Author: David B. Fink

![]() THE HEALTHCARE VALUATION COMMUNITY

THE HEALTHCARE VALUATION COMMUNITY

The impetus for the healthcare valuation community began in the late 1990’s after the Physician Self- Referral Law (commonly known as the Stark Law) was enacted by Congress, which prohibits physicians from referring Medicare patients to health care providers in which the physician has a financial relationship, unless the arrangements meet certain exceptions. Oftentimes, these exceptions have three main requirements: (i) that arrangements between healthcare systems and provider referral sources must be commercially reasonable; (ii) the amounts paid are not based on the “volume or value of referrals or other business generated for a party;” and (iii) the compensation paid must be consistent with fair market value (FMV).

Valuation firms were formed shortly thereafter to address the ever-growing needs of hospitals, health systems, and legal counsel, in light of the regulatory roadblocks. Although this initially resulted in a competitive valuation landscape, the preceding 30 years have shown that not all valuation firms are adaptable and forward-thinking. However, one valuation firm that does check the boxes is HealthCare Appraisers, which pioneered Automated FMV SolutionsTM, an online FMV calculator platform which can transform how healthcare entities do business. This online solution enables users to instantly receive an FMV opinion from the comfort of their computer or mobile. Quality is never compromised because the calculators utilize the same valuation techniques as HealthCare Appraisers’ comprehensive, non-automated opinions. Hundreds of hospital operators and attorneys across the country consistently use these calculators to meet regulatory and compliance needs, including for employment arrangements, professional services arrangements, on-call coverage arrangements, and medical director arrangements, among others.

![]()

![]()

![]()

![]()

![]()

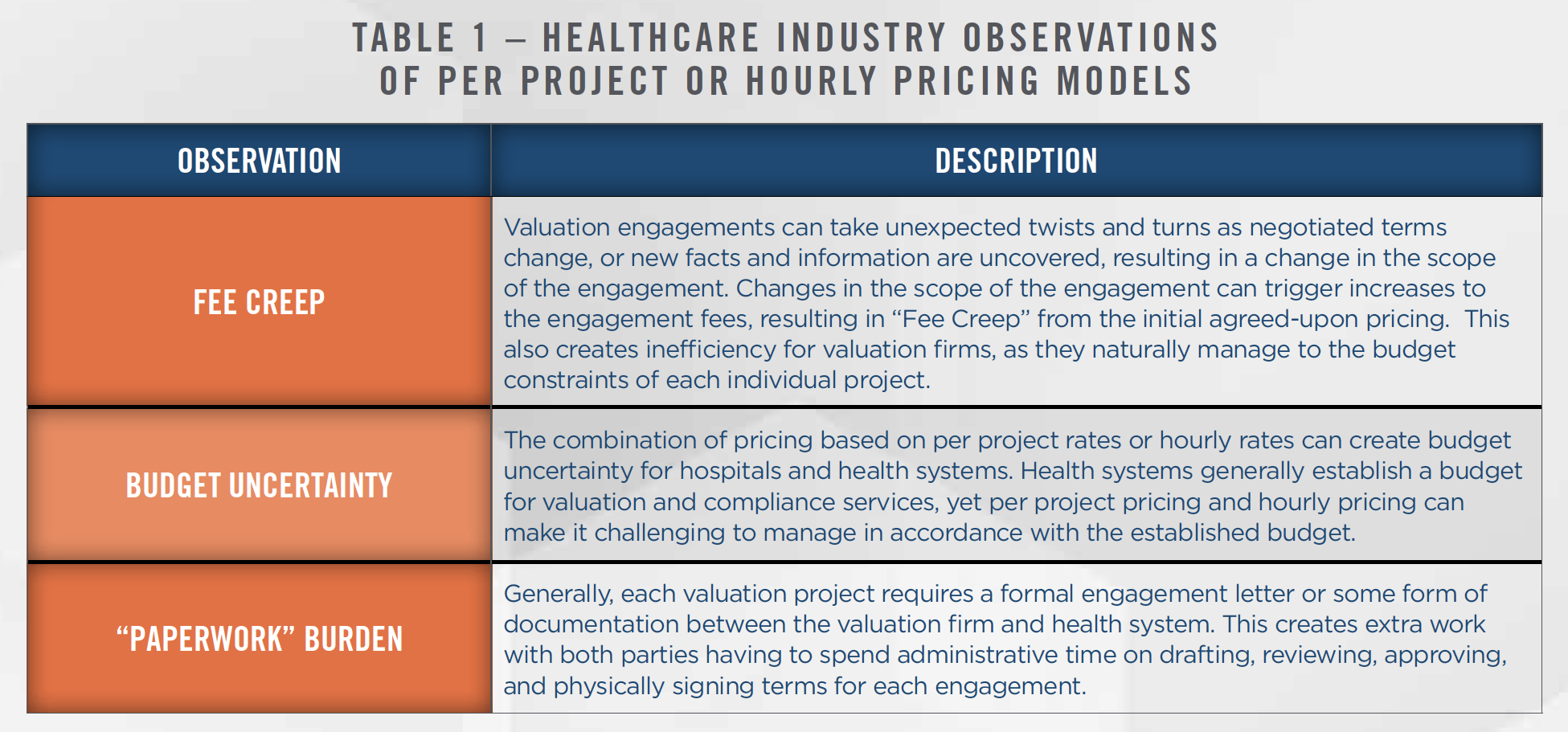

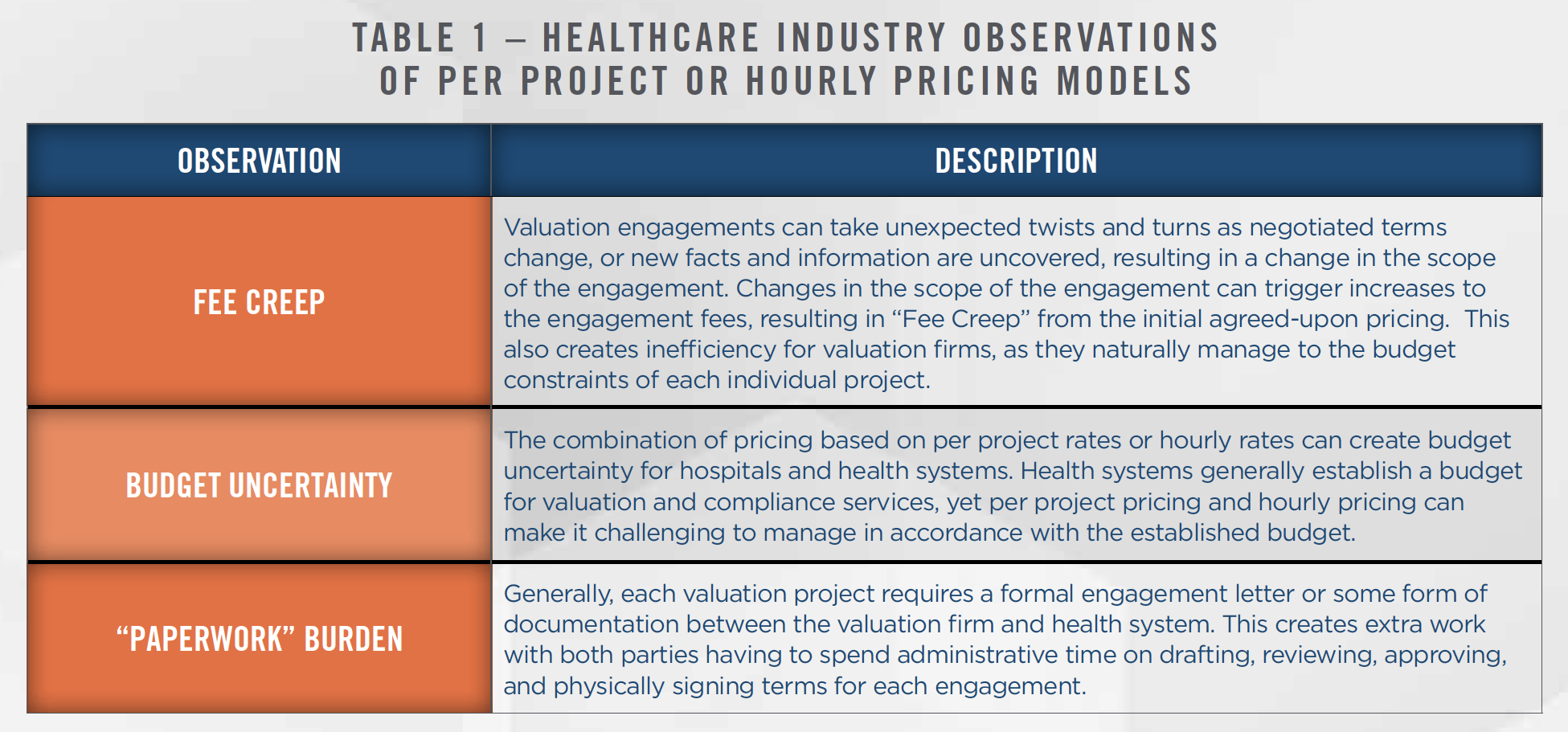

There is no doubt that technological innovations have improved the speed and the economic delivery of FMV services within the industry. However, based on feedback received from the healthcare industry and HealthCare Appraisers’ observations, there are still gaps to be filled. Longstanding and more traditional valuation consulting fee models established by most firms may not necessarily be the most efficient structure for every health system. For example, the majority of valuation firms charge for their services on either a per project basis or on an hourly basis. The potential shortfall of such fee structures are summarized in Table 1.

While the existing fee models may work appropriately for some health systems, it is clear that an innovative fee model is also needed, especially when considering the increasing financial pressures facing hospitals and health systems.

![]()

![]()

![]()

![]()

![]()

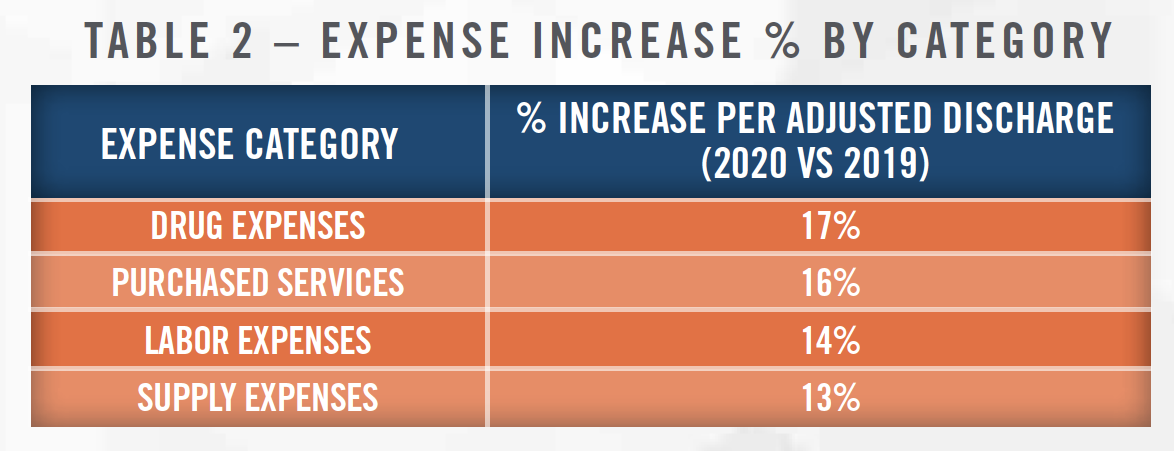

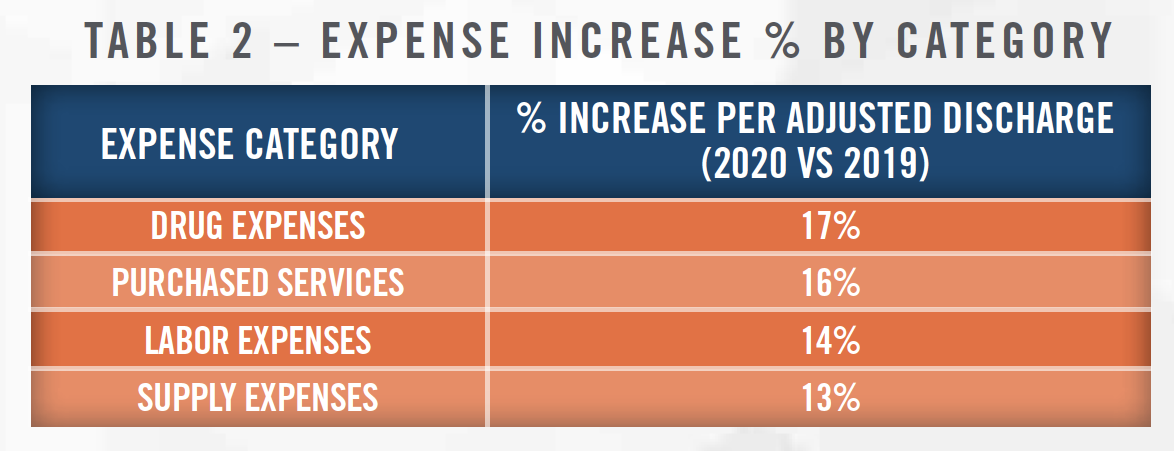

Health systems experienced pre-pandemic financial pressures; however, COVID-19 has only compounded the overall financial concern. An analysis prepared by Kaufman, Hall & Associates, LLC, which was released by the American Hospital Association (AHA) in March 2021, found that the COVID-19 pandemic continues to impact the overall financial picture of hospitals and health systems. The study found that “…total hospital revenue in 2021 could be down between $53 billion and $122 billion from pre-pandemic levels.” In addition to revenue loss, the study indicated that health systems are also facing increases in expenses due to COVID-19, as noted in Table 2:

The healthcare industry’s financial health is getting squeezed from all sides, and naturally, health systems are looking to optimize their spend in other areas.

![]()

![]()

![]()

![]()

![]()

Back in 2007, Amazon launched Amazon Prime, which has since completely revolutionized consumer purchasing habits and the retail industry. Through a single membership fee, Amazon began providing unlimited one-day delivery on millions of products. Today, it is estimated that there are 147 million Prime members in the United States alone. The success of the Prime model was due to the value-added benefits for its members, in terms of cost, convenience, and delivery speed, and it established a mutually beneficial relationship between Amazon and its members.

By examining the potential shortcomings of the existing fee models within the healthcare valuation industry, as well as the aforementioned financial pressures impacting health systems, HealthCare Appraisers decided to build a better fee model, and started with a foundation that provides value-added benefits to the client. This new model is called the Fixed Fee Partnership.

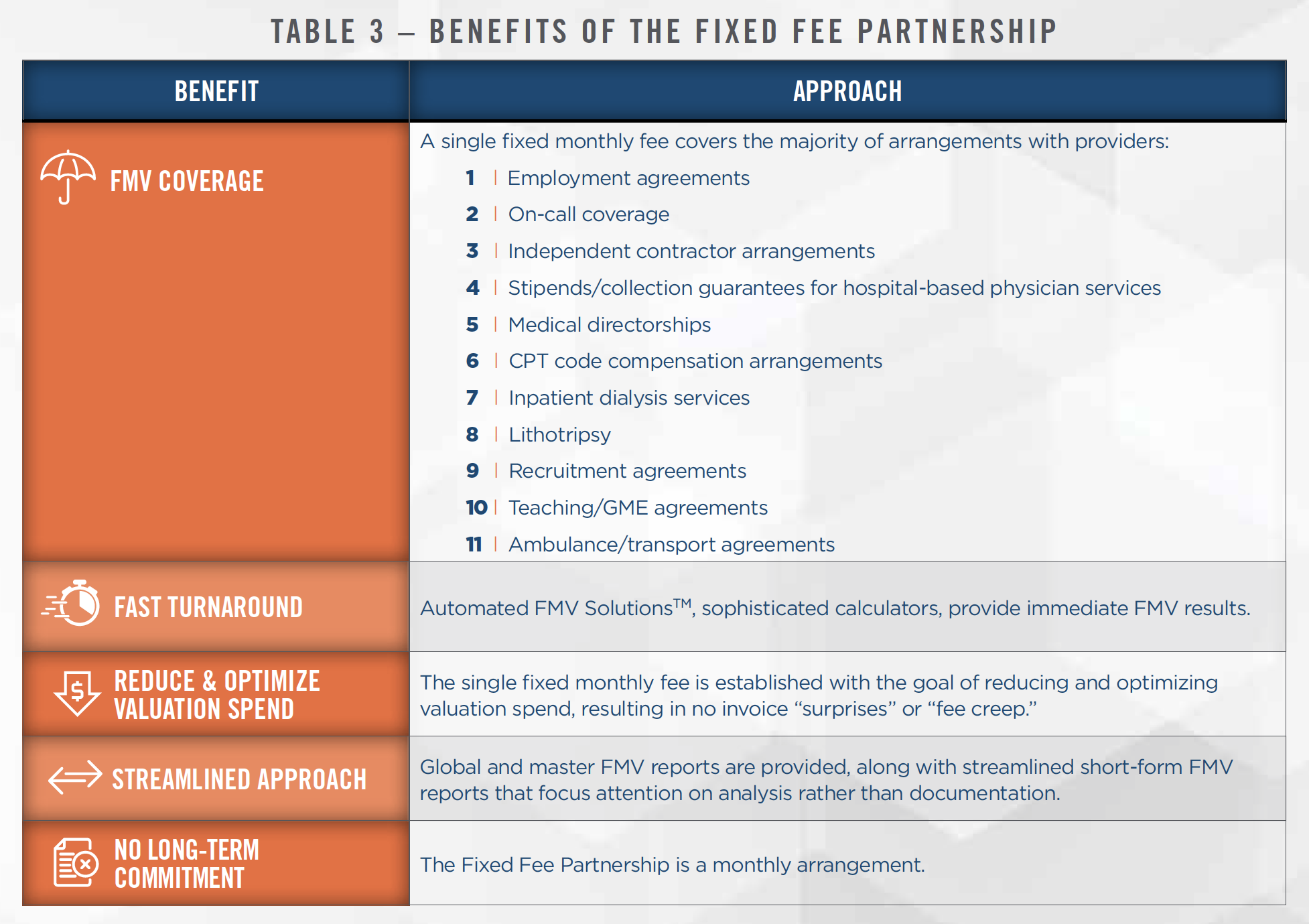

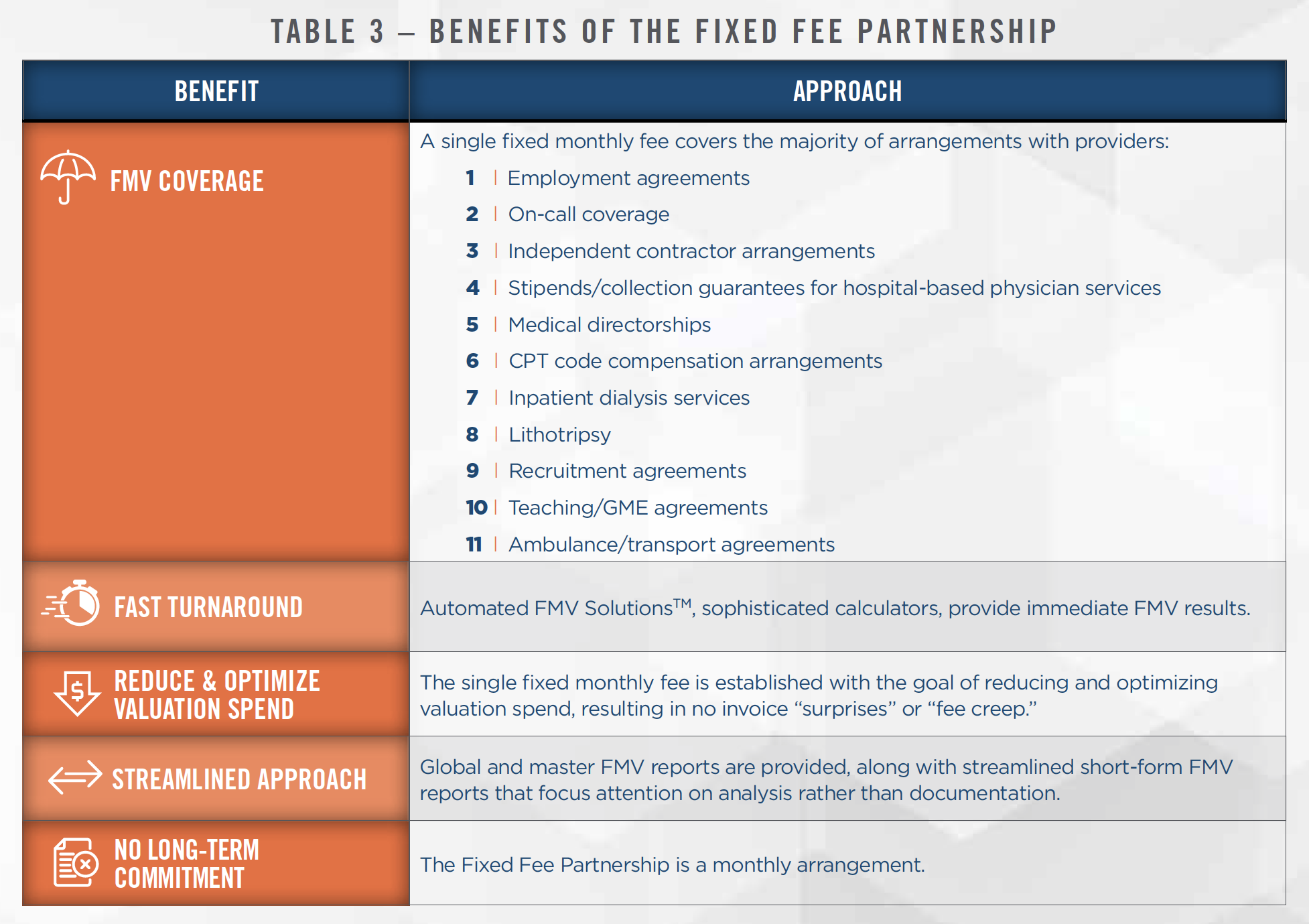

Through a customized, fixed monthly fee, the Fixed Fee Partnership harnesses the power of Automated FMV SolutionsTM to provide a streamlined and economical approach to regulatory compliance. This fee structure provides FMV services for the vast majority of referral-based compensation arrangements. The value-added benefits are summarized in Table 3.

![]()

![]()

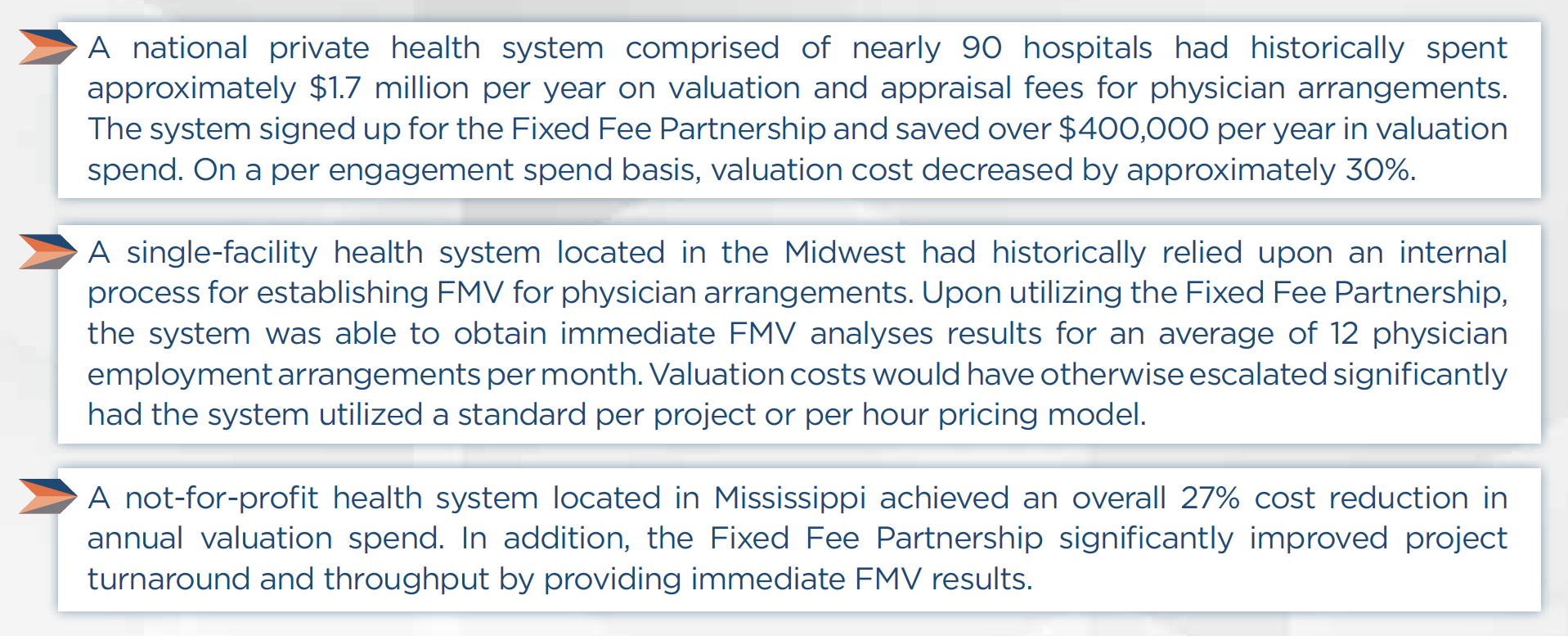

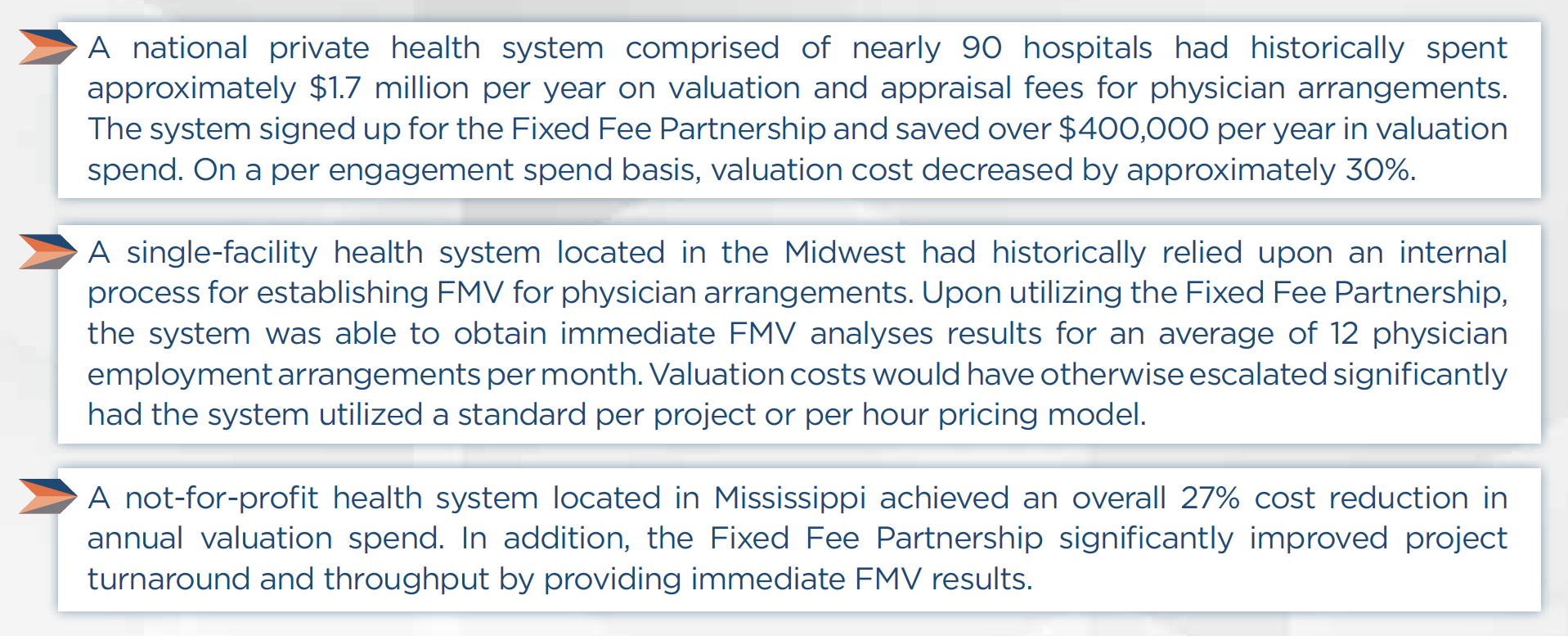

The Fixed Fee Partnership model developed by HealthCare Appraisers has resulted in significant improvement for certain health system’s regulatory compliance programs, in terms of decreased cost while simultaneously improving FMV analysis coverage of provider arrangements. Several successful case study examples are summarized below.

From these case study examples, the Fixed Fee Partnership produces tangible benefits for health systems and hospitals, regardless of their size, scope, or geographic location. To-date, all of HealthCare Appraisers’ clients utilizing the Fixed Fee Partnership have continued to renew their monthly arrangement.

In conclusion, valuation services are never a one-size fits all approach. Each service and solution should be customized for each specific need. HealthCare Appraisers’ Fixed Fee Partnership is a newly established solution designed to meet regulatory and compliance needs while reducing overall valuation spend for health systems. Organizations who are interested in a different approach to valuation may find a good fit with the Fixed Fee Partnership.