Authors: Jim Carr, ASA, MBA and Andrew Worthington

![]() HOSPITAL-BASED CLINICAL COVERAGE ARRANGEMENTS

HOSPITAL-BASED CLINICAL COVERAGE ARRANGEMENTS

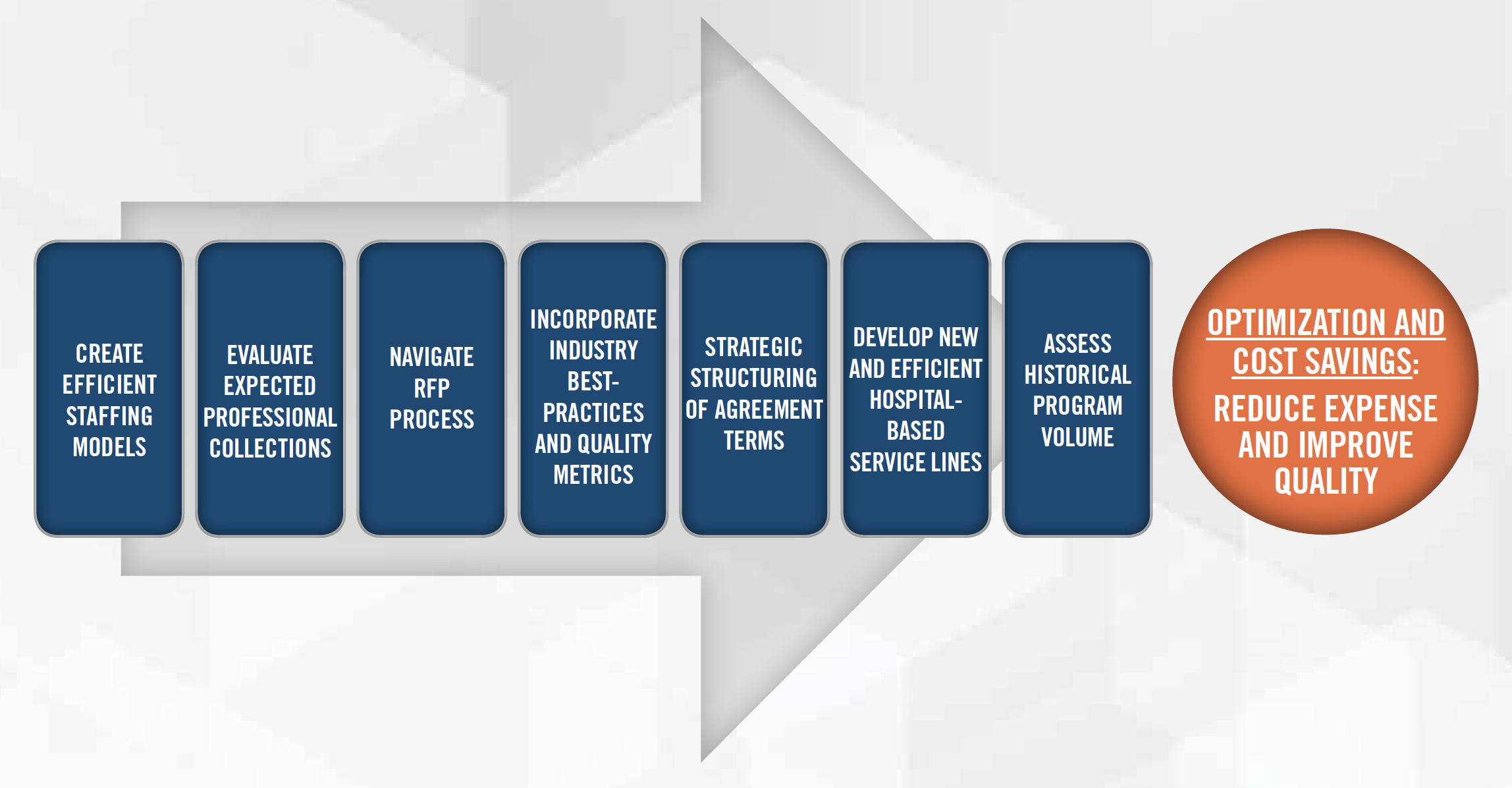

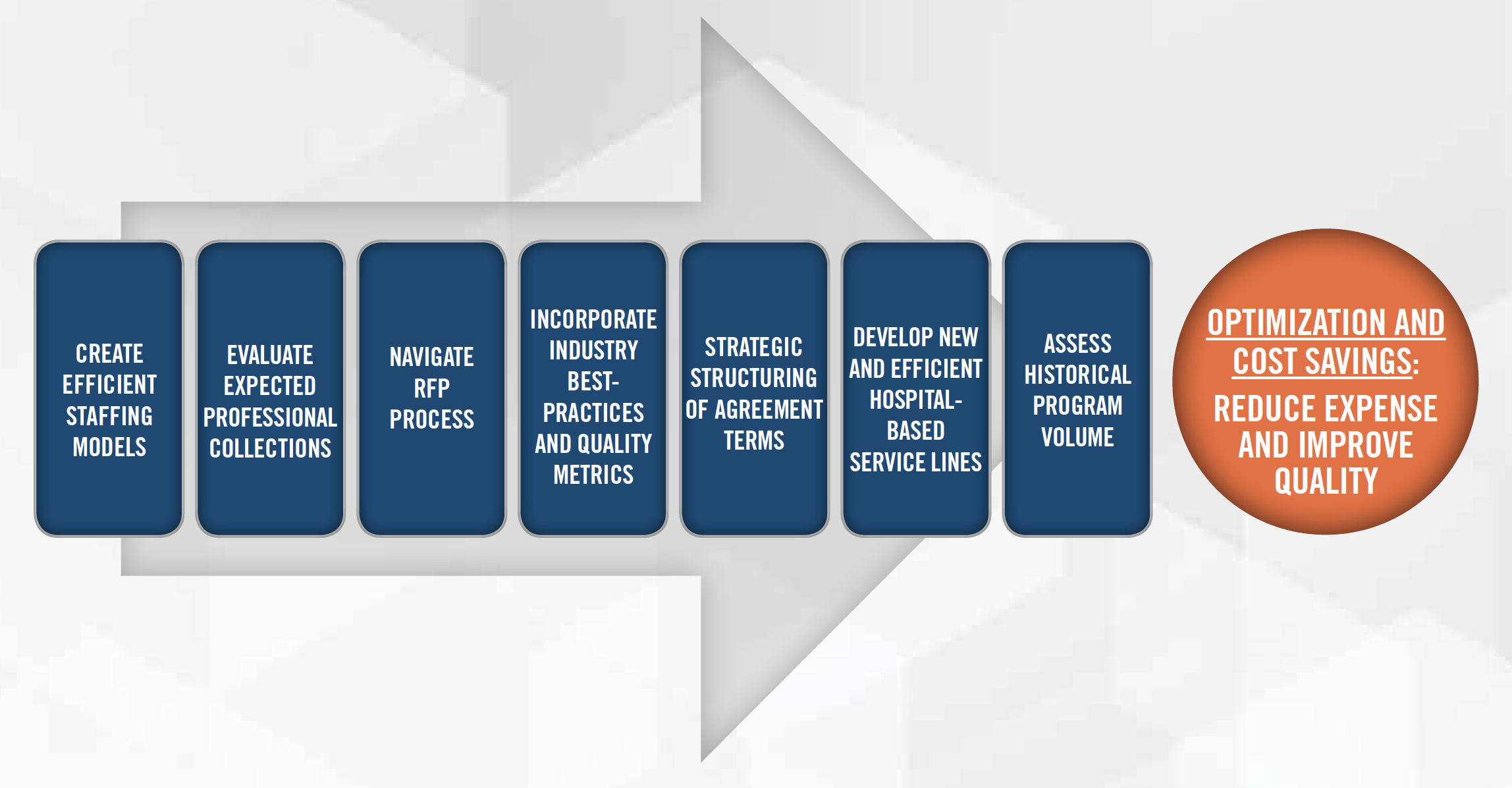

Often, hospitals and health systems do not wish to incur the administrative burden involved in employing the clinical resources needed to cover their hospital-based service lines (e.g., anesthesiology, emergency medicine, hospitalist medicine, and intensive care). Alternatively, hospitals have increasingly opted to enter into hospital-based clinical coverage arrangements (“HBCCAs”) with independent physician groups. Because hospital-based providers commonly generate lower collections from their professional services than their costs to provide those services, HBCCAs usually involve some form of financial support from the hospital(s). HealthCare Appraisers has observed that hospitals and health systems routinely negotiate HBCCAs without seeking significant improvements in the quality of care rendered or material reductions in the financial support provided to the physician group. This article reviews the tactics that hospitals and health systems can utilize to derive more value through their HBCCAs.

![]()

![]()

![]()

![]()

![]()

![]()

Hospitals frequently evaluate their HBCCAs when nearing the end of the current agreement term. At such time, they may be experiencing unsatisfactory quality of care, issues with the provider meeting coverage requirements, and/or large potential increases in the investment needed to secure hospital-based coverage. Even if the hospital is happy with its HBCCA provider group, it may be still be prudent for the hospital to explore proposals from alternative providers in the marketplace to introduce some healthy competition into the process. Additionally, the Request for Proposal, or “RFP,” process can be utilized to introduce new compensation considerations into the HBCCA.

![]()

![]()

![]()

![]()

![]()

![]()

There are several important items to remember and consider including in the RFP. Bidding provider groups are nearly always required to provide financial statements when requested; however, it is important to seek additional information related to your service line’s specific challenges, and to receive honest and accurate responses. Beyond the numbers, it is crucial to understand how a new group can remedy or improve existing issues and challenges.

![]()

![]()

![]()

![]()

![]()

![]()

Once formal proposals have been received, there are numerous key facets to consider in the evaluation of these bids, including care, coverage, collections, and cost.

Coverage:

Collections:

As discussed above, it is common for provider groups under HBCCAs to generate insufficient professional collections to cover their costs. In turn, hospitals typically offer financial support to ensure the groups are able to cover their costs. All things equal, the greater the group’s professional receipts, the less the hospital will have to pay in financial support. During the RFP process, hospitals must be able to identify if a group’s anticipated collections are competitive in the marketplace. Additionally, a hospital must be able to discern if the estimate of professional receipts is overstated, such that a shortfall results in additional financial support once an agreement has been executed. Finally, it is important for a hospital to understand the group’s negotiated reimbursement rates with commercial payors. The quality of the commercial contract can affect not only the financial support, but also the patient. Medical groups may not hold commercial contracts and partake in out of network billing practices. While this can materially increase the group’s professional collections, the patient may be left with a surprise bill.

Care:

As described above, the type of coverage and number of providers are key elements in the efficiency of a service line. However, facilities can truly enhance their hospital-based service lines by looking closely at care. There are several ways facilities and medical groups can work together. Including quality bonuses or withholding portions of the financial support in exchange for improved quality from the group can be a valuable element of an HBCCA. This can motivate the group to improve quality, patient satisfaction, reduce costs, and bolster patient access. There is great opportunity for facilities to engage with medical groups that will be true partners who will work to achieve strategic goals beyond what’s captured in financial statements and coverage schedules.

Cost:

The relationship between care, coverage, and collections is tied closely to the aggregate level of cost incurred by a provider group. Ultimately, the provider’s cost has a significant impact upon the level of financial support that must be paid by a facility. A group may have the optimum level and mix of provider coverage, but compensation paid to those providers could exceed fair market value (“FMV”). Furthermore, HBCCA proposals routinely include additional cost items, such as overhead, start-up expenses, locum tenens support, that require additional scrutiny.

![]()

![]()

![]()

![]()

![]()

![]()

Critically evaluating your existing HBCCAs, let alone navigating an RFP process, can be a daunting task. In the past, many hospitals and health systems have viewed financial support under HBCCAs as a “cost of doing business.” While there certainly is an entrenched cost associated with many HBCCAs, those costs can be optimized and result in operational and care improvements. In today’s value-based healthcare environment, HealthCare Appraisers leverages over two decades of experience evaluating HBCCAs to assist hospitals in assessing their RFP process, developing RFPs, and evaluating proposals. Contact us to experience how we think differently about HBCCAs.