Author: Kevin P. Cassell, ASA and Jim D. Carr, ASA, MBA

Compensation plans based solely or predominantly on work relative value unit (“wRVU”) production have commonly been included in the employment agreements of physicians and other providers affiliated with hospitals, health systems, and integrated delivery networks for the past decade. The simplicity of administering wRVU-based plans, combined with the objectivity of the wRVU as a measure of work, allowed such plans to become the dominant physician compensation model by the start of 2020.

However, even the tried-and-true wRVU compensation model did not emerge from 2020 without its share of upheaval from the COVID-19 pandemic. Furthermore, significant changes in wRVU assignments released by the Centers for Medicare & Medicaid Services (CMS) in the 2021 version of the Medicare Physician Fee Schedule (“MPFS”) promised to introduce substantial variability into provider compensation models based on wRVUs going forward. Consequently, compensation models that are based on wRVUs have forced administrators to make very difficult decisions regarding provider compensation. These decisions have had an immediate impact on the satisfaction of employed providers and will significantly affect compensation survey data in the future.

However, even the tried-and-true wRVU compensation model did not emerge from 2020 without its share of upheaval from the COVID-19 pandemic. Furthermore, significant changes in wRVU assignments released by the Centers for Medicare & Medicaid Services (CMS) in the 2021 version of the Medicare Physician Fee Schedule (“MPFS”) promised to introduce substantial variability into provider compensation models based on wRVUs going forward. Consequently, compensation models that are based on wRVUs have forced administrators to make very difficult decisions regarding provider compensation. These decisions have had an immediate impact on the satisfaction of employed providers and will significantly affect compensation survey data in the future.

This article explores the impact made on wRVU-based compensation plans by various unique events that occurred in 2020 and reviews some responses that medical practices implemented to mitigate the consequences of these events on their wRVU-based compensation plans.

![]() THE COVID-19 PANDEMIC

THE COVID-19 PANDEMIC

As the COVID-19 pandemic engulfed the country during the spring of 2020, many physicians that relied heavily on elective procedures for wRVU production experienced a near freeze in the volume of such procedures. As wRVU production plummeted, numerous questions began to arise for these physicians and their employers. Were base salaries that were set assuming a historical level of production still consistent with fair market value? Did physicians whose compensation depended heavily on current year wRVU production have to absorb a reduction of 60, 70, or 80 percent from prior years? Did future salaries that were contractually stipulated to be based on 2020 wRVU production have to be set at significantly reduced levels?

Many professionals involved in compensation plan design began to consider whether plans should rely so heavily on wRVU production following the pandemic. They reasoned that plans that included a larger proportion of fixed salary or variable compensation based on quality measures might have avoided many of the issues that required their attention (and created their headaches) during 2020. Those questions were still unanswered when the next event shook the foundation of wRVU-based compensation plans.

![]()

![]()

![]()

![]()

![]()

![]()

On August 3, 2020, CMS issued its proposed rule for the 2021 Medicare Physician Fee Schedule. The proposed rule contained significant changes in the wRVU assignments for certain office-based and outpatient evaluation and management (“E&M”) procedures. While each new version of the MPFS typically addresses so-called “misvalued codes,” this iteration contained a magnitude of change that had not been seen in recent history. Specifically, the proposed rule contained changes that amounted to a projected 27 percent total increase in wRVUs associated with CPT codes 99202-99215 alone.

The changes in wRVU assignments for office-based and outpatient E&M codes that were adopted in the 2021 MPFS actually stemmed from the proposed rule for the 2019 version of the MPFS with changes CMS dubbed “Patients over Paperwork” and planned to implement in calendar year 2021. In response to this proposal, the American Medical Association (“AMA”) assembled a workgroup of physicians, advanced practice providers, and commercial payors that aimed to identify solutions to decrease the administrative burden associated with E&M visits. In early 2019, the AMA’s CPT Editorial Panel approved the changes recommended by this workgroup. Following the CPT Editorial Panel’s recommendations, the AMA/Specialty Society RVS Update Committee (“RUC”) also undertook a comprehensive revaluation of the wRVU assignments for the affected CPT codes. The RUC concluded that the subject services were undervalued by amounts ranging from 13 to 34 percent based on the data collected during the study and recommended new wRVU assignments to address these findings. CMS indicated in the final rule for the 2020 MPFS that it intended to adopt the recommendations provided by both the CPT Editorial Panel and the RUC on January 1, 2021.

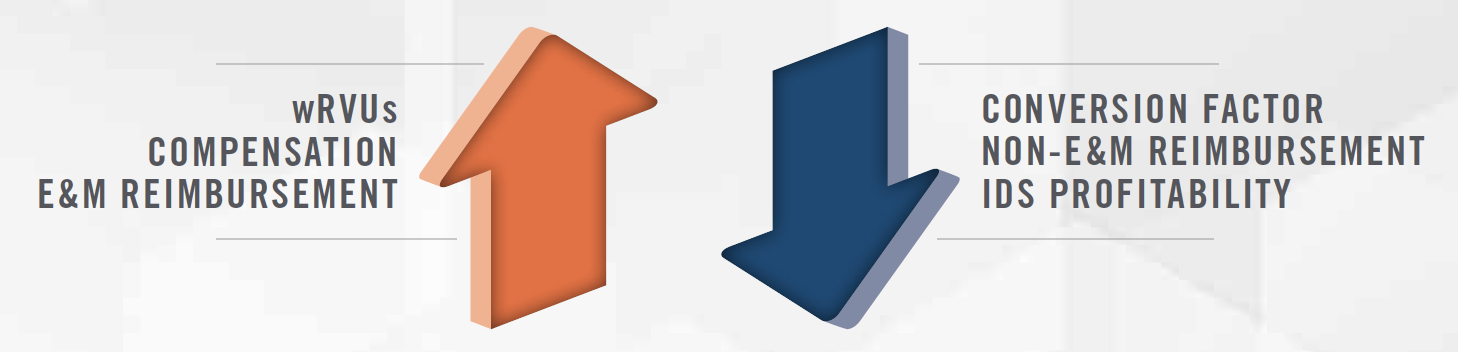

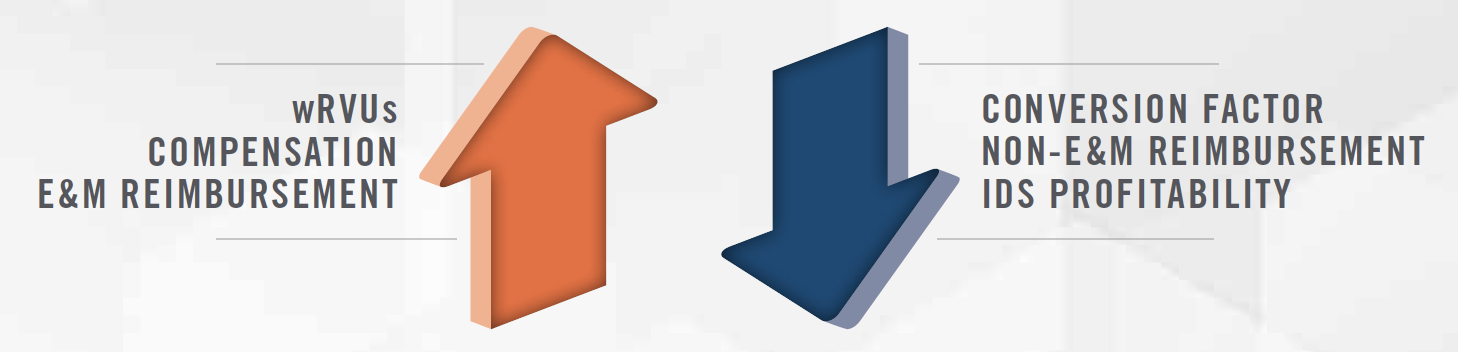

Both the proposed and final rules for the 2021 MPFS indeed contained these changes that had been signaled the prior year; however, they also contained another provision that served to mute their impact. Statutorily, changes in relative value units cannot create an annual change in expenditures from MPFS services of larger than $20 million. Accordingly, to preserve budget neutrality, the 2021 MPFS included a 10.2 percent reduction in the MPFS conversion factor.

As published, the 2021 MFPS introduced very significant changes for all physician groups. Those groups that utilize wRVU-based compensation plans expected to see wRVUs and, consequently, provider compensation, increase by an average of 9 percent, with some specialties, such as family medicine, medical oncology, and rheumatology, seeing increases of approximately 20 percent. Overall Medicare reimbursement was projected to remain flat in 2021; however, that outcome was projected to result from significantly varying impacts on different specialties. Primary care and medical specialty groups that provide many office-based E&M services were projected to see significant (i.e., up to 15 percent) increases in Medicare reimbursement. At the same time, specialist and ancillary groups that do not perform as many outpatient E&M services were projected to experience Medicare reimbursement reductions of up to 10 percent. The speed at which commercial payors would adopt such payment changes for E&M services was largely unknown. As a result, many hospital-affiliated multispecialty practices expected to encounter some relatively small changes in total reimbursement while simultaneously encountering larger growth in wRVUs, which translates to higher levels of provider compensation. The resulting economic impact of these MPFS changes forced many medical groups to scramble to devise a solution to address these issues as January 1 loomed in the very near future.

![]()

![]()

![]()

![]()

![]()

![]()

Just days before the new MPFS was scheduled to go into effect, and while medical groups were in the midst of modeling the impact of the new wRVU assignments on their provider compensation expense, Congress enacted the Consolidated Appropriations Act, 2021. Among many other things, this legislation responded to concerns raised about the impact of the 2021 MPFS conversion factor reduction on specialist groups and prospectively increased the 2021 conversion factor by 7.65 percent from the budget neutral value of $32.41 set forth in the 2021 MPFS final rule. The last-minute change greatly muted the decreased reimbursement that many surgical and ancillary specialties were projected to encounter as a result of the 2021 MPFS changes. With overall Medicare reimbursement for physician services now projected to increase by 3.75 percent, many hospital-affiliated multispecialty groups had a better outlook for 2021 than expected just days earlier and were able to adjust their plans for the coming year accordingly. Nonetheless, given that this change applied solely to Medicare reimbursement, growth in wRVU-based compensation was still projected to far outpace any growth in revenue during 2021, forcing medical group executives and providers to make some difficult choices about their compensation plans as 2021 began. Concurrently, this exercise left many providers in limbo as to how their wRVUbased compensation might or might not change during the next year. Furthermore, the Consolidated Appropriations Act, 2021 is a stopgap measure that expires on December 31 of this year. As a result, the industry again finds itself facing a reimbursement cliff at the end of the year similar to the sustainable growth rate formula of the previous decade.

![]()

![]()

![]()

![]()

![]()

![]()

During the pandemic, we observed many health systems make contemporaneous adjustments to wRVU-based compensation plans in an attempt to hold physicians harmless for large, uncontrollable swings in their production. In addition, as providers were exposed to new, unforeseen levels of risk, certain organizations incorporated premia into their compensation plans that were comparable to “hazard pay” for those on the front-line of the public health emergency.

Retain 2020 MPFS wRVU Assignments

After evaluating the expected changes in both Medicare reimbursement and wRVU-based provider compensation, many employers concluded that adopting the 2021 MPFS wRVU assignments for their compensation plans would create an unsustainable financial situation. Accordingly, many hospital-affiliated groups opted to continue utilizing wRVU values from the 2020 MPFS, at least for the remainder of 2021. This approach gave such organizations time to observe how the market would digest the changes embodied in the 2021 MPFS. Yet this approach certainly could not be characterized as taking a risk-free position. Many providers who are employed by those groups were already struggling with engagement as a result of the incredible patient care demands during the COVID-19 pandemic or the decreased compensation resulting from lower than normal patient care activity experienced by some providers during the same period. The decision to delay implementing the recommendations of the RUC and CMS added further strain to relationships with such providers. Some organizations attempted to maintain a balance between these two positions by providing compensation increases that are proportional to the expected change in Medicare reimbursement. Unfortunately, these organizations will have to revisit the same questions again at the end of 2021, as the increased conversion factor supported by the Consolidated Appropriations Act, 2021 sunsets.

Adopt 2021 MPFS wRVU Assignments

Other organizations concluded that adopting the 2021 MPFS wRVU assignments for their compensation plans was the most appropriate step that could be taken in the face of the uncertainty presented at the end of 2020. The reasons cited to the authors for this decision include upholding organizational values and/ or avoiding legal risk. This approach generally helped such organizations re-energize providers that may have been struggling with some of the engagement issues highlighted previously. That said, this strategy also created its own unique risks, as provider organizations facing double-digit percentage increases in compensation with relatively minimal offsetting revenue further exacerbated the profitability issues that plague provider organizations affiliated with hospitals and health systems. Some organizations attempted to mitigate this risk by reducing the conversion factor paid to employed providers. The pitfalls of this strategy are comparable to those of the organizations that opted to remain with 2020 MPFS wRVU assignments.

![]()

![]()

![]()

![]()

![]()

![]()

The tumultuous year that was 2020 highlighted several shortcomings of wRVU-based compensation models that many provider organizations had never contemplated. The responses to these challenges have varied and created differing types of risk for the organizations employing each strategy.

As the market continues to digest the impact of the COVID-19 pandemic and the 2021 MFPS wRVU assignments on wRVU-based compensation plans, we expect to see many organizations begin to contemplate the next evolution of their provider compensation models. Such compensation plans may involve incremental refinements to wRVU-based plans or the eventual replacement of wRVUs with existing metrics, such as collections or panel size. More progressive organizations may even explore developing their own scale of measuring provider productivity that supersedes wRVUs in provider compensation plans.

Without the clarity provided by a crystal ball, we certainly cannot predict the exact mechanics that provider compensation plans will utilize ten years from now. That said, we do feel confident that those models will have been precipitated by the events that unfolded in 2020 and we expect they will be designed to handle future market-shaping forces more effectively than the wRVU-based models of today.