Authors: Matthew J. Muller, ASA, Anusha Patni, MSAQF and Nicholas J. Janiga, ASA

![]() INTRODUCTION

INTRODUCTION

Specialty pharmacies, which once occupied only a small niche in the pharmacy marketplace, are now a sizeable part of the broader pharmacy industry. In 2018, specialty medicine prescriptions grew by over five percent, more than twice the rate of other drugs.[i] Behind this rapid growth of specialty drugs are a number of trends, such as increasing demand for “personalized” medications that treat chronic diseases by taking into account the individual variability in genes. In this article we provide an overview of the specialty pharmacy industry, assess the tailwinds and headwinds facing the industry, and discuss certain valuation considerations for specialty pharmacies.

![]()

![]()

![]()

![]()

![]()

![]()

According to the National Association of Specialty Pharmacy, “A specialty pharmacy is a state licensed pharmacy that solely or largely provides medications for people with serious health conditions requiring complex therapies.” Medicare defines specialty tier drugs as drugs that have a minimum monthly cost of $670 in 2019.[ii] A medication considered a specialty drug may have some or all of the following key characteristics:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

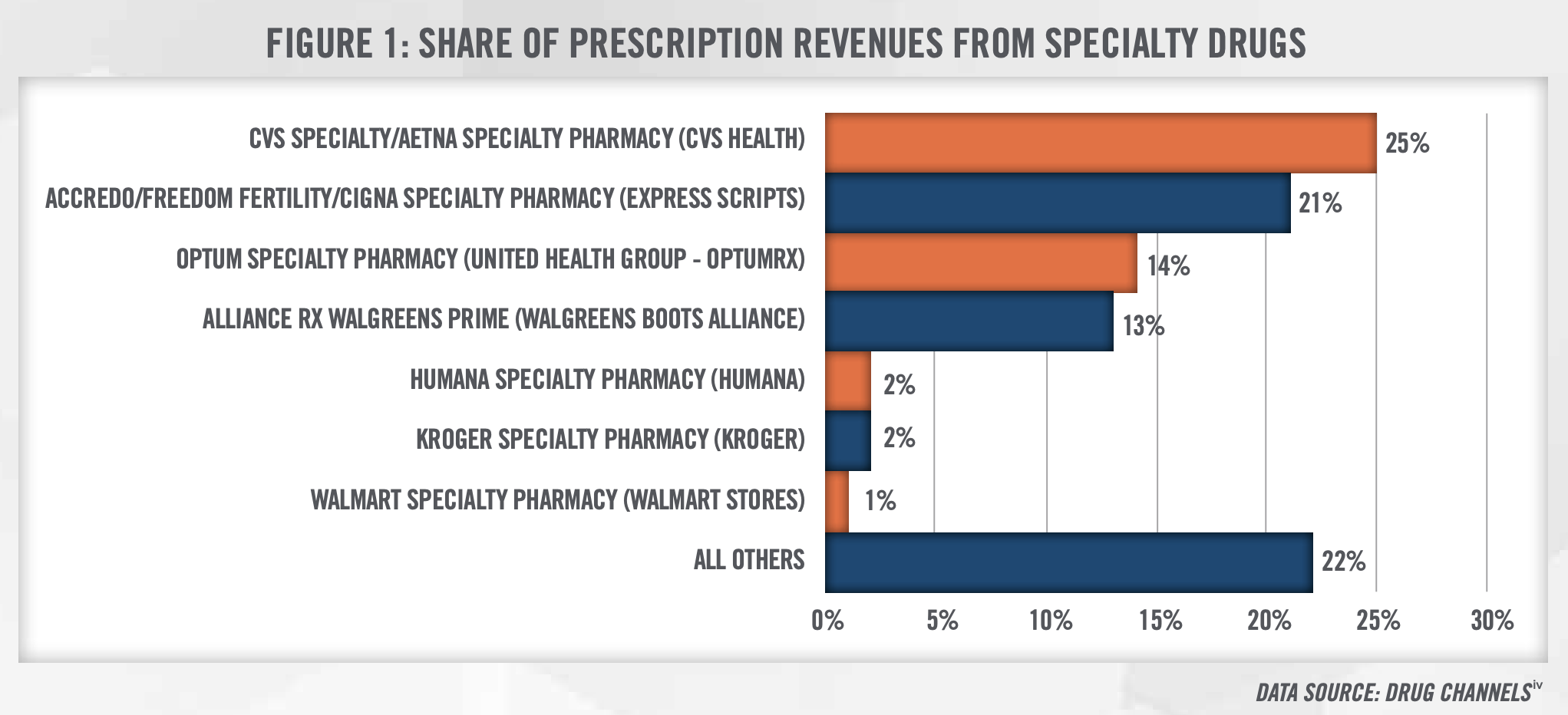

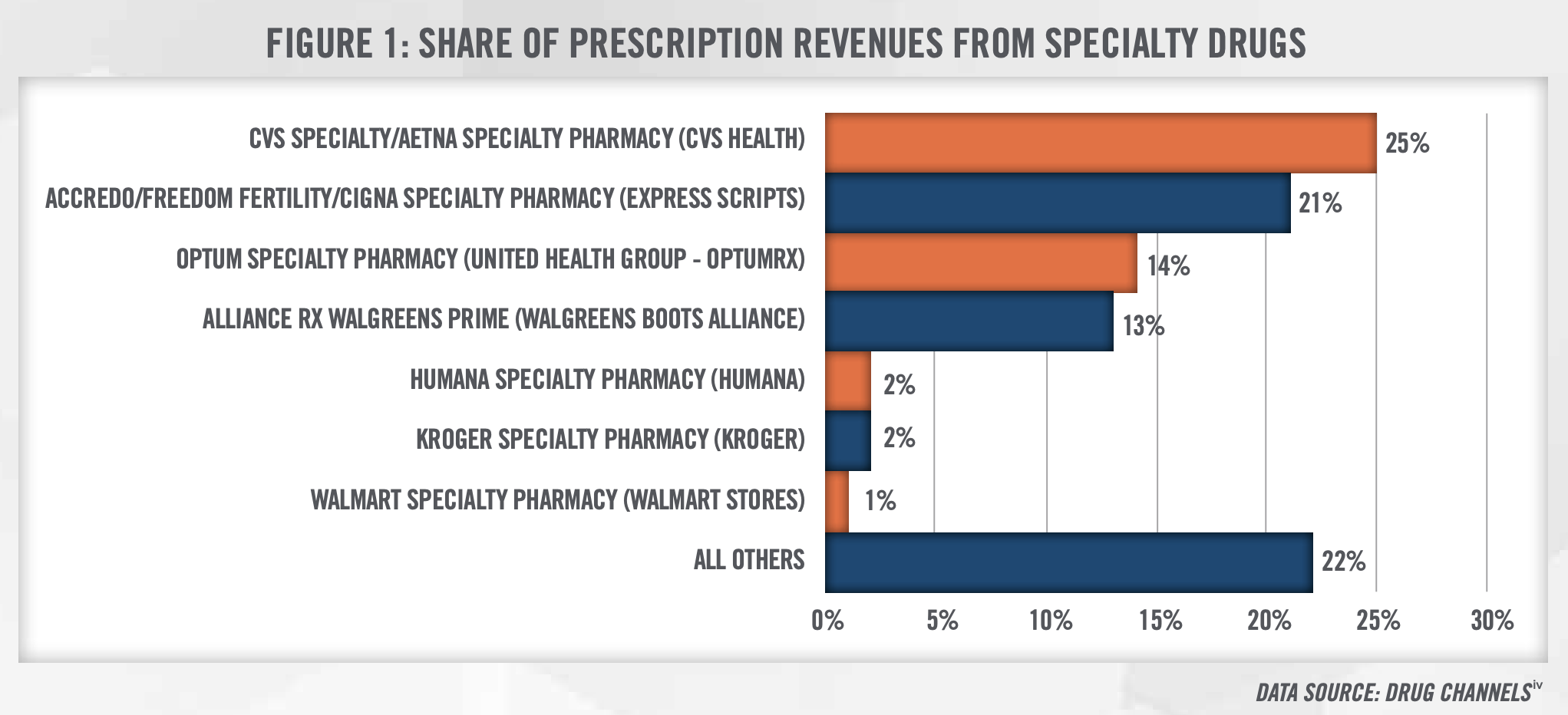

Although there are independent specialty pharmacies, many are owned by a diverse set of organizations such as pharmacy benefit managers (“PBMs”), retail chains, health plans, physician practices, pharmaceutical wholesalers, and hospital systems. Figure 1 outlines the top seven pharmacies measured by specialty drug dispensing revenues in 2018.[iii] According to this data reported by Drug Channels, the top four companies by market share are fully or partly owned by a PBM and account for approximately 73 percent of prescription revenues from pharmacy dispensed specialty drugs.

![]()

![]()

![]()

![]()

![]()

![]()

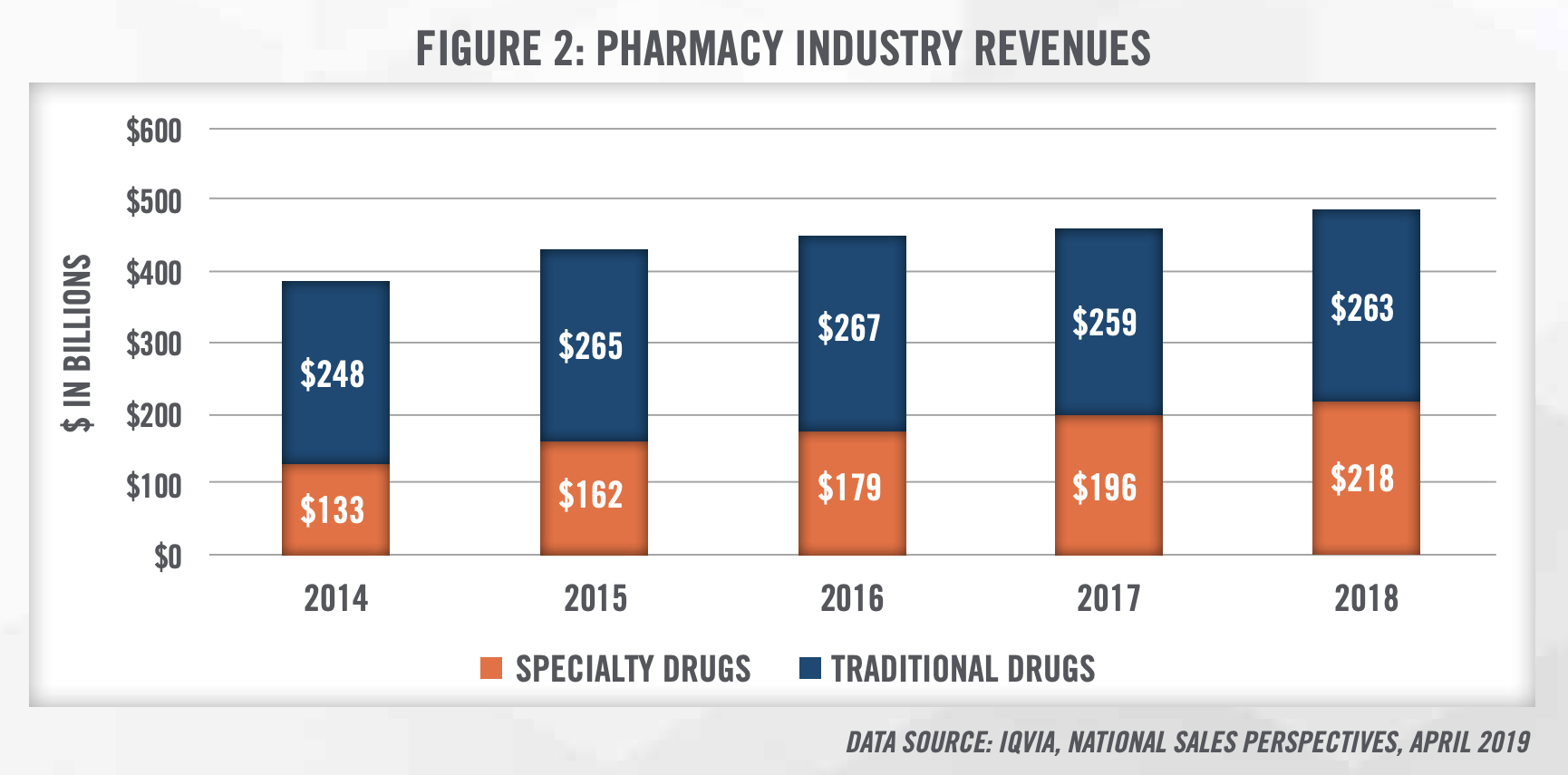

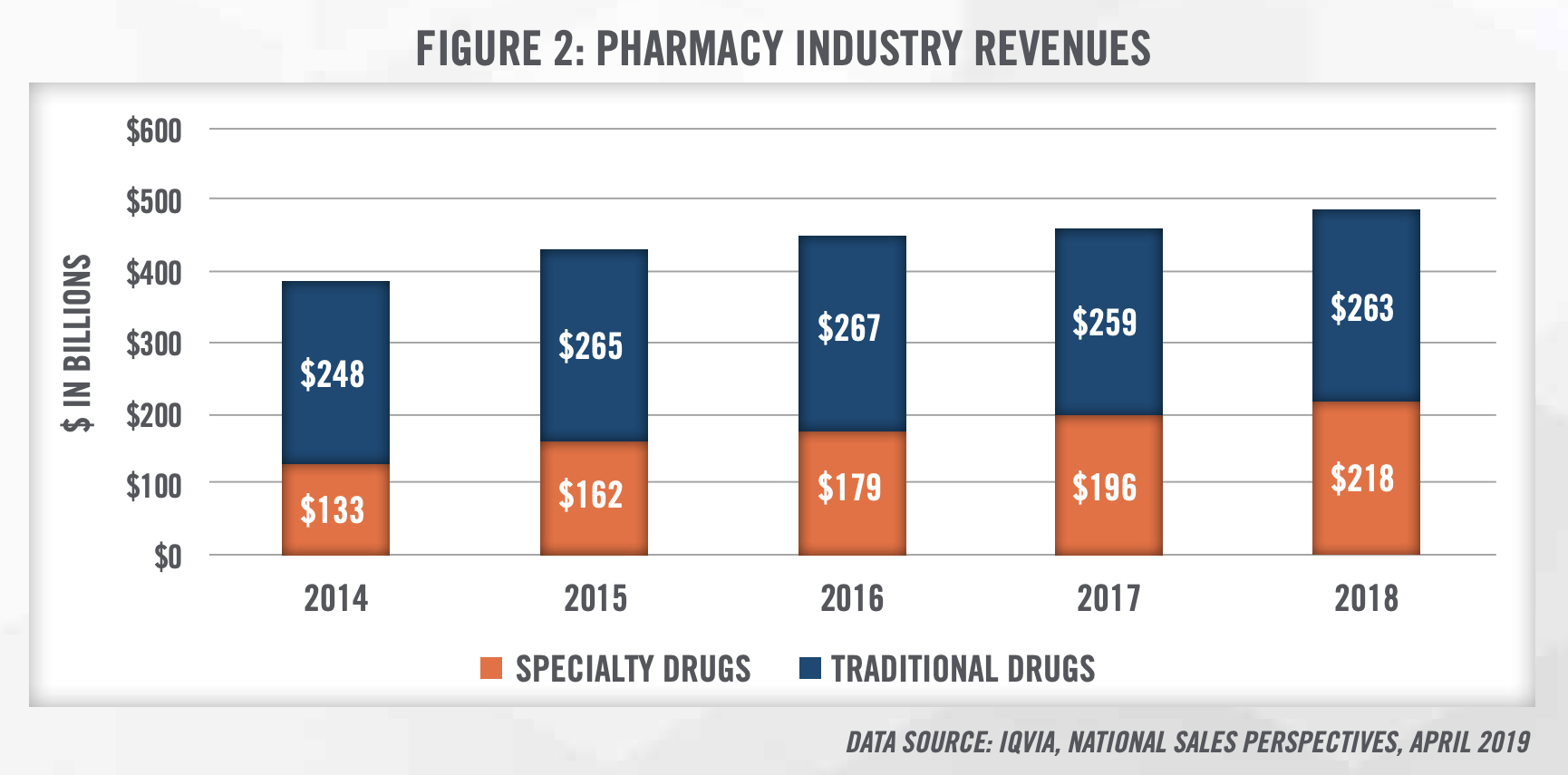

Growth: Growth in revenue for specialty drugs is outpacing the growth in revenue for traditional drugs. According to data from IQVIA, U.S. specialty pharmacy industry revenues have grown from 34.9 percent of the pharmacy industry in 2014 to 45.4 percent in 2018[v] (Figure 2).

Expanding pipeline of specialty drugs: As of 2019, 60 percent of the 508 new drugs awaiting approval from the U.S. Food and Drug Administration (FDA) are specialty drugs.[vi] With the growth of specialty pharmacies correlating to the growth of specialty drugs, this expanding pipeline is a leading indicator of future growth potential for the industry.

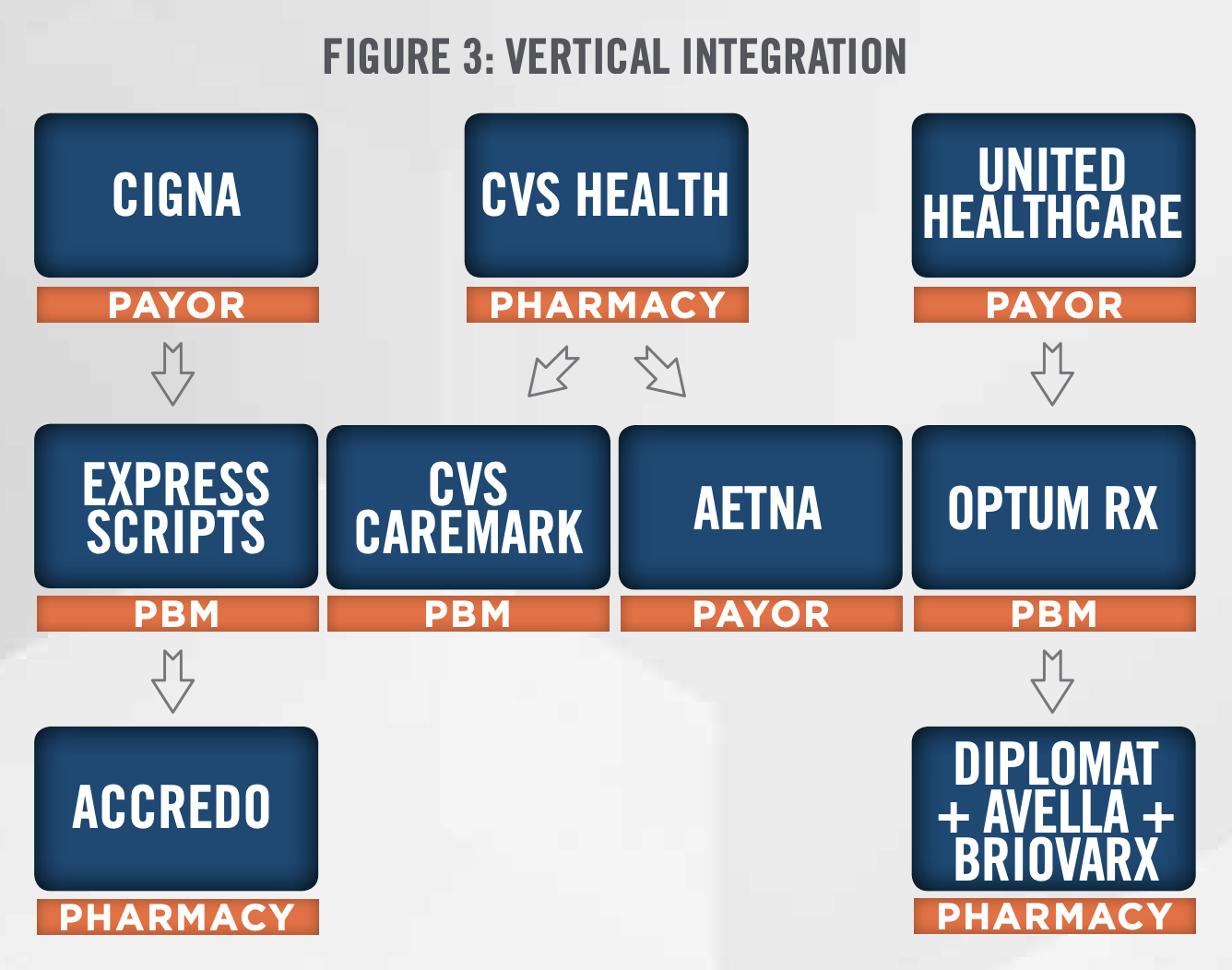

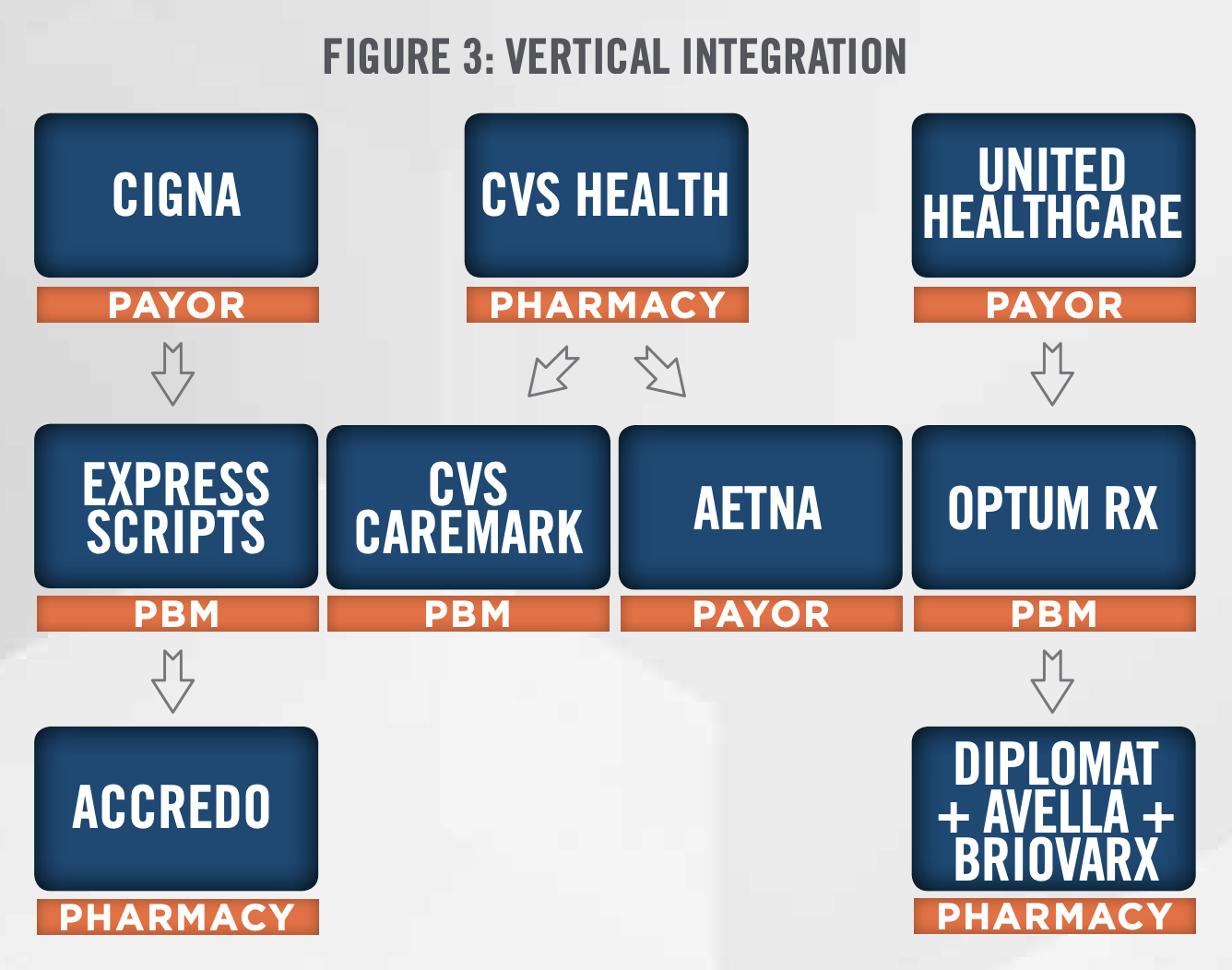

Vertical integration: From Figure 1, we can infer that the market is consolidating in the specialty pharmacy industry as the top four companies account for 70 percent of prescription revenues from pharmacy-dispensed specialty drugs in 2018, a 4 percent increase from 2017.[vii] Consolidation is driven by organizations seeking to deliver coordinated care across the entire patient lifecycle. Cigna’s acquisition of Express Scripts and OptumRx’s acquisitions of Avella Specialty Pharmacy and Diplomat Pharmacy are some recent examples of industry integration and consolidation (Figure 3).

Increasing role of PBMs: PBMs act as intermediaries between insurers and other members of the healthcare industry. PBMs are closely linked to specialty pharmacies as PBMs attempt to improve the quality of healthcare and reduce prescription drug costs. From Figures 1 and 3, we observe the top four specialty pharmacies are all owned or co-owned by PBMs. However, with PBMs now controlling over 70 percent of the market, and as larger companies continue to create vertically integrated systems that are able to control and narrow networks, there have been increasing concerns for independent specialty pharmacies, which are struggling to access specialty medications within payor and PBM networks. This trend was highlighted during a 2019 quarterly earnings call, where Diplomat Pharmacy’s CFO stated that they are observing lower volumes and lower-than-anticipated core specialty contracts due to increased competition by their vertically integrated peers.

Anti-trust and unfair competition: As industry consolidation and integration continue to occur, there may be continued lawsuits brought forth attempting to challenge this market behavior. For example, although unsuccessful in its claim, Prime Aid Pharmacy brought suit against Humana for violations of the Sherman Act by steering patients to its own specialty pharmacy.[viii]

Specialization: Given the increase in competition, smaller specialty pharmacies are focusing on distinguishing themselves so that they can access restricted distribution drugs. Some are underlining a disease-state expertise while others are utilizing a geographic niche by collaborating with regional health systems and insurers.

Dispensing restrictions: The consolidation of the specialty pharmacy industry stems, in large part, from techniques used by manufacturers and payors to narrow specialty drug channels. The number of specialty pharmacies eligible to dispense these costly drugs are limited by the manufacturers, though these actions may be controversial. Additionally, PBMs confine the number of specialty pharmacies selected by the manufacturers by requiring consumers to use the drugstore owned and operated by that PBM.

Oral dosage: Despite the fact that specialty medications have traditionally centered around injectable and infusible formulations, a noteworthy number of specialty drugs in oral dosage forms have recently entered the market. This pattern is expected to continue in the near future and could change the economic and competitive landscapes of the industry.

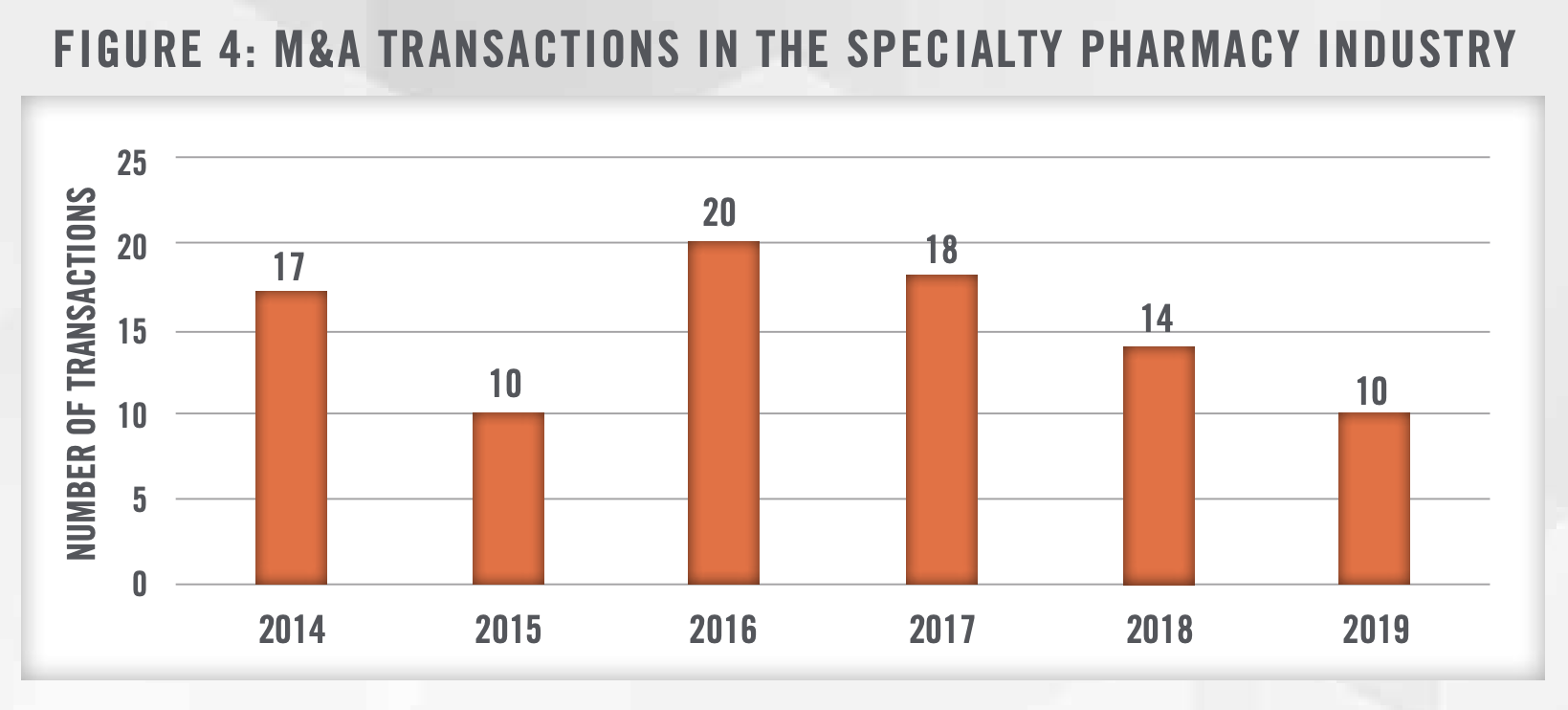

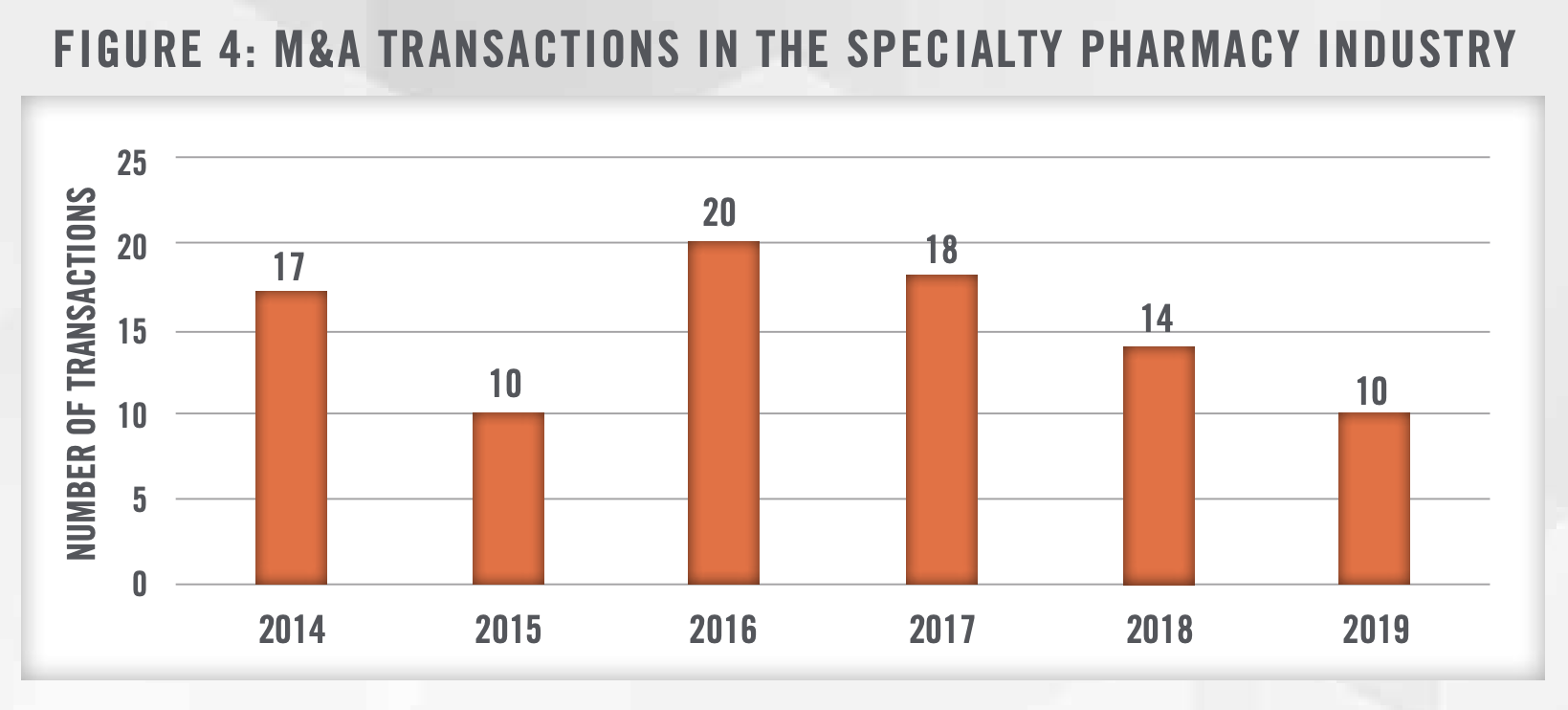

Decreasing transaction activity: According to the Drug Channels Institute analysis of Braff Group data, there has been a slowdown in merger and acquisition activity, from 20 specialty pharmacy transactions in 2016 to 10 transactions in 2019[ix] (Figure 4).

![]()

![]()

![]()

![]()

![]()

![]()

HealthCare Appraisers considers three standard approaches to determine the value of a specialty pharmacy: the Income, Market, and Cost Approaches. The facts and circumstances of the specialty pharmacy should be considered prior to applying the valuation approaches for any particular valuation matter.

Income Approach: The Income Approach generally attempts to quantify the future economic benefits associated explicitly with the operations of the specialty pharmacy. Methodologies under this approach include the Single Period Capitalization Method and Multi-Period Discounted Cash Flow Method. When applying an income approach in valuing a specialty pharmacy, it is important to consider items affecting cash flows, such as access to limited distribution drugs, the regulatory environment, outlook for reimbursement, as well as the diversification risk-profile of a pharmacy that may, for instance, generate a significant portion of its revenue from a few drugs.

Market Approach: The Market Approach provides an indication of value by drawing reference to prices paid in transactions involving similar companies (i.e., Comparative Transaction Method), or for shares in publicly traded companies that provide similar services (i.e., Guideline Public Company Method) as the subject entity being valued.

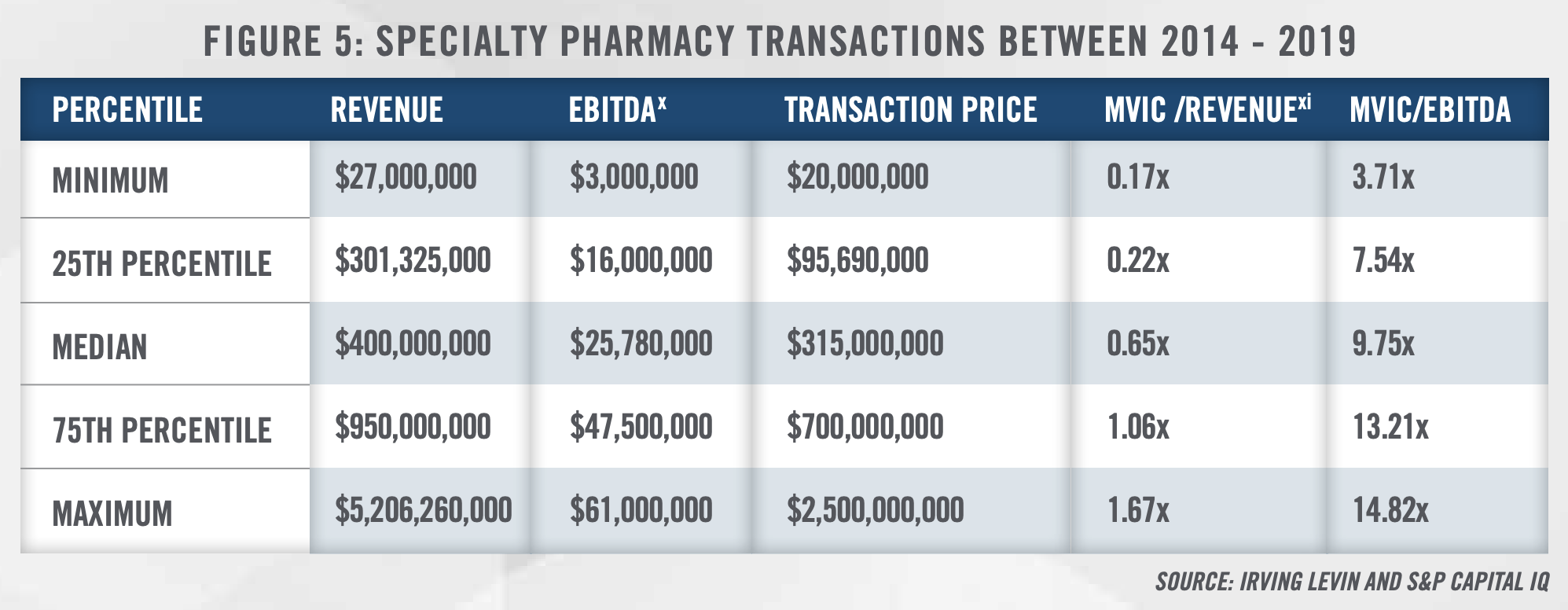

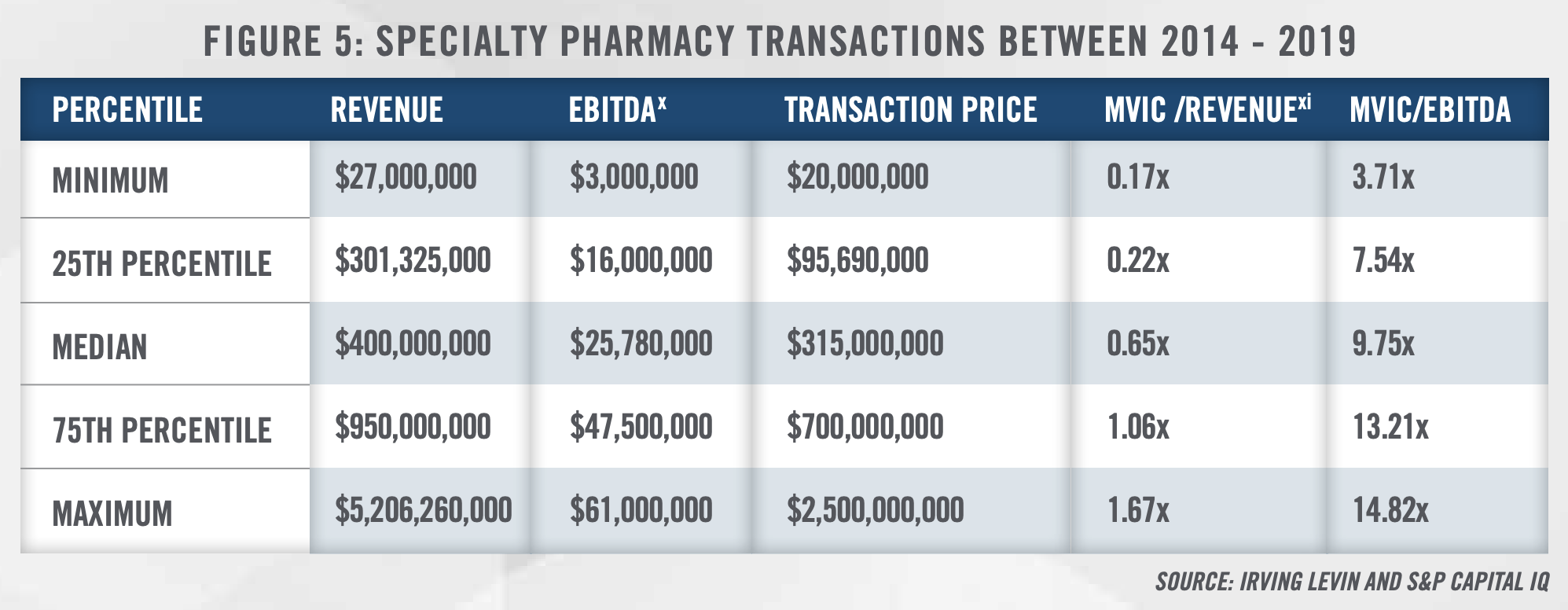

Figure 5 outlines publicly-available valuation multiples for nine specialty pharmacy transactions occurring between 2014 and 2019, in which valuation multiple information surrounding the transactions was made public.

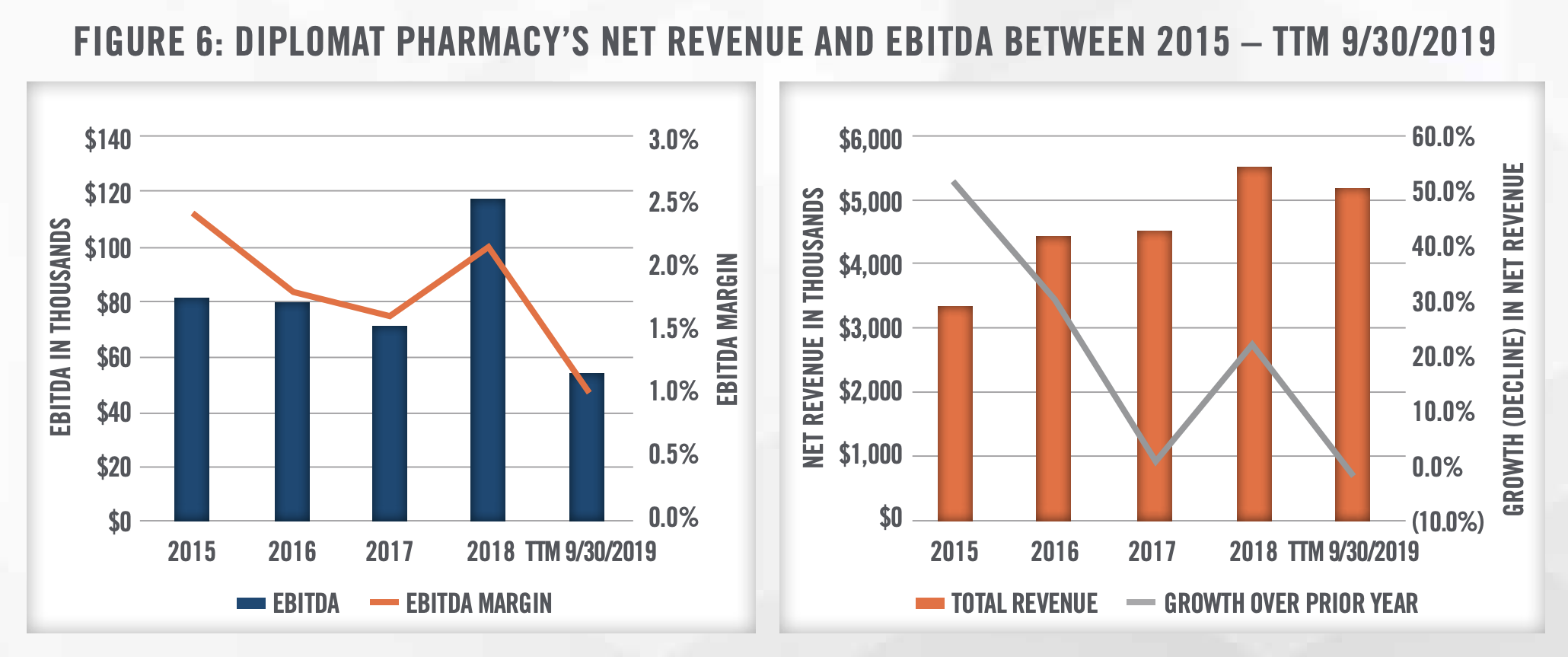

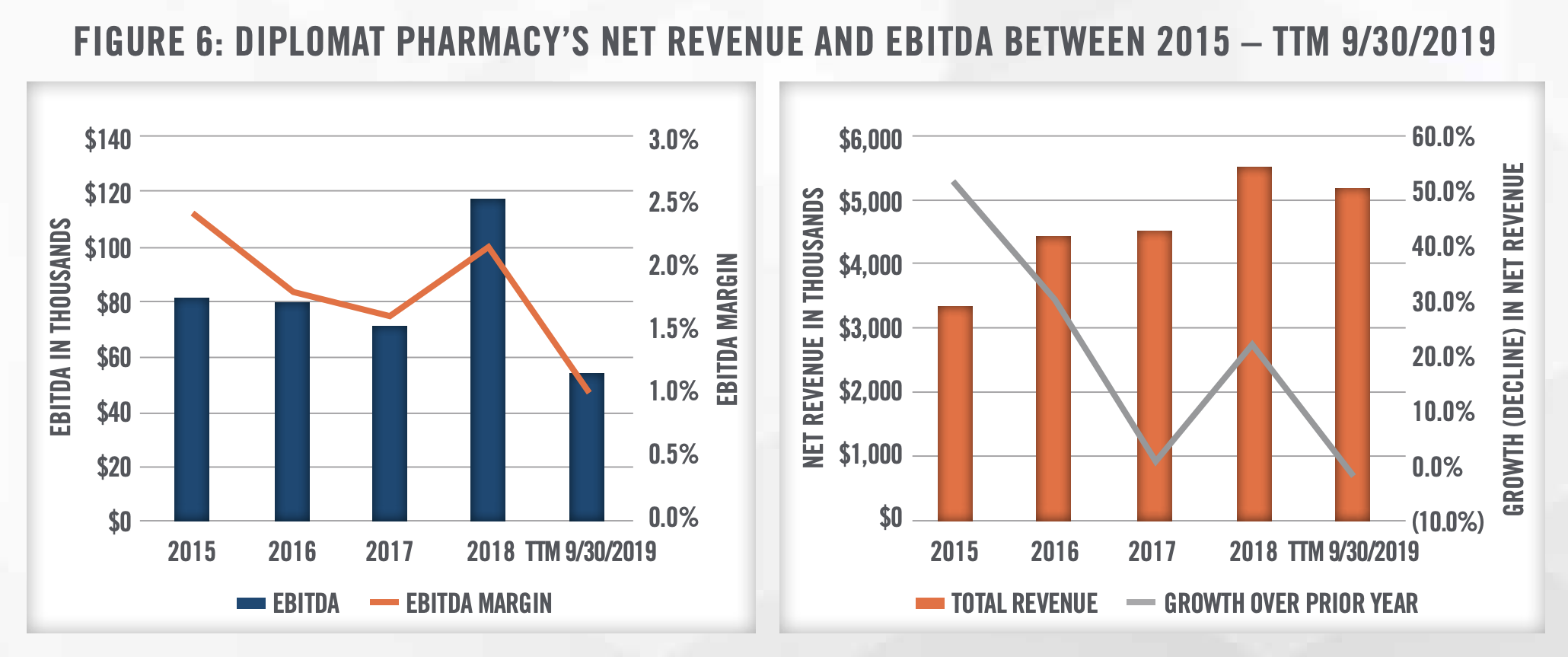

Over the historical period analyzed, MVIC-to-revenue multiples have ranged from 0.17x to over 1.50x. MVIC-to-EBITDA multiples are also dispersed across a wide range, from less than 4.0x to over 14.0x during the historical period analyzed. The importance of carefully selecting companies and transactions that are appropriate for comparison and application to a subject entity was highlighted with OptumRx’s acquisition of Diplomat Pharmacy. On Monday December 9, 2019, the agreed upon acquisition price of $4.00 per share was 31 percent less than where the stock closed the preceding Friday. The previous month, Diplomat Pharmacy communicated it lost one of its largest revenue sources, and had substantial doubt that the company could remain solvent.[xii] While a stock taken private for less than what it is trading at is a rare occurrence, this example emphasizes the fact that an appraiser needs to understand the unique circumstances a company may be facing. When considering the MVIC-to-EBITDA multiple of nearly 15.0x for the Diplomat Pharmacy transaction, it is important for an appraiser to analyze the company-specific and market factors prior to considering its use in a market approach. As illustrated in Figure 6, Diplomat Pharmacy’s declining revenue and depressed EBITDA both quantitatively painted signs of distress prior to the announcement of the acquisition in late 2019.

Cost Approach: The Cost Approach calculates a business’s equity value as the fair market value of its assets less the fair market value of its liabilities. Given that specialty pharmacies are not capital-intensive businesses, this approach is seldom used for a pharmacy generating positive cash flow, as the approach does not assign any value to the future economic benefits that a specialty pharmacy is expected to generate.

![]()

![]()

![]()

![]()

![]()

![]()

The specialty pharmacy sector continues to evolve, as opportunities and threats to the industry continue to drive transaction activity. When valuing specialty pharmacies, it is important to consider the many areas that may have an impact on specialty pharmacy operations. If you are considering buying or selling a specialty pharmacy, contact the valuation experts at HealthCare Appraisers to discuss how our valuation and consulting services can help facilitate your transaction.

[i] IQVIA, Medicine Use and Spending in the U.S., last accessed April 14, 2020 from: https://www.iqvia.com/insights/the-iqvia-institute/reports/medicineuse-and-spending-in-the-us-a-review-of-2018-and-outlook-to-2023

[ii] Centers for Medicare & Medicaid Services, last accessed April 14, 2020 from: https://www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/Downloads/Announcement2019.pdf

[iii] As of 2018 Diplomat Pharmacy was an independent company, however given it is currently a part of Optum, we have included Diplomat Pharmacy in the total for Optum in this Figure

[iv] Drug Channels Institute: The Top 15 Specialty Pharmacies of 2018: PBMs Keep Winning, last accessed April 14, 2020 from: https://www.drugchannels.net/2019/04/the-top-15-specialty-pharmacies-of-2018.html

[v] Specialty Pharmacy Industry Outlook: What’s Next?, last accessed April 14, 2020 from: http://drugchannelsinstitute.com/files/Fein-Gill-LongAsembia2019-FINAL.pdf

[vi] CSI Specialty Group: 2019 State of Specialty Pharmacy Report, last accessed April 14, 2020 from: https://academynet.com/sites/default/files/csi2019spreport.pdf

[vii] Drug Channels Institute: The Top 15 Specialty Pharmacies of 2017, last accessed April 14, 2020 from: https://www.drugchannels.net/2018/03/the-top-15-specialty-pharmacies-of-2017.html

[viii] Specialty Pharmacy’s Antitrust Claim against Humana Fails, Baker Donelson Insurance Antitrust Newsletter, August 31, 2017, last accessed May 19, 2020

https://www.bakerdonelson.com/new-jersey-specialty-pharmacys-antitrust-claim-against-humana-fails

[ix] Drug Channels Institute: Specialty Pharmacy M&A in 2019, last accessed on April 14, 2020 from: https://www.drugchannels.net/2020/02/specialtypharmacy-m-in-2019-cvs.html

[x] Earnings before interest, taxes, depreciation, and amortization

[xi] Market Value of Invested Capital, or “MVIC,” is defined as the market value of common equity plus carrying value of preferred stock, long-term debt (including current portion, and notes payable.

[xii] Nagel, Kurt, UnitedHealth to acquire Flint-based Diplomat Pharmacy in $300 million deal, Crain’s Detroit Business, December 9, 2019, last accessed May 19, 2020: https://www.crainsdetroit.com/health-care/unitedhealth-acquire-flint-based-diplomat-pharmacy-300-million-deal