Authors: Nicholas A. Newsad, MHSA

Updated February 9, 2021 for the Consolidated Appropriations Act of 2021

The 2021 Medicare Physician Fee Schedule (MPFS) final rule included recommendations by the Relative Value Scale Update Committee (RUC) to increase the work relative value units (wRVUs) for common evaluation and management (E&M) office visits. Medicare’s final rule, and the subsequent Consolidated Appropriations Act of 2021, reduced the Medicare conversion factor from $36.09 to $34.89, a reduction of 3.3 percent, but rebasing wRVU values has greater implications. Tens of thousands of physician employment contracts use compensation models based on wRVU productivity.

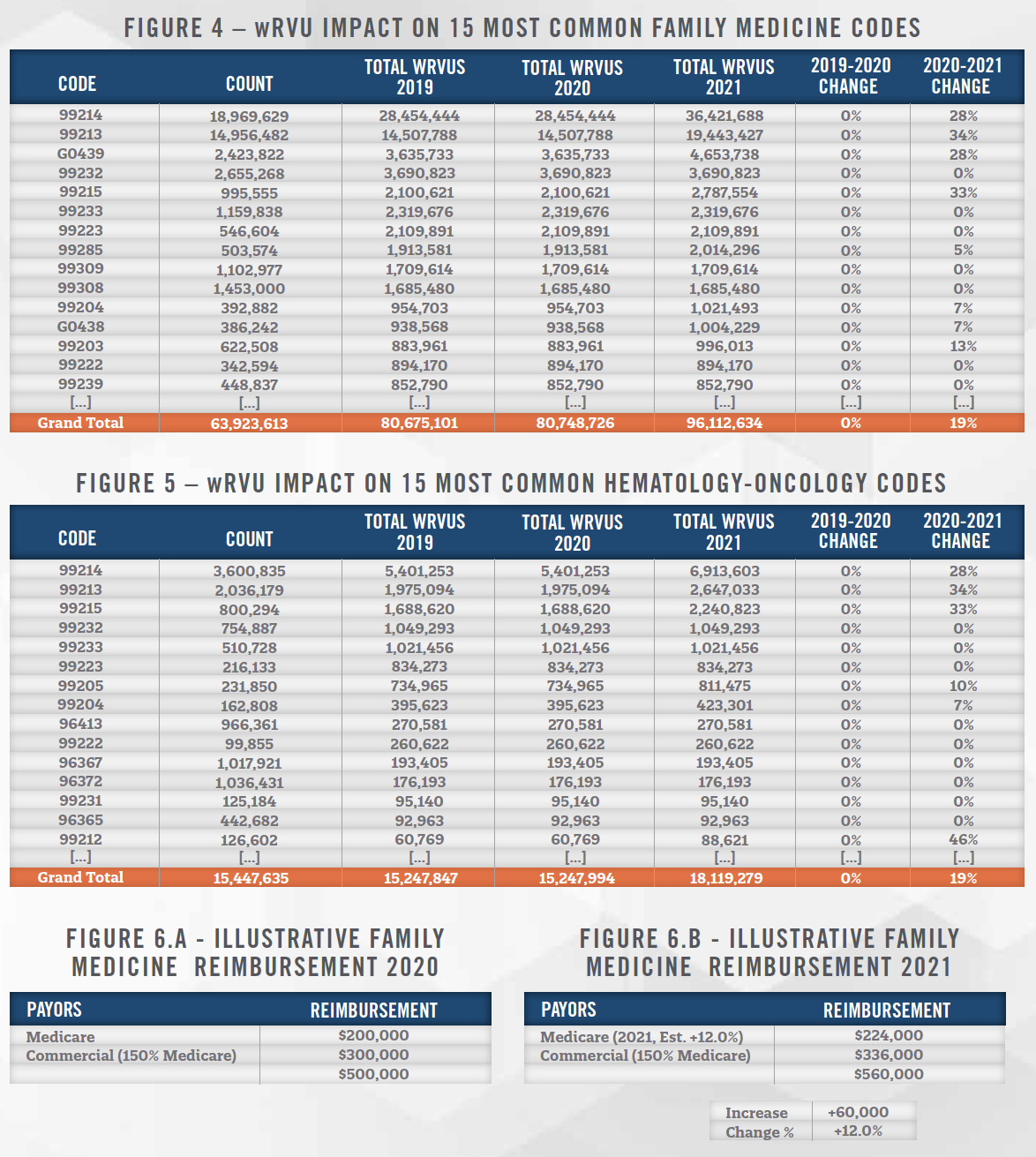

On December 1, Medicare released the 2021 MPFS final rule, which included recommendations by the RUC to increase the wRVU values for the common E&M office visit codes identified in Figure 1.

The Medicare conversion factor is the dollar amount that is multiplied by the total RVU values for each physician service to determine Medicare reimbursement. Medicare’s final rule, and the subsequent Consolidated Appropriations Act of 2021, reduced its conversion factor from $36.09 per RVU to $34.89 per RVU.

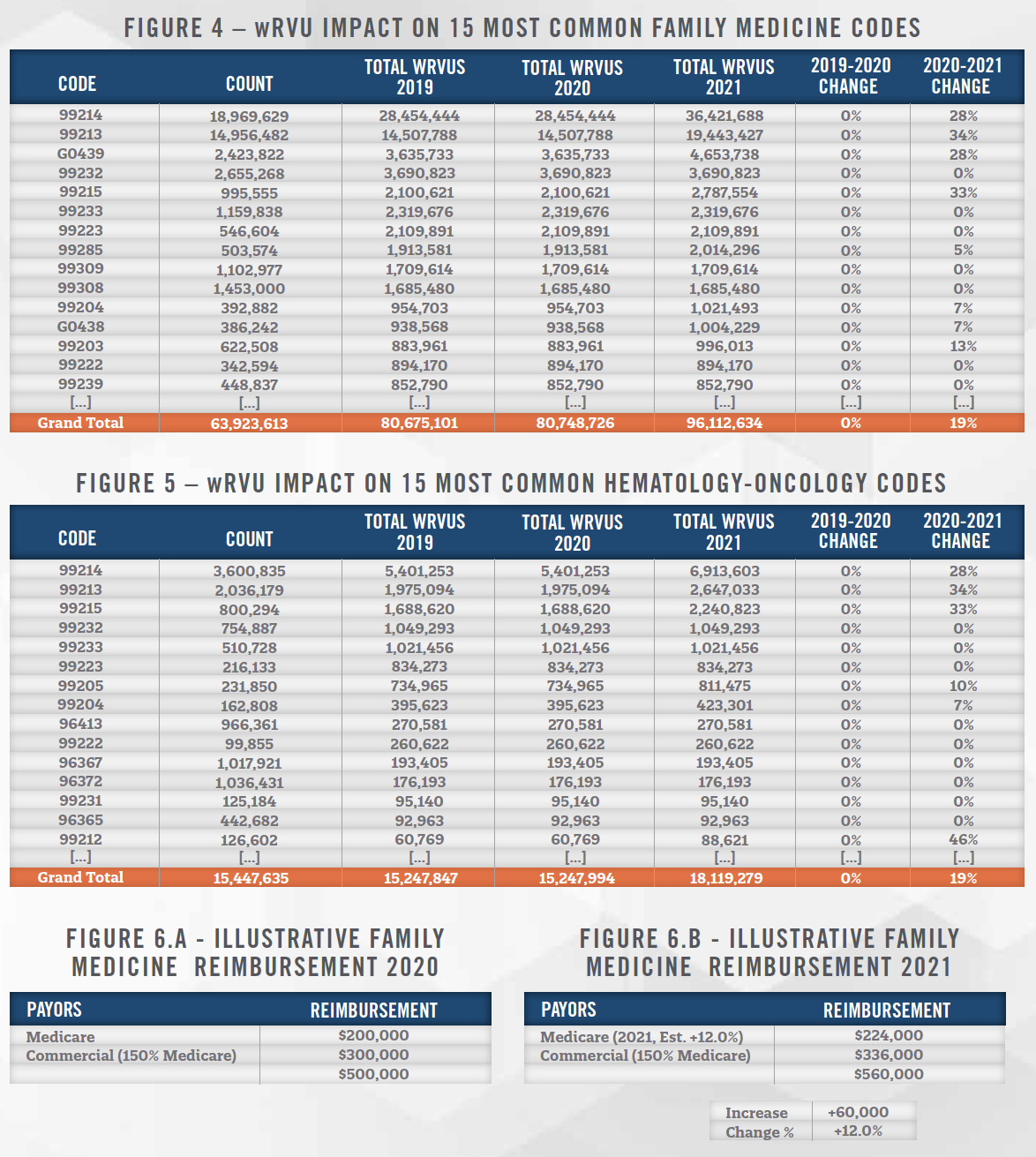

Medicare estimated the effect the final rule changes had on allowed charges (reimbursement) for various physician specialty groups, and the American Medical Association estimated the subsequent effect of the Consolidated Appropriations Act of 2021, as indicated in Figure 2. Significant increases in reimbursement are projected for specialties involving substantial office-based E&M services, including endocrinology (+14%), family medicine (+12%), hematology/oncology (+12%), nephrology (+11%), and rheumatology (+13%).

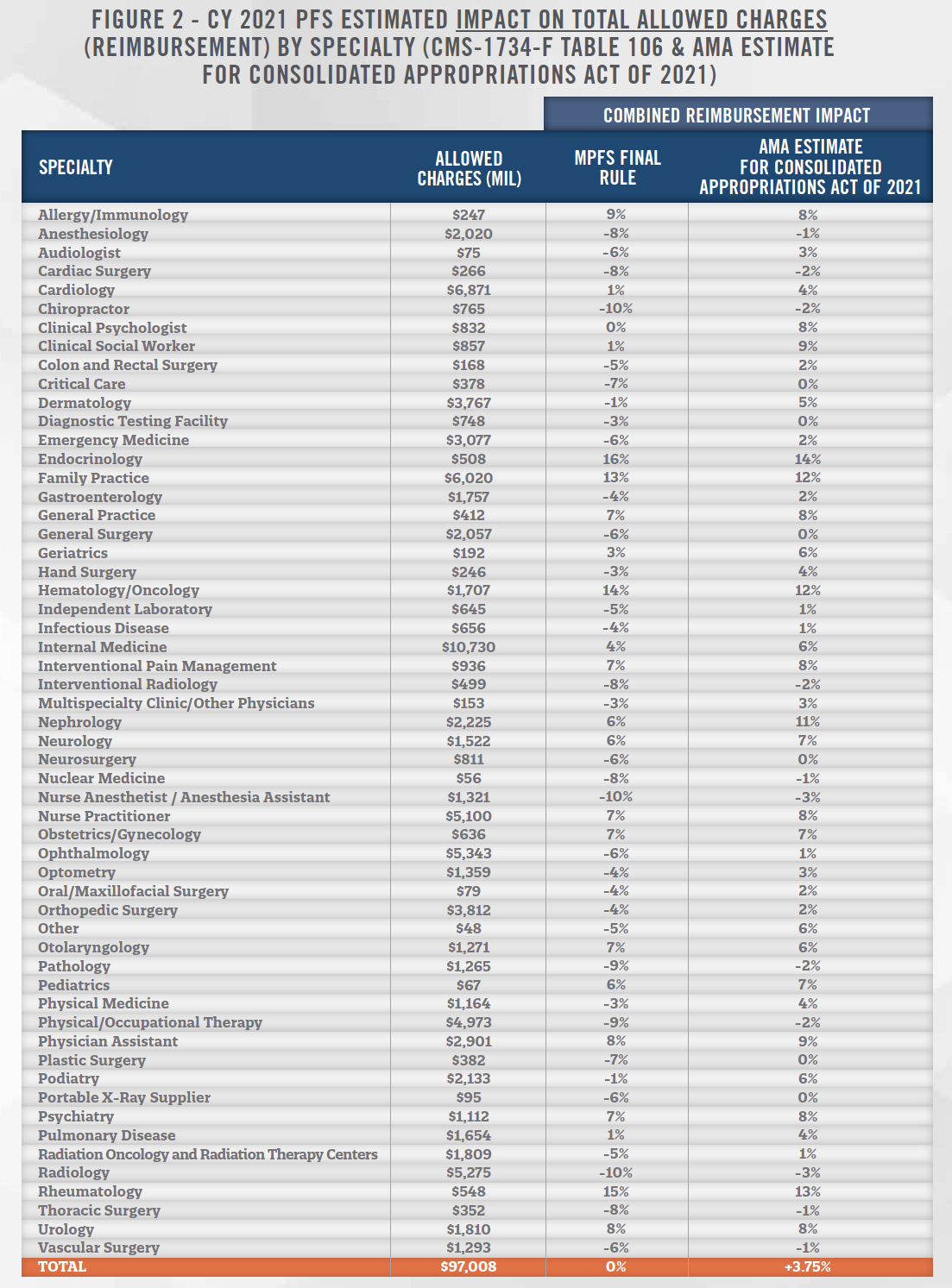

Commercial insurance companies commonly fix their physician reimbursement rates as a percentage markup on the Medicare fee schedule for their geographic region (e.g., 125% of Medicare Adjusted for Colorado GPCI). If not immediate, most commercial insurance reimbursement should be tied to the new Medicare rates within a few years. Because multiplication is distributive, an estimated 12% increase in family medicine Medicare rates would also result in a 12% increase in existing commercial insurance reimbursement from current levels, regardless of what markup on Medicare is being paid. See supplemental Figures 6.a and 6.b for an illustrative example of this effect.

Increasing wRVU values for common E&M office visit codes has greater implications than just Medicare reimbursement. Thousands of physician employment contracts use compensation models based on wRVU productivity. When wRVUs increase more than reimbursement, physician compensation growth can outpace reimbursement growth and strain margins.

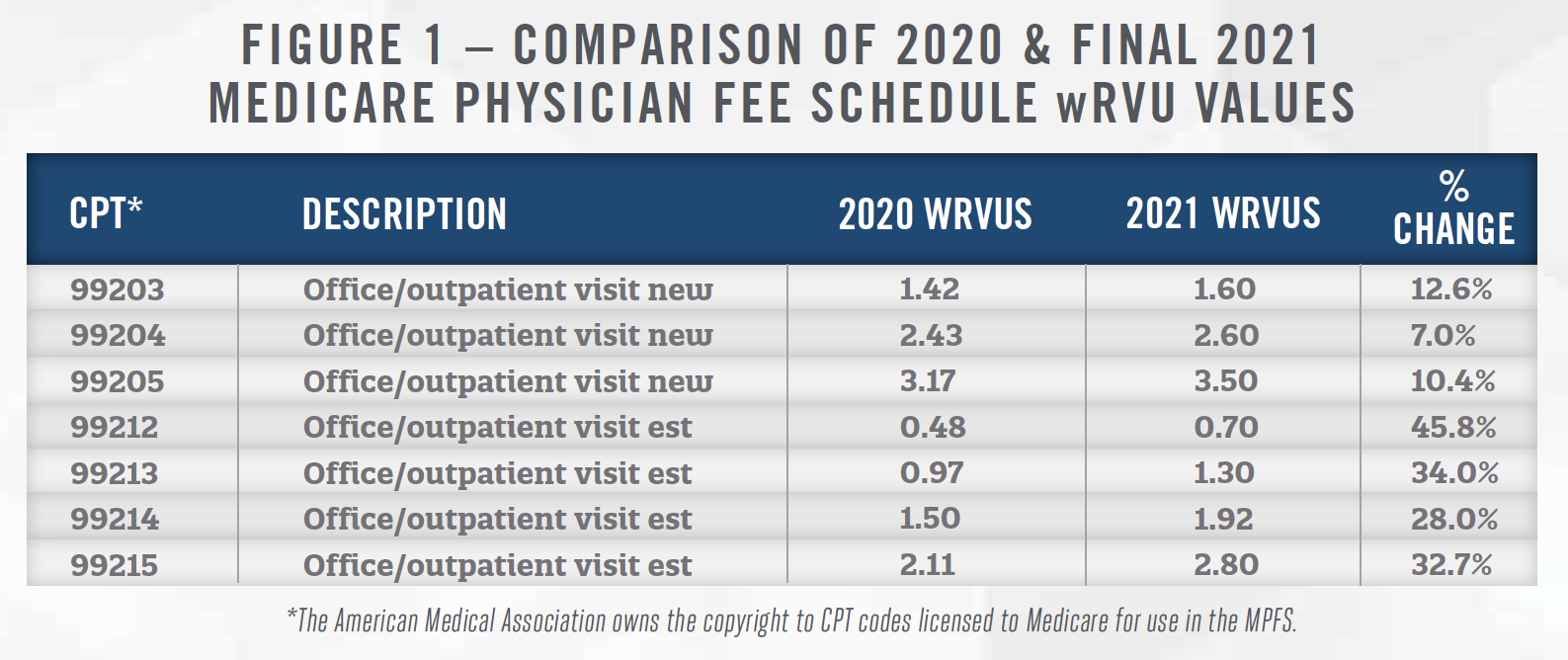

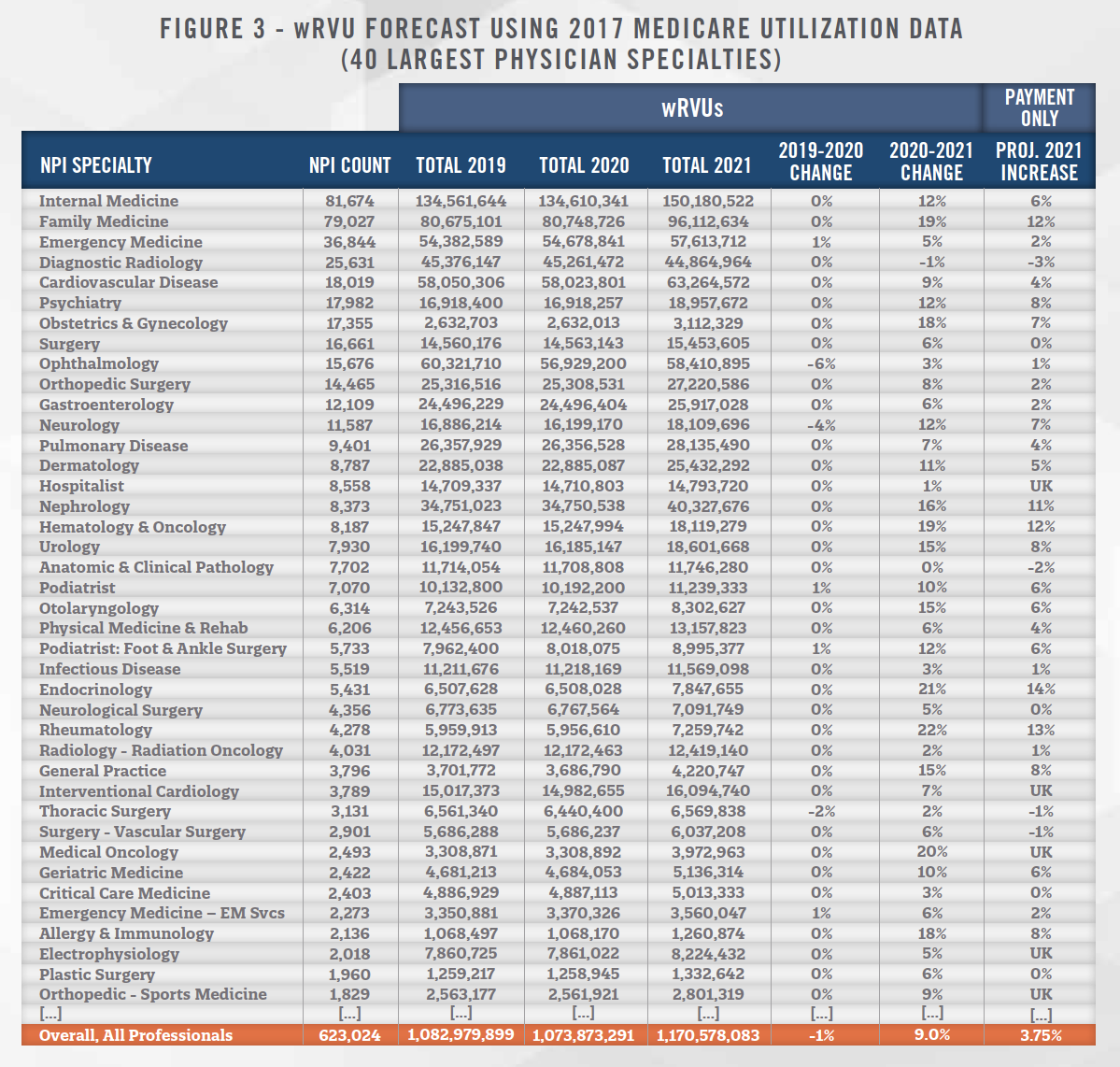

To isolate the effect of the 2021 Final Rule on wRVUs by physician specialty, HAI utilized the wRVU values from the 2019, 2020 and final 2021 MPFS to estimate the total wRVUs based on the public Medicare utilization data from 2017. As summarized in Figure 3, total wRVUs in 2021 are projected to increase at a higher rate (or decrease less) than Medicare’s projected change in allowed charges for all 40 of the largest physician specialties in the Medicare sample. Overall, wRVUs are projected to increase 9 percent for all 623,024 healthcare professionals in the Medicare utilization sample based on the final rule for 2021.

Regardless of whether physicians treat any Medicare patients or not, the wRVU values set by the RUC and adopted by Medicare are still used by EHR vendors, practice management software vendors, and employers to calculate physicians’ wRVUs. The finalized increases in wRVUs took effect immediately for all physician services performed on or after January 1, 2021, unless a different year’s wRVU values are specified for use in individual physician employment contracts.

This change also affects physician specialties that do not customarily serve large numbers of Medicare patients, including employed pediatricians and obstetricians. The projected overall 9 percent increase in wRVUs shown for all specialties at the bottom of Figure 3 includes about 1,000 pediatricians that are categorically under-represented in Medicare utilization data. If pediatricians’ utilization emulates family medicine, then pediatricians may also experience a 19 percent increase in wRVUs during 2021. Like all specialties, the reimbursement effect on pediatricians will be highly influenced by overall payor mix, and market-specific markups on Medicare rates.

To the extent that physician employers are already parties to employment contracts with pre-determined compensation-to-wRVU rates (e.g., $50 of compensation-per-wRVU), the number of wRVUs performed for nearly every specialty increased January 1, 2021 even if the same volume of E&M services are performed. Physician compensation under this model will increase commensurate to the new wRVU values, irrespective of the associated change in reimbursement. Practices with many surgeons and emergency medicine physicians will likely be impacted the worst.

In contrast, physician practices using compensation-to-collections models and fixed salary models will only be affected by changes in reimbursement and not wRVUs directly. If reimbursement increases or decreases, compensation under a compensation-to-collections model will adjust up or down with collections. Compensation under fixed salary models will obviously not change when reimbursement increases or decreases.

The financial and business impact of the 2021 MPFS final rule poses a challenge for organizations that are already financially fragile from the recent COVID-19 crisis. It will be necessary to project both the impact and timing of both reimbursement and physician compensation changes.

![]() CONCLUSION

CONCLUSION

Medicare’s 2021 Physician Fee Schedule final rule, and the Consolidated Appropriations Act of 2021, reallocated Medicare’s reimbursement budget to increase reimbursement for E&M office visits, while decreasing reimbursement for specialists performing few or no office visits. Total wRVUs are projected to increase at a higher rate (or decrease less) than Medicare reimbursement for all 40 of the largest physician specialties. For physician employers using compensation-to-Work-RVU models, the 2021 MPFS changes may increase physician compensation at a higher rate than reimbursement.

If you have not yet implemented 2021 Work RVUs in your organization, contact HealthCare Appraisers to learn how our Provider Compensation Plan Design Services and Automated FMV Solutions™ can help your organization plan and prepare for these changes.

![]()

![]()

![]()

HealthCare Appraisers notes that large increases in wRVUs for certain codes (99213, 99214) are diluted among specialties by the overall mix of procedures performed. This phenomenon is illustrated in detail for family medicine physicians in supplemental Figure 4 and hematologists/medical oncologists in Figure 5.