As more and more healthcare organizations are being courted for their data by life sciences and software companies, there is a growing need for clinical data valuation. In addition to typical data licensing arrangements, clinical data is also being contributed as in-kind investments in new venture start-ups, thereby determining equity ownership stakes in the new companies. The most appropriate valuation approach(es) and technique(s) for valuing clinical data often depends on the type of data involved and the form of the subject transaction.

![]() INCOME APPROACH

INCOME APPROACH

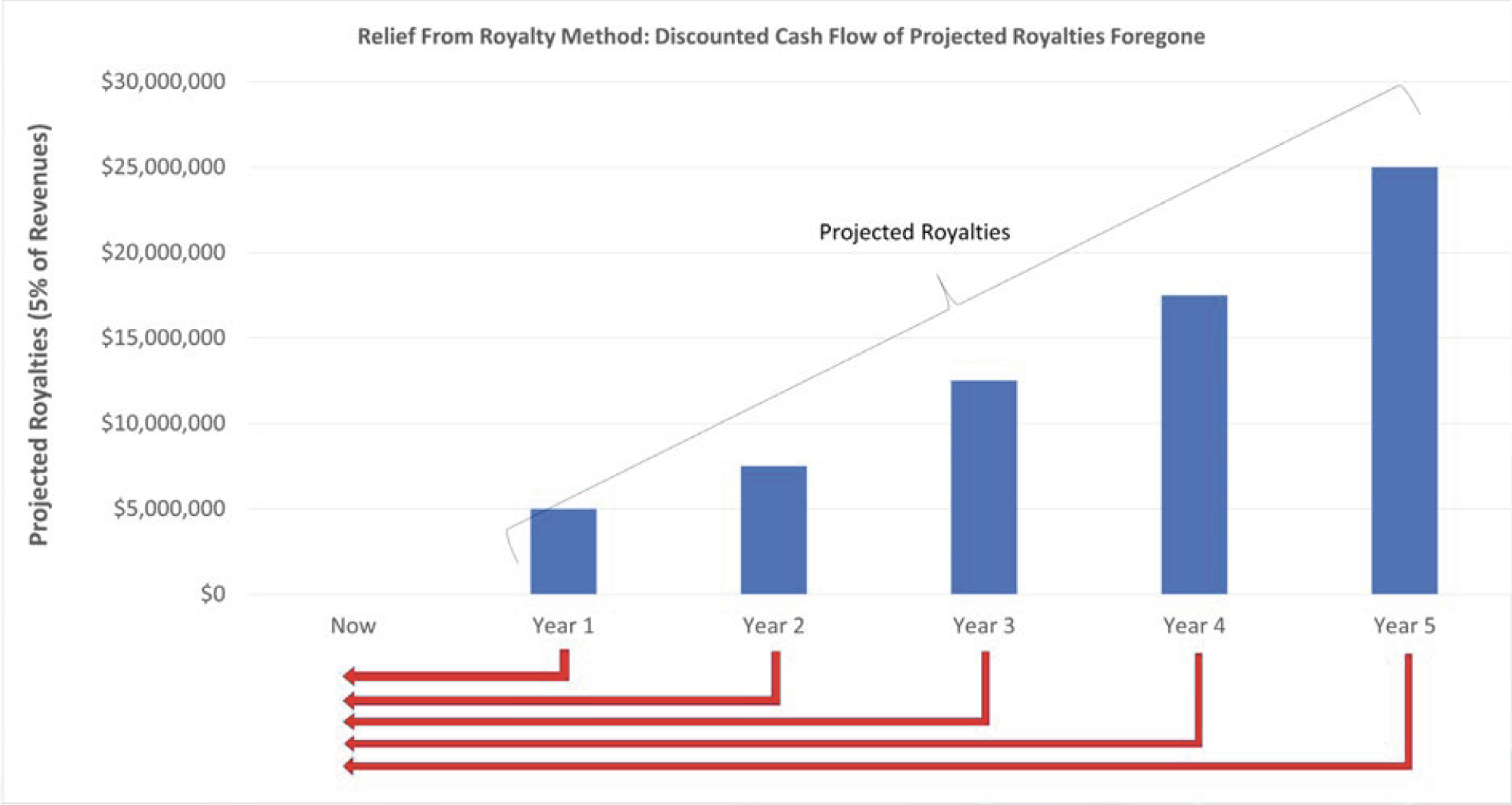

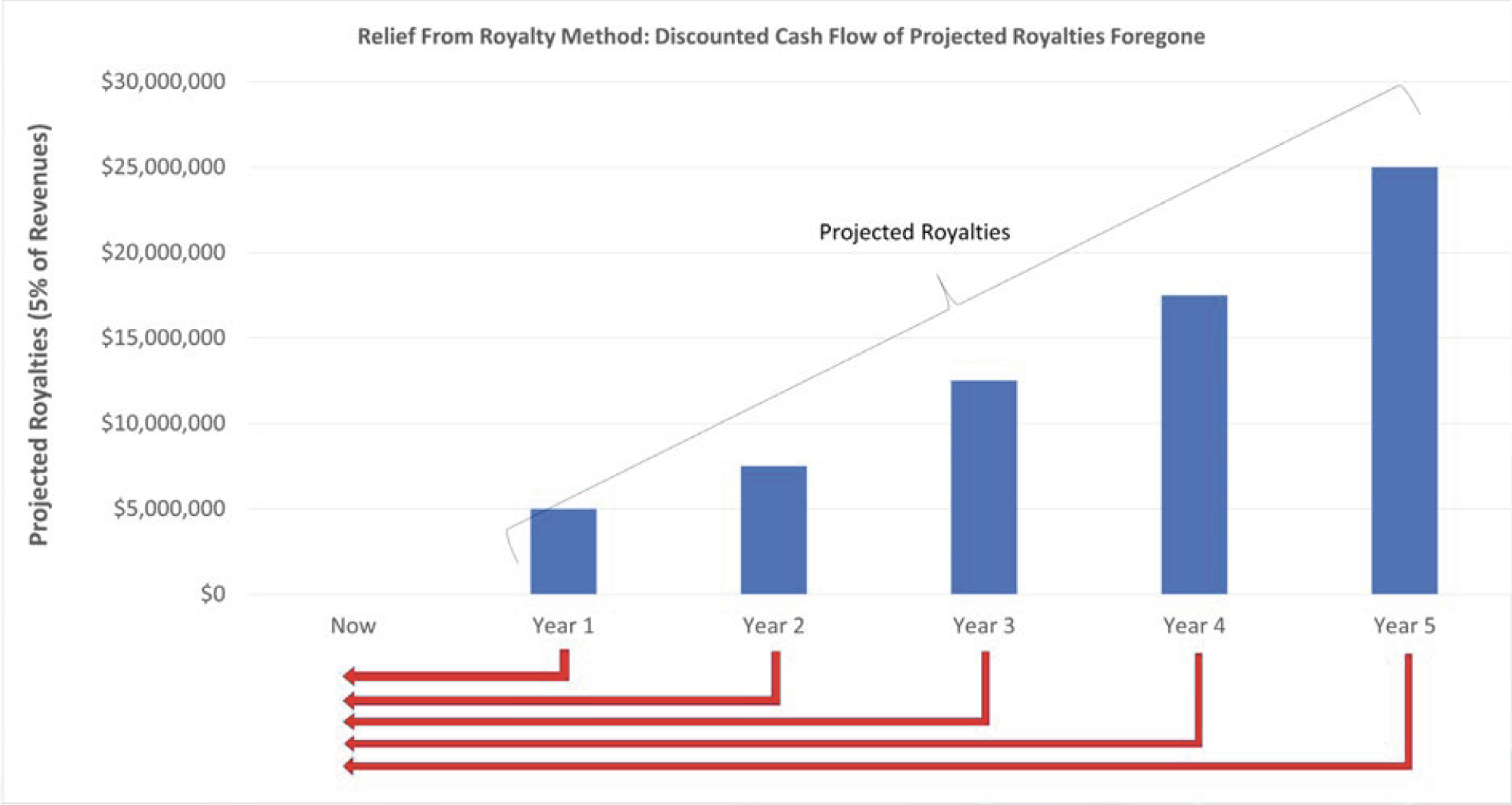

When data is being contributed to a business as a form of investment in-kind, the Relief from Royalty method is one technique that may be deployed under the Income Approach. During this analysis, the projected revenues for the start-up business are forecast, and royalties are calculated to estimate the hypothetical costs the start-up business might otherwise incur to license the data from the owner. The future after-tax royalty cash flows can then be discounted to a present value to determine the value of foregone future costs of the business start-up in terms of today’s dollars. The selection of appropriate royalty rates and present value discount rates are key variables in these calculations.

![]()

![]()

![]()

![]()

The Market Approach uses comparable transactions to estimate a range of market rates for similar assets or services. There are some comparables for data sale and license agreements available through the intangible databases KTMine and RoyaltySource, as well as through other public filings or internal databases. However, the market for condition-specific and intervention-specific clinical data is not yet very robust. Directly comparable transactions for similar types of clinical data can be difficult to identify from SEC filings transactions disclosed by public companies.

The Cost Approach determines the cost required to re-create an intangible asset. This approach is often used to determine the floor price for assets. The cost to recreate clinical data is often very high because clinical data is generated by established physician practices and interactions with both new and established patients with specific types of conditions.

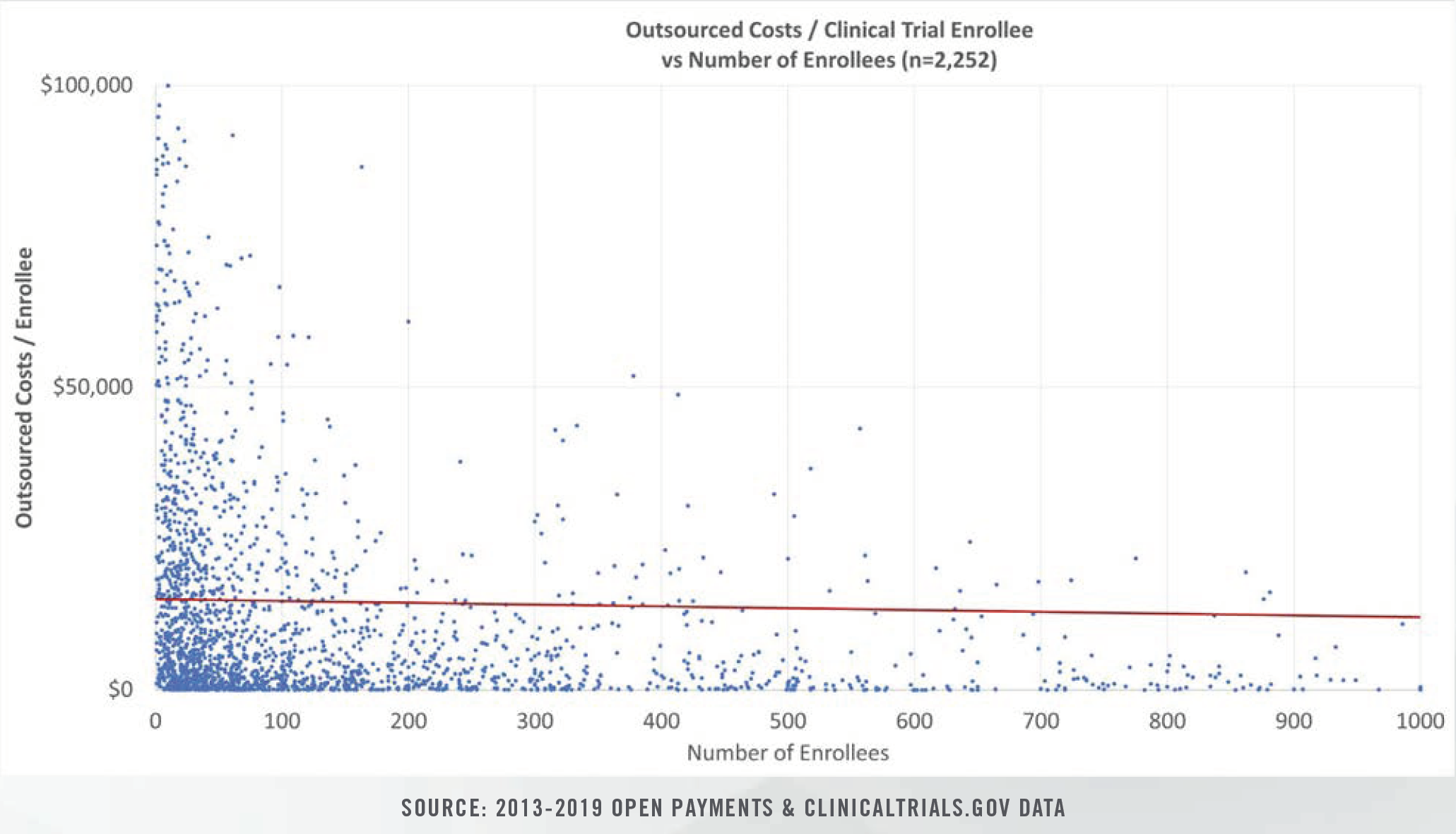

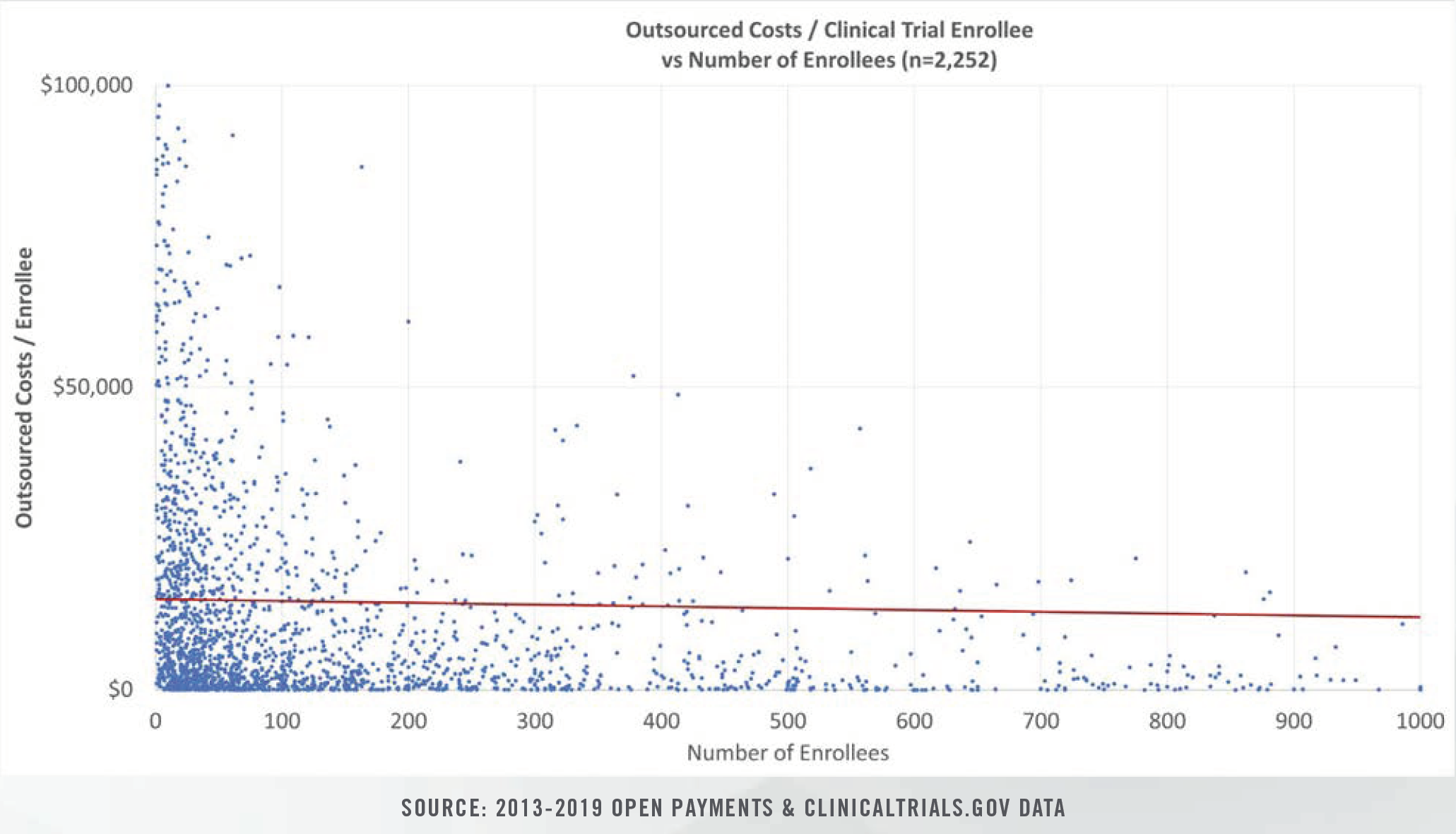

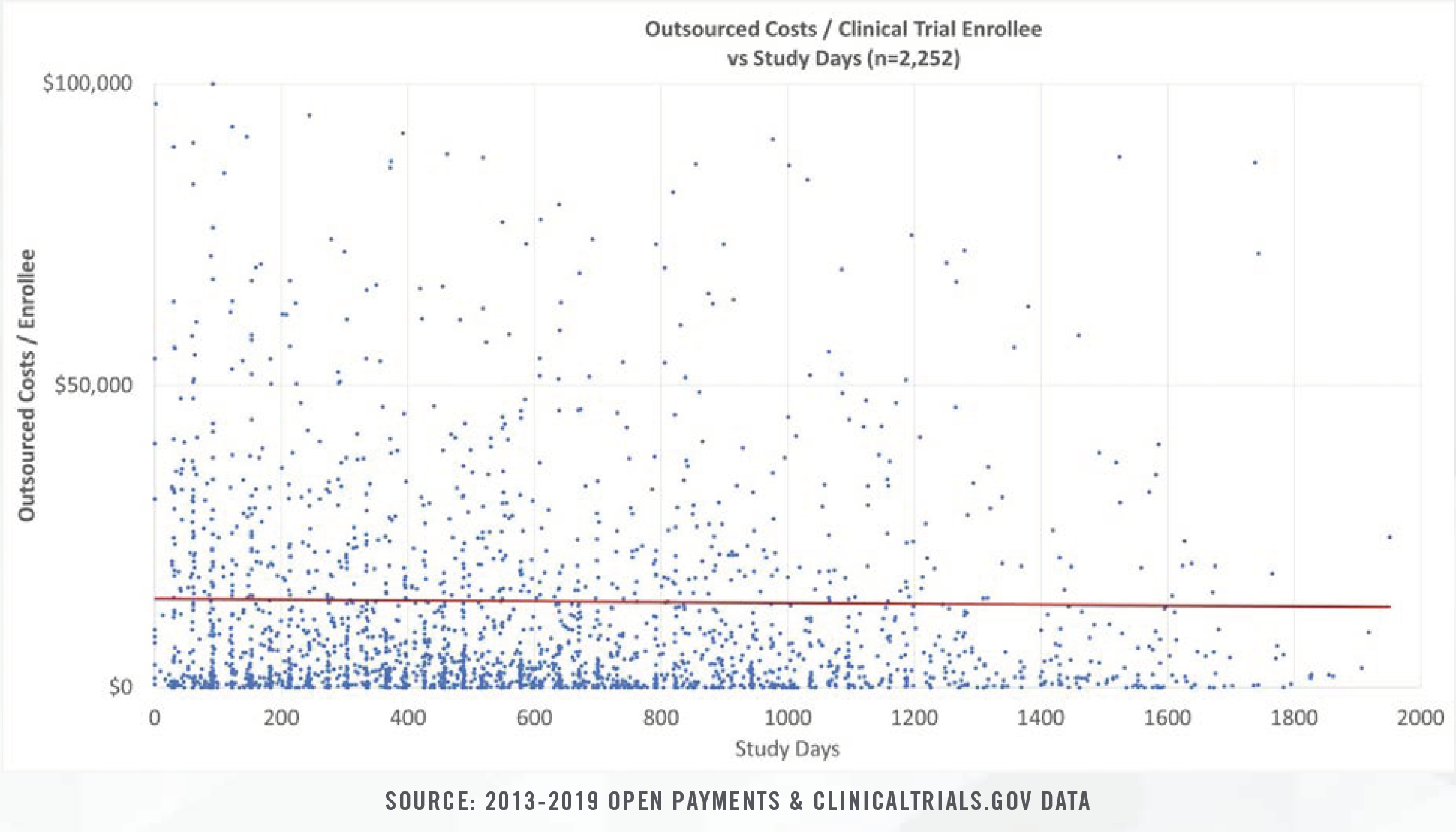

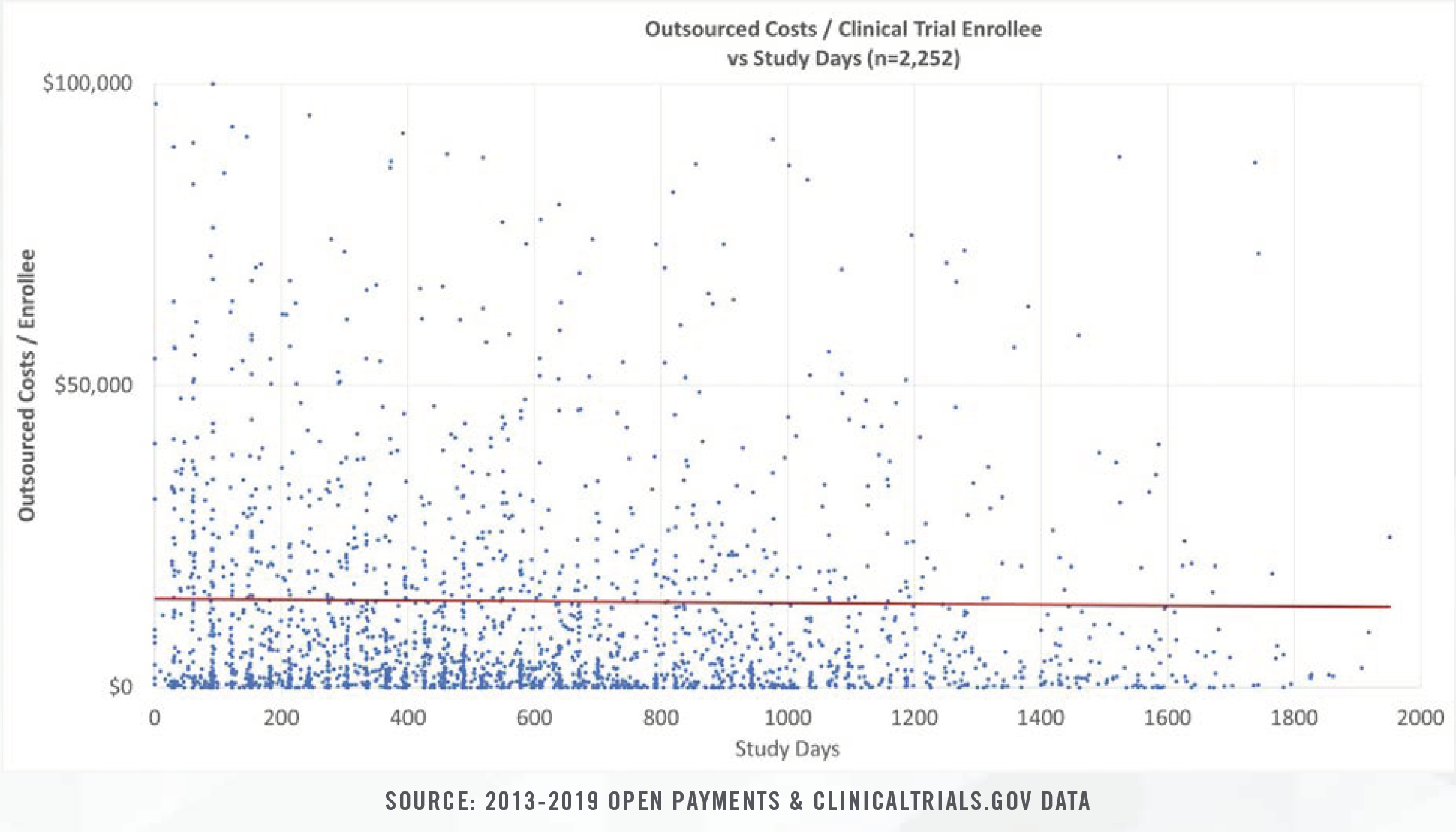

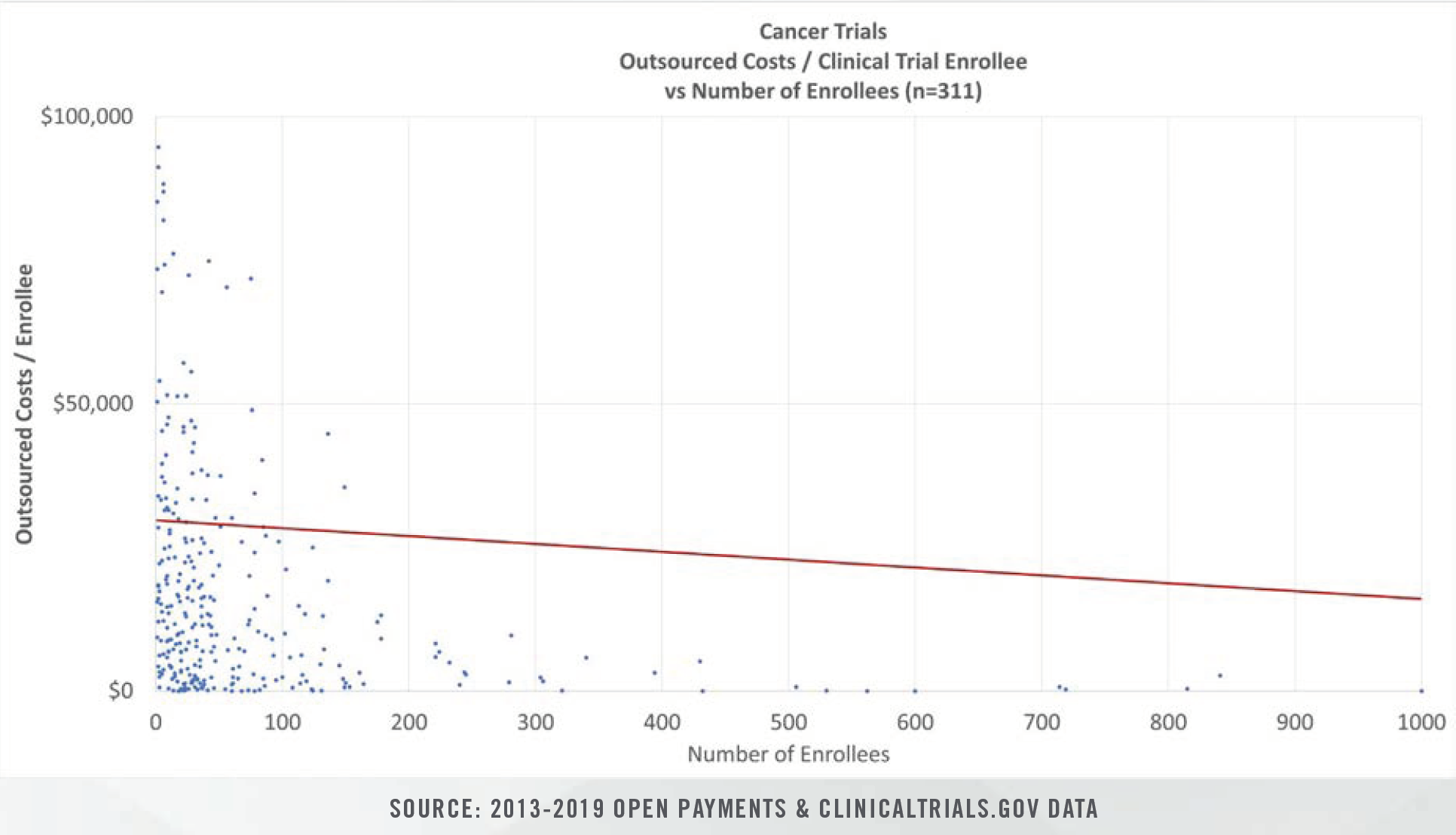

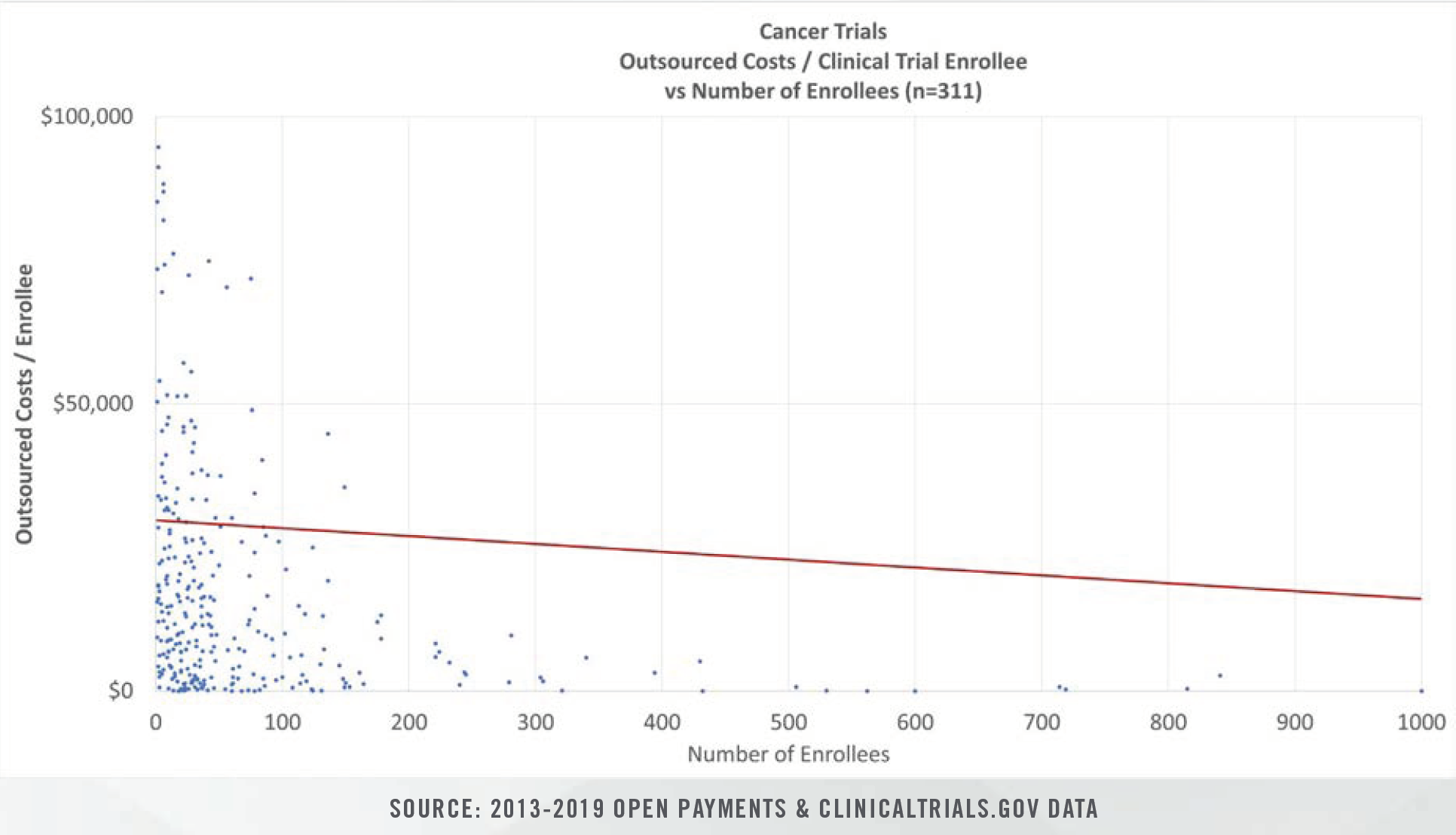

Outsourced clinical trial costs are excellent proxies for the costs to generate clinical data because both direct costs and market pricing are built into the transactions between study sponsors and clinical trial sites. Clinical trials sites are typically physician practices and hospitals. The objective of clinical research trials is to establish the effect of a specific intervention.[1] This is achieved by collecting clinical data during experiments that control for bias and confounding effects. Clinical research sponsors customarily outsource most of the work of clinical trials to physician practices, hospitals, and clinical research organizations (CROs). Study sponsors compensate clinical trial sites for performance of outsourced services. It is common for physician practices and hospitals to be clinical trial sites where patient subject candidates are identified, screened, enrolled, and informed consent is collected. The actual performance of interventions (treatments) and follow-up case reports are also completed by clinical trial sites.

The publication of the Open Payments data sets over the past seven years has led to the availability of outsourced clinical research costs for thousands of completed clinical trials during the period from 2013 through 2019.

Clinical study costs can be bifurcated for specific categories of conditions (e.g., cancer, heart disease, nervous disorders), study length (0 days to >1,000 days), intervention type, and number of human subjects in each trial. Study costs tend to decrease on per patient bases as more patients are enrolled. Furthermore, study period length plays a significant role in costs given that patient identification and enrollment comprise fixed, one-time costs incurred at the beginning of studies, while ongoing case reports, testing, and follow-up visits represent a higher proportion of total costs for studies that span several years.

Molecular profiling, or genomic tumor profiling, is one area of medicine that has experienced explosive data growth over the past 10 years. A growing number of patients are being prescribed testing for comprehensive genomic profiles. Interventions and biomarkers can be studied retrospectively based on existing data in Electronic Health Records and molecular profiles.

The role of next generation sequencing (NGS) in cancer treatment selection, as well as recent advances in gene editing (CRISPR) and precision diagnostic tools (SHERLOCK) all point to a future where clinical data is central to the rapid diagnosis and treatment of cancer, viruses, and autoimmune disorders.

![]()

![]()

![]()

![]()

Hospitals and physician practices have been using Electronic Health Records for years to collect patient data. This has made the monetization of intangible data assets a profitable reality. Passive income streams from existing intangible assets offer low-cost, high return-on-investment options for fragile healthcare organizations to realize new income streams. Thoughtful valuation of clinical data assets by a knowledgeable valuation firm such as HealthCare Appraisers will ensure that your healthcare organization obtains maximum value for your data backed by and independent and defensible opinion.

Read more about healthcare data in HealthCare Appraisers’ prior articles Bytes to Bucks: The Valuation of Data and No Free Lunch: The Hidden Value of “Free” Data Sharing Arrangements.

[1] Fundamental of Clinical Trial Design. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3083073/