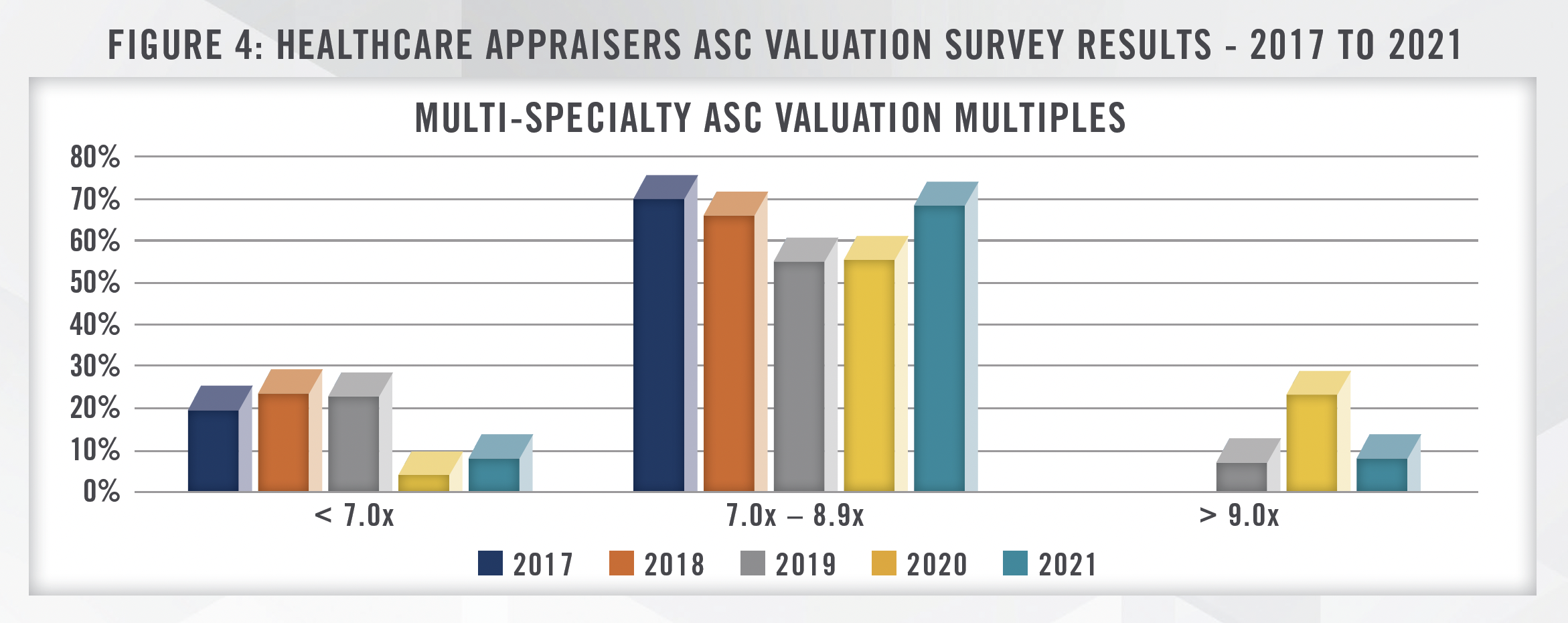

In past years, HealthCare Appraisers has surveyed ASC management companies, bankers, brokers, and health systems, to obtain insights into transaction multiples involving ASCs throughout the United States. In our 2021 survey, participants were comprised of respondents who collectively own or manage approximately 1,200 ASCs across the United States. Over 70 percent of respondents indicated controlling interest multiples in multi-specialty ASCs at 7.0x to 8.9x. Valuation multiples for the last five years of the survey are outlined in Figure 4 below.

Our survey indicates relative annual consistency in valuation multiples over the observed periods. We look forward to the results of our next valuation survey, and encourage those interested in our next survey to subscribe for updates, and connect with us if you are involved in ASC transactions and would like to participate.

As ASC transaction multiples in public databases are limited, valuation analysts may glean information from other public sources to obtain insight into market multiples for ASCs. However, as outlined herein, an analyst must be aware of limitations to this approach, and not simply rely on a multiple in lieu of a deeper valuation analysis of a subject company.

![]() NOTABLE ASC TRENDS

NOTABLE ASC TRENDS

Interest in Cardiology

A notable trend as it pertains to ASCs is the shift of cardiology cases into the ASC setting. Over the years, CMS has removed certain cardiology cases from the inpatient-only list (IOL). With other procedures, it has taken one-step further and added them to the ASC-covered procedure list (CPL). Similar to what occurred over the recent historical past as it pertains to total joint procedures for orthopedics, commercial payors are reimbursing for cardiology procedures that have been removed from the IOL, ahead of Medicare adding the procedure to its CPL. A March 2023 article in Cardiovascular Business indicated an example of this relating to electrophysiology ablations that are currently being performed on commercial patients at dozens of ASCs. The article further states that many expect CMS will be adding not just EP ablations, but left atrial appendage occlusion procedures, transcatheter aortic value replacement, and abdominal aortic aneurism repair to the CPL.[5]

Similar to the appeal of other specialties with strong ability to generate revenue from ancillary services that have drawn the interest of private equity investment, cardiology has emerged as a specialty with high private equity investment interest. Physician Practice Management (PPM) platforms include those such as US Heart and Vascular, Partners First Cardiology, Novacardia, Cardiovascular Associates of America, and Cardiovascular Logistics – the majority of these platforms launching in just the last three years. Based on conversations we have had with those involved in PPM transactions, this interest is in-part driven by the outlook for revenue that can be generated in the ASC setting.

Cardiologists as a group are highly employed by health systems, at nearly 70 percent. This compares to other surgical specialties that are popular in the ASC space, such as orthopedic surgeons, at less than 50 percent health system employment.[6] Based on our experience many physicians employed by health systems do not hold an ownership interest in an ASC, which may result in a slower movement of procedures migrating into the ASC setting, as compared to what was observed in the total joint space with orthopedics.

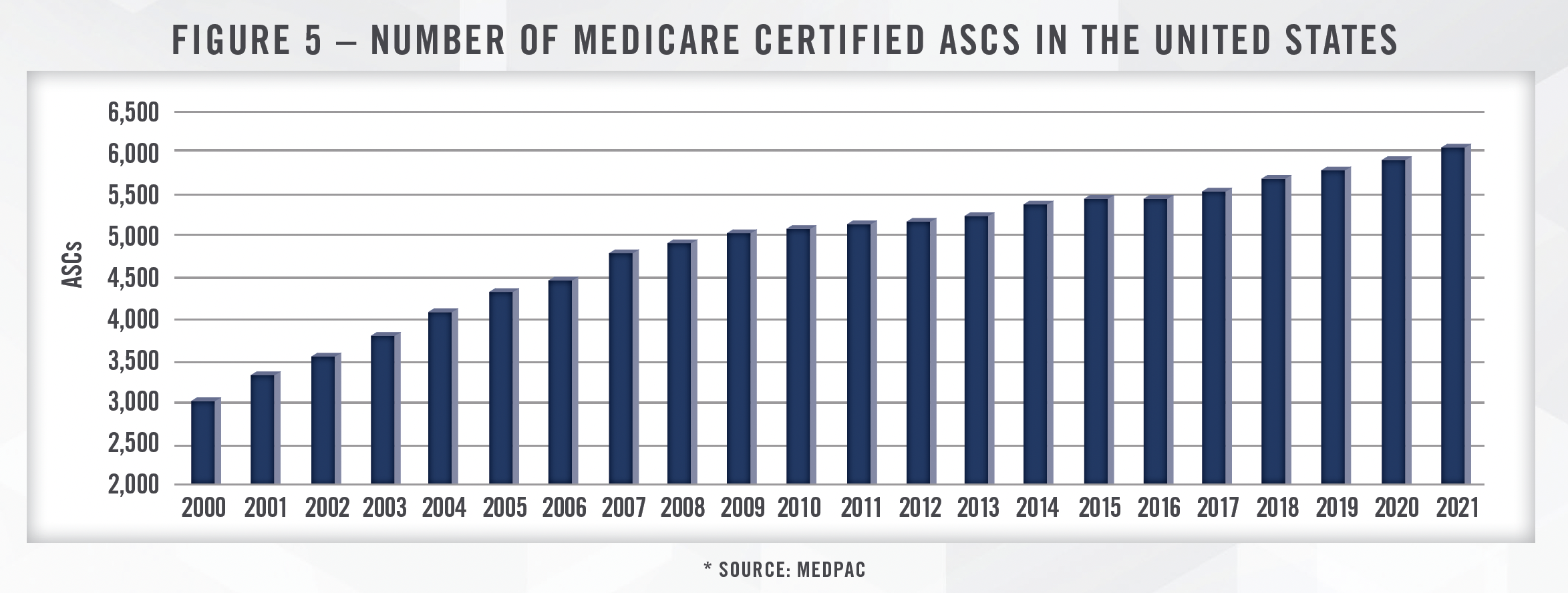

Increasing Number of ASCs and Increasing Rate Disparity

While not a new trend, the number of Medicare ASCs in the country continues to grow. As outlined in Figure 5, the number of ASCs in the country continues to increase annually since the year 2000, providing support for strong investor interest in the space.

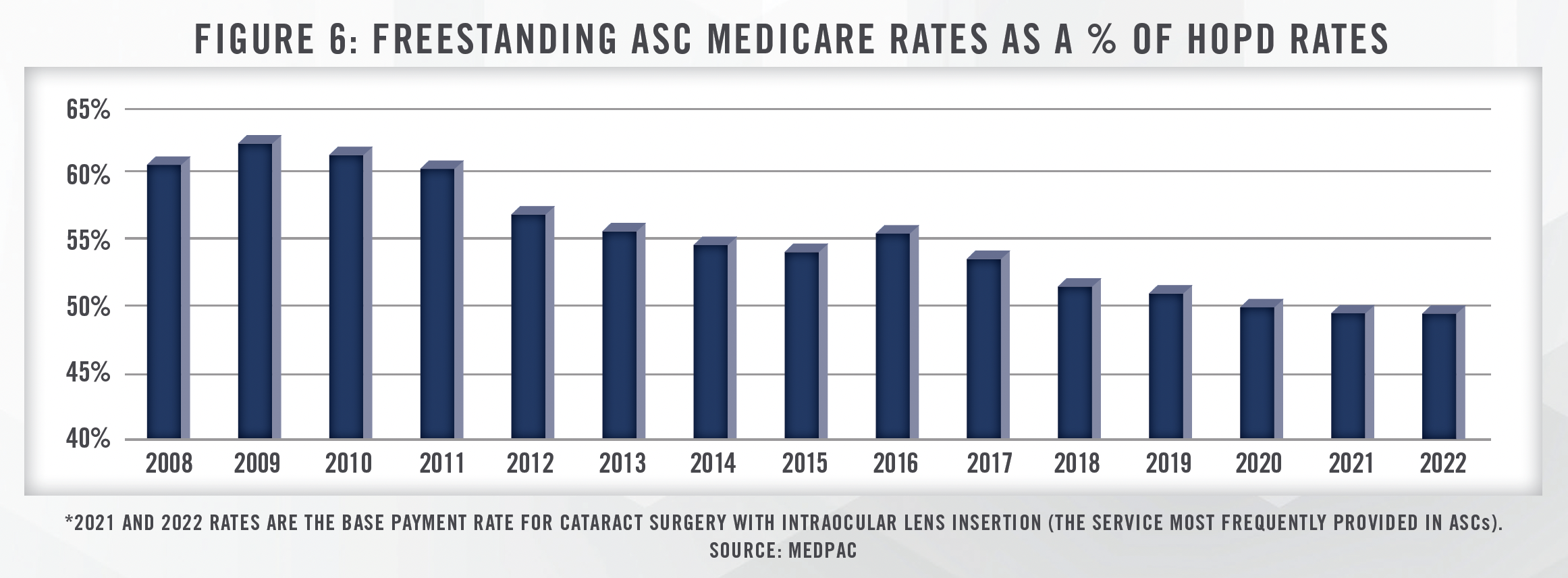

Additional notable data from MedPac relates to the payment disparity between ASCs and HOPDs. As shown in Figure 6, ASC rates are approximately half that of their HOPD counterparts. This discrepancy highlights the value proposition of an ASC, which we have noted is highlighted in many Certificate of Need applications.

![]() ASCS AND STATE CERTIFICATES OF NEED

ASCS AND STATE CERTIFICATES OF NEED

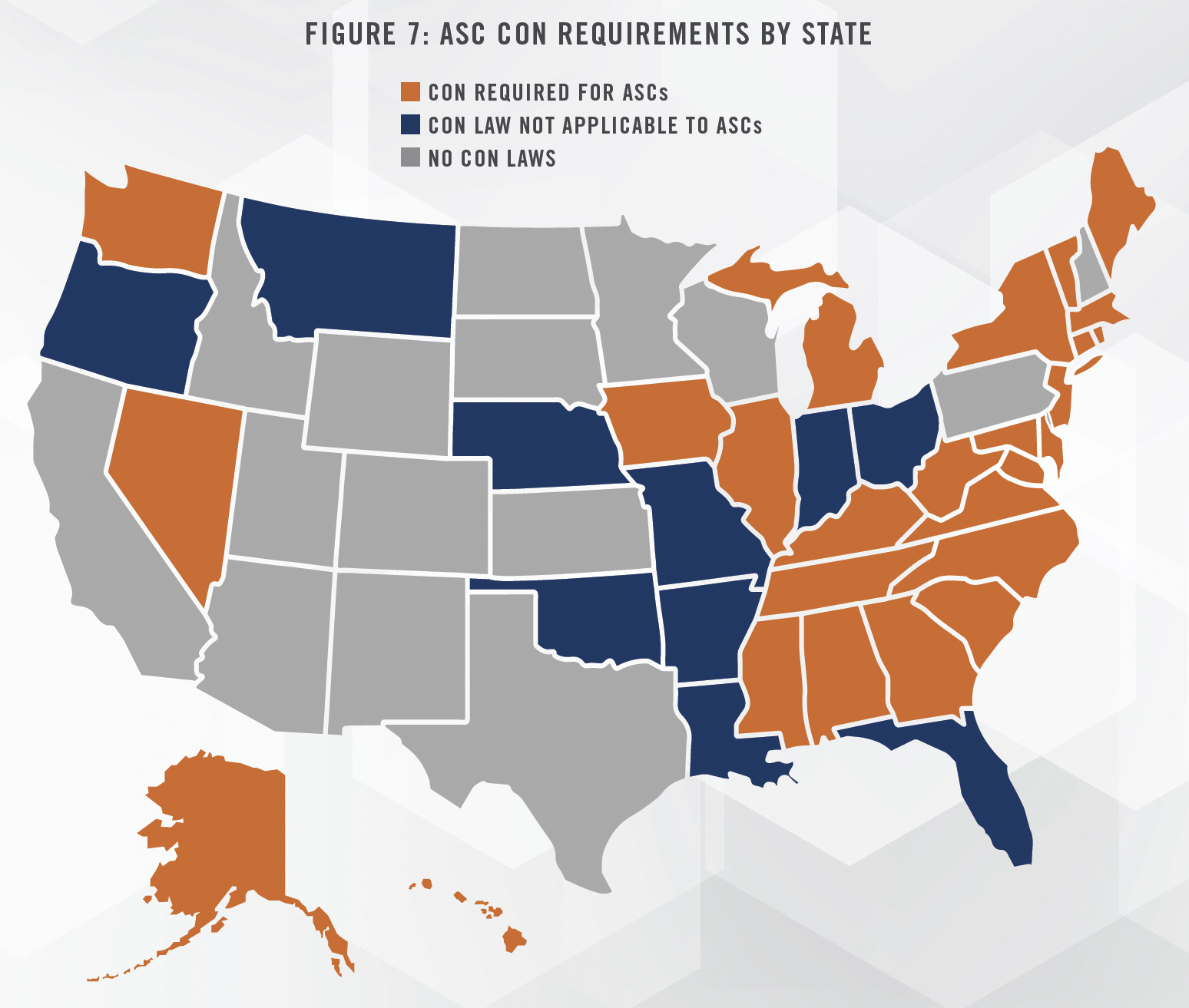

As outlined in Figure 7, many states require a Certificate of Need, or similar sort of approval for operating an ambulatory surgical center. As there is much political debate over the usefulness of such laws, there is constant potential change as it relates to these laws at any given time. Recent notable developments in Montana and North Carolina resulted in changes to laws impacting ASCs. Montana House Bill No 231, which was signed into law May 2021, revised the Certificate of Need Program in Montana, which removed the need for a CON as it pertains to ASCs in the state. On March 27, 2023, North Carolina signed H.B. 76 into law, which expanded Medicaid in the state. The law results in the removal of the need for a CON for ASCs in counties in which the population is greater than 125,000. Based on the nuances of this law, it is anticipated the effective repeal of this CON requirement will occur sometime during the year 2025, so its impact is not immediate. On May 16, 2023, the South Carolina Governor signed into law SB 164, eliminating CON requirements for ASCs and nearly all other health facilities.

![]() ASC FINANCIAL AND OPERATIONAL STATISTICS – STATE DATABASES

ASC FINANCIAL AND OPERATIONAL STATISTICS – STATE DATABASES

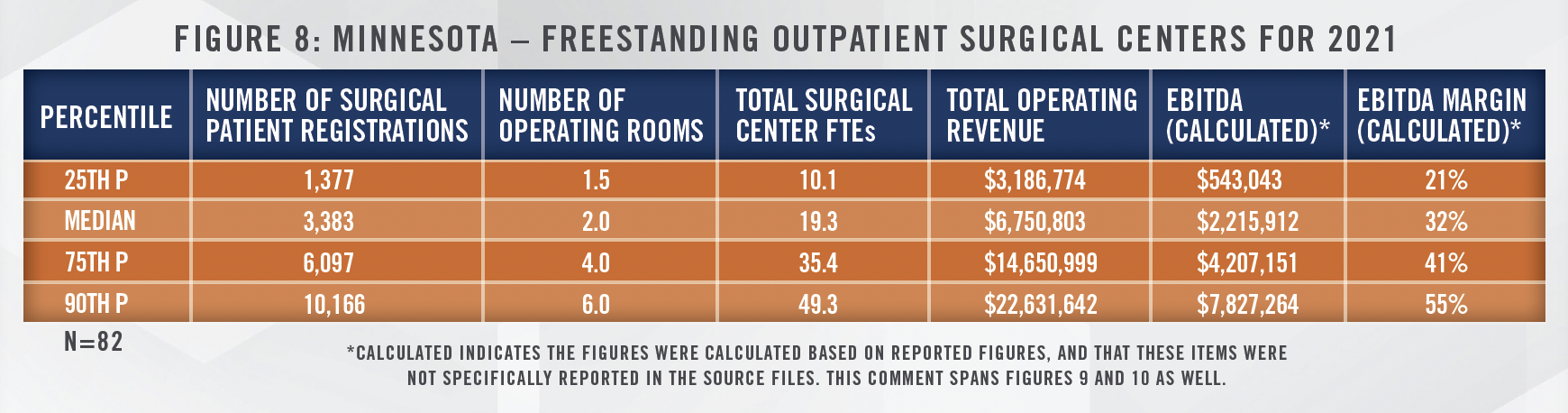

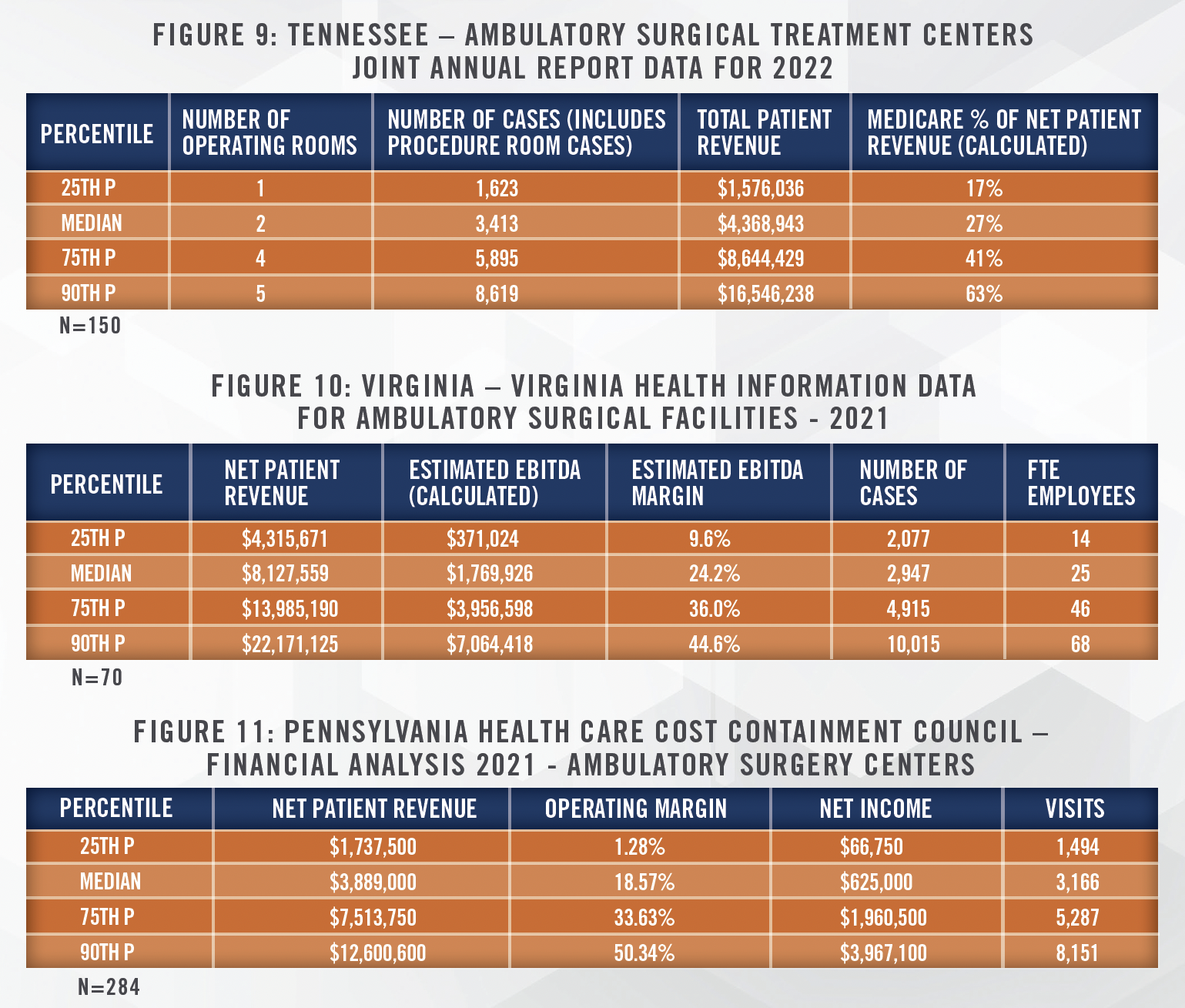

Many states maintain reporting requirements for ASCs, which can result in a trove of useful information to those looking to analyze and benchmark ASC performance. Some examples of data points that can be mined from certain states as it pertains to ASCs are outlined as follows:

As shown herein, we have been able to pull certain statistics directly from response fields collected by the state, while others we have been able to calculate based on how data is reported for a given state.

![]() SUMMARY

SUMMARY

ASCs continue to draw strong interest across the country from a variety of investors, and the sector has many positive tailwinds. Insight into ASC transaction multiples and financial performance can be obtained from a variety of public sources, including SEC filings, earnings calls, investor presentations, state databases, and state certificate of need offices. However, there are inherent limitations in using this data, and it should assist, but not substitute, for a deeper understanding of the various financial, operational, and economic factors involved in determining the value of a given ASC. If you are considering transacting an interest in an ASC, contact the experts at HealthCare Appraisers for assistance with valuation and advisory issues surrounding your transaction.

[1] All references to transaction multiples, unless otherwise stated, represent market value of invested capital to a particular period of EBITDA, or enterprise value to a particular period of EBITDA. While there are slight differences in enterprise value as compared to market value of invested capital, which typically relates to how cash is handled in a transaction, the materiality of these differences is limited for purposes of this article.

[2] 86 were non-controlling with average interest of 39%, and the other six were controlling interest with 55% ownership interest on average

[3] $19,589,993 / $2,184,660 = 9.0x

[4] $30,245,376 / $2,712,884 = 11.1x

[5] Cardiovascular Business. “How to prepare hospitals for the migration of cardiovascular procedures to OBLs and ASCs.” Last accessed April 21, 2023 at: https://cardiovascularbusiness.com/topics/healthcare-management/healthcare-economics/how-prepare-hospitals-migration-cardiovascular-procedures-obls-and-ascs

[6] Physician Advocacy Institute. “Physician Employment and Acquisitions of Physician Practices 2019-2021 Specialties Edition.” Last accessed April 21, 2023 at: http://www.physiciansadvocacyinstitute.org/Portals/0/assets/docs/PAI-Research/Physician%20Practice%20Trends%20 Specialty%20Report%202019-2022.pdf?ver=MWjYUAcARbuGP9uxcgQkPw%3D%3D