The dialysis industry is undergoing an important transformation as payors introduce new payment models designed to reduce the costs of treatment and move more patients to home based models of care. Dialysis providers also face regulatory uncertainty as California has implemented recent regulations to limit reimbursement rates from certain patients, and other states have considered similar measures. This article provides background on the dialysis industry and discusses the major companies within the United States. We analyze the changes taking place in the industry and survey the recent transactions that have taken place. We then discuss valuation approaches and important considerations for valuators to be aware of when performing valuations for the industry.

![]() INTRODUCTION

INTRODUCTION

Dialysis clinics and nephrology practices provide treatment to patients suffering from kidney disease. The prevalence of Chronic Kidney Disease (“CKD”) has been increasing in the United States since the 1960s. The primary causes of CKD include diabetes, high blood pressure, polycystic kidney disease, longterm autoimmune attack, and prolonged urinary tract obstruction. The disease can be characterized by five stages and if caught early can be treated to reduce the acceleration of the disease. However, once a patient loses a substantial amount of kidney function, the loss of function is typically not reversible.

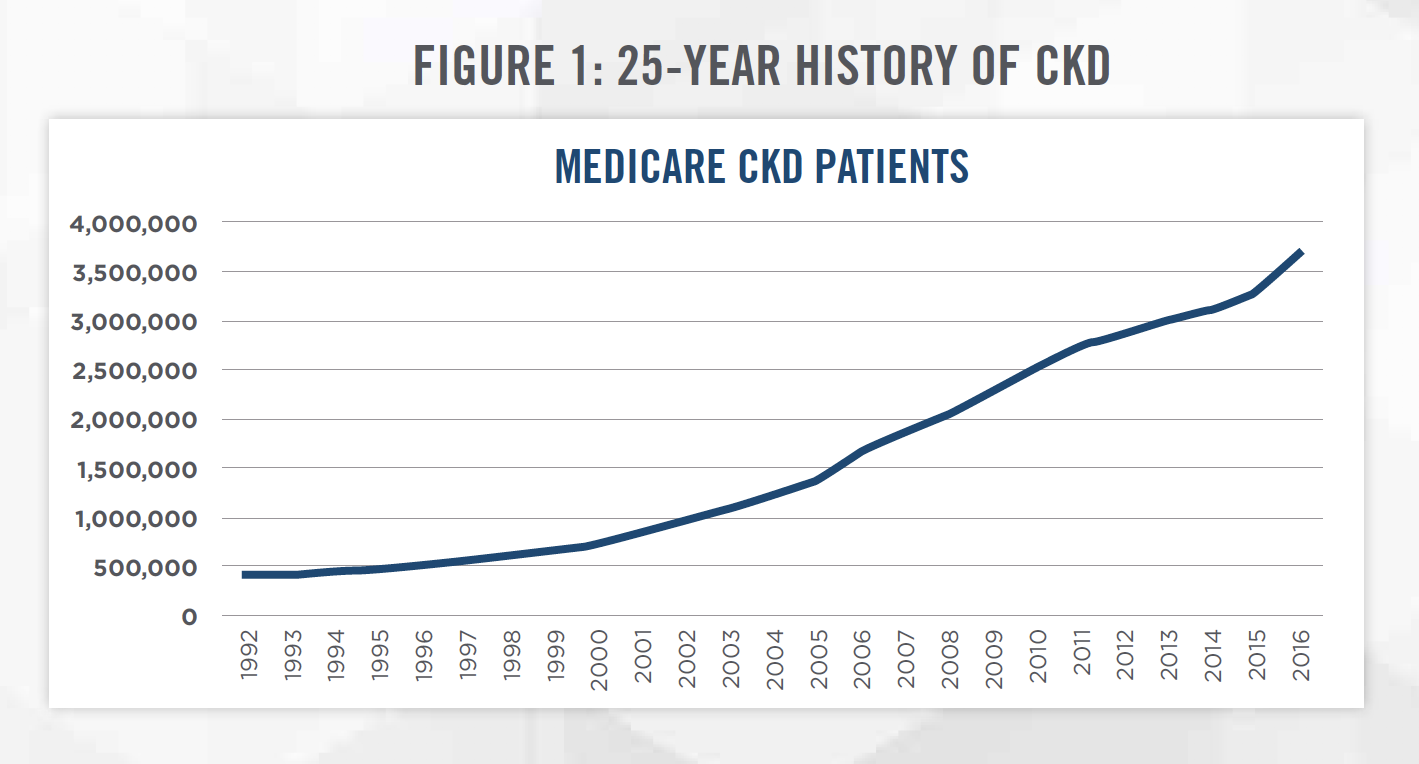

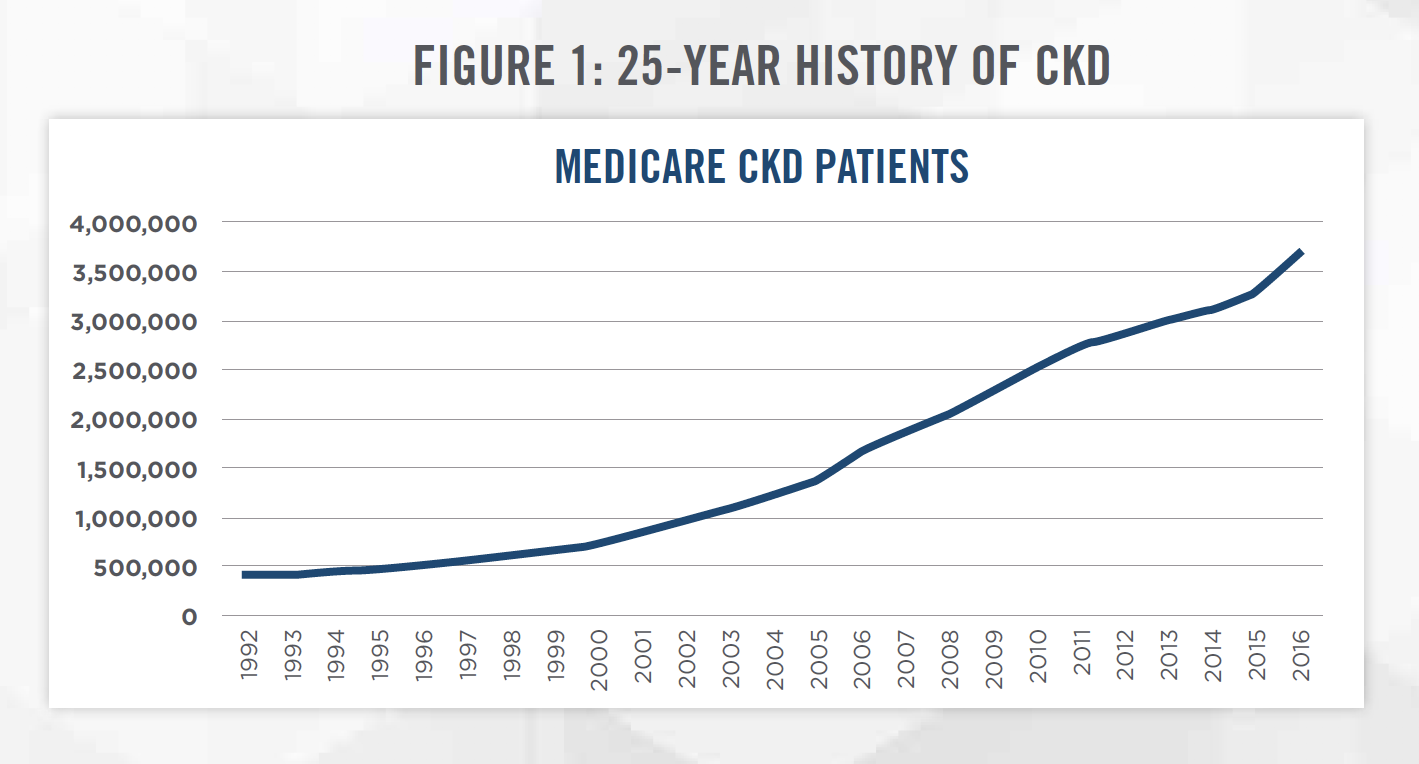

Figure 1 presents the prevalence of CKD from 1992 to 2016 as measured by the number of Medicare CKD patients.[1] CKD patients have increased by an average of approximately 10 percent each year, compared to United States population growth of approximately 1 percent each year.

The final stage of the disease is known as end stage renal disease (“ESRD”), when the patient loses the majority of their kidney function. Once this occurs, patients must either receive a kidney transplant or undergo regular dialysis treatment. Dialysis treatments involve removing excess water and toxins from the blood once the kidneys can no longer perform these functions. There are two forms of dialysis treatments: Hemodialysis (“HD”), which can be performed in a dialysis clinic or at home, and Peritoneal Dialysis (“PD”), which is typically performed at home. The most common treatment option is in-center HD which requires treatment at a dialysis center approximately three times per week, with each treatment lasting three to four hours.

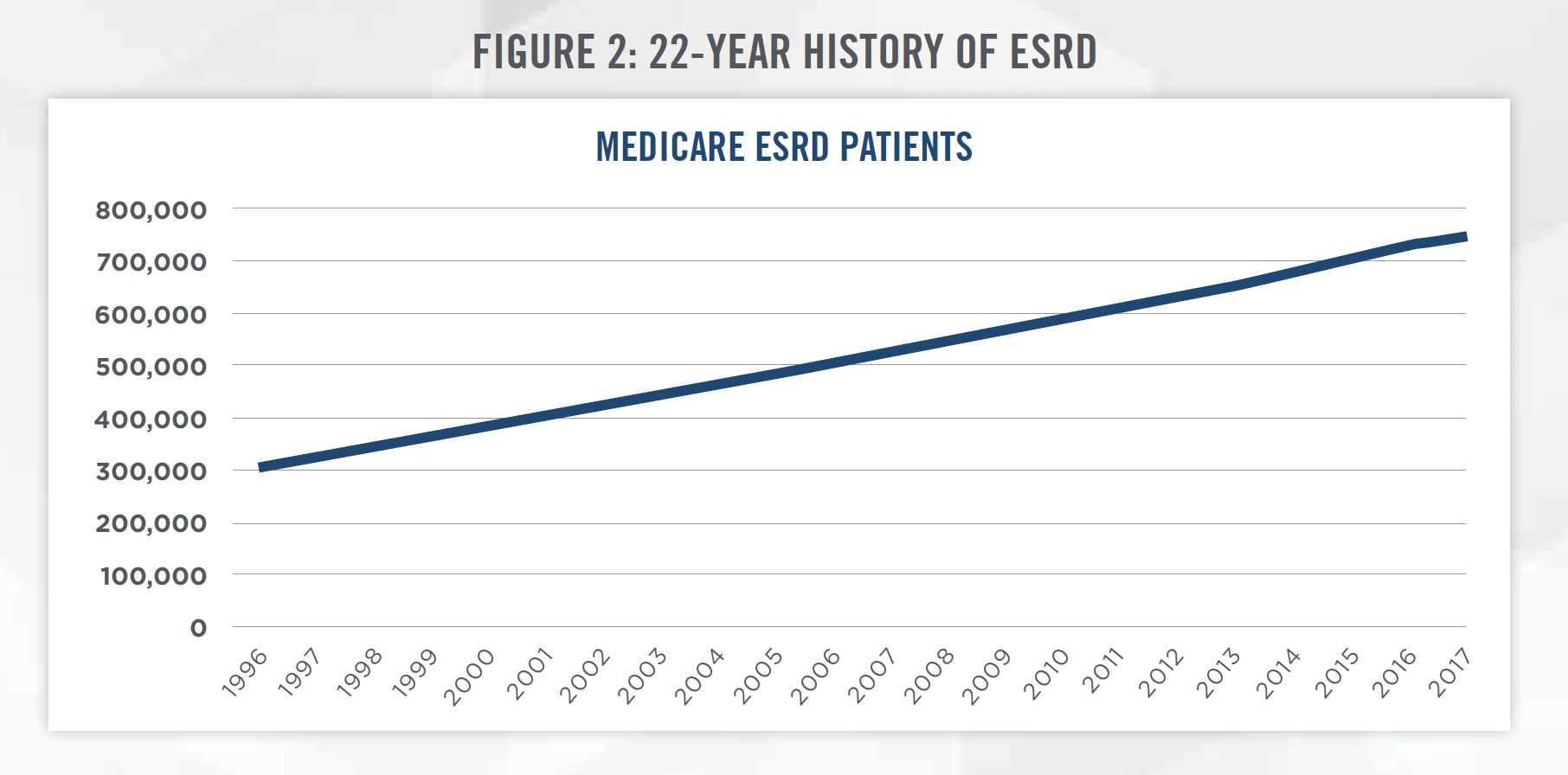

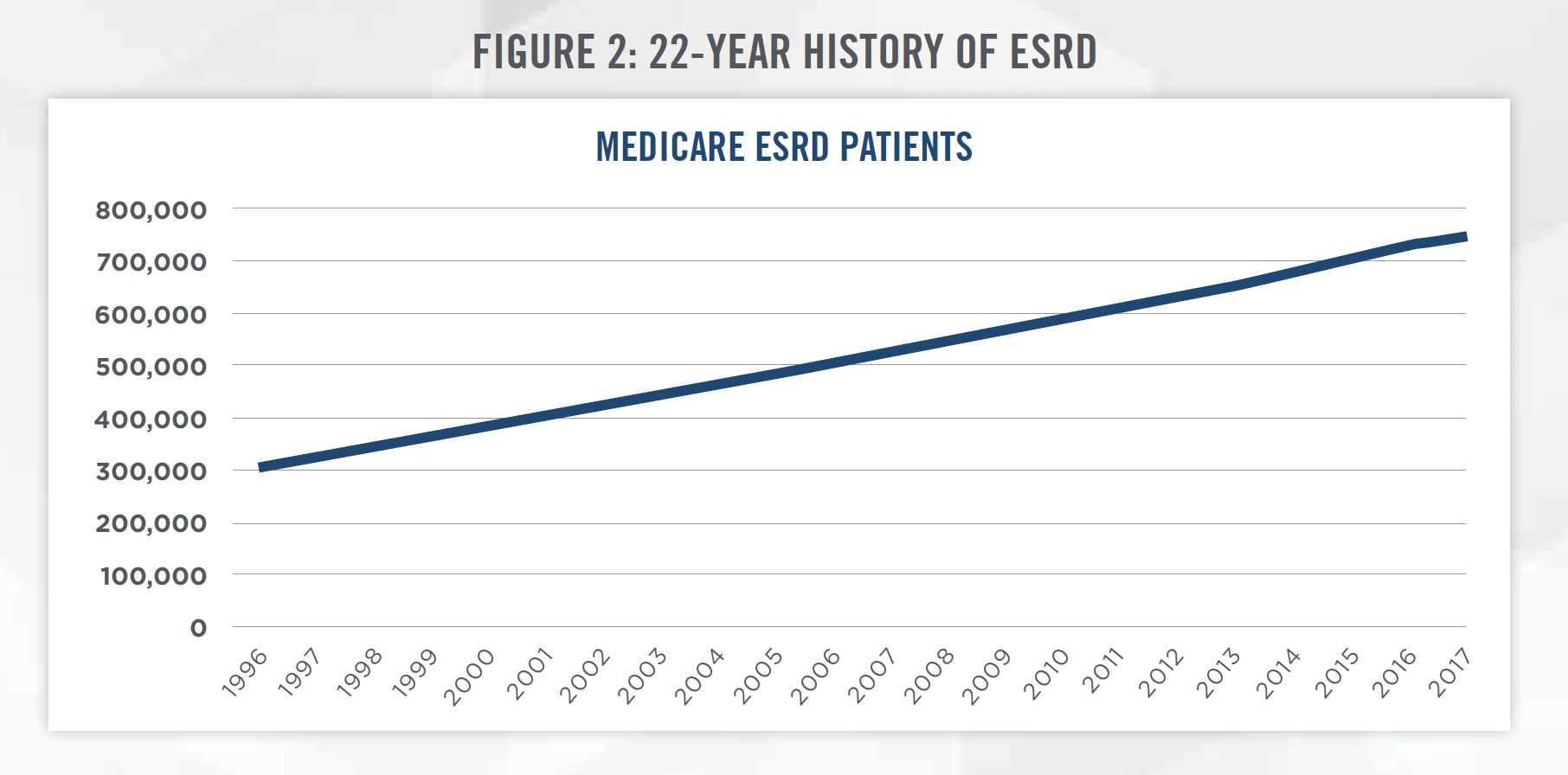

According to the United States Renal Data System 2018 Annual Data Report, there were 746,557 cases of ESRD in the United States in 2017. The number of ESRD cases has continued to increase by approximately 20,000 patients per year. Figure 2 tracks the prevalence of ESRD from 1996 to 2017 as measured by the number of Medicare ESRD patients.[2]

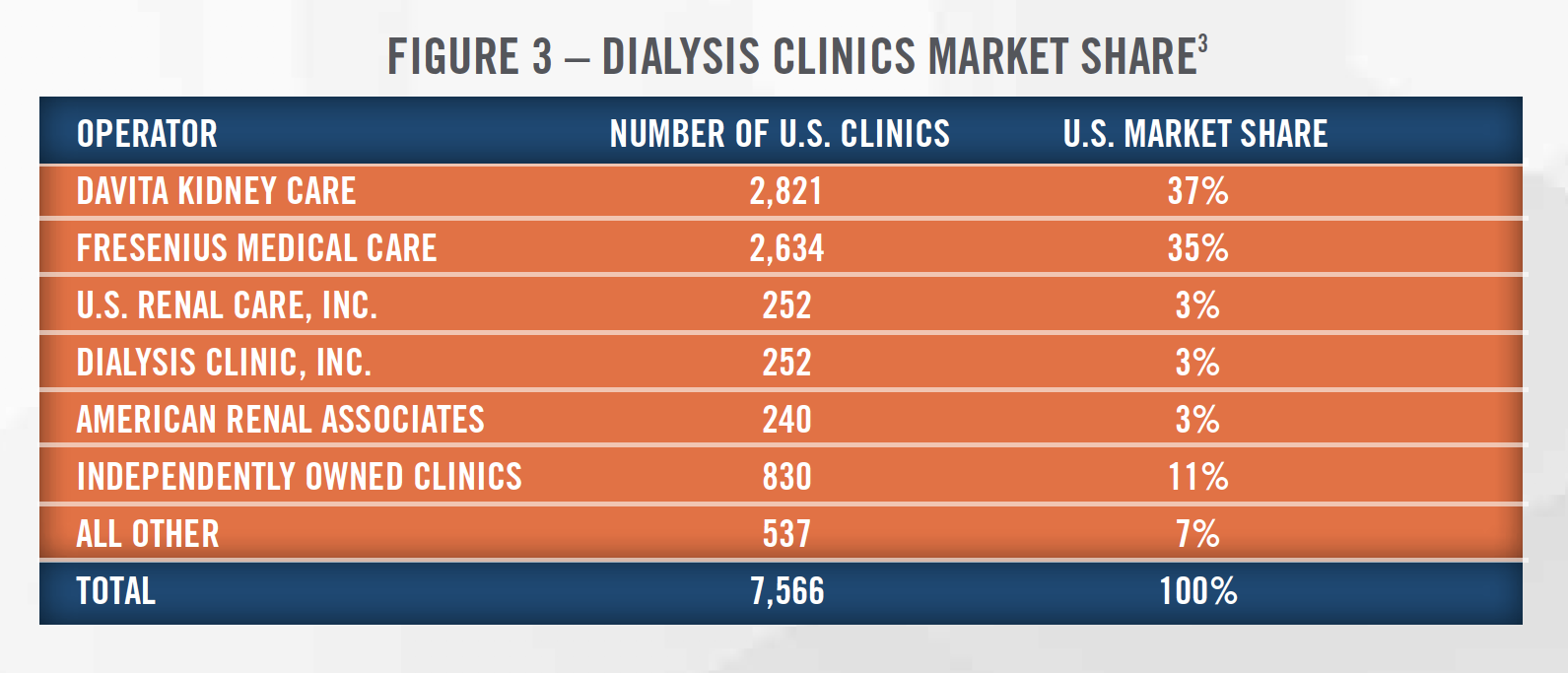

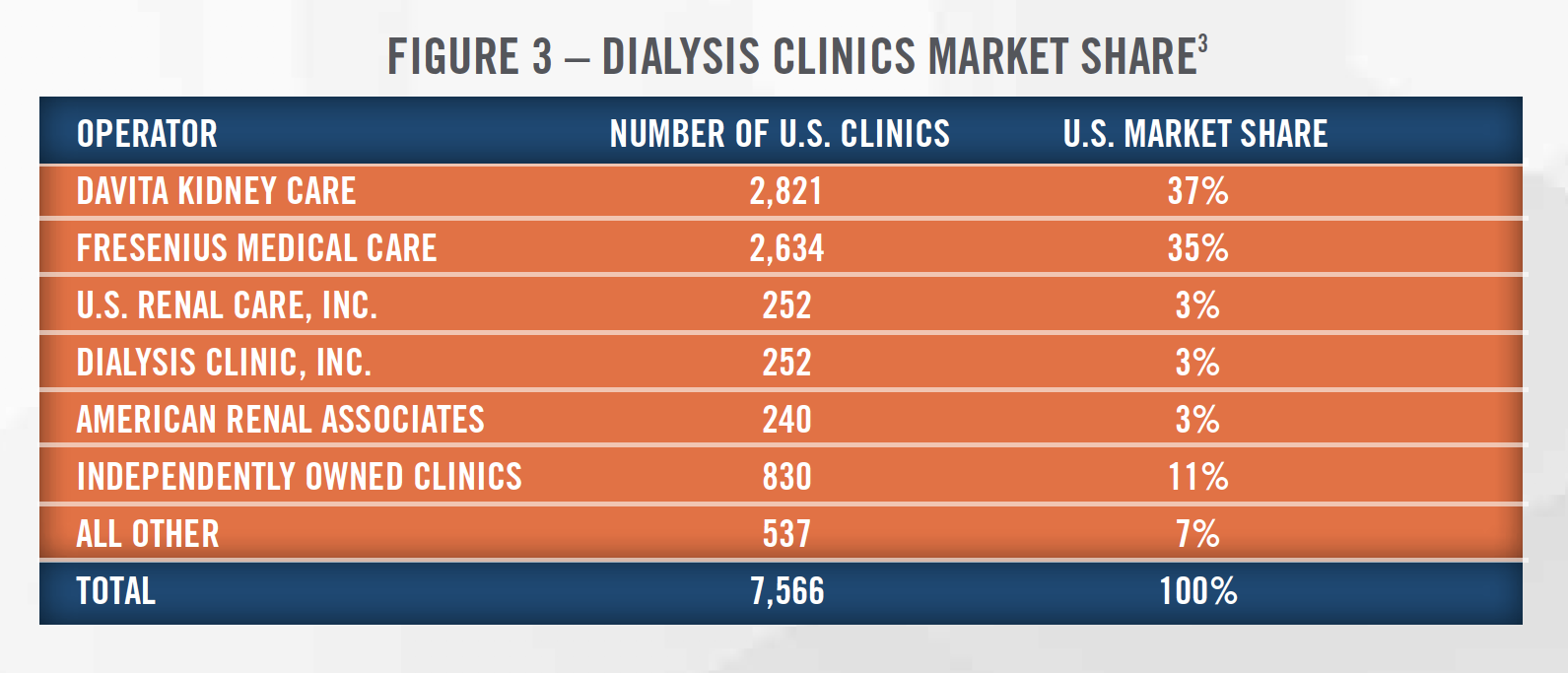

Consistent with the increase in ESRD in the United States, there has been steady growth in dialysis clinics and treatment centers in recent decades. There are now more than 7,500 dialysis clinics in the United States. Figure 3 presents the number of dialysis clinics owned by the major providers of dialysis services in the United States as of January 2020, with market share concentrated among two largest providers.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

DAVITA

DaVita is one of the largest providers of kidney dialysis services and related lab services in the United States. The company was founded in 1979 as Medical Ambulatory Care, Inc and was acquired by DLJ Merchant Banking Partners in 1994, who changed the name to Total Renal Care Holdings. In 2000, the company was renamed DaVita. Until recently, DaVita consisted of two major divisions, DaVita Kidney Care and DaVita Medical Group. DaVita Kidney Care provides dialysis and related lab services. DaVita Medical Group was sold to UnitedHealth Group’s Optum division in June 2019.

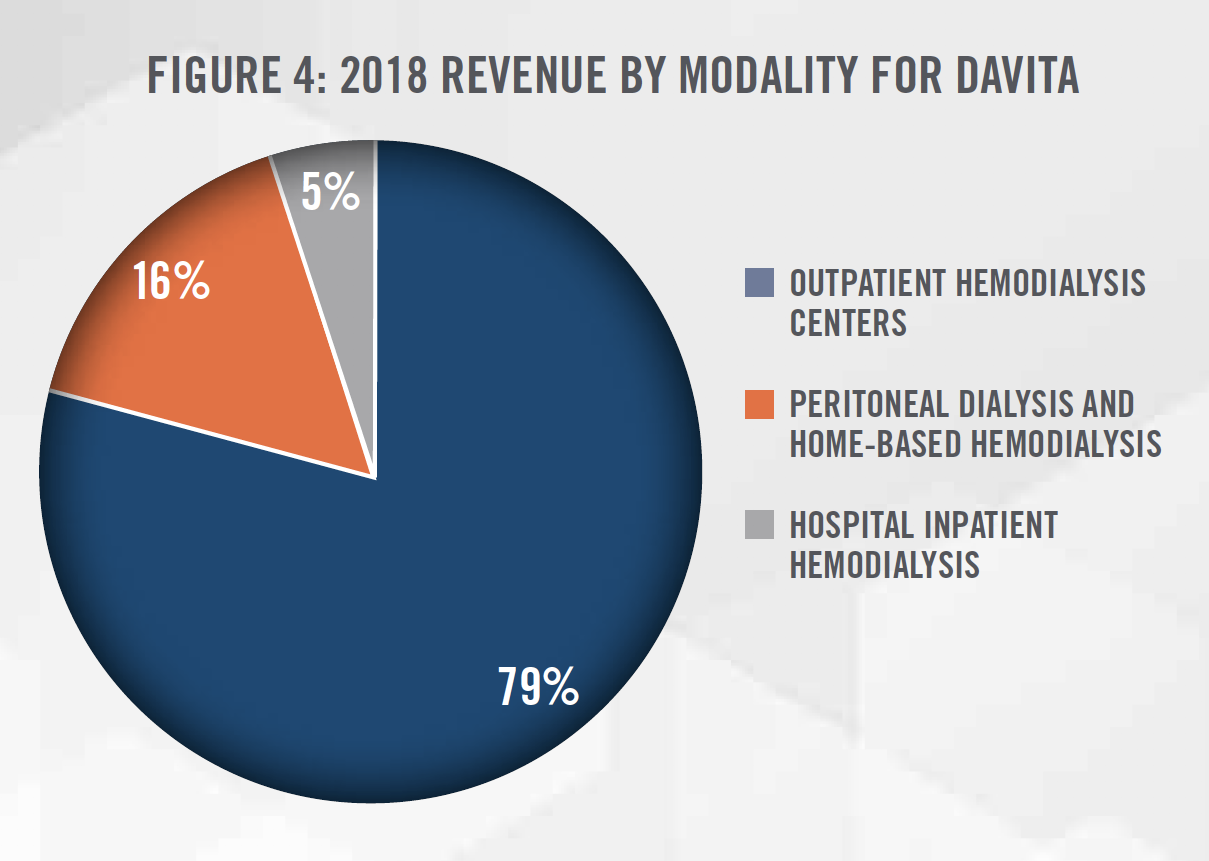

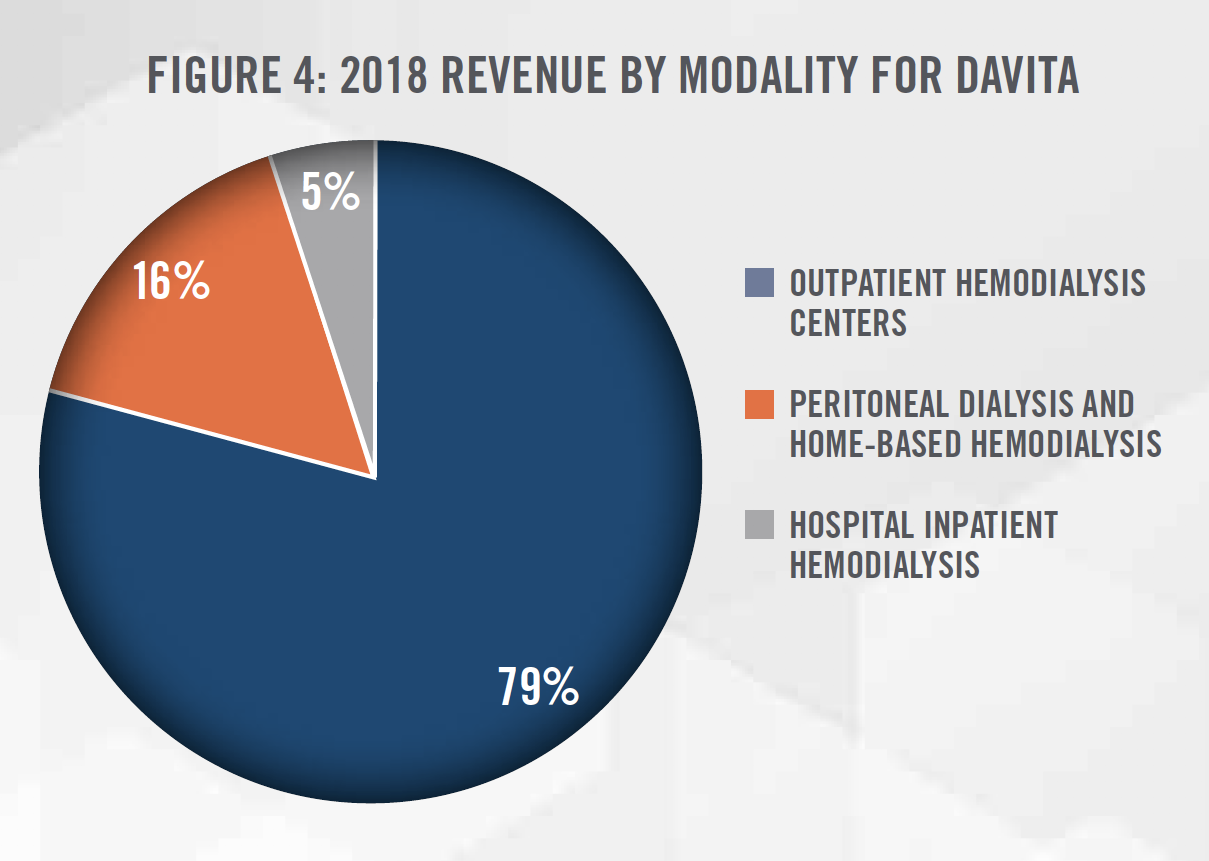

DaVita owns or manages approximately 2,800 outpatient dialysis facilities in the United States and provides acute inpatient dialysis services at approximately 900 hospitals. Based on the number of patients served, DaVita has approximately 37 percent market share within the United States. In 2018, DaVita added 154 facilities to its portfolio through acquisitions and de novo projects. Most of DaVita’s dialysis services are provided at its outpatient hemodialysis centers. Figure 4 summarizes DaVita’s dialysis services revenues by modality for 2018.[4]

FRESENIUS MEDICAL CARE

Fresenius Medical Care was formed in 1996 when Fresenius SE & Co. merged its dialysis business with National Medical Care to form Fresenius Medical Care. Fresenius Medical Care is the world’s largest dialysis company, based on reported revenue and the number of patients served, with a global headquarters in Bad Homburg vor der Höhe, Germany and a North American headquarters in Waltham, Massachusetts. In addition to providing dialysis services, Fresenius Medical Care also develops and manufactures a full range of dialysis equipment used at dialysis clinics.

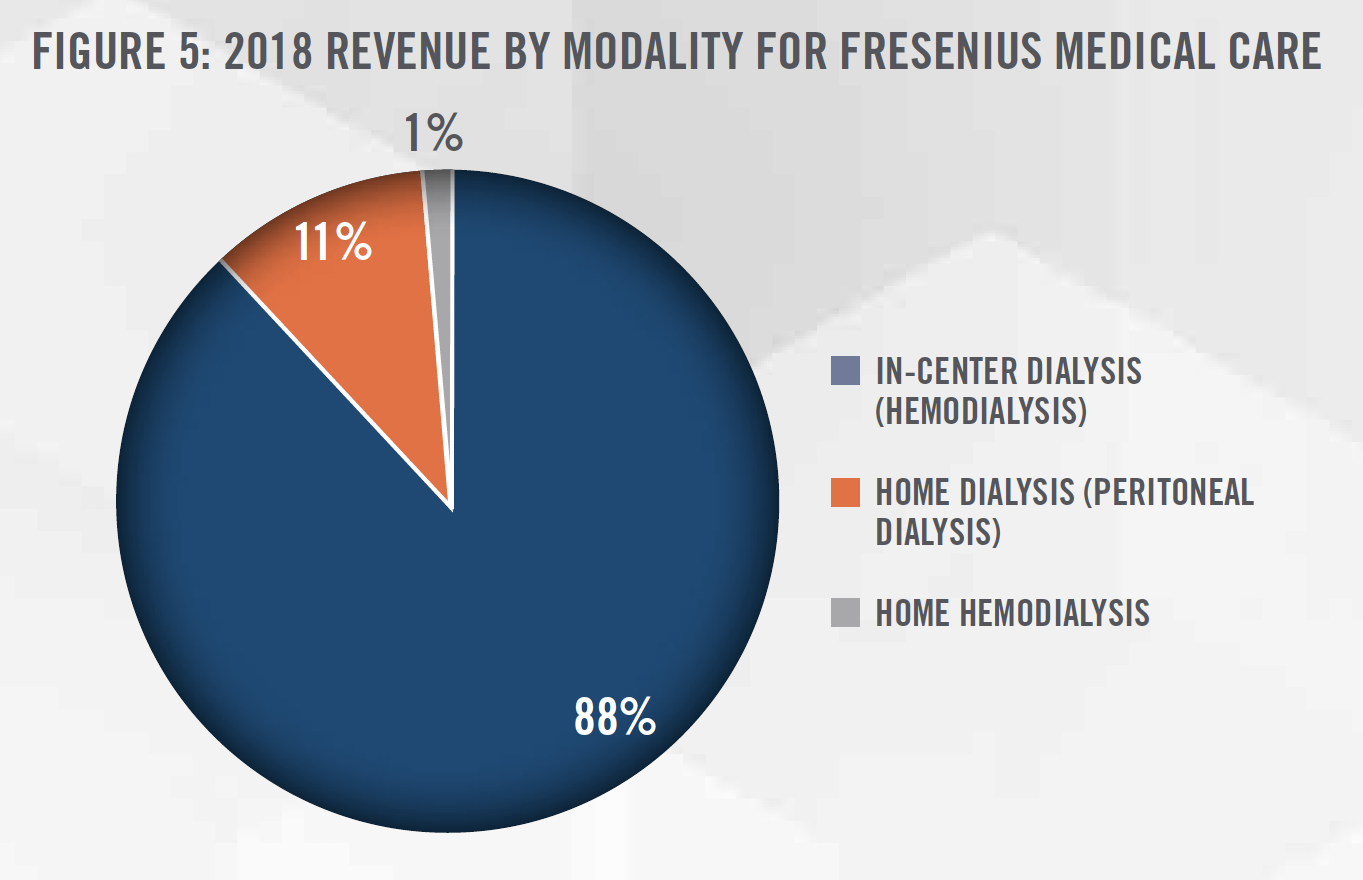

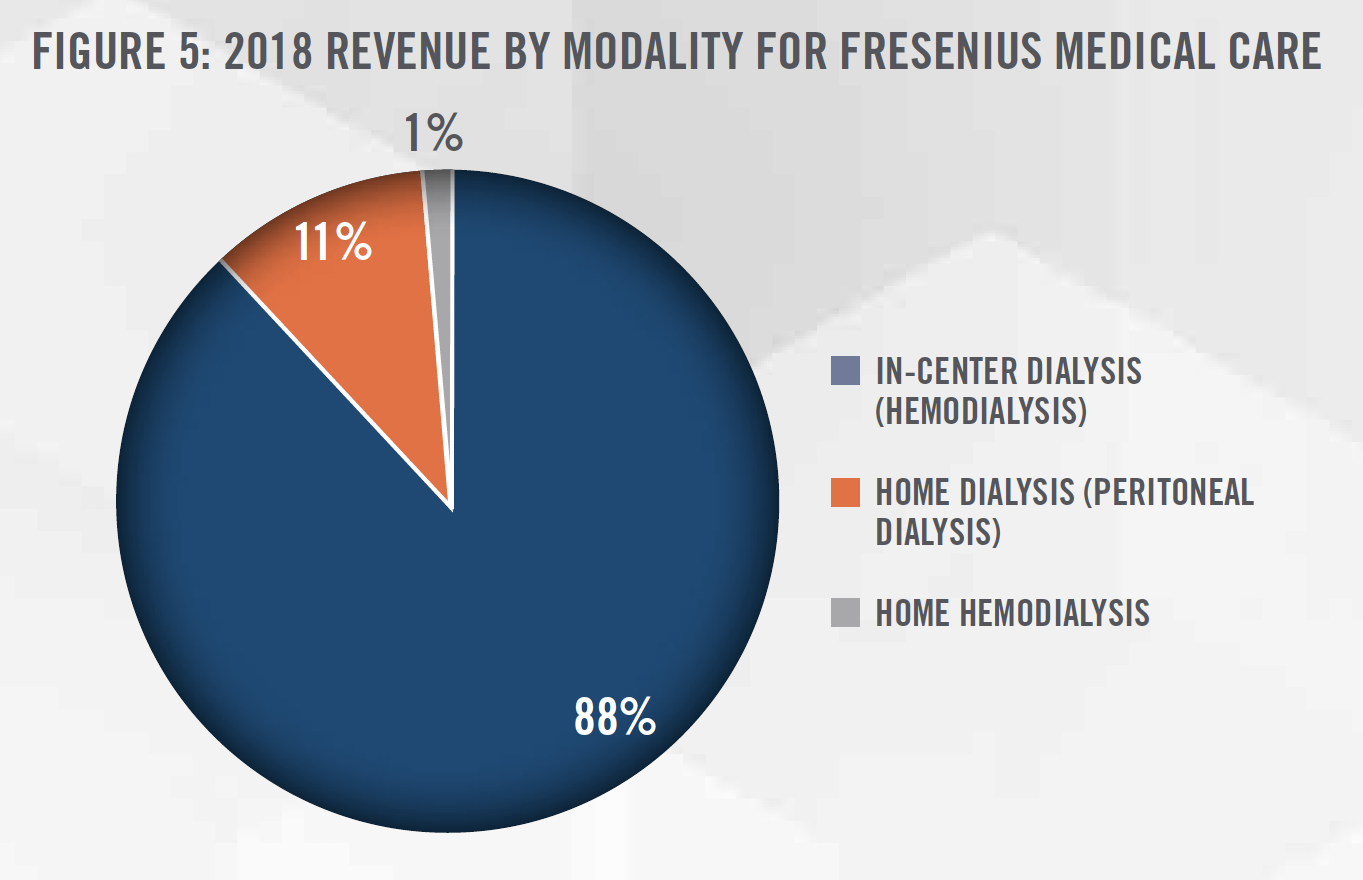

Fresenius Medical Care owns or manages approximately 3,900 outpatient dialysis centers worldwide, which serve approximately 333,000 dialysis patients. In 2018, Fresenius Medical Care treated the majority of its patients in North America (61%). Based on the number of patients served, Fresenius Medical Care has approximately 38 percent market share in the United States. Figure 5 summarizes Fresenius Medical Care’s global dialysis services revenues by modality for 2018.[5]

AMERICAN RENAL ASSOCIATES

American Renal Associates (“ARA”) is a large dialysis provider in the United States focused on joint ventures (“JV”) with nephrology physicians. ARA owns and operates more than 240 dialysis clinics in partnership with approximately 400 nephrologist partners treating approximately 16,500 patients in 27 states and the District of Columbia. ARA has grown through a combination of de novo clinic openings as well as through acquisitions, and the company opened 13 or more de novo clinics each year from 2014 to 2018. This clinic growth helped ARA grow treatment volume at a compound annual growth rate (“CAGR”) of 10.3 percent from 2014 to 2018.[6]

OTHER GROUPS AND NEW ENTRANTS

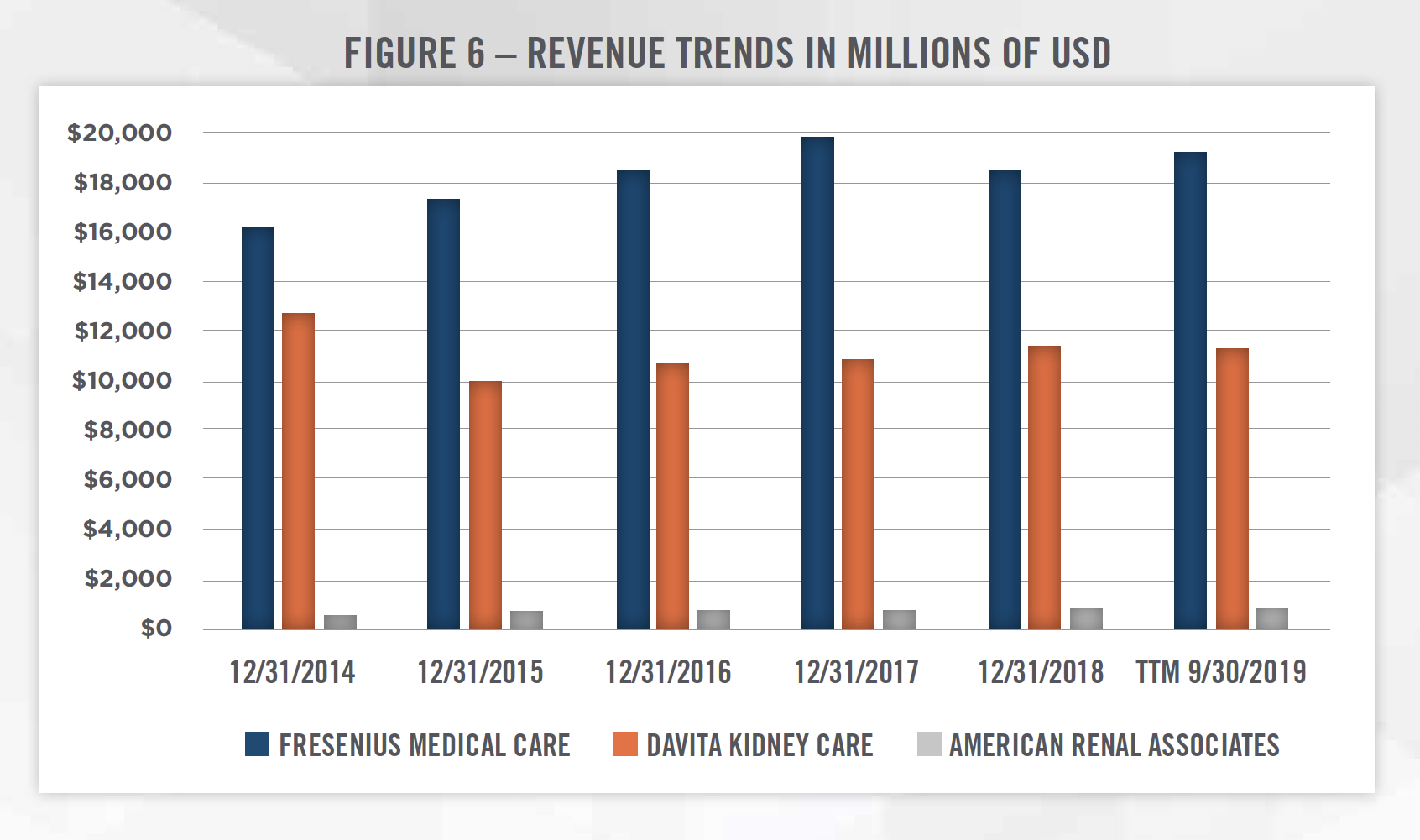

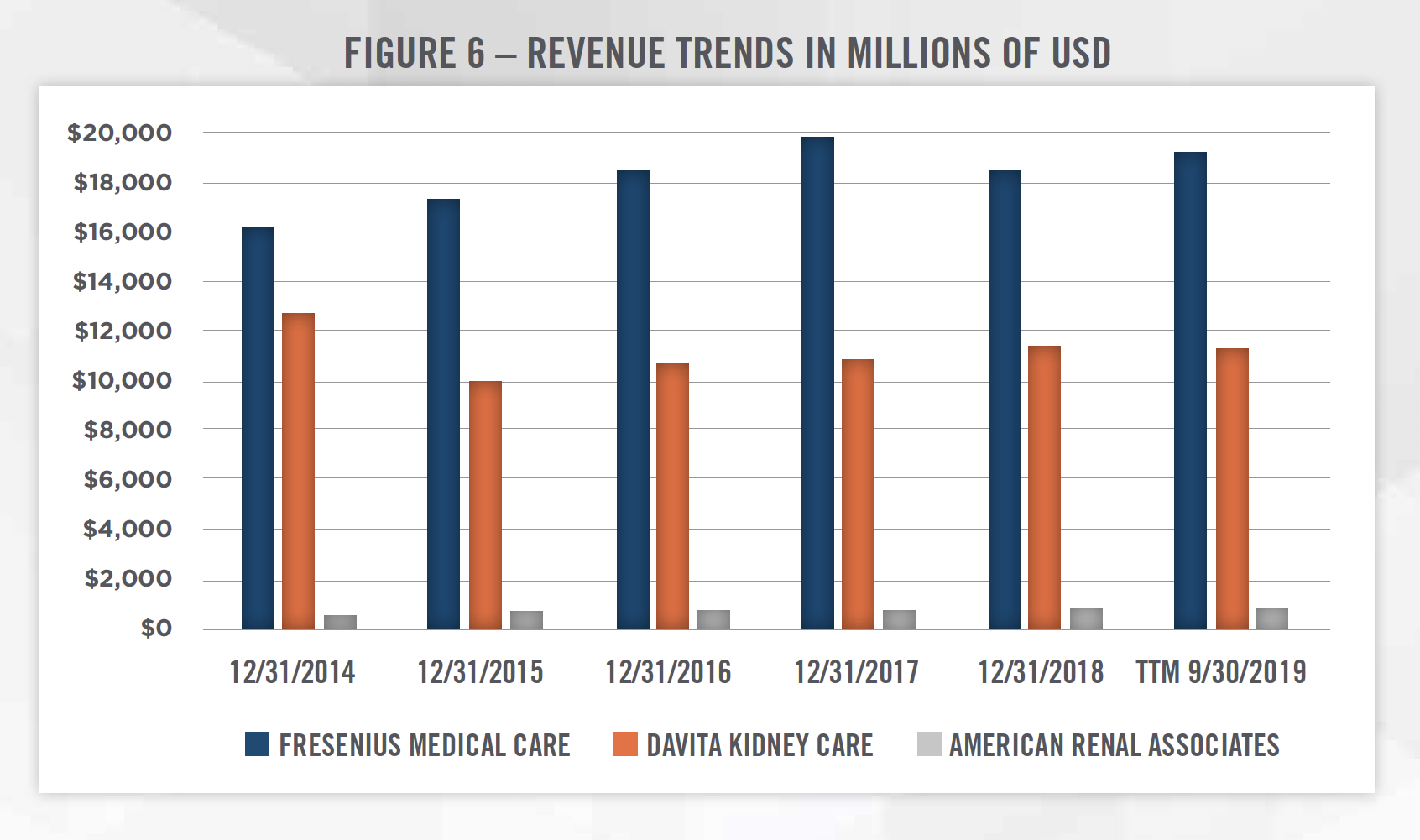

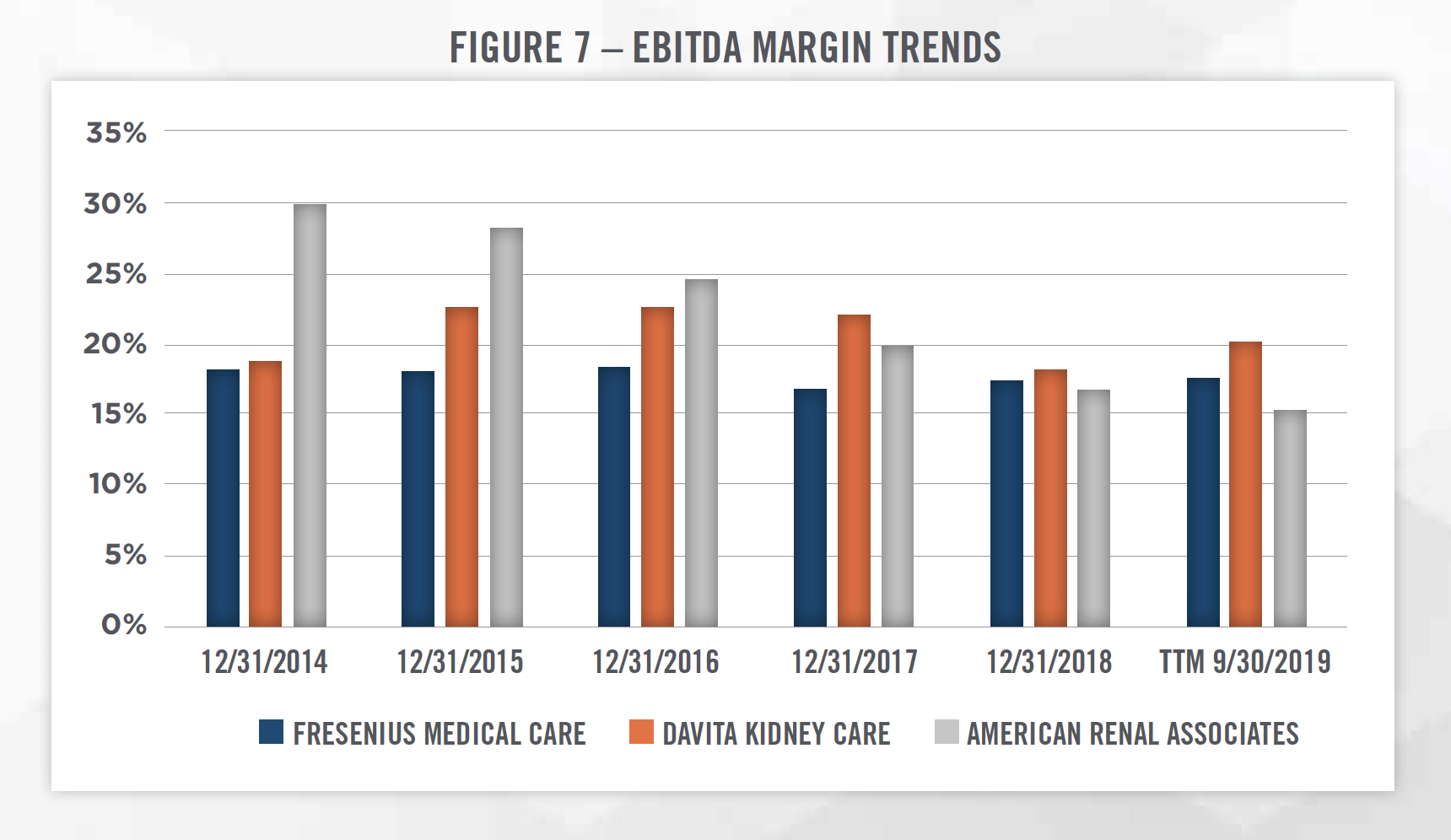

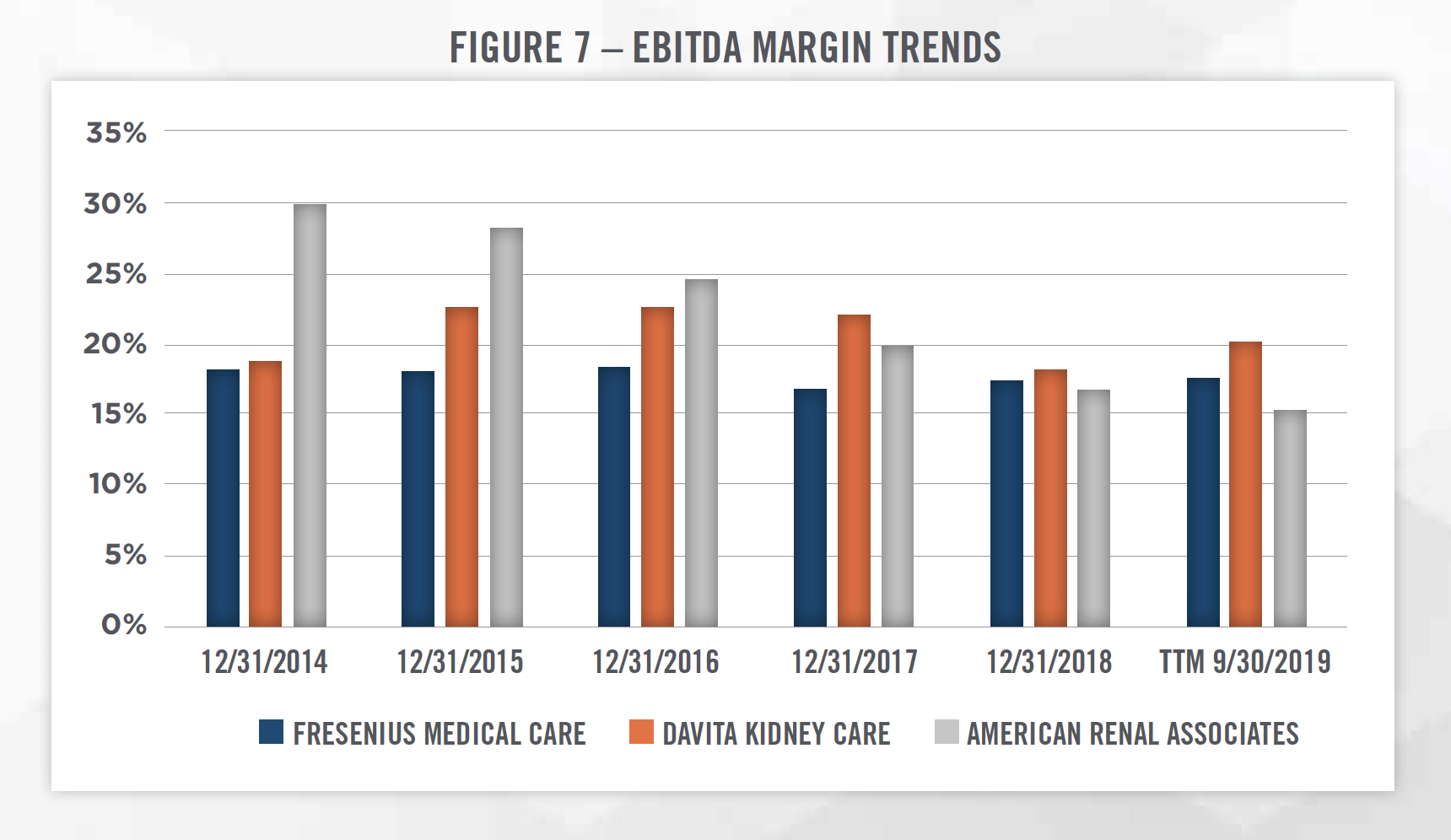

Outside of the publicly traded operators discussed above, there are few other major dialysis providers in the United States. U.S Renal Care and Dialysis Clinic, Inc. each have more than 100 outpatient dialysis centers. The remainder of the market consists of providers operating less than 100 dialysis outpatient facilities. Figures 6 and 7 outline two key financial trends of the three publicly traded dialysis providers in the United States.[7]

![]()

![]()

![]()

![]()

![]()

![]()

![]()

In 1972, Medicare was expanded to include coverage for patients with chronic kidney failure, for all patients regardless of age. For dialysis patients, Medicare covers the cost of dialysis treatments, such as in-center HD, home HD, and PD. The payments are administered through two plans, Medicare Part A (hospital insurance) and Medicare Part B (medical insurance). Most patients in need of dialysis care will qualify for and have both Medicare plans.[8] Given the universal coverage of ESRD by Medicare, providers are subject to regulatory compliance with the Stark Law and Anti-Kickback Statute and need to be mindful of these concerns when entering into arrangements or transactions.

For most patients with private health insurance, the private payor is the primary payor during the first 30 months of dialysis treatment. After the 30-month period, known as the coordination period, Medicare becomes the primary payor. Medicare covers 80 percent of the dialysis treatment cost, with the remaining expense covered by private payors and patients’ out of pocket expense.[9]

The reimbursement rates vary considerably between private payors and governmental payors. One study by researchers at UCLA that was published in JAMA found that the average reimbursement rate per treatment from private payors was $1,041, compared to $248 per treatment for governmental payors. While this study was specific to DaVita, the delta between governmental and private reimbursement rates exists throughout the industry and has led to regulatory and political backlash for dialysis clinics (discussed further in later sections).

Related, the shift from fee-for-service to value-based care that is taking place throughout the healthcare system is impacting the dialysis industry as well. While there is currently a small quality adjustment to the fee-for-service rate received by dialysis clinics from governmental payors, new payment models have been promoted by CMS in recent years, and the Trump Administration has introduced new regulations which aim to move more dialysis into the home setting and reduce the costs associated with providing dialysis services to ESRD patients. A recent proposal associated with the 21st Century Cures Act would enable ESRD patients to enroll in Medicare Advantage plans beginning in 2021, reflecting the continued growth in Medicare Advantage and managed care in general.

COMPREHENSIVE ESRD CARE MODEL

In 2015, CMS created the Comprehensive ESRD Care (CEC) Model as an alternative payment model that created financial incentives to dialysis facilities, nephrologists, and other Medicare providers to coordinate care for Medicare beneficiaries with ESRD. Under the CEC model, a version of accountable care organizations known as ESRD Seamless Care Organizations (ESCO) have been forming to treat Medicare beneficiaries with ESRD. ESCO’s are partnerships between groups of healthcare providers, including nephrologists and dialysis clinics, and suppliers located in a contiguous geographical area designed to coordinate care and reduce per-capita spending on ESRD patients. Under the ESCO payment model, the participants share in the savings or losses relative to a benchmark that is created by CMS.[10] According to a Lewin Group analysis, the CEC model resulted in a $68 million reduction in Medicare spending in the first two years of implementation, although shared savings payments to participants more than offset the reduced spending and caused CMS to generate a net loss from the programs in the short run.[11]

Fresenius accounted for 72 percent of ESCO facilities in the first two waves of participation, and DaVita represented 16 percent of participating facilities. While overall results from the ESCOs were mixed and some providers reported positive outcomes according to Lewin Group, Fresenius has publicly discussed on several investor calls that issues regarding alignment with providers and benchmark setting have contributed to results that were below its expectations. Fresenius also indicated that the problems it experienced with its ESCOs would inform its decision regarding whether, and how much, to participate in voluntary models included in the Advancing American Kidney Health Initiative. DaVita has publicly discussed certain reservations it holds about the models as well.

ADVANCING AMERICAN KIDNEY HEALTH INITIATIVE

On July 10, 2019, President Trump signed an executive order launching the Advancing American Kidney Health Initiative. The initiative outlines several goals, including improving access to kidneys for transplant, shifting more patients to home-based dialysis treatments, encouraging the development of artificial kidney devices, and changing reimbursement for kidney disease treatment. In particular, the initiative created five new payment models, one of which is mandatory and four of which are voluntary. The mandatory payment model is the ESRD Treatment Choices model, and makes mandatory adjustments to reimbursement to participating providers for home-based dialysis and dialysis services. The mandatory model is intended to increase home-based treatment and encourage providers to educate patients on their treatment options.[12] The voluntary payment models fall under the new Kidney Care Choices model, and build upon the CEC model. The four models involve differing levels of risk being taken by the providers, and various models apply only to certain types of providers (e.g., nephrology practices, dialysis clinics). The new payment models are expected to run from 2020 through 2023, and CMS has the option to extend the model by up to two years. As mentioned herein, the degree to which providers participate in these models may depend on their past experiences with the CEC model, which for some providers was mixed.

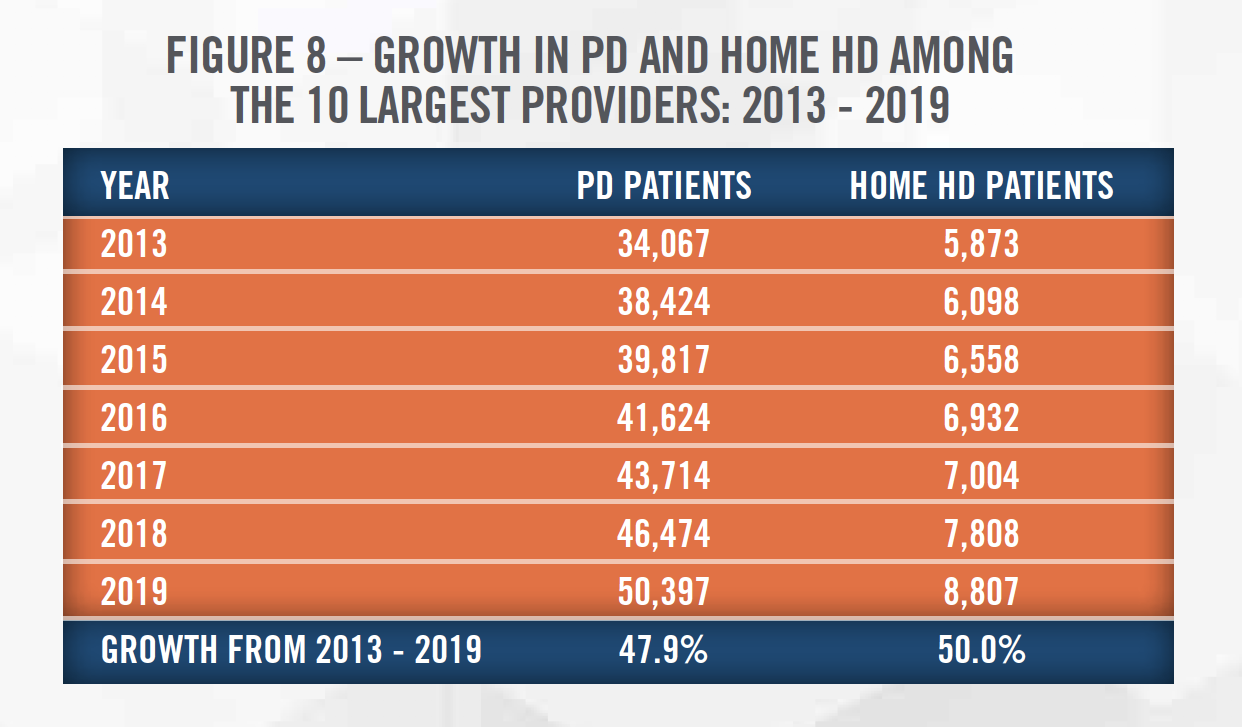

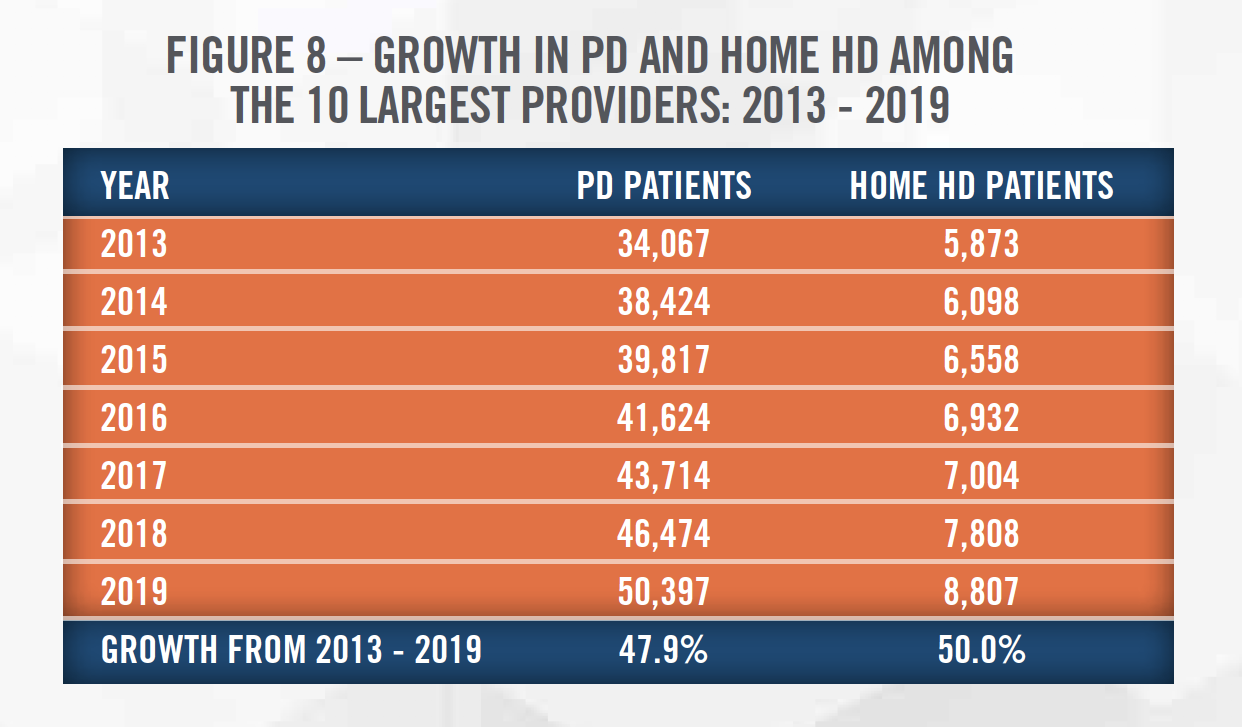

One intent of the new initiative is to shift more patients to homebased dialysis. The move towards home HD treatment is a trend that has been observed in recent years throughout the dialysis industry. Figure 8 outlines the growth in PD and Home HD patients among the top 10 largest providers.[13] Improvements in technology and the continued emphasis on moving treatments to reduced cost settings should help this trend to continue. Changes to telehealth reimbursement should also contribute to the shift to home-based dialysis treatment. Medicare’s originating site geographic requirement will no longer apply for ESRD services in hospital-based or CAH-based renal dialysis centers. Renal dialysis facilities and the home are also now eligible for reimbursement for ESRD-related services and exempt from the distant site geographic requirement as well.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

As previously mentioned, dialysis clinics receive significantly higher reimbursement rates from private insurers than from governmental payors. Some have argued that this incentivized dialysis clinics to target patients with private insurance and contributed to other controversial practices such as charitable premium assistance. In response to these controversies, the state of California introduced proposition 8 in their 2018 elections to cap the profits earned by dialysis providers. While this measure ultimately failed, the dialysis industry spent more than $100 million fighting the legislation.[14] On October 13, 2019, Governor Gavin Newsom of California signed AB 290 into law. This piece of legislation lowers the reimbursement rates from patients who received charitable premium support to Medicare levels, and requires health plans to accept premium payments from charities on behalf of patients. This law has been met with criticism by large dialysis providers such as DaVita and Fresenius Medical Care. The providers argue that this undermines the patient care objectives and will result in worse outcomes for the patient population in the long run. Similar ballot measures are soon to follow in other states and represent a looming regulatory impact to the financial performance of dialysis providers.[15] Certain transactions come with additional antitrust regulatory scrutiny, as discussed in more detail in the following sections.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

MAJOR TRANSACTIONS

Major dialysis providers such as DaVita and Fresenius expand their market share via private acquisitions and de novo expansion projects. These transactions are private, and the details are not made public. However, the consolidation in the marketplace has had significant impacts on the patient population and other stakeholders in the industry, as the dominance of DaVita and Fresenius has contributed to higher commercial reimbursement rates.

Recent large transactions on the provider side include DaVita’s acquisitions of Renal Ventures[16] (38 clinics) and Purity Dialysis (10 clinics). The FTC required that DaVita divest several clinics in the Renal Ventures transaction, which highlights regulators’ concerns about concentration of the market. In addition, U.S. Renal Care, Inc. was recently acquired in a management-led transaction that included a group of private equity buyers. Outside of clinic acquisitions, Fresenius Medical Care acquired NxStage Medical in 2019. NxStage develops, produces and markets medical devices for use in home dialysis and critical care. The acquisition will enable Fresenius to leverage its manufacturing, supply chain and marketing competencies to penetrate the in-home dialysis market and position itself strategically as the industry moves towards cheaper options for providing comprehensive dialysis care for people with ESRD and CKD.

M&A OUTLOOK

The M&A outlook for the dialysis industry will be influenced by several factors, including the presence of private equity investors, as well as the appetite for de novo growth by the large operators. Based on commentary from DaVita in recent quarterly conference calls, the company believes the growth rate of ESRD patients may be slowing, and the company has also expressed concern over recent regulatory actions in California, and reimbursement rates in general. Due to these concerns, DaVita signaled it will be slowing its investments in certain markets. More broadly, the large operators have indicated that returns on invested capital for de novo clinics are frequently higher than returns from acquired clinics. While there are some private equity sponsors active in the market (as evidenced by some of the large transactions previously mentioned), overall there is less activity in dialysis as compared to many other medical specialties. Given the ongoing risk associated withthe reimbursement and regulatory landscape, we believe private equity sponsors will continue to focus on physician groups in other specialties, and transaction activity in the dialysis space will continue to be dictated by the large operators.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

The three standard approaches to valuing businesses and interests in businesses should all be considered when valuing dialysis clinics: the Income, Market and Cost Approaches.

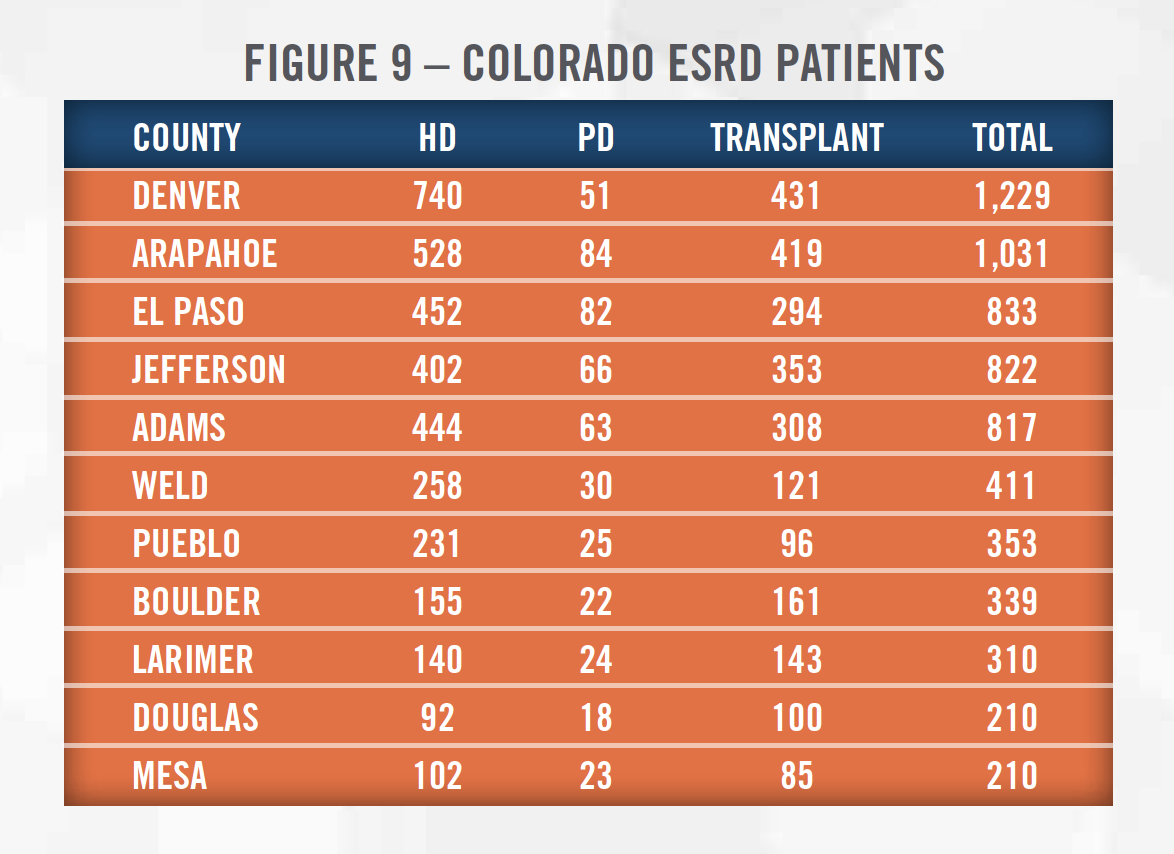

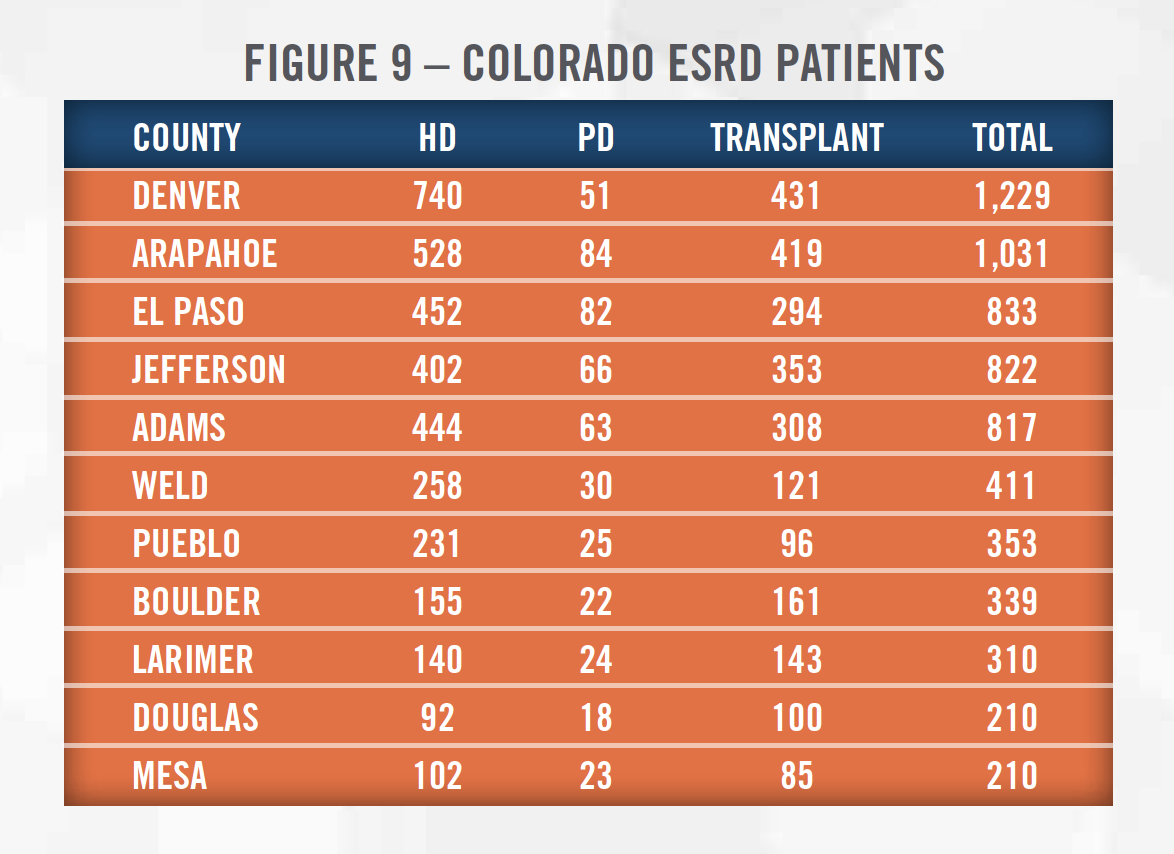

Income Approach: The income approach generally attempts to quantify the future economic benefits expected to accrue to the owner of the business, business interest, or asset. Two methods utilized under the income approach are the multi-period discounted cash flow method and single-period capitalization method. When utilizing either income approach method to value a dialysis clinic, the valuator normalizes recent performance, projects the expected future financial performance of the dialysis clinic, and discounts the cash flows expected to be generated at a risk-adjusted rate of return. Important considerations include socioeconomic characteristics of the primary service area, payor mix of the clinic and the clinic’s service area, expectations surrounding governmental reimbursement rates (e.g., participation in alternative payment models such as an ESCO), the availability of labor to staff the clinic, and the competitive dynamic of the primary service area as these will all impact the clinic’s profitability. Appraisers can estimate the exact size of a service area using the publicly-available USRD database. Figure 9 presents the counties in the State of Colorado with the most ESRD patients.

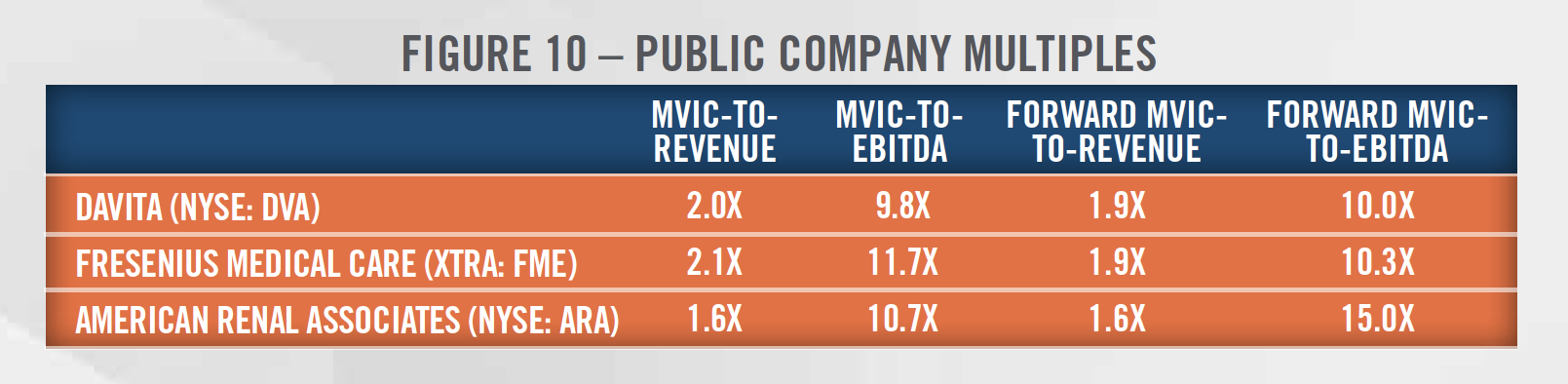

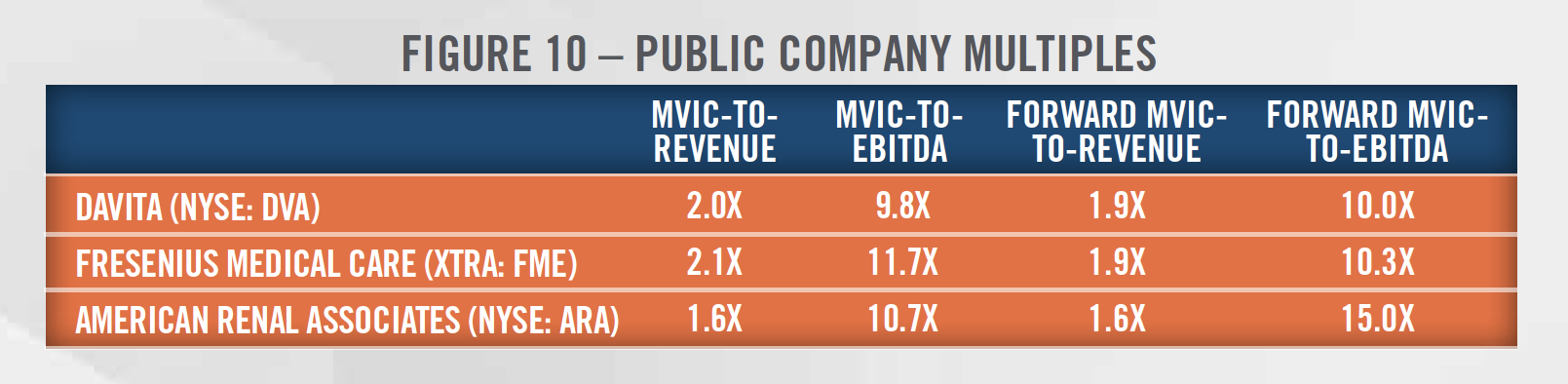

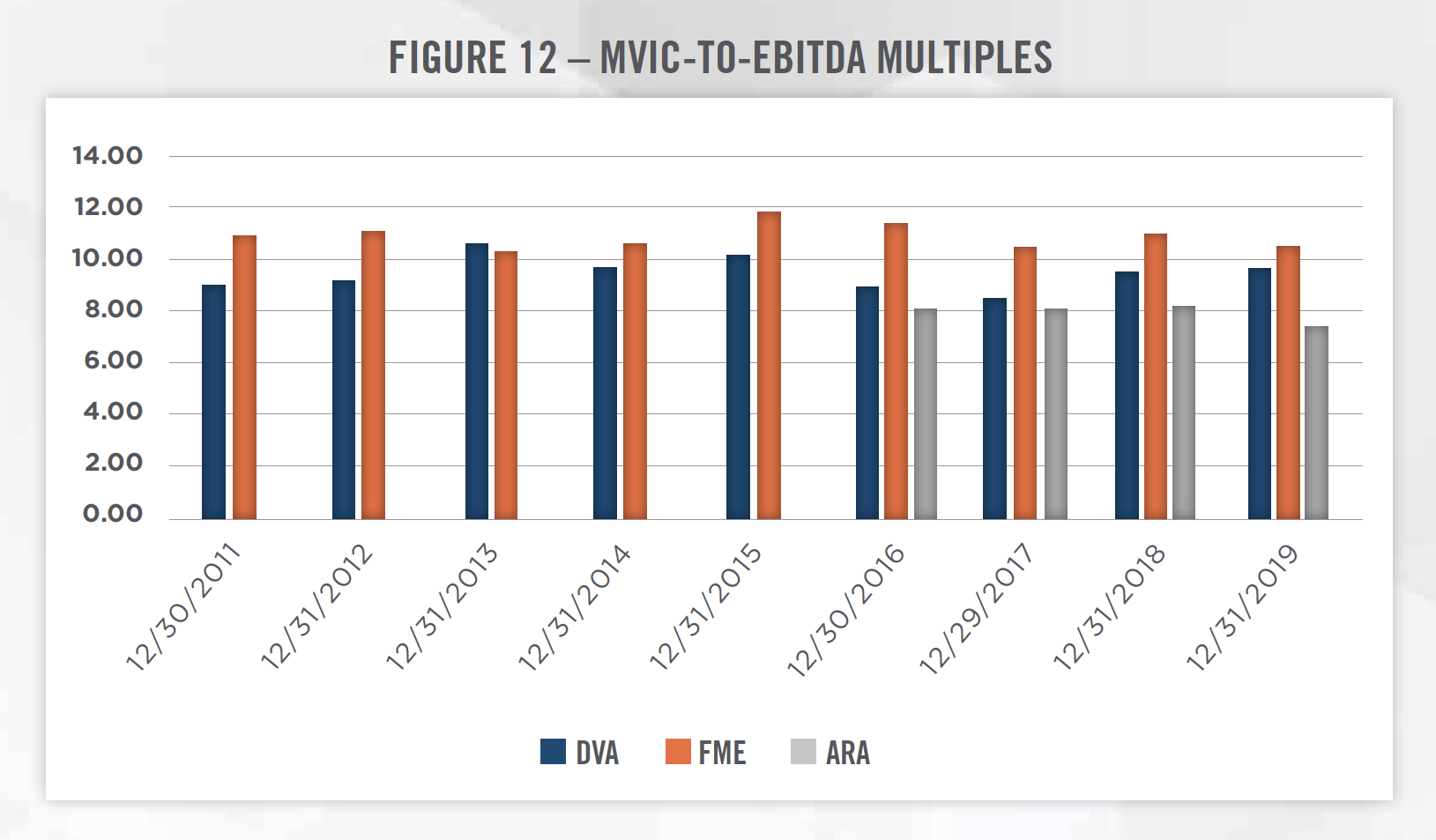

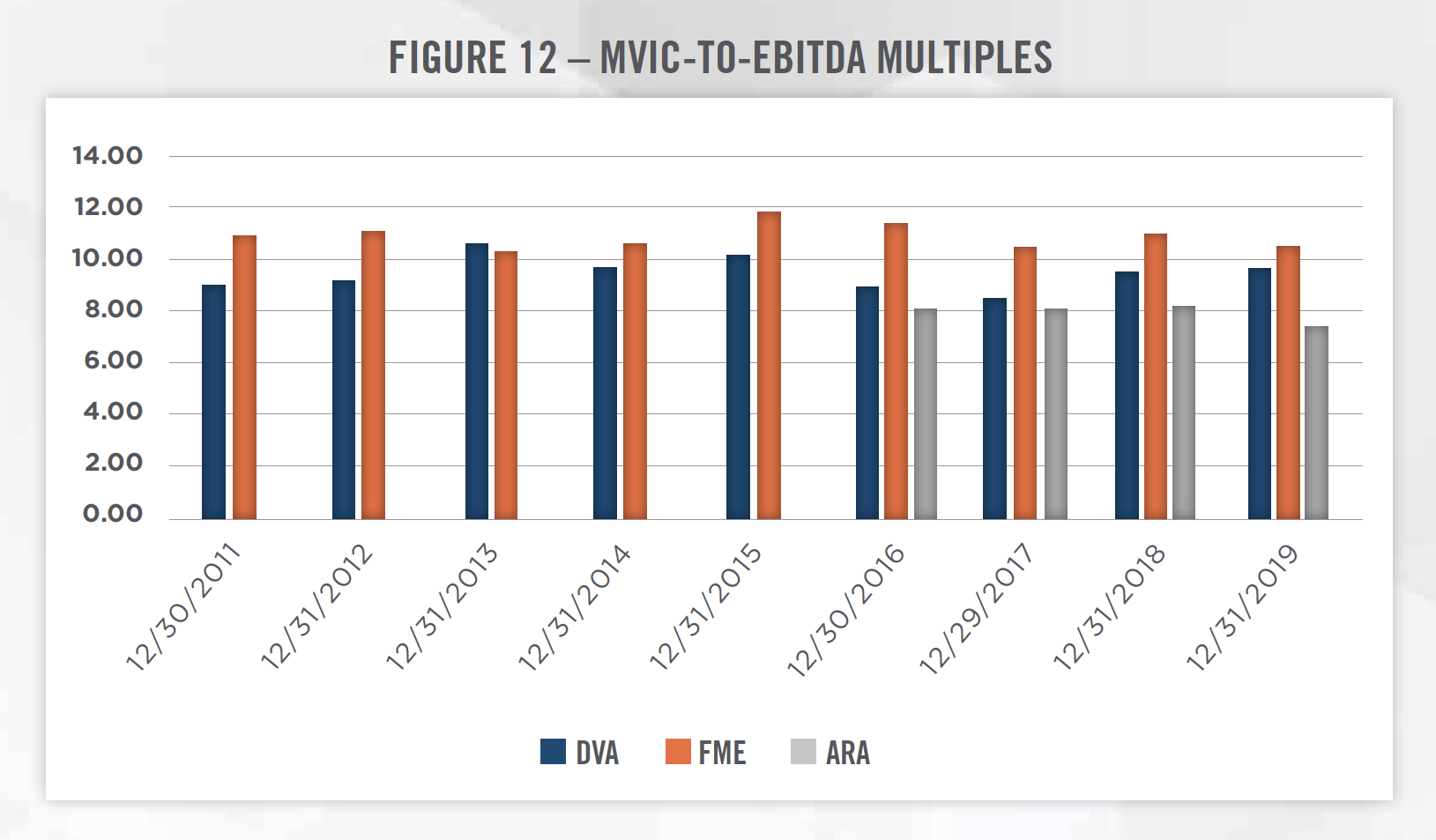

Market Approach: The market approach attempts to quantify the value of a dialysis clinic by referencing the valuation multiples paid in closed transactions for similar clinics, as well as the valuation multiples for publicly-traded operators that generate business through the provision of services similar to those provided by the dialysis clinic. The valuation multiples as of December 31, 2019 for DaVita, Fresenius and ARA are presented in Figure 10. Financial information, including analysts’ estimates of forward revenue and EBITDA, was obtained from S&P Capital IQ.

When applying the market approach, it is important to understand the comparability of the subject entity to the market data that is available. A multitude of factors, including many of those discussed in the income approach section, may influence an appraiser’s decision to apply a valuation multiple higher or lower than what is indicated by the market data. In addition, when comparing to public companies, it is important to consider adjustments for size, scope and geographic diversity that may lead to higher valuation multiples for public companies than for stand-alone operators.

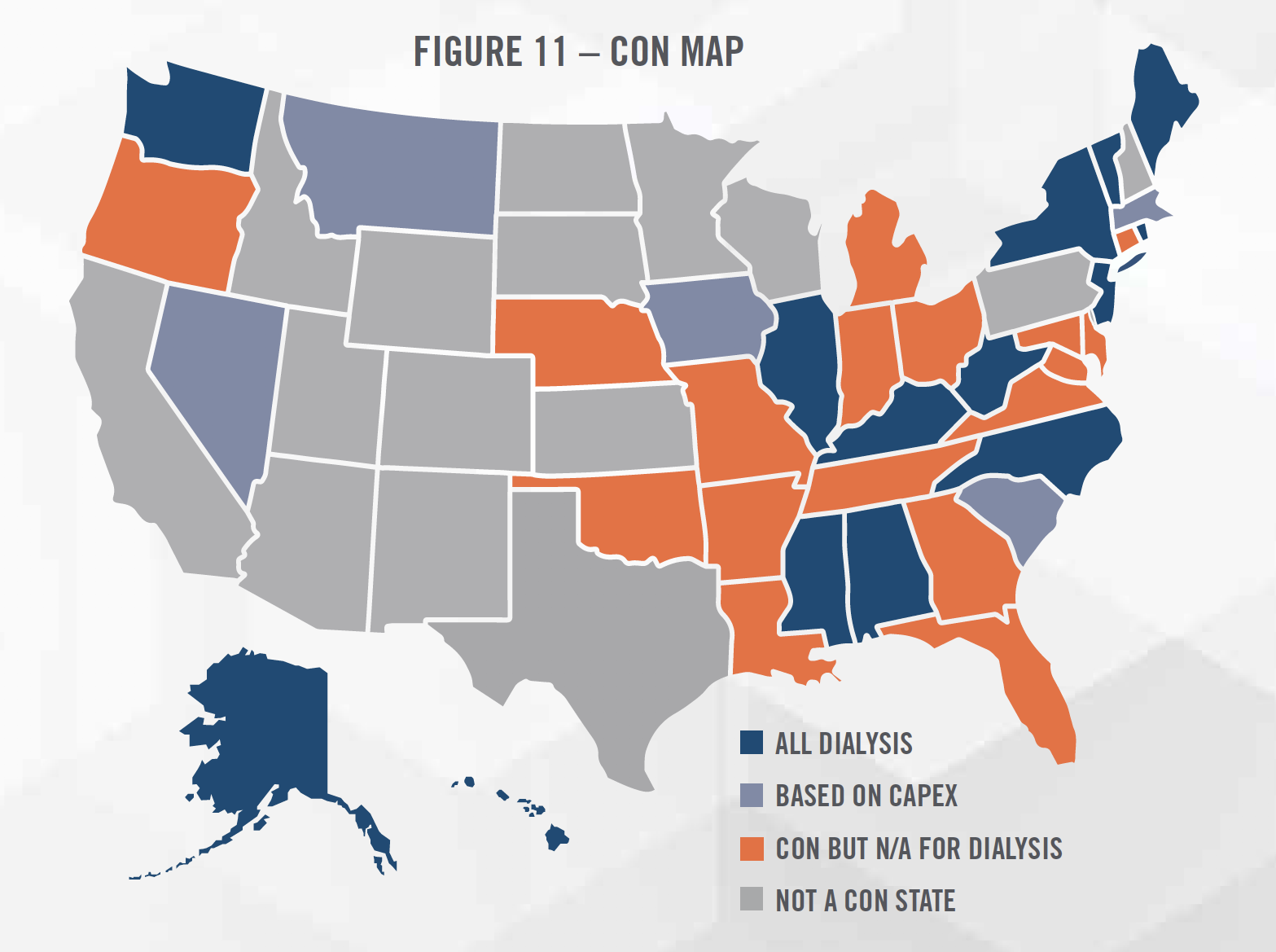

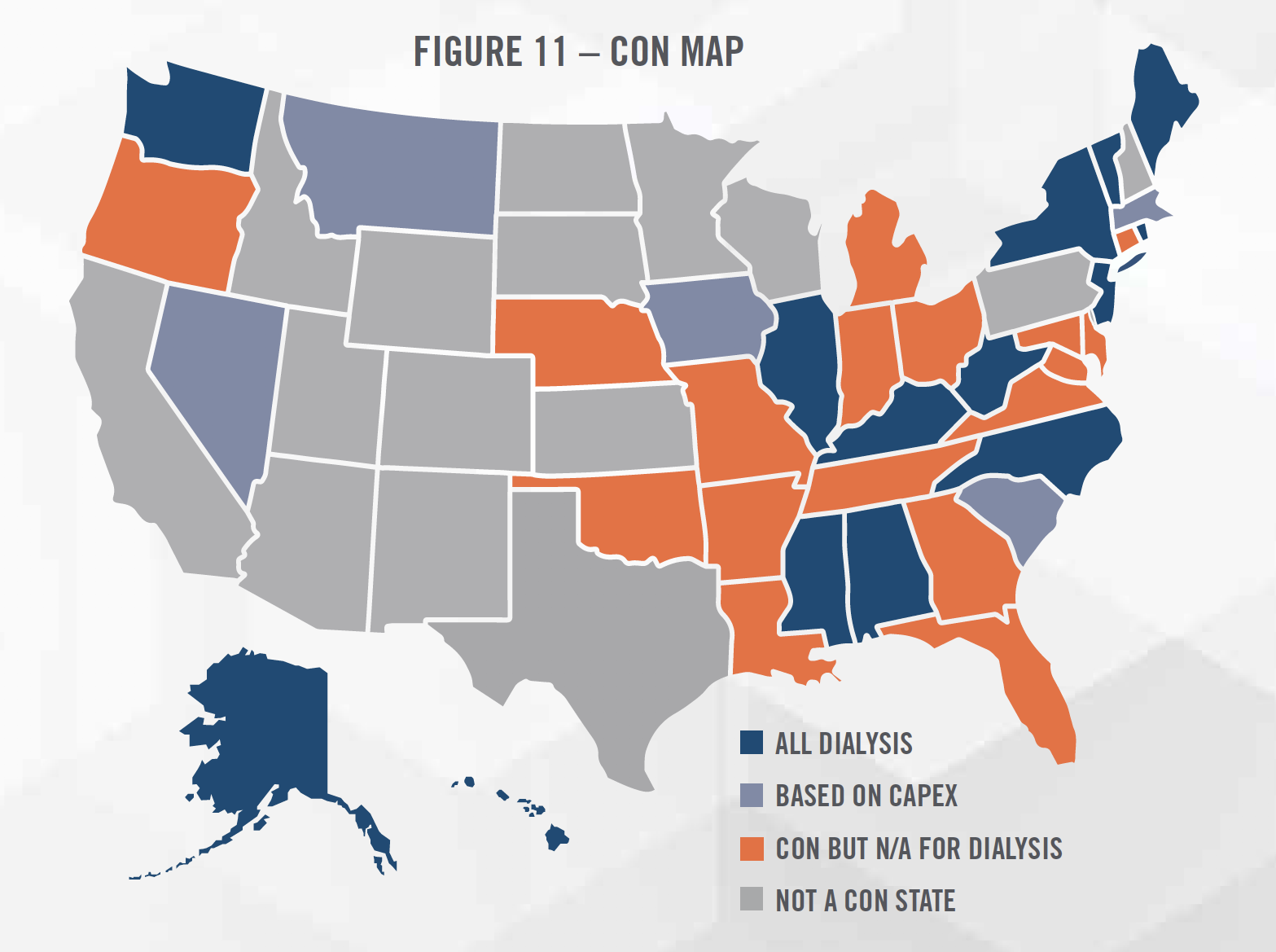

Cost Approach: The cost approach determines the value of a dialysis clinic by estimating the costs an investor would incur to recreate a dialysis clinic providing the same level of benefits as the clinic being valued. Costs that would likely be considered in the valuation include facility expense, medical equipment such as dialysis stations and water filtration systems[17], other fixed assets, expenses associated with hiring the workforce necessary to staff the clinic, as well as costs associated with obtaining the necessary licenses and accreditations to legally operate the clinic. One such cost that could be considered in certain states is the Certificate of Need (“CON”). CON laws are regulations that only enable certain projects or investments to move forward once the “need” for the service in the community has been established through a demonstration of need analysis. CONs can be time-consuming and costly to obtain, and potentially represent significant value to the owner of the intangible asset. Figure 11 summarizes which states have CON laws that apply to dialysis providers. The cost approach typically represents a floor value for a clinic, and could be considered when valuing unprofitable clinics or de novo/start-up clinics.

![]()

![]()

There are many factors affecting the outlook for dialysis clinics. The consistent growth of the prevalence of CKD and ESRD has provided an opportunity for large operators to expand their footprint, and many of the leading indicators for kidney disease, such as diabetes, point toward a continuation of this trend. DaVita and Fresenius have guided investors to expect positive revenue growth in 2020, and equity research analysts have forecasted positive revenue growth for both companies for the next several years.[18] While the growth in treatment volumes is likely to continue, the setting in which treatment is provided and the manner in which it is reimbursed are very likely to change in the coming years. Led by the CEC and Kidney Care Choices models, the shift to value-based care and risk-sharing arrangements are a focus for CMS. To effectively participate in these models, providers will need to invest in technology and staff, such as care coordinators, which could lead to short-term pressure on profit margins. The government is also focused on reducing cost through the provision of home-based dialysis, a trend which we expect to continue, and for which the large operators are preparing.

In addition, regulations similar to those in California that sought to address reimbursement rate disparities and the public’s perception of excessive profits could become more popular in other states as well.[19]

From a valuation perspective, the public company valuation multiples have been fairly consistent over the last several years, as illustrated in Figure 12. We believe valuation multiples are likely to stay consistent in the near term, as potential benefits from industry growth and technological developments are weighed against reimbursement and regulatory risks.

[1] United States Renal Data System Annual 2018 Report, CKD_Ref_B_Prevalence_2018, last accessed February 4, 2020 from: https://www.usrds.org/2018/ view/Default.aspx

[2] United States Renal Data System Annual 2018 Report, ESRD_Ref_B_Prevalence_2018, last accessed February 4, 2020 from: https://www.usrds. org/2018/view/Default.aspx

[3] https://data.medicare.gov/data/dialysis-facility-compare

[4] DaVita. Annual Report 2018, last accessed February 4, 2020 from: https://investors.davita.com/financial-information/financial-reports

[5] Fresenius Medical Care. Annual Report 2018, last accessed February 4, 2020 from: https://www.freseniusmedicalcare.com/en/investors/newspublications/annual-reports/

[6] American Renal Associates. Form 10-K 2018, last accessed February 4, 2020 from: http://ir.americanrenal.com/sec-filings

[7] Data from the Annual Reports and Form 10-K of DaVita, Fresenius, and ARA.

[8] National Institute of Diabetes and Digestive and Kidney Diseases: Financial Help for Treatment of Kidney Failure. https://www.niddk.nih.gov/healthinformation/kidney-disease/kidney-failure/financial-help-treatment

[9] National Kidney Foundation: Insurance Options for People on Dialysis or With a Kidney Transplant. https://www.kidney.org/atoz/content/insuranceoptions-people-dialysis-or-kidney-transplant

[10] Comprehensive ESRD Care Initiative: FAQs; Accessed February 6, 2020; https://innovation.cms.gov/Files/x/cecfaq.pdf

[11] Comprehensive End-Stage Renal Disease Care (CEC) Model: Performance Year 2 Annual Evaluation Report. Lewin Group, Inc., September 2019

[12] ESRD Treatment Choices Model; Accessed February 6, 2020; https://innovation.cms.gov/initiatives/esrd-treatment-choices-model/

[13] Nephrology New & Issues: Large providers continue strong growth in home dialysis. https://www.healio.com/nephrology/home-dialysis/news/print/ nephrology-news-and-issues/%7B75ba2c3a-c1dc-403f-9ac4-127eb8bddb9a%7D/large-providers-continue-strong-growth-in-home-dialysis

[14] https://www.latimes.com/politics/la-pol-ca-proposition-8-dialysis-industry-20181029-story.html

[15] California Gov. Newsom Signs Dialysis Regulations Into Law. HealthLeaders. https://www.healthleadersmedia.com/finance/california-gov-newsomsigns-dialysis-regulations-law

[16] While DaVita did not disclose financial terms, the Renal Ventures transaction was valued at 2.2x Renal Ventures’ 2015 revenue based on FTC data.

[17] While dialysis stations have water filtration systems, many large clinics have water filtration systems located in small room that feeds purified water to the individual dialysis stations.

[18] Based on estimates obtained from S&P Capital IQ.

[19] Ohio would have had a similar ballot measure in 2018 but the measure was invalidated by the state’s Supreme Court because the supporters of the bill did not fill out the proper paperwork.