Orthopedic practices have long generated interest from outside buyers, including hospitals and health systems, and more recently, private equity firms. There are many rationales and factors driving interest in the orthopedic specialty, and we expect transaction activity to remain robust, particularly amongst private equity buyers. This article discusses the different types of transaction structures for each buyer, the volume of deals and valuation multiples in the space, and the financial and strategic rationale for pursuing these deals.

![]() TRANSACTION STRUCTURE

TRANSACTION STRUCTURE

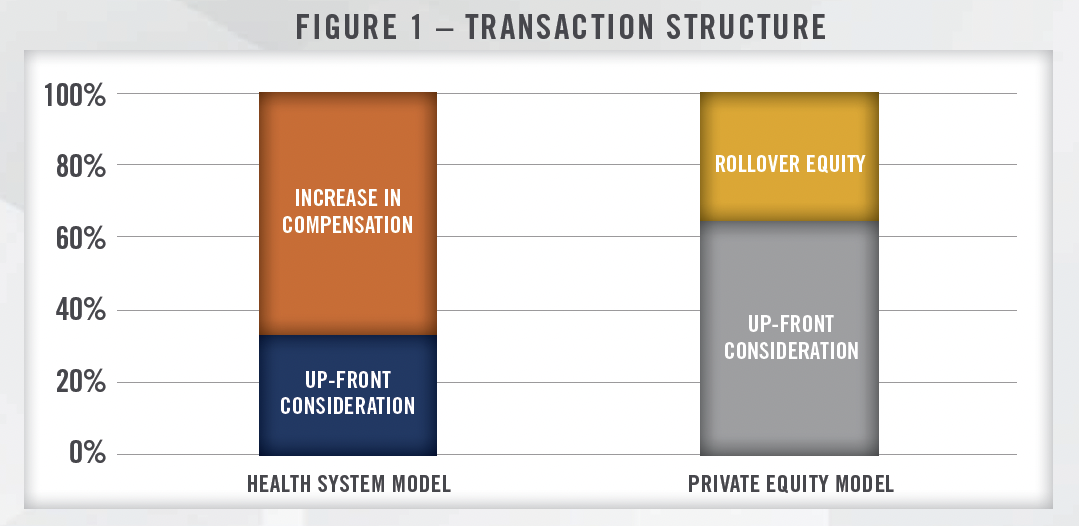

While every orthopedic practice transaction has unique aspects, there are key fundamental differences between acquisitions by hospitals versus private equity firms. Hospital acquisitions typically are heavily focused on post-transaction compensation representing a significant portion of the overall value conveyed to the seller. Figure 1 illustrates an example of how value could be allocated for a practice acquired by a hospital, whereby a material portion of the value achieved by the seller is in the form of higher compensation post-transaction. In this example, one third of the overall value of the transaction would be transferred at closing, with the remaining two-thirds earned over the initial employment term. The amount conveyed through increases in compensation will depend in large part on how much compensation the sellers were generating pre-transaction. Given that compensation paid by hospitals and health systems to physicians must be consistent with fair market value, successful orthopedic groups with highly compensated physicians may not be able to realize large pay increases and may require higher upfront purchase consideration. We have also worked with health systems that have pursued joint venture or affiliation models with large orthopedic groups to avoid the large upfront cost associated with a full acquisition. These transactions are structured to encourage physician engagement and higher levels of autonomy, and also ensure post-transaction profitability for the group. Depending on the specifics of the structure, these deals can look more like private equity transactions (discussed below) without the rollover equity component.

The private equity model is different from the hospital/health system model in that the sellers typically receive a larger payday upfront, with the remaining consideration rolled over into equity in the platform organization. The amount of rollover equity typically ranges from 20 percent to 40 percent of the total purchase consideration, with recent orthopedic transactions we have worked on ranging from 30 to 35 percent. In addition, since physician practices typically distribute all available earnings to the owners, EBITDA must be “created” through a reduction in total cash compensation for the sellers (known as a “scrape”). Many private equity transactions are structured such that a large component of the purchase consideration is related to the sale of personal goodwill by the selling physicians.[1] This can have tax implications for the sellers, and we are frequently engaged to value personal goodwill in connection with physician practices selling to private equity platforms.

![]() PRIVATE EQUITY TRANSACTIONS

PRIVATE EQUITY TRANSACTIONS

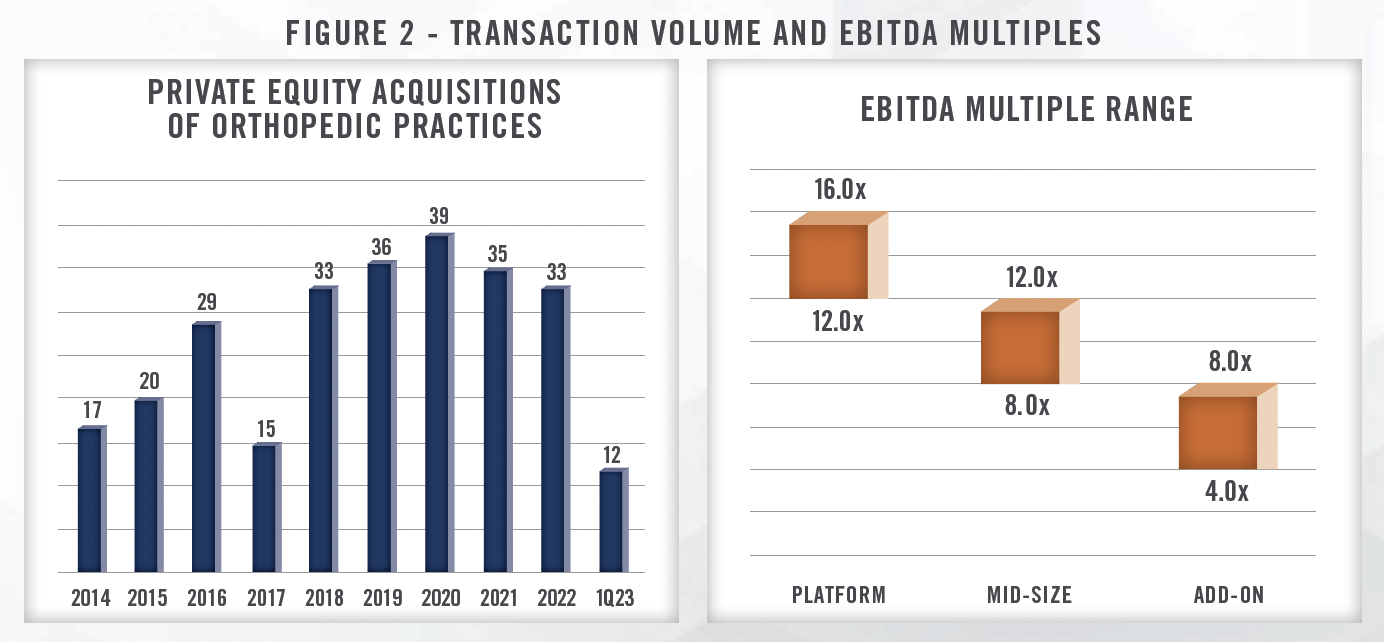

Private equity interest in consolidating physician practices is as high as ever, with orthopedics rapidly becoming one of the specialties generating the most investor interest. While there are several large platforms (typically referred to as Physician Practice Management, or “PPM”, companies) pursuing deals the last few years, the market remains highly fragmented and offers many attractive characteristics that should lead to continued strength in transaction volumes. Figure 2 presents private equity transactions in the orthopedic space from 2014 through the first quarter of 2023, as well as the approximate range of valuation multiples for various types of transactions.[2]

As with all PPM transactions, there is a wide range of valuation multiples paid for orthopedic practices. The valuation multiple depends on a variety of factors including the size of the practice, location, deployment of technology including high functioning EMR, online booking, referral management, and patient engagement, and the presence of ancillaries such as an ambulatory surgical center, physical therapy, pain management, durable medical equipment and imaging. We observe midsized orthopedic practice transactions with EBITDA multiples ranging from the high single digits to low double digits. Larger platform acquisition multiples are typically in the mid-teens range, while smaller tuck-in acquisitions are in the mid-single digits range. In our experience, EBITDA multiples for orthopedic practices tend to be higher than many other medical specialties due to the presence of ancillaries and ability for posttransaction income repair.

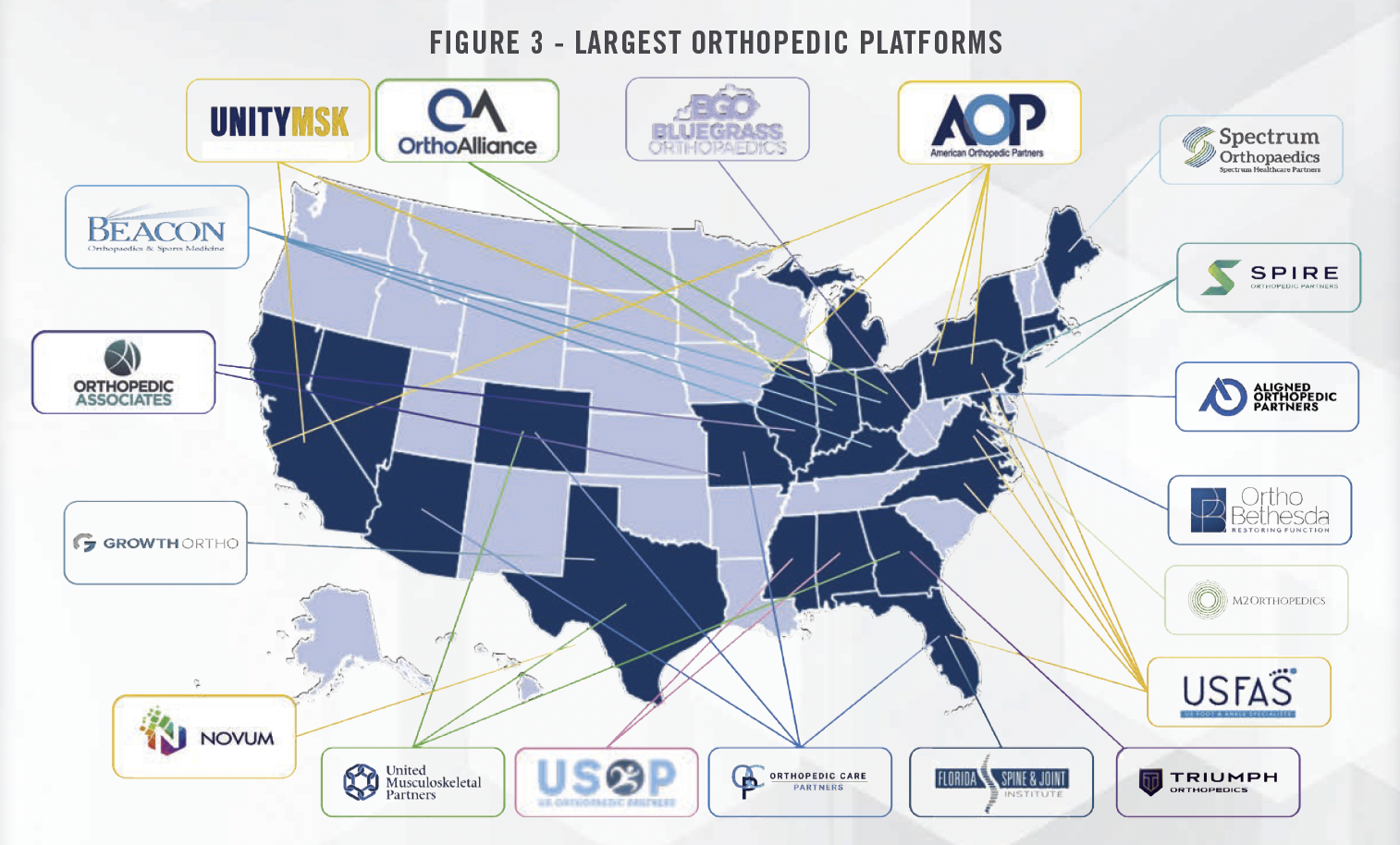

While the consolidation of orthopedic practices by private equity is still in the early stages, there are several large established PPM companies that operate in multiple states. Many of these platforms have more than 100 providers and offer a variety of ancillary services which provide financial and strategic benefits to acquirers. Some of the largest platforms in the United States are presented in Figure 3.

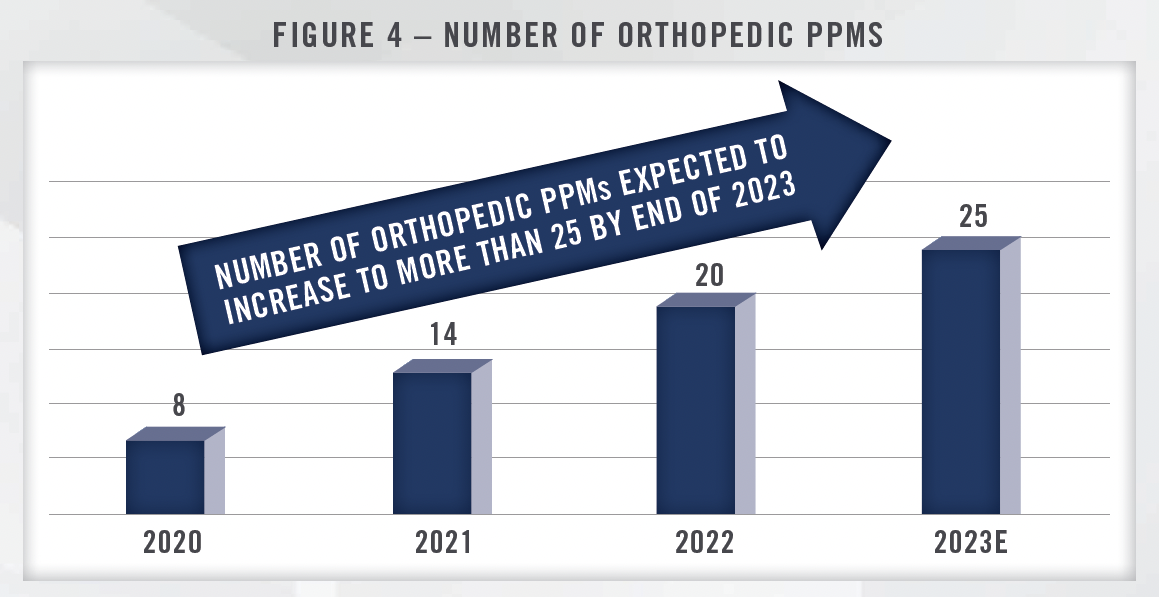

As consolidation activity continues, the number of large orthopedic PPMs is expected to increase, with more than 25 PPMs expected to operate in the space by the end of 2023. More competition for orthopedic practice transactions should support high valuation multiples through a competitive environment, particularly as health systems and payors remain interested in these groups as well. While higher interest rates and the potential for recession are impacting some parts of the healthcare M&A landscape, orthopedic practice transactions have thus far seen relatively little impact.

![]() NON-PRIVATE EQUITY MODELS

NON-PRIVATE EQUITY MODELS

While private equity has been driving much of the consolidation activity in the orthopedic space in recent years, there are other partnerships, arrangements, and models being implemented that do not involve outside capital. The recent formation of PELTO Health Partners by OrthoIndy, EmergeOrtho, and Proliance Surgeons illustrates the ability of large groups to form alliances without a change of control transaction or outside capital investment. Similarly, OrthoIllinois and Midwest Orthopedics at Rush formed an affiliation as OrthoMidwest. These large organizations enable orthopedic practices to invest in shared management and administrative services, similar to a PE backed MSO, without having to sell their practice. The individual practices that are part of the organization expect to benefit from efficiencies and economies of scale while retaining a higher degree of independence. PELTO Health Partners is comprised of more than 400 physicians and more than 1,000 providers, with a presence in Washington State, Indiana and North Carolina.

Another example of a large, independent orthopedic practice is Rothman Orthopedics. As one of the largest orthopedic practices in the United States, Rothman is an independent practice that is leveraging its scale and its providers in various health system arrangements. Rothman manages and helps develop orthopedic surgery service lines (both inpatient and ASC driven) with its hospital and health system partners. Rothman has operations in Pennsylvania, New Jersey, New York and Florida, and frequently markets its brand through sports marketing arrangements with local sports teams.[3]

![]() WHAT MAKES ORTHOPEDICS ATTRACTIVE

WHAT MAKES ORTHOPEDICS ATTRACTIVE

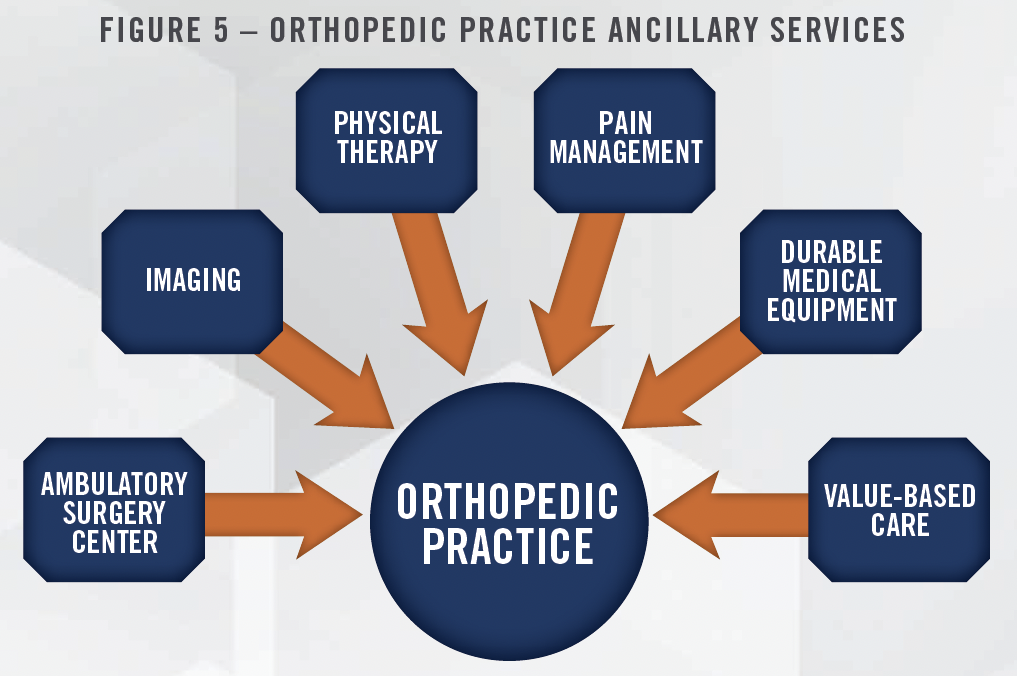

There are many reasons why the orthopedic space is so attractive to private equity investors and other acquirers. The market remains fragmented, creating a large runway for growth for these organizations. Orthopedic surgery is among the most profitable surgical specialties, and orthopedic practices offer the opportunity for ASC ownership. There are many other ancillaries associated with orthopedics, including physical therapy, ortho-focused urgent care centers, radiologic imaging, and durable medical equipment. The ability to add on or expand these services enables income repair for the selling physicians posttransaction as they are able to participate in the economics that are generated from these ancillary revenue streams. Income repair is an important selling point in PPM transactions as the seller physicians are able to increase their compensation levels to something similar to the pre-transaction amount, while also aligning the incentives of the physicians and the PPM. Growing ancillary services also reduces the effective multiple paid by the acquirer through EBITDA growth. Figure 5 presents the various ancillary services that orthopedic practices are able to offer patients.

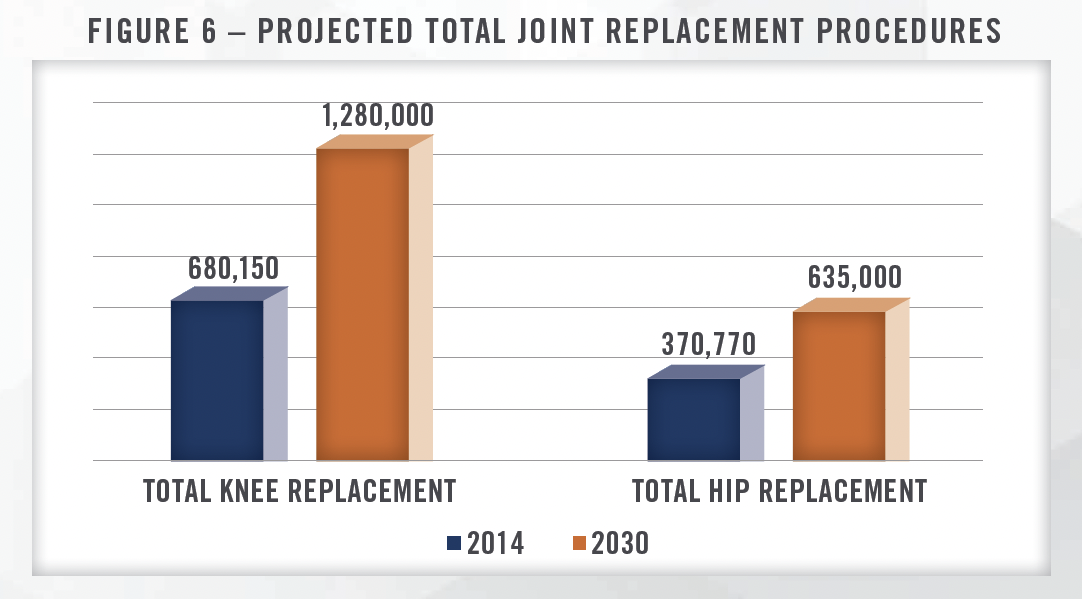

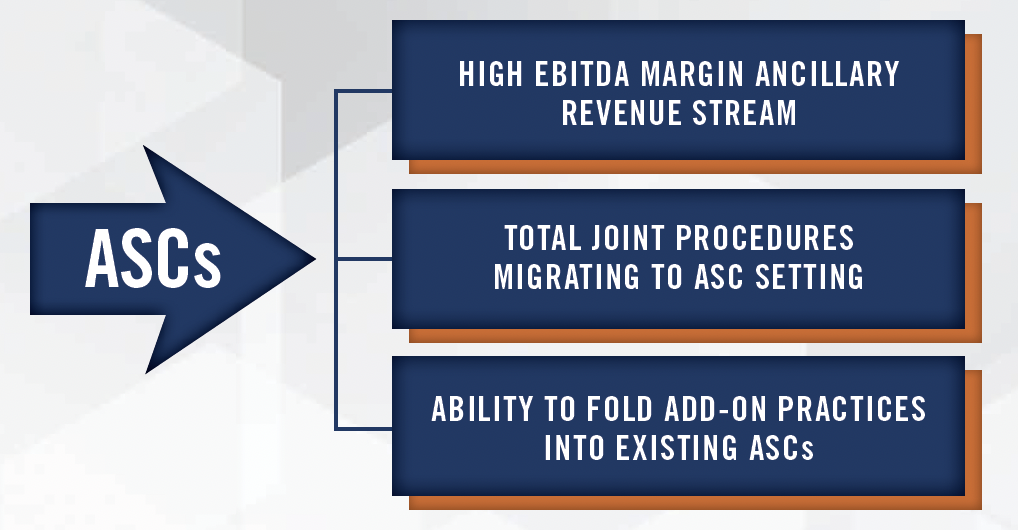

As mentioned above, one of the main sources of ancillary revenue for orthopedic practices are owned ambulatory surgery centers (“ASC”). ASCs offer large groups the ability to capture the facility fee associated with the surgical procedures they perform, and can be extremely profitable, particularly in the orthopedic space. We have worked with orthopedic focused ASCs with EBITDA margins above 50 percent, and there are many tailwinds that should support strong growth and profitability going forward. We frequently observe total joint replacement reimbursement rates from commercial payors in the $10,000 to $20,000 range plus reimbursement for the cost of the implant. These rates offer significant savings relative to the inpatient setting, but are also among the highest reimbursing cases performed in most ASCs. Total joint replacements are migrating to the ASC setting, with an estimated 57 percent of total hips and knees moving to the outpatient setting by 2028.[4] These procedures are expected to increase dramatically in the coming years, with growth driven by an aging and more active population, improvements in implants and related technology, and the prevalence of obesity. Figure 6 illustrates the projected growth of total knee replacement and total hip replacement procedures in the coming years.[5]

This trend has helped shape the strategy of some of the largest ASC operators in the country. Tenet Healthcare Corporation, through its United Surgical Partners International subsidiary, acquired SurgCenter Development for $1.2 billion (approximately 8x EBITDA) in 2021, which has a case mix of approximately 80 percent in musculoskeletal procedures including total joint and spine cases.[6] UnitedHealth Group, through its Surgical Care Affiliates subsidiary, continues to focus on moving more total joint procedures to the outpatient setting. In addition to these large organizations, we have worked with smaller health systems on ASC transactions wherein the migration of total joints and higher acuity procedures out of the hospital was the primary rationale for the transaction.

Physical therapy is one of the other ancillaries we commonly see PPMs bringing (or growing) in house. Orthopods are a significant source of referrals to physical therapy clinics, and large groups can easily support multiple therapists. While the labor market for therapists has been difficult in recent years, we have observed many orthopedic groups successfully offer this service in-house. Based on survey data from MGMA, the median physical therapist’s collections ($220,000) significantly exceed their compensation ($85,000, excluding benefits). This suggests favorable economics that enable practices to cover any incremental overhead and generate profit. Offering the physical therapy service enables the practice to capture that incremental revenue stream, and helps ensure quality and seamlessness of care after the procedure. It is also typically more convenient for the patient, which increases the probability they adhere to the therapy. Providing these services makes it easier to manage value-based care arrangements (discussed below) as well, as practices have fewer outside providers to coordinate with. For more information on the physical therapy industry, see our industry outlook article.

Many orthopedic practices have some imaging services like MRI and Xray in house. While imaging equipment, particularly MRI, requires more of an upfront investment, the ability to bill the facility fee7 for these services represents a significant ancillary revenue stream despite ongoing reimbursement pressure from CMS. Offering these services in-house also affords many of the same benefits discussed above, including patient convenience and enhanced ability to participate in value-based care arrangements. For more information on the radiology and imaging industry, see our industry outlook article. In addition to imaging, practices can offer their own durable medical equipment (“DME”) including braces and orthotics on-site. In our experience, many practices hire an outside management company to manage this service line, although large practices can likely manage in-house. We are frequently asked to value these DME management services arrangements for orthopedic practices as well as other medical specialties.

Opportunities to expand into value-based care arrangements is another driving factor behind many orthopedic transactions and platform strategies. In particular, orthopedic groups partnering or affiliating with health systems and payors to bundle services and provide integrated care represents a growth opportunity for PPMs and other large orthopedic practices. While smaller orthopedic groups may not be able to provide the full continuum of care (i.e., imaging, physical therapy/post-acute, etc.), larger platform organizations can treat the patient throughout the whole episode of care, which can enable better coordination of services and reduce cost. These types of providers are able to negotiate bundled rates with payors under fully capitated or shared savings arrangements. We anticipate these types of arrangements will become more common within the complex, high acuity orthopedic space in the coming years.

![]() CONCLUSION

CONCLUSION

Despite macroeconomic headwinds which have slowed transaction activity in certain healthcare subsectors, we expect orthopedic practice M&A to remain robust. We observe heavy interest in orthopedics from a variety of buyers including private equity firms and health systems who have longer-term investment horizons and are focused on the strategic benefits from these transactions. The number of orthopedic transactions and PPMs operating in the space is expected to increase over the next several years due to the tailwinds discussed throughout this article including the aging population, obesity, the opportunity to add or develop ancillary revenue streams, and the still relatively fragmented market.

[1] Employed physicians can also take a reduction in post-transaction compensation and receive upfront consideration and rollover equity.

[2] LevinPro HC, Levin Associates, 2023, April, levinassociates.com; Pitchbook; and publicly available articles and press releases, as well as our internal databases.

[3] Rothomanortho.com; https://rothmanortho.com/stories/blog/eagles-jefferson-rothman-deal; Accessed April 14, 2023

[4] MedTechDive.com; https://www.medtechdive.com/news/cms-restores-ipo-list-medtronic-stryker/609367/; Accessed April 7, 2023

[5] The Arthritis Foundation; http://blog.arthritis.org/news/future-joint-replacement-procedures/; Accessed April 13, 2023

[6] Tenethealth.com; https://investor.tenethealth.com/press-releases/press-release-details/2021/Tenet-and-USPI-to-Acquire-SurgCenter-Development-and-Establish-Long-Term-Development-Partnership/default.aspx; Accessed April 7, 2023

[7] The most commonly observed arrangement involves the orthopedic practice billing the technical component for an imaging procedure and a radiology group reading the scan and billing the professional component through a teleradiology agreement.