The home care sector, which includes Medicare-certified home health, hospice, personal care, and other specialty providers, represents an attractive investment opportunity for financial and strategic acquirers, despite certain headwinds facing the sector. While the space continues to benefit from aging demographics and the shift to value-based care, several factors, including higher interest rates, reimbursement headwinds, and staffing shortages, have cooled the M&A market. This article provides background information on many of the home care business models we work with, and provides insight into the main factors impacting the market.

![]() BACKGROUND

BACKGROUND

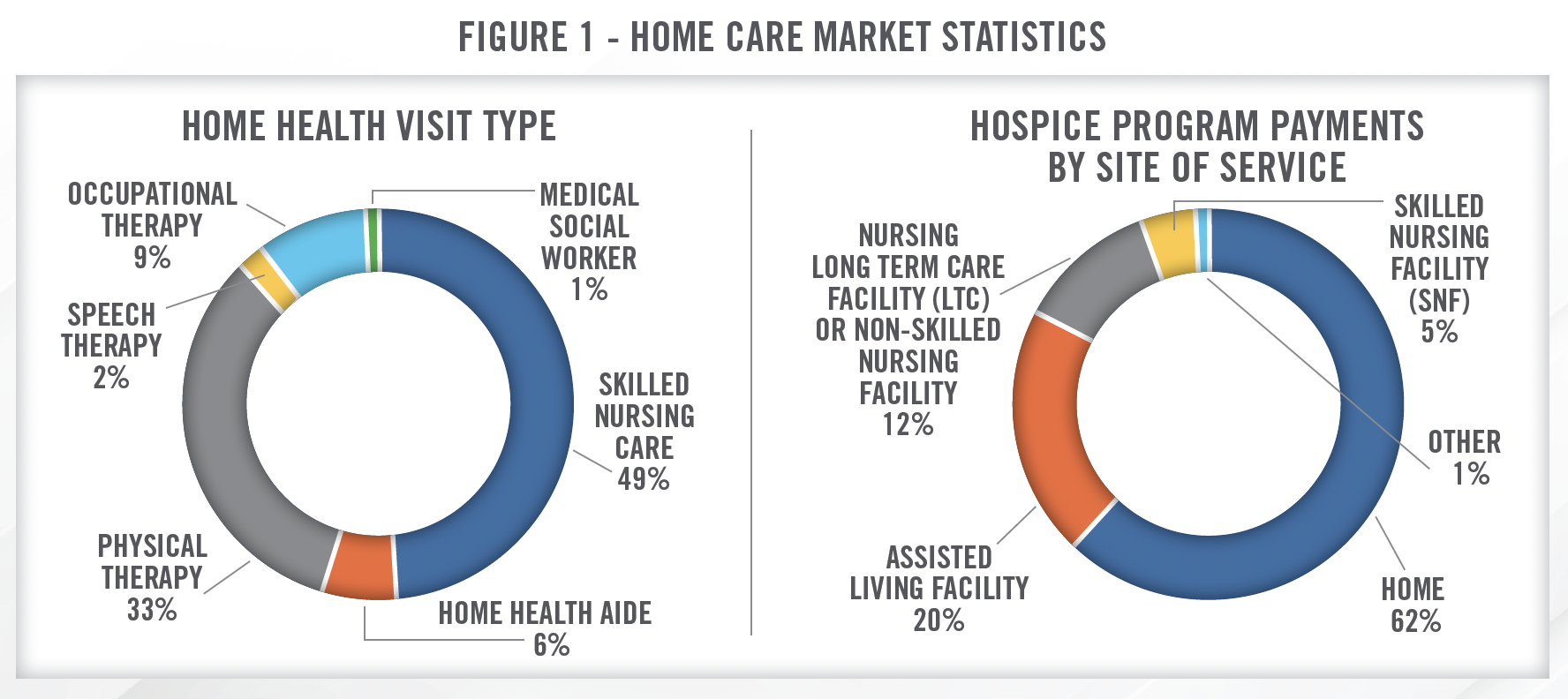

Home healthcare is the provision of medical care in the patient’s home following an injury or illness. The patient’s “home” can range from personal residence, skilled nursing facility, assisted living community, or wherever the patient calls home. Common home healthcare services include patient monitoring, medication management, assessing patient falls, palliative care, identifying diet and nutritional deficiencies, observing mental health, patient education, and functional support such as dressing and feeding patients. In order to qualify for Medicare reimbursement for home health services, the patient must be unable to leave their home without considerable effort, and must require part-time or intermittent skilled care, as certified by a physician. Hospice is a type of healthcare that provides comfort to patients with a prognosis of less than six months to live. In many cases, hospice is provided in a home setting as a type of home healthcare. Personal care is defined more broadly, and may include medical and non-medical care provided in the home, can be provided by a wide range of healthcare professionals, and is reimbursed under a number of different models including Medicaid, private insurance, and cash pay.

Home healthcare agencies engage a variety of providers and non-providers, including nurses, therapists, and social workers, with care coordinated with the patient’s physician. Hospice care, on the other hand, is provided through many of the same types of providers as home health but can also include religious or spiritual counselors and bereavement specialists. Hospice care can also include services outside of traditional medicine, including animal and music therapy. Personal care can be provided by family members or caregivers employed by a personal care agency.

![]() SIZE OF THE MARKET

SIZE OF THE MARKET

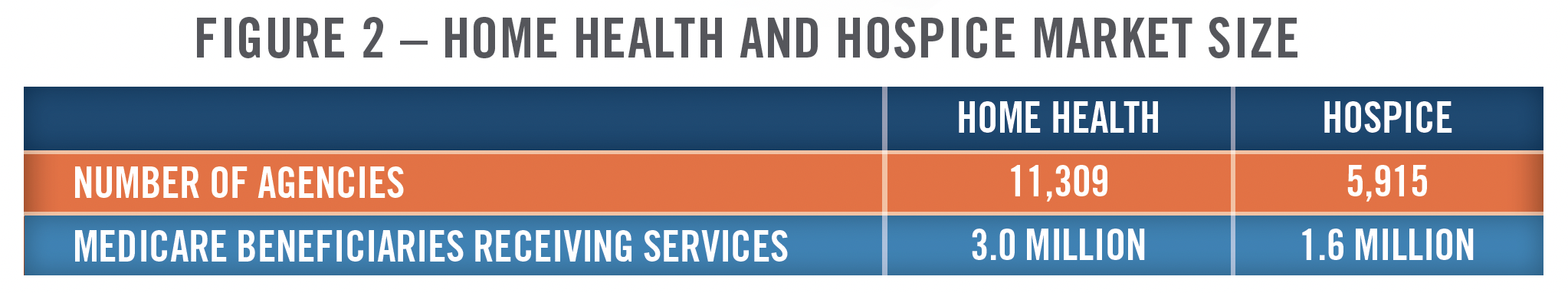

As of 2021, the most recently reported CMS data, there were approximately 3 million Medicare beneficiaries receiving home healthcare services, and 1.7 million Medicare beneficiaries receiving hospice services. There are approximately 11,300 Medicare certified home health agencies and 5,900 hospice agencies in the United States, as presented in Figure 2.[1]

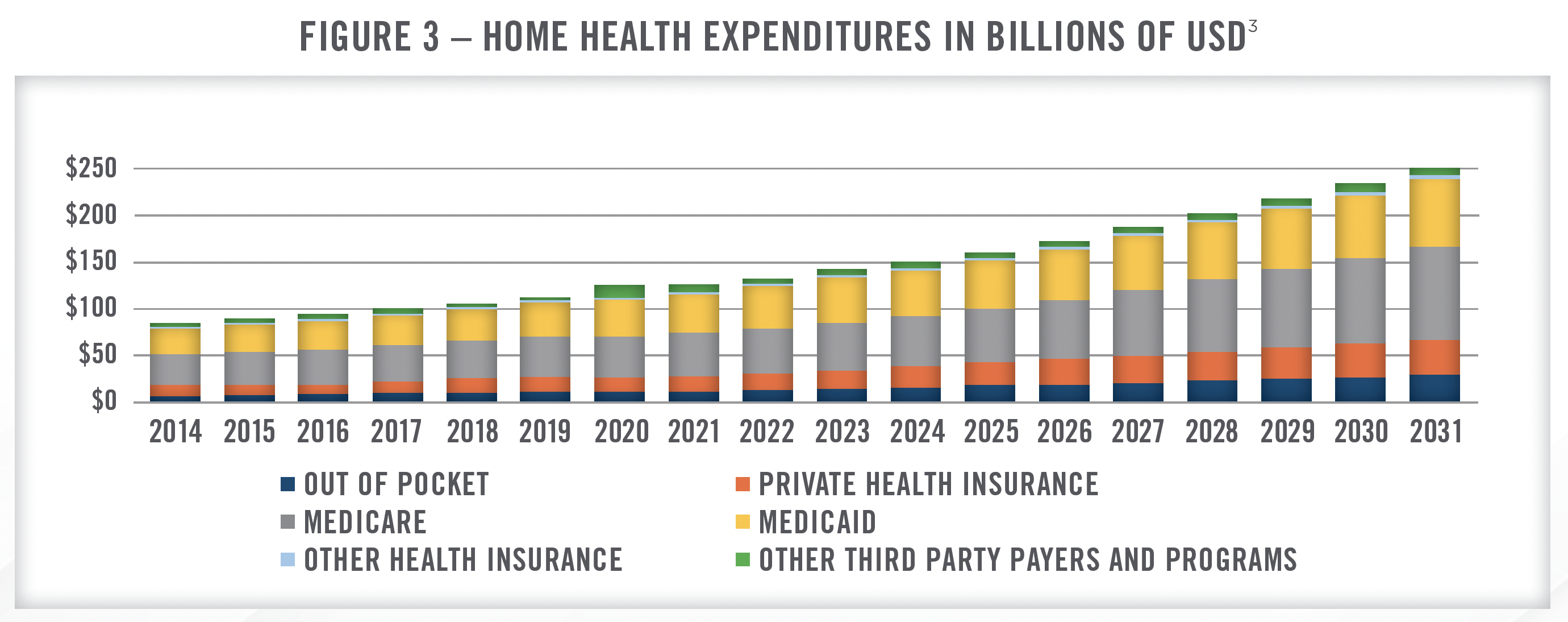

According to CMS, total expenditures for home healthcare in 2021 was $125.[2] billion.2 Home healthcare expenditures had been increasing at a rate of approximately four to five percent per year from 2014 through 2019. In 2020, expenditures increased approximately 11 percent, but remained flat in 2021. The large increase in 2020 was related to COVID-19 as patients preferred to avoid long-term care and other healthcare facilities, which were often the source of outbreaks. Figure 3 presents home health expenditures from 2014 through 2021, as well as projected expenditures through 2031. CMS projects annual increases ranging from 6 percent to 8 percent for home healthcare expenditures through 2031.

There are many growth drivers impacting the increase in home healthcare expenditures in the United States. Major factors include the aging population, the shift to value-based care and recognition by providers and payors that home healthcare can help reduce readmissions, and the overall push to control costs within the healthcare system. In particular, home healthcare is increasingly being utilized to keep elderly patients in their homes as opposed to assisted-living communities. Home healthcare providers are also being used as an alternative to, or an extender of, primary care physicians, and this trend is expected to accelerate as the shortage of primary care physicians is anticipated to worsen in the coming years.[4]

![]() REIMBURSEMENT

REIMBURSEMENT

Home Health

Beginning in 2020, the implementation of Patient-Driven Groupings Model (“PDGM”) significantly altered how home healthcare services are reimbursed. Under this payment model, the number of payment groupings increased from 153 to 432 and are classified based on episode timing, referral source, clinical category, functional/cognitive level, and presence of comorbidities. CMS also eliminated the Request for Anticipated Payment (“RAP”) for new providers in 2020 and for existing providers in 2021. It had been foreseen that the increasing complexity of the payment model, as well as cash flow issues arising from the RAP phase out, would lead to increasing consolidation within the industry; although, thus far, this has not come to fruition. Instead, ongoing uncertainty surrounding pay cuts from CMS and headwinds associated with Medicare Advantage (“MA”) reimbursement have hung over the M&A markets and led to fewer transactions.

In addition to PDGM, CMS recently implemented the nationwide rollout of the Home Health Value-Based Purchasing (“HHVBP”) Model, which applies an adjustment to home health agencies’ reimbursement based on certain quality metrics. The quality metrics include measurements related to mobility, self care, improvements in breathing, improving medication management, various hospital utilization metrics, and patient satisfaction surveys. HHVBP has been tested in several states in recent years and the nationwide rollout took effect in 2023. Under the model, all agencies are eligible for an adjustment of up to 5 percent (positive or negative) based on their performance relative to the benchmarks discussed herein. Given that the program was only recently implemented nationally, there is no data yet regarding outcomes[5], but during the testing phase in the first nine states[6], CMS reported that the program generated average annual savings of $141 million and quality scores generally improved.[7] Our work in the space suggests providers are still learning how to optimize care under the model, but larger providers are likely better able to adjust operationally in order to benefit from the payment system.

The 2024 final rule for home health included a 0.8 percent increase in reimbursement, which, given the inflationary environment in recent years, was met with significant pushback from operators in the space. The final rule was less detrimental than the initial proposed rule, which included a 2.2 percent cut to reimbursement. For multiple years in a row, CMS has proposed significant cuts to reimbursement in the proposed rule and then finalized less severe cuts or slight increases in the final rule. This uncertainty hanging over the industry has created difficulty for operators and created headwinds to M&A activity.

CMS finalized a permanent adjustment cut that will result in a negative 2.6 percent impact, offset by a positive market basket update of 3.3 percent. After productivity adjustments and fixed dollar loss ratio adjustments, the result is a positive 0.8 percent versus the proposed negative 2.2 percent. The continued march of these cuts where the home health community does not know what to expect from Medicare year after year is not helpful in creating a stable home health landscape.

Over the past few months, we have continued to see limited strategic opportunities in both personal care and home health due to the reimbursement uncertainty that exists in each of these segments. As we have more clarity around these particular issues, we believe that we will start to see increasing acquisition opportunities in these segments that will meet our strategic objectives.

In addition to headwinds from CMS reimbursement, many home health operators struggle to achieve favorable reimbursement rates from MA plans. The market for home health remains highly fragmented, and the lack of scale in geographic markets makes it difficult for operators to negotiate with MA plans. Unlike many types of providers, including hospitals and dialysis clinics, which operate in consolidated markets where MA plans pay similar rates to Medicare fee-for-service (“FFS”), in home health, MA rates are typically lower than Medicare FFS. Several large operators in the space have publicly discussed canceling contracts with MA plans and focusing on providing care to patients with Medicare FFS or other payor arrangements. Recent studies suggest that some patients with MA plans may receive fewer visits and have worse functional outcomes compared to Medicare FFS patients.[8] We also believe several of the large transactions in the space, including LHC Group and Amedisys[9] being acquired by UnitedHealth Group’s Optum, have been driven at least in part by MA related headwinds.

And for those plans that continue to view us simply as a cheap per visit provider and won’t recognize that labor inflation is real and try to simply cram lower rates and lower utilization on us, we will no longer be working with them. We just can’t afford to. We have a finite amount of clinical capacity, and we must be paid in a manner that allows us to provide quality of care with the excellent outcomes Amedisys is known for. If plans do not want to partner with us on reasonable terms, we will have to cancel contracts and [shift] our capacity to our strategic partners who value our results.

![]() HOSPICE

HOSPICE

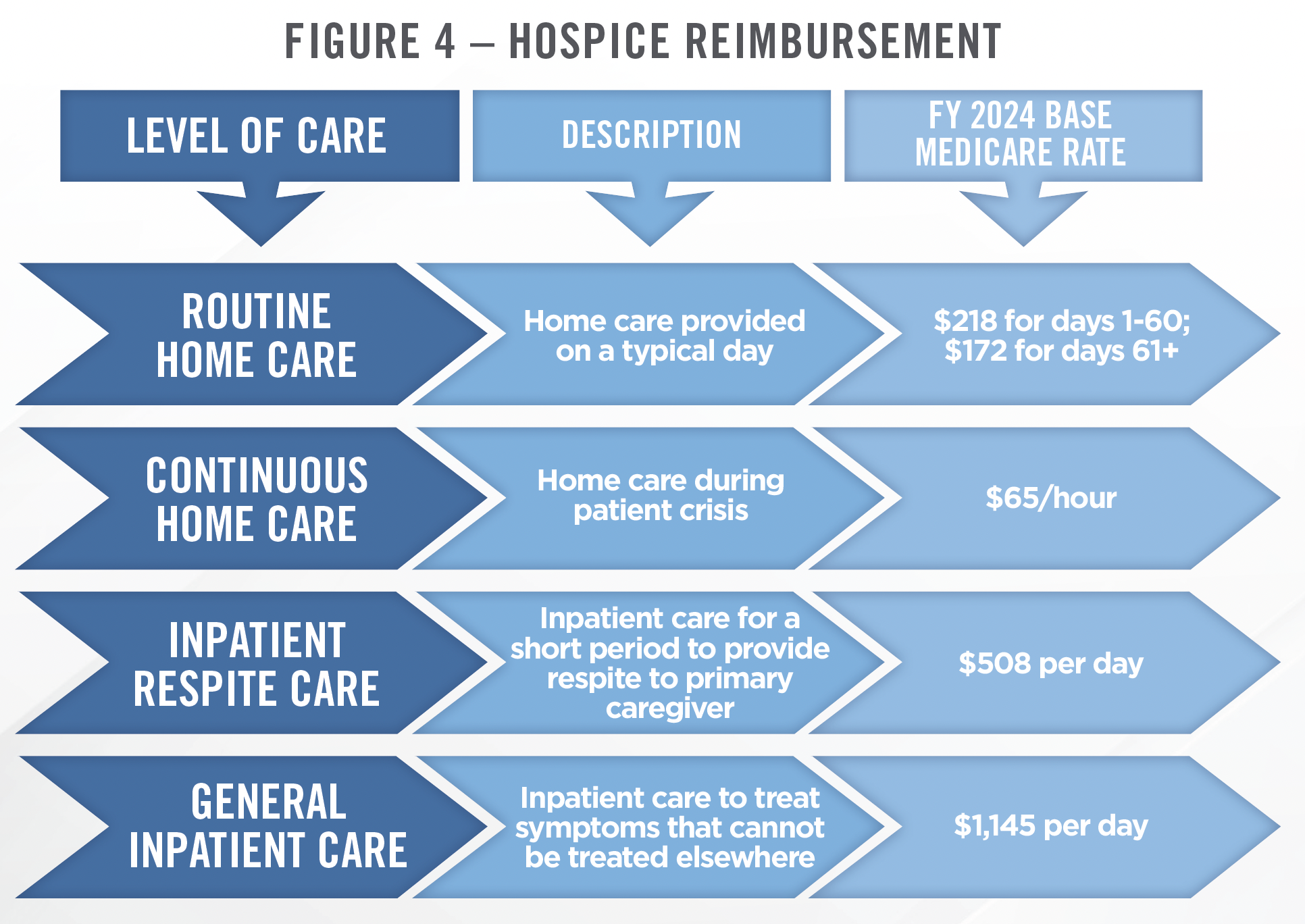

Hospice reimbursement is based on a daily payment rate that is determined according to a fee schedule depending on the level of care provided. There are four levels of care that can be provided under the hospice Medicare benefit, each with its own payment rate. The most common is routine home care, which accounts for 98 percent of all hospice days and has a 2024 payment rate of $218 per day for the first 60 days, and $172 per day thereafter. The four levels of care and the associated base payment rates are presented in Figure 4.[10] The base rates are then adjusted to reflect different labor costs in different geographic locations throughout the United States. There is a cap on aggregate hospice payments per patient, which, for FY 2024, is $33,494. Payments exceeding this cap can result in claw backs by CMS in subsequent years. CMS’s 2024 final rule resulted in a 3.1 percent increase in total payments to hospice providers.

![]() PERSONAL CARE

PERSONAL CARE

Reimbursement for personal care services varies from state to state and can be paid for by Medicaid, MA, private insurance, or cash pay patients. Many state Medicaid plans reimburse for personal care services through a time-based payment method. This is typically an hourly rate, and can range from less than $20 to more than $30 per hour. A few states reimburse on a per day or per visit basis.[11]

In April of 2023, CMS proposed the Ensuring Access to Medicaid Services proposed rule. Among other provisions, the rule would require 80 percent of Medicaid payments for personal care, home health aide, and home maker services be spent on compensation for the direct care workforce. This would leave the remaining 20 percent of the payment to cover overhead expenses and profit of the provider. We note that several states already have similar rules in place, but the CMS rule would apply nationally.[12] While the rule appears to be on track to be finalized, the exact contents of the final rule have not been publicized and could contain different terms from the proposal. Assuming there is an 80 percent passthrough requirement, we believe it could catalyze a period of consolidation, as providers with scale will have the ability to spread a larger revenue base over their fixed cost structure. The following quote illustrates how operators in the space are thinking about the new rule.

Let me provide you with some thoughts related to the Medicaid Access Proposed Rule that was introduced last year. Many comments were submitted expressing concern towards the proposed 80 percent compensation requirement to be implemented by states within a 4-year period. A final rule concerning this issue was sent to The Office of Management and Budget on January 26 for their review and clearance. Based on this timing, we feel that the rule is on track to be finalized in April of this year [2024]. The contents of the final rules are unknown at this time and could be significantly different than the proposed rule. While we aren’t sure whether this rule will contain the 80 percent requirement, a different percentage requirement, or ultimately be implemented, we would not be surprised to see the four-year implementation period extended. We do believe that a key for personal care providers to be successful with any minimum requirement for direct wages is to have scale in each state in which they provide care. This will not only allow those providers to spread their costs over a larger revenue base, but also will provide more opportunity for meaningful patient advocacy within the state in which they operate.

![]() OUTLOOK

OUTLOOK

Higher Acuity Care

Recent improvements in technology and care provision standards have enabled home health providers to admit higher acuity patients. The largest operators in the space have focused on initiatives including “agingin- place,” “hospital-at-home,” and “SNF-at-home” models involving caring for higher acuity patients in the home setting. The increasing prevalence of value-based care arrangements and the rapid growth of MA, are expected to contribute to an acceleration of these trends. A recent example is Amedisys’ acquisition of Contessa Health in June of 2021 for 3.9x LTM revenue, which significantly expanded Amedisys’ footprint in the hospital-at-home, SNF-at-home, and palliative care space. This transaction, and the ability to provide care to higher acuity patients, increases the total addressable market for Amedisys (and other home health providers) from $44 billion to $73 billion.[13] There has also been a push to provide more dialysis in the home, which could provide an additional avenue for growth for home health companies. For more information on home dialysis, and the dialysis industry overall, lookout for our forthcoming Industry Outlook article on the dialysis and kidney care industry.

Recent studies of hospital-at-home programs suggest the care model is effective and many operators believe we are approaching a tipping point of adoption. Specifically, one study of hospital-at-home patients showed relatively few patients were transferred to the hospital[14], while another showed patients were less likely to experience delirium at the home than in the hospital.[15] CMS’s Acute Hospital Care at Home waiver, which started under COVID, has been extended through 2024, and market participants expect another extension through 2025. As of the date of this publication, there are 312 hospitals across 131 health systems that have been approved to participate in the program. There is also proposed legislation (the HOME Services Act) that would expand the scope of services that can be offered through hospitalat- home models to include patients under observational status.

We have observed multiple hospital-at-home models and continue to see interest in the space from operators and investors. The growth and success of Contessa’s joint venture model, and recent improvements in technology, point toward continued expansion of these services, particularly in connection with value-based care arrangements. In addition to the joint venture model, there are hospital-at-home companies, like Medically Home, that enable hospitals and home care providers to implement hospital-athome programs through the use of licensed technology and other services. The lack of long-term clarity on the regulatory environment remains a key risk for operators in the sector, although the continued extension of the CMS waiver and proposed HOME Services Act serve as an indication that the models are here to stay. The ability to find nurses to care for patients in these arrangements remains a challenge, and, in our experience, operators typically recruit nurses with hospital-based work experience due to the requirements of the role. The need for a rapid response network (including 30-minute call response time) requires providers to place a premium on nursing. Utilizing virtual visits has been, and will continue to be, critical to growth of hospital-at-home arrangements, as is the use of social workers. Thus far, more than 100 hospital DRGs are covered by MA plans for hospital-at-home. The most common conditions treated under the CMS Waiver have been respiratory infection, heart failure and shock, and severe sepsis or septicemia, all with a comorbidity or severe complication.[16] An example of a hospital-at-home joint venture model is presented in the following infographic.

Staffing Shortage, Access to Care, and Telehealth

As with many other healthcare sectors, home health companies have struggled with recruiting and retaining nurses, resulting in a shortage of providers and higher costs to provide care. The rise of travel nursing and contract labor, burnout resulting from COVID-19 and other work-related stress, and providers seeking more flexibility and work-life balance, have contributed to the shortage. The shortage of providers leads to a higher reliance on contract labor, which typically is more expensive compared to the cost of employed clinicians. In the hospice space specifically, clinical staff turnover and job vacancies reached elevated levels in 2022 and 2023, leading to a record high rejection rate of 41 percent among hospices.[17] While many of the companies we work with indicate that the staffing situation has improved in recent quarters, reducing turnover and securing adequate supply of clinicians will continue to be a focus for home health providers in the coming years.

In addition to staffing shortages, other factors can contribute to lack of access to care. One factor that influences the availability of home health and hospice services is certificate of need (“CON”) requirements of the state. Based on our analysis of data from CMS, there is a correlation between states where home health and hospice services are regulated by CON laws, and the ratio of Medicare enrollees per agency in that state. For example, when looking at the 10 states with the highest number of enrollees per agency (i.e., less care available per enrollee), 8 have CON laws regulating home health and/or hospice. Conversely, the 10 states with lowest number of enrollees per agency (i.e., more care available per enrollee), 7 have no CON laws regulating home health or hospice, 1 regulates hospice only, and 2 have CON laws pertaining to home health.[18] While this analysis does not account for the size of the agency, this analysis suggests that CON laws, which create barriers to entry for regulated services, has limited the number of agencies per enrollee. The following maps illustrate the relationship between CON regulations and availability of care, with blue states on the CON map encompassing more of the darker blue on the availability of care map. Overall, there are 16 states and the District of Columbia which have CON laws regulating home health and hospice, as well as Florida, which regulates hospice only. Valuation multiples in these states also tend to be higher due to the lesser supply and competition.

Telehealth has played a role in reshaping the home health landscape as providers increase their use of technology to provide better care for patients at lower costs. Some of the most common applications of telehealth in the home health space include patient monitoring, medication management, image sharing technology, mobile apps for telehealth consultations with providers, and population health.[19] The ability to provide these services to patients in their homes without sending a provider to the patient represents a significant opportunity for home health agencies to reach more patients, particularly in rural areas or markets with a material shortage of providers. Similarly, with recent Medicare expansions in reimbursement for telehealth services,[20] home health will increase in prominence as part of the continuum of care after discharge. CMS has made permanent some of the changes to telehealth regulations that were put in place during the pandemic, which should enable continued growth of telehealth services within the home health space. Given the steep Medicare penalties associated with patient readmissions, we have observed many health systems utilize home health as a means to treat patients before they require hospital care. Providers are combining chronic care management with remote patient monitoring to provide costeffective treatment to patients with ongoing serious health conditions. Examples abound of increasing adoption (including among physicians) of remote monitoring devices in the patient’s home in order to improve care.[21]

PACE and Other Specialty Models

We have observed increased interest in the Programs of All-Inclusive Care for the Elderly (“PACE”) program in recent years. PACE is a capitated payment model for dual eligibles that covers both Medicaid and Medicare services for those individuals that enroll in the program. The program provides comprehensive care through a number of providers, but typically includes a substantial home health component, as the goal is to enable the patients to stay in the home as long as possible. There are 159 PACE organizations operating in 32 states, and more than 72,000 individuals are enrolled in the program, up from 35,000 in 2015.[22] Most PACE providers are nonprofit organizations, but InnovAge (Nasdaq: INNV) is one of the larger, for-profit providers in the space. While the program remains relatively small, InnovAge estimates the addressable market to be 2.2 million lives and $235 billion in revenue, and projects the market will grow to approximately 200,000 participants by 2028.[23]

There continues to be significant activity in the in-home physician services space as well. Many of these providers incorporate APPs, home health, and personal care to provide a high touch care model that manages chronic disease and reduces hospitalizations. These groups work with Medicare Advantage, Medicaid, and other value-focused payors. In some models, the provider is sub-capitated beneath the MA plan, while other models involve shared savings/losses or other risk arrangements. Many of the providers we work with in the space emphasize the need to bring as much care as possible under the primary care umbrella and refer patients to specialized settings as needed.

Behavioral home health represents a growing subsector within the home health space, with many operators focused on providing substance abuse, depression, anxiety, and other forms of clinical care in the patient’s home. These providers typically utilize high touch care models and rely on telehealth as well. Types of care provided include psychiatric evaluations, physical assessments, medication management, counseling, patient and family member/care giver education, care coordination, as well as others. With growing focus on behavioral health and the recognition of its contribution to overall patient and population health, we expect this area to continue to generate interest and activity in the coming years.

Consolidation and Value-Based Care

Consolidation activity in the home health sector in recent years has been characterized by large platform transactions, the largest of which were acquired by payors or “payviders.” UnitedHealth Group, through its Optum subsidiary, acquired LHC Group and is in the process of acquiring Amedisys, which would make it the largest home health provider in the country with approximately 10 percent market share. CVS, which owns Aetna, acquired Signify Health, and Humana remains active in building its home health and senior primary care business.

Much of this acquisition activity by large insurance companies is driven by value-based care strategies, particularly in the MA space. UnitedHealth and Humana, in particular, have discussed using home health as a means of delivering ongoing care outside of facilities and helping to manage chronic care patients. Similarly, BrightSpring Health Services recently went public through an initial public offering and provides home health and pharmacy services to senior and specialty patients. BrightSpring focuses on complex patients with multiple health conditions, which represent approximately 5 percent of the population but comprise 50 percent of healthcare spending.[24]

More broadly, the shift to value-based care across the healthcare continuum will likely lead to further demand for home health as the increasing prevalence of capitated payment models and population health initiatives incentivizes groups of providers to lean more heavily on lower-cost settings, when clinically appropriate, for patient care. Home health can be utilized to reduce the cost of post-acute care by keeping patients out of expensive facilities and institutions, as well as to better maintain health and monitor chronic conditions, which could lower emergency room utilization and reduce the overall cost burden associated with these conditions. In general, larger providers are better able to participate in these models given their scale and access to resources and technology. We expect this will contribute to further consolidation.

![]() TRANSACTION ACTIVITY AND VALUATIONS

TRANSACTION ACTIVITY AND VALUATIONS

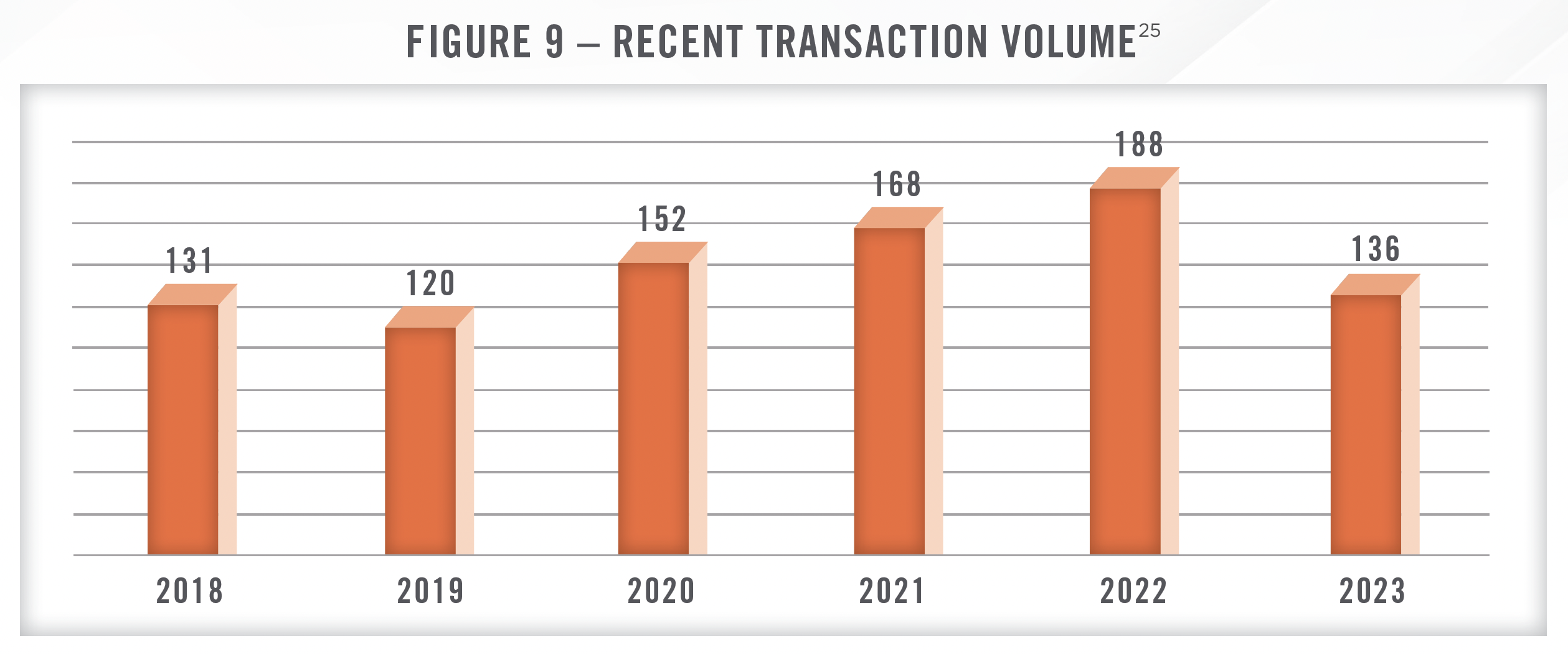

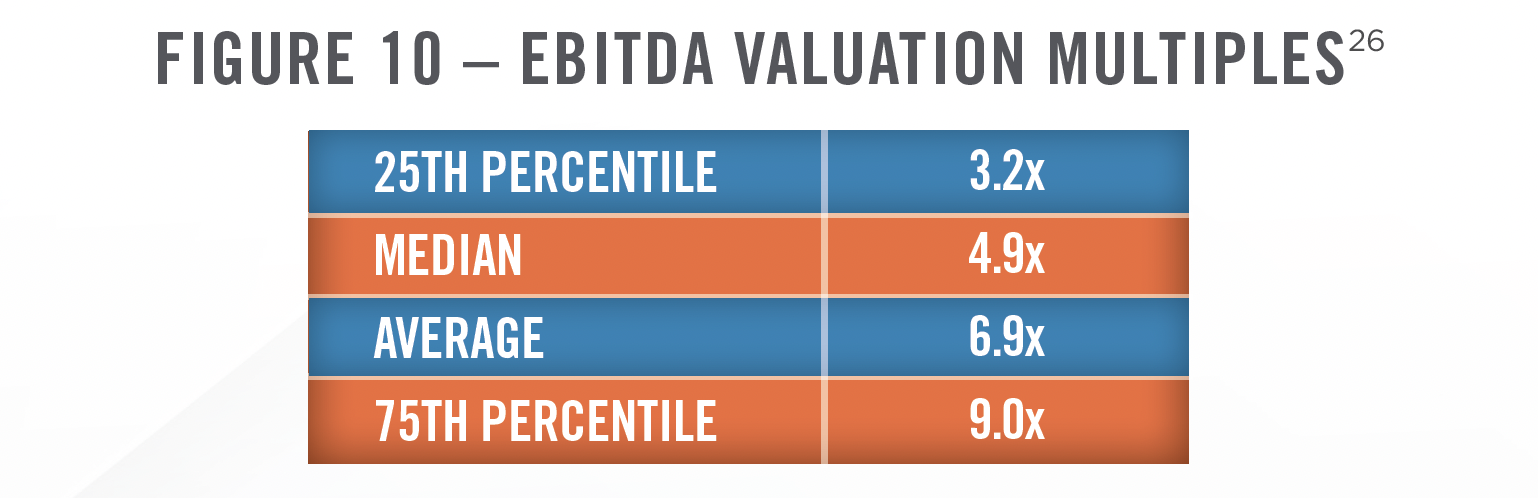

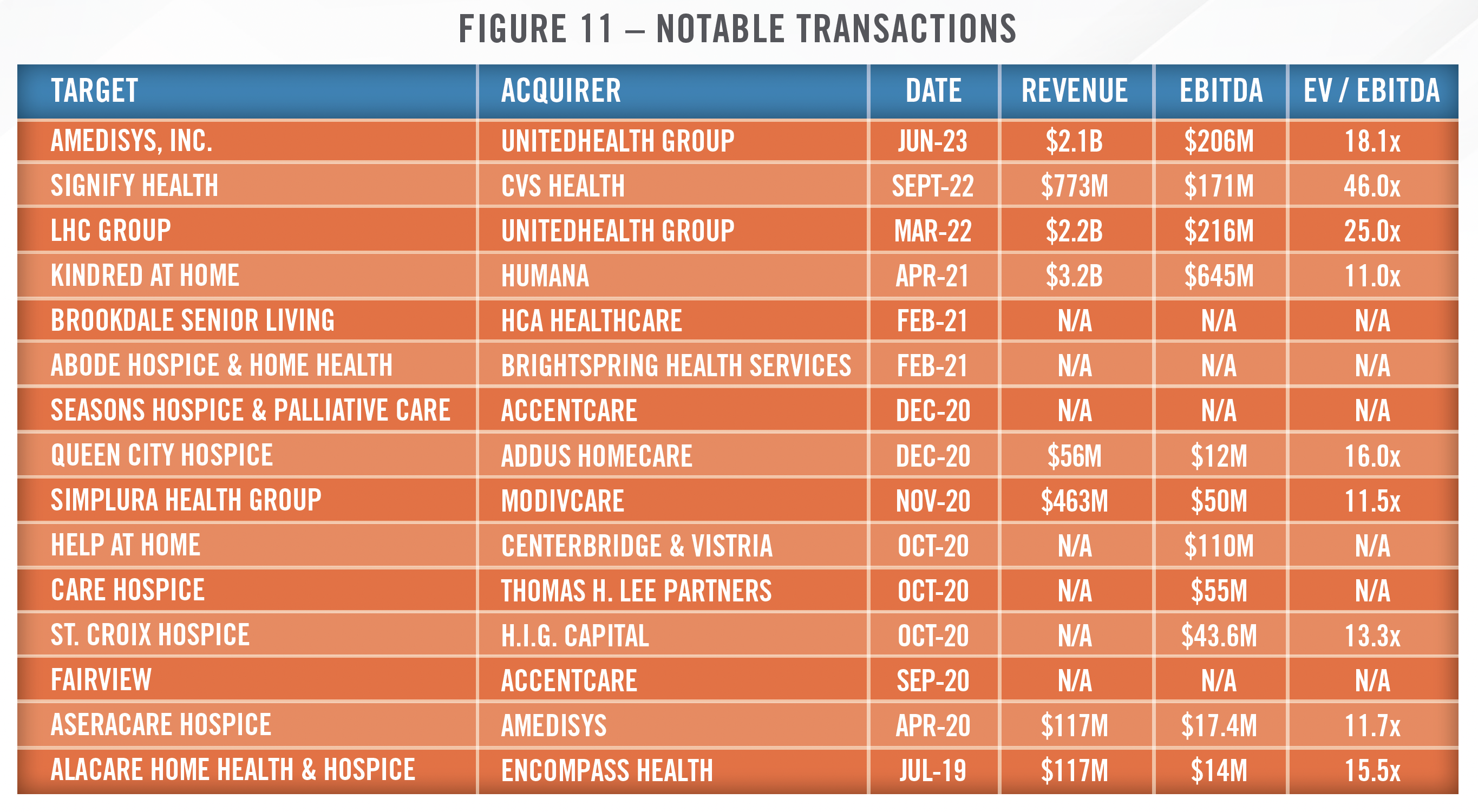

Transaction activity peaked in 2021 and early 2022 before starting to normalize, with 2023 representing a return to pre-COVID levels of transaction volume. As interest rates increased in 2022 and 2023, buyers were less willing to pay elevated multiples, and sellers took time to adjust to the new market dynamics. In addition, the reimbursement headwinds in home health discussed earlier played a role in slowing transaction activity. The prior figure, which is based on data from Irving Levin, DealStats, and Mertz Taggart, presents transaction volume from 2018 through 2023. Based on publicly available transaction data and our experience working on many home health and hospice transactions, smaller agencies are typically transacting in the 4x to 8x EBITDA range (Figure 10). Larger providers with a regional footprint and/or higher acuity services can transact in the mid-teens in terms of EBITDA multiples, although valuations have come down from 2021 levels.

As illustrated in Figure 11 there have been many notable, transformative transactions in recent years. In addition to large, publicly traded home health operators, several private equity firms have established large, regional or national organizations, and health systems and payors, such as UnitedHealth and Humana, are heavily involved in the space. In particular, UnitedHealth acquired LHC Group for approximately 25x EBITDA (22x forward EBITDA). UnitedHealth then announced it intends to acquire Amedisys, which was in talks to merge with Option Care Health (Nasdaq: OPCH), a provider of in-home infusion services. The Amedisys deal has not yet closed, and UnitedHealth Group is currently facing antitrust investigation from the Department of Justice, although the investigation is not limited to its home health business. Once the deal closes, the combined platform would have approximately 10 percent market share. CVS Health acquired Signify Health for 31x estimated forward EBITDA (46x trailing 12-month EBITDA). As valuebased care increases in prominence and importance within the healthcare industry, we expect more integration of the care continuum with payors and health systems bringing more home health services into their networks. We note that many of these valuation multiples include synergies (both revenue and cost synergies), and the ability to execute on those synergies will determine whether or not the transactions are a success.

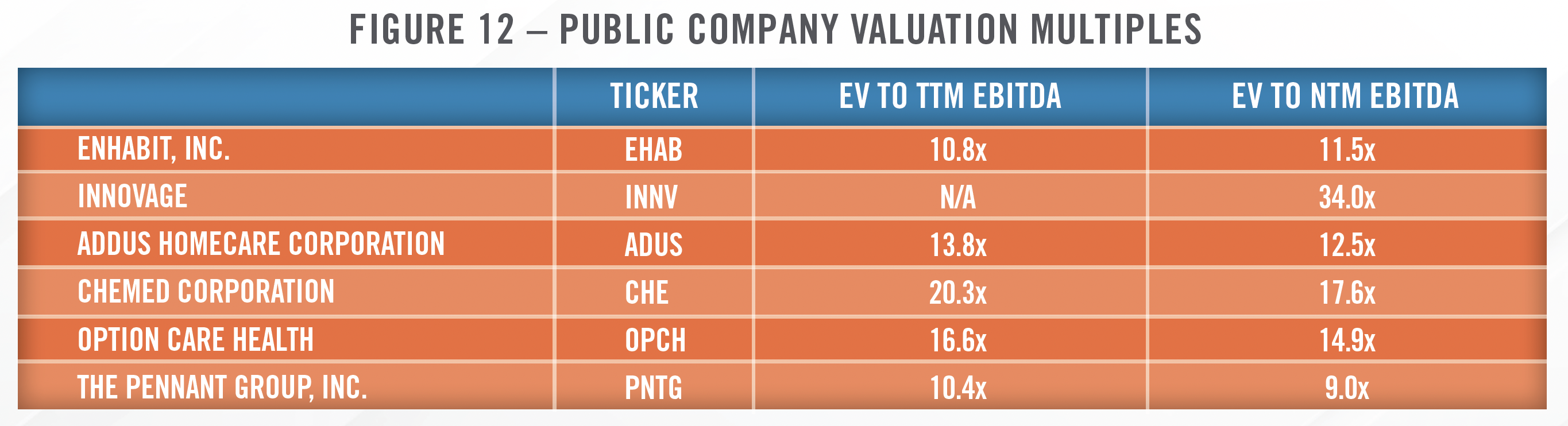

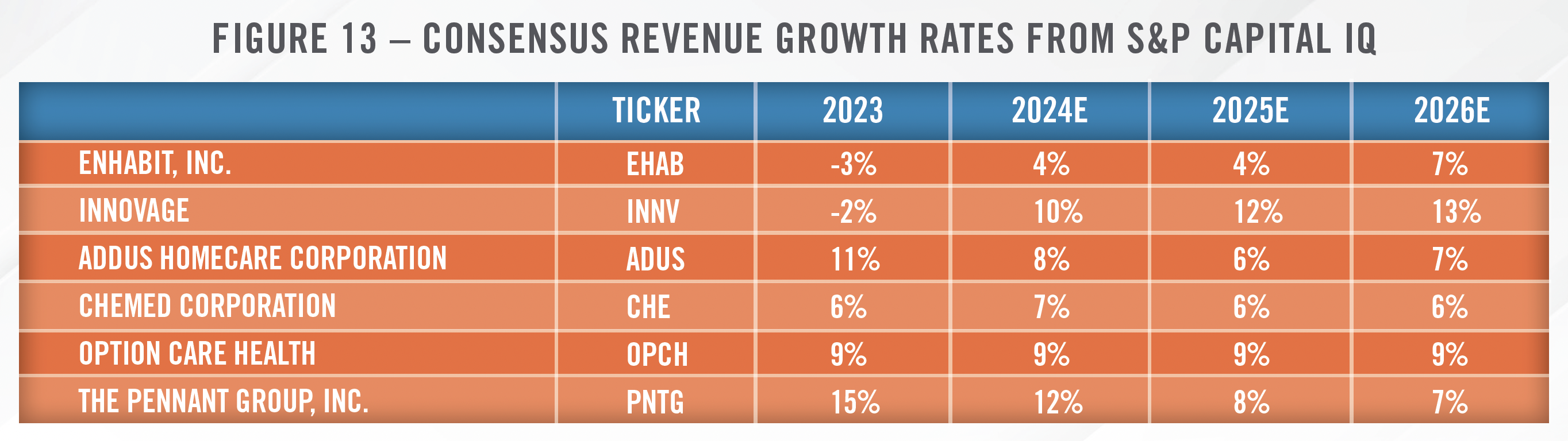

Figures 12 and 13 present valuation multiples and analyst-estimated revenue growth rates for the publicly traded operators in the home care sector. Valuation multiples have come down in recent years due to several of the factors discussed throughout this article, including higher interest rates, provider shortages, and reimbursement uncertainties. Despite these headwinds, analysts project positive revenue growth rates as the shift toward home care and an aging population should provide support for revenue growth going forward. We anticipate many of these public operators may be active in closing bolt-on acquisitions as they may be better positioned than their private-equity backed competitors given the current interest rate environment.

![]() CONCLUSION

CONCLUSION

Despite some of the headwinds discussed herein, including staffing shortages and reimbursement challenges, home care continues to represent an important aspect of the continuum of care. We believe deal volumes will improve in 2024 as both buyers and sellers have had time to adjust to the new interest rate and operating environment. The experts at HealthCare Appraisers have provided advisory and valuation services to home care operators and acquirers for more than 20 years and are well equipped to help navigate the changing landscape.

CONTACT THE EXPERTS AT HEALTHCARE APPRAISERS TO DISCUSS YOUR ADVISORY AND VALUATION NEEDS REGARDING HOME HEALTH, HOSPICE AND PERSONAL CARE IN 2024.

[1] MedPAC.gov; Payment Basics; Accessed February 29, 2024

[2] CMS.gov; CMS analyzed healthcare expenditures based on funding sources, as well as site of service; therefore, healthcare expenditure data for home healthcare includes hospice spending that takes place in the home of the patient but does not include hospice spending taking place in a nursing facility, hospital, or any other clinical setting.

[3] Ibid 2

[4] Health Affairs, https://www.healthaffairs.org/doi/full/10.1377/hlthaff.2019.00529, Accessed February 29, 2024

[5] We anticipate CMS reporting data in 2025 or some time thereabouts.

[6] The nine states were Arizona, Florida, Iowa, Massachusetts, Maryland, Nebraska, North Carolina, Tennessee and Washington.

[7] CMS.gov, https://www.cms.gov/priorities/innovation/innovation-models/expanded-home-health-value-based-purchasing-model, Accessed March 12, 2024

[8] JAMA, https://jamanetwork.com/journals/jama-health-forum/fullarticle/2815745, Accessed March 5, 2024

[9] This transaction was announced in June of 2023 but has not yet closed.

[10] Ibid 1

[11] KFF.org; https://www.kff.org/medicaid/issue-brief/payment-rates-for-medicaid-home-and-community-based-services-states-responses-toworkforce- challenges/, Accessed February 27, 2024

[12] CMS.gov; https://www.cms.gov/newsroom/fact-sheets/ensuring-access-medicaid-services-cms-2442-p-notice-proposed-rulemaking; Accessed February 27, 2024

[13] Amedisys, https://investors.amedisys.com/news/news-details/2021/Amedisys-Announces-Agreement-to-Acquire-Contessa-Health-Creating-a- Comprehensive-Home-Healthcare-Delivery-Platform/default.aspx, Accessed February 28, 2024

[14] Homehealthcarenews.com, https://homehealthcarenews.com/2023/11/cms-acute-hospital-care-at-home-waiver-delivers-promising-results/; Accessed February 28, 2024

[15] JAMA, https://jamanetwork.com/journals/jama-health-forum/fullarticle/2811346, Accessed February 28, 2024

[16] Healthcarefinancenews.com, https://www.healthcarefinancenews.com/news/acute-hospital-care-home-gets-good-grades-cms-research, accessed March 11, 2024

[17] Hospital & Healthcare Compensation Service; https://www.hhcsinc.com/hcs-reports.html, Accessed February 29, 2024

[18] Includes District of Columbia

[19] Healthcare Dive, https://www.healthcaredive.com/news/home-health-agencies-expanding-rolling-out-more-telehealth-services/568320/, Accessed February 29, 2024

[20] Mhealthintelligence.com, https://mhealthintelligence.com/news/cms-finalizes-new-reimbursement-rules-for-remote-patient-monitoring, Accessed February 28, 2024

[21] Mhealthintelligence.com, https://mhealthintelligence.com/news/current-and-future-doctors-are-more-than-ready-to-use-mhealth-wearables, Accessed February 28, 2024

[22] National PACE Association, https://www.npaonline.org/find-a-pace-program#:~:text=Find%20a%20PACE%20Program%20Near,72%2C000%20 participants%20across%20the%20country.&text=Start%20with%20a%20state%20search,search%20to%20refine%20the%20results., Accessed March 12, 2024

[23] InnovAge Investor Presentation, https://investor.innovage.com/static-files/f964ac5b-8cc2-4941-9fcb-22e91cd53032, Accessed March 12, 2024

[24] SEC.gov, BrightSpring Health Services, Inc. S-1 Filing, Accessed March 5, 2024

[25] DealStats, Mertz Taggart, LevinPro HC, Levin Associates, 2024, March, levinassociates.com

[26] DealStats, Accessed March 5, 2024